Real Estate Compliance: Systems Over Luck

In my 20-plus years of educating California real estate professionals, I’ve seen thousands of agents move through the industry. Often what I notice is the ones Read more...

Real Estate Compliance: Systems Over Luck

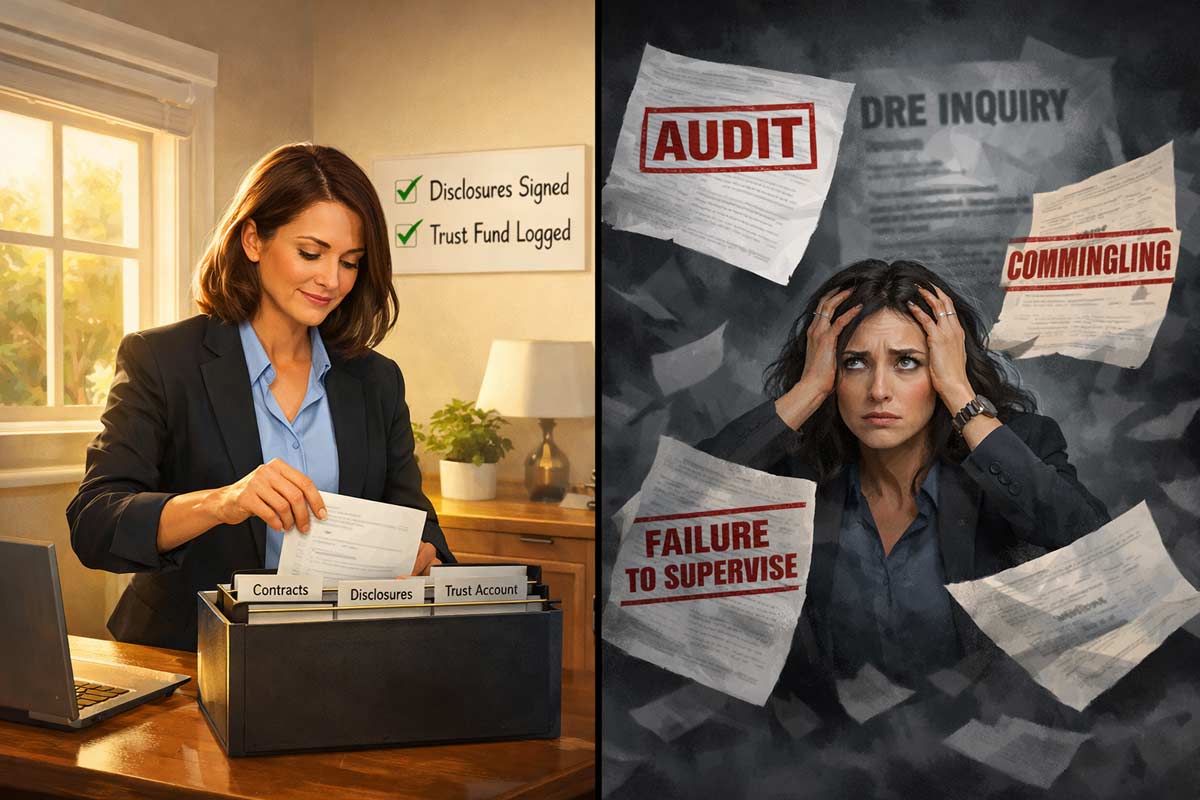

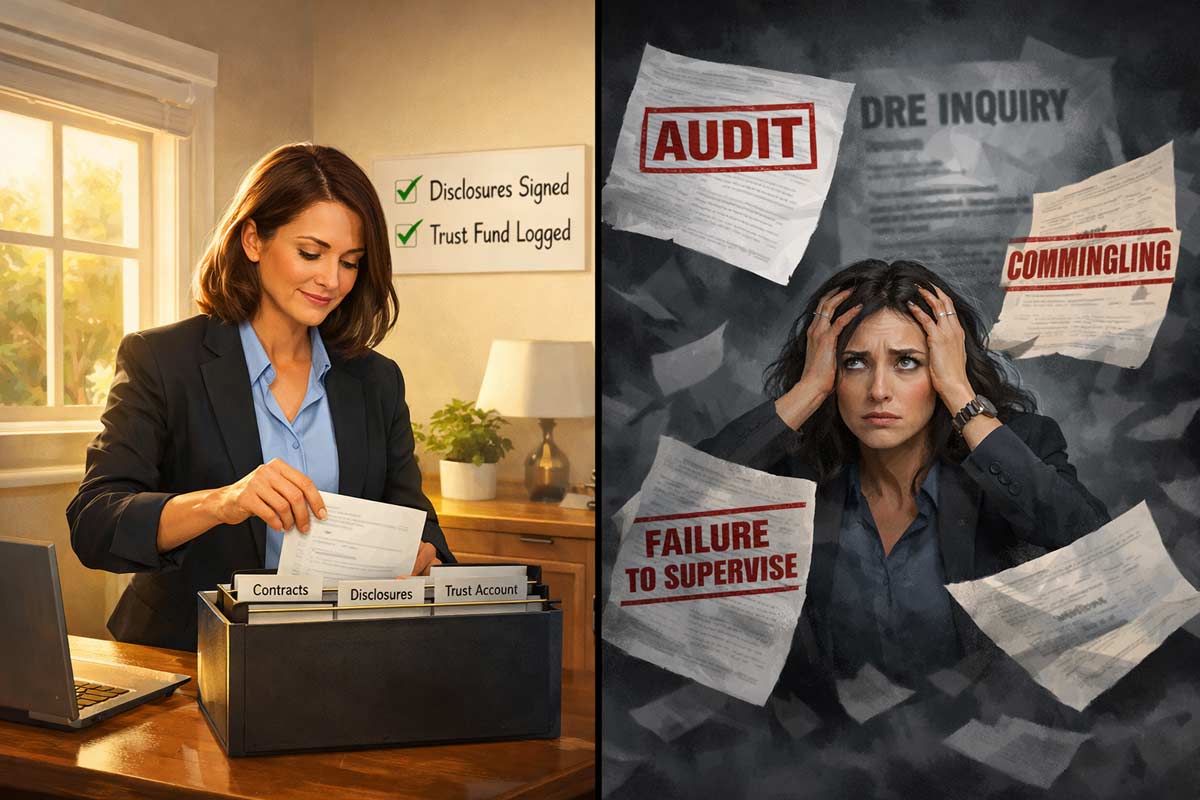

In my 20-plus years of educating California real estate professionals, I’ve seen thousands of agents move through the industry. Often what I notice is the ones who stay out of trouble aren't necessarily the ones who memorized the entire Business and Professions Code; they are often the ones with consistent systems.

Most California DRE violations aren't the result of "bad" people doing "bad" things. They are the result of "busy" people doing "sloppy" things. The Department of Real Estate (DRE) is a consumer protection agency. Their job is to ensure the public is protected, and they do that by enforcing transparency, supervision, and documentation.

If you treat compliance as a "to-do" list rather than a "worry" list, you’ll find that the DRE isn't something to fear—it’s just the framework of your business.

What "A Violation" Means in Practice

A violation isn't always a dramatic headline. In the real world, enforcement is usually triggered by small, preventable issues that accumulate into compliance problems.

Complaint-Driven: A disgruntled client or a competing agent flags an ad or a missing disclosure.

Visibility Issues: When a yard sign or social media profile is missing key details, it becomes an easy target for a random inquiry or a complaint from the public.

Audit Triggers: The DRE performs audits of brokerages, including Investigative Audits (prompted by complaints) and Proactive Audits (routine checks, often targeting high-risk activities like property management).

Documentation Gaps: Most discipline stems from what is missing—a signature, a date, or a record of a deposit.

The DRE focuses on patterns of neglect. One typo on a flyer might result in a warning or a minor administrative penalty; a team of ten agents all advertising without license numbers suggests a broader failure of supervision.

The Top Common DRE Violation Categories

1. Advertising & Marketing Compliance

What it looks like: Business cards, yard signs, or Instagram posts that look "clean" but omit the required license information.

The trigger: Public visibility. A "For Sale" sign or a digital ad without the agent's DRE number is easily flagged by the public or competing brokers.

How to avoid it: Every piece of "first point of contact" material must have your license number and your broker's name. Review our guide on Real Estate Advertising With Your License Number for specific visibility and legibility rules.

Quick self-check:

Does my IG bio have my DRE # and Broker name?

Is my license number as prominent as the other contact info?

2. Trust Fund Mishandling

What it looks like: An agent receives an Earnest Money Deposit (EMD) check and keeps it in their car for a few days before handing it over.

The trigger: Delays in depositing or recording funds. If money isn't handled correctly, it raises flags for "commingling" or, in extreme cases, "conversion."

How to avoid it: Per B&P §10145 and Reg 2832, a broker must generally deposit trust funds within three business days following receipt. As a salesperson, you must deliver funds to your broker or escrow immediately.Refer to Trust Fund Handling Rules for California Agents for timing nuances.

Quick self-check:

Did I deliver this check the same day I received it?

3. Team Name & DBA Misuse

What it looks like: "The Premier Group" appears on a yard sign, but that name has not been submitted to and approved by the DRE as a DBA.

The trigger: Advertising under a business name not listed on the license. Audits specifically check for DBA approval.

How to avoid it:Any name used in your real estate business that is not your exact personal license name is a DBA and must be pre-approved by the DRE. To be approved, a DBA typically must include the surname of a licensee (e.g., broker or salesperson) and often uses a descriptor like "& Associates," "Group," or "Team." It cannot sound like a separate corporate entity (e.g., "Inc.," "Realty," "Properties" alone). You must have the DRE's approval letter on file before using the name.

4. Inadequate Supervision

What it looks like: A broker has 50 agents but hasn’t reviewed a transaction file in months.

The trigger: An agent makes a mistake, and the DRE discovers the broker had no oversight system.

How to avoid it: Brokers must establish written policies and review points. Agents must follow SOPs for every document.

Quick self-check:

Has my broker or manager looked over the mandatory documents in this active file?

5. Unverified Claims & Misrepresentation

What it looks like: Advertising "brand new electrical" without verification, or claiming "#1 Agent in the City" without citing a source.

The trigger: A buyer relies on an unverified claim (B&P §10140) that turns out false.

How to avoid it: Stick to the facts. If you can't verify it with a permit or a receipt, use qualifiers like "per seller" and cite the source for any "ranking" claims.

Quick self-check:

Can I prove this statement if an auditor asks for the source?

6. Transaction File Gaps (Completeness)

What it looks like: A file is "closed" but missing signatures or dates.

The trigger: Audit finds documents legally incomplete.

How to avoid it: Use a closing checklist. Do not move a file to "completed" until every required field is populated.

Quick self-check:

Is every "Initial Here" box actually initialed and dated?

7. Record Retention Failures

What it looks like: A transaction closed three years ago, but the agent deleted the emails and cannot produce the file.

The trigger: Audit requests a file from the previous three years.

How to avoid it: Per B&P §10148, you must retain transaction records for at least three years from the date of closing (or the listing date if the deal fell through). This includes listings, deposit receipts, and all substantive correspondence.

Quick self-check:

If the DRE asked for a file from three years ago today, could I produce it?

8. Unlicensed Activity

What it looks like: An unlicensed assistant "hosting" an open house and answering questions about property features.

The trigger: A client mentions the assistant discussed property features or terms.

How to avoid it:Know the line. Assistants can handle clerical tasks, schedule appointments, and courier documents, but they cannot show properties or negotiate terms. See What the California DRE Actually Enforces.

Quick self-check:

Am I letting an unlicensed person discuss price or property features with a client?

9. Fair Housing Advertising Violations

What it looks like: Using phrases like "adults only" or "perfect for young families."

The trigger: Advertising that indicates preference or limitation based on protected classes.

How to avoid it: Focus strictly on the property’s features, not the type of person you think should live there. Avoid references to neighborhood demographics or religious facilities.

Quick self-check:

Does my ad describe the house or the person I want to buy the house?

The Compliance Operating System

You don't need to be a lawyer to stay compliant. You just need a framework.

Standardized Templates: Use your association's (C.A.R.) forms. Don't draft your own "mini-contracts."

The Transaction Checklist: Use a "master list" for every file. If a signature is missing, the file isn't "done."

Weekly Compliance Habit: Spend 15 minutes every Friday reviewing your active ads and digital profiles to ensure DRE #s are visible.

The "Stop Sign" Rule: If a client asks you to do something that feels "grey" (like skipping a disclosure), stop and call your broker immediately.

Quick Compliance Checklist (Screenshot This)

License #: On every email, business card, and social profile.

Broker Name: Clearly visible on all marketing.

Trust Funds: Handed off to broker/escrow immediately (Salesperson) or deposited within 3 business days (Broker).

DBA: Team name is DRE-approved and includes required suffixes (Team/Group).

Disclosures: Provided to the buyer as early as possible.

File Completeness: Every signature, initial, and date is present.

Retention: All records stored securely for a minimum of 3 years (§10148).

Unlicensed Staff: Limited to administrative, non-licensed tasks only.

Supervision: Broker has established review points for all contracts.

Fair Housing: All advertising language focuses on property features, not people.

FAQs

What does the DRE actually enforce most often?

The DRE frequently cites issues related to trust fund mishandling, failure to supervise, and misrepresentation of material facts.

What triggers a DRE investigation?

Most investigations are reactive, triggered by consumer complaints or issues found during routine proactive office audits.

Can a first-time mistake get me disciplined?

Yes. While the DRE may issue a warning for minor technicalities, any violation of the Real Estate Law can lead to administrative penalties, license restriction, or suspension.

What’s the fastest way to clean up my advertising compliance?

Audit your social media "Linktree" and bio. Ensure your DRE number and broker’s name are visible without needing to click deep into your profile.

How long should I keep transaction records?

Per B&P §10148, you must keep records for at least three years. However, many brokerages require longer retention (5–7 years) for liability protection. Always follow your broker’s specific policy.

Stay Protected with the Master Guide

Compliance isn’t a personality trait; it’s a system you build into your business. By following these steps, you protect your license, your broker, and your clients. For a deeper dive into the specific statutes and requirements, visit our California Real Estate Laws & Compliance Guide.

|

SB 9 Potential in California Real Estate

As a real estate professional in California, you’ve likely seen "SB 9 Potential" popping up in MLS remarks. With 20+ years helping California agents and Read more...

SB 9 Potential in California Real Estate

As a real estate professional in California, you’ve likely seen "SB 9 Potential" popping up in MLS remarks. With 20+ years helping California agents and students navigate compliance at ADHI Schools, I have seen how new laws create both massive opportunity and significant professional landmines.

The Danger:

Marketing SB 9 as a "guaranteed" four-unit build. If a buyer closes based on your marketing, only to find the city rejects the permit due to local objective standards or utility constraints, you—and your broker—could be in the crosshairs.

Legal Disclaimer:This guide is for informational purposes only and does not constitute legal or land-use advice. SB 9 implementation varies significantly by local jurisdiction. Always advise clients to verify feasibility in writing with the local planning department and qualified land-use counsel.

FAST ANSWER: What is SB 9?

Senate Bill 9 (SB 9) provides a ministerial pathway for homeowners to subdivide a single-family lot (Urban Lot Split) or build up to two primary units on one lot. While it limits local discretionary review, projects must still meet "objective standards" and specific eligibility criteria.

Agent Note: Never guarantee approval; always verify site-specific feasibility in writing with the city.

SB 9 Eligibility: The Quick Screen

Before you spend hours on a property, run these four checks. If any of these "Red Flags" appear, the project may be ineligible under state or local rules.

Zoning: Is it a single-family residential zoning designation (e.g., R-1, RS, etc.)?

Location: Is it in an "Urbanized Area" or "Urban Cluster"? Verify this on the local agency’s SB 9 eligibility map.

Tenancy History: Hard-stop restrictions apply if the property was occupied by a tenant in the last 3 years. Generally, SB 9 cannot be used to alter or demolish tenant-occupied housing. Refer to Rent Control Laws in California (Agent Guide) to evaluate displacement risks.

Ineligible Sites: Sites in very high fire hazard severity zones, floodways, or earthquake fault zones often trigger ineligibility. Treat these as red flags requiring written confirmation from the city. See Environmental Regulations California Agents Should Know for more on these overlays.

What SB 9 Actually Does (Agent Translation)

To advise clients safely, you must distinguish between the two separate pathways provided by the law.

1. Urban Lot Split (Gov. Code § 66411.7)

The "40/60" Rule: Per state statute, the split must result in two lots where the smaller lot is at least 40% of the original lot's size. Both newly created parcels must be at least 1,200 square feet, unless a local ordinance allows smaller.

Owner-Occupancy: State law requires an applicant to sign an affidavit stating they intend to occupy one of the units as a principal residence for at least three years. Exception: This requirement does not apply to "community land trusts" or "qualified nonprofit corporations."

2. Two-Unit Development (Gov. Code § 65852.21)

The "800 Sq. Ft." Rule: Local objective standards generally cannot be applied in a way that would physically preclude the construction of at least two units that are at least 800 square feet each. This is a "backstop" against restrictive local standards, not a guarantee that every lot can accommodate this size.

The Unit Cap: In practice, many jurisdictions treat the total unit count (including ADUs and JADUs) as capped at four across the original lot footprint. If a lot already has an ADU, your client’s SB 9 potential may be limited—verify local implementation.

SB 9 vs. ADU: Why Clients Get Confused

Agents risk misrepresentation claims when they conflate these two very different permit paths.

Primary vs. Accessory: SB 9 units are "primary" dwellings; ADUs are "accessory."

Separate Sale: SB 9 units can potentially be sold separately if a lot split is recorded and ownership is structured appropriately—verify with counsel. ADUs generally cannot be sold separately. (Learn more: California ADU Laws Explained).

Parking: While state law limits parking requirements to 1 space per unit, multiple local waivers apply—verify the city’s specific SB 9 standards.

Setbacks: State law generally allows a local agency to require up to 4-foot side and rear setbacks (Gov. Code § 65852.21), but no setback is required for existing structures rebuilt in the same footprint.

Marketing & Liability: How to Talk About "Potential" Safely

The "Do vs. Don't" Table

Don’t Say (High Risk)

Do Say (Compliance First)

"Approved SB 9 Lot Split"

"May qualify for SB 9; Buyer to verify with city."

"Guaranteed 4-Unit Build"

"Check local unit-count caps for SB 9 + ADU."

"Split Ready / No Restrictions"

"Subject to local objective standards & affidavits."

Pro-TipDo not use the words approved, guaranteed, by-right, or split-ready unless you have a written planning confirmation or city-stamped approval in your hand.

Verification Artifacts (The "Agent File" Checklist)

Written email confirmation from the Planning Department regarding the specific APN.

Preliminary Title Report highlighting any private CC&Rs (SB 9 does not automatically override private restrictions).

"Will-Serve" notes from utility providers (water/sewer/power).

Seller-signed tenant history declaration.

Real-World Scenarios

The Unrecorded Access: A listing marketed "SB 9 split potential." The buyer discovered the "back lot" had no legal frontage and the neighbor refused an easement.

Agent Fix: Check for Water Rights & Easements in California Real Estate and ensure legal access is recorded on title. Document in file: Preliminary Title Report.

The Utility Capacity Halt: An investor bought a lot for a duplex build. The water district denied new meters due to infrastructure limits.

Agent Fix: Always include "will-serve" verification in your buyer's due diligence. Document in file: Water District written response.

The Tenant Surprise: A seller failed to disclose a roommate who paid rent. The city denied the permit because the property wasn't "tenant-free" for the required 3-year lookback.

Agent Fix: Document in file: Signed seller declaration regarding tenancy.

Frequently Asked Questions

Can I list "SB 9 potential" if there are HOAs?

SB 9 does not explicitly override private CC&Rs. Treat HOA/CC&Rs as a major red flag requiring attorney review before you market the project as feasible.

What kills SB 9 feasibility most often?

High-fire hazard zones, unrecorded easements, and the 3-year tenant occupancy rule are the most common "deal killers."

Is owner-occupancy always required?

For an Urban Lot Split, yes—a 3-year affidavit is required (Gov. Code § 66411.7(g)(1)), unless the applicant is a community land trust or qualified nonprofit. For a Two-Unit Development (no split), many cities do not require it.

Your Compliance Playbook

Navigating California land use requires more than just reading a headline. This article is part of our California Real Estate Laws & Compliance Guide, designed to be your professional compliance playbook.

|

Submitting your renewal in eLicensing feels like the finish line—and emotionally, it is. But operationally, the next 48 hours are where most avoidable problems happen. Between payment clearing lags, Read more...

Submitting your renewal in eLicensing feels like the finish line—and emotionally, it is. But operationally, the next 48 hours are where most avoidable problems happen. Between payment clearing lags, public lookup delays, and administrative roster updates, the transition from one license cycle to the next requires a few specific "operator" moves.

I have spent 20+ years helping California agents navigate licensing and compliance, and have seen the same pattern repeatedly: the biggest renewal headaches don’t happen during renewal—they happen when agents don’t document and verify what they just submitted.

The “I Just Renewed” Quick Checklist (10–20 Minutes)

Verify status + new expiration date in the DRE Public License Lookup.

Download/save your eLicensing receipt or transaction summary.

Store all 45-hour CE completion certificates in one “Audit Folder.”

Provide updated proof to your broker/office admin (if your brokerage requires it).

Add renewal reminders to your calendar for the next cycle (set for 3 years, 9 months out).

Quick compliance sweep: Audit your email signature and key marketing touchpoints for DRE # placement (common best practice).

How to Verify Your California Real Estate License Renewal Status

Don’t assume the final confirmation screen means everything is fully complete. Occasionally, payment issues, data-entry mistakes, or processing delays can leave your renewal in a “pending” state longer than expected.

What to check in the DRE Public License Lookup:

Expiration Date: This is the most important indicator. Has it officially advanced to the new four-year cycle?

Status: Does it show "Active" (or the correct current status for your situation)?

Accuracy: Confirm name and license number details look correct.

Real-World Scenario:You renew over the weekend. Monday morning, your office admin says your status hasn’t updated yet. This doesn't necessarily mean something is wrong, but you should monitor the portal until the expiration date officially moves forward.

Step 2: Build Your “Renewal Proof” File (DRE Audit Ready)

The DRE can request CE documentation after renewal. If you can’t produce proof when asked, it can create a serious compliance issue regarding a task you already completed.

CA DRE > Renewals > 2026 Renewal (CE + Receipt)

We recommend keeping these records for at least five years. In practice, you should assume you are the primary record-keeper; the DRE will not "call your school" to reconstruct your file during an inquiry.

Notify Your Broker and Update Compliance Records

Many brokerages maintain internal compliance files and may ask for proof your renewal is complete. This is essential risk reduction. You don't want a lender, title company, or office compliance officer flagging your license status as "Expired" or "Pending" in the middle of an active escrow.

Make sure your license status in internal systems aligns with the public record. For more context on why CE and documentation matter long-term, see How CE Helps Agents Stay Out of DRE Trouble.

Resetting the 4-Year Clock: Planning Your Next Renewal

The best time to plan your next renewal is the day after you complete this one.

Calendar it: Set a reminder for 3 years and 9 months from now so you’re never scrambling at the 11th hour.

Plan smarter: Requirements and options often differ between first vs. subsequent renewals. Don’t guess—use the California Real Estate License Renewal Guide as your reference point for the next cycle.

Step 5: Turn Renewal Into Momentum

Renewal clears mental bandwidth—use it to restart your pipeline with a simple relaunch.

Two-week relaunch sprint:

Database touches: Reach out to 30–50 past clients or warm contacts. Use the "new license cycle" as a subtle reason to confirm your contact info is current in their records.

Marketing sweep: Spend 15 minutes ensuring your DRE license number is present on all "first point of contact" materials, as this is a common compliance expectation.

Red-Flag Mistakes to Avoid

Losing certificates: Assuming "the system has them." You should always maintain your own copies.

Losing the receipt: This is your only proof of payment and submission if a technical error occurs.

Ignoring the date: Not verifying that the expiration date actually moved forward in the public lookup.

Address/Email changes: Forgetting to update your profile in eLicensing if you moved during the renewal period.

Frequently Asked Questions

How long does it take for my renewal to show up in the public lookup?

It often updates quickly, but allow 24–48 hours for processing. If it hasn’t updated within that window, use your receipt as proof of submission and contact the DRE licensing department.

What if I entered a course number incorrectly?

Handle it early. Keep your receipt and contact DRE licensing support to correct the record rather than waiting for an inquiry later.

Do I need to mail certificates to the DRE?

Typically no—renewals are handled through eLicensing—but you must keep digital copies of certificates in case documentation is requested during an audit.

Can I work if my status says “Pending”?

If you are uncertain about what “pending” means for your ability to perform licensed activity, coordinate with your broker or office compliance department immediately.

I lost my certificates—what now?

Contact your CE provider. Reputable schools (like ADHI Schools) usually retain course completion records for a specific period and can reissue proof upon request.

Your Post-Renewal Action Plan (Do This Today)

Verify your status and expiration date in the DRE public lookup.

Archive your receipt and CE certificates into one permanent cloud folder.

Check the California Real Estate License Renewal Guide to ensure you're set for the next cycle.

|

Imagine you’re the listing agent for a 1970s fourplex in Los Angeles. The seller tells you the rents are "well below market" and the buyer can easily raise them by 20% to stabilize the asset. You include Read more...

Imagine you’re the listing agent for a 1970s fourplex in Los Angeles. The seller tells you the rents are "well below market" and the buyer can easily raise them by 20% to stabilize the asset. You include this in your MLS marketing.

The buyer closes, attempts the increase, and is immediately hit with a wrongful rent increase lawsuit and a city enforcement action. It turns out that because the property is in the City of L.A., it is subject to a local 3% cap for the current cycle (specifically the period through June 30, 2027)—not the statewide 10% maximum.

As an agent, you don’t need to be a lawyer, but you must be a high-level "compliance operator." In California’s 2026 regulatory environment, a single misstatement about "market rent potential" can lead to a professional liability nightmare.

Compliance Disclaimer: This is educational and not legal advice; agents should verify current rules as of the publish date. Local rules are frequently stricter than state law; always consult qualified counsel or local housing departments for jurisdiction-specific guidance.

The Two-Layer System: Statewide vs. Local

To keep your clients safe, use this mental model for every residential transaction:

The State Baseline (AB 1482): This applies to most multi-family housing and corporate-owned rentals statewide.

The Local Card: Cities like Los Angeles, San Francisco, and San Jose have local Rent Stabilization Ordinances (RSOs). If the local rule is more restrictive, the local rule prevails.

Field Scenario: You are showing a property in a city you aren't familiar with. Before discussing rent upside, your first move should be advising the buyer to check the city’s website for a "Rent Stabilization" or "Housing Department" page.

What Agents Must Know About Statewide Rent Caps (AB 1482)

Under the Tenant Protection Act, annual rent increases are capped at 5% plus the local Consumer Price Index (CPI), or 10% total, whichever is lower.

Common Exemptions (Verify for Every Deal)

Properties that are sometimes exempt from the state cap include:

Rolling 15-Year Rule: Residential property issued a certificate of occupancy within the last 15 years (verify the specific date on the CO).

Qualifying SFHs & Condos: Generally exempt only if the owner is not a REIT, a corporation, or an LLC with a corporate member.

Owner-Occupied Duplexes: If the owner occupied one of the units at the start of the tenancy and still lives there.

Agent Pitfall: A single-family home is not automatically exempt. For the exemption to hold, the landlord must have provided the tenant with specific statutory disclosure language in the lease. If that notice is missing, the property may remain "covered" by the rent cap.

“Just Cause” and Tenant Protections in a Sale

The "Just Cause" framework means a landlord cannot terminate a month-to-month lease without a valid legal reason once a tenant has been in place for 12 months.

Vacancy Assumptions: Never promise a buyer the property will be "delivered vacant." If the tenant is protected by "Just Cause," vacancy usually requires a "no-fault" reason like an owner move-in or a substantial remodel.

Relocation Assistance: "No-fault" evictions typically require the landlord to pay the tenant relocation assistance (often equal to one month’s rent, though local laws may require more).

Renovation Requirements: For a "substantial remodel" to be valid, the work must require permits (which must be provided with the notice) and must render the unit unsafe for occupancy for at least 30 consecutive days.

The Agent’s Rent-Control Workflow

Use this checklist during your due diligence period. This is the same logic we outline in our California Real Estate Laws & Compliance Guide.

Rent Control Compliance Checklist

Verify Age: Check the original Certificate of Occupancy date (do not rely solely on assessor data).

Audit Ownership: Confirm if the owner is a person, a trust, or a corporation.

Confirm Local Rules: Check the city/county for local RSO or unincorporated area protections.

Lease Review: Scan (also advise the buyer to) the current lease for AB 1482 "Notice of Exemption" or "Notice of Coverage" language.

Verify Rent History: Request the last 24 months of rent ledgers to ensure previous increases were lawful.

Confirm CPI Basis: Use the 2026 CPI figures for that specific metropolitan area (typically based on April data for increases after August 1).

Marketing Audit: Remove any "guaranteed" income or "easy eviction" claims from the MLS.

Advertising & Pricing Claims: What Not to Say

Risky Statement

Safer Alternative

“Can raise rent to market immediately.”

“Buyer to verify rent control applicability and allowable increases.”

“Guaranteed vacancy at close.”

“Subject to tenant rights; buyer to verify vacancy procedures with qualified professionals.”

“Property is exempt from rent control.”

“Owner-reported exemption to be verified by buyer during due diligence.”

Common Deal Killers (And How to Prevent Them)

Underwriting Mismatch: Lenders often use conservative rent growth assumptions if they see the property is subject to an RSO.

SB 9 & ADU Complications: Adding a unit can sometimes trigger different regulatory layers. See California ADU Laws Explained and SB 9 Explained for Real Estate Agents.

Missing Environmental Disclosures: Rent control isn't the only risk. See Environmental Regulations California Agents Should Know.

Water Rights Issues: Especially in rural properties, see Water Rights & Easements in California Real Estate.

FAQ

How do I know if a city has stricter rent control?

Search the city name + "Rent Stabilization Ordinance." If the city has its own cap (like the L.A. 3% limit), that number overrides the state floor.

Can rent be increased after a property sells?

A change in ownership does not reset the rent cap. The new owner is bound by the same annual limits as the previous owner for any existing tenants.

What is "Vacancy Decontrol"?

This is the concept that once a tenant moves out voluntarily, a landlord can usually reset the rent to market rate. However, once the new tenant moves in, the cap usually applies again.

Do local ordinances apply in unincorporated county areas?

Yes. For example, L.A. County has a dedicated Rent Stabilization and Tenant Protections Ordinance that covers unincorporated areas.

What documents should I request during due diligence?

Always request the original lease, all addendums, the Certificate of Occupancy, and a certified rent roll for the last 2 years.

Does AB 1482 apply to duplexes or triplexes?

Yes, unless they meet specific exemptions such as the "owner-occupied duplex" rule where the owner lived there before the tenancy began.

|

The most stressful mail a licensee can receive isn't a lost commission check—it's an inquiry letter from the California Department of Real Estate(DRE).

Most agents don’t set out to break the law; Read more...

The most stressful mail a licensee can receive isn't a lost commission check—it's an inquiry letter from the California Department of Real Estate(DRE).

Most agents don’t set out to break the law; they fall into "DRE trouble" because of outdated habits or misunderstood regulations. In my 20-plus years of advising California licensees, I’ve seen that the best defense isn't a legal team—it’s a solid operational foundation. This is where Continuing Education (CE) shifts from a bureaucratic hurdle to a professional firewall to help agents avoid DRE violations.

Key Takeaways

Reduces Complaint Risk: Identifies the "red flag" behaviors that trigger consumer grievances.

Prevents Audit Deficiencies: Ensures your trust fund and transaction records meet DRE standards.

Forces Documentation Habits: Moves compliance from a "memory task" to a repeatable system.

What “DRE Trouble” Actually Looks Like

DRE trouble rarely starts with a "bad" person; it starts with a bad process. Here is how the regulatory machinery typically moves:

Consumer Complaints: Often triggered by a frustrated client, these lead to an investigative inquiry that can open up your entire file history.

Audit/Document Requests: Whether random or "for cause," an auditor will scrutinize your transaction folders and trust fund records for technical accuracy.

Renewal Delays: Simple errors in your CE reporting or incomplete requirements can lead to a "deficiency" notice, potentially causing your license to expire while you scramble to fix it.

Disciplinary Actions: This can range from a private citation and fine to a public "Accusation" that may result in a restricted license or revocation.

Disclaimer: This article provides educational information on compliance and is not intended as legal advice.

The 80/20 of What Gets Agents in Trouble

The DRE focuses on patterns. Most violations happen in these high-risk zones:

Advertising & Representation: Improper team names that omit the broker’s identity or missing license numbers on social media marketing.

Disclosure Failures: Missing "material facts" or failing to provide Agency Disclosure forms at the earliest practical moment.

Trust Funds & Records: The "cardinal sin." Commingling funds or failing to maintain a proper 3-column record of client money.

Management & Supervision: A major magnet for DRE trouble. Brokers are responsible for the oversight of salespersons and unlicensed assistants; a lack of a "reasonable system of supervision" is a frequent cause for discipline.

Records & Documentation: Failing to retain transaction-related documents for the required three-year period. If it isn't in the file, as far as an auditor is concerned, it didn't happen.

How CE Prevents Violations

When you approach your California Real Estate License Renewal with a focus on compliance, you treat each CE bucket as a defensive strategy.

1. Ethics & Disclosure

The Misunderstanding: "I only need to disclose things that are physically broken."

The Reality: California requires disclosure of anything that affects the value or desirability of the property.

The Scenario: An agent fails to mention a neighbor's recurring noise complaint. The buyer finds out, files a DRE complaint, and the agent faces an inquiry around misrepresentation.

CE Takeaway: Use your Risk Management CE to audit a recent Transfer Disclosure Statement (TDS) and Agent Visual Inspection Disclosure (AVID). If you're unsure, disclose it.

2. Fair Housing (Interactive Requirements)

The Misunderstanding: "I'm a good person, so I'm not violating fair housing."

The Reality: Bias in marketing and "steering" are primary DRE focus areas.

The Scenario: An agent tells a caller, "You'd probably be more comfortable in the neighborhood across town." Even if meant "helpfully," this is steering.

CE Takeaway: DRE renewal requirements now include interactive fair housing and implicit bias components. Use this training to practice compliant responses to client questions about "neighborhood demographics."

3. Trust Fund Handling

The Misunderstanding: "My broker handles the money, so the timing doesn't matter for me."

The Reality: If you touch a check, you are responsible for the record-keeping and handling according to DRE and brokerage-specific timelines.

The Scenario: An agent holds an earnest money check for several days without a written agreement to do so. An audit reveals the delay, leading to a citation for improper handling.

CE Takeaway: Implement a "Monday Morning" rule: any funds received must be logged and processed according to your broker's compliance manual immediately.

“Audit-Proof” CE Choices

To ensure your renewal goes smoothly and your files stay clean, use this checklist:

Verify Sponsor: Ensure the provider is a DRE-approved sponsor, like ADHI Schools, with a valid ID.

Interactive Requirements: Confirm you’ve completed the mandatory interactive fair housing and implicit bias components.

Correct Hours: Confirm you have the full 45 hours (or the required amount for your specific renewal cycle).

Storage: Save your certificates in a dedicated folder named CE-2026-Renewal-Certs.

DRE eLicensing: Upload your info early to avoid the last-minute "system is down" panic.

Post-Renewal: Your 30-Day “Stay-Out-of-Trouble” Plan

Once you’ve completed your CE, don't just file the certificates. Implement these operational habits:

Task

Action

Ad Audit

Review your Instagram bio, email signature, and website. Do they include your DRE number and brokerage name?

Complaint-Proofing

Start a "Communication Log" for every transaction. Document all verbal instructions from clients via a "confirming email."

File Hygiene

Spend 10 minutes every Friday reviewing your active transaction files for missing signatures or incomplete disclosures.

SOP Update

Ask your broker or manager for a simple one-page Standard Operating Procedure (SOP) for how your team handles "material fact" discoveries.

Once you’ve handled the technical side of the law, you can focus on the growth side of your business. For more on what to do once the renewal is submitted, see our guide on What to Do After Renewing Your CA Real Estate License.

Staying Compliant Is a Choice

AtADHI Schools, we build our CE courses around real-world compliance outcomes because we know a license is more than a piece of paper—it’s your livelihood. Think of CE as your biennial "compliance tune-up." It’s the most cost-effective insurance policy you can buy.

|

One of the most common questions we hear sounds like: “I upgraded to a broker license—do I have extra CE hours now?” or “Do I have to take different classes than when I had my sales license?”

The Read more...

One of the most common questions we hear sounds like: “I upgraded to a broker license—do I have extra CE hours now?” or “Do I have to take different classes than when I had my sales license?”

The confusion is understandable. In California, brokers carry a higher level of legal responsibility—so it feels like the DRE should require more education. The reality is simpler: the total hours are the same, but the required subject mix is where brokers can get tripped up.

Key Takeaways

Total Hours: Brokers and salespersons both complete 45 hours of DRE-approved CE each 4-year renewal cycle.

The Content Mix: Brokers must include Management and Supervision as a mandatory topic (salespersons don’t on their first renewal).

The 9-Hour Survey: For second and subsequent renewals (for licenses expiring on/after Jan 1, 2023), a 9-hour survey can cover all mandatory topics in one course.

Interactive Requirement: For licenses expiring on/after Jan 1, 2023, Fair Housing must include an interactive, participatory component.

Quick Answer: Broker vs. Salesperson CE

In California, brokers and salespersons both need 45 hours of continuing education to renew. The difference is what’s inside the 45 hours: brokers must ensure they complete Management and Supervision as part of their mandatory topic mix. While the total hour count is identical, the DRE requires brokers to undergo specific training related to their role as a potential supervisor.

Comparison Table: Salesperson vs. Broker Renewal

Feature

Salesperson (First Renewal)

Broker (First Renewal)

Second+ Renewals (Both)*

Total Hours

45 hours

45 hours

45 hours

Mandatory Core Courses

4 Subjects (3-hrs each)

5 Subjects (3-hrs each)

Included in 9-hour survey

Fair Housing

3-hr + Interactive Implicit Bias

3-hr + Interactive Implicit Bias

Included in 9-hour survey

Implicit Bias

2-hr Required

2-hr Required

Included in 9-hour survey

Mgmt. & Supervision

Not Required

Required

Included in 9-hour survey

*Applies to licenses expiring on/after Jan 1, 2023, and late renewals filed after that date.

What’s the Same for Everyone?

Regardless of license type, the DRE’s CE structure is built around consumer protection—so the baseline framework stays consistent. That’s why the California Real Estate License Renewal Requirements don’t "punish" brokers with extra hours.

The 4-year renewal cycle applies to everyone.

The total is always 45 hours—no "broker bonus hours."

Mandatory topics + consumer protection hours are the backbone of every renewal package.

What’s Different for Brokers?

If the hours are the same, why does broker CE feel different? Accountability.

A broker isn’t just responsible for their own files—they’re responsible for the supervision standard in the office: policies, advertising compliance, trust fund handling, and risk reduction. That’s why Management and Supervision is explicitly part of the broker requirement - even on the first renewal.

Operator Scenarios: Where Brokers Actually Get Exposed

The Supervision Trap: A broker assumes "supervision" just means reviewing contracts. In reality, brokers can be on the hook for agent advertising and compliance breakdowns across the entire team.

Trust Fund Risk: Most salespersons never touch trust fund handling—brokers live inside it. Small process errors can turn into big consequences during a DRE audit.

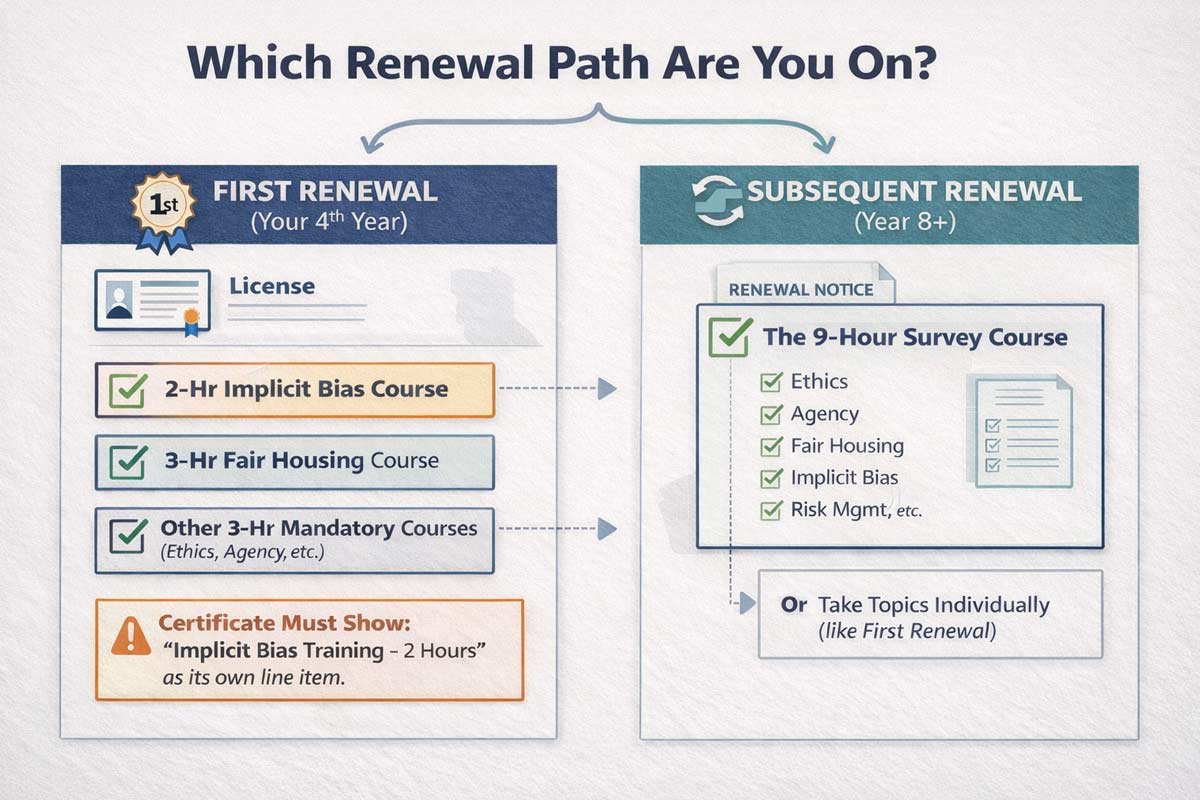

First Renewal vs. Subsequent Renewals

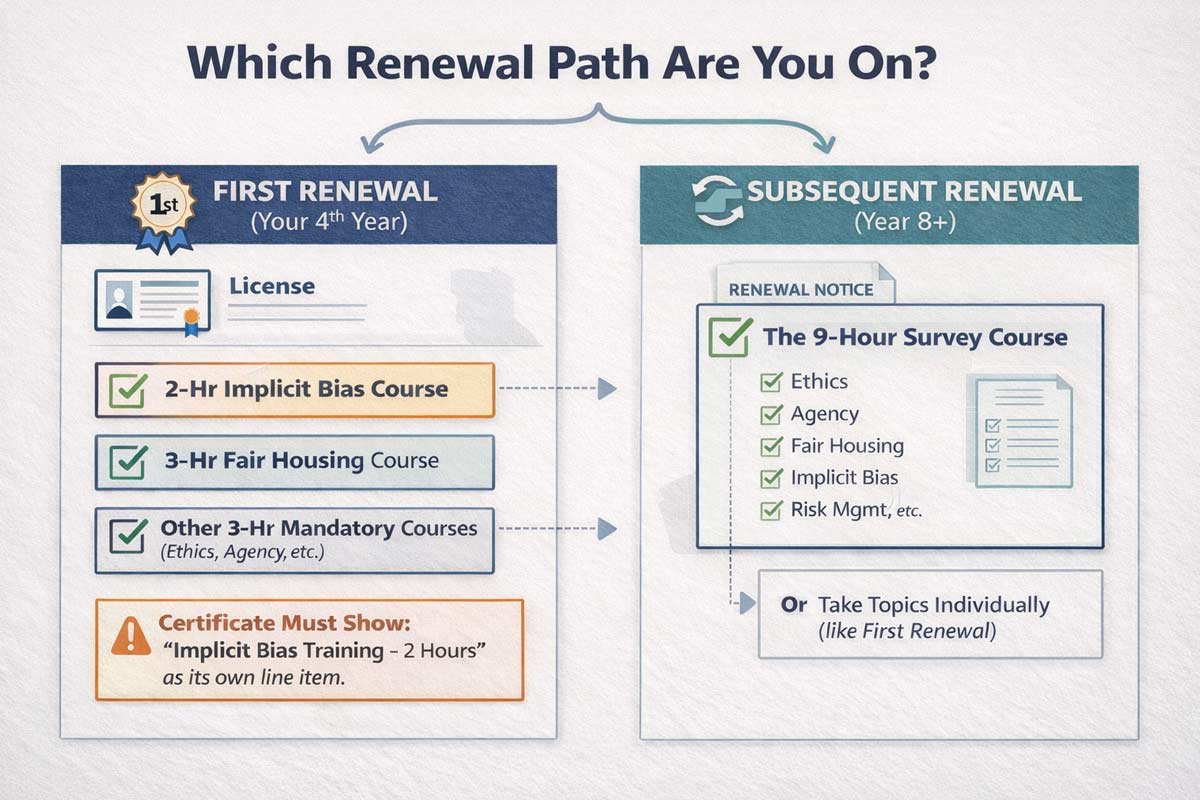

This is where people accidentally choose the wrong package. Your path depends on your renewal "generation."

1) First Renewal

First renewal requires the mandatory subjects as individual courses, plus the required Fair Housing and Implicit Bias components.

Salespersons: 4 separate 3-hour courses (Ethics, Agency, Trust Funds, Risk Management) + 3-hour interactive Fair Housing + 2-hour Implicit Bias.

Brokers: All of the above PLUS a 3-hour Management and Supervision course.

To avoid confusion, view the full roadmap here: California Real Estate License Renewal Guide

2) Second and Future Renewals

For licenses expiring on/after Jan 1, 2023, the DRE allows a 9-hour survey course that covers all mandatory topics (including Management and Supervision) in a single module. You then complete the remaining hours with electives—ideally from clearly qualified Courses That Count Toward CE in California.

7 Common Mistakes That Trigger Delays

REALTOR® Ethics vs. DRE Ethics: Assuming NAR training counts (it usually doesn’t unless the provider specifically issued a DRE-approved CE certificate).

Non-Interactive Fair Housing: Taking an old-style text course for Fair Housing when your license expires after Jan 1, 2023.

Missing Implicit Bias: Failing to ensure the 2-hour standalone course is in your package. See: Does California Require Implicit Bias Training for Renewal?

Overbuying Hours: Thinking brokers need more than 45. Confirm yourCalifornia CE hour requirements before paying.

Unverified Providers: Using a "national" school that lacks a California DRE Sponsor Number.

Waiting Until the Final 24 Hours: Because of the 15-hour exam limit (see below), you literally cannot finish 45 hours in one day.

Wrong Package Type: A broker taking a salesperson package and missing the Management and Supervision credit.

Step-by-Step: Choosing the Right CE Package

Verify Sponsor Details: Ensure the school is DRE-approved.

Check Fair Housing: Confirm it includes the "interactive participatory component."

Respect the 24-Hour Rule: The DRE limits licensees to completing final examinations for a maximum of 15 credit hours per 24-hour period. If you have 45 hours of testing to do, you need at least three separate 24-hour windows to complete your exams.

FAQ

Do brokers need more CE hours than salespersons in California?

No. Both license types require 45 hours every four years.

Is Management and Supervision required for brokers?

Yes. It is mandatory for all broker renewals (first and subsequent).

What is the 9-hour survey course?

It's a condensed course covering all seven mandatory subjects, available only for second and subsequent renewals.

Does Fair Housing have to be interactive?

For licenses expiring on or after Jan 1, 2023, yes. This includes late renewals filed after that date.

How early can I renew?

You can submit your renewal via eLicensing up to 90 days before your expiration date.

Broker renewal shouldn’t create uncertainty or cause you to buy the wrong package. The goal is simple: meet the DRE requirements cleanly, protect your license, and keep your business.

|

You’re staring at your 45-hour renewal options and you notice a new line item: “Implicit Bias Training.”

The real question isn’t what it is—it’s whether missing it can delay your renewal.

Read more...

You’re staring at your 45-hour renewal options and you notice a new line item: “Implicit Bias Training.”

The real question isn’t what it is—it’s whether missing it can delay your renewal.

For California renewals tied to the post–January 1, 2023 CE rules, Implicit Bias is a mandatory DRE-required topic—and the only “gotcha” is how it must appear on your CE completion records depending on whether this is your first renewal or a later renewal.

This guide clarifies the rules so you can renew your license without a rejection.

Quick Answer: Do I Need This?

Yes. Implicit Bias Training is required as part of California’s renewal CE.

Requirement: 2 hours of DRE-approved Implicit Bias Training.

Does it add hours? No—it's part of your required 45 hours (not extra).

Key difference: First-time renewals must complete a standalone 2-hour Implicit Bias course. Subsequent renewals can satisfy it via the 9-hour survey course or by taking the mandatory topics as individual courses.

Related Resources:

California Real Estate License Renewal Guide

California Real Estate License Renewal Requirements (2026)

Why Is This Required? (SB 263)

This requirement comes from California’s CE rule updates implementing Senate Bill 263, which added a two-hour implicit bias training component and expanded the survey/update course to nine hours to cover the mandatory topics.

The curriculum focuses on understanding historical and systemic housing barriers and providing actionable steps to recognize unconscious bias in client interactions. The goal is risk management: protecting your license and ensuring compliance with Fair Housing laws.

The "First Renewal" vs. "Subsequent" Rule

The Department of Real Estate (DRE) has precise rules for how this training appears on your certificate. This is where most licensees make mistakes.

Scenario A: This is Your First Renewal

If you are renewing for the very first time (your 4-year anniversary), you cannot use the "survey course" shortcut. You must take separate courses.

If you are a Salesperson:

Your 45 hours must include:

Four separate 3-hour courses: Ethics, Agency, Trust Fund Handling, Risk Management.

One 3-hour Fair Housing course (with the required interactive component).

One 2-hour Implicit Bias Training course.

At least 18 hours of Consumer Protection, plus remaining hours in Consumer Protection or Consumer Service.

If you are a Broker (or Officer):

The structure is similar, but adds one more mandatory topic:

Five separate 3-hour courses: Ethics, Agency, Trust Fund Handling, Risk Management, Management & Supervision.

One 3-hour Fair Housing course (with the interactive component).

One 2-hour Implicit Bias Training course.

At least 18 hours of Consumer Protection, plus remaining hours in Consumer Protection or Consumer Service.

The Certificate Rule: You need a completion record that clearly shows "Implicit Bias Training – 2 Hours" as its own course line item.

Operator Note: If you want the full breakdown of what counts and how the DRE buckets these hours, read our guide on California Real Estate License Renewal Requirements (2026).

Scenario B: This is a Second (or Later) Renewal

For second and subsequent renewals, you have two compliant paths:

The Survey Option: Take the single 9-hour CE survey course that covers all mandatory topics (including Implicit Bias).

The Individual Option: Take the mandatory topics as individual courses instead of the survey.

Broker licensees will often ask ADHI Schools if brokers have different CE requirements in CA? A key difference is all broker licensees renewing must take a Management and Supervision course, but first time salespersons renewing do not.

Does It Count Toward My 45 Hours?

Yes. Implicit Bias is not "extra" work. It fits inside your existing bucket.

License Renewal Type

Total Hours Required

Does Implicit Bias Count?

First Renewal

45 Hours

Yes (Counts as 2 mandatory hours)

Subsequent Renewal

45 Hours

Yes (Could be taken in a 9-hr Survey course)

Late Renewal

45 Hours

Yes (Same rules apply)

To see exactly how the math works for your specific license type, check our breakdown of how many CE hours are required for CA license renewal?

"Audit-Proofing" Your Renewal

The DRE audits a percentage of renewals every month. If you are pulled for an audit simply follow the requests that the DRE makes and respond in a timely manner.

The Audit Checklist:

Check the Provider: Ensure the course provider is DRE-approved. A "Diversity Training" certificate from your other corporate job does not count. It must have an four-digit DRE Sponsor Number listed on the certificate of completion. Learn exactly what courses count toward CE in California to avoid registering for an invalid course.

Verify the Year: If you took a Fair Housing course in 2021 that didn't have the new interactive component or implicit bias module, it is invalid for a 2026 renewal.

Keep Your Records: Keep your certificates longer than you think. DRE recommends retaining CE completion certificates up to five years in case of audit, and providers are required to maintain participant records for five years.

Common Mistakes That Reject Renewals

We see licensees panic-renew 24 hours before their license expires. That is when mistakes happen.

Mistake #1: The "HR" Course. Submitting a workplace harassment or bias certificate from a non-real estate employer.

Result: Rejected.

Mistake #2: The "Old" Course. DRE rule of thumb: Continuing education credit expires four years from the course completion date, so older certificates can trigger rejection codes during renewal processing.

Mistake #3: Taking Courses From a Provider That is Not Approved. Make sure to ask for the 4 digit sponsor number of any course provider before registering.

Stay Compliant, Stay Active

Implicit Bias training is now a standard part of doing business in California. It isn't just about checking a box; it's about protecting your license and serving a diverse client base professionally.

Don't let a missing 2-hour certificate pause your career. If you are unsure exactly which courses you need based on your license status, check the full roadmap below.

California Real Estate License Renewal Guide →

FAQ

1. Can I take Implicit Bias training online?

Yes. As long as the provider is DRE-approved for correspondence or online study, you can take the course entirely online.

Does my Fair Housing course cover Implicit Bias?

No. They are separate requirements. However, if you take the 9-Hour Survey Course (for subsequent renewals), both Fair Housing and Implicit Bias are included in that single 9-hour block.

I am over 70 years old. Do I still need this?

If you are eligible for the "70/30" exemption (70+ years old AND 30 years of continuous good standing), you are exempt from all CE, including Implicit Bias. You simply submit the exemption form.

What happens if I renew late?

If you renew within your two-year grace period, the requirements are the same: you must complete the 45 hours, including Implicit Bias, before you can reinstate your license and pay the appropriate late fee.

|

In California real estate, "busy" is sometimes viewed a badge of honor. But after 20 years of coaching and operating in this industry, I can tell you the truth: Busy isn't the goal. Profit and freedom Read more...

In California real estate, "busy" is sometimes viewed a badge of honor. But after 20 years of coaching and operating in this industry, I can tell you the truth: Busy isn't the goal. Profit and freedom are.

This guide provides a practical, operator-level time management system for California real estate agents designed to move you from a reactive state to a systems-first mindset. If you don't control your calendar, your clients, escrow officers, and the 405 freeway will control it for you.

To master the essential Real Estate Agent Skills California requires a shift from chasing the day to owning it.

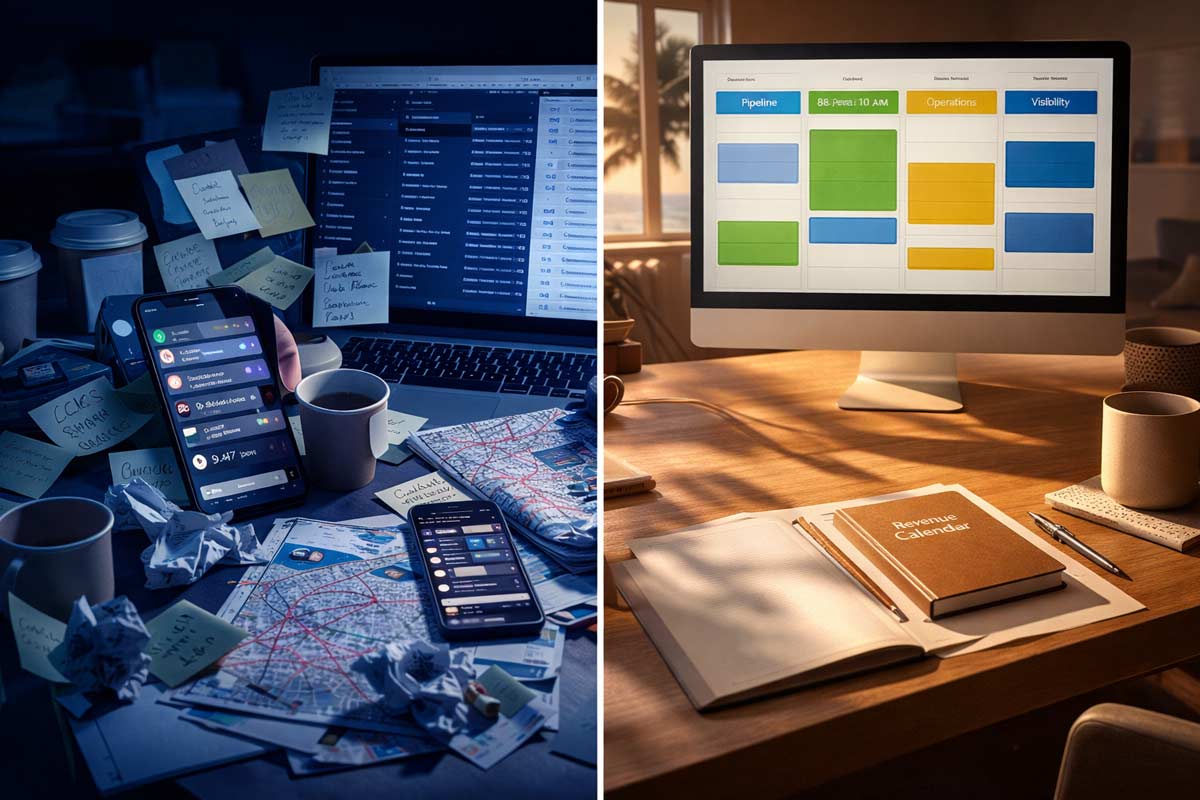

TL;DR: The California Operator System

The 3-Bucket Filter: If it creates revenue, it’s Pipeline. If it saves a deal, it’s Operations. If it builds the future, it’s Visibility.

The Morning Power: 8:00 AM – 10:00 AM is for non-negotiable follow-up. No email allowed.

The "One Window" Rule: Batch all escrow and admin tasks into a single 90-minute block.

The Guardrail: If it isn't on the calendar, it doesn't exist.

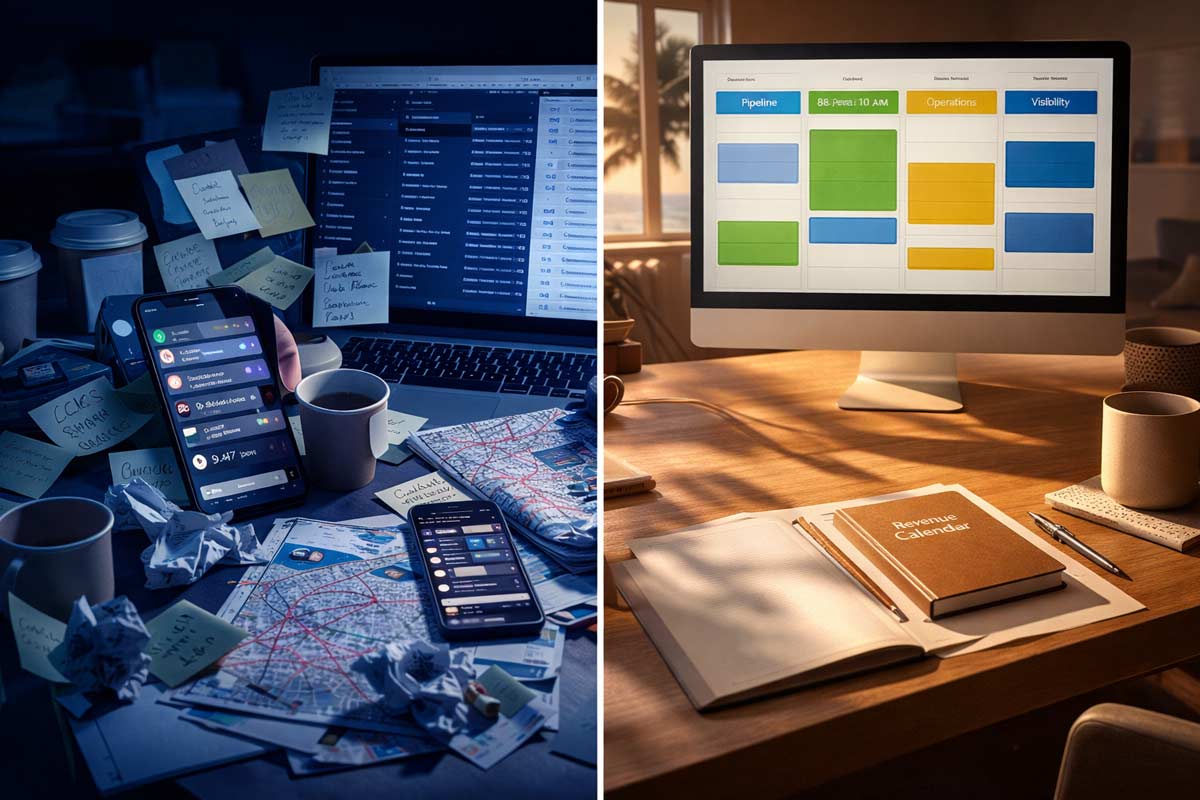

Reactive Calendar vs. Revenue Calendar

Most agents operate on a Reactive Calendar. You wake up, check your email, respond to a frustrated buyer, get lost in a DM rabbit hole, and suddenly it’s 2:00 PM. You’ve done "work," but you haven't generated a single dollar of future revenue.

A Revenue Calendar is designed to protect income-producing activities first.

Diagnostic: 5 Signs You Are Operating Reactively

You start your day by answering emails instead of making outbound calls.

You don't have a recurring "Follow-Up" block in your digital calendar.

An inspection or appraisal request can derail your entire afternoon.

You find yourself scrolling Instagram under the guise of "content research."

Your "lead generation" only happens when you realize you have no active escrows.

The 3-Bucket Decision Rule

To manage your time, you must categorize your tasks instantly. Stop treating an escrow signature with the same urgency as a cold lead follow-up. Use these filters:

Pipeline (Revenue): Does this create or advance a commission check today or tomorrow? (Follow-up, appointments, negotiations)

Operations (Delivery): Does this protect a deal currently in motion? (Disclosures, inspections, TC coordination)

Visibility (Future): Does this build my pipeline for 6 months from now? (Content creation, networking, database building)

The secret to consistency is ensuring all three buckets have a "home" in your week. This balance is one of the daily habits of top-producing agents that separates the earners from the hobbyists.

The California Agent Weekly Template

California real estate has a specific rhythm. Traffic is a factor, and weekend "work" is mandatory. Use this table as your base real estate agent schedule:

Time Block

Focus

Purpose

8am – 10am

Revenue (Pipeline)

Calls, texts, and CRM follow-up.

10am – 11:30am

Delivery (Operations)

Escrow Command Center / Admin.

12pm – 1pm

Recharge

Lunch / Personal time (No pings).

1pm – 5pm

Appointments / Field

Showings, listing presentations, previews.

5pm – 6pm

Future (Visibility)

Social media content / Networking.

The "New Agent" vs. "Busy Agent" Flex

New Agents: Spend 4+ hours daily in the Pipeline bucket. You need reps more than you need "systems" right now.

Busy Agents: Spend more time in Operations but must protect the 8 AM – 10 AM window at all costs to avoid the "income roller coaster."

Effective time management begins by knowing how to set goals as a new real estate agent—once your goals are clear, the calendar follows.

Win the Morning: The Follow-Up Operating System

The first two hours of your day dictate your commission check three months from now. Time management for California real estate agents lives or dies in the CRM.

The Daily Priority Stack:

New Leads: Contact within 5 minutes (or first thing in your 8 AM block).

Hot Nurtures: Clients likely to transact in the next 30–60 days.

Active Clients: Brief status updates (even if the update is "no news").

Past Clients: Staying top-of-mind for referrals.

To make this work, you need a system. Learning how to build a real estate CRM that actually works is the only way to automate your reminders so you don't spend hours "organizing" instead of "doing."

Escrow and Transaction Control

In California’s fast-paced escrow environment, a single inspection report can trigger 20 phone calls. If you handle these as they come in, you will never have a productive day.

The Escrow Command Center Rule: Schedule one "Operations Window" (e.g., 10:00 AM – 11:30 AM). Batch all your emails to escrow officers, lenders, and TCs during this time.

Kartik’s Tip: When a lender calls at 2:00 PM while you're at a showing, let it go to voicemail. Listen, then reply during your next designated admin block. Most "emergencies" are simply other people’s poor planning.

Open Houses & Traffic Realities

California traffic is a variable you must account for. If you have a showing in Irvine at 4:00 PM, you aren't "working" from 3:30 PM to 6:00 PM—you are commuting and showing.

The 20% Buffer: Always add 20% more time to travel than GPS suggests.

Weekend Recovery: If you work 6 hours on Saturday and Sunday, you must protect Monday morning as "Off" time to prevent the burnout cycle.

Pre-Prep: Don't print flyers on Sunday morning. Do all "Visibility" prep on Thursday so your weekend is focused on the people in front of you.

Burnout Guardrails (Energy Management)

"Always on" is a recipe for a short career. Sustainable time management requires energy management.

The Hard Stop: Pick a time (e.g., 7:00 PM) where the phone goes in the drawer.

The One True Day Off: One day a week, you are not an agent. You are a human being.

Boundary Scripts: "I’m headed into an appointment, but I will check this first thing at 8:00 AM tomorrow."

Effective burnout prevention for real estate professionals is built into the calendar, not added as an afterthought.

FAQ: Real Estate Time Management

How many hours should a real estate agent work?

A: Successful full-time agents typically work 40–50 hours per week, but the composition of those hours matters more than the total. 15 hours of focused lead generation is more valuable than 60 hours of "random busywork."

What’s a good daily schedule for real estate agents?

A: A high-production schedule starts with 2 hours of follow-up (8–10 AM), 90 minutes of admin/escrow (10–11:30 AM), and afternoons dedicated to appointments and field work.

How do I handle "looky-loo" buyers who waste my time?

A: Use a mandatory buyer consultation. If they won't meet for 20 minutes to discuss their needs and financing, they aren't worth a 2-hour drive.

What if a client gets mad because I didn't answer at 9:00 PM?

A: Set expectations early. Tell them: "I am fully focused on my clients from 8:00 AM to 7:00 PM. If you text after that, I'll have an answer for you first thing in the morning."

Implementation Challenge: The 14-Day Reset

Commit to this for the next 14 days before you customize:

Block 8:00 AM – 10:00 AM for lead follow-up only. No email. No social media.

Batch your "Operations" into one 90-minute window.

Identify 3 "Stop-Doing" items: Activities that resulted in zero revenue last week.

Time management isn't about doing more; it's about doing what matters. Master these systems, and you’ll find that a successful California real estate career doesn't have to cost you your sanity.

Ready to level up your entire business? Visit our Real Estate Agent Skills California hub to learn more about building a sustainable, high-performance career with ADHI Schools.

|

You’re stuck in traffic on the 405, your phone is buzzing with a frantic text about a repair contingency in Santa Monica, and you just realized you forgot to follow up with that listing lead from Sunday’s Read more...

You’re stuck in traffic on the 405, your phone is buzzing with a frantic text about a repair contingency in Santa Monica, and you just realized you forgot to follow up with that listing lead from Sunday’s open house.

You feel "busy," but your production doesn't reflect the chaos.

In my 20+ years of coaching thousands of California agents at ADHI Schools, I’ve seen this movie before. Most agents mistake motion for progress. They react to their inbox, their phone, and their fires, leaving their income to chance.

Top producers—the ones with consistent listing flow and a steady referral engine—don’t have more "hustle" than you. They have a better operating system.

They protect three specific pillars every single day:

Pipeline

Operations

Visibility

Here is the exact daily habit stack used by the most successful agents in the California market.

The 10 Daily Habits of Top-Producing Agents

1. The Morning Pipeline Block

What they do: Spend the first 90 minutes of the workday on proactive outbound lead generation (calls, texts, or door knocking) before getting deep into email.

Why it works: Your pipeline is the only thing that guarantees future commissions. If you don't feed the engine first, the fires of the day will consume your time.

How to implement:

Set a "Do Not Disturb" on your phone from 8:00 AM to 9:30 AM.

Use a simple script: "Hi [Name], I was looking at the latest comps in [Neighborhood] and thought of you. Have you had any thoughts on the market lately?"

Common mistake to avoid: Checking your "Escrow is closing" emails first. That money is already earned; go find the money you haven't earned yet.

2. The 5-5-4 Follow-Up Loop

What they do: Every day, they contact 5 new leads, 5 past clients, and 4 people in their "active" sphere.

Why it works: Real estate is a game of attrition. Most deals are lost because an agent stopped calling after the second attempt.

How to implement:

Use your CRM to pull a daily "Touch List." If you're struggling with what to say, check out our guide on how to set goals as a new real estate agent to align these calls with your production targets.

Common mistake to avoid: "Checking in" without offering value (like a market update or a vendor recommendation).

3. Strict CRM Hygiene

What they do: Every conversation is logged, and every contact has a "Next Action" date before the agent closes their laptop.

Why it works: A top producer’s brain is for creating solutions, not storing dates. If it isn't in the CRM, it doesn't exist.

How to implement:

Spend 15 minutes at the end of every meeting logging notes. Tag leads by "Temperature" (Hot, Warm, Cold) so you know who to prioritize tomorrow. Learn how to build a real estate CRM that actually works to automate this process.

Common mistake to avoid: Keeping lead info on sticky notes or in your phone’s "Notes" app.

4. The "Deal Protection" Audit

What they do: A quick 20-minute daily review of all active escrows and pending contracts to ensure deadlines (contingencies, disclosures) are met.

Why it works: In California, missing a contingency date can cost your client thousands and cost you your reputation.

How to implement:

Create a checklist for every transaction.

Ask: "Who is the ball currently with—the lender, the escrow officer, or the other agent?"

Common mistake to avoid: Assuming the escrow officer or TC (Transaction Coordinator) is handling everything without your oversight.

5. One Daily Visibility Action

What they do: Produce one piece of "social proof" or community-focused content (a video tour, a market stat graphic, or a photo at a local business).

Why it works: Visibility amplifies ability. If people don't see you working, they assume you aren't.

How to implement:

Document, don't create. Take a photo of a home inspection or a beautiful kitchen during a showing.

Post it with a caption explaining a specific Real Estate Agent Skills California trait, like negotiation or local expertise.

Common mistake to avoid: Aiming for "viral" instead of "local and helpful."

6. The 15-Minute Market Pulse

What they do: Review the "Hot Sheet" in the MLS to see what went pending, what sold, and what price-dropped in their target zip codes.

Why it works: You cannot be an advisor if you don't know the inventory. Clients pay for your interpretation of the data.

How to implement:

Set an MLS alert for your primary farm areas.

Internalize the numbers: "The average days on market in Irvine just dropped to 12."

Common mistake to avoid: Relying on national news headlines instead of local MLS data.

7. Script & Objection Mastery

What they do: Practice handling common California objections (e.g., "The rates are too high," or "I want to wait for the market to crash") for 10 minutes.

Why it works: Professional athletes practice more than they play. Top agents practice so their delivery is natural and confident.

How to implement:

Roleplay with a partner or record yourself on your phone.

Focus on empathy first: "I hear you, and many of my clients feel the same way. What I’ve found is..."

Common mistake to avoid: Winging it during a high-stakes listing presentation.

8. Hard Energy Boundaries

What they do: Set specific "Off" times where they do not answer the phone, ensuring they recharge for the next day.

Why it works: High-performance requires recovery. Constant "on-call" status leads to the errors that kill deals.

How to implement:

Use "Auto-Reply" texts after 7:00 PM: "I am currently with my family, but I will return your call first thing tomorrow morning."

Review these strategies for burnout prevention for real estate professionals.

Common mistake to avoid: Answering non-emergency client texts at 10:00 PM (it trains them to disrespect your time).

9. The End-of-Day Shutdown

What they do: Clear the desk, review the calendar for tomorrow, and identify the "Big 3" tasks that must happen.

Why it works: You win the morning the night before. This prevents the "What should I do now?" paralysis at 9:00 AM.

How to implement:

The Shutdown Checklist:

Inbox to zero (or filed).

CRM tasks updated.

Tomorrow’s "Pipeline Block" list ready.

Common mistake to avoid: Ending the day mid-task without a plan for tomorrow.

10. The 3-Number Scoreboard

What they do: Track three specific numbers at the end of every day: conversations, follow-ups completed, and one visibility asset shipped.

Why it works: What gets measured gets repeated. This turns "I was busy" into "I moved the business forward."

How to implement:

Use a sticky note, Notion, or your CRM dashboard.

Target: 10 conversations, 10 follow-ups, 1 visibility post (adjust as you scale).

Review weekly and identify what’s slipping—pipeline, operations, or visibility.

Common mistake to avoid: Tracking vanity metrics (likes, followers) instead of conversations and appointments.

Top Producer Reality Check: What They Don’t Do

Success is often about what you remove from your day. Top agents:

Don’t check email as the first act of the day.

Don’t keep lead information in text threads or DMs; it goes to the CRM.

Don’t take random vendor meetings during their Pipeline Block.

Don’t confuse "scrolling" and consuming social media with "creating" visibility.

What Top Agents Do Before 9:00 AM

Most California agents start their day in a "reactive" state. Top producers use the time before 9:00 AM to build a mental moat:

No Screens: Avoid the "inbox trap" for at least the first 30 minutes of waking.

Movement: A quick walk or workout to handle the high-stress nature of the industry.

Review the Big 3: Confirm the three non-negotiable tasks for the day before the world starts calling.

Daily Habits: New vs. Experienced Agents

Your routine should shift as your business matures:

New Agents (Years 1–2): 80% of your day should be pipeline and visibility. You have more time than clients; use it to build the database.

Experienced Agents (Years 5+): 50% pipeline/visibility and 50% systems and depth. Focus on deepening existing relationships and refining time management for California real estate agents to handle increased transaction volume.

Sample Daily Schedule: The California Operator Template

If your calendar keeps getting hijacked by non-urgent tasks, mastering your time as a real estate agent is your first priority. Use this block schedule to regain control.

Time

Activity

Focus

8:00 AM

Market Pulse

Review MLS Hot Sheets & local news.

9:00 AM

Pipeline Block

Non-negotiable outbound calls/prospecting.

10:30 AM

The Follow-Up Loop

Returning voicemails, texts, and emails.

12:00 PM

Lunch / Visibility

Eat at a local spot; post a "Day in the life" story.

1:30 PM

Operations & Admin

Listing prep, transaction review, CRM cleanup.

3:00 PM

Field Work

Showings, listing appointments, or door knocking.

5:30 PM

Shutdown

Plan tomorrow; set phone to "Do Not Disturb."

Why Most Agents Fail to Keep Habits (And the Fix)

Most agents fail because they are reactive. If your calendar is a blank slate, other people will write on it. This creates a "feast or famine" cycle that leads to burnout.

The Fix: The 2-Day Rule:

Never miss your daily habits two days in a row. If a closing goes sideways and you miss your morning calls today, that’s life. If you miss them tomorrow, that’s a choice. This isn’t about working longer hours—it’s about protecting the few actions that compound.

Start Here Today: The Minimum Viable Day (MVD)

If you are overwhelmed, do this 60-minute checklist to keep your business alive:

30 Minutes: Pipeline outreach (Contact 5 people).

15 Minutes: CRM Hygiene (Log calls/set next follow-ups).

10 Minutes: Visibility (Post one market update to social media).

5 Minutes: Plan tomorrow’s "Big 3" tasks.

Frequently Asked Questions

What do top producing agents do every day?

They prioritize "Revenue Generating Activities" (RGAs) like lead generation and follow-up during their peak energy hours and leave administrative tasks for the afternoon.

How many calls do top agents make per day?

Many top producers aim for 10–20 real conversations per day and increase volume during growth phases. The key metric is meaningful conversations, not just dials.

What is a good daily schedule for a real estate agent?

A good schedule is "time-blocked," meaning specific hours are dedicated to lead gen, client meetings, and admin. This prevents administrative "busy work" from eating into your prospecting time.

How do agents stay consistent without burnout?

By setting firm boundaries and treating their "recharge" time as a non-negotiable appointment on their calendar, just like a listing presentation.

Ready to Master the Business?

Habits are the foundation, but skills are the ceiling. If you want to move from "busy" to "profitable," you need to master the full stack of Real Estate Agent Skills California required for this unique market.

Next Steps for Your Growth:

New Agents: Start by setting your 90-day goals.

Mid-Career Agents: Audit your CRM system to find the holes in your follow-up.

|

TL;DR: The System Summary

A successful real estate CRM is a daily follow-up machine, not a contact list. To make it work, you need:

Minimalist Data: Only track what helps you make Read more...

TL;DR: The System Summary

A successful real estate CRM is a daily follow-up machine, not a contact list. To make it work, you need:

Minimalist Data: Only track what helps you make the next call.

Strict Pipeline Stages: Define exactly where a lead sits in the journey.

The Golden Rule: Every contact must have a Next Step and a Next Date.

Daily Discipline: A 10-minute "CRM Block" to clear your tasks.

The CRM Graveyard: Why Most Systems Fail

Let’s be honest: Most California real estate agents have a "CRM graveyard." It’s a software subscription you pay for every month, filled with names you haven't called in 90 days and "leads" from an open house three years ago that were never categorized.

I’ve spent over 20 years coaching and operating in the California real estate education space, and I see the same mistake everywhere. Agents try to build a "database" when they should be building a real estate lead follow-up system.

If your CRM isn’t telling you exactly who to contact by 9:00 AM today, it’s not a CRM—it’s a hobby. In a market where you’re fighting 101 freeway traffic and juggling multiple escrows, speed-to-lead is the only metric that matters. If you aren't contacting an inbound lead within minutes, you are often competing with 3–5 other agents. Your CRM is what allows you to win that race.

CRM Setup in 30 Minutes (Beginner-Proof)

Don't spend weeks "researching" software. Pick a tool and follow this 30-minute sprint:

Create your 7 stages: Use the framework in the table below.

Set your required fields: Source, Lead Type, Stage, Next Follow-Up Date, Tags.

Configure 3 saved views: Today, This Week, Nurture.

Import 10 contacts: Start with your phone’s "recent" list or warm sphere.

Assign a Next Step + Next Date: Do this for every single one.

Calendar it: Put a recurring 10-minute CRM Block on your calendar for every weekday morning.

The CRM Build: Your Minimum Viable System

To build a real estate CRM that sticks, you need to strip away the "tech-bro" features most CRM for real estate agents are bloated with and focus on the core structure.

1.The Only Fields You Actually Need

Stop trying to fill out 50 fields of data. You’ll burn out. Stick to these:

Name & Contact Info: Phone and Email are the essentials.

Source: Zillow, Open House, Sphere, Referral.

Lead Type: Buyer, Seller, Investor, Renter.

Pipeline Stage: Where are they in the process?

Next Follow-Up Date: The most important field in your business.

Tags: FHA-Buyer, Inland-Empire-Retail, Probate, Past-Client, Hot-Lead.

Common Mistake: Don't create a "custom field" for every little detail. Use the "Notes" section for the story; use "Tags" for the category. Over-complicating fields is the fastest way to stop using the system.

2. Your Pipeline Stages (Entry/Exit Criteria)

Your pipeline stages real estate logic must be tight. If you don't know why someone is in a specific stage, the system breaks.

Stage

What it means

Move forward when...

New Lead

Inbound or added, not contacted

You’ve attempted contact + set Next Date

Contacted

Two-way exchange happened

You have timeline + motivation basics

Qualified

Budget + timeline + reason confirmed

You scheduled consult/showing/listing appt

Active Search

You’re actively working inventory

They’re ready to offer or pause

Offer / Escrow

Under contract

You close or deal dies (then re-stage)

Closed / Past

Transaction complete

You set post-close follow-up + nurture

Nurture

6+ months out

They re-engage (then re-qualify)

The Follow-Up Engine (The Real Product)

Your real estate CRM workflow is only as good as your persistence. Most agents stop after two attempts. Top operators go further.

The “No-Response” Ladder

Use this framework when a lead goes quiet:

Touch 1 (Day 1): Call + short text: “Hey [Name], it’s Kartik—saw your inquiry about [area]. Quick question: are you looking to move in the next 30–90 days or just researching?”

Touch 2 (Day 2–3): Value text: “If you tell me your target city + price range, I’ll send 3 options that match your criteria today.”

Touch 3 (Day 5–7): Close-the-loop: “I don’t want to spam you—should I stop reaching out, or is there a better time next week?”

If no response occurs after Touch 3, move them to the Nurture stage and set a Next Date for 21–30 days out.

Workflow: The Daily Execution

A CRM is only as good as your Daily Habits. To stay organized, stop looking at "All Contacts." Instead, use these three saved views:

Today: Shows only leads where the Next Date = Today or is Overdue.

This Week: Shows leads with a Next Date within the next 7 days (for planning).

Nurture: Shows leads with a Next Date 21–30 days out.

The Daily & Weekly Rhythm

Success requires a Time Management for California Real Estate Agents strategy that protects your "system time."

Daily (10 Mins): Clear your "Today" view every morning. Log outcomes in one sentence. Set the next date.

Weekly Reset (15 Mins): Every Friday at 4:30 PM, review your pipeline. Drag leads back to the correct stages and ensure no one is missing a Next Date.

Automation vs. Human Touch

Automation should support you, not replace you.

Do Automate: Immediate "Thanks for reaching out" texts; Appointment reminders.

Don't Automate: Deep relationship building. If an automation can’t be answered with a human reply, it probably shouldn’t be sent.

Common Failure Points and Fixes

"I don't have time to update it."

Fix: Make the update process smaller. Log the outcome immediately after the call, not at the end of the day.

"I'm burning out on follow-up."

Fix: Read our guide on Burnout Prevention for Real Estate Professionals. Usually, burnout comes from the anxiety of forgetting someone, not the act of calling them.

"I'm in escrow chaos all week."