You’ve seen the word "PASS" on the screen at the exam center. It is a massive milestone, but it is important to understand one thing immediately:

Passing the real estate exam is not the same as having Read more...

You’ve seen the word "PASS" on the screen at the exam center. It is a massive milestone, but it is important to understand one thing immediately:

Passing the real estate exam is not the same as having a license issued.

Until the California Department of Real Estate (DRE) processes your formal application and issues a license number, you cannot legally perform acts requiring a license or collect a commission. This is the final administrative step between passing and practicing, and navigating it correctly prevents administrative delays that can push back your start date in the market.

ADHI Schools typically recommends the DRE Exam/License Combo application for speed. While it requires paying both the exam and license fees upfront, it often reduces the back-and-forth after you pass and helps you move from ‘passed’ to ‘license issued’ faster. That said, many applicants don’t choose the combo (or aren’t sure which path they’re on), so this guide walks you through exactly what to do after passing—step by step.

Quick Summary

Determine your path: Confirm if you filed a "Combo" or "Exam Only" application via eLicensing.

Background clearance: Ensure your Live Scan fingerprints are submitted; issuance is gated by the DRE's receipt and screening of DOJ/FBI reports.

Documentation: Submit the appropriate application and the required $350 fee (if not already paid).

Activation: Decide whether you’ll issue as "Inactive" or "Active" with an employing broker.

Verification: Check your status and Current Processing Timeframes on the official DRE website.

The 60-Second Post-Pass Checklist

Verify Exam Status: Confirm "Pass" reflects in your eLicensing account.

Check Application Type: If you filed the Combo, track your status—do not submit a second application.

Live Scan: Have you performed your fingerprints?

Broker Info: Do you have your employing broker’s license number? (Optional for issuance, required for "Active" status).

Form Accuracy: Ensure your name matches your government ID exactly to avoid identity mismatches.

Step 1: Identify Which Path You’re On

Before you fill out new forms, you must know if the DRE already has your license application.

If you...

Your Path is...

Your Next Move...

Paid the $450 combo fee

Combo Application

Monitor eLicensing. Ensure Live Scan is done.

Paid the exam fee only

Post-Pass Path

Submit Salesperson License Application + $350 fee.

If you are unsure which path you followed, review your initial How to Apply for the California Real Estate Exam steps or check your payment history in eLicensing.

Operator Tip: If you’re unsure, check your eLicensing payment and application history before submitting anything new—duplicate filings can slow the review process.

Step 2: Complete the Application Correctly

If you are on the "Post-Pass" path, you must submit the Salesperson License Application (RE 202).

Name Consistency: Use your legal name exactly as it appears on your ID.

Disclosure Accuracy: Be thorough regarding past criminal convictions or disciplinary actions. Inconsistencies here commonly trigger follow-up requests and delay issuance.

Avoid This Delay: Check the Common Mistakes Applicants Make on DRE Forms to ensure your paperwork doesn't get kicked back for a simple oversight.

Step 3: Live Scan & Background Clearance

The DRE will not issue an original license until DOJ and FBI reports are received and screened. This is often the "pending trap" where applications sit for weeks while background checks process.

The Form: Use the official Live Scan Service Request (RE 237).

The Process: Review the DRE’s Fingerprint Requirements to ensure you are using a certified provider.

Tracking: Keep your ATI number (found on the bottom of your Live Scan form) in case the DRE asks you to reference your submission.

Step 4: Fees and Document Hygiene

Fees must be exact. According to the official DRE Fee Schedule:

Salesperson Original License: $350

Salesperson Exam & License (Combo): $450

Operator Tip: Confirm the payment processed successfully and save the confirmation/receipt from eLicensing. If filing by mail, ensure you haven't missed a signature or a page. Unreadable uploads or incomplete paper packets are common "paper cuts" that add weeks to the process.

Step 5: Understanding Broker Affiliation

You can get your license number issued even if you haven't picked a company yet.

Active Status: Your employing broker provides their license number and signs your application (manually or via eLicensing).

Inactive Status: You submit the application without broker info. You will receive a license number, but you cannot legally perform real estate activities until you affiliate with an employing broker and activate your status.

What Delays Licenses (Operator Warnings)

Name Mismatch: Ensure your name on your Live Scan matches your DRE application exactly.

Missing Signatures: A single missing signature on a mail-in RE 202 will result in a deficiency letter.

Failed Payments: Always verify your transaction status in eLicensing before closing your browser.

Unreadable Uploads: Avoid blurry phone photos; use a proper scanner for all document uploads to the portal.

Real Scenarios from 20+ Years of Experience

The "Identity Mismatch" Delay: A student passed and mailed their RE 202 using a nickname. The DRE couldn't match the application to the Live Scan results (filed under a legal name), resulting in the application being set aside.

The Fix: Check your Live Scan receipt against your application before hitting "submit."

The "Sponsorship" Wait: A candidate believed they couldn't apply for their license until they were hired. They waited three weeks to even start the paperwork.

The Fix: Submit your license application immediately after passing; you can update your "employing broker" status in minutes once you make a hiring decision.

FAQ

How long after I pass does it take to get my license?

There is no "standard" time, but you can track progress via the DRE Current Timeframes page.

Do I need fingerprints if I already did Live Scan for the exam?

If the DRE already has your fingerprints on file for this application cycle, you typically don’t need to redo them.

What happens if my application is incomplete?

The DRE will notify you of the "deficiency." You will have to correct the error, which essentially puts your application at the back of the processing queue.

Can I work immediately after passing?

No. You must wait until your status shows as "Active" on the DRE Public License Lookup.

Your Next Step

Navigating the final steps of California licensing is about precision. By following this sequence, you reduce the risk of your application sitting on a desk for the wrong reasons.ADHI Schools typically recommends the DRE Exam/License Combo application for speed, but this guide ensures you can reach the finish line regardless of which path you chose.

Ready to ensure your paperwork is perfect?

Explore our California Real Estate License Guide for a complete roadmap.

|

When you begin the journey toward a California real estate license, the fear of choosing the "wrong" school is often the first hurdle. For most applicants, the natural instinct is to search for the most Read more...

When you begin the journey toward a California real estate license, the fear of choosing the "wrong" school is often the first hurdle. For most applicants, the natural instinct is to search for the most popular real estate schools in California.

I guess the logic is simple: if thousands of other students are using a specific program, it must be the “safest path” to passing the state exam.

However, in my 20+ years of helping students navigate the DRE’s 135-hour requirement, I’ve seen that popularity is often a reflection of marketing scale rather than individual student success. While high-volume schools offer certain advantages, "popular" does not always mean "best fit" for your specific learning needs or timeline.

How can I identify the most popular real estate schools?

Since the California DRE does not publicly rank schools by enrollment or pass rates, popularity is best identified through visibility signals like high search volume, large numbers of reviews on third-party platforms, and established partnerships with major brokerage firms. To find the Best Real Estate Schools in California, look past the volume and verify the school's specific support channels, course expiration policies, and the depth of their California-specific exam prep.

What Popularity Actually Signals (and What It Doesn't)

Before you enroll based on a brand name, it is important to distinguish between a school’s size and its effectiveness for your learning style.

What Popularity Signals

What Popularity Does NOT Signal

Broad Accessibility: Stable online platform and mobile app.

Individual Support: May default to automated tickets instead of live help.

Social Proof: Thousands of reviews to gauge user experience.

High Pass Rates: Large enrollment doesn’t guarantee higher exam success.

Familiarity: Frequent content on Instagram or Reddit builds recognition.

Curriculum Depth: National schools may miss California-specific law nuances.

How to Observe Popularity Signals Without a Brand List

Since enrollment data isn't public, you can verify a school’s "popular" status by looking for these three indicators:

Search Visibility: Are they consistently at the top of search results (be careful to look for "Sponsored" labels vs. organic rankings)?

Review Density: Do they have thousands of reviews on platforms like Trustpilot or Google, rather than just a few dozen?

Broker Mentions: Ask a local office manager which school they see most often on incoming certificates.

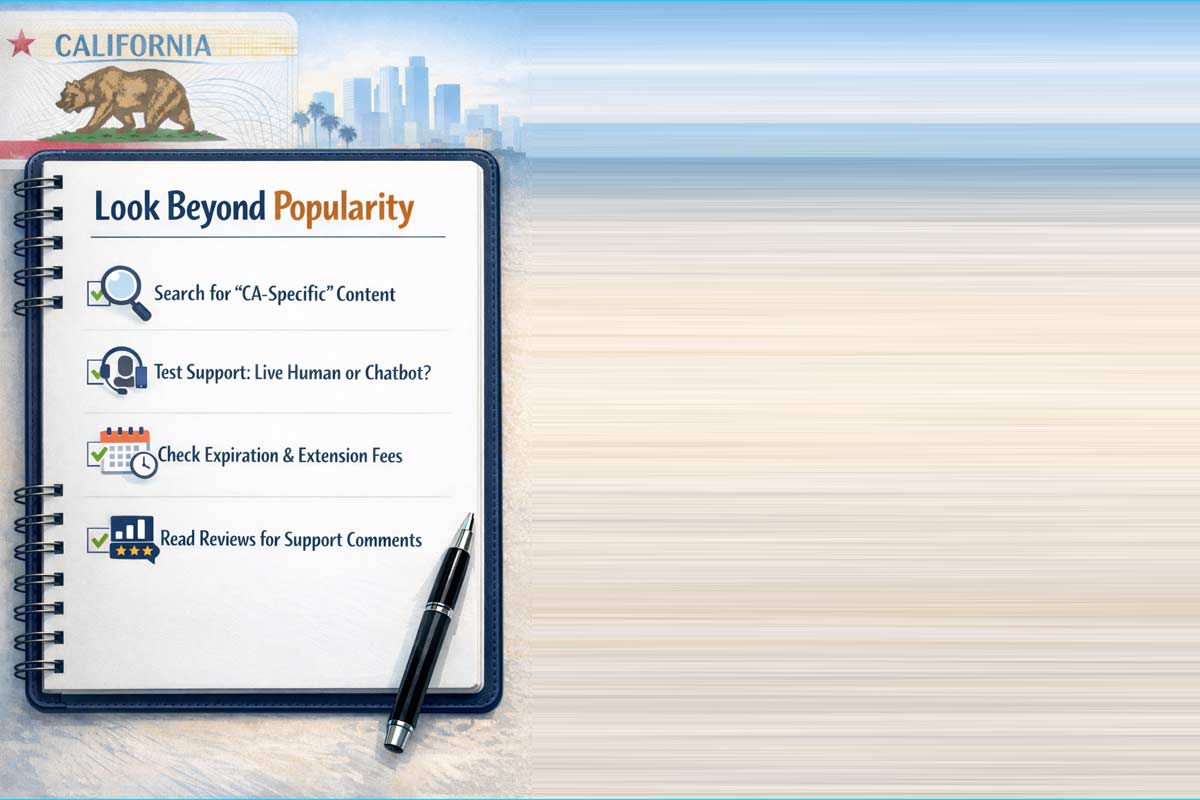

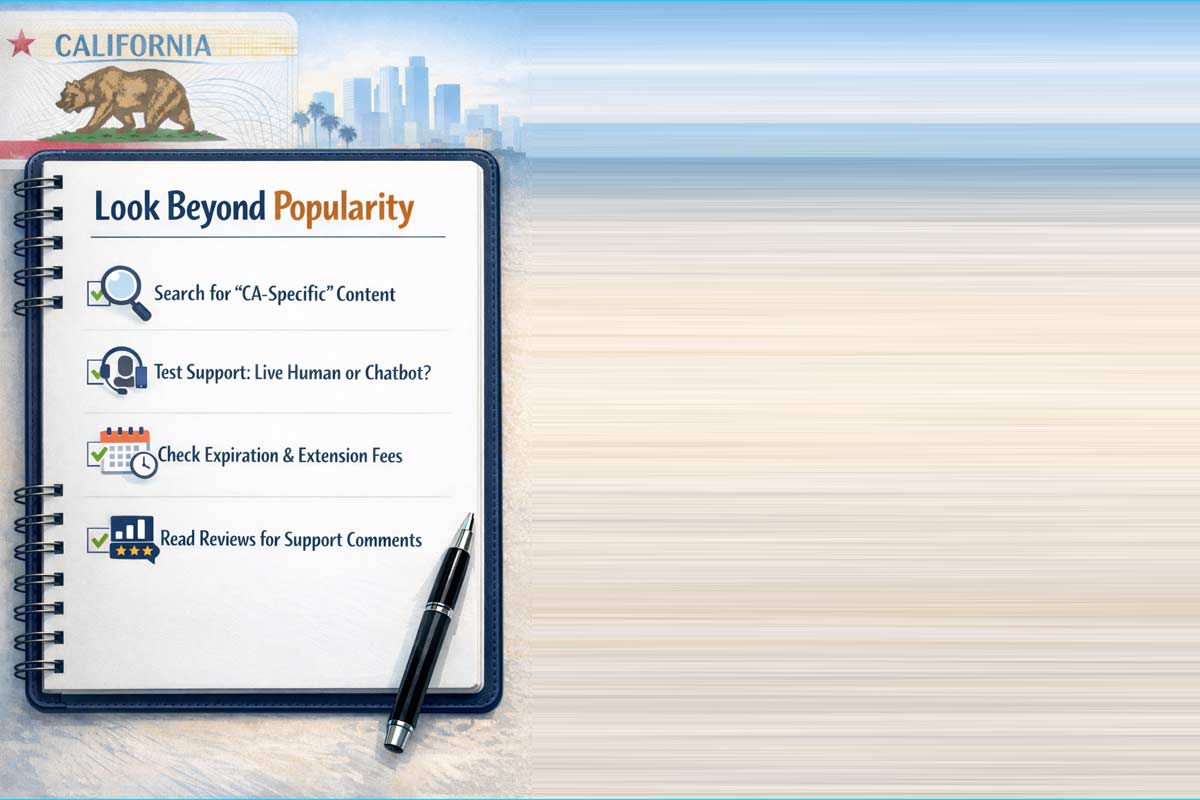

The "Fit Framework": An Operator’s Due Diligence Checklist

Instead of choosing the "biggest" school, use this checklist to verify the artifacts of a quality education. This is the same framework we use to evaluate the Best Real Estate Schools in California.

1. The Support Infrastructure

Don't just look for a "Help" button. Identify the channel :

The Test: Send an email or call the school on a Tuesday morning. Do you get a live human or a chatbot?

Instructor Access: Is there a designated time for live Q&A, or are you limited to searching a knowledge base?

2. Policy-Driven Costs (The "Expiration Trap")

Many popular, low-cost programs have rigid policies that can lead to unexpected fees:

Expiration Windows: Does the course expire in 6 months or 12?

Extension Fees: If you get busy and need another 30 days, is it a $50 fee or do you have to repurchase the entire course?

Retake Policies: If you fail a final school exam, is there a waiting period or an additional charge to retake it?

3. Seat-Time and Access Rules

Module Locking: Does the school force a specific "timer" on every page, or can you move at your own natural reading pace?

Content Freshness: Look for California-specific references. Does the material mention current CA-specific nuances?

Why Students Search for Popular Options

The 135-hour pre-licensing grind is a significant time investment. Students often gravitate toward online real estate schools in California that have high volume because they want to avoid "making a mistake."

This is especially true for those looking for the fastest way to get a real estate license in California. The logic is:"If it's popular, the system must be efficient." While often true for the tech platform, speed without comprehension can lead to multiple failed attempts at the state exam.

Two Paths: Real-World Scenarios

The Autonomous Learner: A student with a high degree of self-discipline chooses a high-volume online program. They don't need help, they never call the school, and they move through the material flawlessly. For them, popularity was a great signal for a stable platform.

The Momentum-Seeker: Another student chooses the same program but hits a point of confusion regarding Trust Fund Handling. They submit a support ticket but don't hear back for 48 hours. That delay causes them to lose momentum, and they eventually miss their 6-month completion window, resulting in a "re-enrollment fee" that makes the cheapest real estate school in California much more expensive in the long run.

Which Path Matches Your Learning Style?

"I need structure and peer interaction": Popularity in the online world doesn't replace the accountability of in-person real estate classes in California.

"I'm tech-focused and self-driven": You may find that the best online real estate schools in California offer the best mobile apps and user interfaces.

"I want the lowest entry price": You can often find the cheapest real estate schools in California among high-volume providers, provided you are confident you won't need extensions.

Common Mistakes When Choosing by Volume

1. Confusing "Top of Search" with "Top of Class"

Heavy advertising is a sign of a healthy marketing budget, not necessarily a superior educational outcome.

2. Overlooking "Generic" Content

Some national brands use "multi-state" materials. Always verify the content focuses on California-specific law and practice.

3. Assuming a "Popular" Prep is Enough

Many high-volume schools are excellent at the 135-hour requirement but provide only basic "practice questions" for the state exam. Real exam prep should include simulated exams and a targeted study plan.

Frequently Asked Questions

How do I know if a popular school is DRE-approved?

You can verify any school by searching the California DRE's searchable database of approved providers. Never enroll until you've confirmed their license status.

Are big national schools better than local California schools?

For this purpose, not really. Local California schools have more direct access to instructors who understand the specific nuances of the state exam and the licensing process in California that is unlike any other state.

Does a "popular" school have better pass rates?

There is no publicly available data to prove this. Pass rates are generally a reflection of the student's dedication and the quality of the school's specific "Exam Prep" product, not the size of the school.

What happens if I start with a popular school and want to switch?

You can usually switch, but your progress doesn’t transfer. You will likely have to restart the specific 45-hour course you were in and pay a new enrollment fee.

Making an Informed Choice

Popularity is a helpful data point, but it shouldn't be your only decision rule. Your goal isn't just to enroll—it's to get licensed.

If you’re ready to see how the top programs in the state stack up based on actual quality, support, and student outcomes, visit our main decision hub: Best Real Estate Schools in California.

|

Key Takeaways:

DRE Approval is the Standard: If a provider is not approved by the California Department of Real Estate (DRE), your coursework will not be accepted for the state exam.

Verify Both Read more...

Key Takeaways:

DRE Approval is the Standard: If a provider is not approved by the California Department of Real Estate (DRE), your coursework will not be accepted for the state exam.

Verify Both Sponsor and Course: A school must have an active sponsor ID, and the specific course you take must be listed as an approved statutory offering. This typically starts with the letter “S”. ADHI Schools is S0348, for example.

Check the Payment Source: The company you pay should match the name on the official DRE listing to avoid lead-generation traps.

The “Cost of Getting Fooled”

For most California real estate license hopefuls, the goal is simple: get licensed as quickly and efficiently as possible. However, in the rush to start a new career, students can fall into the trap of enrolling in programs that lack the proper state-mandated credentials.

The "cost" of choosing a non-DRE-approved provider isn't just the registration fee—it's the weeks, or even months, of wasted time and the frustration of having your state application delayed or rejected if the certificates don’t qualify. In my 20+ years of helping California students navigate licensing requirements, I have seen far too many people forced to start from scratch because they missed one simple verification step.

How do I avoid non-DRE-approved real estate schools in California?

To avoid unapproved schools, verify the provider’s 4-digit DRE sponsor ID and specific course listing on the official DRE Statutory Course Search Page. Ensure the course titles match the DRE’s list of approved statutory courses (Principles, Practice, and an elective). Avoid any provider that uses vague terms like "state-aligned" without providing a specific DRE sponsor number.

Define the Real Risk (Without Speculation)

It is important to distinguish between a program that is "legal" and one that is "DRE-approved" for pre-licensing credit. For example, a general real estate investing course can be legitimate education, but it won’t satisfy the DRE’s statutory pre-licensing requirements.

Marketing vs. Approval

A company may have a professional website and high-production videos, but unless they are a DRE-approved statutory course provider, they cannot issue the certificates you need. In California, what matters is whether the sponsor and the specific statutory course are listed as DRE-approved. Once you confirm a provider is approved, online reviews for real estate schools become the next tool for judging actual support quality and course usability.

Exam Prep vs. Pre-licensing Credit

"Exam Prep" consists of practice questions designed to help you pass the test. "Pre-licensing" consists of the 135 hours of mandated education. If you just purchase a "Crash Course" thinking it satisfies the 135-hour requirement, your application may be rejected or delayed by the DRE.

The 5-Step Verification Checklist

Here’s the exact 5-step workflow I recommend students run before paying:

Verify the Sponsor and Course Listing: Use the official DRE Statutory Course Lookup. Search by the school name or Sponsor ID and ensure the specific course you are buying appears in their approved list.

What to screenshot/save: The Sponsor ID, the specific Course Title, the Course Category (Principles/Practice/Elective), and a screenshot of the DRE listing page.

Confirm the Course Category: Ensure the school offers the "Big Three": Real Estate Principles, Real Estate Practice, and a DRE-approved elective. Using a guide on how to know if a real estate school is legit in California can help you cross-reference these requirements.

Check for Pacing Requirements: DRE-approved programs enforce minimum completion-time requirements. If a provider promises you can finish all three courses in a single weekend, treat it as a major warning sign and verify their approval status in writing.

Review Expiration Policies: Does the course expire in 6 months? 12? Reputable providers typically publish clear terms regarding course access and extensions. You can find more on this in our guide on Red Flags When Choosing a Real Estate School.

Test the Support System: Call the school or use their live chat. Ask them to email you their DRE Sponsor ID and confirm the exact course title you are buying matches the DRE listing. If they cannot provide this in writing, it is difficult to verify their legitimacy.

Common Risk Signals & Misleading Patterns

You don’t need to guess if a school is legitimate. Look for these evidence-based patterns that often indicate a program may not be authorized to provide credit:

Vague Regulatory Language: Watch out for phrases like "Accepted nationwide" or "Curriculum based on California standards." Verification should always come from the DRE database, not marketing copy.

Missing Transparency: Reputable providers typically publish clear refund policies, identity verification procedures, and physical contact information. If these are missing, treat the provider as not verified.

The Payment Test: Make sure the company collecting your payment is the same sponsor shown on the DRE listing. Some websites are prep-only or lead-generation pages that can be mistaken for course providers.

What to Do If You Already Paid or Started

If you suspect your school might not be approved, take these practical steps:

Verify Immediately: Stop your studies and check the DRE database using the direct link provided above.

Request Identifiers: Email the school and ask for their DRE Sponsor ID and the exact approved course titles as they appear on the DRE website.

Evaluate the Trade-off: Sometimes it is better to pivot early than to finish a course only to have your application rejected. Understanding why DRE accreditation matters more than online reviews can help you realize that a non-approved course is actually the most expensive option because it provides no legal value.

FAQ

How do I check if a real estate school is DRE-approved in California?

Visit the official DRE Statutory Course Lookup and search by the school’s name or 4-digit Sponsor ID.

Are there lookalike real estate schools online?

Yes. Some websites are prep-only or lead-generation pages that can be mistaken for course providers.

Does ‘exam prep’ count for DRE credit?

No. Real estate exam prep is a study tool. You must still complete 135 hours of statutory education from an approved provider.

If a school is popular, does that mean it’s approved?

Not necessarily. Marketing reach does not equal approval. Always verify the DRE Sponsor ID before enrolling.

Do reviews matter if a school is approved?

Yes. Approval proves the school is legal; reviews prove the school is effective. Use both to make your decision.

What matters more: reviews or accreditation?

Accreditation (DRE Approval) is the "pass/fail" gate. Without it, reviews are irrelevant because the school cannot help you qualify for the exam.

Choosing the Right Path

Confirming that a school is legitimate is just the first step. Once you’ve filtered out non-approved providers, your goal shifts to finding a program that fits your learning style, timeline, and support needs.

DRE approval is the baseline—but the quality of instructors and the depth of materials are what determine your success on exam day. To see how the top-tier providers compare once you've done your due diligence, view our full breakdown of the Best Real Estate Schools in California.

|

Choosing a real estate school can feel like a high-stakes decision because in some ways it is. You are investing your time, money, and career aspirations into a regulated process.

Naturally, most Read more...

Choosing a real estate school can feel like a high-stakes decision because in some ways it is. You are investing your time, money, and career aspirations into a regulated process.

Naturally, most students turn to the digital "safety net": online reviews.

Reviews feel like certainty in an uncertain process. However, in professional licensing, a high star rating doesn't always translate to a smooth path to a license. Understanding how to weigh student feedback against regulatory facts is the difference between starting your career on time or getting stuck in a cycle of hidden fees and technical hurdles.

How important are reviews when choosing a real estate school?

Online reviews are a valuable secondary tool for evaluating student support and platform usability, but they should never be your primary filter. Reviews help you predict the student experience; DRE legitimacy predicts whether your effort produces a certificate accepted by the state. Always verify a school’s DRE approval and specific provider policies before relying on a star rating.

The Right Way to Use Reviews: "Triangulation"

In over 20 years of helping California students, I’ve seen a recurring pattern: students choose a school based on a high star rating, only to realize the "support" mentioned in ratings doesn't exist when they actually need help.

Instead of looking at reviews first, use a triangulation method:

Legitimacy First: Verify the school is currently on the DRE’s approved provider list. (Always verify directly on the DRE website, not from a third-party review profile.)

Fit Second: Ensure the format (live vs. online) matches your learning style.

Verification Third: Check the school’s specific terms regarding refunds, extensions, and certificate delivery—ask about typical turnaround times for certificates.

Reviews Last: Use student feedback to look for patterns that confirm or contradict the first three steps.

Before you trust a star rating, it is essential to understand how to know if a real estate school is legit in California.

High-Signal Categories: What to Actually Look For

When scanning student feedback, look for "Signal" reviews that mention specific operational details:

Support Responsiveness

Look for mentions of problem resolution, not just friendliness. Does the reviewer mention how long it took to get a response? You will have questions about certificates or exam applications; you need a school that provides more than just automated "ticket loops."

Provider Pacing Restrictions

Provider pacing restrictions are platform rules that limit how quickly you can progress—even if you are ready—such as cooldown periods, minimum intervals between module exams, or capped progress. Look for reviews that mention being "stuck" or unable to progress at a natural speed due to these platform-imposed caps.

Certificate Issuance and Turnaround

You cannot apply for the state exam without your completion certificates. Feedback mentioning delays in certificate processing is a high-signal warning of administrative friction that could delay your career by weeks.

Platform Reliability and Content Freshness

Look for mentions of whether the material feels current. This is one of the red flags when choosing a real estate school that impacts your actual learning.

Where Reviews Mislead: The "Expectation Gap"

Online feedback often contains "noise" that can lead you toward a poor decision.

The Exam Prep Mismatch: A student might hit a school with a negative review because they struggled with the state exam. It is vital to remember that pre-licensing education is not necessarily the same as exam readiness. A pre-licensing course fulfills legal education requirements; exam readiness depends on how you study and retain information under timed conditions.

The "Price Emotion" Trap: Low-cost providers often have high review volumes because people feel they "got a deal." However, "cheap" often comes with hidden costs like $50 extension fees or non-existent support.

The Campaign Effect: If you notice a sudden burst of reviews, treat it as a data point to investigate rather than assuming manipulation. Bursts can happen for innocent reasons—such as a new platform launch or a graduation cycle—so look for specifics in those ratings to see if they align with your needs.

The "3 Filters" for Evaluating Student Feedback

To find the truth in the comments section, apply these three filters:

Specificity: Does the review mention a specific process (e.g., "The refund took 3 days" or "The instructor answered my question about Disclosure laws")?

Recency: Is the feedback from the last 90–180 days? Real estate platforms and support teams change frequently.

Repetition: Is the same issue—such as a specific technical bug or a delay in certificates—mentioned by multiple unrelated reviewers?

Using these filters helps you avoid fake or unaccredited CA real estate schools that may use volume to mask poor service.

The Hierarchy: DRE Approval Outranks Popularity

In California, you are buying a certificate of completion that the DRE must accept. If a school has 10,000 five-star reviews but their provider identity is unclear or they aren't on the DRE’s current list, those reviews are irrelevant to your licensing outcome.

This is why DRE accreditation matters more than online reviews. You are managing "license risk"—the risk that your time and money won't result in a license. A legitimate school will always prioritize DRE compliance over appearing popular. For a deeper dive, see our guide on why DRE accreditation matters more than online reviews.

Checklist: How to Read Reviews Fast

Sort by "Most Recent": Is the platform and support currently functional?

Search Within Reviews: Use "Find" to search for keywords like refund, extension, support, phone, and certificate.

Verify the Provider: Ensure the school name on the review site matches the name on the DRE’s approved provider list.

Identify Throttles: Do students complain about being unable to finish the course due to "forced wait times" or pacing caps?

Check for CA Relevance: Ensure the reviewers are taking the California-specific curriculum.

Frequently Asked Questions

Are online reviews reliable for choosing a real estate school in California?

Reviews are reliable for gauging student support and platform usability, but they do not guarantee a school's legitimacy. Always use them as secondary evidence alongside a DRE approval check.

What matters more: online reviews or DRE approval?

DRE approval is non-negotiable. Without it, your certificates are not valid for licensing. Reviews only tell you how pleasant (or difficult) the process of obtaining those certificates might be.

How can I spot “provider pacing restrictions” in reviews?

Look for complaints about "wait times," "cooldowns," or being "locked out" of the next chapter. These reviews indicate the school has platform-imposed limits on how quickly you can study.

Do negative reviews mean a real estate school is bad?

Not necessarily. Many negative reviews stem from an "expectation gap" where students confuse pre-license education with state exam prep. Focus on reviews that mention technical failures or poor support.

Making a Grounded Decision

Reviews are a tool, but they aren't the blueprint. Your goal is to find a school that is transparent about its policies, responsive to your needs, and strictly compliant with California law.

Want a step-by-step framework to choose your school confidently?

Use the full evaluation system here: Best Real Estate Schools in California

|

Choosing a real estate school in California is the first major "business decision" you will make. It’s also the first time you’ll encounter the noise of the internet in the real estate world. If you Read more...

Choosing a real estate school in California is the first major "business decision" you will make. It’s also the first time you’ll encounter the noise of the internet in the real estate world. If you spend five minutes looking for student reviews of online real estate schools in California, you will find two extremes: glowing 5-star testimonials that sound like marketing copy, and 1-star "rage reviews" from students who felt abandoned by a computer screen.

In over 20 years of helping thousands of Californians through this process, I’ve noticed a consistent pattern: a school’s 'user experience' and its 'educational results' aren't always the same thing.

The truth?

Reviews are a tool, but only if you know how to read between the lines. Here is how to filter the noise and find a school that actually gets you licensed.

Quick Take: The 2026 Review Filter

Look for Outcomes, Not Ease: A "fast and easy" course often leads to a "difficult and repeated" state exam.

Check the Date: California DRE regulations and exam topics shift; reviews older than 12-18 months are less relevant.

Identify the Support Model: "Great support" should mean access to human experts, not just a technical help desk.

The Goal is the License: Prioritize reviews that mention "passing the state exam" over those that only mention "finishing the hours."

What Students Most Commonly Praise (and what it actually indicates)

When you see a 5-star review, you need to determine if the student is praising the convenience or the effectiveness.

“The platform was so simple and fast.”

In 2026, user experience matters, but "simple" can be a double-edged sword. If a platform is too simple, it may be because it lacks the depth required to pass a high-stakes exam. Students often praise a school for letting them click through quickly, but this rarely translates to retention. This is why many online real estate school reviews in California overemphasize convenience while underreporting exam outcomes. How long students should expect real estate school to take depends on the quality of the material, not just the speed of the software.

“Great support whenever I had a question.”

You must define what "support" means in these reviews. Does it mean a live person answered a question about contract law, or does it mean someone helped them reset their password? Real support—the kind that actually gets you licensed—is about how you learn, not just how the website works. Look for reviews that mention instructors who clarify complex topics like encumbrances or agency disclosure.

“The practice questions were just like the exam.”

This is the gold standard of praise. If multiple reviewers mention that the school's preparation tools mirrored the actual California State Exam environment, that is a high-value signal. It suggests the school prioritizes exam readiness over course completion.

While the exact exam questions are never public, a great program prepares you for the logic behind them. This ensures that no matter how a question is framed, you have the knowledge to answer it correctly.

What Students Most Commonly Complain About

Negative reviews are often more revealing than positive ones, but they require a "root cause" analysis.

“No one would help me / I felt like a number.”

The Root Cause: Many online schools are "set it and forget it" models. They provide the PDFs but no bridge to a human being.

How to Verify: Before enrolling, call the school. If you can’t get a human on the phone during business hours now, you won't get one when you’re stuck on Chapter 7 later.

“The materials felt outdated.”

The Root Cause: The California real estate market and laws change. A school using a curriculum from ten years ago is doing you a disservice.

How to Verify: Check if the school mentions 2026 updates or current DRE standards.

Do online real estate classes actually prepare you?

Only if the content reflects the current exam pool.

“I fell behind and lost my motivation.”

The Root Cause: Purely self-paced courses require 100% of the discipline to come from the student. Repeated complaints like this point to a system problem, not a character flaw.

The Reality: This isn't always the school's "fault," but it indicates a lack of an accountability framework. If you see this often, it means the school provides the "what" but not the "how" of staying engaged.

The Review Pattern Test: Your 3-Minute Audit

Don't read every review. Apply this framework to the top 20 reviews you find for any California real estate school.

Rule

What to Look For

The Specificity Rule

Does the reviewer mention a specific chapter, instructor, or "lightbulb moment"? (High Value)

The Recency Rule

Is the review from 2025 or 2026? Tech and DRE rules move fast. (High Value)

The Outcome Rule

Does it say "I passed the state exam"? That is the only metric that matters. (Highest Value)

The Support Signal Rule

Do multiple reviews mention access to instructors or real humans beyond tech support? (Trust Signal)

The 1-Star Filter

Is the reviewer mad about a refund policy they didn't read, or a fundamental lack of teaching? (Context is Key)

Student Checklist for Review Auditing:

Did the reviewer pass on the first or second attempt?

Does the school offer physical textbooks (often a sign of a more serious program)?

Are there mentions of "live" components or webinars?

Does the "clunkiness" mentioned in reviews affect the learning or just the aesthetics?

What Reviews Can’t Tell You (The "Hidden" Factors)

Even the best online real estate school reviews in California have blind spots. There are things you must verify directly with the school:

DRE Compliance: Is the school currently approved for the specific courses you need? Check the DRE website directly.

Repetition Logic: Does the system force you to review what you got wrong, or does it just let you move on?

Your Study Environment: A 5-star school won't help you if you’re studying on a phone in a noisy coffee shop. The optimal study setup for real estate school is as important as the curriculum itself.

Holding Periods: California law requires a minimum of 18 days per course. This is one reason timelines in reviews often conflict with reality. Some reviews complain about "delays" that are actually legal requirements the student didn't understand.

Decision Matrix: Which School Type Fits You?

Based on common student feedback, here is how to choose your path:

The "Busy Professional": Look for reviews mentioning mobile-friendly formats but high-quality physical books for weekend deep-dives.

The "Anxious Test-Taker": Prioritize schools with "heavy" practice question banks and live exam-prep crash courses.

The "Discipline Challenged": Avoid "pure" self-paced schools. Look for reviews that mention how to stay motivated during real estate school through instructor check-ins or structured schedules.

Reviews are Input, Not the Decision

In my experience, the students who succeed are those who treat their education like a job interview. They don't just look for the cheapest or "easiest" option. They look for a partner that provides the structure they lack and the expertise they need.

Reviews tell you about the experiences of others, but they don't guarantee your outcome. Your success depends on your ability to find a school that balances modern convenience with old-fashioned academic rigor.

To see how we categorize the different types of programs available today, view our complete guide on the Best Real Estate Schools in California.

|

You’ve passed the real estate exam, joined a brokerage, and ordered your business cards. Now comes the most pressing question every new California agent faces:

"Where do I get my first lead?"

The Read more...

You’ve passed the real estate exam, joined a brokerage, and ordered your business cards. Now comes the most pressing question every new California agent faces:

"Where do I get my first lead?"

The industry is flooded with marketing noise and subscription platforms promising instant closings. But after 20 years in the California real estate business, I’ve seen thousands of agents burn through their savings chasing the wrong leads.

The truth is that lead sources are far less important than your lead-to-relationship conversion and your consistency.

A lead isn't a commission check; it’s an introduction. California markets are fragmented—what works in Riverside won't always work in West LA.

To start a real estate career in California that actually lasts, you need a system, not just a tactic.

Key Takeaways

Trust over Tech: Your Sphere of Influence (SOI) remains the highest-converting lead source.

Sweat Equity: Open houses are the fastest way to meet "now" buyers without an upfront budget.

Speed Wins: The agent who follows up same-day—often within minutes—usually wins the client. This is often called “speed-to-lead”.

Local Authority: Consistency in a small "micro-farm" beats sporadic efforts across a whole city.

Ranked: The Best Lead Sources for New Agents

Note: "Skill Level" refers to your conversion and communication skill, not your personality type.

Lead Source

Cost

Time-to-Result

Skill Level

Best For...

Sphere of Influence (SOI)

Free

Days/Weeks

Low

Immediate trust & referrals

Open Houses

Free/Low

Days/Weeks

Medium

Meeting unrepresented buyers fast

Open House Follow-Up

Free

Days/Weeks

Medium

Turning “tourists” into clients

Database + CRM Follow-Up

Free/Low

Weeks

Medium

Staying top-of-mind consistently

Local Partner Referrals

Low

Weeks/Months

Medium

Warm intros from lenders/escrow

Agent-to-Agent Referrals

Low

Weeks/Months

Medium

Relocation + overflow clients

Community Networking

Low

Weeks/Months

Medium

Trust-building (schools, chambers)

Micro-Farming (100–300 homes)

Medium

Months

High

Long-term local dominance

Rentals / Landlords

Low

Weeks/Months

Medium

Leads that become buyers later

FSBO / Expireds

Low

Weeks

High

High-volume conversations

Online Inbound Basics

Low/Medium

Months

Medium

Compounding flow (reviews)

Paid Leads (Optional)

High

Days/Weeks

High

Agents with a break-even mindset

The Core Strategy: Where to Start

1. Your Sphere of Influence (SOI)

Your SOI includes friends, family, and past coworkers. These are people who already want you to succeed.

Why it works: Trust is pre-built. You aren't "selling"; you're informing.

Scenario: Instead of a sales pitch, try: "I'm not calling to sell you anything—I just wanted to let you know I'm officially with [Brokerage]. If you ever have a quick question about what's happening in our neighborhood, I'm happy to be your resource."

Do this this week: Call 5 people a day. Update their contact info in your CRM.

2. Open Houses as a Lead Engine

Don't just "sit" in a house. Use it as a platform. Learning how new agents should hold open houses effectively can transform a boring Saturday into three new buyer representation agreements.

Why it works: You meet active buyers in a specific zip code.

Scenario: When a visitor walks in: "Thanks for coming by. Most people I meet here are either neighbors or looking to move in the next 90 days—which one are you?"

Do this this week: Ask a top producer in your office to host their listing open this weekend.

3. Building Your Database

Every person you meet belongs in a CRM. You must build a real estate database from scratch to automate your "top of mind" awareness.

A Simple Follow-Up Cadence

Day 0: Quick text + “What stood out to you at the house?”

Day 1: Phone call (short, human).

Day 3: Value add (neighborhood note or listing link).

Day 7: Call + clarify timeline.

Month 2+: Monthly market update + personal check-in.

Expanding Your Reach

Local Partner & Agent Referrals

Lenders, escrow officers, and out-of-area agents are massive referral sources.

Why it works: These are professional, warm introductions.

#1 Rookie Mistake: Asking for leads before offering any value.

Do this this week: Invite a local lender to coffee to learn about their specific programs.

Community Networking & Micro-Farming

Become the "Digital Mayor" of a small area. Focus on 100–300 homes (a micro-farm) or your local PTA/Chamber.

Why it works: It builds "omnipresence" in a small, manageable pond.

Do this this week: Draft a simple, one-page market update for your specific neighborhood.

Online Inbound & Rentals

Claim your Google Business Profile and gather reviews immediately. Additionally, don't ignore renters; in California, today’s tenant is often next year’s first-time buyer.

FSBO / Expireds

Why it works: These are people with high "intent to sell."

Compliance Reminder: Strictly follow the National Do Not Call (DNC) Registry, respect all opt-outs, and follow your brokerage’s specific outreach policies.

What to Avoid: The "New Agent Traps"

Paid Leads: The "High Tuition" Trap

Paid leads aren't evil—they're just expensive if you aren't ready. If you can't respond in under 5 minutes and don't have a conversion system, paid leads are just a donation to a tech company.

Small Commercial (The "Lite" Path)

You don’t need to be a commercial specialist on day one. Start commercial-lite: small retail/office leases and local owner conversations. Partner with a senior agent when complexity rises. Done right, it builds a professional reputation that feeds your residential business.

The 30-Day Lead Generation Operating System

Success requires strict new agent time management strategies.

Week 1: Set up CRM. Call everyone in your phone. Schedule two open houses.

Week 2: Execute follow-up cadence (Day 0–7). Meet one local partner.

Week 3: Start your 100-home micro-farm. Drop off a market report.

Week 4: Evaluate metrics. How many conversations did you actually have?

Weekly Scorecard

Contacts added to CRM: ________

Real estate conversations: ________

Speed-to-lead (Avg minutes): ________

Follow-up attempts: ________

Appointments set: ________

FAQ

What is the best lead source for new California real estate agents?

Your sphere of influence (SOI) is the highest-converting starting point because trust is built-in. Pair it with open houses for faster “now buyer” conversations.

Are open houses a good way to get clients in California?

Yes—they are one of the fastest ways to meet unrepresented buyers. The key is capturing contact info and running a same-day follow-up plan.

How quickly should I follow up with a new lead?

Same day—ideally within minutes. In California’s fast-paced market, the first agent to provide value and set the next step usually wins the client.

Can I get real estate leads for free?

Yes. SOI outreach, open houses, and partner relationships produce leads with $0 in ad spend; your main cost is time and consistency.

How many follow-ups does it take to convert a lead?

Many leads convert after 5–12 touches over weeks or months. Most new agents fail by stopping after the second attempt.

Are paid leads worth it?

Only if you have a proven conversion system and understand break-even math. Without these, they are "expensive tuition."

Is cold calling illegal in California?

It is not automatically illegal, but it is heavily regulated. You must follow the National DNC Registry, honor opt-outs, and follow brokerage policy.

Should I focus on buyers or sellers first?

Buyers are often easier to find early through open houses. Sellers usually require the trust and proof you build through consistent activity.

Can new agents get commercial leads?

Yes, via "commercial-lite" paths like small leases. Keep expectations realistic and how to find your first 3 clients as a new agent often involves starting with these accessible opportunities.

Build Your Career Foundation

Lead generation is the heartbeat of your business, but it only works if you have the competence to back it up. Focus on building a career system rather than chasing the tactic of the month. Remain consistent, lead with value, and treat every contact like a long-term relationship.

|

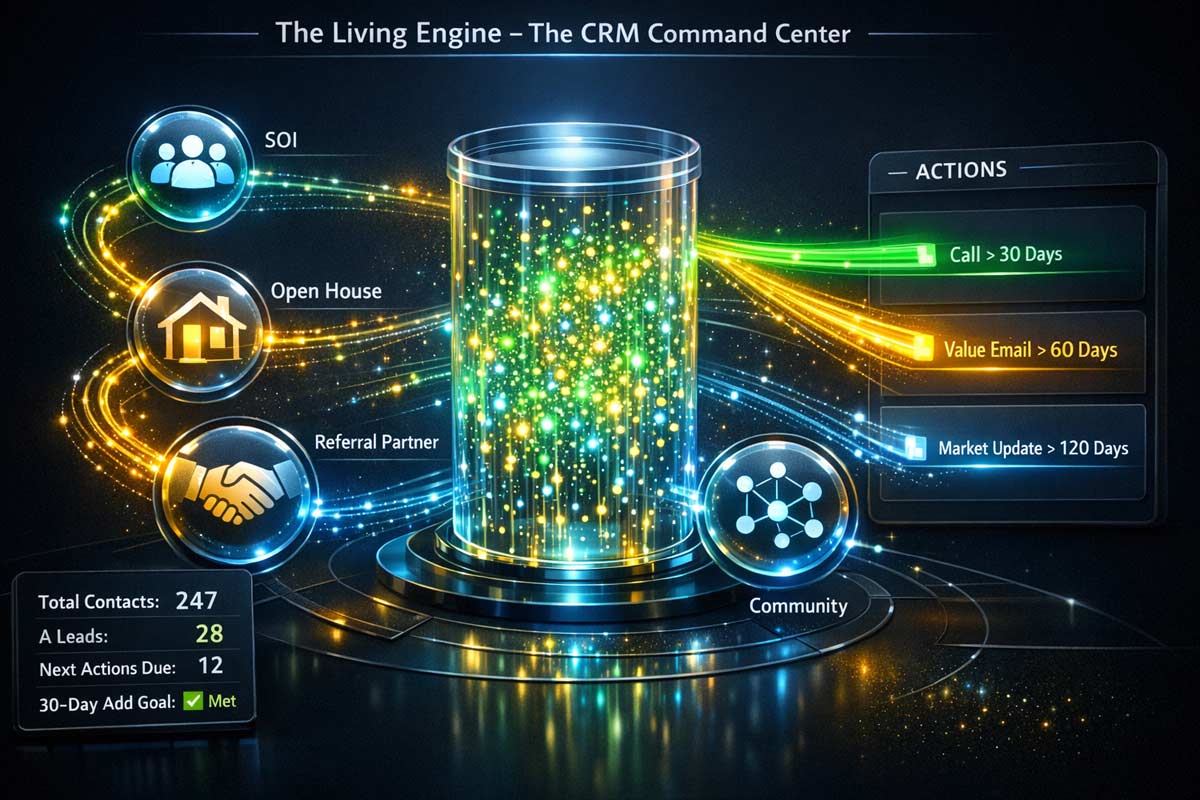

You’ve passed the real estate exam, your license is issued, and you’ve chosen a broker. Then, Monday morning hits. You sit at your desk, and the "post-license cliff" sets in: your calendar is empty, Read more...

You’ve passed the real estate exam, your license is issued, and you’ve chosen a broker. Then, Monday morning hits. You sit at your desk, and the "post-license cliff" sets in: your calendar is empty, and your phone isn't ringing.

The temptation for most new California agents is to reach for a credit card and buy leads. Every real estate office has that guest speaker pitching a magical "lead-gen tool" for $199 a month.

That is a short-term fix for a long-term problem.

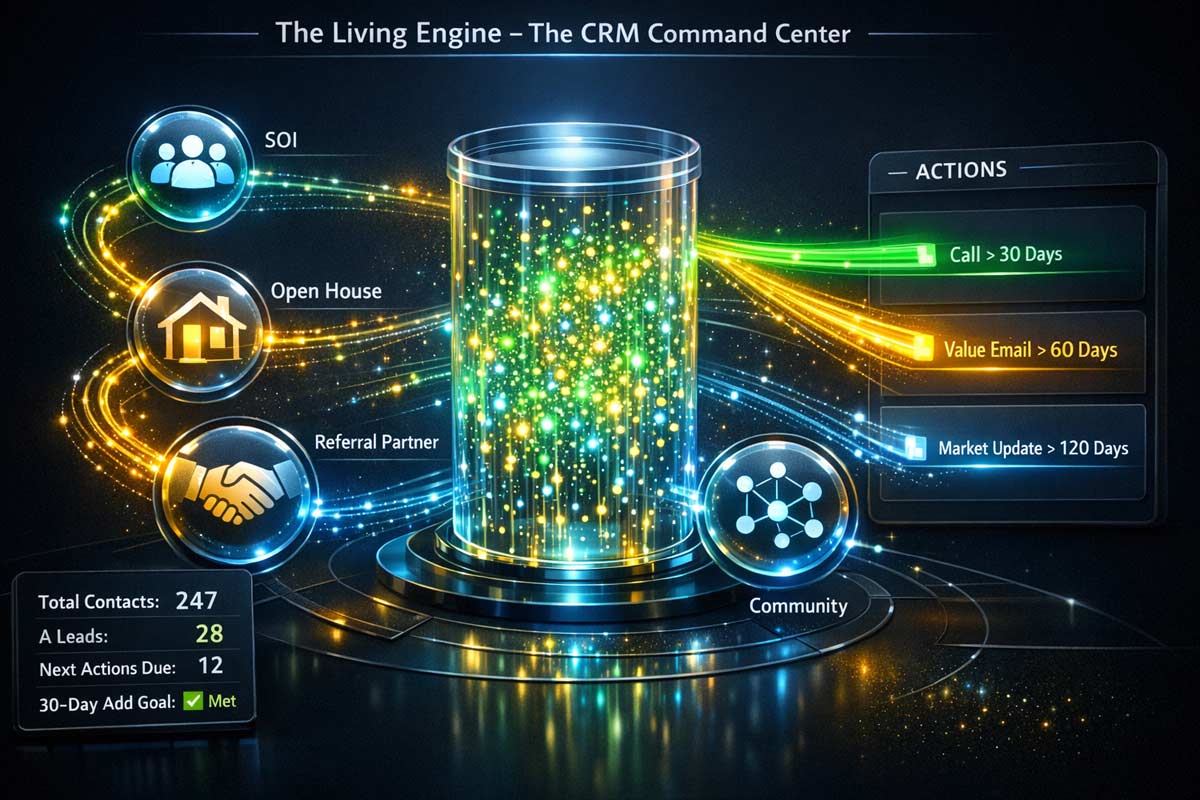

In our industry, your database is your business. It is the only asset you truly own. One clean database can produce repeat clients for 10 years; one lead-buy produces, at best, a one-time conversation.

A database doesn’t magically create deals—it creates conversations, and conversations create appointments.

A "from scratch" database isn't about empty contacts—it's about missing the system for consistent, targeted follow-up.

By the end of this guide, you will have a clear, 30-day roadmap to move from zero contacts to a professional follow-up system that produces consistent commissions.

Real Estate Database Essentials

A database is not just a list of names or an exported CSV file from your phone. A database is a list with memory. It records context (notes) and creates the next action (follow-up date).

What Should You Track in a Real Estate Database?

To turn a contact list into a revenue-generating database, you need specific data points. If you don't know what columns to make in your spreadsheet, copy this exact template:

Full Name: Identify clearly (e.g., Maria Lopez)

Phone & Email: Ensure reliable contact info

Preferred Contact Method: Respect communication style (Text, Call, Email)

City/Neighborhood: Crucial for hyper-local California markets

School District/Commute Corridor: The “why” behind their location

Relationship Status: How do you know them? (Sphere, Open House, Referral)

Source: Lead origin (Referral, Social, Vendor)

Tags/Categories: A/B/C ranking, Buyer, Seller

Last Contact Date: Track cadence

Next Follow-Up Date: Ensure action is scheduled

Notes: Kids’ names, pets, hobbies, real estate goals

Your First Database Rule: One Contact = One Next Action

If someone is worth saving, they’re worth scheduling. Every new entry in your system must have either:

A next follow-up date, OR

A "Do Not Contact" note.

There is no third option. Why: if it isn’t scheduled, it won’t happen.

Choose Your Tool (Without Overcomplicating)

Do not get stuck "tool shopping." You can lose weeks comparing software features while making zero phone calls.

Choose a system based on your current volume:

Google Sheets (0–100 Contacts): The fastest way to start. Google Sheets is free, searchable, and forces you to learn the mechanics of data entry.

Basic/Free CRM (100–300 Contacts): Many brokerages provide a CRM included when you join (like BoldTrail (formerly KV Core) or Chime). Use what you already have before paying for a third-party tool.

Full CRM (300+ Contacts): Only invest in premium platforms once you have a consistent lead flow and need advanced automation.

The Rule: If you have under 100 contacts, start with a spreadsheet. If you spend more than two days "researching" CRMs, you are procrastinating. Pick one and execute.

The 8 Best Places to Get Your First 100 Contacts

You aren't starting from zero; you’re starting from "unorganized." Here is where to find your first 100 entries:

Phone Contacts: Export your contact list. Don’t “clean first.” Import them, then add 25 per day for four days. Momentum beats perfection.

Past Coworkers: Start with 10 you’d confidently ask for advice. You were a professional before you were an agent; these people already trust your work ethic.

The Gym/School/Hobby Circle: Anyone you see at least once a month belongs in the database.

Vendors: Your lender, escrow officer, and local contractors. Tag these as “Vendors” to build a referral exchange.

Open House Sign-ins: This is your primary engine. Rule: If they sign in, they go into your database before you leave the property—while the conversation is still fresh enough to write real notes. Learn how new agents should hold open houses to maximize this capture.

Social DMs: Look at who “likes” your posts. Message them: “Hey [Name], I’m updating my professional directory—what’s the best email to send my local market reports to?”

Community Groups: Local neighborhood associations or Facebook groups (be the helper, not the solicitor).

Out-of-Area Agents: Tag them as “Referral Partners.” A small group of active agents outside your zip code can become your most consistent referral pipeline.

Clean Data Beats Big Data (Hygiene)

Before you chase "more contacts," fix the basics. A messy database is a useless database.

Standardize Names: "Mike Smith," not "Mike S." or "Dad's Friend."

One Primary Contact: Identify one main phone number and email per person.

Merge Duplicates: Do not have three entries for the same person.

Add "Source": Always know where a lead came from so you can track ROI later.

Fix Bouncebacks: If an email bounces or a number is wrong, update it the same day.

The "DNC" Tag: Create a "Do Not Contact" tag so you don’t burn relationships by calling people who asked you to stop.

Tagging & Segmentation: The Power of "A-B-C"

If you treat everyone in your database the same, you will burn out. You must segment your contacts so you know who to call first.

The Starter Tag Framework

Tag Category

Examples

Purpose

Ranking

A (Referral source), B (Met once), C (Cold)

Prioritizes your daily call list.

Timeline

Hot (0–3 mo), Warm (3–12 mo), Long-term

Focuses your energy on immediate deals.

Type

Buyer, Seller, Investor, Vendor, Referral Partner

Determines what kind of content you send.

Source

Open House, Sphere, Referral

Tracks which lead sources for new California agents are working.

The Follow-Up Operating System

Building the list is only 20% of the work. The remaining 80% is the follow-up.

Successful agents use new agent time management strategies to ensure they aren't just "busy," but productive.

Follow-Up Cadence

"A" Leads (Referral Sources): Contact every 30 days.

"B" Leads (Met Once/Acquaintances): Contact every 60–90 days.

"C" Leads (Cold/Distant): Contact every 120–180 days (about twice a year) with broad value.

Value-Based Scripts

The "Permission" Text (Low Pressure, High Reply):

"Hey [Name]—quick question. Would it be helpful if I kept you posted when something notable happens in [Neighborhood] (sales, price changes, anything meaningful)? If yes, what’s the best email for you?"

The "Market Micro-Update" (Email/Text):

"Hey [Name], I saw that a house just like yours around the corner sold for [Price]. It's interesting to see how [City] is holding up right now. Let me know if you’d ever like a quick look at your current home value!"

The "Direct Ask" (Voice):

"I'm taking on a couple more clients this month. Who do you know that’s mentioned moving, upsizing, downsizing, or investing—even if it’s ‘later this year’?"

30-Day Build Plan

Follow this checklist to go from a blank screen to a functioning business engine.

The 30-Day Database Blueprint

Week 1: The Foundation. Create your spreadsheet using the template fields above. Import phone contacts. Apply "A, B, C" rankings to the first 50 people.

Week 2: The Reach Out. Add 25 more names. Send the "Permission" text script to everyone tagged "A" or "B."

Week 3: The Expansion. Log all responses. Call those who replied. Research how to find your first 3 clients as a new agent to convert these conversations into appointments.

Week 4: The Routine. Establish a "Minimum Daily Action": Add 5 new people, contact 5 existing people, and log 5 sets of notes.

Common Mistakes That Kill Databases

Over the last 20+ years, Kartik Subramaniam has seen thousands of students launch their careers.

The ones who fail usually hit these eight pitfalls:

Waiting until you "feel ready" to start calling.

Saving contacts with no notes (you will forget who they are).

Failing to use tags, leading to a "messy" list you eventually ignore.

No "Next Follow-Up" date— if it isn't scheduled, it won't happen.

Relying on "Likes"— social media engagement is not a database relationship.

Buying leads before you’ve exhausted your free sphere of influence.

Sounding like a salesperson instead of a local guide.

Ignoring Open Houses as a primary way to feed the database engine.

Kartik's Insider Tip:

“I’ve seen agents turn a 'maybe next year' lead into a $30,000 commission simply because they had a 'follow up in 6 months' tag and actually made the call.

Most agents quit after one 'no.' The database ensures you are there when the 'no' turns into a 'now.'”

Start Your Career the Right Way

A database is the difference between a "job" and a "business." Without it, you are unemployed every time a transaction closes.

With it, you have a predictable stream of referrals and repeat clients.

If you are ready to move beyond the basics, it is time to look at the bigger picture of your professional development.

If you’re building your first-year foundation in California, that’s the full roadmap.

Start a Real Estate Career in California →

|

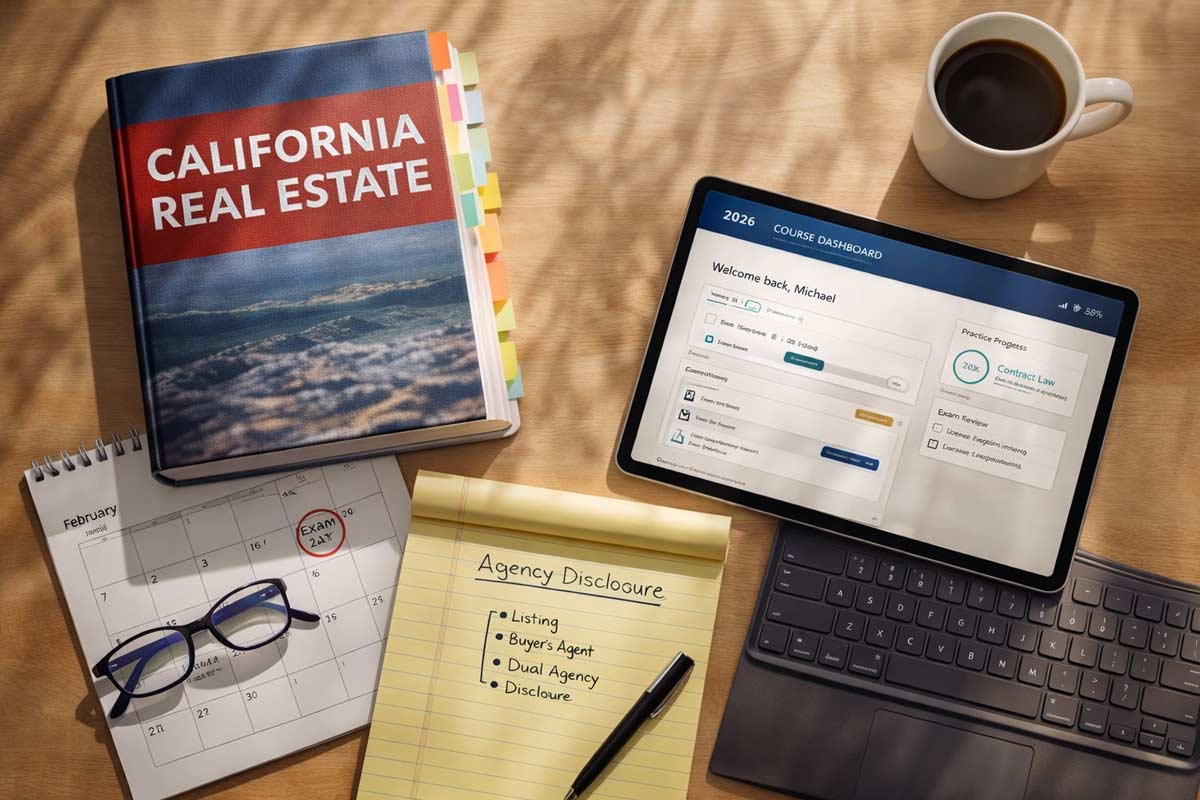

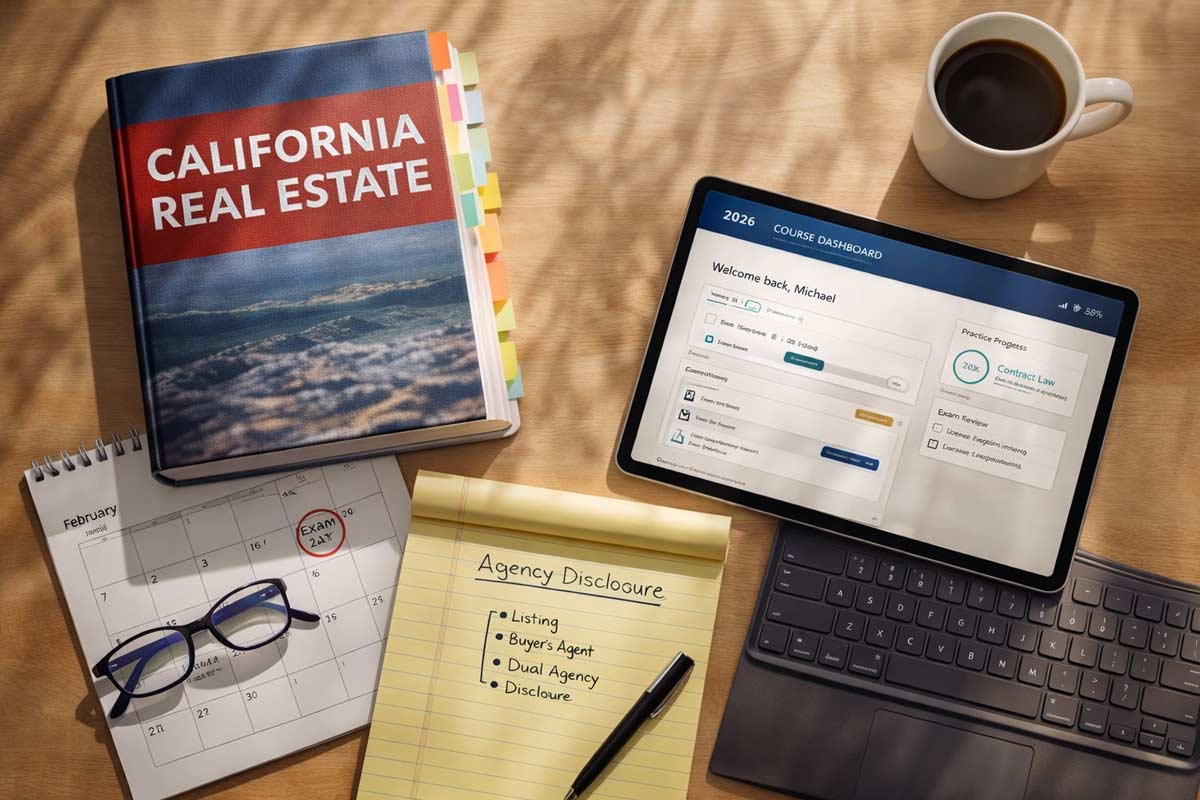

Choosing anonline real estate school can feel like an endless loop of open tabs and conflicting opinions. And in real estate licensing, “close enough” isn’t close enough—if you enroll in a program Read more...

Choosing anonline real estate school can feel like an endless loop of open tabs and conflicting opinions. And in real estate licensing, “close enough” isn’t close enough—if you enroll in a program that’s hard to use, light on support, or weak on exam prep, you don’t just lose money.

You lose momentum.

Over the last 20+ years, I have seen the same truth play out: the “best” online school isn’t a universal winner. It’s the one that fits how you actually learn and how your life actually runs. In the next 10 minutes, you’ll know which online format fits you, what to verify for compliance with the California Department of Real Estate, and which tradeoffs matter most—support, speed, or exam readiness.

What “Online” Really Means in 2026

In California, “online” can mean very different study experiences depending on the delivery method:

Self-Paced Online: Log in anytime. Move through modules/videos on your schedule. Maximum flexibility—requires self-discipline.

Livestream / Virtual Classroom: Scheduled sessions (often via Zoom-style platforms). Best for accountability and real-time instructor access.

Hybrid Programs: Self-paced core hours + optional live Q&A, crash reviews, or office hours to reinforce understanding.

Mobile-First Platforms: Purpose-built mobile study vs. “mobile responsive.” If you study during commutes or breaks, mobile usability becomes a deciding factor.

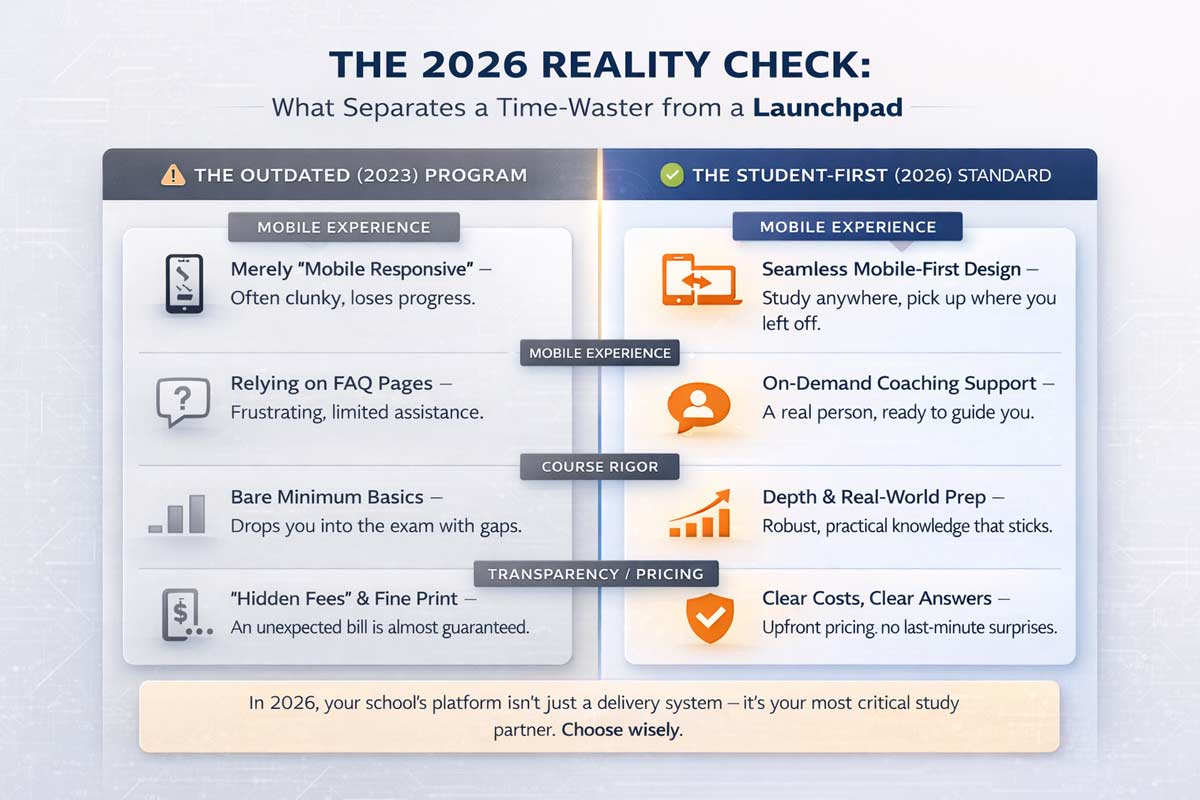

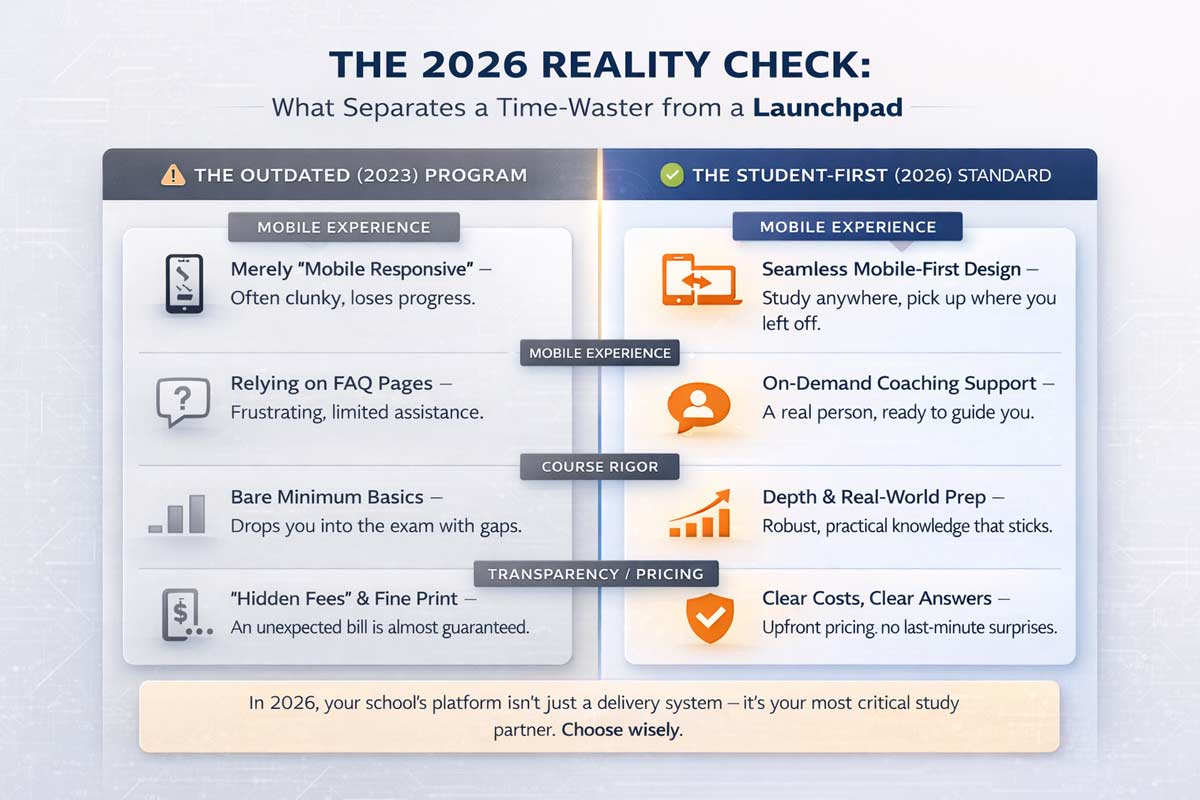

What’s Different About Online Schools Now (2026 Reality Check)

Three things separate “just acceptable” programs from programs that actually help students finish and pass:

Mobile-first study is no longer optional. The best programs let you move seamlessly between laptop and phone without losing your place.

Support quality varies wildly. “Support” is a buzzword unless you can reach a real person quickly when you’re stuck.

Course rigor matters more than ever. The DRE approves individual statutory courses and assigns sponsor IDs/approval numbers—so “thin,” outdated, or sloppy delivery isn’t just annoying; it creates avoidable exam friction.

The 2026 Rankings Framework: Finding Your “Best”

Instead of pretending there’s one perfect school for everyone, use this outcome-based framework. Find the category that matches your situation, then choose the program that checks the right boxes.

0. Best Overall for Most Students (The Balanced Choice)

What to look for: A structured path, real human support, strong real estate exam prep, and a clean user experience.

Red Flags: Unclear support channels, short access lengths (too little runway if life gets busy), and constant upsells for basics.

1. Best for Maximum Support (The “I Have Questions” Choice)

What to look for: Direct instructor access, weekly live Q&A, and a responsive student success team.

Red Flag: Ticket-only support with slow turnaround times when you’re on a deadline.

2. Best for Fast Completion (The “I Need This Done” Choice)

What to look for: A streamlined interface, clear progress tracking, and a smooth certificate process (no bottlenecks).

Red Flag: Clunky navigation that turns study time into frustration time.

Deep Dive: If speed is your primary driver, read the deeper breakdown here: Fastest Real Estate License Programs in California.

3. Best for Exam Prep Strength (The “One-and-Done” Choice)

What to look for: High-volume practice questions, exam-style simulations, and strong explanations (not just “right/wrong”).

Red Flag: Exam prep treated as a “bonus” instead of an essential part of passing.

4. Best for Budget-Focused Students (The “Value” Choice)

What to look for: Transparent pricing and packages that clearly include your required courses.

Red Flag: Teaser pricing that later charges extra for key items (certificates, support, prep tools).

Deep Dive: Before you pick the lowest sticker price, read the tradeoffs here: Cheapest Real Estate Schools in California (Pros & Cons).

???? The ADHI Standard (What a “Student-First” Program Should Include)

This isn’t about hype—it’s about what actually helps students finish. It’s also how ADHI designs programs internally:

Clarity: A step-by-step study path so you’re never guessing what’s next.

Support: Real help when you’re stuck (not a black-hole ticket system).

Prep Depth: Enough practice to build confidence before exam day.

Usability: Mobile-friendly study that fits into a working schedule.

No Surprises: Transparent inclusions so you’re not nickel-and-dimed later.

Use that as your checklist when comparing options—no matter what provider you’re looking at.

???? Related Guides

Best In-Person Real Estate Schools in California

Cheapest Real Estate Schools in California (Pros & Cons)

Fastest Real Estate License Programs in California

Most Popular Real Estate Schools in California (Student Volume)

The Non-Negotiables Checklist

Quick note: the DRE approves individual statutory courses (and assigns sponsor IDs/approval numbers). Always verify the course approvals—not just marketing claims.

DRE Course Approval: Verify the specific course approval/sponsor ID in the DRE database (secure.dre.ca.gov).

Statutory Hours: Ensure the program satisfies the required 135 hours of statutory coursework.

Device Compatibility: Does it work smoothly on phone + laptop (without glitches)?

Access Duration: Enough time to finish without stress (6–12 months).

Refund Policy: Clear, written, and easy to find.

Online vs. In-Person: The Final Decision

A lot of students start by looking for the Most Popular Real Estate Schools in California, but popularity doesn’t guarantee fit.

Choose online if you need schedule flexibility and you’re comfortable learning independently. Choose in-person if you need a structured environment to stay consistent.

To compare online, in-person, cheapest, fastest, and popularity-based options side-by-side, use our Best Real Estate Schools in California hub.

FAQ

Is online real estate school allowed in California?

Yes—California allows pre-license/statutory coursework to be completed through approved offerings, including online formats, as long as the course is properly approved/listed. (California Department of Real Estate)

How do I verify DRE approval?

Use the DRE statutory course search and confirm the specific course approval and sponsor details. Remember: DRE approval is tied to courses (with sponsor IDs/approval numbers), not blanket marketing claims. (California Department of Real Estate)

Self-paced vs. livestream—what’s better?

Self-paced is best for flexibility. Livestream is best for accountability and real-time Q&A. Hybrid works well if you want both.

Can I finish faster online?

Online programs can help you move efficiently because you aren’t waiting for scheduled class dates. That said, California rules limit how quickly statutory courses can be completed: a single course may not be completed in less than 2½ weeks, and no more than two courses may be completed in any five-week period. (California Department of Real Estate)

Does an online school include exam prep?

It varies. Some include robust prep tools in the base package; others treat it as an add-on. If you want to pass with fewer attempts, prioritize programs in the “Exam Prep Strength” category.

How long do I have access to the course?

Access lengths vary by provider. The key is to choose enough runway so you don’t feel forced to rush if work or life gets busy.

Key Takeaways

Verify course approval (not marketing). Confirm sponsor/course approvals in the DRE database.

Choose the format that matches your life. Self-paced vs. livestream vs. hybrid is the real decision.

Exam prep is what gets you across the finish line. Courses earn credit; prep earns confidence.

Avoid surprise fees and weak support. Transparent inclusions + real help matter.

Plan your timeline around DRE pacing rules. 2½ weeks per course; max two courses per five weeks.

Ready to choose?

Compare online, in-person, cheapest, fastest, and popularity-based paths in our Best Real Estate Schools in California hub.

|

In twenty years of leading students at ADHI Schools, I have seen thousands of students start their licensing journey. At this point, I can tell pretty quickly whether a student will be licensed in four Read more...

In twenty years of leading students at ADHI Schools, I have seen thousands of students start their licensing journey. At this point, I can tell pretty quickly whether a student will be licensed in four months or still "working on it" in twelve.

The difference isn't intelligence or background. It often comes down to their environment.

Folks often treat real estate school like a hobby—they fit it into the gaps of their life. First-time passers treat it like a closing. They don't rely on motivation; they rely on a Passive-to-Active (PTA) System. If you do not intentionally design your study setup, your environment will design your failure.

Quick Take: The High‑Pass System

The Framework: The "PTA System" (Environment, Tools, Routine).

The Non‑Negotiable: Total phone isolation and a "Single‑Task" browser setup.

The Metrics: Shift from "hours logged" to "concepts mastered via active recall."

The Goal: Eliminate the 3–6 month "drift" that kills most real estate careers.

The PTA System: A 3‑Pillar Framework

To pass the California state exam on your first attempt, you must move from Passive Consumption (watching videos) to Active Recall (retrieving information). My PTA System is the architecture that forces this transition.

1. Environment: The Distraction‑Free Command Center

Your brain is a proximity‑based machine. If your phone is within reach, a portion of your cognitive load is dedicated to not checking it.

The "Clean Desk" Mandate: Workspace = device, notes, and a glass of water. Nothing else.

Phone Isolation (The "Faraday" Rule): Phone belongs in another room. Even silenced, it drains focus.

The Lighting Trigger: A dedicated lamp signals “study mode” vs. “life mode.”

The "Minimum Viable Corner": No office? Use headphones and a placemat as your “walls.”

2. Tools: The "Single‑Task" Tech Stack

Most students fail because they use tools that encourage multitasking. A tablet with 15 open apps is not a study tool; it’s a distraction device.

The Hardware Hierarchy: Desktop/laptop only. Keyboard + large screen for side‑by‑side study.

The Browser Lockdown: Use a dedicated browser solely for real estate school. No social media logins.

Note‑Taking (The "Write‑to‑Recall" Method): Write questions, not answers. Example: “What are the 4 unities of Joint Tenancy?”

The 20‑Minute "Sprints": Use a physical kitchen timer. Avoid phone timers that invite distraction.

3. Routine: The "20/2/1" Execution Plan

The biggest mistake I see is “binge studying.” Students try to pull 8‑hour sessions on Sundays. They retain nothing.

The Daily 20: Twenty minutes of practice questions every morning before the world wakes up.

The Deep 2: Two hours of new curriculum mid‑week.

The Sunday 1: One full, timed practice exam.

The "Start Ritual": A 60‑second sequence (Water → Headphones → Login) that signals “exam mode.”

The "Exam‑Readiness" Upgrade (Why Passive Students Fail)

This is where most students lose a year of their lives. They mistake familiarity for mastery.

I’ve seen students who claim to have “read” the textbook but can’t pass a 150‑question practice test. They fell into the trap of passive reading. They chose a setup that made it easy to "watch" but hard to "do."

Do online real estate classes actually prepare you? Only if your setup forces you to answer questions. If your study routine doesn't involve being "wrong" at least 30% of the time during practice, you aren't learning—you’re just scrolling.

Kartik’s Reality Check: In two decades, I have never seen a student fail the state exam because they didn't "read enough." They fail because they didn't "retrieve enough." Your setup must be a retrieval machine.

Common Setup Failures (The "Don't" List)

If your current study habit looks like this, you are effectively choosing to fail:

The "Second Screen" Trap: Having the TV on or a movie playing while "going through the slides."

The "Highlighter Fallacy": Thinking that coloring a page yellow equals moving it into your long‑term memory.

The "Drift": Not knowing exactly which lesson you will tackle before you sit down.

Skipping Practice Tests: Waiting until the "end" of the course to see if you actually know the material.

Profile

The "Pass" Strategy

The Failure Mode

The Busy Pro

20‑min daily sprints

"I'll do it all on Saturday"

The Career Changer

Active recall / PTA System

Passive reading / Highlighting

The Academic

Practice test drilling

Over‑studying theory / No testing

Implementation: Choose Your Path

You are at a crossroads that determines how long real estate school should take. You can either drift through the material and hope for the best, or you can build a PTA system that guarantees a result.

Consistency is the byproduct of a good environment. If you find yourself constantly losing steam, read our analysis on how to stay motivated during real estate school. Usually, it’s not a lack of "willpower"—it’s a broken setup.

When you compare the Best Real Estate Schools in California, look for the one that doesn't just give you a login, but gives you a framework for success. Check the student reviews of online real estate schools and you’ll see that the ones who pass are the ones who treated the process with the professional rigor it deserves.

PTA System FAQs

Q: Is it okay to study at a coffee shop?

A: Only if you have noise‑canceling headphones and can handle the "Portable PTA Kit." If people‑watching is more interesting than the Law of Agency, stay home.

Q: Should I use digital flashcards?

A: Yes, but only if you create them yourself. The act of writing the question is 50% of the learning.

Q: What if I miss a week of my routine?

A: Do not try to "catch up" by doubling your hours. You’ll just burn out. Return to the 20/2/1 plan immediately. The system is designed to absorb life’s interruptions.

Q: How do I know if my setup is working?

A: By your practice test scores. If your scores aren't rising, your environment is likely too passive.

Q: Does the PTA system work for everyone?

A: It works for everyone who actually implements it. It is the converged "best practice" of 20 years of successful California brokers.

The Verdict

If you don’t design your setup, your environment will design your outcome. A professional career starts with a professional study habit. Build your PTA Command Center today, put your phone in another room, and start your first 20‑minute sprint.

Your future as a California agent depends on the systems you build today.

|

You’ve passed the real estate exam, your license is hanging at a brokerage, and the initial celebration has subsided. Now, you’re staring at a blank calendar and a quiet phone. It’s what I call the Read more...

You’ve passed the real estate exam, your license is hanging at a brokerage, and the initial celebration has subsided. Now, you’re staring at a blank calendar and a quiet phone. It’s what I call the “post-license cliff”. This moment is particularly acute in California, where high competition meets complex markets, and the pressure to “figure it out fast” can lead new agents toward expensive, ineffective shortcuts.

If you’re a new real estate agent in California wondering how to get your first clients without buying leads, this article is your playbook. Securing your first three clients isn't just about income—it’s about proof of concept. In my 20+ years of working in the California real estate market, I’ve noticed the agents who survive the first year are those who replace "hustle" with systems and processes.

What Success Looks Like in 30 Days

Before we dive in, let’s define a "win." Success in your first month isn't measured by closed escrows—it’s measured by inputs.

These inputs work because they maximize trust-building touches, not impressions.

If you follow this operating system, your 30-day scoreboard should look like this:

100+ Real Conversations: 5 per business day.

40+ Contacts: Added to your database.

4 Open Houses: Hosted during the month.

1–2 Buyer Consultations: Booked as a direct result of consistent follow-up.

Practice Over Profit: The First 3 Principle

This is the phase where most new real estate agents in California either build momentum—or quietly stall. Your first three clients are your learning labs. You are building the muscle memory of a professional. Success here comes from

Practice + Proximity + Follow-up

not expensive marketing.

Before You Prospect: Two Things You Must Set Up This Week

Before you pick up the phone, you need a professional foundation. California’s disclosure-heavy environment means your first clients are as much about the learning process as closing deals.

1. Broker Expectations: Sit down with your broker or team lead. Ask for (a) upcoming open house opportunities, (b) "floor time" for walk-ins (if this is still a thing in your area), and (c) their preferred CRM.

2. Compliance Guardrails: This is California—disclosures matter. Don’t wing it. Don't promise specific financial outcomes, keep all communications professional, and stay within your brokerage’s legal policies.

Pathway 1: The "Inner Circle" Strategy (The Database)

The Reality: Your first client is almost always someone you already know, or someone they know. People do business with people they trust.

The Action Plan: Stop "announcing" your career and start consulting. Use these micro-scripts to offer value:

The Call: "I’ve officially launched my real estate practice. I’m not calling for business—I just want to be your resource. If you ever need a quick valuation or want to know what’s moving in the neighborhood, I'm here."

The Text: "Hey! Just wrapped up my licensing. If you ever have a random real estate question or need a vendor recommendation, feel free to reach out!"

Micro-Credibility Boost:

Avoid: “I just got licensed and I’m looking for clients.”

Use: “I’m building my practice and want you to have a real resource.”

The 14-Day Follow-Up Cadence:

Day 0: Initial outreach (Call/Text).

Day 7: Value Touch (Send a quick, one-page market snapshot of their specific zip code).

Day 14: The Soft Ask: "I’m helping a few people find homes this month. Do you know anyone else thinking about a move this year?"

The Deeper Resource:

A "system" is simply: Name + Source + Last Contact + Next Action. In week one, a spreadsheet is fine. To move toward a sustainable pipeline, you need to build a real estate database from scratch.

Pathway 2: The Open House Capture & Conversion

The Reality: Open houses are one of the few places consumers actually expect to talk to an agent. It is a high leverage use of your time.

The Action Plan (The 3-Step Flow):

The Welcome: "Welcome! Are you from the neighborhood or just starting your search?"

The Qualification: "Have you seen anything else in this price point, or are you still getting a feel for the local inventory?"

The Close for the Next Step: "I have a list of three similar homes nearby that aren't on everyone's radar yet. Would you like me to send those over?"

A productive open house for a new agent isn’t measured by attendance—it’s measured by 2–3 follow-up conversations scheduled within 48 hours.

The Deeper Resource:

To turn a handshake into a contract, you need a specific follow-up method. Learn the full process in our guide: How New Agents Should Hold Open Houses in California.

Pathway 3: Leverage Office Inventory & Stale Leads

The Reality: While most agents chase "perfect" leads, you can find your first three clients by looking where others don't.

High-volume agents often ignore these opportunities because they require follow-up instead of marketing scale.

The Action Plan: