In California real estate, water and access are two of the easiest facts to misstate—and two of the hardest problems to fix after closing. If you market “water rights,” “year-round water,” or Read more...

In California real estate, water and access are two of the easiest facts to misstate—and two of the hardest problems to fix after closing. If you market “water rights,” “year-round water,” or “guaranteed access” without written verification, you’re not just risking a failed deal; you’re risking a misrepresentation claim.

The trap is predictable: agents often confuse legal entitlement with physical reality. A water bill is not the same thing as a legal right to a source, and a driveway you can drive today is not proof of a recorded right to use it tomorrow.

This guide is part of the California Real Estate Laws & Compliance Guide.

Notice: This guide is for informational purposes only and does not constitute legal advice. California water and land-use rules can be highly fact-specific. Always consult the local agency, title/escrow, and a qualified real estate attorney or land-use professional for property-specific guidance.

Fast Answer: Water Rights & Easements in California (What Agents Must Verify)

In California, water service (a meter/account with a district or mutual system) might be different from water rights (a legal claim to use a water source), and physical access is different from legal access (a recorded right to use a path for a defined purpose). Agents reduce liability by verifying: (1) the true water source and any conditions for continued service, and (2) the existence, scope, and map location of any access easement—in writing—before using those claims in marketing.

Verify in writing (minimum):

Water: District/mutual/well source, written confirmation of service availability/conditions, and any fees/limits.

Access: Recorded easement document + scope (ingress/egress, width, permitted uses), plus whether the actual road sits inside the easement boundaries.

Title: Easement exceptions, ambiguous “blanket” easements, or anything requiring a survey and/or legal review.

Water Rights vs. Water Service: The Critical Distinction

The most common mistake is assuming a property has "water rights" just because water is present.

Topic

What it is

What agents should verify

Common marketing mistake

Water Service

Utility delivery (district/mutual)

Service status, transfer requirements, written confirmation of service availability, connection fees, meter availability.

Saying “water rights included” when it’s only a service account.

Water Rights

Legal entitlement/claim to a source

Any documentation/agreements/permits, limitations, transferability, and counsel review when unclear.

Treating a claim as guaranteed capacity or permanent.

Physical Access

A road/driveway exists

Ownership, maintenance responsibility, gates/controls, visible encroachments.

Assuming physical use equals a legal right.

Legal Access

Recorded right to cross land

Recorded document, scope, width, map/exhibit location, and any lender/fire authority concerns.

Saying “deeded access” without reading the easement.

Who This Matters For (High-Risk Scenarios)

Verification is non-negotiable for these property types:

Rural & Ag Parcels: Properties with wells, irrigation, or horse/livestock needs.

Flag Lots & Private Roads: Properties relying on shared driveways or "off-main" access.

Waterfront & Creek-Adjacent: Land bordering natural watercourses where riparian claims may arise.

Development & ADU Sites: Parcels where "legal access" must meet specific fire-code widths or where utility capacity is capped.

California Water Rights Basics

Riparian and Appropriative Concepts

Riparian: Generally tied to land bordering a natural watercourse and typically used on that land; these rights are fact-specific and not something agents should "promise" without appropriate review.

Appropriative: Often tied to priority and permitting. If a property relies on diverted surface water, verification can require complex agency records and legal review.

Groundwater and Wells

Practical Reality: Well performance is a tested condition, not an assumption. Local groundwater rules and basin management can affect drilling, pumping, and long-term reliability.

What Documents Usually Prove What (Quick Reference)

Resource

Evidence/Document to Request

Water District Service

Recent bill + district confirmation of transfer/service status.

Mutual Water

Share certificate + current standing confirmation + transfer rules.

Private Well

Well records (if available) + current yield/flow + potability results.

Shared Well

Written agreement covering access, maintenance, and cost-sharing.

Access Easement

Recorded easement/right-of-way document + map/exhibit showing location.

How to Spot Easements in the Preliminary Title Report (Schedule B)

Your primary defense is the Preliminary Title Report—but only if you treat it like a checklist, not a formality.

Start with Schedule B (Exceptions): This is where easements, rights-of-way, and restrictions can appear.

Pull every referenced document: If an exception cites a recording date/instrument number, ask title/escrow for the actual recorded document—don’t rely on the one-line summary.

Identify scope: Does it allow ingress/egress, utilities, drainage, or something else? Is it limited to certain vehicles or purposes?

Check whether it’s appurtenant or in gross: Does it benefit the parcel (runs with land) or an entity (utility, agency)?

Find the map/exhibit: Many easements live on a plat or exhibit that shows location/width. If the easement isn’t clearly mapped, treat it as a risk flag.

Compare paper to pavement: If the road/driveway doesn’t appear to sit within the easement area, recommend a survey and/or legal review before removing contingencies.

Title Red Flags:

“Blanket” easements that cover large areas without a defined corridor.

Easement exists, but doesn’t connect to a public right-of-way or reach the actual structure.

Language that conflicts with current use (e.g., pedestrian-only vs. vehicle access).

Encroachments (fences/sheds sitting in the easement area).

Agent Workflow: The 6-Step Due Diligence Loop

Ask: Source, history, disputes, and shared agreements.

Pull: Title/prelim + exhibits; read Schedule B and referenced documents.

Confirm: District/mutual status, will-serve terms, and transfer rules.

Test: Yield and potability during contingencies (for wells).

Map: Confirm easement location vs. actual road; survey if needed.

Disclose + Market Safely: Use precise language tied to documents.

Water & Access SOP (Verify in Writing)

Water

Source type: District meter, mutual water company, shared well, or private well.

Transfer requirements: Rules/fees to transfer service or shares; confirm standing with the provider.

Vacant land: Get written confirmation of service availability/conditions (often called a “will-serve” confirmation).

Well properties: Recommend yield/flow and potability testing; ask for prior repair history.

Shared well: Confirm a written agreement exists covering maintenance, cost-sharing, and repair access.

Access / Easements

Recorded document: Obtain and read the recorded easement/right-of-way document.

Scope + width: Confirm permitted uses (vehicle/utility), width, and any restrictions.

Maintenance: Confirm who pays; if shared, verify if a recorded maintenance agreement exists (may be a lender/underwriting concern).

Physical reality: Check for gates, parking conflicts, or fences/encroachments; recommend survey if alignment is unclear.

Local requirements: Confirm emergency access expectations with the local fire authority.

Marketing Language: Safe vs. Risky

Risky Language (Avoid)

Safe Language (Use Instead)

"Unlimited water rights."

"Property served by private well; buyer to verify capacity and rights via current testing."

"Deeded access to the highway."

"Access via recorded ingress/egress easement; see preliminary title report and recorded documents for scope."

"Abundant water for horses."

"Buyer to verify water capacity for specific agricultural needs."

"Easy shared driveway."

"Shared driveway, see recorded maintenance agreement for details."

"Right-of-way guaranteed."

"Recorded right-of-way; see documents for scope and width."

"Build your dream home here."

"Buyer to verify utility availability, permits, and emergency access requirements."

"Water shares included."

"Sale includes shares in [Name] Mutual Water Co.; verify standing."

"Year-round creek access."

"Bordered by [Creek Name]; buyer to verify riparian claims/use."

Navigating the Broader Regulatory Landscape

Understanding the Dominant vs. Servient Tenement relationship is just one piece of the puzzle. This guide is a core component of our larger California Real Estate Laws & Compliance Guide, designed to help agents navigate the state’s complex land-use regulations.

Development and Density Constraints

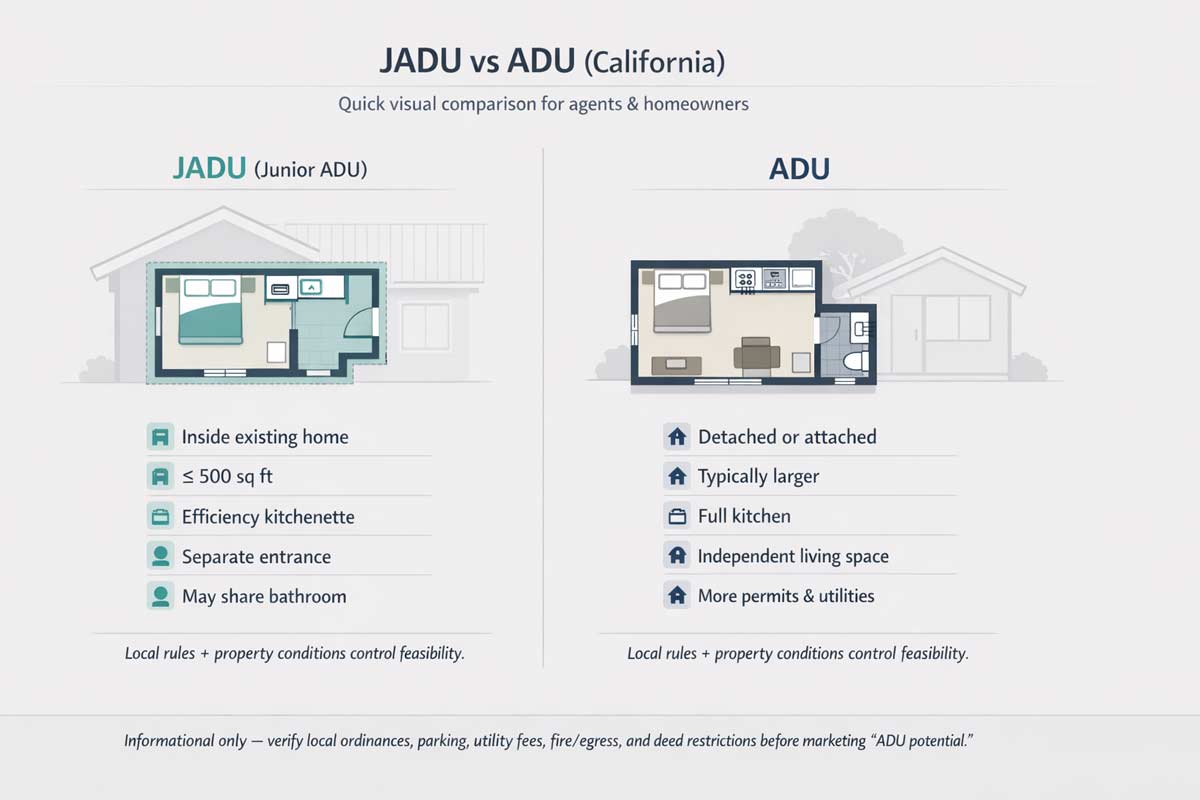

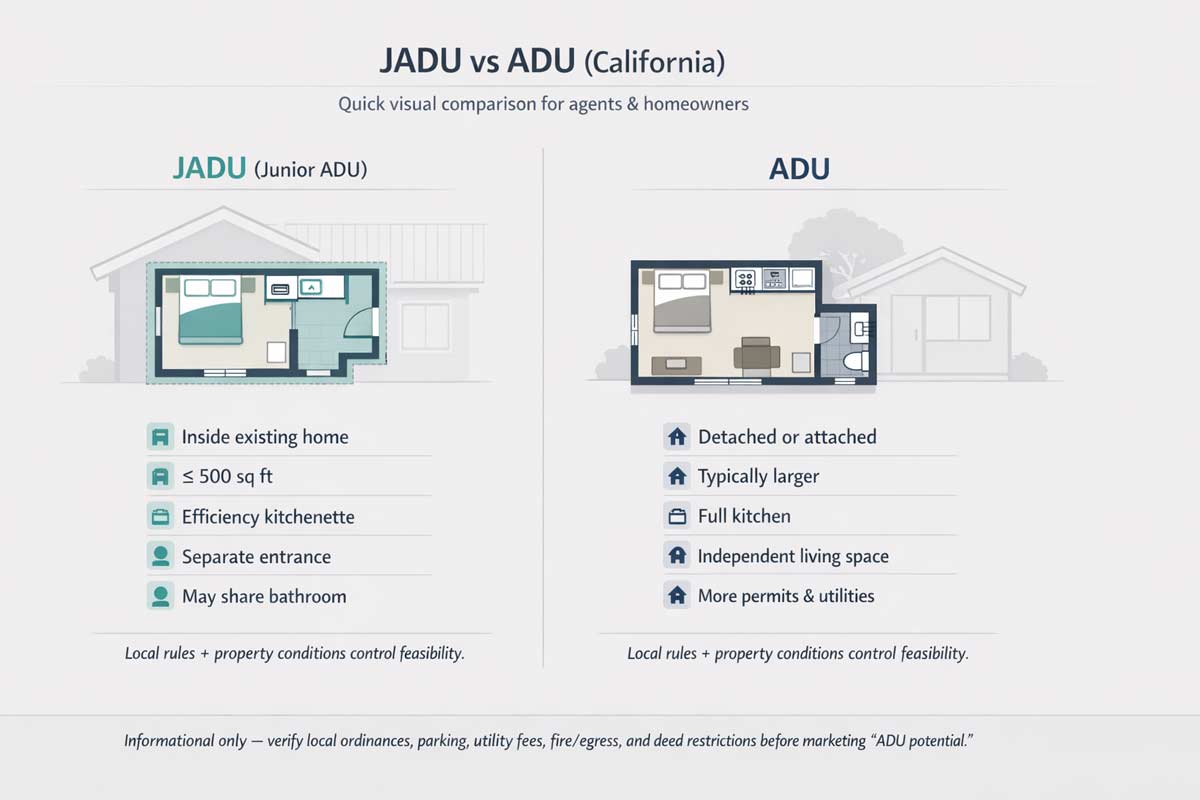

Easements are often the "make-or-break" factor when a client is looking to increase property value through density. If you want to learn a little more about exploring a lot split, refer to our breakdown of SB 9 Explained for Real Estate Agents; access and utility feasibility are the primary hurdles that can quickly derail development assumptions.

Similarly, when evaluating the addition of secondary units, California ADU Laws Explained will help you distinguish between state-mandated allowances and the real-world water or access constraints that often limit buildable space.

Environmental and Tenant Considerations

For properties in coastal or rural settings, easements often intersect with protected land. Reviewing the Environmental Regulations California Agents Should Know is essential, as these restrictions can strictly limit the grading and drainage work necessary to maintain an easement.

Finally, if you are handling a tenant-occupied property where shared utilities or access rights are in play, our Rent Control Laws in California (Agent Guide) is a vital resource for ensuring that easement maintenance doesn't inadvertently trigger a tenant dispute or a violation of local habitability ordinances.

FAQ

Q: What is a “will-serve” letter?

A: A document from a utility district confirming they have the capacity to serve a property, often under specific conditions or fees.

Q: What’s the difference between an easement and a license?

A: An easement is a general right to use land that runs with the land; a license is personal and revocable.

Q: Can I say “legal access” in marketing?

A: Only if you’ve reviewed the recorded documents (and exhibits) and the claim matches the scope and location; otherwise use “access via recorded easement—buyer to verify.”

Q: What is a “blanket easement”?

A: An easement that isn't clearly defined on a map. It can create major development limits or disputes.

Q: Can a neighbor take away an easement?

A: It is difficult if recorded, but can happen via merger or court action. Always verify with title.

Water and access issues aren’t “rural quirks”—they’re core transaction risks. For the full framework on how agents avoid misrepresentation, read the California Real Estate Laws & Compliance Guide and keep a “verify in writing” file for every listing.

|

Notice: This guide is for informational purposes only and does not constitute legal advice. California housing laws are subject to frequent legislative updates; always consult with a qualified land-use Read more...

Notice: This guide is for informational purposes only and does not constitute legal advice. California housing laws are subject to frequent legislative updates; always consult with a qualified land-use attorney, local planning department, and the applicable utility agency for property-specific feasibility.

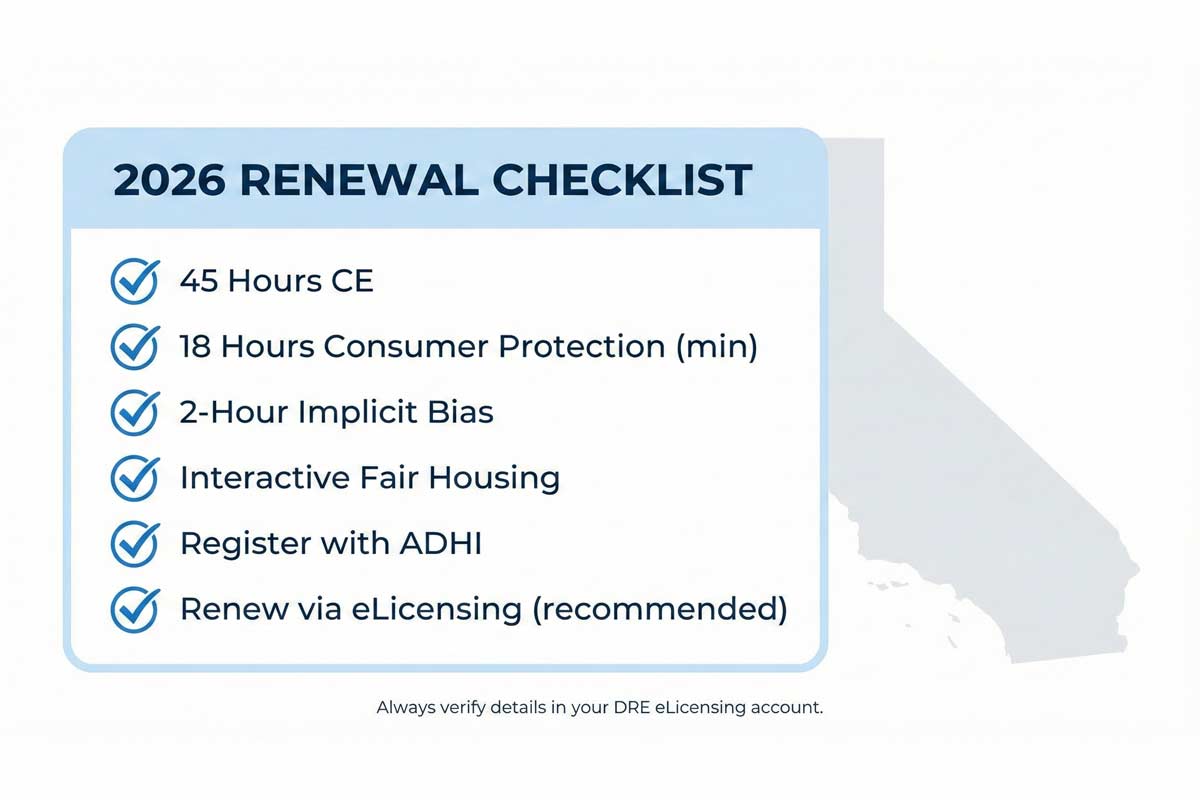

Accessory Dwelling Units (ADUs) can be a major inventory-growth lever in California — but “ADU potential” is also one of the easiest ways for an agent to create liability if it’s marketed like a guarantee. This guide is part of our California Real Estate Laws & Compliance Guide and focuses on what agents need most: the state’s ministerial (no-hearing) process and the administrative “shot clocks” designed to prevent permit stalling — plus the exact items you should verify in writing before you talk numbers.

Fast Answer: What California ADU Law Actually Does

California’s ADU framework is no longer “local preference.” It’s a state-enforced ministerial system: cities must approve ADU applications that meet objective standards, and they must process them on strict timelines.

“Ministerial” just means that there’s a checklist that has to be followed, and as long as everything on that checklist is done the approval doesn’t require a hearing. However, it’s still not a guarantee until the city confirms the application is complete and compliant.

The two clocks agents should know:

1) Completeness clock (15 business days)

Cities have a 15-business-day window to determine whether an application for an ADU is complete. If the permitting agency does not make a timely completeness determination, the application is treated as complete for timing purposes and the next clock starts.

VERIFY IN WRITING (do this every time):

Get a portal timestamp / receipt confirmation showing the submission date and time.

If submitted by email/mail, keep proof of receipt (and ask the agency to confirm the “received” date in writing).

2) Decision clock (60 days after complete)

Once an application is complete, the city generally has 60 days to approve or deny it. Missing that deadline can trigger “deemed approved” status, subject to the statutory mechanics (and tolling if the applicant requests delay).

VERIFY IN WRITING:

Ask the city (email is fine) to confirm the “complete” date that starts the 60-day clock.

If the city denies, request the full written set of correction comments (all departments) in one package — not piecemeal.

Key Considerations

1) State law sets the baseline (and limits local games)

State ADU law preempts conflicting local standards. Cities can add rules, but they must stay within the state framework and use objective standards — not subjective “we don’t like it here” discretion.

VERIFY IN WRITING:

Request the city’s current ADU ordinance + ADU handout/checklist (many cities have an “ADU packet”).

If staff cites a rule that seems to conflict with state standards, ask them to identify the code section in writing.

2) The 60-day clock is real — and denials must be “complete”

If the city denies, it must provide a full written set of correction comments describing what’s wrong and how to fix it. This is designed to prevent the “drip-feed denial” tactic.

VERIFY IN WRITING:

Please provide the complete set of correction comments from all reviewers and confirm this is the full list.

3) Parking: stop making promises; use exemptions carefully

Parking rules are often 0 spaces in common scenarios (especially conversions) but be sure to confirm local and state rules.

Parking may be capped and often waived under specific statutory exemptions (transit proximity, conversion of existing space, historic district rules, permit restrictions, etc.).

Replacement parking is often not required when converting certain existing parking structures — but don’t market that as universal without city confirmation.

VERIFY IN WRITING:

Ask planning to confirm how many parking spaces are required for the specific property and why (which exemption they’re applying).

4) Fees: impact fees ≠ utility connection/capacity charges

This is where agent marketing can get folks in hot water.

Impact fee rules can depend on ADU size thresholds and local fee programs.

Utility connection/capacity charges are a separate universe (water/sewer/power) and can still surprise owners even when impact fees don’t.

VERIFY IN WRITING:

City: “What impact fees apply for an ADU of approximately ___ sq ft?”

Utilities: “What connection/capacity charges apply and under what calculation method?”

Consider brushing up on Water Rights & Easements in California Real Estate (because easements + utility constraints are where projects can fall apart.

5) Short-Term Rentals (Airbnb): keep the warning, tighten the language

California law requires 30+ day rental terms for JADUs and for ADUs approved under the § 66323 “state standards” pathway.

For ADUs approved under a local ordinance, state law gives cities the authority to require 30+ day terms — and many jurisdictions do.

VERIFY IN WRITING:

Never market “ADU short-term rental income” unless you have the city’s short-term rental rule in writing for that parcel.

Agent Tip: To protect your commission and your client, never market “ADU short-term rental income” unless you have verified the city’s specific STR ordinance in writing.

6) Environmental overlays and recorded easements are the silent killers

Most “ADU denials” aren’t philosophical. They’re constraints: hillside grading, coastal, fire severity, biological, historic, sewer/water limitations, or recorded easements.

VERIFY IN WRITING:

Ask the city: “Are there any overlays affecting ADU placement (hillside/coastal/fire/historic/biological)?”

Confirm easements on the prelim/title report before promising anything.

Environmental Regulations California Agents Should Know

Water Rights & Easements in California Real Estate

7) The SB 9 Intersection: When ADUs Aren't Enough

If a client wants more than just an ADU, they may ask about SB 9. While ADUs add "accessory" units, SB 9 allows for primary density increases through ministerial lot splits and two-unit developments.

Summary of SB 9 (2025-2026 Updates):

The "Two-Unit" Rule: On a single-family lot, an owner can ministerially build two primary units (effectively a duplex) instead of a house + ADU.

The "Urban Lot Split": SB 9 allows a single lot to be split into two. Each new lot must be at least 1,200 sq ft.

The "Unit Cap" Trap: If a lot is split under SB 9, the city can limit the total number of units to two per new lot (inclusive of ADUs/JADUs).This means you generally cannot "stack" an SB 9 lot split with multiple ADUs to get 6 or 8 units unless the local ordinance specifically allows it.

Owner-Occupancy (The Big Catch): Unlike ADUs, an SB 9 lot split requires the owner to sign an affidavit stating they intend to occupy one of the units as their primary residence for at least three years.

VERIFY IN WRITING:

"Does this specific parcel qualify for an SB 9 lot split (check for historic districts/fire zones)?"

"If we split the lot, what is the maximum total unit count (including ADUs) allowed per parcel?"

8) The Rental Strategy Trap: Rent Control & AB 1482

This is a critical due diligence item for investors. While a single-family home (SFH) is typically exempt from statewide rent control under the Costa-Hawkins Rental Housing Act, adding an ADU can change that.

Rental strategy trap (state + local): don’t underwrite rents in your head.

If a client wants more than just an ADU, they may ask about SB 9. While ADUs add "accessory" units, under AB 1482 depending on the property type, ownership structure, and required tenant notices

VERIFY IN WRITING: Before you market “rent upside,” have the buyer/owner confirm (a) whether the property is covered by a local rent stabilization ordinance, and (b) whether AB 1482 applies or an exemption applies — preferably with a landlord-tenant attorney or written guidance from a credible local housing/rent authority.

“What to Say in Listing Remarks” (safe, punchy, defensible)

Use language like this:

Property may be eligible for an ADU (subject to city review, utility capacity, and recorded easements). Buyer to verify ADU feasibility, fees, parking, and rental restrictions with the City and utility providers.

Avoid language like:

“Guaranteed ADU”

“By-right ADU” (unless you’re prepared to prove the exact pathway + objective compliance)

“No fees”

“No parking required”

“Airbnb income”

The shift from local control to a state-mandated ADU framework has created a massive opportunity for California homeowners, but for real estate agents, it has also moved the goalposts for professional liability. Mastering ADU rules is no longer just about knowing square footage; it is about protecting your clients from expensive permitting delays and "soft" denials.

As we move through 2026, the key to a successful ADU-focused transaction is transparency. By using the "administrative shot clocks" provided by SB 543 and the streamlined pathways of AB 1154, you can help your clients navigate the process with confidence—provided you never mistake "potential" for a "guarantee."

Your Starter Checklist for Every ADU Listing:

Don't Guess on Fees: Get the city’s impact fee and the utility’s capacity charge schedules in writing.

Watch the Clock: Use timestamped receipts to hold agencies to their 15-business-day and 60-day legal windows.

Build the Professional Team: Always refer your clients to a qualified land-use attorney, a licensed architect, and a contractor to confirm site-specific feasibility.

Staying "compliance-first" is what separates top-tier agents from the rest. By facilitating the right conversations with the right experts, you protect your commission, your reputation, and your client’s investment.

|

Environmental issues are the "silent deal killers" of California real estate. A single undisclosed underground tank or a mismanaged mold complaint can trigger five-figure remediation costs and six-figure Read more...

Environmental issues are the "silent deal killers" of California real estate. A single undisclosed underground tank or a mismanaged mold complaint can trigger five-figure remediation costs and six-figure lawsuits.

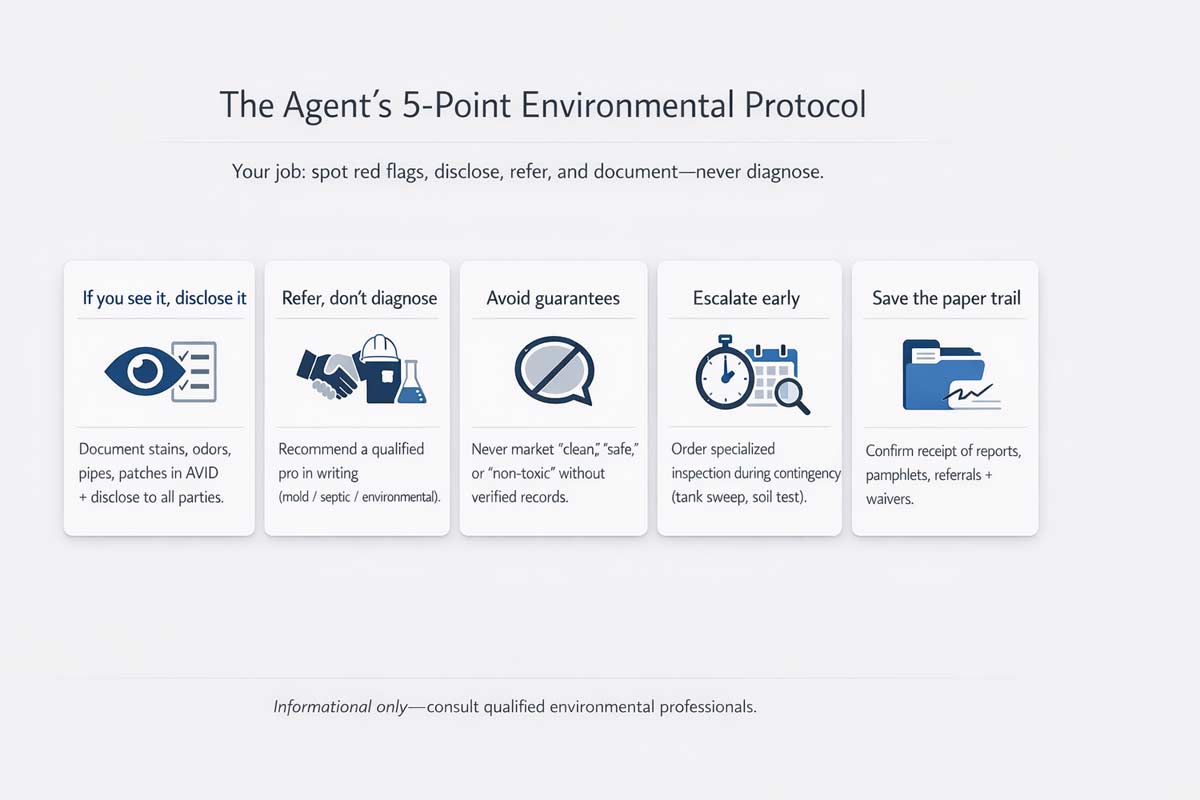

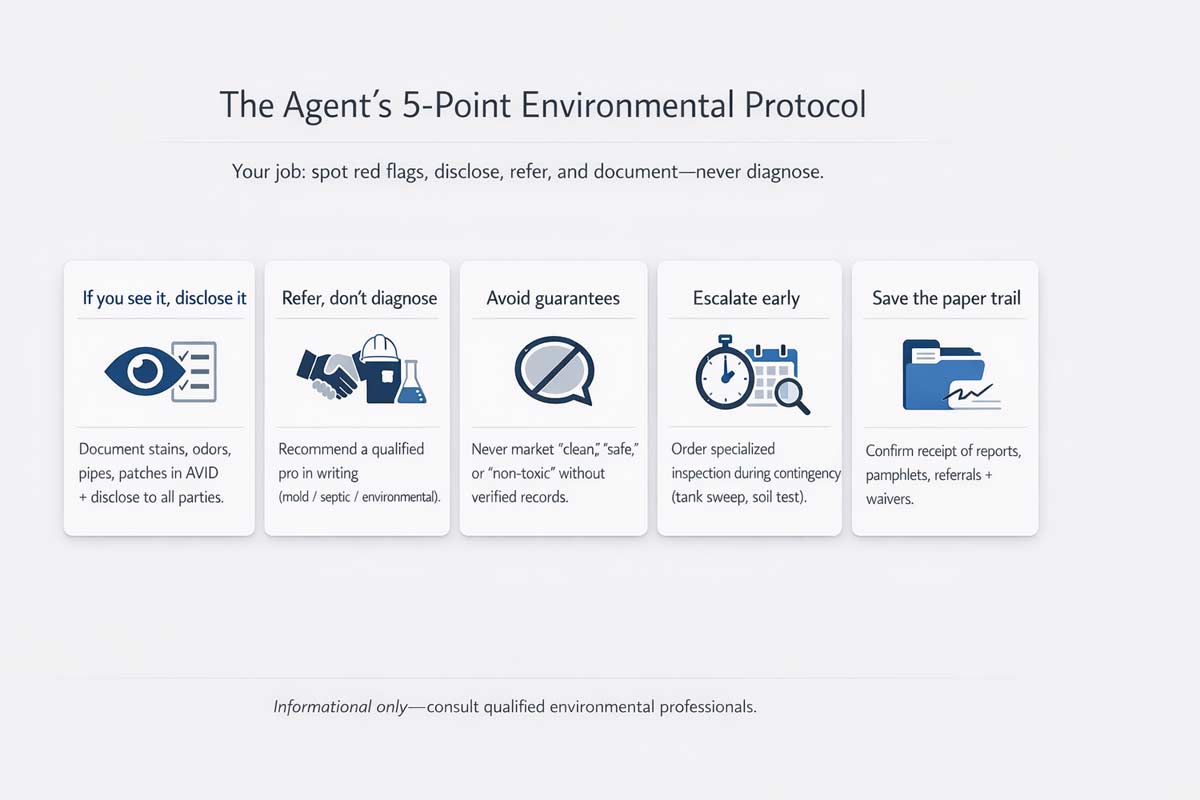

In practice, your job is to surface red flags, disclose material facts, and document referrals—not to diagnose or guarantee property conditions. This guide provides a practice-based protocol for protecting your license and your clients from environmental liability.

Disclaimer: Informational only, not legal or environmental engineering advice. Rules vary by property and local jurisdiction; consult qualified counsel and environmental professionals.

The Agent’s 5-Point Environmental Protocol

If you see it, disclose it: Document visual flags (stains, pipes, odors) in your AVID and disclose them to all parties.

Refer, don't diagnose: Never tell a client "that looks like harmless mildew." Recommend a professional (mold, septic, or environmental pro) in writing.

Avoid Guarantees: Never market a property as "clean," "safe," or "non-toxic" in MLS remarks or conversations.

Escalate Early: Recommend specialized inspections (like tank sweeps or soil tests) during the contingency period, not after.

Save the Paper Trail: 5.Obtain signed receipts for all environmental reports, pamphlets, and written recommendations and any inspection waivers.

The Agent’s "Non-Negotiables"

Problems often stem, not from the hazard itself, but from an agent’s failure to follow these rules:

Rule 1: You are not the expert. Even if you’ve seen a hundred "slurry-filled" oil tanks, do not give an opinion on the safety or cost of removal. Point it out and suggest a specialist.

Rule 2: Perform required visual diligence. Disclose observable red flags where applicable. Missing a blatant red flag can lead to a negligence claim.

Rule 3: Verify claims with records. If a seller says soil is "clean," do not market it as such until you see closure documentation or other credible third-party records (as applicable) and reference those reports in your discussions.

Rule 4: Recommend in writing—even if they decline. If a buyer waives an environmental inspection, send an email (or have them sign a document) confirming they have chosen to assume that risk against your advice.

Hazards: Red Flags

1. Mold & Moisture Intrusion

In California, mold is a primary habitability issue. For rentals, these issues often trigger complex Rent Control Laws in California (Agent Guide) disputes regarding repair timelines and tenant leverage.

Red Flags: Musty odors, water stains, bubbling paint.

Safe Script: "I noticed discoloration; I recommend a mold professional test the air quality."

What NOT to Say: "Bleach will fix it." Do not make health claims like "non-toxic."

2. Asbestos & Lead-Based Paint

In pre-1978 construction, lead based paint may be present. This is a critical consideration before discussing California ADU Laws because construction disturbs suspect materials.

Red Flags: Popcorn ceilings, linoleum, or "shingle" siding in older homes.

Safe Script: "Due to the age of the home, these materials may be present. Consult a specialist before renovating."

Recommend: Delivery of the CalEPA "Environmental Hazards" booklet and other documentation as required by law and your brokerage.

3. Underground Storage Tanks (UST) & Contamination

Red Flags: Metal pipes in the yard, circular concrete patches, or proximity to old dry cleaners.

Safe Script: "This pipe may indicate a former tank; we should recommend a search for closure records."

SB 9 Alert: Feasibility marketing is where agents get sued. Before you market the feasibility of a lot split, ensure environmental constraints don't kill the path for SB 9 Explained for Real Estate Agents.

What NOT to Say: "The tank was definitely removed correctly."

4. Private Wells & Rural Hazards

Environmental due diligence must expand to include water potability, yield, and seasonality.

Red Flags: Nearby industrial sites, agricultural runoff, or "smelly" water.

Safe Script: "Since this property uses a private well, I recommend a professional test for potability and yield."

Pro Tip: Beyond physical service, ensure you understand Water Rights & Easements in California Real Estate.

5. Septic Systems & Leach Fields

Red Flags: Lush green patches in dry weather, soggy soil, or slow drains.

Recommend: Septic inspection, records search, and pumper's report.

What NOT to Say: "It passed before" or "pumping proves it functions perfectly."

6. Former Agricultural Use & Dumping

Red Flags: Abandoned burn pits, distressed vegetation, or historical records of crop spraying.

Recommend: Soil testing by a qualified pro; consult an environmental specialist.

What NOT to Say: "It was just farmland, so it’s clean."

Regulatory Touchpoints

California environmental "regulation" for agents is primarily about disclosure mechanisms:

The NHD Mechanism: The Natural Hazard Disclosure (NHD) flags "zones" (Fire, Flood, Seismic). It does not certify property condition—it only flags state-mapped risks.

Wildfire & Build Feasibility: Treat wildfire exposure as a build-feasibility constraint, especially if your client plans an ADU.

Phase I ESA: A research report used to identify "Recognized Environmental Conditions" (RECs)—signs the property’s history may involve contamination risk.

The TDS: The Transfer Disclosure Statement is where sellers disclose known property conditions, including environmental hazards.

Marketing Language: "Bad vs. Better"

Bad Language (High Risk)

Better Language (Lower Risk)

"No environmental issues"

"Seller reports no known issues; recommend buyer inspection."

"Mold-free home"

"Professional remediation completed [Date]; see attached report."

"Safe well water"

"Water quality to be investigated by buyer during contingency."

"No tank on property"

"No known tanks disclosed; buyer to verify via records/testing."

"Clean Phase I"

"Phase I ESA available for review; buyer to perform due diligence."

Agent Due Diligence Checklist

Review NHD Early: Flag any fire, flood, or fault exposures for the buyer immediately.

Where Relevant, Check Databases: For suspected history, check databases such as GeoTracker or EnviroStor.

Document in AVID: Note all odors, stains, or nearby industrial uses.

Confirm Receipt: Document delivery of all disclosures (NHD, TDS, advisories, and booklets).

Written Referral: Recommend appropriate professional evaluation during contingency; document acceptance/decline.

Frequently Asked Questions

Does "buyer to verify" protect an agent from liability in California?

It is a standard supplement, but it does not absolve you of the duty to disclose a known red flag or material fact.

What should I do if the buyer waives inspections?

Immediately document the waiver in writing. Send an email confirming that you recommended the inspection and they have chosen to assume the risk of the unknown and have the buyer sign a waiver that they are acting against your recommendation.

Is a seller's refusal to allow testing a material fact?

A refusal to allow requested testing is a major red flag and should be communicated to the buyer immediately; ensure this communication is documented in writing.

What is the difference between Phase I and Phase II?

A Phase I is historical research (no drilling). A Phase II involves actual soil or water sampling to determine if contamination exists.

Build Your Compliance System

Environmental risk management is just one piece of a successful real estate practice. If you are building a professional compliance system, start here:

California Real Estate Laws & Compliance Guide

|

Choosing your first brokerage in California is a high-stakes decision disguised as a simple choice. Your hard-earned license is a tool, not a trophy, and its value is determined entirely by the support Read more...

Choosing your first brokerage in California is a high-stakes decision disguised as a simple choice. Your hard-earned license is a tool, not a trophy, and its value is determined entirely by the support system you choose to wield it.

You’ve passed the exam, but your license is truly tested the moment a client asks a question you can’t answer and you have nowhere to turn. In my 20+ years of experience, I’ve watched the same costly pattern repeat: agents seduced by a charismatic recruiter or a premium office, only to fail months later on a missed deadline or botched disclosure.

The fatal flaw isn’t picking the “wrong” brand—it’s choosing for atmosphere over accountability, for splits over support. This guide is your tactical framework. It replaces hope with strategy, helping you cut through the polish to find the partner that will truly protect your career and answer the phone when you’re in over your head.

The New Agent Brokerage Scorecard

Use this rubric to evaluate every office you visit. Score each category from 1 (poor) to 5 (excellent).

The Scorecard Rule:

If the average score for Training Proof, Compliance Review, and Broker Support is under 4, walk away.

If Broker Support cannot define a specific deadline-response path (how fast they answer on weekends), walk away.

If the All-in Fee Sheet isn't provided in writing, walk away.

Evaluation Rubric

Category

What to Look For

Why It Matters

Training Proof

A physical calendar showing weekly live contract drills and roleplay.

"We have training" is a platitude. You need to see the schedule.

All-In Fee Sheet

Get splits/caps/fees in writing. (Commission Splits Explained for New Agents)

If it isn't in writing, it will be "misremembered" later.

Broker Support

A documented response path for after-hours / deadline questions.

You need a manager with a defined response time when a deal is on the line.

TC Process

A dedicated Transaction Coordinator and a file-review checklist.

CA disclosures are paperwork-heavy; you need a professional safety net.

Mentor Structure

Minimum commitments: Weekly

You want a mentor with specific,

Required Tools

Who pays for the CRM, doc-sign software, and website?

Some brokerages hide "tech bundles" in your monthly fees.

Compliance Review

Does a broker review your RPA before it goes to a client?

This prevents expensive legal mistakes before they happen.

Lead

Distribution rules, contact rates,

Avoid vague promises of "leads"

Generation

and the specific cost (split/fee).

without a defined system.

Exit Terms

Who owns team-provided leads? What are the non-solicit terms?

Some agreements restrict your ability to work your database if you leave.

E&O Insurance

A summary of coverage, deductible responsibility, and who pays.

New agents are often blindsided by deductible costs ($1k–$5k) after a mistake.

The "No-Go" Dealbreakers

Can't provide an all-in fee sheet: Hidden costs are a leading cause of first-year "quit" rates.

No broker review process: If no one audits your contracts, you are flying blind with your license on the line.

No training calendar: If they "can't show it right now," the training is unproven and likely inconsistent.

No after-hours support path: Real estate doesn't happen 9-to-5; you need a documented path for weekend deadlines.

The "Closed-Door" Policy: They won’t let you speak to 1–2 agents who joined in the last 12 months.

The Proof Pack (Ask for these in writing)

Full Fee Sheet (E&O, desk fees, franchise fees, deductibles)

Current month's onboarding/training calendar

Example Transaction Checklist / File Review Rubric

Written Mentor Structure (Frequency, responsibilities, and who covers the deal desk)

Copy of the Independent Contractor Agreement (ICA)

The Core: Brokerage Models (Choosing Your Fit)

The right choice depends on your learning style. Verify these details locally and do not rely on a national logo.

1. Training-First Model (The Classroom)

Best for: Career-changers who thrive in a structured environment and want a clear, step-by-step playbook.

The Trade-Off: You’re paying a higher split to buy speed-to-competence.

Verify This: Show me last month’s training recordings or the specific agenda for contract drills.

Failure Mode: If you skip the "reps," you will freeze in front of your first client.

2. Team-Centric Model (The Appointment Engine)

Best for: You want appointments now and accept a lower net commission to buy "reps" and experience.

The Trade-Off: You’re "renting" leads; you’ll pay for them forever unless you build your own pipeline.

Verify This: Show lead distribution rules, minimum activity requirements, and the team agreement. Need more context? I wrote a guide on whether you Should You Join a Team or Go Solo.

3. Boutique/Community Model (The Culture)

Best for: You value direct access to the owner and a localized, non-corporate vibe.

The Trade-Off: You’ll either become self-sufficient fast or you will drift.

Verify This: Show the file-audit checklist and the broker review cadence.

Failure Mode: If you require rigid structure to stay productive, you will likely stall here.

4. Fee-Based / Self-Directed Model (The High Margin)

Best for: You already have an existing pipeline or network and just need a place to "hang" your license.

The Trade-Off: Minimal hands-on supervision and zero provided training.

Verify This: Show support portal response standards and identify exactly who answers legal/compliance questions.

Failure Mode: This model is brutal without an existing pipeline; you will likely stall before your first closing.

5. Outbound Team (The Dialer)

Best for: You can commit to 2–4 hours a day of outbound calling and have a high tolerance for rejection.

The Trade-Off: High burnout risk and very low splits on team-provided leads.

Verify This: Show contact rate expectations and the script coaching cadence.

6. Traditional Full-Service Office (The Hybrid)

Best for: You want a mix of a brand name and on-site resources like transaction coordinators.

The Trade-Off: Mid-range splits; can often feel "sink-or-swim" if the manager is checked out.

Verify This: Show me the actual resources—TC availability, deal desk schedule, and broker-to-agent ratio.

Money Reality Check: The Math of Support

Don't be blinded by a split percentage. Consider this comparison for your first 6–9 months:

Scenario

Example A(High Split / Low Support)

Example B(Lower Split / High Support)

Training/Leads

None (Self-taught)

Intensive Coaching + Mentor

Production (6–9 mo)

0 Deals (Struggled to launch)

2 Deals (at an ~$800k price point)

Gross Commission (GCI)

$0

$40,000

Agent Net (Pre-Tax)

$0

$20,000

Note: Example only—commission rates and splits vary by market, brokerage, and side. Assumes 2.5% commission on a single side before broker fees, team splits, MLS dues, and taxes. The point remains: 2 deals at a lower split beats 0 deals at a high split.

Beginner Traps to Avoid

Paperwork Avoidance: Joining a model that doesn't force you to learn the RPA and disclosures. You cannot "out-sell" a lack of legal competence.

Recruitment Theater: Big promises during the interview but zero calendars, checklists, or accountability once you sign.

The "Invisible" Training: Accepting "we have online videos" as a substitute for live contract training.

Exit Term Surprises: Some team agreements claim ownership over team-provided leads and restrict solicitation. Red Flags When Choosing Your First Brokerage covers this in depth.

California-Specific Context: Compliance is Protection

California’s regulatory environment is demanding. Disclosures like the TDS, SPQ, and AVID are time-sensitive and legally heavy. For most new agents, joining an office without a documented file-audit process is gambling with your license.

Ask This: "Do you perform live RPA clause-by-clause drills and disclosure timeline walkthroughs?"

Ask This: "Who reviews my first 3 contracts before they go out to ensure I don't miss a disclosure deadline?"

The 60-Minute Decision Path

Self-Diagnose: Pick your top 2 needs (e.g., Appointments now vs. Paperwork Training).

Shortlist: Pick three local offices that represent different models.

Interview with a Weapon: Bring the Scorecard. Before you go, read How to Interview a Brokerage as a New Agent.

The Proof Pack: Do not leave without a fee sheet and training calendar.

Your first brokerage is a launchpad, not your final destination. Choose for speed-to-competence today; optimize splits later.

Ready to take the first step?

Start a Real Estate Career in California

FAQ SECTION

Q: Is a 100% commission brokerage good for new agents?

A: Only if you already have a solid lead pipeline and a documented plan for contract support. Without infrastructure, most rookies fail before their first deal.

Q: What should my broker’s response time be?

A: You should expect a response on the same day, and significantly faster during active contingency deadlines.

Q: Should I join a team my first year?

A: If you need a check quickly, a team accelerates the process. However, be aware of the long-term cost and the exit terms regarding lead ownership.

Q: How do I verify training is real?

A: Ask to see the calendar for the current month. If they can't show it, treat it as unproven and likely inconsistent.

TL;DR

Verify Training Proof: "We have training" is a placeholder until you see a live calendar with contract drills and roleplay.

Manager Availability (SLA): Your first crisis won't happen during office hours. You need a documented response path for deadlines.

All-In Cost Sheet: Get every desk, tech, insurance, and franchise fee in writing. If it isn't on the sheet, it doesn't exist.

Skill > Splits: A 100% split of zero is still zero. Prioritize speed-to-competence over high margins for your first 12 months.

|

When people walk into my office or call ADHI Schools for the first time, they often wonder the same thing: “Am I actually cut out for this?”

They’re usually picturing a "high-gloss" TV agent with Read more...

When people walk into my office or call ADHI Schools for the first time, they often wonder the same thing: “Am I actually cut out for this?”

They’re usually picturing a "high-gloss" TV agent with infinite charisma and a Rolodex of celebrities. If that doesn't feel like them, they worry they’ll fail. Having coached thousands of students through the licensing process, I can tell you the truth:

You don’t need the perfect personality—you need the right operating system.

The winners in our industry aren't necessarily the loudest people in the room; they are the most consistent, ethical, and system-driven. Before you decide whether or not you should become a real estate agent in California, you need to evaluate your willingness to build these 12 traits.

Helpful Tendencies vs. Trainable Traits

There is a difference between a personality tendency (like being an extrovert) and a professional trait (like being tenacious). A tendency might make the first five minutes of a conversation easier, but a trait ensures you actually follow up six months later when the client is finally ready to buy.

In California’s high-stakes real estate market, we view success as a set of behaviors you can practice until they become your default "Operating System." To evaluate your fit, look at these 12 traits through this three-part lens:

The Behavior: What it looks like in a real California transaction.

The Cost: What happens to your business if this trait is missing.

The Practice: One specific system you can use to build this trait.

The Professional Operating System: 12 Traits of Top Agents

1. Integrity & Ethical Backbone

The Behavior: You find an old, unpermitted water heater in a San Bernardino bungalow. You immediately ensure it is disclosed to the buyer, even if it complicates the closing.

The Cost: The NAR “2025 Profile of Home Buyers and Sellers” reports that having an agent with integrity was rated “very important”. Without this, you lose the only asset that matters: your reputation.

The Practice: Adopt a "Full Disclosure" checklist. If you wonder, ”Should I mention this?””— the answer is always yes.

2. Process Tenacity

The Behavior: Keeping your lead-generation systems running on a Tuesday morning even when your pipeline feels empty and you’ve had three "no's" in a row.

The Cost: The "Rollercoaster Income" trap—one big check followed by four months of zero.

The Practice: Use a "Power Hour" script. Focus on the activity (making 10 calls), not the outcome.

3. Coachability & Learning Velocity

The Behavior: After losing a listing presentation in Irvine, you ask your broker for a critique of your pitch and actually implement their changes for the next one.

The Cost: Stagnation. The California market shifts monthly; if you can't adapt, you get left behind.

The Practice: Schedule a 15-minute "Win/Loss" review with a mentor after every major client interaction.

4. Consistency & Habit Discipline

The Behavior: Never ending your workday until every lead from an open house is entered into your CRM with a scheduled "Next Action" date.

The Cost: "Lead Leakage." You spend money to find clients and then lose them because you simply forgot to call.

The Practice: Create a "CRM Sunset Ritual"—15 minutes at the end of every day dedicated solely to data integrity.

5. Empathy & Client Translation

The Behavior: A first-time buyer is paralyzed by a 50-page inspection report. You don't tell them "it's fine"; you translate the jargon into a simple "Safety vs. Cosmetic" summary.

The Cost: High-stress "escrow fallout" caused by client panic.

The Practice: Use an "Onboarding Discovery Form" to ask clients "What is the one part of this process that scares you the most?"

6. Calm Under Pressure

The Behavior: When an appraisal comes in low three days before the contingency removal, you remain the "calmest person in the room" while presenting logical paths forward.

The Cost: Emotional contagion. If you panic, the client panics, and the deal dies.

The Practice: Tell the truth and never deliver bad news without having researched at least two potential solutions first.

7. Initiative & Resourcefulness

The Behavior: A client needs a structural engineer on a Saturday. Instead of saying "I'll look into it Monday," you have a pre-vetted contact ready to call immediately.

The Cost: You become a "middleman" rather than a "problem solver."

The Practice: Build a "Vendor Rolodex" in your phone—5 pros for every major trade (plumbing, roofing, legal, etc.).

8. Communication Clarity

The Behavior: After every phone call where a decision is made, you send a "As Discussed" email summarizing the points and next steps.

The Cost: "He-said, she-said" legal disputes that end up in front of a grievance committee.

The Practice: Set a template in your email called "Post-Call Summary" to send immediately after hanging up.

9. Time Management & Self-Direction

The Behavior: Treating your real estate business like a job with a start and end time, even though no one is "making" you show up. This is especially vital if you’re considering starting real estate part-time in CA.

The Cost: You spend all day "working" (scrolling social media) without ever doing revenue-generating activities.

The Practice: The "Calendar is Law" rule. If a task isn't time-blocked, it doesn't exist.

10. Tech-Adaptability

The Behavior: Rapidly adopting AI tools for property descriptions or digital transaction management software to keep files "audit-ready" at all times.

The Cost: Inefficiency. You end up spending 10 hours on a task that a tech-savvy agent finishes in 10 minutes.

The Practice: Spend 1 hour a week in a "Sandbox Session" testing one new PropTech tool.

11. Confidence Without Ego

The Behavior: Spending 20 minutes every morning looking at the "New Listings" and "Sold" data in your specific farm area just to see how the market is breathing.

The Cost: Giving stale, generic advice that doesn't help your clients win in a multiple-offer scenario.

The Practice: Subscribe to local city council newsletters to hear about zoning changes before they hit the news.

12. Curiosity

The Behavior: Spending 20 minutes every morning looking at the "New Listings" and "Sold" data in your specific farm area just to see how the market is breathing.

The Cost: Giving stale, generic advice that doesn't help your clients win in a multiple-offer scenario.

The Practice: Subscribe to local city council newsletters to hear about zoning changes before they hit the news.

The Trait → System Mapping Table

Trait

What the Client Experiences

The System/Tool

First Step Today

1. Integrity

Peace of mind and total trust

Disclosure Checklist

Download a standard TDS form and review it with your manager

2. Tenacity

A proactive, tireless advocate

Prospecting Calendar

Block 9 AM – 10 AM for calls

3. Coachability

Faster results, better advice

Win/Loss Debrief

Book 15 mins with your broker

4. Consistency

Reliable follow-through

CRM Sunset Ritual

Log 100% of today’s contacts

5. Empathy

Feeling heard and protected

Onboarding Form

Add "What scares you?" to intake

6. Calm

Stability during escrow stress

24-Hour Solution Rule

Research 2 fixes before calling

7. Initiative

Rapid problem solving

Vendor Rolodex

Add 5 local pros to your contacts

8. Clarity

Professionalism and certainty

Post-Call Summary

Add "What scares you?" to intake

9. Time Mgmt

An agent who is always "on"

Time-Blocking

Move "To-Do" items to a calendar

10. Tech

Modern, efficient service

Monthly Tech Sandbox

Master one CRM automation

11. Confidence

Firm, data-driven guidance

Evidence-Based Scripts

Use market stats in your next chat

12. Curiosity

Cutting-edge local expertise

Daily Hot Sheet Review

Check local "Solds" for 15 mins

Self-Assessment: Do you have the profile?

Rate yourself on a scale of 1 (Not me yet) to 5 (This is a core strength) for the following:

I can follow a self‑imposed schedule without a boss watching. 1 2 3 4 5

I am comfortable delivering news that people might not want to hear. 1 2 3 4 5

I enjoy solving puzzles that involve multiple people and deadlines. 1 2 3 4 5

I document my conversations as a matter of habit. 1 2 3 4 5

I can keep my cool when other people are emotional. 1 2 3 4 5

I view "prospecting" as a service, not a nuisance. 1 2 3 4 5

I prioritize the client's long-term protection over my quick commission. 1 2 3 4 5

I am tech-literate and enjoy learning new software. 1 2 3 4 5

I view "No" as a request for more information, not a personal rejection. 1 2 3 4 5

I am naturally curious about the local housing market and stats. 1 2 3 4 5

I am proactive about disclosing potential problems immediately. 1 2 3 4 5

I can explain complex legal or financial ideas in simple terms. 1 2 3 4 5

Scoring Your Fit:

50–60: Strong Fit. You have a high "Success OS" already installed.

35–49: Fit With Systems. You have the foundation, but you need to rely on tools to avoid "habit drift."

Below 35: Proceed Carefully. You may find the lack of structure in real estate exhausting unless you commit to a major shift in how you work.

The Hard Truth: Necessary but not Sufficient

You can have the greatest personality in the world, but it won't pay your mortgage in the first few months. One of the biggest trust-builders I can offer you is the unvarnished truth: even with these traits, you will face a "ramp time."

To calibrate expectations, see How Much Do New Real Estate Agents Make in California?.Then map your runway with How Long Does It Take to Start a Real Estate Career?

Understanding that timeline is part of the "Confidence Without Ego" trait—knowing that you need a financial runway to match your professional ambition.

Not a Fit (Yet)?

If you currently struggle with avoiding follow-up because you’re afraid of being "pushy," or if you find yourself cutting corners on documentation to save time, you are in a high-risk zone for failure.

The fix: Stop viewing these as personality flaws and start viewing them as "software bugs." Install a CRM that forces the follow-up and find a broker who demands the documentation.

FAQs

Can introverts be top agents?

Yes. In fact, introverts often out-perform extroverts because they tend to be better listeners and more diligent with their "As Discussed" documentation.

What if I hate cold calling?

You don't have to cold call, but you must have a system for finding business. Whether it’s through your "Vendor Rolodex," social media, or geographic farming, you need a tenacity for the process.

What if I’m doing this part-time?

Part-time agents can succeed, but they must be "Full-Time Professionals." Your systems for time management and communication clarity must be twice as good as a full-timer's.

Do you need to be “salesy”?

No. In California, clients want an advisor and a project manager. Being "salesy" often creates a lack of trust.

What’s the #1 trait clients care about most?

Integrity. It’s the trait clients feel immediately—and the one they punish fastest when it’s missing.

What’s the #1 trait you can build fastest?

Communication Clarity. You can start sending "As Discussed" emails today in your current job or personal life.

What trait causes most new agents to quit?

A lack of Process Tenacity. They quit when they realize that "waiting for the phone to ring" isn't a business strategy.

Choose Your Next Step

If you've read through these traits and feel that "insider spark," it’s time to move from assessment to action. If you’re ready to move from "thinking" to "doing," start here: Start a Real Estate Career in California.

Whether you are worried about money, the timeline, or balancing a current job, we are here to help you move past the anxiety and into a plan. Contact ADHI Schools today to speak with a mentor.

|

If you choose your first brokerage based on the commission split alone, you will lose money—probably a lot of it.

I have spent over 20 years watching new agents walk into a recruiter’s office, see Read more...

If you choose your first brokerage based on the commission split alone, you will lose money—probably a lot of it.

I have spent over 20 years watching new agents walk into a recruiter’s office, see a “90/10” split on a whiteboard, and start spending the money in their heads. Then reality hits. The "Smiling Recruiter" forgot to mention the $500 monthly desk fee, the transaction fees, and the fact that there is zero training to help you actually get a contract signed.

As you Start a Real Estate Career in California, your biggest risk isn't a low split; it's a high split that comes with no support, leaving you with 100% of zero.

TL;DR: The Bottom Line

Effective Split > Nominal Split: The "90/10" on the wall isn't what you take home.

Year 1 is Flight School: You are paying for supervision so you don't lose your license.

Fees are the "Silent Killer": Desk, franchise, and tech fees can eat 20% of your check before you see it.

Negotiability: By law, commissions and splits are negotiable; there is no "standard" rate.

The Goal: Choose the brokerage that gives you the highest probability of closing beyond Deal #1.

Decode the Pitch: The Real Vocabulary

To make a smart decision, you must stop using recruiter jargon and start using mine.

Gross Commission Income (GCI): This is the total pie. If you sell a $1.2M home at a 2.5% commission, the GCI is $30,000.

The Split: The first slice. If you are on a 70/30 split, the broker takes $9,000 and your "Initial Share" is $21,000.

Off-The-Top: Off the top fees are brokerage expenses deducted from a realtor's commission before they receive their share of the split.

Fees: The silent nibblers. They eat your slice from the edges after the split is taken.

Effective Split (The King Metric): The net percentage of the GCI that actually hits your bank account.

Kartik’s Rule of Thumb: The Effective Split Formula

To find the truth, use this calculation. "Your Share" is the dollar amount the broker hands you after their split but before they subtract desk fees, insurance, or transaction costs.

Takeaway: A "90% split" often results in a 65% effective split once the monthly "rent" is paid.

The Five Models: Who Are They Really For?

Model

The Pitch

The Reality

Choose This ONLY If...

The Apprenticeship

"We'll teach you everything."

50/50 or 60/40. High support.

You need a mentor to review every file.

The Ladder

"Earn more as you grow."

Graduated splits (e.g., 60% to 80% as you grow).

You have a clear 12-month lead-gen plan.

The Illusion

"Keep 100% of the cash."

You are a tenant, not a partner.

You have a massive, proven database.

The Gauntlet

"Cap your fees, then keep it all."

High pressure to hit the "cap" fast.

You have cash reserves.

The Safety Net

"We pay you a base salary."

Rare; heavy oversight/shackles.

You value stability over high upside.

Takeaway: Match the model to your current skill level, not your future ego.

The Fee Menu: What They Charge You For

I once reviewed a contract for a student who was promised an 80/20 split. After we calculated the "menu" below, their effective split was 52%. They walked away. Here is how those fees are usually grouped:

"The Rent" (Desk Fees): Monthly fees ranging from $50 to $1,000+.

Kartik’s Note: Paying over $200/month for a desk without a documented, daily training schedule is a major red flag when choosing a brokerage.

Errors & Omissions (E&O): Professional liability insurance. Some brokers charge this annually; others charge a flat fee per transaction.

"The Franchise Tax": Typically 5%–8%. As mentioned above, this may be deducted "off the top" before the split or calculated into your specific fee schedule.

Compliance/Risk Management Fee: A per-file fee charged for the broker's staff to review your disclosures and contracts for legal errors.

The Partnership Tax: If you join a team, expect them to also take a cut. See Should You Join a Team or Go Solo? for the math.

The War Game Scenarios

Scenario 1: The "High Split" vs. The Traditional Partner

Assumption: A $1M sale at 2.5% ($25,000 GCI).

Metric

85/15 "Cloud/Boutique"

60/40 Traditional

Initial Share

$21,250

$15,000

Monthly Desk Fee

–$500

$0

Franchise/Admin Fee

–$1,500

$0

Transaction Fee

–$500

–$250

NET TO AGENT

$18,750

$14,750

Effective Split

75%

59%

Support Provided

Software login + FAQ

Structured coaching & contract review

The Logic: If the 60/40 model provides the systems that help you close one deal a month, while the 85/15 model leaves you to figure out lead-gen alone (leading to zero deals), the "lower" split is more profitable over time.

Scenario 2: The Cap Crusher (The Cash Flow Trap)

An agent joins a "Cap" brokerage with a $20,000 annual cap and $800/month in fixed fees.

The Math: If that agent goes 6 months without a deal, they have spent $4,800 out of pocket.

The Risk: Most new agents quit by month 7. The "Cap" only benefits you if you have the volume to hit it. For a rookie, a no-monthly-fee 50/50 split is safer than a "100%" model that drains your savings while you're learning.

Scenario 3: The Team Tango (The Double Split)

You join a team on an 80/20 brokerage split. The team takes a 50% split for providing the lead.

GCI: $10,000.

Brokerage takes 20%: $8,000 left.

Team takes 50%: $4,000 left.

Effective Split: 40%. Is this lead worth 60% of the commission? If they handle the TC, lead gen and the marketing, it often is.

Audit Checklist: Offer A vs. Offer B

Before signing, put both offers side-by-side:

Item to Audit

Brokerage A

Brokerage B

Nominal Split %

Monthly Fixed Costs ($)

Per-Transaction Fees ($)

Off-the-top Franchise %

Who pays for the CRM?

Documented Weekly Training?

The Interview Playbook: Scripts for the Audit

Don't ask "what is the split?" That's a rookie question. Use these scripts from our guide on How to Interview a Brokerage as a New Agent:

"Can you provide a written, all-in fee schedule and walk me through the net income on a $1.25M sale?"

"What is your documented process for a new agent to get an offer reviewed under time pressure on a Sunday night?"

"If I use a company-provided lead, what is the total effective split after referral fees are deducted?"

The Verdict: What a New Agent MUST Do (Year 1)

For 19 out of 20 new agents, the Apprenticeship/Traditional model is the only logical choice.

I’ve seen too many agents go for a 100% split only to miss a critical disclosure contingency because no one was available to review their file on a weekend. That "saved" commission disappears the moment you're hit with a legal claim.

Year one is about risk mitigation. You need a broker who is financially incentivized to make sure you don't crash. Once you've closed three deals, you have the leverage to look at the Best Brokerages for New Agents in California that offer higher splits for producers.

Takeaway: Buy the education in Year 1 so you can own the market in Year 5.

FAQ: The Blunt Truth

1. Can I negotiate my split?

Yes, but as a new agent, your leverage is low. Focus on negotiating for better tools or waived initial fees rather than the split.

2. What is a "Cap"?

A ceiling on what the broker takes. After you pay them a set amount (e.g., $20k), you keep 100% for the rest of the anniversary year.

3. What is a typical split for a new agent in CA?

Usually between 50/50 and 70/30. Anything higher often indicates a lack of provided leads or support.

4. Is 100% commission ever worth it?

Only if you are a "business in a box" with your own systems, leads, and staff. For a rookie, it's a liability.

5. Do teams take another split?

Yes. Team splits are separate from and usually in addition to brokerage splits.

6. What fees are "normal" in California?

A transaction fee ($250-$500) and E&O insurance are standard. Watch out for hidden "marketing" or "admin" fees.

7. What if the brokerage provides the leads?

Expect a referral fee (25-40%) to be taken before the split is calculated.

8. What is a transaction fee vs. a TC fee?

Transaction fees go to the broker. TC (Transaction Coordinator) fees go to the professional who manages your escrow paperwork.

9. How do splits work on leases?

Often a flat fee or a much higher split (e.g., 50/50) because the dollar amounts are lower.

10. Should I join a high-split brokerage if I'm part-time?

No. Part-time agents need more supervision because they aren't in the office daily to catch changes in law or contracts.

11. Does the split change if I represent the buyer vs. the seller?

Usually no, but check your independent contractor agreement.

12. How do I avoid Red Flags When Choosing Your First Brokerage?

If they talk about the "split" for 30 minutes but can't show you a training calendar, walk out.

The Call to Arms

Your goal is not to find the perfect split. Your goal is to find the first broker who will turn you from a liability into an asset.

The commission split is just one piece of your launch plan. To build your complete, step-by-step career blueprint and avoid the "learning tax" most rookies pay, start here:Start a Real Estate Career in California.

|

California doesn’t expect agents to be engineers, contractors, or city planners—but it does expect licensees to communicate accurately and avoid passing off assumptions as facts. The goal of this guide Read more...

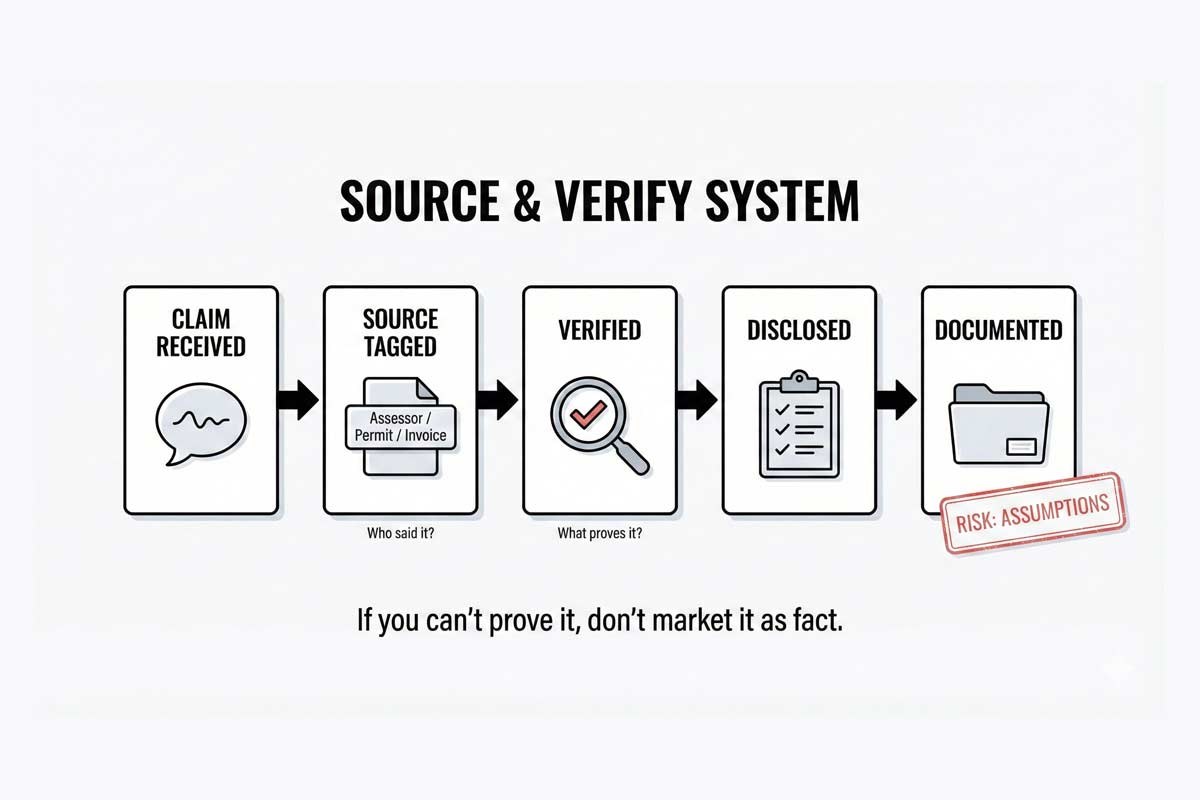

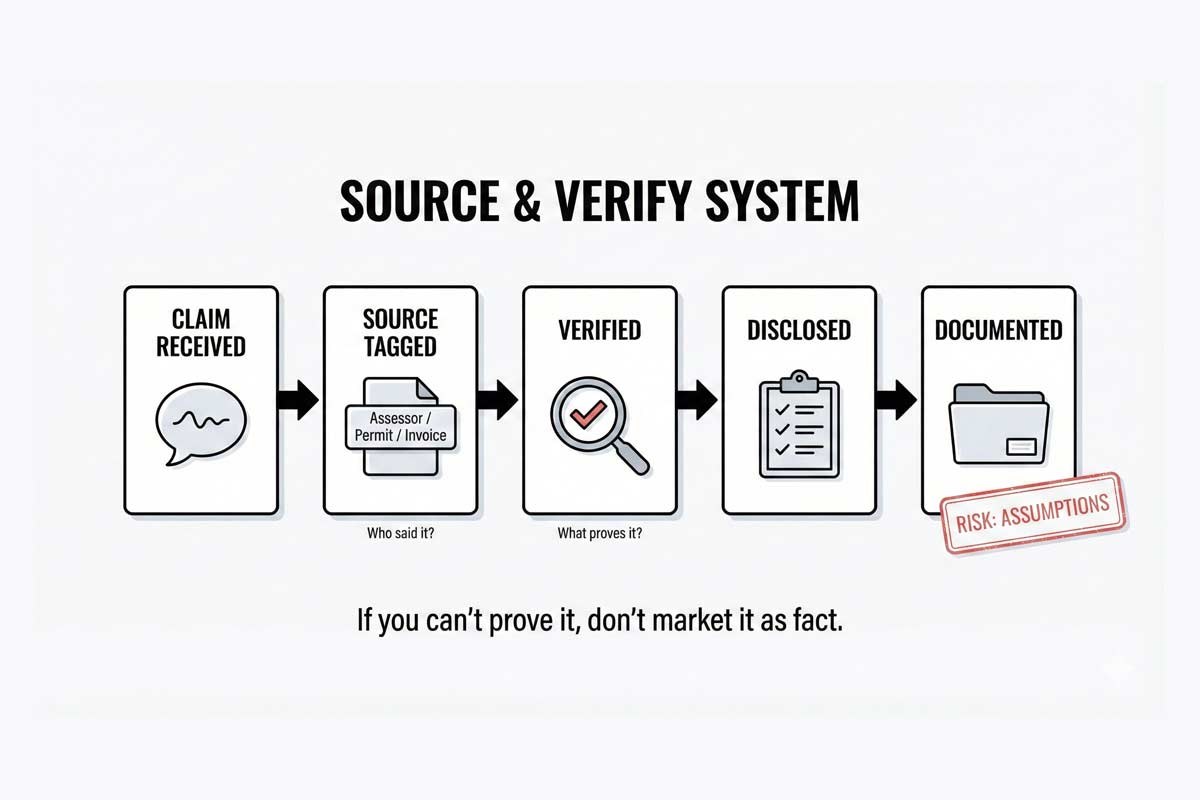

California doesn’t expect agents to be engineers, contractors, or city planners—but it does expect licensees to communicate accurately and avoid passing off assumptions as facts. The goal of this guide is simple: help you build a repeatable “source → verify → disclose → document” workflow so your MLS remarks, emails, and conversations stay clean and defensible.

Many agents assume lawsuits happen to “bad” people—scammers or fraudsters. But in California real estate, a significant portion of DRE discipline and civil litigation stems from negligent misrepresentation. It’s not that the agent lied on purpose; it’s that they repeated a seller’s claim without verifying it, or they made a casual assumption that turned out to be wrong.

If you want a long career, you must shift your mindset from salesperson to fact-checker.

What “misrepresentation” actually means

In plain English, misrepresentation is a false statement of fact that induces a party to enter into a contract. It isn’t just lying; it’s providing incorrect information that a buyer relies on.

While the definition seems simple, the application is complex because California holds licensees to a higher standard than the general public. That higher standard is the foundation of our California Real Estate Laws & Compliance Guide, and it’s why misrepresentation typically falls into three practical buckets:

1) Intentional misrepresentation (fraud)

This occurs when an agent actively hides a defect or lies about a feature.

Example: "You know the roof leaks, but you paint over the water stains and tell the buyer, 'The roof is in perfect condition.'"

Result: This is considered a career-ending category involving major civil exposure, severe discipline risk, and potentially punitive consequences.

2) Negligent misrepresentation (the danger zone)

This is where most agents get into trouble. It happens when you make a statement you believe is true, but you had no reasonable basis for believing it—usually because you didn’t verify it.

Example: The seller tells you the square footage is 2,500. You put 2,500 in the MLS without checking the source. It turns out to be 2,100.

Result: You’re exposed because you’re expected to treat material facts like verifiable facts, not casual conversation.

3) Innocent misrepresentation

This occurs when an agent makes a false statement that they had reasonable grounds to believe was true.

Example: You rely on a formal report from a licensed surveyor that later turns out to contain an error.

Result: Even without bad intent, deals can unwind and disputes can still happen.

The “material fact” rule

California operates under a strict disclosure standard. A material fact is anything that would affect the value of the property or a buyer’s decision to purchase it. If you are debating whether something is material, it almost certainly is.

The 10 most common misrepresentation traps in California

These are the scenarios where agents unknowingly drift into misrepresentation.

1) “Remodeled with permits”

The trap: The seller says, “We added that master bath with permits.” You list it as “Permitted Master Bath.”

The reality: The seller assumed their contractor pulled permits—but they didn’t.

The fix: Never claim permits exist unless you have seen the final permit sign-off or confirmed city records. Use language like “Buyer to verify all permits.”

2) Square footage & lot size

The trap: Copying the square footage from a prior MLS listing or trusting the owner’s estimate.

The fix: Always cite the source (“Per Assessor,” “Per Appraiser,” “Per Builder”). If there’s a discrepancy between records and the physical home, flag it immediately.

3) “The roof is new”

The trap: The seller says the roof is 5 years old. You market it as “Newer Roof.”

The fix: Avoid acting like a general contractor. State the age only if it’s documented, or treat it as a seller statement and recommend inspection.

4) Zoning and ADU potential

With the ADU boom, agents are eager to advertise “ADU Potential.”

The trap: Telling a buyer, “You can definitely build a back house here.”

The fix: Zoning is complex (setbacks, easements, utilities, overlays). Defer to the city: “Buyer to investigate feasibility with the city.”

5) Nuisances and stigmas

The trap: Failing to mention the loud plant that operates at night or an ongoing neighbor dispute over the fence line.

The fix: If a nuisance affects enjoyment or decision-making, it’s material. Hiding it conflicts with Ethical Duties Under the California Business & Professions Code, where honesty and fair dealing are not optional just because the deal is fragile.

6) Multiple offer pressure

The trap: Telling a buyer’s agent, “We have an offer higher than yours,” when you don’t—just to drive up price.

The fix: Communicate what’s true and only what’s true, especially in hot markets where buyers are already stressed—this is exactly why disciplined conduct matters in Handling Multiple Offers Ethically.

7) Marketing hyperbole vs. fact

The trap: “Walking distance to the beach” (it’s 3 miles) or “quiet street” (it’s a cut-through).

The fix: Let photos and maps do the persuasion. Subjective phrases can become “facts” in a dispute. Stick to measurable statements.

8) Repairs and credits

The trap: The seller agrees to fix a leak. You tell the buyer, “The leak has been fixed.”

The fix: Don’t confirm repairs yourself. Transfer documentation: invoice, contractor statement, permit (if applicable), and buyer re-inspection.

9) Natural hazards

The trap: “This area rarely floods,” or “Fire insurance shouldn’t be a problem.”

The fix: Never minimize hazard risk. Refer clients to the NHD and their insurance professional; keep your language document-based.

10) Minimizing defects

The trap: Seeing a crack and telling the buyer, “That’s just normal settling.”

The fix: Unless you’re a structural engineer, you don’t diagnose. Flag the observed condition and recommend evaluation.

The anti-misrepresentation system

You can eliminate a major share of your liability by adopting a “source and verify” habit.

1) Label fact vs. opinion

If you are sharing an opinion, label it. If you are sharing a fact, cite the source.

Instead of: “1,800 square feet.”

Write: “Approx. 1,800 sq ft per Assessor (buyer to verify).”

2) Verify before you amplify

Before you blast a feature in marketing, ask: “Do I have a document that proves this?” If not, tone it down or remove it.

3) The transaction checklist

Run this check at every stage:

Listing intake: Have the seller complete the TDS and SPQ completely; don’t let blanks slide.

Document handling: Treat client documents and sensitive details like controlled material—careless forwarding, oversharing, or casual disclosure can create liability and negotiation harm, which is exactly why disciplined workflows matter under Privacy Rules for Managing Client Information.

Marketing prep: Review MLS comments against disclosures—do they match?

Negotiation: Ensure counters and emails don’t imply promises that aren’t written.

Closing: Repairs and credits should have documentation attached and traceable.

Safe language toolkit: say this, not that

❌ Risky: “New roof”✅ Safe: “Seller states roof replaced in 2021; buyer to verify.”

❌ Risky: “Permitted guest house”✅ Safe: “Guest house present; buyer to verify permits with the city/county.”

❌ Risky: “Great rental potential”✅ Safe: “Buyer to verify rental restrictions and market rates.”

❌ Risky: “Quiet neighborhood”✅ Safe: “Located on a cul-de-sac” (stick to facts).

❌ Risky: “The plumbing is fine”✅ Safe: “No known plumbing issues per seller disclosures as of [date].”

❌ Risky: “I’m sure they’ll accept X”✅ Safe: “I will present your offer immediately and confirm receipt.”

Mini case studies: California scenarios

Scenario A: The “just cosmetic” crack

The situation: A seller points out a hairline crack and says it's from heavy rain. The agent markets “pristine condition.”

The outcome: A serious foundation issue appears after closing. The agent is sued for negligent misrepresentation.

What the agent should have done: Note the condition on the AVID, ensure disclosure is complete, and recommend specialist evaluation without diagnosing.

Scenario B: The dual agency disconnect

The situation: You represent both buyer and seller. The seller mentions divorce stress and urgency. You tell the buyer to help close the deal.

The outcome: Confidentiality and loyalty get questioned immediately, and parties often argue they relied on a misrepresented level of neutrality or advocacy. That’s why Dual Agency in California (Legal Guide) treats role clarity and confidentiality as non-negotiable.

What the agent should have done: Keep motivation confidential and stick to verifiable property facts and written terms.

Scenario C: The “updated” electrical

The situation: A flipper says the panel is “fully updated.” The agent writes “New Electrical Panel” in MLS.

The outcome: Inspector finds it’s old and painted. Buyer demands a credit and threatens claims for false advertising.

What the agent should have done: Require receipt/permit before using “new,” or describe only what you can prove.

Your license is worth more than one commission

Avoiding misrepresentation isn’t about being paranoid—it’s about being professional. It requires a shift from “selling” to “guiding.”

Your best defense is simple:

Verify what the seller tells you.

Disclose what you know.

Document where it came from.

If you don’t know the answer, “I don’t know, but let’s verify it” is one of the safest phrases in your vocabulary.

|

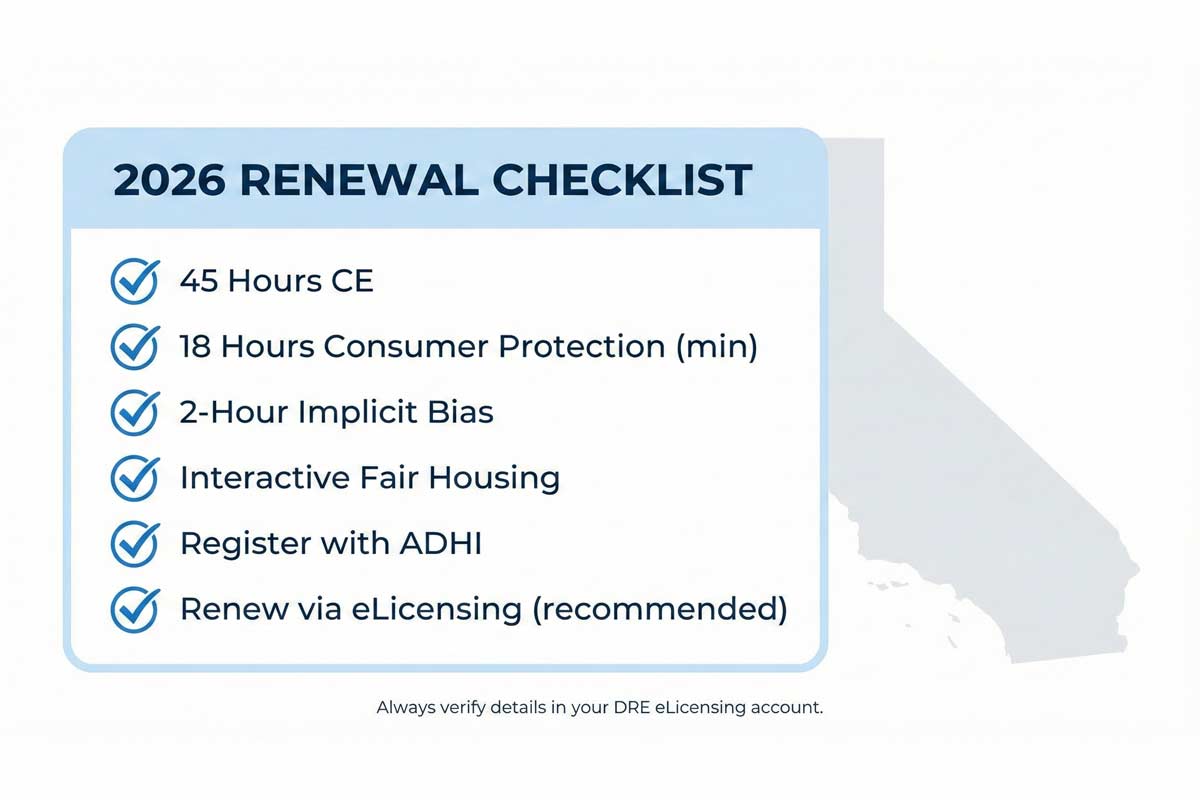

You’ve spent weeks staring at practice real estate exams and memorizing the difference between joint tenancy and community property.

You passed.

You have that provisional sense of accomplishment. Read more...

You’ve spent weeks staring at practice real estate exams and memorizing the difference between joint tenancy and community property.

You passed.

You have that provisional sense of accomplishment. But here is the unvarnished truth: Passing the California real estate exam tested your memory. Choosing your brokerage will test your judgment—and the wrong choice can be more expensive than a failed test.

In California, your broker is your supervisor. Your brokerage isn't just a place to hang your license; it is a professional partnership where they are responsible for your conduct and you are responsible for their reputation. This interview is a risk audit.

Imagine this: It’s 8:00 PM on a Thursday. You’re in your first escrow. The buyer’s agent is screaming about a missed disclosure deadline on the Transfer Disclosure Statement (TDS). If you miss this window, you risk triggering cancellation disputes, the potential loss of your client’s deposit, a DRE complaint, and significant professional liability. You call your broker. It goes to voicemail. You call the office manager. No answer. You are alone, and your license is on the line.

New agents don’t fail because they lack “hustle.” They fail because they lack structured support. This guide is designed to transform you from a nervous applicant into a confident investigator.

THE 10-MINUTE PRE-INTERVIEW CHECKLIST

Do not walk into the office until you have these items in your hand:

The Scorecard: A physical copy of the scoring rubric found at the bottom of this guide.

My Goals Sheet: Your target hours per week and your monthly “keep the lights on” budget.

The Evidence Folder: A notepad ready to document specific proof (calendars, checklists, and fee schedules).

The Deal Timeline: A printed sheet showing the lifecycle of a deal (Offer → Acceptance → Disclosures → Contingencies → Closing) to ask exactly where their review gates occur.

1. Your Pre-Interview Intelligence Gathering

Before you step into an office, you need to know who you are talking to. Not every brokerage is built for a rookie. First, you must Decode the Model. Is this a training-centric firm, a “desk-fee farm,” or a high-volume team? If you aren't sure which path fits your personality, stop and read Should You Join a Team or Go Solo before you schedule the meeting.

Next, scan for online red flags. Look at their social media. Are they constantly recruiting “unlimited potential” but showing zero photos of actual training sessions? For a deeper dive into the specific warning signs I’ve seen over the last 20 years, see our guide on Red Flags When Choosing Your First Brokerage.

2. The Five-Point Interrogation (The System Audit)

Category 1: Training PROOF, Not Promises

Core Question: Does this brokerage have a repeatable system to turn a student into a producer?

Ask the Script: “Walk me through the exact training schedule for my first 30 days. Can I see the syllabus for your contract writing role-play?”

Proof to Demand: Demand to see a Live Calendar, a Course Syllabus, and an Invitation to sit in as a guest at the next session.

Good Answer: “We have a 4-week ‘Launch’ program. It’s live every Tuesday and Thursday. Here is a copy of the calendar; you are welcome to attend the 10 AM session this Thursday to see for yourself.”

Dangerous Answer: “We have an amazing culture of learning. Everyone here is an open book, and you can watch our library of videos whenever you want.”

Category 2: Broker Access & Supervision (Your License SLA)

Core Question: Who saves you when a deal goes sideways at 9:00 PM?

Ask the Script: “What is your agent-to-supervisor ratio? What is your guaranteed response time for a contract emergency? If you aren't available, who is the designated backup by name and title?”

Proof to Demand: Demand a Written Service Level Agreement (SLA) or a clear, documented protocol for after-hours support.

Good Answer: “Our ratio is 25:1. I am available until 9 PM, after which [Name], our Assistant Manager, takes over. We guarantee a 30-minute response for active escrows.”

Dangerous Answer: “We’re like a family here. Someone is always around, and you can just text the group chat if you get stuck.”

Category 3: Compliance & Risk Protection

Core Question: How do they prevent you from making a career-ending disclosure error?

Ask the Script: “Where is your transaction checklist stored and who enforces it? Show me your broker review gates in writing—at what exact points am I blocked from proceeding without your signature?”

Proof to Demand: Demand to see a Transaction Checklist.

Good Answer: “We use [Software]. You cannot send an offer or release contingencies until our compliance officer signs off on these four specific gates. Here is the checklist we use.”

Dangerous Answer: “We trust our agents to be professional. Just upload everything to the folder before the deal closes so we can pay you.”