Real Estate Compliance: Systems Over Luck

In my 20-plus years of educating California real estate professionals, I’ve seen thousands of agents move through the industry. Often what I notice is the ones Read more...

Real Estate Compliance: Systems Over Luck

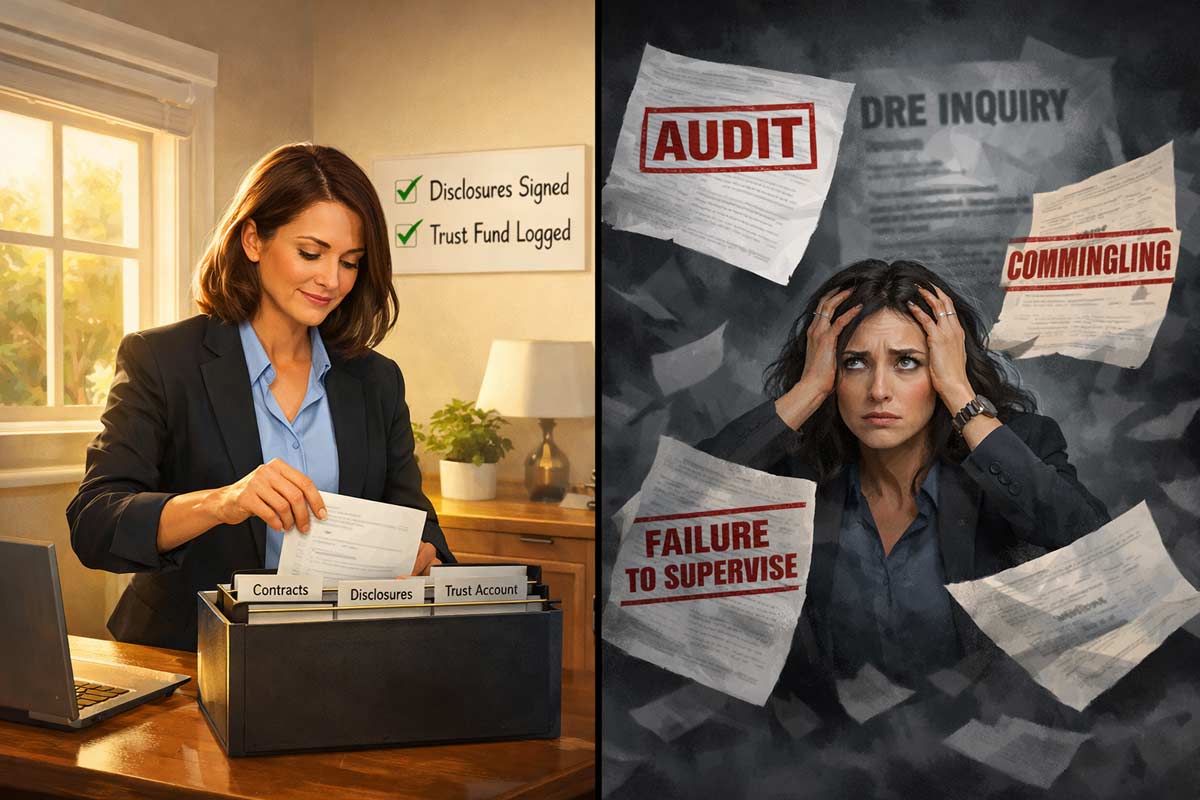

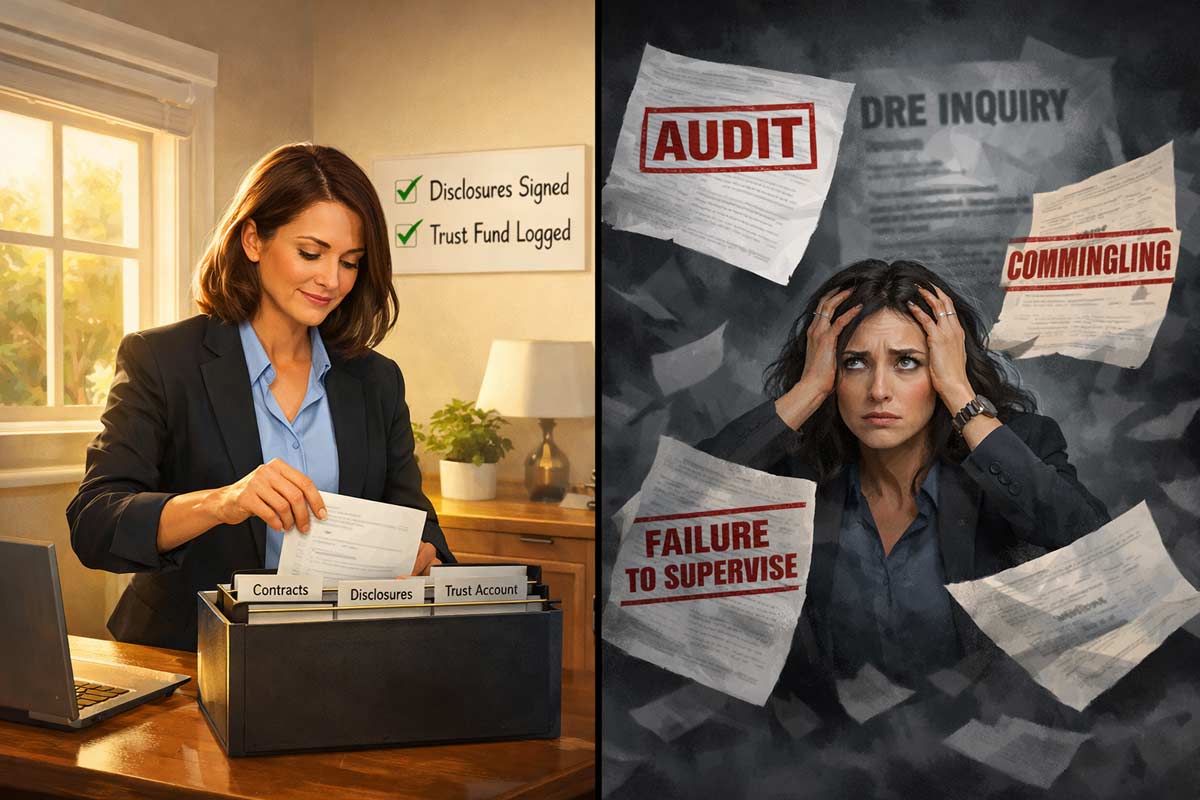

In my 20-plus years of educating California real estate professionals, I’ve seen thousands of agents move through the industry. Often what I notice is the ones who stay out of trouble aren't necessarily the ones who memorized the entire Business and Professions Code; they are often the ones with consistent systems.

Most California DRE violations aren't the result of "bad" people doing "bad" things. They are the result of "busy" people doing "sloppy" things. The Department of Real Estate (DRE) is a consumer protection agency. Their job is to ensure the public is protected, and they do that by enforcing transparency, supervision, and documentation.

If you treat compliance as a "to-do" list rather than a "worry" list, you’ll find that the DRE isn't something to fear—it’s just the framework of your business.

What "A Violation" Means in Practice

A violation isn't always a dramatic headline. In the real world, enforcement is usually triggered by small, preventable issues that accumulate into compliance problems.

Complaint-Driven: A disgruntled client or a competing agent flags an ad or a missing disclosure.

Visibility Issues: When a yard sign or social media profile is missing key details, it becomes an easy target for a random inquiry or a complaint from the public.

Audit Triggers: The DRE performs audits of brokerages, including Investigative Audits (prompted by complaints) and Proactive Audits (routine checks, often targeting high-risk activities like property management).

Documentation Gaps: Most discipline stems from what is missing—a signature, a date, or a record of a deposit.

The DRE focuses on patterns of neglect. One typo on a flyer might result in a warning or a minor administrative penalty; a team of ten agents all advertising without license numbers suggests a broader failure of supervision.

The Top Common DRE Violation Categories

1. Advertising & Marketing Compliance

What it looks like: Business cards, yard signs, or Instagram posts that look "clean" but omit the required license information.

The trigger: Public visibility. A "For Sale" sign or a digital ad without the agent's DRE number is easily flagged by the public or competing brokers.

How to avoid it: Every piece of "first point of contact" material must have your license number and your broker's name. Review our guide on Real Estate Advertising With Your License Number for specific visibility and legibility rules.

Quick self-check:

Does my IG bio have my DRE # and Broker name?

Is my license number as prominent as the other contact info?

2. Trust Fund Mishandling

What it looks like: An agent receives an Earnest Money Deposit (EMD) check and keeps it in their car for a few days before handing it over.

The trigger: Delays in depositing or recording funds. If money isn't handled correctly, it raises flags for "commingling" or, in extreme cases, "conversion."

How to avoid it: Per B&P §10145 and Reg 2832, a broker must generally deposit trust funds within three business days following receipt. As a salesperson, you must deliver funds to your broker or escrow immediately.Refer to Trust Fund Handling Rules for California Agents for timing nuances.

Quick self-check:

Did I deliver this check the same day I received it?

3. Team Name & DBA Misuse

What it looks like: "The Premier Group" appears on a yard sign, but that name has not been submitted to and approved by the DRE as a DBA.

The trigger: Advertising under a business name not listed on the license. Audits specifically check for DBA approval.

How to avoid it:Any name used in your real estate business that is not your exact personal license name is a DBA and must be pre-approved by the DRE. To be approved, a DBA typically must include the surname of a licensee (e.g., broker or salesperson) and often uses a descriptor like "& Associates," "Group," or "Team." It cannot sound like a separate corporate entity (e.g., "Inc.," "Realty," "Properties" alone). You must have the DRE's approval letter on file before using the name.

4. Inadequate Supervision

What it looks like: A broker has 50 agents but hasn’t reviewed a transaction file in months.

The trigger: An agent makes a mistake, and the DRE discovers the broker had no oversight system.

How to avoid it: Brokers must establish written policies and review points. Agents must follow SOPs for every document.

Quick self-check:

Has my broker or manager looked over the mandatory documents in this active file?

5. Unverified Claims & Misrepresentation

What it looks like: Advertising "brand new electrical" without verification, or claiming "#1 Agent in the City" without citing a source.

The trigger: A buyer relies on an unverified claim (B&P §10140) that turns out false.

How to avoid it: Stick to the facts. If you can't verify it with a permit or a receipt, use qualifiers like "per seller" and cite the source for any "ranking" claims.

Quick self-check:

Can I prove this statement if an auditor asks for the source?

6. Transaction File Gaps (Completeness)

What it looks like: A file is "closed" but missing signatures or dates.

The trigger: Audit finds documents legally incomplete.

How to avoid it: Use a closing checklist. Do not move a file to "completed" until every required field is populated.

Quick self-check:

Is every "Initial Here" box actually initialed and dated?

7. Record Retention Failures

What it looks like: A transaction closed three years ago, but the agent deleted the emails and cannot produce the file.

The trigger: Audit requests a file from the previous three years.

How to avoid it: Per B&P §10148, you must retain transaction records for at least three years from the date of closing (or the listing date if the deal fell through). This includes listings, deposit receipts, and all substantive correspondence.

Quick self-check:

If the DRE asked for a file from three years ago today, could I produce it?

8. Unlicensed Activity

What it looks like: An unlicensed assistant "hosting" an open house and answering questions about property features.

The trigger: A client mentions the assistant discussed property features or terms.

How to avoid it:Know the line. Assistants can handle clerical tasks, schedule appointments, and courier documents, but they cannot show properties or negotiate terms. See What the California DRE Actually Enforces.

Quick self-check:

Am I letting an unlicensed person discuss price or property features with a client?

9. Fair Housing Advertising Violations

What it looks like: Using phrases like "adults only" or "perfect for young families."

The trigger: Advertising that indicates preference or limitation based on protected classes.

How to avoid it: Focus strictly on the property’s features, not the type of person you think should live there. Avoid references to neighborhood demographics or religious facilities.

Quick self-check:

Does my ad describe the house or the person I want to buy the house?

The Compliance Operating System

You don't need to be a lawyer to stay compliant. You just need a framework.

Standardized Templates: Use your association's (C.A.R.) forms. Don't draft your own "mini-contracts."

The Transaction Checklist: Use a "master list" for every file. If a signature is missing, the file isn't "done."

Weekly Compliance Habit: Spend 15 minutes every Friday reviewing your active ads and digital profiles to ensure DRE #s are visible.

The "Stop Sign" Rule: If a client asks you to do something that feels "grey" (like skipping a disclosure), stop and call your broker immediately.

Quick Compliance Checklist (Screenshot This)

License #: On every email, business card, and social profile.

Broker Name: Clearly visible on all marketing.

Trust Funds: Handed off to broker/escrow immediately (Salesperson) or deposited within 3 business days (Broker).

DBA: Team name is DRE-approved and includes required suffixes (Team/Group).

Disclosures: Provided to the buyer as early as possible.

File Completeness: Every signature, initial, and date is present.

Retention: All records stored securely for a minimum of 3 years (§10148).

Unlicensed Staff: Limited to administrative, non-licensed tasks only.

Supervision: Broker has established review points for all contracts.

Fair Housing: All advertising language focuses on property features, not people.

FAQs

What does the DRE actually enforce most often?

The DRE frequently cites issues related to trust fund mishandling, failure to supervise, and misrepresentation of material facts.

What triggers a DRE investigation?

Most investigations are reactive, triggered by consumer complaints or issues found during routine proactive office audits.

Can a first-time mistake get me disciplined?

Yes. While the DRE may issue a warning for minor technicalities, any violation of the Real Estate Law can lead to administrative penalties, license restriction, or suspension.

What’s the fastest way to clean up my advertising compliance?

Audit your social media "Linktree" and bio. Ensure your DRE number and broker’s name are visible without needing to click deep into your profile.

How long should I keep transaction records?

Per B&P §10148, you must keep records for at least three years. However, many brokerages require longer retention (5–7 years) for liability protection. Always follow your broker’s specific policy.

Stay Protected with the Master Guide

Compliance isn’t a personality trait; it’s a system you build into your business. By following these steps, you protect your license, your broker, and your clients. For a deeper dive into the specific statutes and requirements, visit our California Real Estate Laws & Compliance Guide.

|

SB 9 Potential in California Real Estate

As a real estate professional in California, you’ve likely seen "SB 9 Potential" popping up in MLS remarks. With 20+ years helping California agents and Read more...

SB 9 Potential in California Real Estate

As a real estate professional in California, you’ve likely seen "SB 9 Potential" popping up in MLS remarks. With 20+ years helping California agents and students navigate compliance at ADHI Schools, I have seen how new laws create both massive opportunity and significant professional landmines.

The Danger:

Marketing SB 9 as a "guaranteed" four-unit build. If a buyer closes based on your marketing, only to find the city rejects the permit due to local objective standards or utility constraints, you—and your broker—could be in the crosshairs.

Legal Disclaimer:This guide is for informational purposes only and does not constitute legal or land-use advice. SB 9 implementation varies significantly by local jurisdiction. Always advise clients to verify feasibility in writing with the local planning department and qualified land-use counsel.

FAST ANSWER: What is SB 9?

Senate Bill 9 (SB 9) provides a ministerial pathway for homeowners to subdivide a single-family lot (Urban Lot Split) or build up to two primary units on one lot. While it limits local discretionary review, projects must still meet "objective standards" and specific eligibility criteria.

Agent Note: Never guarantee approval; always verify site-specific feasibility in writing with the city.

SB 9 Eligibility: The Quick Screen

Before you spend hours on a property, run these four checks. If any of these "Red Flags" appear, the project may be ineligible under state or local rules.

Zoning: Is it a single-family residential zoning designation (e.g., R-1, RS, etc.)?

Location: Is it in an "Urbanized Area" or "Urban Cluster"? Verify this on the local agency’s SB 9 eligibility map.

Tenancy History: Hard-stop restrictions apply if the property was occupied by a tenant in the last 3 years. Generally, SB 9 cannot be used to alter or demolish tenant-occupied housing. Refer to Rent Control Laws in California (Agent Guide) to evaluate displacement risks.

Ineligible Sites: Sites in very high fire hazard severity zones, floodways, or earthquake fault zones often trigger ineligibility. Treat these as red flags requiring written confirmation from the city. See Environmental Regulations California Agents Should Know for more on these overlays.

What SB 9 Actually Does (Agent Translation)

To advise clients safely, you must distinguish between the two separate pathways provided by the law.

1. Urban Lot Split (Gov. Code § 66411.7)

The "40/60" Rule: Per state statute, the split must result in two lots where the smaller lot is at least 40% of the original lot's size. Both newly created parcels must be at least 1,200 square feet, unless a local ordinance allows smaller.

Owner-Occupancy: State law requires an applicant to sign an affidavit stating they intend to occupy one of the units as a principal residence for at least three years. Exception: This requirement does not apply to "community land trusts" or "qualified nonprofit corporations."

2. Two-Unit Development (Gov. Code § 65852.21)

The "800 Sq. Ft." Rule: Local objective standards generally cannot be applied in a way that would physically preclude the construction of at least two units that are at least 800 square feet each. This is a "backstop" against restrictive local standards, not a guarantee that every lot can accommodate this size.

The Unit Cap: In practice, many jurisdictions treat the total unit count (including ADUs and JADUs) as capped at four across the original lot footprint. If a lot already has an ADU, your client’s SB 9 potential may be limited—verify local implementation.

SB 9 vs. ADU: Why Clients Get Confused

Agents risk misrepresentation claims when they conflate these two very different permit paths.

Primary vs. Accessory: SB 9 units are "primary" dwellings; ADUs are "accessory."

Separate Sale: SB 9 units can potentially be sold separately if a lot split is recorded and ownership is structured appropriately—verify with counsel. ADUs generally cannot be sold separately. (Learn more: California ADU Laws Explained).

Parking: While state law limits parking requirements to 1 space per unit, multiple local waivers apply—verify the city’s specific SB 9 standards.

Setbacks: State law generally allows a local agency to require up to 4-foot side and rear setbacks (Gov. Code § 65852.21), but no setback is required for existing structures rebuilt in the same footprint.

Marketing & Liability: How to Talk About "Potential" Safely

The "Do vs. Don't" Table

Don’t Say (High Risk)

Do Say (Compliance First)

"Approved SB 9 Lot Split"

"May qualify for SB 9; Buyer to verify with city."

"Guaranteed 4-Unit Build"

"Check local unit-count caps for SB 9 + ADU."

"Split Ready / No Restrictions"

"Subject to local objective standards & affidavits."

Pro-TipDo not use the words approved, guaranteed, by-right, or split-ready unless you have a written planning confirmation or city-stamped approval in your hand.

Verification Artifacts (The "Agent File" Checklist)

Written email confirmation from the Planning Department regarding the specific APN.

Preliminary Title Report highlighting any private CC&Rs (SB 9 does not automatically override private restrictions).

"Will-Serve" notes from utility providers (water/sewer/power).

Seller-signed tenant history declaration.

Real-World Scenarios

The Unrecorded Access: A listing marketed "SB 9 split potential." The buyer discovered the "back lot" had no legal frontage and the neighbor refused an easement.

Agent Fix: Check for Water Rights & Easements in California Real Estate and ensure legal access is recorded on title. Document in file: Preliminary Title Report.

The Utility Capacity Halt: An investor bought a lot for a duplex build. The water district denied new meters due to infrastructure limits.

Agent Fix: Always include "will-serve" verification in your buyer's due diligence. Document in file: Water District written response.

The Tenant Surprise: A seller failed to disclose a roommate who paid rent. The city denied the permit because the property wasn't "tenant-free" for the required 3-year lookback.

Agent Fix: Document in file: Signed seller declaration regarding tenancy.

Frequently Asked Questions

Can I list "SB 9 potential" if there are HOAs?

SB 9 does not explicitly override private CC&Rs. Treat HOA/CC&Rs as a major red flag requiring attorney review before you market the project as feasible.

What kills SB 9 feasibility most often?

High-fire hazard zones, unrecorded easements, and the 3-year tenant occupancy rule are the most common "deal killers."

Is owner-occupancy always required?

For an Urban Lot Split, yes—a 3-year affidavit is required (Gov. Code § 66411.7(g)(1)), unless the applicant is a community land trust or qualified nonprofit. For a Two-Unit Development (no split), many cities do not require it.

Your Compliance Playbook

Navigating California land use requires more than just reading a headline. This article is part of our California Real Estate Laws & Compliance Guide, designed to be your professional compliance playbook.

|

Submitting your renewal in eLicensing feels like the finish line—and emotionally, it is. But operationally, the next 48 hours are where most avoidable problems happen. Between payment clearing lags, Read more...

Submitting your renewal in eLicensing feels like the finish line—and emotionally, it is. But operationally, the next 48 hours are where most avoidable problems happen. Between payment clearing lags, public lookup delays, and administrative roster updates, the transition from one license cycle to the next requires a few specific "operator" moves.

I have spent 20+ years helping California agents navigate licensing and compliance, and have seen the same pattern repeatedly: the biggest renewal headaches don’t happen during renewal—they happen when agents don’t document and verify what they just submitted.

The “I Just Renewed” Quick Checklist (10–20 Minutes)

Verify status + new expiration date in the DRE Public License Lookup.

Download/save your eLicensing receipt or transaction summary.

Store all 45-hour CE completion certificates in one “Audit Folder.”

Provide updated proof to your broker/office admin (if your brokerage requires it).

Add renewal reminders to your calendar for the next cycle (set for 3 years, 9 months out).

Quick compliance sweep: Audit your email signature and key marketing touchpoints for DRE # placement (common best practice).

How to Verify Your California Real Estate License Renewal Status

Don’t assume the final confirmation screen means everything is fully complete. Occasionally, payment issues, data-entry mistakes, or processing delays can leave your renewal in a “pending” state longer than expected.

What to check in the DRE Public License Lookup:

Expiration Date: This is the most important indicator. Has it officially advanced to the new four-year cycle?

Status: Does it show "Active" (or the correct current status for your situation)?

Accuracy: Confirm name and license number details look correct.

Real-World Scenario:You renew over the weekend. Monday morning, your office admin says your status hasn’t updated yet. This doesn't necessarily mean something is wrong, but you should monitor the portal until the expiration date officially moves forward.

Step 2: Build Your “Renewal Proof” File (DRE Audit Ready)

The DRE can request CE documentation after renewal. If you can’t produce proof when asked, it can create a serious compliance issue regarding a task you already completed.

CA DRE > Renewals > 2026 Renewal (CE + Receipt)

We recommend keeping these records for at least five years. In practice, you should assume you are the primary record-keeper; the DRE will not "call your school" to reconstruct your file during an inquiry.

Notify Your Broker and Update Compliance Records

Many brokerages maintain internal compliance files and may ask for proof your renewal is complete. This is essential risk reduction. You don't want a lender, title company, or office compliance officer flagging your license status as "Expired" or "Pending" in the middle of an active escrow.

Make sure your license status in internal systems aligns with the public record. For more context on why CE and documentation matter long-term, see How CE Helps Agents Stay Out of DRE Trouble.

Resetting the 4-Year Clock: Planning Your Next Renewal

The best time to plan your next renewal is the day after you complete this one.

Calendar it: Set a reminder for 3 years and 9 months from now so you’re never scrambling at the 11th hour.

Plan smarter: Requirements and options often differ between first vs. subsequent renewals. Don’t guess—use the California Real Estate License Renewal Guide as your reference point for the next cycle.

Step 5: Turn Renewal Into Momentum

Renewal clears mental bandwidth—use it to restart your pipeline with a simple relaunch.

Two-week relaunch sprint:

Database touches: Reach out to 30–50 past clients or warm contacts. Use the "new license cycle" as a subtle reason to confirm your contact info is current in their records.

Marketing sweep: Spend 15 minutes ensuring your DRE license number is present on all "first point of contact" materials, as this is a common compliance expectation.

Red-Flag Mistakes to Avoid

Losing certificates: Assuming "the system has them." You should always maintain your own copies.

Losing the receipt: This is your only proof of payment and submission if a technical error occurs.

Ignoring the date: Not verifying that the expiration date actually moved forward in the public lookup.

Address/Email changes: Forgetting to update your profile in eLicensing if you moved during the renewal period.

Frequently Asked Questions

How long does it take for my renewal to show up in the public lookup?

It often updates quickly, but allow 24–48 hours for processing. If it hasn’t updated within that window, use your receipt as proof of submission and contact the DRE licensing department.

What if I entered a course number incorrectly?

Handle it early. Keep your receipt and contact DRE licensing support to correct the record rather than waiting for an inquiry later.

Do I need to mail certificates to the DRE?

Typically no—renewals are handled through eLicensing—but you must keep digital copies of certificates in case documentation is requested during an audit.

Can I work if my status says “Pending”?

If you are uncertain about what “pending” means for your ability to perform licensed activity, coordinate with your broker or office compliance department immediately.

I lost my certificates—what now?

Contact your CE provider. Reputable schools (like ADHI Schools) usually retain course completion records for a specific period and can reissue proof upon request.

Your Post-Renewal Action Plan (Do This Today)

Verify your status and expiration date in the DRE public lookup.

Archive your receipt and CE certificates into one permanent cloud folder.

Check the California Real Estate License Renewal Guide to ensure you're set for the next cycle.

|

You’ve passed the real estate exam, joined a brokerage, and ordered your business cards. Now comes the most pressing question every new California agent faces:

"Where do I get my first lead?"

The Read more...

You’ve passed the real estate exam, joined a brokerage, and ordered your business cards. Now comes the most pressing question every new California agent faces:

"Where do I get my first lead?"

The industry is flooded with marketing noise and subscription platforms promising instant closings. But after 20 years in the California real estate business, I’ve seen thousands of agents burn through their savings chasing the wrong leads.

The truth is that lead sources are far less important than your lead-to-relationship conversion and your consistency.

A lead isn't a commission check; it’s an introduction. California markets are fragmented—what works in Riverside won't always work in West LA.

To start a real estate career in California that actually lasts, you need a system, not just a tactic.

Key Takeaways

Trust over Tech: Your Sphere of Influence (SOI) remains the highest-converting lead source.

Sweat Equity: Open houses are the fastest way to meet "now" buyers without an upfront budget.

Speed Wins: The agent who follows up same-day—often within minutes—usually wins the client. This is often called “speed-to-lead”.

Local Authority: Consistency in a small "micro-farm" beats sporadic efforts across a whole city.

Ranked: The Best Lead Sources for New Agents

Note: "Skill Level" refers to your conversion and communication skill, not your personality type.

Lead Source

Cost

Time-to-Result

Skill Level

Best For...

Sphere of Influence (SOI)

Free

Days/Weeks

Low

Immediate trust & referrals

Open Houses

Free/Low

Days/Weeks

Medium

Meeting unrepresented buyers fast

Open House Follow-Up

Free

Days/Weeks

Medium

Turning “tourists” into clients

Database + CRM Follow-Up

Free/Low

Weeks

Medium

Staying top-of-mind consistently

Local Partner Referrals

Low

Weeks/Months

Medium

Warm intros from lenders/escrow

Agent-to-Agent Referrals

Low

Weeks/Months

Medium

Relocation + overflow clients

Community Networking

Low

Weeks/Months

Medium

Trust-building (schools, chambers)

Micro-Farming (100–300 homes)

Medium

Months

High

Long-term local dominance

Rentals / Landlords

Low

Weeks/Months

Medium

Leads that become buyers later

FSBO / Expireds

Low

Weeks

High

High-volume conversations

Online Inbound Basics

Low/Medium

Months

Medium

Compounding flow (reviews)

Paid Leads (Optional)

High

Days/Weeks

High

Agents with a break-even mindset

The Core Strategy: Where to Start

1. Your Sphere of Influence (SOI)

Your SOI includes friends, family, and past coworkers. These are people who already want you to succeed.

Why it works: Trust is pre-built. You aren't "selling"; you're informing.

Scenario: Instead of a sales pitch, try: "I'm not calling to sell you anything—I just wanted to let you know I'm officially with [Brokerage]. If you ever have a quick question about what's happening in our neighborhood, I'm happy to be your resource."

Do this this week: Call 5 people a day. Update their contact info in your CRM.

2. Open Houses as a Lead Engine

Don't just "sit" in a house. Use it as a platform. Learning how new agents should hold open houses effectively can transform a boring Saturday into three new buyer representation agreements.

Why it works: You meet active buyers in a specific zip code.

Scenario: When a visitor walks in: "Thanks for coming by. Most people I meet here are either neighbors or looking to move in the next 90 days—which one are you?"

Do this this week: Ask a top producer in your office to host their listing open this weekend.

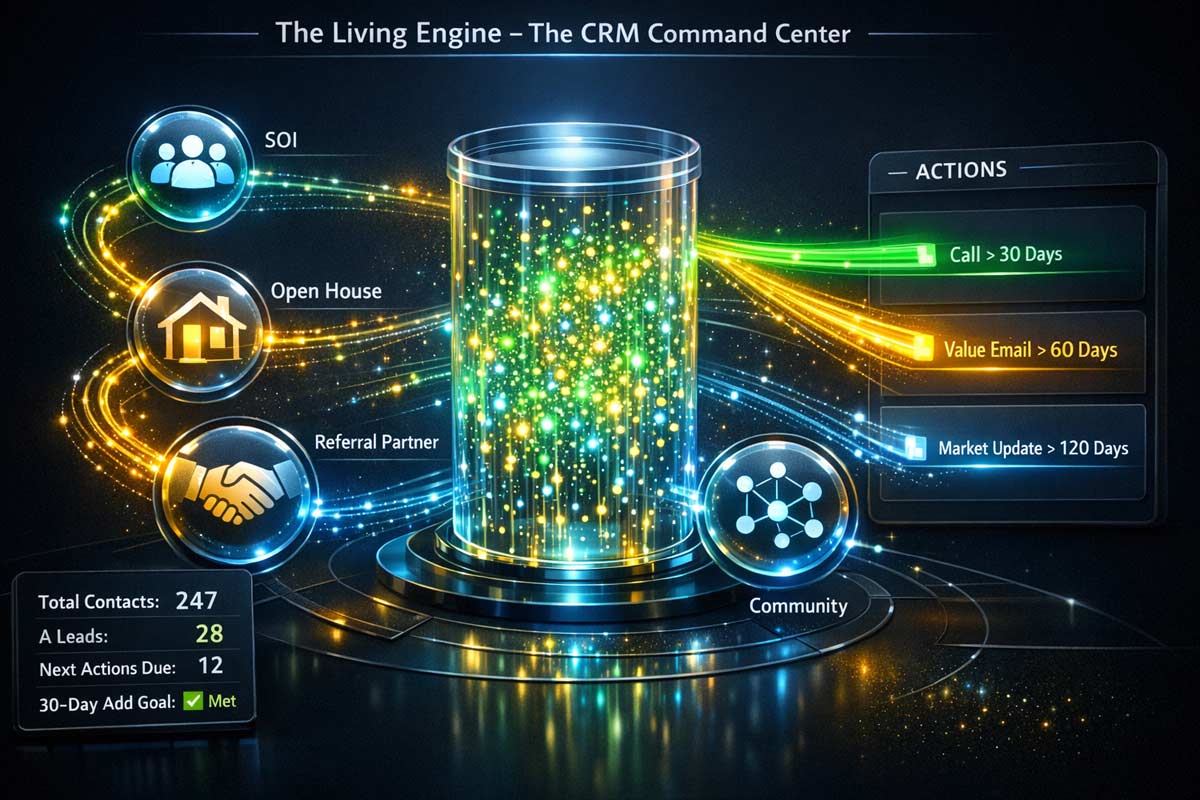

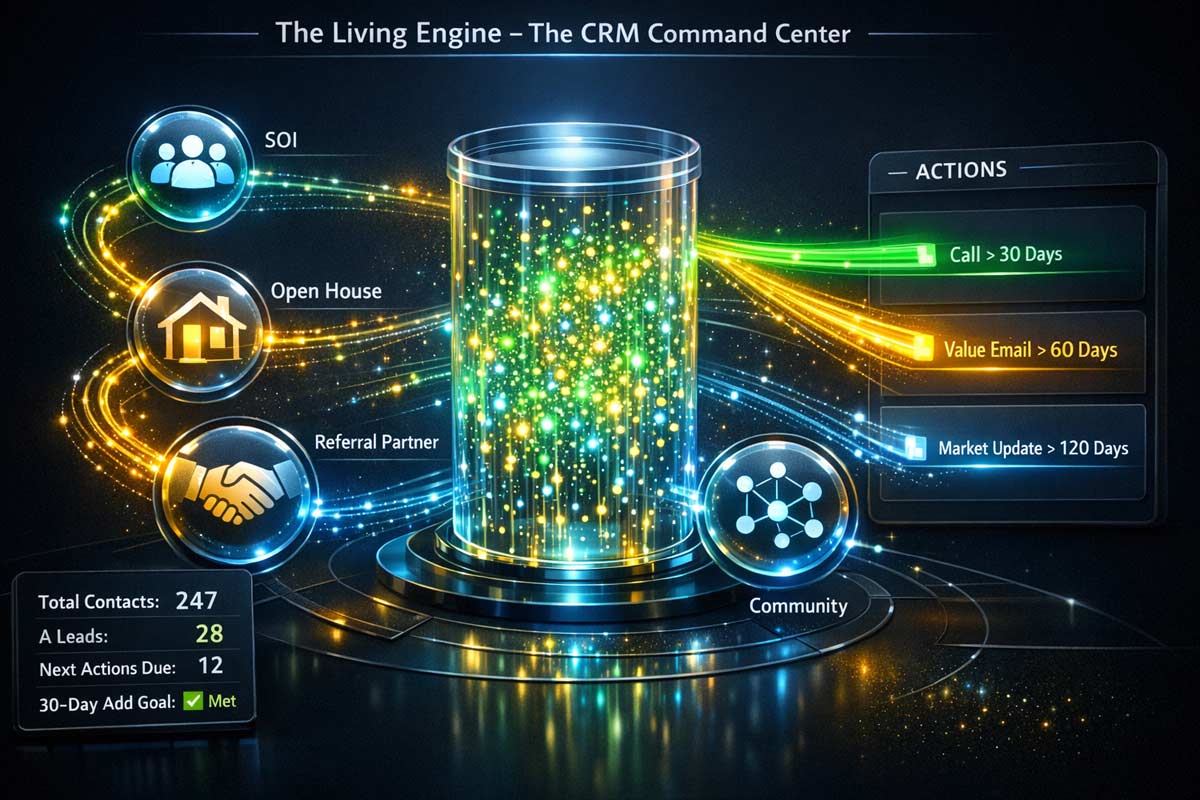

3. Building Your Database

Every person you meet belongs in a CRM. You must build a real estate database from scratch to automate your "top of mind" awareness.

A Simple Follow-Up Cadence

Day 0: Quick text + “What stood out to you at the house?”

Day 1: Phone call (short, human).

Day 3: Value add (neighborhood note or listing link).

Day 7: Call + clarify timeline.

Month 2+: Monthly market update + personal check-in.

Expanding Your Reach

Local Partner & Agent Referrals

Lenders, escrow officers, and out-of-area agents are massive referral sources.

Why it works: These are professional, warm introductions.

#1 Rookie Mistake: Asking for leads before offering any value.

Do this this week: Invite a local lender to coffee to learn about their specific programs.

Community Networking & Micro-Farming

Become the "Digital Mayor" of a small area. Focus on 100–300 homes (a micro-farm) or your local PTA/Chamber.

Why it works: It builds "omnipresence" in a small, manageable pond.

Do this this week: Draft a simple, one-page market update for your specific neighborhood.

Online Inbound & Rentals

Claim your Google Business Profile and gather reviews immediately. Additionally, don't ignore renters; in California, today’s tenant is often next year’s first-time buyer.

FSBO / Expireds

Why it works: These are people with high "intent to sell."

Compliance Reminder: Strictly follow the National Do Not Call (DNC) Registry, respect all opt-outs, and follow your brokerage’s specific outreach policies.

What to Avoid: The "New Agent Traps"

Paid Leads: The "High Tuition" Trap

Paid leads aren't evil—they're just expensive if you aren't ready. If you can't respond in under 5 minutes and don't have a conversion system, paid leads are just a donation to a tech company.

Small Commercial (The "Lite" Path)

You don’t need to be a commercial specialist on day one. Start commercial-lite: small retail/office leases and local owner conversations. Partner with a senior agent when complexity rises. Done right, it builds a professional reputation that feeds your residential business.

The 30-Day Lead Generation Operating System

Success requires strict new agent time management strategies.

Week 1: Set up CRM. Call everyone in your phone. Schedule two open houses.

Week 2: Execute follow-up cadence (Day 0–7). Meet one local partner.

Week 3: Start your 100-home micro-farm. Drop off a market report.

Week 4: Evaluate metrics. How many conversations did you actually have?

Weekly Scorecard

Contacts added to CRM: ________

Real estate conversations: ________

Speed-to-lead (Avg minutes): ________

Follow-up attempts: ________

Appointments set: ________

FAQ

What is the best lead source for new California real estate agents?

Your sphere of influence (SOI) is the highest-converting starting point because trust is built-in. Pair it with open houses for faster “now buyer” conversations.

Are open houses a good way to get clients in California?

Yes—they are one of the fastest ways to meet unrepresented buyers. The key is capturing contact info and running a same-day follow-up plan.

How quickly should I follow up with a new lead?

Same day—ideally within minutes. In California’s fast-paced market, the first agent to provide value and set the next step usually wins the client.

Can I get real estate leads for free?

Yes. SOI outreach, open houses, and partner relationships produce leads with $0 in ad spend; your main cost is time and consistency.

How many follow-ups does it take to convert a lead?

Many leads convert after 5–12 touches over weeks or months. Most new agents fail by stopping after the second attempt.

Are paid leads worth it?

Only if you have a proven conversion system and understand break-even math. Without these, they are "expensive tuition."

Is cold calling illegal in California?

It is not automatically illegal, but it is heavily regulated. You must follow the National DNC Registry, honor opt-outs, and follow brokerage policy.

Should I focus on buyers or sellers first?

Buyers are often easier to find early through open houses. Sellers usually require the trust and proof you build through consistent activity.

Can new agents get commercial leads?

Yes, via "commercial-lite" paths like small leases. Keep expectations realistic and how to find your first 3 clients as a new agent often involves starting with these accessible opportunities.

Build Your Career Foundation

Lead generation is the heartbeat of your business, but it only works if you have the competence to back it up. Focus on building a career system rather than chasing the tactic of the month. Remain consistent, lead with value, and treat every contact like a long-term relationship.

|

Imagine you’re the listing agent for a 1970s fourplex in Los Angeles. The seller tells you the rents are "well below market" and the buyer can easily raise them by 20% to stabilize the asset. You include Read more...

Imagine you’re the listing agent for a 1970s fourplex in Los Angeles. The seller tells you the rents are "well below market" and the buyer can easily raise them by 20% to stabilize the asset. You include this in your MLS marketing.

The buyer closes, attempts the increase, and is immediately hit with a wrongful rent increase lawsuit and a city enforcement action. It turns out that because the property is in the City of L.A., it is subject to a local 3% cap for the current cycle (specifically the period through June 30, 2027)—not the statewide 10% maximum.

As an agent, you don’t need to be a lawyer, but you must be a high-level "compliance operator." In California’s 2026 regulatory environment, a single misstatement about "market rent potential" can lead to a professional liability nightmare.

Compliance Disclaimer: This is educational and not legal advice; agents should verify current rules as of the publish date. Local rules are frequently stricter than state law; always consult qualified counsel or local housing departments for jurisdiction-specific guidance.

The Two-Layer System: Statewide vs. Local

To keep your clients safe, use this mental model for every residential transaction:

The State Baseline (AB 1482): This applies to most multi-family housing and corporate-owned rentals statewide.

The Local Card: Cities like Los Angeles, San Francisco, and San Jose have local Rent Stabilization Ordinances (RSOs). If the local rule is more restrictive, the local rule prevails.

Field Scenario: You are showing a property in a city you aren't familiar with. Before discussing rent upside, your first move should be advising the buyer to check the city’s website for a "Rent Stabilization" or "Housing Department" page.

What Agents Must Know About Statewide Rent Caps (AB 1482)

Under the Tenant Protection Act, annual rent increases are capped at 5% plus the local Consumer Price Index (CPI), or 10% total, whichever is lower.

Common Exemptions (Verify for Every Deal)

Properties that are sometimes exempt from the state cap include:

Rolling 15-Year Rule: Residential property issued a certificate of occupancy within the last 15 years (verify the specific date on the CO).

Qualifying SFHs & Condos: Generally exempt only if the owner is not a REIT, a corporation, or an LLC with a corporate member.

Owner-Occupied Duplexes: If the owner occupied one of the units at the start of the tenancy and still lives there.

Agent Pitfall: A single-family home is not automatically exempt. For the exemption to hold, the landlord must have provided the tenant with specific statutory disclosure language in the lease. If that notice is missing, the property may remain "covered" by the rent cap.

“Just Cause” and Tenant Protections in a Sale

The "Just Cause" framework means a landlord cannot terminate a month-to-month lease without a valid legal reason once a tenant has been in place for 12 months.

Vacancy Assumptions: Never promise a buyer the property will be "delivered vacant." If the tenant is protected by "Just Cause," vacancy usually requires a "no-fault" reason like an owner move-in or a substantial remodel.

Relocation Assistance: "No-fault" evictions typically require the landlord to pay the tenant relocation assistance (often equal to one month’s rent, though local laws may require more).

Renovation Requirements: For a "substantial remodel" to be valid, the work must require permits (which must be provided with the notice) and must render the unit unsafe for occupancy for at least 30 consecutive days.

The Agent’s Rent-Control Workflow

Use this checklist during your due diligence period. This is the same logic we outline in our California Real Estate Laws & Compliance Guide.

Rent Control Compliance Checklist

Verify Age: Check the original Certificate of Occupancy date (do not rely solely on assessor data).

Audit Ownership: Confirm if the owner is a person, a trust, or a corporation.

Confirm Local Rules: Check the city/county for local RSO or unincorporated area protections.

Lease Review: Scan (also advise the buyer to) the current lease for AB 1482 "Notice of Exemption" or "Notice of Coverage" language.

Verify Rent History: Request the last 24 months of rent ledgers to ensure previous increases were lawful.

Confirm CPI Basis: Use the 2026 CPI figures for that specific metropolitan area (typically based on April data for increases after August 1).

Marketing Audit: Remove any "guaranteed" income or "easy eviction" claims from the MLS.

Advertising & Pricing Claims: What Not to Say

Risky Statement

Safer Alternative

“Can raise rent to market immediately.”

“Buyer to verify rent control applicability and allowable increases.”

“Guaranteed vacancy at close.”

“Subject to tenant rights; buyer to verify vacancy procedures with qualified professionals.”

“Property is exempt from rent control.”

“Owner-reported exemption to be verified by buyer during due diligence.”

Common Deal Killers (And How to Prevent Them)

Underwriting Mismatch: Lenders often use conservative rent growth assumptions if they see the property is subject to an RSO.

SB 9 & ADU Complications: Adding a unit can sometimes trigger different regulatory layers. See California ADU Laws Explained and SB 9 Explained for Real Estate Agents.

Missing Environmental Disclosures: Rent control isn't the only risk. See Environmental Regulations California Agents Should Know.

Water Rights Issues: Especially in rural properties, see Water Rights & Easements in California Real Estate.

FAQ

How do I know if a city has stricter rent control?

Search the city name + "Rent Stabilization Ordinance." If the city has its own cap (like the L.A. 3% limit), that number overrides the state floor.

Can rent be increased after a property sells?

A change in ownership does not reset the rent cap. The new owner is bound by the same annual limits as the previous owner for any existing tenants.

What is "Vacancy Decontrol"?

This is the concept that once a tenant moves out voluntarily, a landlord can usually reset the rent to market rate. However, once the new tenant moves in, the cap usually applies again.

Do local ordinances apply in unincorporated county areas?

Yes. For example, L.A. County has a dedicated Rent Stabilization and Tenant Protections Ordinance that covers unincorporated areas.

What documents should I request during due diligence?

Always request the original lease, all addendums, the Certificate of Occupancy, and a certified rent roll for the last 2 years.

Does AB 1482 apply to duplexes or triplexes?

Yes, unless they meet specific exemptions such as the "owner-occupied duplex" rule where the owner lived there before the tenancy began.

|

One of the most common questions we hear sounds like: “I upgraded to a broker license—do I have extra CE hours now?” or “Do I have to take different classes than when I had my sales license?”

The Read more...

One of the most common questions we hear sounds like: “I upgraded to a broker license—do I have extra CE hours now?” or “Do I have to take different classes than when I had my sales license?”

The confusion is understandable. In California, brokers carry a higher level of legal responsibility—so it feels like the DRE should require more education. The reality is simpler: the total hours are the same, but the required subject mix is where brokers can get tripped up.

Key Takeaways

Total Hours: Brokers and salespersons both complete 45 hours of DRE-approved CE each 4-year renewal cycle.

The Content Mix: Brokers must include Management and Supervision as a mandatory topic (salespersons don’t on their first renewal).

The 9-Hour Survey: For second and subsequent renewals (for licenses expiring on/after Jan 1, 2023), a 9-hour survey can cover all mandatory topics in one course.

Interactive Requirement: For licenses expiring on/after Jan 1, 2023, Fair Housing must include an interactive, participatory component.

Quick Answer: Broker vs. Salesperson CE

In California, brokers and salespersons both need 45 hours of continuing education to renew. The difference is what’s inside the 45 hours: brokers must ensure they complete Management and Supervision as part of their mandatory topic mix. While the total hour count is identical, the DRE requires brokers to undergo specific training related to their role as a potential supervisor.

Comparison Table: Salesperson vs. Broker Renewal

Feature

Salesperson (First Renewal)

Broker (First Renewal)

Second+ Renewals (Both)*

Total Hours

45 hours

45 hours

45 hours

Mandatory Core Courses

4 Subjects (3-hrs each)

5 Subjects (3-hrs each)

Included in 9-hour survey

Fair Housing

3-hr + Interactive Implicit Bias

3-hr + Interactive Implicit Bias

Included in 9-hour survey

Implicit Bias

2-hr Required

2-hr Required

Included in 9-hour survey

Mgmt. & Supervision

Not Required

Required

Included in 9-hour survey

*Applies to licenses expiring on/after Jan 1, 2023, and late renewals filed after that date.

What’s the Same for Everyone?

Regardless of license type, the DRE’s CE structure is built around consumer protection—so the baseline framework stays consistent. That’s why the California Real Estate License Renewal Requirements don’t "punish" brokers with extra hours.

The 4-year renewal cycle applies to everyone.

The total is always 45 hours—no "broker bonus hours."

Mandatory topics + consumer protection hours are the backbone of every renewal package.

What’s Different for Brokers?

If the hours are the same, why does broker CE feel different? Accountability.

A broker isn’t just responsible for their own files—they’re responsible for the supervision standard in the office: policies, advertising compliance, trust fund handling, and risk reduction. That’s why Management and Supervision is explicitly part of the broker requirement - even on the first renewal.

Operator Scenarios: Where Brokers Actually Get Exposed

The Supervision Trap: A broker assumes "supervision" just means reviewing contracts. In reality, brokers can be on the hook for agent advertising and compliance breakdowns across the entire team.

Trust Fund Risk: Most salespersons never touch trust fund handling—brokers live inside it. Small process errors can turn into big consequences during a DRE audit.

First Renewal vs. Subsequent Renewals

This is where people accidentally choose the wrong package. Your path depends on your renewal "generation."

1) First Renewal

First renewal requires the mandatory subjects as individual courses, plus the required Fair Housing and Implicit Bias components.

Salespersons: 4 separate 3-hour courses (Ethics, Agency, Trust Funds, Risk Management) + 3-hour interactive Fair Housing + 2-hour Implicit Bias.

Brokers: All of the above PLUS a 3-hour Management and Supervision course.

To avoid confusion, view the full roadmap here: California Real Estate License Renewal Guide

2) Second and Future Renewals

For licenses expiring on/after Jan 1, 2023, the DRE allows a 9-hour survey course that covers all mandatory topics (including Management and Supervision) in a single module. You then complete the remaining hours with electives—ideally from clearly qualified Courses That Count Toward CE in California.

7 Common Mistakes That Trigger Delays

REALTOR® Ethics vs. DRE Ethics: Assuming NAR training counts (it usually doesn’t unless the provider specifically issued a DRE-approved CE certificate).

Non-Interactive Fair Housing: Taking an old-style text course for Fair Housing when your license expires after Jan 1, 2023.

Missing Implicit Bias: Failing to ensure the 2-hour standalone course is in your package. See: Does California Require Implicit Bias Training for Renewal?

Overbuying Hours: Thinking brokers need more than 45. Confirm yourCalifornia CE hour requirements before paying.

Unverified Providers: Using a "national" school that lacks a California DRE Sponsor Number.

Waiting Until the Final 24 Hours: Because of the 15-hour exam limit (see below), you literally cannot finish 45 hours in one day.

Wrong Package Type: A broker taking a salesperson package and missing the Management and Supervision credit.

Step-by-Step: Choosing the Right CE Package

Verify Sponsor Details: Ensure the school is DRE-approved.

Check Fair Housing: Confirm it includes the "interactive participatory component."

Respect the 24-Hour Rule: The DRE limits licensees to completing final examinations for a maximum of 15 credit hours per 24-hour period. If you have 45 hours of testing to do, you need at least three separate 24-hour windows to complete your exams.

FAQ

Do brokers need more CE hours than salespersons in California?

No. Both license types require 45 hours every four years.

Is Management and Supervision required for brokers?

Yes. It is mandatory for all broker renewals (first and subsequent).

What is the 9-hour survey course?

It's a condensed course covering all seven mandatory subjects, available only for second and subsequent renewals.

Does Fair Housing have to be interactive?

For licenses expiring on or after Jan 1, 2023, yes. This includes late renewals filed after that date.

How early can I renew?

You can submit your renewal via eLicensing up to 90 days before your expiration date.

Broker renewal shouldn’t create uncertainty or cause you to buy the wrong package. The goal is simple: meet the DRE requirements cleanly, protect your license, and keep your business.

|

You’ve passed the real estate exam, your license is issued, and you’ve chosen a broker. Then, Monday morning hits. You sit at your desk, and the "post-license cliff" sets in: your calendar is empty, Read more...

You’ve passed the real estate exam, your license is issued, and you’ve chosen a broker. Then, Monday morning hits. You sit at your desk, and the "post-license cliff" sets in: your calendar is empty, and your phone isn't ringing.

The temptation for most new California agents is to reach for a credit card and buy leads. Every real estate office has that guest speaker pitching a magical "lead-gen tool" for $199 a month.

That is a short-term fix for a long-term problem.

In our industry, your database is your business. It is the only asset you truly own. One clean database can produce repeat clients for 10 years; one lead-buy produces, at best, a one-time conversation.

A database doesn’t magically create deals—it creates conversations, and conversations create appointments.

A "from scratch" database isn't about empty contacts—it's about missing the system for consistent, targeted follow-up.

By the end of this guide, you will have a clear, 30-day roadmap to move from zero contacts to a professional follow-up system that produces consistent commissions.

Real Estate Database Essentials

A database is not just a list of names or an exported CSV file from your phone. A database is a list with memory. It records context (notes) and creates the next action (follow-up date).

What Should You Track in a Real Estate Database?

To turn a contact list into a revenue-generating database, you need specific data points. If you don't know what columns to make in your spreadsheet, copy this exact template:

Full Name: Identify clearly (e.g., Maria Lopez)

Phone & Email: Ensure reliable contact info

Preferred Contact Method: Respect communication style (Text, Call, Email)

City/Neighborhood: Crucial for hyper-local California markets

School District/Commute Corridor: The “why” behind their location

Relationship Status: How do you know them? (Sphere, Open House, Referral)

Source: Lead origin (Referral, Social, Vendor)

Tags/Categories: A/B/C ranking, Buyer, Seller

Last Contact Date: Track cadence

Next Follow-Up Date: Ensure action is scheduled

Notes: Kids’ names, pets, hobbies, real estate goals

Your First Database Rule: One Contact = One Next Action

If someone is worth saving, they’re worth scheduling. Every new entry in your system must have either:

A next follow-up date, OR

A "Do Not Contact" note.

There is no third option. Why: if it isn’t scheduled, it won’t happen.

Choose Your Tool (Without Overcomplicating)

Do not get stuck "tool shopping." You can lose weeks comparing software features while making zero phone calls.

Choose a system based on your current volume:

Google Sheets (0–100 Contacts): The fastest way to start. Google Sheets is free, searchable, and forces you to learn the mechanics of data entry.

Basic/Free CRM (100–300 Contacts): Many brokerages provide a CRM included when you join (like BoldTrail (formerly KV Core) or Chime). Use what you already have before paying for a third-party tool.

Full CRM (300+ Contacts): Only invest in premium platforms once you have a consistent lead flow and need advanced automation.

The Rule: If you have under 100 contacts, start with a spreadsheet. If you spend more than two days "researching" CRMs, you are procrastinating. Pick one and execute.

The 8 Best Places to Get Your First 100 Contacts

You aren't starting from zero; you’re starting from "unorganized." Here is where to find your first 100 entries:

Phone Contacts: Export your contact list. Don’t “clean first.” Import them, then add 25 per day for four days. Momentum beats perfection.

Past Coworkers: Start with 10 you’d confidently ask for advice. You were a professional before you were an agent; these people already trust your work ethic.

The Gym/School/Hobby Circle: Anyone you see at least once a month belongs in the database.

Vendors: Your lender, escrow officer, and local contractors. Tag these as “Vendors” to build a referral exchange.

Open House Sign-ins: This is your primary engine. Rule: If they sign in, they go into your database before you leave the property—while the conversation is still fresh enough to write real notes. Learn how new agents should hold open houses to maximize this capture.

Social DMs: Look at who “likes” your posts. Message them: “Hey [Name], I’m updating my professional directory—what’s the best email to send my local market reports to?”

Community Groups: Local neighborhood associations or Facebook groups (be the helper, not the solicitor).

Out-of-Area Agents: Tag them as “Referral Partners.” A small group of active agents outside your zip code can become your most consistent referral pipeline.

Clean Data Beats Big Data (Hygiene)

Before you chase "more contacts," fix the basics. A messy database is a useless database.

Standardize Names: "Mike Smith," not "Mike S." or "Dad's Friend."

One Primary Contact: Identify one main phone number and email per person.

Merge Duplicates: Do not have three entries for the same person.

Add "Source": Always know where a lead came from so you can track ROI later.

Fix Bouncebacks: If an email bounces or a number is wrong, update it the same day.

The "DNC" Tag: Create a "Do Not Contact" tag so you don’t burn relationships by calling people who asked you to stop.

Tagging & Segmentation: The Power of "A-B-C"

If you treat everyone in your database the same, you will burn out. You must segment your contacts so you know who to call first.

The Starter Tag Framework

Tag Category

Examples

Purpose

Ranking

A (Referral source), B (Met once), C (Cold)

Prioritizes your daily call list.

Timeline

Hot (0–3 mo), Warm (3–12 mo), Long-term

Focuses your energy on immediate deals.

Type

Buyer, Seller, Investor, Vendor, Referral Partner

Determines what kind of content you send.

Source

Open House, Sphere, Referral

Tracks which lead sources for new California agents are working.

The Follow-Up Operating System

Building the list is only 20% of the work. The remaining 80% is the follow-up.

Successful agents use new agent time management strategies to ensure they aren't just "busy," but productive.

Follow-Up Cadence

"A" Leads (Referral Sources): Contact every 30 days.

"B" Leads (Met Once/Acquaintances): Contact every 60–90 days.

"C" Leads (Cold/Distant): Contact every 120–180 days (about twice a year) with broad value.

Value-Based Scripts

The "Permission" Text (Low Pressure, High Reply):

"Hey [Name]—quick question. Would it be helpful if I kept you posted when something notable happens in [Neighborhood] (sales, price changes, anything meaningful)? If yes, what’s the best email for you?"

The "Market Micro-Update" (Email/Text):

"Hey [Name], I saw that a house just like yours around the corner sold for [Price]. It's interesting to see how [City] is holding up right now. Let me know if you’d ever like a quick look at your current home value!"

The "Direct Ask" (Voice):

"I'm taking on a couple more clients this month. Who do you know that’s mentioned moving, upsizing, downsizing, or investing—even if it’s ‘later this year’?"

30-Day Build Plan

Follow this checklist to go from a blank screen to a functioning business engine.

The 30-Day Database Blueprint

Week 1: The Foundation. Create your spreadsheet using the template fields above. Import phone contacts. Apply "A, B, C" rankings to the first 50 people.

Week 2: The Reach Out. Add 25 more names. Send the "Permission" text script to everyone tagged "A" or "B."

Week 3: The Expansion. Log all responses. Call those who replied. Research how to find your first 3 clients as a new agent to convert these conversations into appointments.

Week 4: The Routine. Establish a "Minimum Daily Action": Add 5 new people, contact 5 existing people, and log 5 sets of notes.

Common Mistakes That Kill Databases

Over the last 20+ years, Kartik Subramaniam has seen thousands of students launch their careers.

The ones who fail usually hit these eight pitfalls:

Waiting until you "feel ready" to start calling.

Saving contacts with no notes (you will forget who they are).

Failing to use tags, leading to a "messy" list you eventually ignore.

No "Next Follow-Up" date— if it isn't scheduled, it won't happen.

Relying on "Likes"— social media engagement is not a database relationship.

Buying leads before you’ve exhausted your free sphere of influence.

Sounding like a salesperson instead of a local guide.

Ignoring Open Houses as a primary way to feed the database engine.

Kartik's Insider Tip:

“I’ve seen agents turn a 'maybe next year' lead into a $30,000 commission simply because they had a 'follow up in 6 months' tag and actually made the call.

Most agents quit after one 'no.' The database ensures you are there when the 'no' turns into a 'now.'”

Start Your Career the Right Way

A database is the difference between a "job" and a "business." Without it, you are unemployed every time a transaction closes.

With it, you have a predictable stream of referrals and repeat clients.

If you are ready to move beyond the basics, it is time to look at the bigger picture of your professional development.

If you’re building your first-year foundation in California, that’s the full roadmap.

Start a Real Estate Career in California →

|

The most stressful mail a licensee can receive isn't a lost commission check—it's an inquiry letter from the California Department of Real Estate(DRE).

Most agents don’t set out to break the law; Read more...

The most stressful mail a licensee can receive isn't a lost commission check—it's an inquiry letter from the California Department of Real Estate(DRE).

Most agents don’t set out to break the law; they fall into "DRE trouble" because of outdated habits or misunderstood regulations. In my 20-plus years of advising California licensees, I’ve seen that the best defense isn't a legal team—it’s a solid operational foundation. This is where Continuing Education (CE) shifts from a bureaucratic hurdle to a professional firewall to help agents avoid DRE violations.

Key Takeaways

Reduces Complaint Risk: Identifies the "red flag" behaviors that trigger consumer grievances.

Prevents Audit Deficiencies: Ensures your trust fund and transaction records meet DRE standards.

Forces Documentation Habits: Moves compliance from a "memory task" to a repeatable system.

What “DRE Trouble” Actually Looks Like

DRE trouble rarely starts with a "bad" person; it starts with a bad process. Here is how the regulatory machinery typically moves:

Consumer Complaints: Often triggered by a frustrated client, these lead to an investigative inquiry that can open up your entire file history.

Audit/Document Requests: Whether random or "for cause," an auditor will scrutinize your transaction folders and trust fund records for technical accuracy.

Renewal Delays: Simple errors in your CE reporting or incomplete requirements can lead to a "deficiency" notice, potentially causing your license to expire while you scramble to fix it.

Disciplinary Actions: This can range from a private citation and fine to a public "Accusation" that may result in a restricted license or revocation.

Disclaimer: This article provides educational information on compliance and is not intended as legal advice.

The 80/20 of What Gets Agents in Trouble

The DRE focuses on patterns. Most violations happen in these high-risk zones:

Advertising & Representation: Improper team names that omit the broker’s identity or missing license numbers on social media marketing.

Disclosure Failures: Missing "material facts" or failing to provide Agency Disclosure forms at the earliest practical moment.

Trust Funds & Records: The "cardinal sin." Commingling funds or failing to maintain a proper 3-column record of client money.

Management & Supervision: A major magnet for DRE trouble. Brokers are responsible for the oversight of salespersons and unlicensed assistants; a lack of a "reasonable system of supervision" is a frequent cause for discipline.

Records & Documentation: Failing to retain transaction-related documents for the required three-year period. If it isn't in the file, as far as an auditor is concerned, it didn't happen.

How CE Prevents Violations

When you approach your California Real Estate License Renewal with a focus on compliance, you treat each CE bucket as a defensive strategy.

1. Ethics & Disclosure

The Misunderstanding: "I only need to disclose things that are physically broken."

The Reality: California requires disclosure of anything that affects the value or desirability of the property.

The Scenario: An agent fails to mention a neighbor's recurring noise complaint. The buyer finds out, files a DRE complaint, and the agent faces an inquiry around misrepresentation.

CE Takeaway: Use your Risk Management CE to audit a recent Transfer Disclosure Statement (TDS) and Agent Visual Inspection Disclosure (AVID). If you're unsure, disclose it.

2. Fair Housing (Interactive Requirements)

The Misunderstanding: "I'm a good person, so I'm not violating fair housing."

The Reality: Bias in marketing and "steering" are primary DRE focus areas.

The Scenario: An agent tells a caller, "You'd probably be more comfortable in the neighborhood across town." Even if meant "helpfully," this is steering.

CE Takeaway: DRE renewal requirements now include interactive fair housing and implicit bias components. Use this training to practice compliant responses to client questions about "neighborhood demographics."

3. Trust Fund Handling

The Misunderstanding: "My broker handles the money, so the timing doesn't matter for me."

The Reality: If you touch a check, you are responsible for the record-keeping and handling according to DRE and brokerage-specific timelines.

The Scenario: An agent holds an earnest money check for several days without a written agreement to do so. An audit reveals the delay, leading to a citation for improper handling.

CE Takeaway: Implement a "Monday Morning" rule: any funds received must be logged and processed according to your broker's compliance manual immediately.

“Audit-Proof” CE Choices

To ensure your renewal goes smoothly and your files stay clean, use this checklist:

Verify Sponsor: Ensure the provider is a DRE-approved sponsor, like ADHI Schools, with a valid ID.

Interactive Requirements: Confirm you’ve completed the mandatory interactive fair housing and implicit bias components.

Correct Hours: Confirm you have the full 45 hours (or the required amount for your specific renewal cycle).

Storage: Save your certificates in a dedicated folder named CE-2026-Renewal-Certs.

DRE eLicensing: Upload your info early to avoid the last-minute "system is down" panic.

Post-Renewal: Your 30-Day “Stay-Out-of-Trouble” Plan

Once you’ve completed your CE, don't just file the certificates. Implement these operational habits:

Task

Action

Ad Audit

Review your Instagram bio, email signature, and website. Do they include your DRE number and brokerage name?

Complaint-Proofing

Start a "Communication Log" for every transaction. Document all verbal instructions from clients via a "confirming email."

File Hygiene

Spend 10 minutes every Friday reviewing your active transaction files for missing signatures or incomplete disclosures.

SOP Update

Ask your broker or manager for a simple one-page Standard Operating Procedure (SOP) for how your team handles "material fact" discoveries.

Once you’ve handled the technical side of the law, you can focus on the growth side of your business. For more on what to do once the renewal is submitted, see our guide on What to Do After Renewing Your CA Real Estate License.

Staying Compliant Is a Choice

AtADHI Schools, we build our CE courses around real-world compliance outcomes because we know a license is more than a piece of paper—it’s your livelihood. Think of CE as your biennial "compliance tune-up." It’s the most cost-effective insurance policy you can buy.

|

You’ve passed the real estate exam, your license is hanging at a brokerage, and the initial celebration has subsided. Now, you’re staring at a blank calendar and a quiet phone. It’s what I call the Read more...

You’ve passed the real estate exam, your license is hanging at a brokerage, and the initial celebration has subsided. Now, you’re staring at a blank calendar and a quiet phone. It’s what I call the “post-license cliff”. This moment is particularly acute in California, where high competition meets complex markets, and the pressure to “figure it out fast” can lead new agents toward expensive, ineffective shortcuts.

If you’re a new real estate agent in California wondering how to get your first clients without buying leads, this article is your playbook. Securing your first three clients isn't just about income—it’s about proof of concept. In my 20+ years of working in the California real estate market, I’ve noticed the agents who survive the first year are those who replace "hustle" with systems and processes.

What Success Looks Like in 30 Days

Before we dive in, let’s define a "win." Success in your first month isn't measured by closed escrows—it’s measured by inputs.

These inputs work because they maximize trust-building touches, not impressions.

If you follow this operating system, your 30-day scoreboard should look like this:

100+ Real Conversations: 5 per business day.

40+ Contacts: Added to your database.

4 Open Houses: Hosted during the month.

1–2 Buyer Consultations: Booked as a direct result of consistent follow-up.

Practice Over Profit: The First 3 Principle

This is the phase where most new real estate agents in California either build momentum—or quietly stall. Your first three clients are your learning labs. You are building the muscle memory of a professional. Success here comes from

Practice + Proximity + Follow-up

not expensive marketing.

Before You Prospect: Two Things You Must Set Up This Week

Before you pick up the phone, you need a professional foundation. California’s disclosure-heavy environment means your first clients are as much about the learning process as closing deals.

1. Broker Expectations: Sit down with your broker or team lead. Ask for (a) upcoming open house opportunities, (b) "floor time" for walk-ins (if this is still a thing in your area), and (c) their preferred CRM.

2. Compliance Guardrails: This is California—disclosures matter. Don’t wing it. Don't promise specific financial outcomes, keep all communications professional, and stay within your brokerage’s legal policies.

Pathway 1: The "Inner Circle" Strategy (The Database)

The Reality: Your first client is almost always someone you already know, or someone they know. People do business with people they trust.

The Action Plan: Stop "announcing" your career and start consulting. Use these micro-scripts to offer value:

The Call: "I’ve officially launched my real estate practice. I’m not calling for business—I just want to be your resource. If you ever need a quick valuation or want to know what’s moving in the neighborhood, I'm here."

The Text: "Hey! Just wrapped up my licensing. If you ever have a random real estate question or need a vendor recommendation, feel free to reach out!"

Micro-Credibility Boost:

Avoid: “I just got licensed and I’m looking for clients.”

Use: “I’m building my practice and want you to have a real resource.”

The 14-Day Follow-Up Cadence:

Day 0: Initial outreach (Call/Text).

Day 7: Value Touch (Send a quick, one-page market snapshot of their specific zip code).

Day 14: The Soft Ask: "I’m helping a few people find homes this month. Do you know anyone else thinking about a move this year?"

The Deeper Resource:

A "system" is simply: Name + Source + Last Contact + Next Action. In week one, a spreadsheet is fine. To move toward a sustainable pipeline, you need to build a real estate database from scratch.

Pathway 2: The Open House Capture & Conversion

The Reality: Open houses are one of the few places consumers actually expect to talk to an agent. It is a high leverage use of your time.

The Action Plan (The 3-Step Flow):

The Welcome: "Welcome! Are you from the neighborhood or just starting your search?"

The Qualification: "Have you seen anything else in this price point, or are you still getting a feel for the local inventory?"

The Close for the Next Step: "I have a list of three similar homes nearby that aren't on everyone's radar yet. Would you like me to send those over?"

A productive open house for a new agent isn’t measured by attendance—it’s measured by 2–3 follow-up conversations scheduled within 48 hours.

The Deeper Resource:

To turn a handshake into a contract, you need a specific follow-up method. Learn the full process in our guide: How New Agents Should Hold Open Houses in California.

Pathway 3: Leverage Office Inventory & Stale Leads

The Reality: While most agents chase "perfect" leads, you can find your first three clients by looking where others don't.

High-volume agents often ignore these opportunities because they require follow-up instead of marketing scale.

The Action Plan:

Support High-Volume Listings: Call top listing agents in your office. Offer to host their "stale" listings or prospect the surrounding neighborhood for them.

Renters-to-Buyers: Many people attending open houses are currently renting. Position yourself as the guide who helps them transition.

The Guardrails: Always follow "Do Not Call" rules and brokerage policy. Your job is service, not pressure.

Once you've mastered these manual methods, you can explore broader

lead sources for new California agents to scale.

The Two Moments That Start Real Careers

Moment #1: Someone trusts you enough to ask a "small" question (e.g., "What's my neighbor's house listed for?").

Moment #2: You followed up when the "rockstar" agent in your office forgot to.

Neither moment looks dramatic—but both are how real careers actually start.

Practical Pitfalls

Most new agents quit because they confuse activity with income-producing actions. This is how agents stay ‘busy’ for six months and exit the industry silently.

The below activities do NOT count as prospecting:

Perfecting your logo or business cards.

Scrolling Instagram for "content ideas."

Endlessly "tinkering" with CRM tags.

Watching "motivational" YouTube videos.

Re-designing your email signature.

The only 3 activities that count:

Real conversations

Intentional follow-up

Studying local inventory.

Managing this focus is the difference between a hobby and a career. Implement these New Agent Time Management Strategies to stay on track.

Your 30-Day Plan (Simple Version)

Week

Primary Focus

Daily Minimum

Week 1

Database Outreach + 1 Open House

5 Conversations

Week 2

Follow-ups + 1 Open House

5 Conversations

Week 3

Repeat + Book 1 Buyer Consult

5 Conversations

Week 4

Tighten Pipeline + Ask for Referrals

5 Conversations

Note: Five conversations means real two-way dialogue—not texts sent or DMs unanswered.

The Path Forward

Finding your first three clients is the hardest part of this business because it requires the most faith. But once you close that third deal, the "imposter syndrome" fades.

Mastering these first three clients is how you build a durable practice, not just a fleeting side hustle.

For the complete framework on launching correctly—from mindset to long-term planning—your next step is our foundational guide: Start Your Real Estate Career in California.

|

For a brand-new California real estate agent, the first few months can feel like a race against an empty pipeline. You have a real estate license and ambition, but you don't yet have the clients.

This Read more...

For a brand-new California real estate agent, the first few months can feel like a race against an empty pipeline. You have a real estate license and ambition, but you don't yet have the clients.

This is why the open house remains an undisputed "fast track" to success. It provides the high-volume conversation reps you need and the immediate lead capture required to build a business from zero.

Who This Article Is For:

New Licensees: (0–12 months) looking for a repeatable system.

The Systems-Minded: Agents who want to move from "hosting" to "converting."

In California, an open house is more than a public showing—it’s a high-intent prospecting event. When run correctly, it becomes one of the best repeatable lead sources available to a new agent (especially when paired with other proven lead sources for new California agents).

Fair warning - if you don’t capture usable contact info from guests, you can’t follow up—and the open house becomes a branding event instead of a pipeline event. To win, you need to transition from "showing a house" to "running an operating system."

The Open House Kit (What to Bring)

Your goal is to look calm and prepared—because prospects pair “prepared” with “competent.” Pack this like a pilot packs a flight bag:

Signage: 10–15 directionals + 1 main “Open House” sign.

Lead Capture: QR placard + tablet sign-in + paper backup.

Property Materials: Feature sheets + disclosure packet access + MLS remarks.

Script Support: 1 small note card with your greeting + 3 discovery questions.

Ops Essentials: Pens, tape, small stapler, portable charger, water.

Safety Basics: Fully charged phone, keep keys on you, clear exit path.

California Note: Sign placement rules and HOA sensitivity vary by city—always confirm your brokerage standards and be respectful about placement to avoid fines.

The 90-Minute Open House Timeline (New Agent Checklist)

Follow this timestamped sequence to ensure you never look "scrambled":

45 minutes prior: Arrive at the property. Open all blinds, turn on every light, and do a quick "sanity sweep."

35 minutes prior: Signs placed + QR code placard at the entry.

25 minutes prior: Set up your "command center" (usually the kitchen island) with sign-in sheets and flyers.

15 minutes prior: Walk the "tour path" one last time. Rehearse your greeting.

Start: Greet guests warmly, but let them tour at their own pace.

During: Ask 2–3 discovery questions max. Jot down notes in between visitors.

End: Final lap, lock up, and retrieve signs.

30 minutes after: Enter all new leads into your CRM and tag them with specific notes.

Same Day: Send the first follow-up text to every "hot" prospect.

The Conversation System: Scripts That Convert

The biggest mistake new agents make is being too aggressive or too passive. Use these "Operator" scripts to gather data without the "salesy" vibe.

The Neighbor Line (The Listing Goldmine):

"Are you here because you’re curious about the value of your own place, or do you know someone thinking of moving into the neighborhood?"

The "We Already Have an Agent" Pivot:

"Perfect—then you’re in good hands. Are you already touring homes this weekend, or still narrowing neighborhoods?"

If Someone Refuses to Sign In:

"Totally fine—please take a look around. If you decide you want a feature sheet, or updates on similar homes in this school district, the QR code on the table makes it easy for me to send those over."

The Follow-Up Operating System

Every open house is a database-building event—log your leads the same day to avoid "lead decay."

To make this automatic, block time for it. The easiest way is to treat every open house like a scheduled workflow: 30 minutes after lock-up for CRM entry and 20 minutes that evening for follow-ups.

If you don’t protect that time, the week fills up and your leads decay—this is exactly why new agent time management strategies matter early in your career.

Email Template (Day 1)

Subject: Oak Street open house — quick follow-up

Body:

“Hi [Name] — great meeting you today at the Oak Street open house. Based on what you mentioned regarding your [Timeline] and [Specific Feature], I pulled 3 similar options currently on the market: [Links].

If you want, reply with your 'must-haves' and I’ll tailor a search for you. — [Your Name]”

California Compliance & Professionalism

As I have observed over 20+ years of training agents, professionalism in California is defined by how you handle the "gray areas."

Do

Don’t

Ask about timeline, financing readiness, and search criteria.

Ask about family status, religion, or national origin.

Offer disclosures and encourage professional inspections.

Speculate on protected-class suitability or schools.

Maintain a clear exit path and stay between guests and the door.

Follow people into small rooms or turn your back to a crowd.

Building Your System

Open houses work best when they’re part of a weekly prospecting cadence—so you’re not relying on luck, you’re running a pipeline. By using this system, you ensure that every weekend moves you closer to finding your first 3 clients as a new agent.

If you're ready to move beyond the "hosting" phase and start operating like a pro, it's time to Start a Real Estate Career in California with the right education and strategy.

FAQ: Open Houses for New Agents in California

Do I need to make everyone sign in at an open house?

No—but you do need a professional way to capture contact info if you want follow-up to be possible. Use a QR placard + soft language: “If you’d like a feature sheet, or updates on similar homes, the QR makes it easy for me to send them.” Some brokerages prefer a hard sign-in policy, others don’t—confirm your office standard.

What if the open house is dead and nobody shows up?

A slow open house still has value if you treat it like a pipeline block, not a social event. Use the time to:

Tighten your tour path + talking points

Practice your script out loud

Message neighbors and past visitors

and review your follow-up workflow so you execute it automatically next time.

If your traffic is consistently low, pair open houses with other lead sources for new California agents so your week doesn’t depend on Saturday luck.

How many open house signs should a new agent use?

A good baseline is 10–15 directionals plus one main sign, placed at key turns that funnel traffic to the home. Keep them clean, consistent, and easy to read. Placement rules and HOA sensitivity vary by city—use good judgment and follow your brokerage policy.

What should I say when someone asks, “Is the seller desperate?”