SB 9 Potential in California Real Estate

As a real estate professional in California, you’ve likely seen "SB 9 Potential" popping up in MLS remarks. With 20+ years helping California agents and Read more...

SB 9 Potential in California Real Estate

As a real estate professional in California, you’ve likely seen "SB 9 Potential" popping up in MLS remarks. With 20+ years helping California agents and students navigate compliance at ADHI Schools, I have seen how new laws create both massive opportunity and significant professional landmines.

The Danger:

Marketing SB 9 as a "guaranteed" four-unit build. If a buyer closes based on your marketing, only to find the city rejects the permit due to local objective standards or utility constraints, you—and your broker—could be in the crosshairs.

Legal Disclaimer:This guide is for informational purposes only and does not constitute legal or land-use advice. SB 9 implementation varies significantly by local jurisdiction. Always advise clients to verify feasibility in writing with the local planning department and qualified land-use counsel.

FAST ANSWER: What is SB 9?

Senate Bill 9 (SB 9) provides a ministerial pathway for homeowners to subdivide a single-family lot (Urban Lot Split) or build up to two primary units on one lot. While it limits local discretionary review, projects must still meet "objective standards" and specific eligibility criteria.

Agent Note: Never guarantee approval; always verify site-specific feasibility in writing with the city.

SB 9 Eligibility: The Quick Screen

Before you spend hours on a property, run these four checks. If any of these "Red Flags" appear, the project may be ineligible under state or local rules.

Zoning: Is it a single-family residential zoning designation (e.g., R-1, RS, etc.)?

Location: Is it in an "Urbanized Area" or "Urban Cluster"? Verify this on the local agency’s SB 9 eligibility map.

Tenancy History: Hard-stop restrictions apply if the property was occupied by a tenant in the last 3 years. Generally, SB 9 cannot be used to alter or demolish tenant-occupied housing. Refer to Rent Control Laws in California (Agent Guide) to evaluate displacement risks.

Ineligible Sites: Sites in very high fire hazard severity zones, floodways, or earthquake fault zones often trigger ineligibility. Treat these as red flags requiring written confirmation from the city. See Environmental Regulations California Agents Should Know for more on these overlays.

What SB 9 Actually Does (Agent Translation)

To advise clients safely, you must distinguish between the two separate pathways provided by the law.

1. Urban Lot Split (Gov. Code § 66411.7)

The "40/60" Rule: Per state statute, the split must result in two lots where the smaller lot is at least 40% of the original lot's size. Both newly created parcels must be at least 1,200 square feet, unless a local ordinance allows smaller.

Owner-Occupancy: State law requires an applicant to sign an affidavit stating they intend to occupy one of the units as a principal residence for at least three years. Exception: This requirement does not apply to "community land trusts" or "qualified nonprofit corporations."

2. Two-Unit Development (Gov. Code § 65852.21)

The "800 Sq. Ft." Rule: Local objective standards generally cannot be applied in a way that would physically preclude the construction of at least two units that are at least 800 square feet each. This is a "backstop" against restrictive local standards, not a guarantee that every lot can accommodate this size.

The Unit Cap: In practice, many jurisdictions treat the total unit count (including ADUs and JADUs) as capped at four across the original lot footprint. If a lot already has an ADU, your client’s SB 9 potential may be limited—verify local implementation.

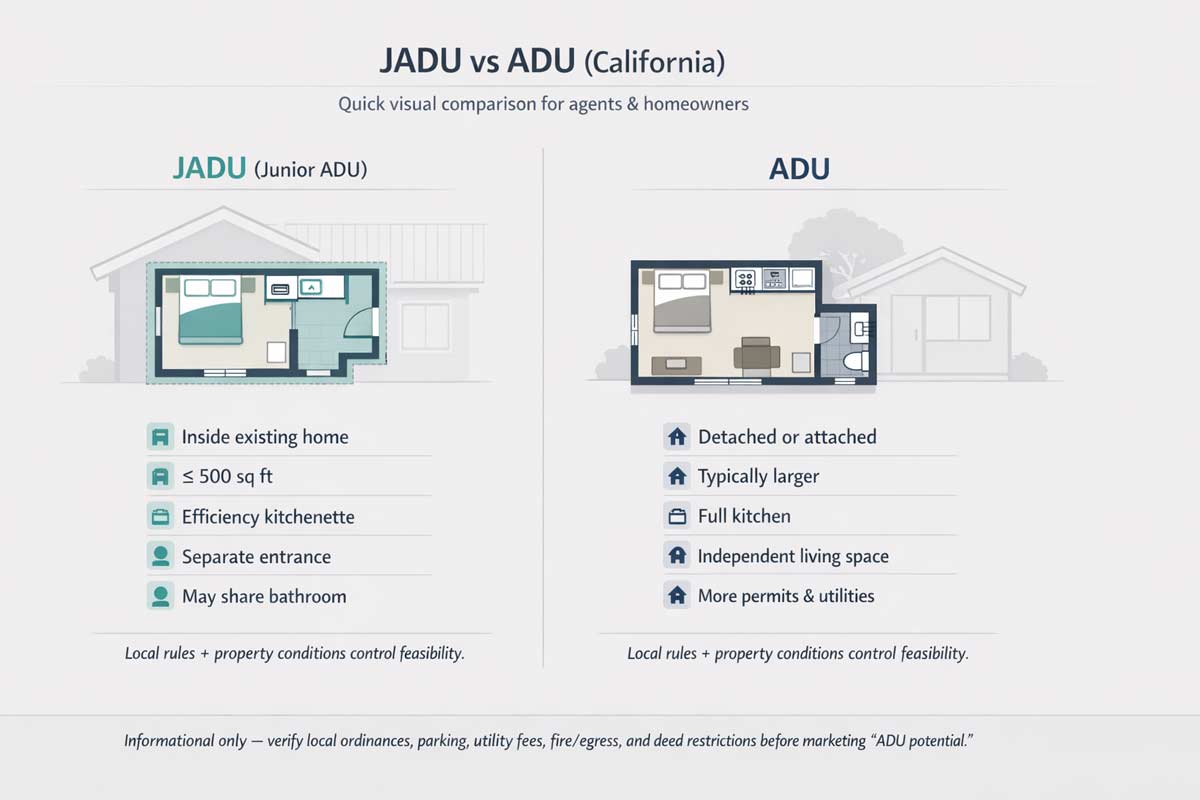

SB 9 vs. ADU: Why Clients Get Confused

Agents risk misrepresentation claims when they conflate these two very different permit paths.

Primary vs. Accessory: SB 9 units are "primary" dwellings; ADUs are "accessory."

Separate Sale: SB 9 units can potentially be sold separately if a lot split is recorded and ownership is structured appropriately—verify with counsel. ADUs generally cannot be sold separately. (Learn more: California ADU Laws Explained).

Parking: While state law limits parking requirements to 1 space per unit, multiple local waivers apply—verify the city’s specific SB 9 standards.

Setbacks: State law generally allows a local agency to require up to 4-foot side and rear setbacks (Gov. Code § 65852.21), but no setback is required for existing structures rebuilt in the same footprint.

Marketing & Liability: How to Talk About "Potential" Safely

The "Do vs. Don't" Table

Don’t Say (High Risk)

Do Say (Compliance First)

"Approved SB 9 Lot Split"

"May qualify for SB 9; Buyer to verify with city."

"Guaranteed 4-Unit Build"

"Check local unit-count caps for SB 9 + ADU."

"Split Ready / No Restrictions"

"Subject to local objective standards & affidavits."

Pro-TipDo not use the words approved, guaranteed, by-right, or split-ready unless you have a written planning confirmation or city-stamped approval in your hand.

Verification Artifacts (The "Agent File" Checklist)

Written email confirmation from the Planning Department regarding the specific APN.

Preliminary Title Report highlighting any private CC&Rs (SB 9 does not automatically override private restrictions).

"Will-Serve" notes from utility providers (water/sewer/power).

Seller-signed tenant history declaration.

Real-World Scenarios

The Unrecorded Access: A listing marketed "SB 9 split potential." The buyer discovered the "back lot" had no legal frontage and the neighbor refused an easement.

Agent Fix: Check for Water Rights & Easements in California Real Estate and ensure legal access is recorded on title. Document in file: Preliminary Title Report.

The Utility Capacity Halt: An investor bought a lot for a duplex build. The water district denied new meters due to infrastructure limits.

Agent Fix: Always include "will-serve" verification in your buyer's due diligence. Document in file: Water District written response.

The Tenant Surprise: A seller failed to disclose a roommate who paid rent. The city denied the permit because the property wasn't "tenant-free" for the required 3-year lookback.

Agent Fix: Document in file: Signed seller declaration regarding tenancy.

Frequently Asked Questions

Can I list "SB 9 potential" if there are HOAs?

SB 9 does not explicitly override private CC&Rs. Treat HOA/CC&Rs as a major red flag requiring attorney review before you market the project as feasible.

What kills SB 9 feasibility most often?

High-fire hazard zones, unrecorded easements, and the 3-year tenant occupancy rule are the most common "deal killers."

Is owner-occupancy always required?

For an Urban Lot Split, yes—a 3-year affidavit is required (Gov. Code § 66411.7(g)(1)), unless the applicant is a community land trust or qualified nonprofit. For a Two-Unit Development (no split), many cities do not require it.

Your Compliance Playbook

Navigating California land use requires more than just reading a headline. This article is part of our California Real Estate Laws & Compliance Guide, designed to be your professional compliance playbook.

|

Imagine you’re the listing agent for a 1970s fourplex in Los Angeles. The seller tells you the rents are "well below market" and the buyer can easily raise them by 20% to stabilize the asset. You include Read more...

Imagine you’re the listing agent for a 1970s fourplex in Los Angeles. The seller tells you the rents are "well below market" and the buyer can easily raise them by 20% to stabilize the asset. You include this in your MLS marketing.

The buyer closes, attempts the increase, and is immediately hit with a wrongful rent increase lawsuit and a city enforcement action. It turns out that because the property is in the City of L.A., it is subject to a local 3% cap for the current cycle (specifically the period through June 30, 2027)—not the statewide 10% maximum.

As an agent, you don’t need to be a lawyer, but you must be a high-level "compliance operator." In California’s 2026 regulatory environment, a single misstatement about "market rent potential" can lead to a professional liability nightmare.

Compliance Disclaimer: This is educational and not legal advice; agents should verify current rules as of the publish date. Local rules are frequently stricter than state law; always consult qualified counsel or local housing departments for jurisdiction-specific guidance.

The Two-Layer System: Statewide vs. Local

To keep your clients safe, use this mental model for every residential transaction:

The State Baseline (AB 1482): This applies to most multi-family housing and corporate-owned rentals statewide.

The Local Card: Cities like Los Angeles, San Francisco, and San Jose have local Rent Stabilization Ordinances (RSOs). If the local rule is more restrictive, the local rule prevails.

Field Scenario: You are showing a property in a city you aren't familiar with. Before discussing rent upside, your first move should be advising the buyer to check the city’s website for a "Rent Stabilization" or "Housing Department" page.

What Agents Must Know About Statewide Rent Caps (AB 1482)

Under the Tenant Protection Act, annual rent increases are capped at 5% plus the local Consumer Price Index (CPI), or 10% total, whichever is lower.

Common Exemptions (Verify for Every Deal)

Properties that are sometimes exempt from the state cap include:

Rolling 15-Year Rule: Residential property issued a certificate of occupancy within the last 15 years (verify the specific date on the CO).

Qualifying SFHs & Condos: Generally exempt only if the owner is not a REIT, a corporation, or an LLC with a corporate member.

Owner-Occupied Duplexes: If the owner occupied one of the units at the start of the tenancy and still lives there.

Agent Pitfall: A single-family home is not automatically exempt. For the exemption to hold, the landlord must have provided the tenant with specific statutory disclosure language in the lease. If that notice is missing, the property may remain "covered" by the rent cap.

“Just Cause” and Tenant Protections in a Sale

The "Just Cause" framework means a landlord cannot terminate a month-to-month lease without a valid legal reason once a tenant has been in place for 12 months.

Vacancy Assumptions: Never promise a buyer the property will be "delivered vacant." If the tenant is protected by "Just Cause," vacancy usually requires a "no-fault" reason like an owner move-in or a substantial remodel.

Relocation Assistance: "No-fault" evictions typically require the landlord to pay the tenant relocation assistance (often equal to one month’s rent, though local laws may require more).

Renovation Requirements: For a "substantial remodel" to be valid, the work must require permits (which must be provided with the notice) and must render the unit unsafe for occupancy for at least 30 consecutive days.

The Agent’s Rent-Control Workflow

Use this checklist during your due diligence period. This is the same logic we outline in our California Real Estate Laws & Compliance Guide.

Rent Control Compliance Checklist

Verify Age: Check the original Certificate of Occupancy date (do not rely solely on assessor data).

Audit Ownership: Confirm if the owner is a person, a trust, or a corporation.

Confirm Local Rules: Check the city/county for local RSO or unincorporated area protections.

Lease Review: Scan (also advise the buyer to) the current lease for AB 1482 "Notice of Exemption" or "Notice of Coverage" language.

Verify Rent History: Request the last 24 months of rent ledgers to ensure previous increases were lawful.

Confirm CPI Basis: Use the 2026 CPI figures for that specific metropolitan area (typically based on April data for increases after August 1).

Marketing Audit: Remove any "guaranteed" income or "easy eviction" claims from the MLS.

Advertising & Pricing Claims: What Not to Say

Risky Statement

Safer Alternative

“Can raise rent to market immediately.”

“Buyer to verify rent control applicability and allowable increases.”

“Guaranteed vacancy at close.”

“Subject to tenant rights; buyer to verify vacancy procedures with qualified professionals.”

“Property is exempt from rent control.”

“Owner-reported exemption to be verified by buyer during due diligence.”

Common Deal Killers (And How to Prevent Them)

Underwriting Mismatch: Lenders often use conservative rent growth assumptions if they see the property is subject to an RSO.

SB 9 & ADU Complications: Adding a unit can sometimes trigger different regulatory layers. See California ADU Laws Explained and SB 9 Explained for Real Estate Agents.

Missing Environmental Disclosures: Rent control isn't the only risk. See Environmental Regulations California Agents Should Know.

Water Rights Issues: Especially in rural properties, see Water Rights & Easements in California Real Estate.

FAQ

How do I know if a city has stricter rent control?

Search the city name + "Rent Stabilization Ordinance." If the city has its own cap (like the L.A. 3% limit), that number overrides the state floor.

Can rent be increased after a property sells?

A change in ownership does not reset the rent cap. The new owner is bound by the same annual limits as the previous owner for any existing tenants.

What is "Vacancy Decontrol"?

This is the concept that once a tenant moves out voluntarily, a landlord can usually reset the rent to market rate. However, once the new tenant moves in, the cap usually applies again.

Do local ordinances apply in unincorporated county areas?

Yes. For example, L.A. County has a dedicated Rent Stabilization and Tenant Protections Ordinance that covers unincorporated areas.

What documents should I request during due diligence?

Always request the original lease, all addendums, the Certificate of Occupancy, and a certified rent roll for the last 2 years.

Does AB 1482 apply to duplexes or triplexes?

Yes, unless they meet specific exemptions such as the "owner-occupied duplex" rule where the owner lived there before the tenancy began.

|

In California real estate, water and access are two of the easiest facts to misstate—and two of the hardest problems to fix after closing. If you market “water rights,” “year-round water,” or Read more...

In California real estate, water and access are two of the easiest facts to misstate—and two of the hardest problems to fix after closing. If you market “water rights,” “year-round water,” or “guaranteed access” without written verification, you’re not just risking a failed deal; you’re risking a misrepresentation claim.

The trap is predictable: agents often confuse legal entitlement with physical reality. A water bill is not the same thing as a legal right to a source, and a driveway you can drive today is not proof of a recorded right to use it tomorrow.

This guide is part of the California Real Estate Laws & Compliance Guide.

Notice: This guide is for informational purposes only and does not constitute legal advice. California water and land-use rules can be highly fact-specific. Always consult the local agency, title/escrow, and a qualified real estate attorney or land-use professional for property-specific guidance.

Fast Answer: Water Rights & Easements in California (What Agents Must Verify)

In California, water service (a meter/account with a district or mutual system) might be different from water rights (a legal claim to use a water source), and physical access is different from legal access (a recorded right to use a path for a defined purpose). Agents reduce liability by verifying: (1) the true water source and any conditions for continued service, and (2) the existence, scope, and map location of any access easement—in writing—before using those claims in marketing.

Verify in writing (minimum):

Water: District/mutual/well source, written confirmation of service availability/conditions, and any fees/limits.

Access: Recorded easement document + scope (ingress/egress, width, permitted uses), plus whether the actual road sits inside the easement boundaries.

Title: Easement exceptions, ambiguous “blanket” easements, or anything requiring a survey and/or legal review.

Water Rights vs. Water Service: The Critical Distinction

The most common mistake is assuming a property has "water rights" just because water is present.

Topic

What it is

What agents should verify

Common marketing mistake

Water Service

Utility delivery (district/mutual)

Service status, transfer requirements, written confirmation of service availability, connection fees, meter availability.

Saying “water rights included” when it’s only a service account.

Water Rights

Legal entitlement/claim to a source

Any documentation/agreements/permits, limitations, transferability, and counsel review when unclear.

Treating a claim as guaranteed capacity or permanent.

Physical Access

A road/driveway exists

Ownership, maintenance responsibility, gates/controls, visible encroachments.

Assuming physical use equals a legal right.

Legal Access

Recorded right to cross land

Recorded document, scope, width, map/exhibit location, and any lender/fire authority concerns.

Saying “deeded access” without reading the easement.

Who This Matters For (High-Risk Scenarios)

Verification is non-negotiable for these property types:

Rural & Ag Parcels: Properties with wells, irrigation, or horse/livestock needs.

Flag Lots & Private Roads: Properties relying on shared driveways or "off-main" access.

Waterfront & Creek-Adjacent: Land bordering natural watercourses where riparian claims may arise.

Development & ADU Sites: Parcels where "legal access" must meet specific fire-code widths or where utility capacity is capped.

California Water Rights Basics

Riparian and Appropriative Concepts

Riparian: Generally tied to land bordering a natural watercourse and typically used on that land; these rights are fact-specific and not something agents should "promise" without appropriate review.

Appropriative: Often tied to priority and permitting. If a property relies on diverted surface water, verification can require complex agency records and legal review.

Groundwater and Wells

Practical Reality: Well performance is a tested condition, not an assumption. Local groundwater rules and basin management can affect drilling, pumping, and long-term reliability.

What Documents Usually Prove What (Quick Reference)

Resource

Evidence/Document to Request

Water District Service

Recent bill + district confirmation of transfer/service status.

Mutual Water

Share certificate + current standing confirmation + transfer rules.

Private Well

Well records (if available) + current yield/flow + potability results.

Shared Well

Written agreement covering access, maintenance, and cost-sharing.

Access Easement

Recorded easement/right-of-way document + map/exhibit showing location.

How to Spot Easements in the Preliminary Title Report (Schedule B)

Your primary defense is the Preliminary Title Report—but only if you treat it like a checklist, not a formality.

Start with Schedule B (Exceptions): This is where easements, rights-of-way, and restrictions can appear.

Pull every referenced document: If an exception cites a recording date/instrument number, ask title/escrow for the actual recorded document—don’t rely on the one-line summary.

Identify scope: Does it allow ingress/egress, utilities, drainage, or something else? Is it limited to certain vehicles or purposes?

Check whether it’s appurtenant or in gross: Does it benefit the parcel (runs with land) or an entity (utility, agency)?

Find the map/exhibit: Many easements live on a plat or exhibit that shows location/width. If the easement isn’t clearly mapped, treat it as a risk flag.

Compare paper to pavement: If the road/driveway doesn’t appear to sit within the easement area, recommend a survey and/or legal review before removing contingencies.

Title Red Flags:

“Blanket” easements that cover large areas without a defined corridor.

Easement exists, but doesn’t connect to a public right-of-way or reach the actual structure.

Language that conflicts with current use (e.g., pedestrian-only vs. vehicle access).

Encroachments (fences/sheds sitting in the easement area).

Agent Workflow: The 6-Step Due Diligence Loop

Ask: Source, history, disputes, and shared agreements.

Pull: Title/prelim + exhibits; read Schedule B and referenced documents.

Confirm: District/mutual status, will-serve terms, and transfer rules.

Test: Yield and potability during contingencies (for wells).

Map: Confirm easement location vs. actual road; survey if needed.

Disclose + Market Safely: Use precise language tied to documents.

Water & Access SOP (Verify in Writing)

Water

Source type: District meter, mutual water company, shared well, or private well.

Transfer requirements: Rules/fees to transfer service or shares; confirm standing with the provider.

Vacant land: Get written confirmation of service availability/conditions (often called a “will-serve” confirmation).

Well properties: Recommend yield/flow and potability testing; ask for prior repair history.

Shared well: Confirm a written agreement exists covering maintenance, cost-sharing, and repair access.

Access / Easements

Recorded document: Obtain and read the recorded easement/right-of-way document.

Scope + width: Confirm permitted uses (vehicle/utility), width, and any restrictions.

Maintenance: Confirm who pays; if shared, verify if a recorded maintenance agreement exists (may be a lender/underwriting concern).

Physical reality: Check for gates, parking conflicts, or fences/encroachments; recommend survey if alignment is unclear.

Local requirements: Confirm emergency access expectations with the local fire authority.

Marketing Language: Safe vs. Risky

Risky Language (Avoid)

Safe Language (Use Instead)

"Unlimited water rights."

"Property served by private well; buyer to verify capacity and rights via current testing."

"Deeded access to the highway."

"Access via recorded ingress/egress easement; see preliminary title report and recorded documents for scope."

"Abundant water for horses."

"Buyer to verify water capacity for specific agricultural needs."

"Easy shared driveway."

"Shared driveway, see recorded maintenance agreement for details."

"Right-of-way guaranteed."

"Recorded right-of-way; see documents for scope and width."

"Build your dream home here."

"Buyer to verify utility availability, permits, and emergency access requirements."

"Water shares included."

"Sale includes shares in [Name] Mutual Water Co.; verify standing."

"Year-round creek access."

"Bordered by [Creek Name]; buyer to verify riparian claims/use."

Navigating the Broader Regulatory Landscape

Understanding the Dominant vs. Servient Tenement relationship is just one piece of the puzzle. This guide is a core component of our larger California Real Estate Laws & Compliance Guide, designed to help agents navigate the state’s complex land-use regulations.

Development and Density Constraints

Easements are often the "make-or-break" factor when a client is looking to increase property value through density. If you want to learn a little more about exploring a lot split, refer to our breakdown of SB 9 Explained for Real Estate Agents; access and utility feasibility are the primary hurdles that can quickly derail development assumptions.

Similarly, when evaluating the addition of secondary units, California ADU Laws Explained will help you distinguish between state-mandated allowances and the real-world water or access constraints that often limit buildable space.

Environmental and Tenant Considerations

For properties in coastal or rural settings, easements often intersect with protected land. Reviewing the Environmental Regulations California Agents Should Know is essential, as these restrictions can strictly limit the grading and drainage work necessary to maintain an easement.

Finally, if you are handling a tenant-occupied property where shared utilities or access rights are in play, our Rent Control Laws in California (Agent Guide) is a vital resource for ensuring that easement maintenance doesn't inadvertently trigger a tenant dispute or a violation of local habitability ordinances.

FAQ

Q: What is a “will-serve” letter?

A: A document from a utility district confirming they have the capacity to serve a property, often under specific conditions or fees.

Q: What’s the difference between an easement and a license?

A: An easement is a general right to use land that runs with the land; a license is personal and revocable.

Q: Can I say “legal access” in marketing?

A: Only if you’ve reviewed the recorded documents (and exhibits) and the claim matches the scope and location; otherwise use “access via recorded easement—buyer to verify.”

Q: What is a “blanket easement”?

A: An easement that isn't clearly defined on a map. It can create major development limits or disputes.

Q: Can a neighbor take away an easement?

A: It is difficult if recorded, but can happen via merger or court action. Always verify with title.

Water and access issues aren’t “rural quirks”—they’re core transaction risks. For the full framework on how agents avoid misrepresentation, read the California Real Estate Laws & Compliance Guide and keep a “verify in writing” file for every listing.

|

Notice: This guide is for informational purposes only and does not constitute legal advice. California housing laws are subject to frequent legislative updates; always consult with a qualified land-use Read more...

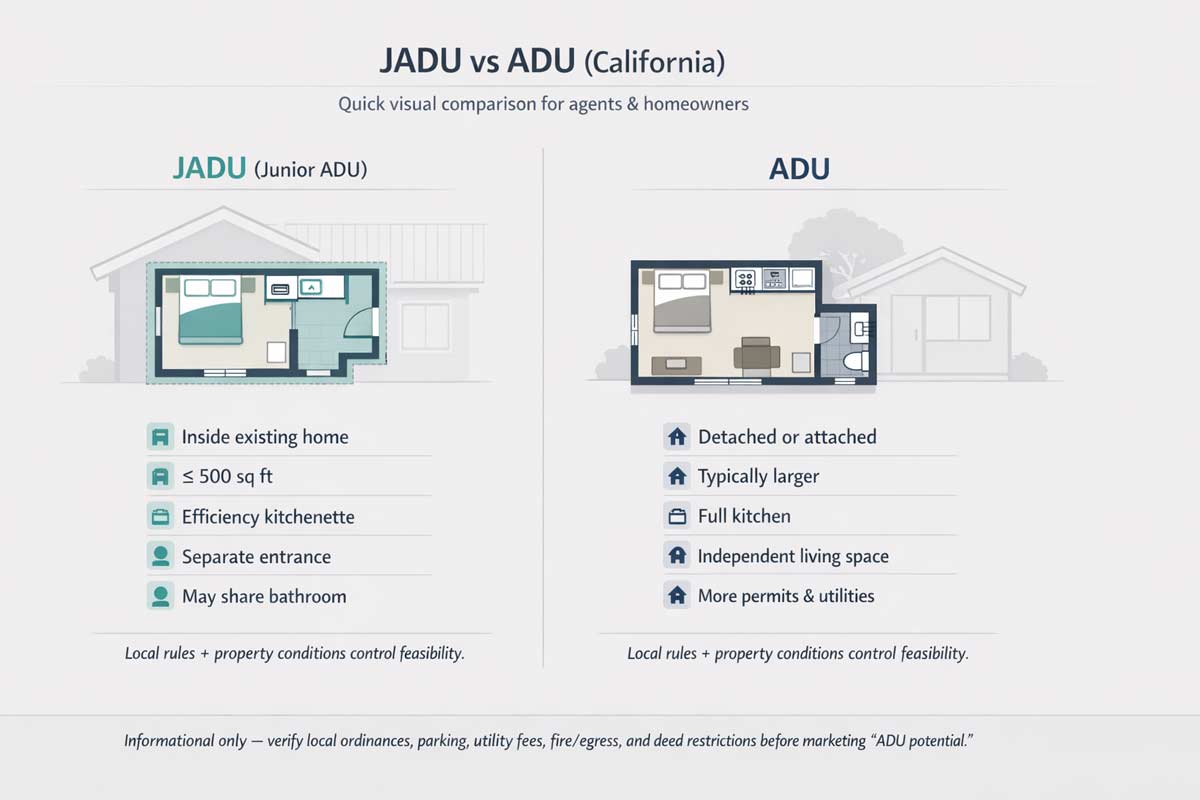

Notice: This guide is for informational purposes only and does not constitute legal advice. California housing laws are subject to frequent legislative updates; always consult with a qualified land-use attorney, local planning department, and the applicable utility agency for property-specific feasibility.

Accessory Dwelling Units (ADUs) can be a major inventory-growth lever in California — but “ADU potential” is also one of the easiest ways for an agent to create liability if it’s marketed like a guarantee. This guide is part of our California Real Estate Laws & Compliance Guide and focuses on what agents need most: the state’s ministerial (no-hearing) process and the administrative “shot clocks” designed to prevent permit stalling — plus the exact items you should verify in writing before you talk numbers.

Fast Answer: What California ADU Law Actually Does

California’s ADU framework is no longer “local preference.” It’s a state-enforced ministerial system: cities must approve ADU applications that meet objective standards, and they must process them on strict timelines.

“Ministerial” just means that there’s a checklist that has to be followed, and as long as everything on that checklist is done the approval doesn’t require a hearing. However, it’s still not a guarantee until the city confirms the application is complete and compliant.

The two clocks agents should know:

1) Completeness clock (15 business days)

Cities have a 15-business-day window to determine whether an application for an ADU is complete. If the permitting agency does not make a timely completeness determination, the application is treated as complete for timing purposes and the next clock starts.

VERIFY IN WRITING (do this every time):

Get a portal timestamp / receipt confirmation showing the submission date and time.

If submitted by email/mail, keep proof of receipt (and ask the agency to confirm the “received” date in writing).

2) Decision clock (60 days after complete)

Once an application is complete, the city generally has 60 days to approve or deny it. Missing that deadline can trigger “deemed approved” status, subject to the statutory mechanics (and tolling if the applicant requests delay).

VERIFY IN WRITING:

Ask the city (email is fine) to confirm the “complete” date that starts the 60-day clock.

If the city denies, request the full written set of correction comments (all departments) in one package — not piecemeal.

Key Considerations

1) State law sets the baseline (and limits local games)

State ADU law preempts conflicting local standards. Cities can add rules, but they must stay within the state framework and use objective standards — not subjective “we don’t like it here” discretion.

VERIFY IN WRITING:

Request the city’s current ADU ordinance + ADU handout/checklist (many cities have an “ADU packet”).

If staff cites a rule that seems to conflict with state standards, ask them to identify the code section in writing.

2) The 60-day clock is real — and denials must be “complete”

If the city denies, it must provide a full written set of correction comments describing what’s wrong and how to fix it. This is designed to prevent the “drip-feed denial” tactic.

VERIFY IN WRITING:

Please provide the complete set of correction comments from all reviewers and confirm this is the full list.

3) Parking: stop making promises; use exemptions carefully

Parking rules are often 0 spaces in common scenarios (especially conversions) but be sure to confirm local and state rules.

Parking may be capped and often waived under specific statutory exemptions (transit proximity, conversion of existing space, historic district rules, permit restrictions, etc.).

Replacement parking is often not required when converting certain existing parking structures — but don’t market that as universal without city confirmation.

VERIFY IN WRITING:

Ask planning to confirm how many parking spaces are required for the specific property and why (which exemption they’re applying).

4) Fees: impact fees ≠ utility connection/capacity charges

This is where agent marketing can get folks in hot water.

Impact fee rules can depend on ADU size thresholds and local fee programs.

Utility connection/capacity charges are a separate universe (water/sewer/power) and can still surprise owners even when impact fees don’t.

VERIFY IN WRITING:

City: “What impact fees apply for an ADU of approximately ___ sq ft?”

Utilities: “What connection/capacity charges apply and under what calculation method?”

Consider brushing up on Water Rights & Easements in California Real Estate (because easements + utility constraints are where projects can fall apart.

5) Short-Term Rentals (Airbnb): keep the warning, tighten the language

California law requires 30+ day rental terms for JADUs and for ADUs approved under the § 66323 “state standards” pathway.

For ADUs approved under a local ordinance, state law gives cities the authority to require 30+ day terms — and many jurisdictions do.

VERIFY IN WRITING:

Never market “ADU short-term rental income” unless you have the city’s short-term rental rule in writing for that parcel.

Agent Tip: To protect your commission and your client, never market “ADU short-term rental income” unless you have verified the city’s specific STR ordinance in writing.

6) Environmental overlays and recorded easements are the silent killers

Most “ADU denials” aren’t philosophical. They’re constraints: hillside grading, coastal, fire severity, biological, historic, sewer/water limitations, or recorded easements.

VERIFY IN WRITING:

Ask the city: “Are there any overlays affecting ADU placement (hillside/coastal/fire/historic/biological)?”

Confirm easements on the prelim/title report before promising anything.

Environmental Regulations California Agents Should Know

Water Rights & Easements in California Real Estate

7) The SB 9 Intersection: When ADUs Aren't Enough

If a client wants more than just an ADU, they may ask about SB 9. While ADUs add "accessory" units, SB 9 allows for primary density increases through ministerial lot splits and two-unit developments.

Summary of SB 9 (2025-2026 Updates):

The "Two-Unit" Rule: On a single-family lot, an owner can ministerially build two primary units (effectively a duplex) instead of a house + ADU.

The "Urban Lot Split": SB 9 allows a single lot to be split into two. Each new lot must be at least 1,200 sq ft.

The "Unit Cap" Trap: If a lot is split under SB 9, the city can limit the total number of units to two per new lot (inclusive of ADUs/JADUs).This means you generally cannot "stack" an SB 9 lot split with multiple ADUs to get 6 or 8 units unless the local ordinance specifically allows it.

Owner-Occupancy (The Big Catch): Unlike ADUs, an SB 9 lot split requires the owner to sign an affidavit stating they intend to occupy one of the units as their primary residence for at least three years.

VERIFY IN WRITING:

"Does this specific parcel qualify for an SB 9 lot split (check for historic districts/fire zones)?"

"If we split the lot, what is the maximum total unit count (including ADUs) allowed per parcel?"

8) The Rental Strategy Trap: Rent Control & AB 1482

This is a critical due diligence item for investors. While a single-family home (SFH) is typically exempt from statewide rent control under the Costa-Hawkins Rental Housing Act, adding an ADU can change that.

Rental strategy trap (state + local): don’t underwrite rents in your head.

If a client wants more than just an ADU, they may ask about SB 9. While ADUs add "accessory" units, under AB 1482 depending on the property type, ownership structure, and required tenant notices

VERIFY IN WRITING: Before you market “rent upside,” have the buyer/owner confirm (a) whether the property is covered by a local rent stabilization ordinance, and (b) whether AB 1482 applies or an exemption applies — preferably with a landlord-tenant attorney or written guidance from a credible local housing/rent authority.

“What to Say in Listing Remarks” (safe, punchy, defensible)

Use language like this:

Property may be eligible for an ADU (subject to city review, utility capacity, and recorded easements). Buyer to verify ADU feasibility, fees, parking, and rental restrictions with the City and utility providers.

Avoid language like:

“Guaranteed ADU”

“By-right ADU” (unless you’re prepared to prove the exact pathway + objective compliance)

“No fees”

“No parking required”

“Airbnb income”

The shift from local control to a state-mandated ADU framework has created a massive opportunity for California homeowners, but for real estate agents, it has also moved the goalposts for professional liability. Mastering ADU rules is no longer just about knowing square footage; it is about protecting your clients from expensive permitting delays and "soft" denials.

As we move through 2026, the key to a successful ADU-focused transaction is transparency. By using the "administrative shot clocks" provided by SB 543 and the streamlined pathways of AB 1154, you can help your clients navigate the process with confidence—provided you never mistake "potential" for a "guarantee."

Your Starter Checklist for Every ADU Listing:

Don't Guess on Fees: Get the city’s impact fee and the utility’s capacity charge schedules in writing.

Watch the Clock: Use timestamped receipts to hold agencies to their 15-business-day and 60-day legal windows.

Build the Professional Team: Always refer your clients to a qualified land-use attorney, a licensed architect, and a contractor to confirm site-specific feasibility.

Staying "compliance-first" is what separates top-tier agents from the rest. By facilitating the right conversations with the right experts, you protect your commission, your reputation, and your client’s investment.

|

Environmental issues are the "silent deal killers" of California real estate. A single undisclosed underground tank or a mismanaged mold complaint can trigger five-figure remediation costs and six-figure Read more...

Environmental issues are the "silent deal killers" of California real estate. A single undisclosed underground tank or a mismanaged mold complaint can trigger five-figure remediation costs and six-figure lawsuits.

In practice, your job is to surface red flags, disclose material facts, and document referrals—not to diagnose or guarantee property conditions. This guide provides a practice-based protocol for protecting your license and your clients from environmental liability.

Disclaimer: Informational only, not legal or environmental engineering advice. Rules vary by property and local jurisdiction; consult qualified counsel and environmental professionals.

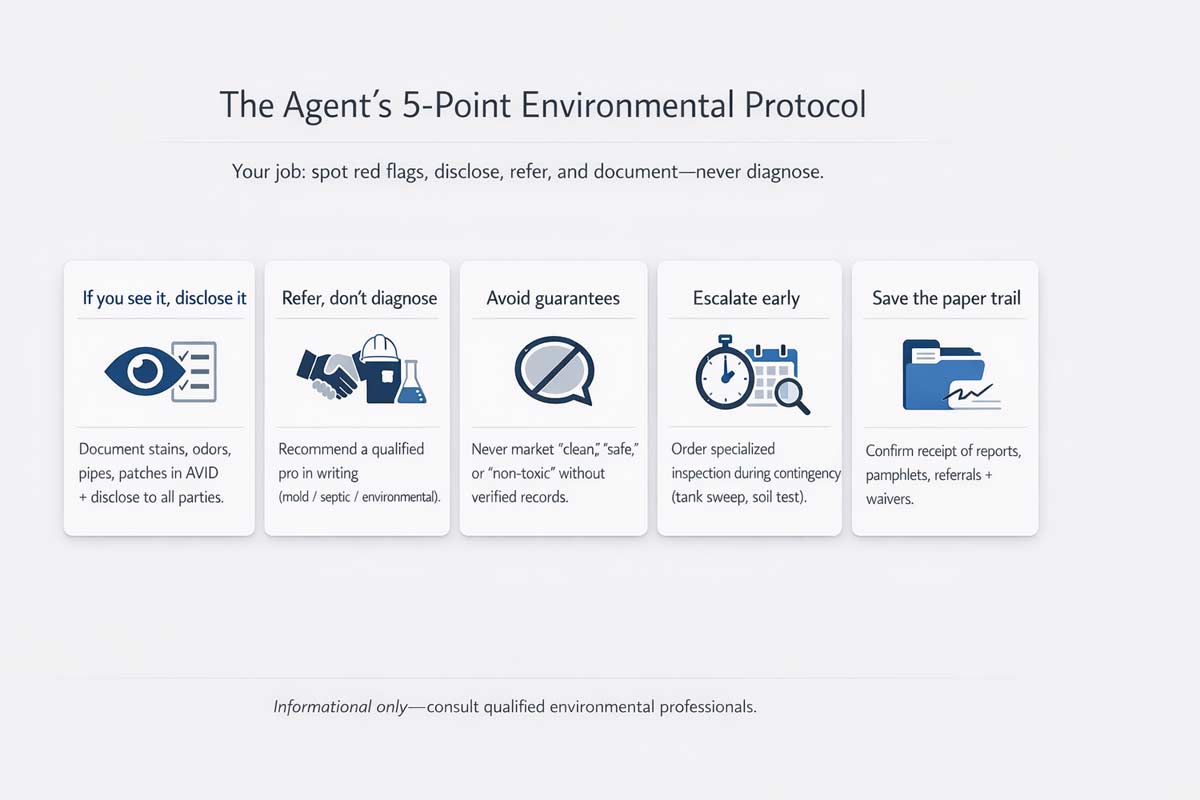

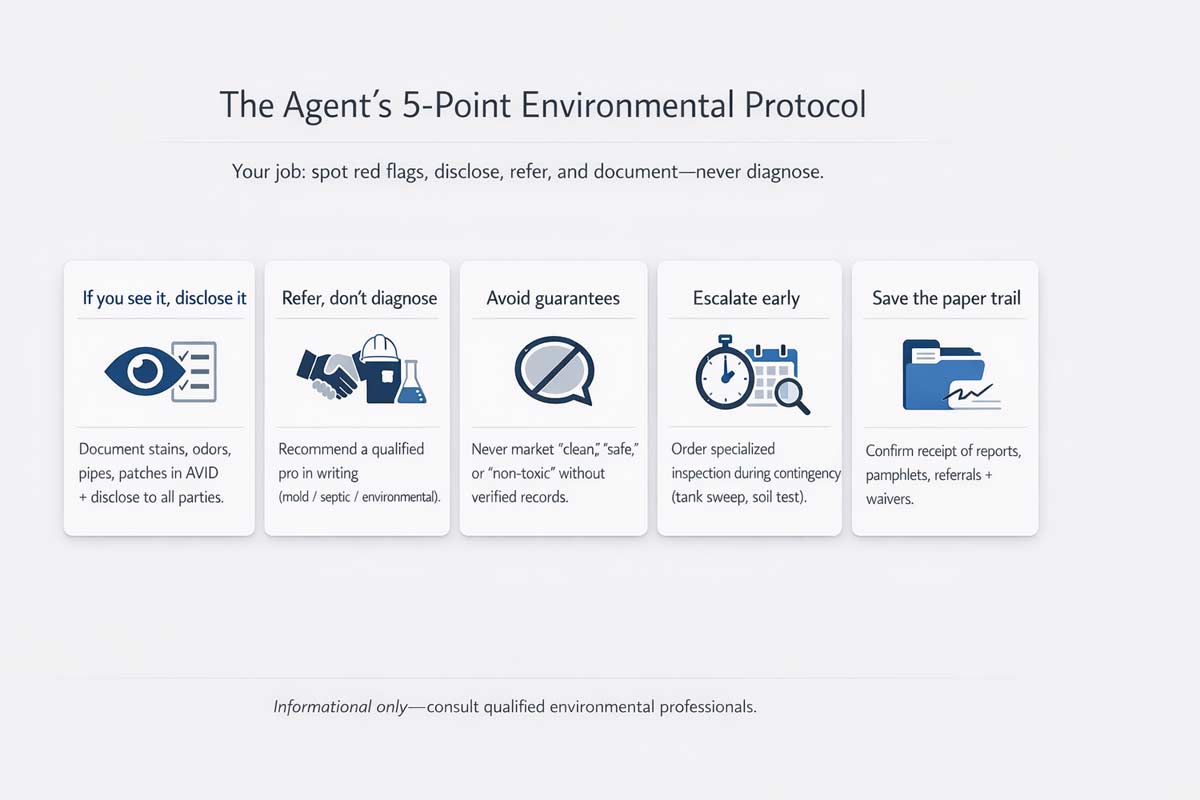

The Agent’s 5-Point Environmental Protocol

If you see it, disclose it: Document visual flags (stains, pipes, odors) in your AVID and disclose them to all parties.

Refer, don't diagnose: Never tell a client "that looks like harmless mildew." Recommend a professional (mold, septic, or environmental pro) in writing.

Avoid Guarantees: Never market a property as "clean," "safe," or "non-toxic" in MLS remarks or conversations.

Escalate Early: Recommend specialized inspections (like tank sweeps or soil tests) during the contingency period, not after.

Save the Paper Trail: 5.Obtain signed receipts for all environmental reports, pamphlets, and written recommendations and any inspection waivers.

The Agent’s "Non-Negotiables"

Problems often stem, not from the hazard itself, but from an agent’s failure to follow these rules:

Rule 1: You are not the expert. Even if you’ve seen a hundred "slurry-filled" oil tanks, do not give an opinion on the safety or cost of removal. Point it out and suggest a specialist.

Rule 2: Perform required visual diligence. Disclose observable red flags where applicable. Missing a blatant red flag can lead to a negligence claim.

Rule 3: Verify claims with records. If a seller says soil is "clean," do not market it as such until you see closure documentation or other credible third-party records (as applicable) and reference those reports in your discussions.

Rule 4: Recommend in writing—even if they decline. If a buyer waives an environmental inspection, send an email (or have them sign a document) confirming they have chosen to assume that risk against your advice.

Hazards: Red Flags

1. Mold & Moisture Intrusion

In California, mold is a primary habitability issue. For rentals, these issues often trigger complex Rent Control Laws in California (Agent Guide) disputes regarding repair timelines and tenant leverage.

Red Flags: Musty odors, water stains, bubbling paint.

Safe Script: "I noticed discoloration; I recommend a mold professional test the air quality."

What NOT to Say: "Bleach will fix it." Do not make health claims like "non-toxic."

2. Asbestos & Lead-Based Paint

In pre-1978 construction, lead based paint may be present. This is a critical consideration before discussing California ADU Laws because construction disturbs suspect materials.

Red Flags: Popcorn ceilings, linoleum, or "shingle" siding in older homes.

Safe Script: "Due to the age of the home, these materials may be present. Consult a specialist before renovating."

Recommend: Delivery of the CalEPA "Environmental Hazards" booklet and other documentation as required by law and your brokerage.

3. Underground Storage Tanks (UST) & Contamination

Red Flags: Metal pipes in the yard, circular concrete patches, or proximity to old dry cleaners.

Safe Script: "This pipe may indicate a former tank; we should recommend a search for closure records."

SB 9 Alert: Feasibility marketing is where agents get sued. Before you market the feasibility of a lot split, ensure environmental constraints don't kill the path for SB 9 Explained for Real Estate Agents.

What NOT to Say: "The tank was definitely removed correctly."

4. Private Wells & Rural Hazards

Environmental due diligence must expand to include water potability, yield, and seasonality.

Red Flags: Nearby industrial sites, agricultural runoff, or "smelly" water.

Safe Script: "Since this property uses a private well, I recommend a professional test for potability and yield."

Pro Tip: Beyond physical service, ensure you understand Water Rights & Easements in California Real Estate.

5. Septic Systems & Leach Fields

Red Flags: Lush green patches in dry weather, soggy soil, or slow drains.

Recommend: Septic inspection, records search, and pumper's report.

What NOT to Say: "It passed before" or "pumping proves it functions perfectly."

6. Former Agricultural Use & Dumping

Red Flags: Abandoned burn pits, distressed vegetation, or historical records of crop spraying.

Recommend: Soil testing by a qualified pro; consult an environmental specialist.

What NOT to Say: "It was just farmland, so it’s clean."

Regulatory Touchpoints

California environmental "regulation" for agents is primarily about disclosure mechanisms:

The NHD Mechanism: The Natural Hazard Disclosure (NHD) flags "zones" (Fire, Flood, Seismic). It does not certify property condition—it only flags state-mapped risks.

Wildfire & Build Feasibility: Treat wildfire exposure as a build-feasibility constraint, especially if your client plans an ADU.

Phase I ESA: A research report used to identify "Recognized Environmental Conditions" (RECs)—signs the property’s history may involve contamination risk.

The TDS: The Transfer Disclosure Statement is where sellers disclose known property conditions, including environmental hazards.

Marketing Language: "Bad vs. Better"

Bad Language (High Risk)

Better Language (Lower Risk)

"No environmental issues"

"Seller reports no known issues; recommend buyer inspection."

"Mold-free home"

"Professional remediation completed [Date]; see attached report."

"Safe well water"

"Water quality to be investigated by buyer during contingency."

"No tank on property"

"No known tanks disclosed; buyer to verify via records/testing."

"Clean Phase I"

"Phase I ESA available for review; buyer to perform due diligence."

Agent Due Diligence Checklist

Review NHD Early: Flag any fire, flood, or fault exposures for the buyer immediately.

Where Relevant, Check Databases: For suspected history, check databases such as GeoTracker or EnviroStor.

Document in AVID: Note all odors, stains, or nearby industrial uses.

Confirm Receipt: Document delivery of all disclosures (NHD, TDS, advisories, and booklets).

Written Referral: Recommend appropriate professional evaluation during contingency; document acceptance/decline.

Frequently Asked Questions

Does "buyer to verify" protect an agent from liability in California?

It is a standard supplement, but it does not absolve you of the duty to disclose a known red flag or material fact.

What should I do if the buyer waives inspections?

Immediately document the waiver in writing. Send an email confirming that you recommended the inspection and they have chosen to assume the risk of the unknown and have the buyer sign a waiver that they are acting against your recommendation.

Is a seller's refusal to allow testing a material fact?

A refusal to allow requested testing is a major red flag and should be communicated to the buyer immediately; ensure this communication is documented in writing.

What is the difference between Phase I and Phase II?

A Phase I is historical research (no drilling). A Phase II involves actual soil or water sampling to determine if contamination exists.

Build Your Compliance System

Environmental risk management is just one piece of a successful real estate practice. If you are building a professional compliance system, start here:

California Real Estate Laws & Compliance Guide

|

Assembly Bill 1033 has created a new class of real estate in California: the sellable ADU. In jurisdictions that opt in, homeowners can now convert their property into a condominium, allowing the ADU Read more...

Assembly Bill 1033 has created a new class of real estate in California: the sellable ADU. In jurisdictions that opt in, homeowners can now convert their property into a condominium, allowing the ADU to be sold separately from the main residence. This unlocks a brand-new listing category for agents but also brings the complexities of condo law, lender sign-offs, and extensive disclosures into what would otherwise be a simple residential sale. This guide provides the essential details you'll need to navigate these transactions confidently.

What AB 1033 Actually Does (and Why It's Not a "Lot Split")

AB 1033 allows cities and counties to pass an ordinance that lets a homeowner sell their ADU separately from the primary residence. However, it's critical to understand the legal method: this is not a lot split. Instead, you are creating a common interest development—essentially, a small, two-unit condominium project.

Here’s the practical distinction:

A lot split divides the land itself, creating two or more legally independent parcels. Each new lot is owned outright.

An AB 1033 conversion keeps the original lot intact. The land becomes a "common area" jointly owned by the owners of the main home and the ADU with each owner holding a separate interest in their airspace unit.

This brings up a common question: "Won't the two units have different Assessor's Parcel Numbers (APNs)?"

Yes, they most likely will. Once the condominium is legally created, the county assessor will typically assign a separate APN to each unit (the main home and the ADU). However, this is done for property tax purposes only. Since the units can be owned by different people, the county needs a way to send two separate tax bills. The assignment of an APN is an administrative function for taxation and does not change the legal fact that the property is a condominium on a single, shared lot—not two separate lots.

Ultimately, the state law only provides the framework; this entire process is only possible when a local city or county officially opts in and defines the specific local rules.

Where This Is Live (and why adoption is uneven)

Because AB 1033 is opt-in, the map is patchy. San José moved first —adopting an ordinance in July 2024 and green-lighting the state’s first ADU condo sale in August 2025. That milestone proved the concept and kicked off copycat discussions in other cities. Always verify local status before you market or write offers.

The Path for Sellers: From ADU to “micro-condo”

Think of the conversion as three intertwined tracks—legal mapping, habitability sign-off, and lender consent—followed by a familiar marketing and escrow period.

Confirm opt-in & pull the city checklist. If your city hasn’t adopted, you’re done. If it has, the checklist will mirror state guardrails but add local steps and forms.

Assemble the deal team early. You’ll need a land-use or condo attorney, title, a surveyor, and someone who can draft CC&Rs that divide maintenance and spell out access, parking, utilities, noise, and exclusive-use areas.

Plan the disclosure stack. In addition to the standard residential TDS and NHD and other mandated disclosures, the buyer will need condo docs (CC&Rs, bylaws, operating budget/reserves), the condo map/plan, any shared-elements easements, and recorded lienholder consents (more on that below).

Meet the safety inspection requirement. Before the map records, AB 1033 requires proof of a safety inspection—either a certificate of occupancy issued by the local agency or a HUD Housing Quality Standards (HQS) report by a certified inspector. Build time for this into your timeline.

Secure lender consent (non-negotiable). The condo map cannot record without written consent from each lienholder. Lenders can refuse or require conditions (e.g., refinancing, reserve thresholds, or revised collateral language). The consent must include specific statutory language and be recorded with the county. Start these conversations early—this is where otherwise clean deals can stall.

Sort utilities and notify providers. Separate meters may be required by local policy or utility providers; if not, the CC&Rs must clearly allocate costs, access, and shut-off rights. Upon condo creation, the homeowner must notify utility providers of the separate conveyance.

Record, list, and close. Once the map and consents are recorded, market the ADU as a condo. Expect the county assessor to assign separate APNs post-conveyance (timing varies by county). Underwriting, comps, and buyer expectations look different from a standard condo—see below.

The Buyer’s Reality: Financing, monthlys, and resale

Financing. These are condominium loans, and the smaller the unit, the more attention lenders pay to project questionnaires (reserves, insurance coverage, owner-occupancy mix, litigation). Be ready to provide the new HOA budget and reserve plan. Underwriters will model HOA dues and reserves into DTI.

Monthlies. Coach buyers on the full monthly picture: mortgage + taxes + HOA dues (with reserve contributions), potential special assessments, and shared insurance mechanics (e.g., master policy + HO-6). That clarity prevents cold feet at contingency removal.

Resale. Micro-condos trade more like cottages than flats: private entries, small footprints, and the presence (or absence) of exclusive-use outdoor space, storage, and parking drive value. Your comp set will be tiny condos, cottage courts, and—ideally—local ADU-condo comps as they emerge.

Some Documents That Protect Your Client (and you)

Statutory disclosures: TDS (Civ. Code §1102) and NHD (Civ. Code §1103 et seq.) still apply.

Condo packet: recorded CC&Rs, bylaws, operating budget and (if available) reserve study/plan, condo map/plan, shared-elements easements, utility agreements, lienholder consents, and any city notices or checklist forms.

AVID & over-disclosure: Map shared systems (sewer laterals, water lines, shared roofs/driveways) and note any open permits or variances. It’s hard to over-disclose on a first-generation product category.

HOA landmines (and how to avoid them)

Most post-closing drama comes from maintenance responsibility and use rules. Avoid ambiguity by:

Drawing a maintenance matrix that names each component (roof, siding, foundation, shared driveway/gate, landscape, fences, trash enclosure, shared meters) and assigns responsibility and inspection cadence.

Being explicit about exclusive use (patios, side yards, storage sheds) versus common area.

Setting realistic noise and parking expectations in the rules—especially where units are close.

Checking short-term rental rules at both city and HOA levels; do not imply rental income without verifying.

Utilities, access, and parking: the practical stuff

AB 1033 recognizes that upon separate conveyance, a local agency or utility may require a new or separate utility connection (and proportionate connection fees) where it wasn’t otherwise required for a standard, non-separately-conveyed ADU. If services remain shared, the CC&Rs need crystal-clear language on access, meter reading, maintenance, and billing. Record any access and utility easements so future owners—and lenders—aren’t guessing.

Pricing and positioning a micro-condo

Treat these like livable, detached cottages with condo paperwork. Price on privacy and function: no shared corridors, ground-level entries, outdoor space, light, and acoustic separation. Include a to-scale floor plan and a simple site plan (labeling the unit, parking, trash, and paths of travel). For buyers coming from apartment-style condos, the single-story cottage experience can command a premium per square foot despite smaller size.

Compliance notes your clients will thank you for

Don’t oversell “automatic.” Everything depends on local opt-in and meeting statutory conditions (inspection, mapping, consents).

Be precise about the past. Prior law had a narrow nonprofit exception; AB 1033 adds a broad condo pathway via local ordinance.

A quick case study: San José’s “first”

San José’s early adoption set the pattern: pass a clear ordinance, publish a homeowner-facing conversion guide, and coordinate internal teams (planning, building, and code enforcement). The city then approved the first recorded ADU condo in August 2025—an example that has helped normalize lender and title workflows statewide. Use that precedent when socializing the concept with your local stakeholders, but always cite your own city’s ordinance in contracts and disclosures.

What to do this week (agent checklist)

Build a local “opt-in” tracker. Keep links to city ordinances and checklists in one doc.

Collect a lender short-list. Identify originators who’ve already closed small-unit condos and will engage early on questionnaires and reserves.

Template your condo packet. Create a repeatable binder: TDS/NHD + CC&Rs + budget + map/plan + easements + utility agreements + lienholder consents.

Educate your farm. A one-page explainer for ADU owners can generate listing calls months before they’re ready to convert. Make sure to check with your broker on advertising compliance.

Bottom line: AB 1033 turns some backyards into starter homes—but only in jurisdictions that opt in, and only when you clear the condo law hurdles. The agents who win here will be the ones who master the process (mapping, inspection, lender consent), package the disclosures cleanly, and set expectations early on financing and HOA realities. Check with legal counsel and your broker to make sure you are staying compliant and you’ll be the first call when your market’s homeowners decide their ADU is ready for the big leagues.

|

Why Understanding Market Indicators Matters

Want to excel as a real estate agent? Mastering market analysis is essential, and it's a skill you can start developing now, even while you're still Read more...

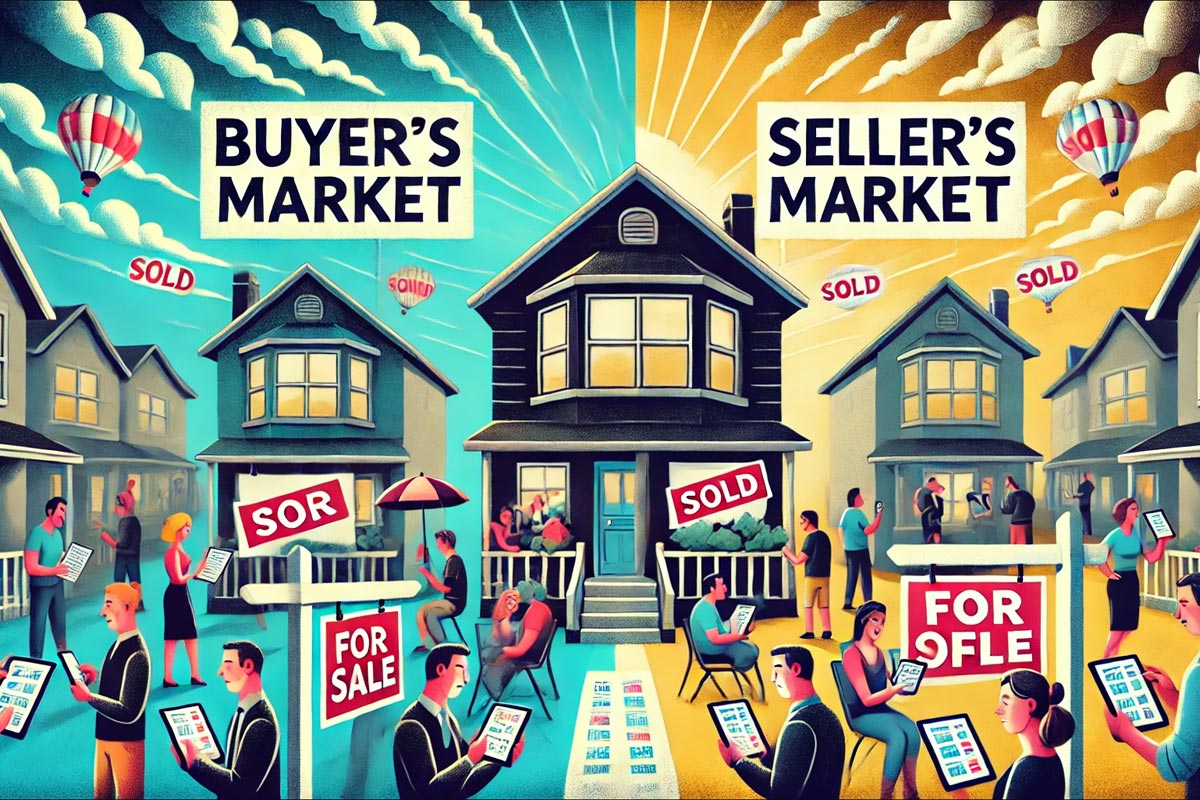

Why Understanding Market Indicators Matters

Want to excel as a real estate agent? Mastering market analysis is essential, and it's a skill you can start developing now, even while you're still in real estate school. Understanding market trends empowers you to advise clients effectively, price properties accurately, and anticipate market shifts. This guide breaks down the key indicators—median and average home prices, days on market (DOM), inventory levels, interest rates, foreclosure rates, and the absorption rate—providing clear explanations and practical examples. I’ll show you why a holistic approach to market analysis is crucial and how local conditions and seasonality influence these metrics. By the end, you'll have the knowledge and confidence to navigate any market.

Median vs. Average Home Price

Median Home Price:

The median home price is the middle price of all homes sold in a particular area during a given time.

For example, if five homes sold for:

$200,000

$220,000

$250,000

$600,000

$700,000

The median is $250,000 (the one in the middle).

The median, being less affected by outliers, is a reliable measure when there are a few very expensive or very cheap homes that could make the average less accurate.

Average Home Price:

To find the average home price, you simply add up all the sold home prices and divide by the number of homes. Using the same prices above, the total is $1,970,000. Divide that by five, and you get an average of $394,000.The average, while useful for spotting general trends, can be heavily skewed by extremely high or low prices, making it less reliable in such cases.

What These Prices Tell Us:

If median and average prices are rising, it often means home values are going up. If they’re falling, it might mean the market is slowing down.

Days on Market (DOM)

Days on Market (DOM) measures how long a home takes to sell.

Short DOM (under 30 days): Suggests a hot market with many interested buyers. This is often called a seller’s market because sellers have the upper hand.

Medium DOM (30-60 days): A balanced market where buyers and sellers have similar power.

Long DOM (60+ days): Suggests a more extraordinary market with fewer buyers. This is often called a buyer’s market because buyers have more choices and bargaining power.

Inventory Levels (Months’ Supply of Inventory)

Ever wondered how long it would take to sell all the homes on the market if no new ones were listed? That's what a month's supply of inventory tells us.

How to Calculate:

Months’ Supply = (Number of Homes for Sale) ÷ (Number of Homes Sold per Month)For instance, if there are 600 homes for sale and 200 sell each month, you can easily calculate the months’ supply as 600 ÷ 200 = 3 months, giving you a clear picture of the market conditions.

Low Inventory (Under 4 Months): Seller’s market.

4-6 Months: Balanced market.

Over 6 Months: Buyer’s market.

Interest Rates

Interest rates affect how much it costs to borrow money to buy a home.

Low Interest Rates: More people can afford homes, so demand usually goes up.

High Interest Rates: Fewer people can afford homes, so demand usually slows down.

The Federal Reserve’s policies can influence these rates, so it’s smart to keep an eye on their announcements.

Foreclosure Rates

Foreclosure rates tell us how many homes are being taken back by lenders because their owners cannot pay their loans.

If foreclosures are high, it can mean that the economy is struggling, and home prices might drop because many distressed properties hit the market.

Foreclosure data can be found on local government websites, local MLS systems, or online real estate data providers.

Absorption Rate

The absorption rate shows how fast homes are selling in a certain area.

How to Calculate: Absorption Rate (%) = (Number of Homes Sold in a Given Period ÷ Number of Homes Available) × 100

For example, if 100 homes are for sale and 20 sell in one month, the absorption rate is (20 ÷ 100) × 100 = 20%.

A higher absorption rate means homes sell quickly (seller’s market), while a lower rate means they sell slowly (buyer’s market).

Seasonality: How the Time of Year Affects Indicators

Real estate activity often changes with the seasons.

Spring and Summer:

These seasons are a hotbed for real estate activity. Many buyers are on the lookout for homes when the weather is pleasant and before the new school year begins. This surge in demand often results in shorter DOM and escalating prices.

Fall and Winter: These seasons bring a shift in real estate dynamics. With fewer buyers in the market due to colder weather and holiday distractions, homes may take longer to sell. Prices, in turn, tend to remain stable or experience a slight dip.Understanding how seasonality affects your local market is not just a skill, it's a responsibility. It can help you advise clients on the best time to list or buy a home, ensuring they make the most informed decisions.

Looking at Indicators Together: Two Scenarios

Relying on one number can be misleading. By using multiple indicators, you get a clearer picture.

Scenario 1: Seller’s Market

Median Home Price: Rising for the last six months.

DOM: Dropped from 40 days to 15 days.

Inventory: Went from 5 months to 2 months of supply.

Interest Rates: Remain low.

Foreclosures: Very few.

Absorption Rate: Increased to 25%.

Analysis: Everything points to a seller’s market. Prices are going up, homes sell fast, inventory is low, rates are low, and there aren’t many distressed sales. This means sellers can expect strong offers and may not need to lower their asking prices.

Scenario 2: Buyer’s Market

Median Home Price: Flat or slightly decreasing.

DOM: Increased from 30 days to 60 days.

Inventory: Rose from 4 months to 7 months of supply.

Interest Rates: Slightly higher than last year.

Foreclosures: A bit higher than normal.

Absorption Rate: Dropped to 10%.

Analysis: In this market, buyers have more choices, and homes sit on the market longer. With rising inventory and slower sales, buyers can negotiate more and might get lower prices or better terms.

How Market Indicators Affect Appraisals

Appraisers look at recent home sales and market trends to determine a home’s value. It's crucial to understand that market conditions can significantly influence appraisal values. In a hot seller’s market with rising prices and low inventory, an appraisal might come in higher because comparable homes sell quickly and at higher prices. In a slower buyer’s market, appraisals might reflect lower prices, especially if there are many homes for sale and fewer sales to compare against.

Focusing on Local Data: More Specific Sources

Real estate is local. National numbers can give you a big-picture idea, but local data tells you what’s really happening in your area. Here are a few resources to help you find local information:

Local MLS Systems: For example, CRMLS in California or Stellar MLS in Florida provide data on listings, sales, and DOM.

Government Websites: The U.S. Census Bureau can provide population and housing data. Some cities and counties also have their own websites with housing reports, like NYC Housing and Vacancy Survey.

Real Estate Portals: Websites like Realtor.com Local Market Trends or Zillow Research can offer local statistics on prices, rent, and more.

By checking these sources, you can get the most accurate information for the neighborhoods where you work.

The Limits of Market Analysis

Market indicators can help you understand what’s happening, but they aren’t crystal balls. Conditions can change quickly due to new jobs in town, changes in mortgage rules, or shifts in the local economy. Also, predictions based on indicators are not guaranteed. It's crucial to be cautious and mindful, remembering that these tools guide your decision-making but don’t always tell you exactly what will happen in the future.

Putting Your Knowledge into Action

By learning about these market indicators, you can better guide your clients, set fair prices, and know when to act. Remember to look at multiple indicators at once to get the full story. Also, focus on local and seasonal trends, pay attention to how conditions affect appraisals, and understand that no analysis is perfect.

If you want to dig deeper, we encourage you to take action:

Enroll in our real estate licensing course to gain more in-depth market analysis skills.

Contact us for a free consultation to discuss your real estate career goals.

By staying informed, you can make smarter decisions and stand out as a trusted real estate professional.

Love,

Kartik

|

Imagine listing a home and it sitting on the market for months, or worse, selling it for far less than it's worth.

The key to avoiding these pitfalls? A Comparative Market Analysis (CMA).

Read more...

Imagine listing a home and it sitting on the market for months, or worse, selling it for far less than it's worth.

The key to avoiding these pitfalls? A Comparative Market Analysis (CMA).

Understanding a home's true market value is crucial when buying or selling a home. A CMA is a detailed report used by real estate professionals to determine a property's fair market value based on current market conditions and recent sales of comparable properties.

What Is a CMA and Why Is It Important?

A CMA is a data-driven approach to pricing a home, ensuring it's neither overpriced nor underpriced. An accurate asking price not only attracts serious buyers but also empowers buyers to make informed offers, giving them a sense of control. A CMA removes much of the guesswork from home valuation by using up-to-date data, instilling confidence in both parties.

How Do Real Estate Professionals Use CMAs?

Agents use CMAs to guide clients in making strategic decisions, providing them with professional guidance and reassurance. For sellers, a CMA helps determine the optimal listing price. For buyers, it ensures they don't overpay. Agents typically gain CMA expertise through real estate education and training, further enhancing their strategic role.

The Steps Involved in Creating a CMA

Here's a breakdown of the CMA process:

Identify the Subject Property: Agents gather details about the property, including size, bedrooms, bathrooms, amenities, condition, style, and unique features. They also consider the neighborhood, schools, and nearby amenities.

Select Comparable Properties ("Comps"): Agents choose "comps"—similar properties based on location, size, condition, style, and age. These are typically sourced from the Multiple Listing Service (MLS) and should ideally have sold within the last three to six months and be located near the subject property.

Adjust for Differences: Since no two homes are identical, agents adjust the prices of comps to reflect the subject property's value. This involves adding or subtracting value based on key differences.

Analyze Market Conditions: Agents consider current market conditions, including supply and demand, interest rates, and economic trends. This step is crucial in the CMA process as it provides a broader understanding of the real estate landscape, making the audience feel more informed.

Review the Data and Present the Findings: The agent creates a report summarizing the comps, adjustments, and conclusions, which are presented clearly to the client.

Adjust for Differences: A Closer Look

This crucial step involves adjusting comp prices to account for differences from the subject property. Here are some examples:

Size: If a comp is 100 square feet smaller, and a similar space is valued at $100/sq ft, the agent adds $10,000.

Bedrooms/Bathrooms: Based on local market data, an extra bathroom might cost $5,000- $10,000.

Garage/Parking: A two-car garage is typically worth more than a one-car garage or street parking (e.g., $5,000-$10,000).

Updates/Renovations: A renovated kitchen adds value; an outdated kitchen in the subject property compared to a renovated one in a comp might result in a deduction.

Lot Size/Location: A more considerable or desirable location (e.g., corner lot) can increase value.

Using consistent, market-based adjustment values is essential for accuracy.

Analyzing Market Conditions

Beyond individual property features, market conditions play a significant role.

Agents consider:

Absorption Rate: How quickly homes are selling.

Days on Market (DOM): The average time for selling homes.

Inventory Levels: The number of homes for sale.

Seasonal Trends: Market changes throughout the year.

Interest Rates: Affect buyer affordability and demand.

The Role of Technology in CMAs

Modern CMAs leverage technology:

MLS Data: Direct access to comprehensive sales data.

CMA Software: Streamlines data analysis and report generation.

Automated Valuation Models (AVMs): While useful for quick estimates, AVMs lack the nuanced analysis of a CMA performed by an agent.

Benefits of a CMA

For Sellers: A data-backed listing price attracts buyers and reduces time on the market.

For Buyers: Confidence in making fair offers and more vigorous negotiation.

Common Questions About CMAs

Is a CMA the same as an appraisal? No. An appraisal is a formal valuation by a licensed appraiser, often required by lenders. A CMA is a less formal estimate by a real estate professional.

Can a CMA guarantee a sale price? While a CMA provides a strong indication of market value, the final sale price depends on various factors, including negotiation and market fluctuations.

Making Informed Real Estate Decisions

A CMA is an essential tool for informed real estate decisions. A CMA provides a clear picture of a home's fair market value by analyzing comparable properties, adjusting for differences, and factoring in market conditions.

Love,

Kartik

|

Cap or capitalization rates are a widely used metric for assessing real estate investments. However, not every piece of advice you’ll find online is accurate, and many investors still struggle to understand Read more...

Cap or capitalization rates are a widely used metric for assessing real estate investments. However, not every piece of advice you’ll find online is accurate, and many investors still struggle to understand what this is. From simplistic interpretations of a property’s income potential to overreliance on a single metric, various cap rate myths can lead even experienced investors astray. In this article, I wanted to tackle some of the most common cap rate misconceptions and help you better understand what the cap rate can and can’t tell you.

What Is a Cap Rate?

Before we dive into the myths, let’s start with a quick refresher. A cap rate represents a property’s net operating income (NOI) divided by market value. It’s essentially a snapshot of what kind of return you could expect if you purchased a property outright (without financing) and held it for an entire year. Although cap rates are a valuable starting point, they are not magic numbers that guarantee investment success. With that context in mind, let’s debunk a few myths.

Myth #1: A Higher Cap Rate Is Always Better

One of the most common cap rate myths is falling into the trap of thinking a higher cap rate automatically equals a superior investment. A high cap rate can be misleading, as it doesn't account for all the risks involved.

Why This Is a Myth: A high cap rate often correlates with higher perceived risk; the property could be located in a less stable neighborhood, may have deferred maintenance, or may need help attracting stable tenants. Just because the number is more significant doesn’t mean the property will offer better long-term value or peace of mind.

The Reality: A “good” cap rate varies by market, property type, and investment strategy. Sometimes, a moderate cap rate with lower risk is far more beneficial than a sky-high number from a problematic property.

Myth #2: Cap Rates Are a Perfect Indicator of Property Value

One of the biggest misunderstandings new investors have about cap rates is relying on them as the sole indicator of value. It's tempting to simplify investment analysis, but this can be a costly mistake. A cap rate provides a snapshot of return based on current income and value—not a prediction of future performance.

Why This Is a Myth: Cap rates don’t factor in future rental increases, upcoming maintenance costs, or changes in the neighborhood’s desirability. They also don’t reflect financing costs or tax implications.

The Reality: Treat cap rates as starting points, not the final say. Pair your cap rate analysis with a thorough market study, property inspection, and financial projections considering longer-term shifts in income and expenses.

Myth #3: Cap Rates Are Universal Across Markets

Another big cap rate misconception is that a solid cap rate is the same in every city, every neighborhood, and every property class. If you read investment forums, you’ll see advice like “always aim for an 8% cap rate,” as if this golden number applies everywhere.

Why This Is a Myth: Real estate markets are inherently local. A solid cap rate in a New York City neighborhood might look radically different from what’s typical in a suburban market in the Midwest. A property in a high-growth area with excellent tenant demand might comfortably trade at a lower cap rate because of its stability and appreciation potential.

The Reality: Research local market norms before making judgments. Understand typical cap rates for similar properties in the area and compare those benchmarks against your target property’s location, risk profile, and long-term investment goals.

Myth #4: Cap Rates Only Matter to New Investors

Experienced investors and analysts sometimes dismiss cap rates as a “beginner’s tool.” This leads to misunderstandings about cap rates as being too simplistic. While sophisticated investors employ advanced metrics like Internal Rate of Return (IRR) or Discounted Cash Flow (DCF) models, that doesn’t diminish the usefulness of a cap rate.

Why This Is a Myth: Believing that cap rates are only for beginners ignores that they serve as a foundational benchmark. Even seasoned investors need a quick metric to identify whether a deal is worth exploring.

The Reality: Cap rates remain a valuable first-pass metric. Use them to filter potential deals before diving into more complex analyses. Even experts understand the value of a reliable, quick, simple yardstick.

Myth #5: A Cap Rate Doesn’t Change Over Time

Another cap rate misconception is assuming that once you’ve calculated a cap rate, it stays relevant indefinitely. Markets evolve, rental incomes shift, and property valuations fluctuate, all of which can alter the cap rate over time.

Why This Is a Myth: If you calculate a cap rate at the time of purchase and never revisit it, you’re ignoring changing market conditions and the property’s performance. A cap rate calculated five years ago might not accurately represent the property’s current standing.

The Reality: Revisit and recalculate your cap rates periodically. This will help you track performance, gauge the effectiveness of your management strategy, and decide if and when to sell.

Myth #6: Cap Rates Tell the Full Story of Investment Risk

Some investors rely heavily on cap rates to understand risk, assuming that a specific cap rate implicitly signals low or high risk. This is another instance of misunderstanding cap rates, as they cannot capture all the nuances of a property’s risk profile.

Why This Is a Myth: Cap rates do not factor in the quality of the tenants, lease terms, property condition, vacancy history, or future maintenance needs. A property may have a decent cap rate but be saddled with unreliable tenants or looming capital expenditures.

The Reality: Always supplement your cap rate analysis with a broader risk assessment. Look at tenant mix, lease duration, local economic trends, and property condition reports. Consider insurance costs, regulatory changes, and other external factors impacting future income streams.

Myth #7: Cap Rates Are Irrelevant If You Use Financing

Some investors think cap rates matter only for all cash purchases and that they become irrelevant once you introduce a mortgage. This is a more technical cap rate myth, but it can misguide investors looking at leverage.

Why This Is a Myth: While the cap rate doesn’t consider financing, it still serves as a baseline for the property’s intrinsic performance. Financing affects your cash-on-cash returns and leverage ratios, but the cap rate can still tell you if the underlying asset is sound.

The Reality: Use the cap rate to measure the property’s core ability to generate income relative to its value. Then, layer on financing to see how leverage affects overall returns and risk.

How to Use Cap Rates Wisely

Now that I’ve debunked several cap rate misconceptions, here are a few tips on using this metric effectively:

Combine Metrics: Don’t rely solely on cap rates. Use them alongside measures like cash-on-cash return, IRR, and rent multipliers to form a comprehensive investment picture.

Localize Your Analysis: Understand local market norms. A solid cap rate in one region may be underwhelming or overambitious in another.

Regular Re-Evaluation: Recalculate cap rates as market conditions change. Keeping a pulse on your property’s performance ensures you’re making informed decisions.

Consider Context: Always factor in property condition, tenant stability, and future improvements. A cap rate should always be balanced against qualitative factors.

The key to avoiding cap rate myths is understanding what a cap rate measures and recognizing its limitations. By debunking these cap rate misconceptions, you’ll be better positioned to make informed decisions, whether adding your first investment property to your portfolio or fine-tuning your approach as a seasoned real estate entrepreneur. When used correctly—within the broader context of detailed due diligence.

Hope this helps

Love,

Kartik

|

If you've ever considered buying a rental property or investing in commercial real estate, you may have encountered the term "cap rate." Short for "capitalization rate," this number Read more...

If you've ever considered buying a rental property or investing in commercial real estate, you may have encountered the term "cap rate." Short for "capitalization rate," this number plays a significant role in how investors judge a property's potential. But what exactly is it, how is it calculated, and why is it so important? In this guide, we'll break down the cap rate, how to use it, and why it matters when looking at real estate investments. You'll feel confident enough to understand and talk about cap rates like a pro by the end.

Understanding the Basics of a Cap Rate

At its simplest, a cap rate is a number that helps investors figure out how well a real estate investment might perform. Think of it as a quick way to measure how much net income you could make from a property compared to how much it costs. The cap rate, shown as a percentage, gives you a snapshot of the property's ability to produce income, much like a car's miles-per-gallon rating gives you a sense of its fuel efficiency.