If you are researching your next career move at 11:00 PM after a long shift or while the kids are finally asleep, you probably have one burning question:

Can you get a California real Read more...

If you are researching your next career move at 11:00 PM after a long shift or while the kids are finally asleep, you probably have one burning question:

Can you get a California real estate license online?

The short answer is: Mostly, but not entirely.

While the California Department of Real Estate (DRE) has embraced digital transformation—allowing you to complete your education and submit your paperwork from your couch—there are still physical "gatekeepers" that require you to show up in person.

The Reality Check: Online vs. In-Person

What You CAN Do Online

What You MUST Do In Person

Complete all 135 hours of pre-licensing courses.

Sit for the actual State Exam at a DRE exam center.

Submit your application via eLicensing.

Get your Live Scan (digital) fingerprints taken.

Pay your application and license fees.

Present valid government-issued photo ID.

Manage your license renewals later on.

Physically attend the testing center.

The Bottom Line: You can complete 100% of your required education online, but the State of California requires you to physically appear for your exam and your background check. It is important to check the fine print: while the "schooling" is digital, the "licensing" still has a few real-world milestones.

Defining "Online" in the California Licensing Process

When people ask about getting a California real estate license online, they are usually referring to the flexibility of the curriculum. In California, you are required to complete three college-level courses: Real Estate Principles, Real Estate Practice, and one elective.

At ADHI Schools, we’ve spent over 20 years helping students navigate this. We know that for a busy professional, the ability to take online real estate courses in California is the difference between starting a career and just dreaming about one.

However, the "license" itself isn't a digital download. It is a credential granted by the state after you prove your knowledge in a proctored, high-security environment.

The 18-Day Regulatory Rule For Coursework

In California, DRE regulations specify that a student must spend a minimum amount of time with their course materials before they are eligible to take a final exam. This is typically implemented as a seat-time requirement of 18 days per course. Because you must take three courses, your total minimum education time is 54 days—a timeline that applies even if you are the fastest reader in the state.

Step-by-Step: What Parts Can Be Done Online?

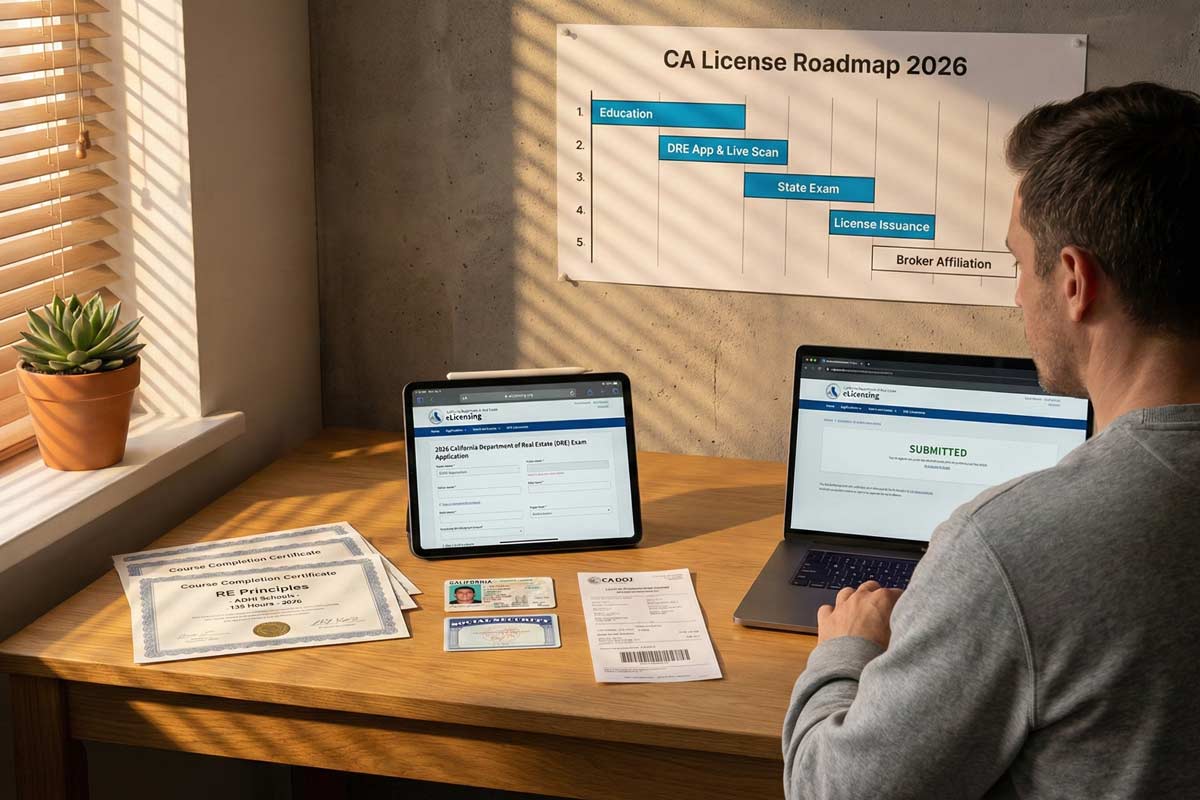

To help you plan, here is the numbered flow of the licensing process, showing exactly where the "online" part ends and the "real world" begins.

Pre-Licensing Education (Online): Complete your three courses (Real Estate Principles, Practice, and an elective). This takes a minimum of 54 days due to mandated study timers.

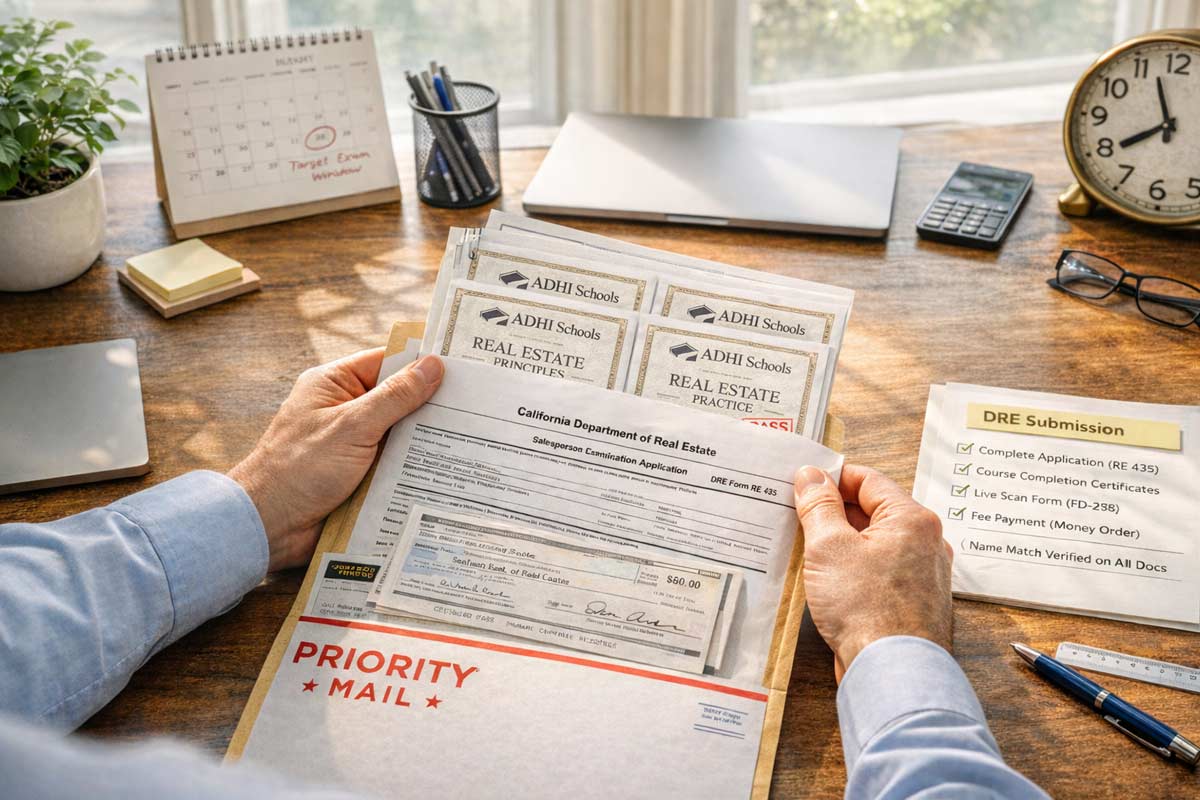

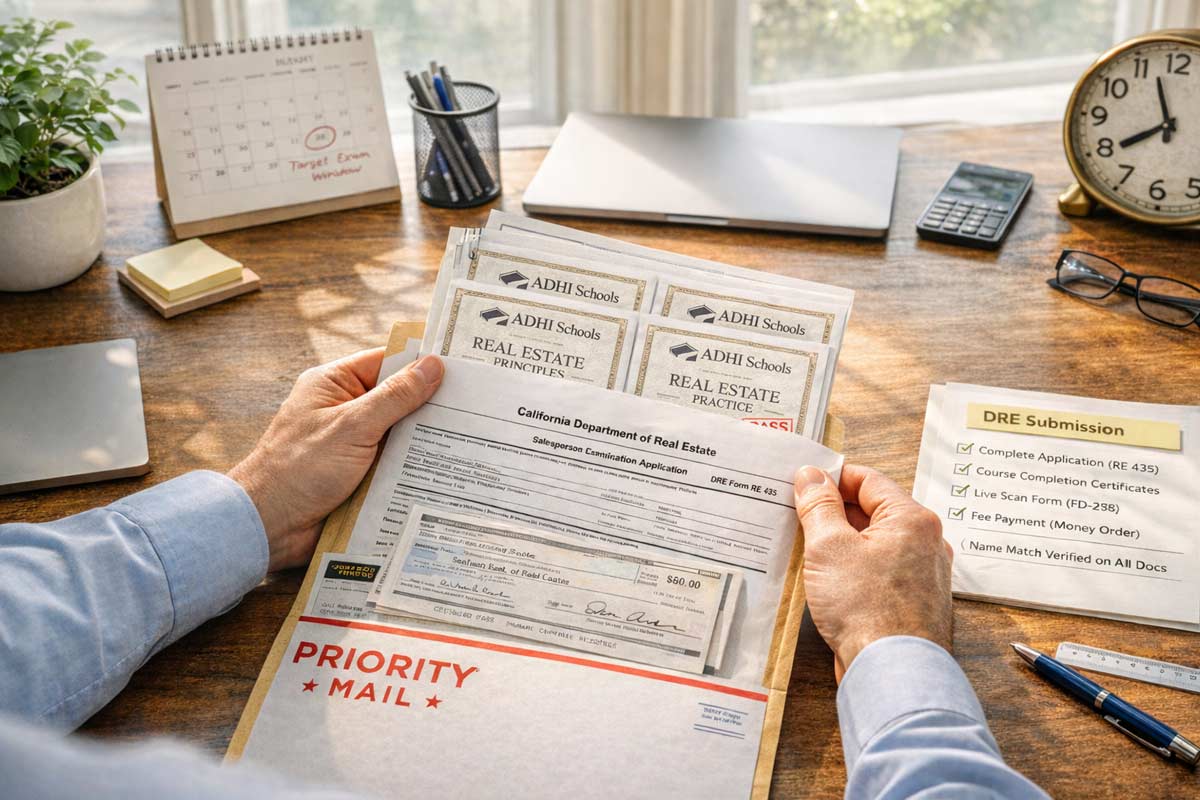

Application Submission (Online): Use the DRE eLicensing system to submit your combined Exam/License application.

Live Scan Fingerprints (In Person): You must visit a Live Scan provider to have your fingerprints electronically transmitted to the DOJ and FBI.

The State Exam (In Person): Once your application is processed, you will schedule a date to visit one of the five DRE testing centers (Sacramento, Oakland, Fresno, La Palma, or San Diego).

License Issuance (Digital/Mail): Once you pass, the DRE processes your results. You can often see your license number online before the paper certificate even arrives.

What Must Be Done In Person (And Why)

The DRE takes the integrity of the real estate profession seriously. The reasons you can't do it all from a laptop come down to two things:

Security and Compliance.

Exam Integrity: To prevent cheating and ensure that the person taking the test is actually the applicant, exams are held in monitored facilities where phones and notes are prohibited.

Identity Verification: Live Scan fingerprinting ensures that your criminal background check is tied to your actual identity, which requires a physical "chain of custody" at a licensed provider.

Expert Tip: If you’re in a rush, you’ll want to look into the fastest way to get a real estate license in California.

Timeline Planning

If you are trying to map out your calendar, your "online" progress is the most predictable part of the journey. Once you move into the "in-person" phase, you are at the mercy of DRE processing times and exam seat availability.

For most students, a realistic schedule involves finishing the online coursework while simultaneously preparing their paperwork. For a detailed breakdown of these phases, check out our California real estate license timeline. If you're wondering how those months look on a week-to-week basis, read our deep dive on how long it takes to become a real estate agent in CA.

Cost & Convenience Reality Check

While you save time and gas money by choosing to get a real estate license online in California, you still need to budget for the state-mandated fees.

As of 2026, the DRE fee for a salesperson exam is $100, and the original license fee is $350, totaling $450 paid directly to the state. Additionally, you will need to account for Live Scan fingerprinting. This involves a $49 state processing fee, plus a "rolling fee" charged by the private provider (typically $30–$45).

For a full breakdown of every nickel and dime, see our guide on how much it costs to get a real estate license in California.

Common Misconceptions

"I can take the state exam from home." No. You must travel to a DRE-approved testing site.

"Online courses are instant." No. California law requires you to spend a minimum amount of time with the material (typically 18 days per course).

"Once I finish courses, my license is automatic." No. Finishing courses only makes you eligible to apply for the state exam.

"Online = instant approval." Even if you submit online, the DRE may take several weeks to review your file and authorize you to test.

FAQ Section

Can I take the California real estate exam online from home?

No. The California State Exam must be taken in person at one of the Department of Real Estate’s designated testing centers to ensure exam security.

Can I complete the required real estate courses online?

Yes. You can complete all 135 hours of required pre-licensing education (Principles, Practice, and an elective) through an approved online provider like ADHI Schools.

Do I have to do Live Scan in person?

Yes. Live Scan requires a physical scan of your fingerprints by a certified technician at a licensed provider. This cannot be done via a smartphone or home scanner.

How long does it take if I do everything possible online?

Most students finish in 3 to 5 months. This accounts for the 54-day mandatory study period and current DRE administrative processing times.

What is the fastest way to get licensed in California?

The fastest route is to submit a "Combined" Exam and License application and complete your Live Scan immediately after finishing your online courses to avoid "dead time" while waiting for your test date.

How much does it cost to get licensed in California?

You should budget roughly $600 to $1,100 total. This includes your online course tuition, the $450 in DRE exam and license fees, and your Live Scan fingerprinting costs.

What is the most common reason people get delayed?

The most common delay is waiting to schedule the state exam. If you wait until after your courses are finished to start your DRE application, you may find yourself in a weeks-long queue for a testing seat.

Ready to Start Your Journey?

The road to a new career starts with the right map. While you can't do everything online, choosing a flexible, high-quality online education provider is the best way to maintain your current lifestyle while building a new one.

For a comprehensive look at the entire process, visit our California Real Estate License Guide.

|

Last Reviewed: February 2026 (Always verify the latest rules on the official California Department of Real Estate (DRE) website before your exam day.)

Quick Summary (TL;DR): To sit for the California Read more...

Last Reviewed: February 2026 (Always verify the latest rules on the official California Department of Real Estate (DRE) website before your exam day.)

Quick Summary (TL;DR): To sit for the California real estate exam, you must present a valid government-issued photo ID that matches your registration name. Electronic devices—including phones and smartwatches—are prohibited in the testing room. Plan to arrive at least 30 minutes early; severely late arrivals are often denied entry and may need to reschedule.

The biggest obstacle to passing your California real estate exam shouldn’t be the check-in desk. Every year, qualified candidates are turned away or disqualified—not for lack of study, but for violating a small set of non-negotiable exam-day rules.

With over 20 years of preparing candidates, I have seen the preventable errors that delay months of hard work. This guide cuts through the anxiety and gives you the rules you need so your only job on exam day is answering questions.

The 80/20 Rule: The Policies That Most Often Get Candidates in Trouble

Most exam-day issues stem from a handful of avoidable mistakes. Focus your attention here:

Identification issues: An invalid, expired, or unacceptable ID is the fastest way to be denied entry.

Prohibited personal items: Phones, watches, bags, and even your own pens can trigger disqualification if brought into the testing room.

Late arrival: Sessions begin promptly—arrive early or risk being denied entry and potentially forfeiting your exam fee.

Food, drink, and study materials: These are not permitted in the testing environment.

Not following instructions: Proctors enforce exam-security rules strictly.

Identification & Name-Match Policies: Your Non-Negotiable Entry Ticket

Your photo ID is your passport into the exam. The DRE is explicit about what is accepted and what is not.

What you must present

You must show one valid, original, government-issued photo ID from the authorized list:

A current state-issued driver’s license or DMV identification card.

A valid U.S. Passport (or a passport issued by a foreign government).

A valid U.S. Military identification card.

The critical name-match reality

Your registration and application must be under your legal name. Common friction points that lead to entry denial include:

Middle Names: Middle initial on one document vs. full middle name on another.

Life Changes: Marriage/divorce name changes not reflected consistently across your documents.

Shortened Names: Using nicknames like “Mike” vs. the legal name “Michael.”

Pro-Tip: If your identity cannot be verified cleanly against the roster, proctors may deny entry. Reconcile any discrepancies at least two weeks before your exam date.

For a full breakdown of documentation and common mismatch fixes, see Identification Requirements for the CA Exam.

Security Screening & Personal Belongings

Knowing the “logistics of the lobby” reduces day-of stress. Here is the standard flow at many exam sites:

Check-in: A proctor verifies your ID and matches you to the roster.

Storage: You will be directed to store personal belongings (typically in lockers, or a designated storage process if lockers are limited).

The Phone Rule: Phones must be powered off and stored as directed. Possession or use of a phone during the exam session—including during breaks—can lead to immediate disqualification.

Final Entry: Once cleared of personal items, you will be assigned a seat.

Best practice: Leave valuables at home or secured in your vehicle. Bring as little as possible to the site.

Prohibited Items: What Not to Bring

The DRE maintains an “Examination Control Information” list. Bringing prohibited items into the testing room can lead to immediate disqualification.

Category

Prohibited Items

Electronics

Cell phones, smartwatches, fitness trackers, tablets, laptops, cameras/recording devices.

Personal Items

Purses, wallets, keys, backpacks, briefcases, suitcases.

Stationery

Your own pens/pencils, paper, notes, flashcards.

Accessories

Hats/caps, lapel pins, tie tacks, smart glasses.

Consumables

Food, drinks/water bottles, gum, and candy.

"Bring Less, Bring Right" Checklist

To ensure a frictionless check-in, only have these items on your person when you approach the proctor:

Your valid, original government-issued photo ID.

Your car key (if not attached to a bulky keychain).

A light sweater or jacket (testing rooms can be chilly).

If you want the “positive list” of what to bring (so you don’t over-pack), read What to Bring to the California Real Estate Exam.

Timing Rules: Arrival, Late Policy, and Breaks

Arrival: Plan to arrive at least 30 minutes early to allow time for check-in, storage, and security.

Late policy: If you arrive after the session has started, you may be denied entry and required to reschedule (which can mean losing your slot and paying again).

Breaks: The exam is a continuous sitting. If you step out for any reason, assume your exam clock continues and follow the proctor’s procedure.

Test-Day Conduct: Disqualification & “Don’t Do This”

No communication: Don’t speak to or signal other candidates.

No copying: Don’t look at other screens or attempt to reconstruct questions to share later.

Absolute compliance: Follow proctor instructions immediately and without argument.

Violations can result in the exam being terminated and may affect future licensing applications.

Special Situations: Accommodations and “What If…”

Testing accommodations: If you need accommodations (e.g., extra time), you must request and receive approval through the official DRE process well before your exam date.

Medical/comfort aids: Items like insulin pumps or braces may require advance notice for screening—handle this early.

If you are turned away: Don’t panic. Fix the underlying issue (renew ID, correct name mismatch, etc.) and follow our recovery plan in What Happens If You Fail the CA Real Estate Exam.

Final Exam Day Checklist & Next Steps

If you follow these rules, you’ll clear check-in smoothly and can spend your mental energy on the exam itself.

If you pass, read: What Happens After You Pass the CA Real Estate Exam

For the complete roadmap and context, visit the: California Real Estate Exam Guide

Frequently Asked Questions (FAQ)

1. Can I wear a watch during the exam?

No. Watches (including smartwatches) are commonly prohibited. Plan to rely on the on-screen timer.

2. Can I bring my phone if it stays in the locker?

Yes, but it must be powered off and stored exactly as instructed. Do not access it during breaks.

3. What if my ID expired yesterday?

You will likely not be admitted. Your ID must be valid on the exam date.

4. Can I bring my own calculator?

Typically no. There is no longer any math on the California real estate exam and the testing sites no longer provide calculators or dry erase boards.

5. How early should I arrive?

At least 30 minutes before your scheduled start time.

|

Seeing the word "PASS" after you leave the Department of Real Estate (DRE) testing center is a massive milestone. You’ve successfully navigated the 150-question hurdle that stalls thousands of aspiring Read more...

Seeing the word "PASS" after you leave the Department of Real Estate (DRE) testing center is a massive milestone. You’ve successfully navigated the 150-question hurdle that stalls thousands of aspiring agents every year.

However, after over 20 years of preparing candidates for this moment, the most important truth I can share is this:

Passing the real estate exam is the end of your studies, but it is only the beginning of the licensing process. Understanding exactly what happens after you pass the CA real estate exam is critical to ensuring you don’t get stuck in a months-long "administrative gap" caused by paperwork errors or timing mistakes.

The Big Distinction: "Pass" vs. "License Issued"

A common mistake new candidates make is assuming they can hit the ground running the second they walk out of the testing center.

The Professional Reality: You do not have a license yet; you have a passing score. You cannot legally perform any activities that require a license—including representing yourself as a licensed salesperson to the public—until the DRE officially issues your license number and your status reflects as "Licensed" in their public database and your license is placed with a broker.

Consider this scenario: A candidate passes on Tuesday, celebrates on social media by calling themselves a "licensed agent," and begins soliciting clients on Wednesday. Because their license hasn't been officially issued, they are technically practicing without a license, which can lead to disciplinary action before their career even begins.

Two Common Paths After You Pass

Your next steps depend entirely on which application path you chose at the beginning of this journey.

Path 1: Exam + License Combo Applicants

If you filed the ,b>Salesperson Exam/License Application (RE 435) and paid both fees upfront, your path is generally the most streamlined.

What Happens Now: The DRE already has your intent to be licensed. Once your passing score is uploaded (usually within a few business days), they move straight to your background check and licensee issuance.

Your Move: Check if your license was issued here. This path is often the fastest when your file is clean and your fingerprints clear quickly.

Path 2: Exam-Only Applicants

If you only applied to take the test using form RE 400A, the DRE has no record of your license application yet.

What Happens Now: You must log into the DRE eLicensing system to download the Salesperson License Application (RE 202). You have exactly one year from your pass date to submit this application; if you miss that window, you must retake the exam - This is one of many reasons ADHI Schools recommends the combo exam/license application.

Your Move: This form must be submitted along with your Live Scan Service Request (RE 237) and the required licensing fee. Follow the DRE instructions for the current submission method (mail or other accepted electronic methods).

Decision Helper: Which path did I choose?

If you paid $450 in DRE fees up front, you are likely a "Combo" applicant. If you only paid the $100 exam fee and never submitted license materials, you are "Exam-Only." You can verify your application history by logging into your DRE eLicensing profile.

The Post-Pass Checklist: Actionable Steps to Your License

To avoid the "delay cycle," follow this checklist with the precision of a professional agent.

Verify Your Identity Consistency: Ensure the name on your application matches your government-issued ID exactly. For a refresher on why name matching is vital for identity consistency, see our guide on Identification Requirements for the CA Exam.

Access Forms via eLicensing: Use the DRE’s eLicensing portal to download your RE 202 (if applicable) and to track your status. Ensure you follow all current DRE instructions for how to submit these documents once completed.

Handle the Live Scan: If you haven't completed your fingerprints, do so immediately. The DRE cannot issue a license until they receive fingerprint responses from the DOJ and FBI.

Secure Your Sponsoring Broker: While the DRE can issue your license as Licensed NBA (No Broker Affiliation), you cannot perform licensed acts or earn commissions until you are affiliated with a responsible broker.

Maintain Professional Standards: Exam-day policies are strict, and the licensing process is strict too—don’t treat either casually. Refer to the California Real Estate Exam Rules & Testing Policies to remember the level of discipline the DRE expects from its applicants.

How Long Does It Take After Passing?

Processing times for after passing the California real estate exam fluctuate based on the DRE’s current volume. The DRE regularly updates their processing timeframes on their website, showing the "as of" dates for the applications they are currently reviewing.

Reviewable files (no missing signatures, correct fees, clear fingerprints) move through the system as soon as they are reached in the queue.

Deficient files (missing initials, mismatched names, or incorrect fees) are sent back to the applicant, which can add significant delays to the timeline.

To speed up the process:

Use the exact, current fee amount

Keep a copy of your Live Scan RE 237 with your ATI number to prove the fingerprints were transmitted.

Ensure all required signatures—including your sponsoring broker’s—are in the correct boxes.

If Something Goes Wrong: The Two Failure Modes

Even after passing, two common issues can stall your career:

The Administrative Loop: This is usually caused by sloppy paperwork. Revisit our list of What to Bring to the California Real Estate Exam as a reminder that professional success always starts with meticulous documentation and clean logistics.

The Support Gap: If you have colleagues who didn't make it this time, they may need to review our guide on What Happens If You Fail the CA Real Estate Exam to help them plan their retake.

Pro-Level Guidance: Think Like a Professional Already

The transition from "student" to "licensee" is your first official real estate transaction. Success in this business depends on paperwork discipline and responsiveness.

Be Meticulous: Real estate is a game of contracts. Treat your RE 202 with the same care you would a million-dollar purchase agreement.

Be Proactive: Check eLicensing regularly to see if your license number has been generated.

Build Habits Early: Use this waiting period to interview brokers and set up your business foundation.

FAQ: Post-Exam Essentials

How long after passing the CA real estate exam do I get my license?

It varies based on the DRE's current queue. "Combo" applicants often see results faster, but separate applications generally take several weeks for processing and background clearance.

Can I work as an agent after I pass the exam?

No. You cannot legally perform any acts requiring a license until your status is officially "Licensed" in the DRE database and you are working under a broker.

What if my name doesn’t match my documents?

This will cause an administrative delay. The DRE requires your legal name to be consistent across your ID, exam record, and background check.

What’s the difference between passing and getting a license issued?

Passing means you've met the testing requirement. "Issued" means the DRE has verified your application, fees, and background, granting you the legal authority to practice.

Your Next Step

Your journey to a successful real estate career is just beginning. To ensure you stay on the right track and avoid common pitfalls, bookmark our master guide:

California Real Estate Exam Guide

|

If you just saw the word "FAIL" on your exam results, take a breath.

The California real estate exam is a rigorous barrier to entry designed to ensure only prepared professionals enter the industry. Read more...

If you just saw the word "FAIL" on your exam results, take a breath.

The California real estate exam is a rigorous barrier to entry designed to ensure only prepared professionals enter the industry. At ADHI Schools, I have spent over 20 years helping thousands of students navigate this exact moment.

What happens if you fail the CA real estate exam isn’t the end of your career—it is a reconnaissance mission. You now have firsthand experience with the testing environment and the specific phrasing of the questions. Here is your professional recovery plan to turn this detour into a license.

First: What Failing Actually Means

Procedurally, failing simply means you didn’t hit the required scoring threshold. According to the California Department of Real Estate (DRE) standards:

Salesperson Candidates: Must score at least 70%.

Broker Candidates: Must score at least 75%.

Quick Snapshot: Your Immediate To-Do List

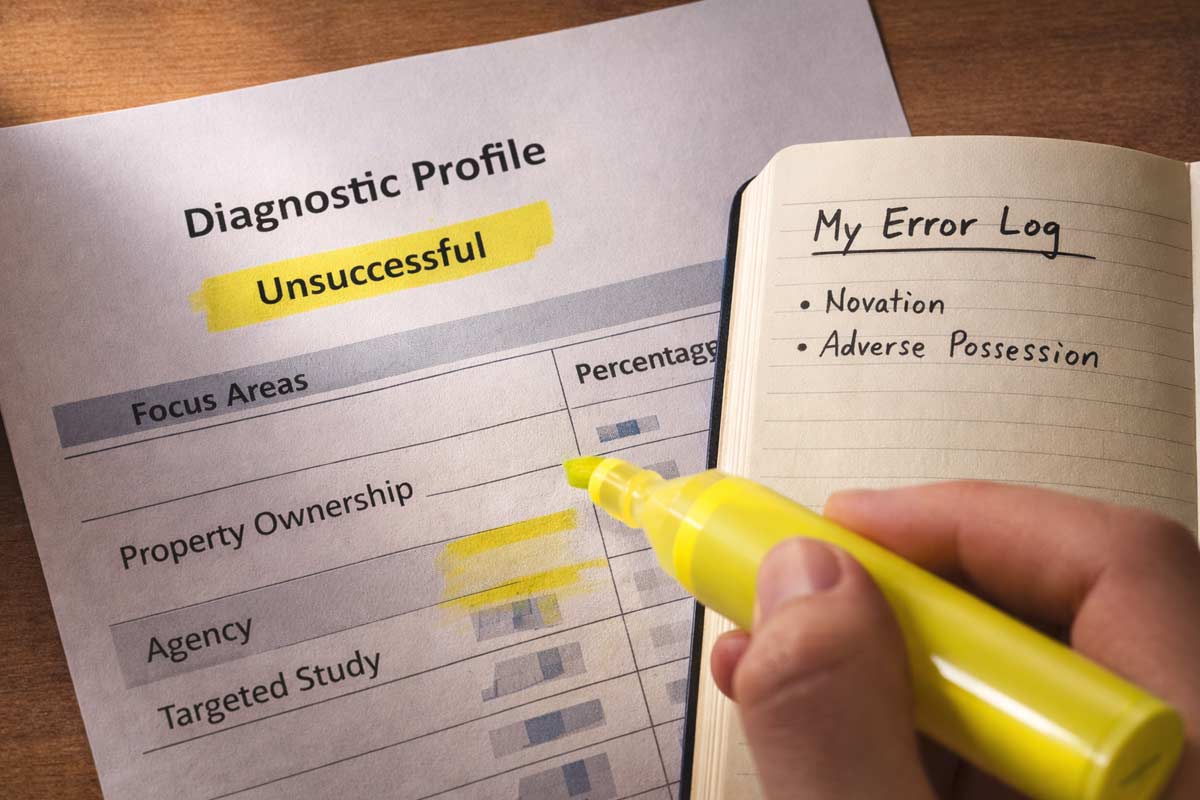

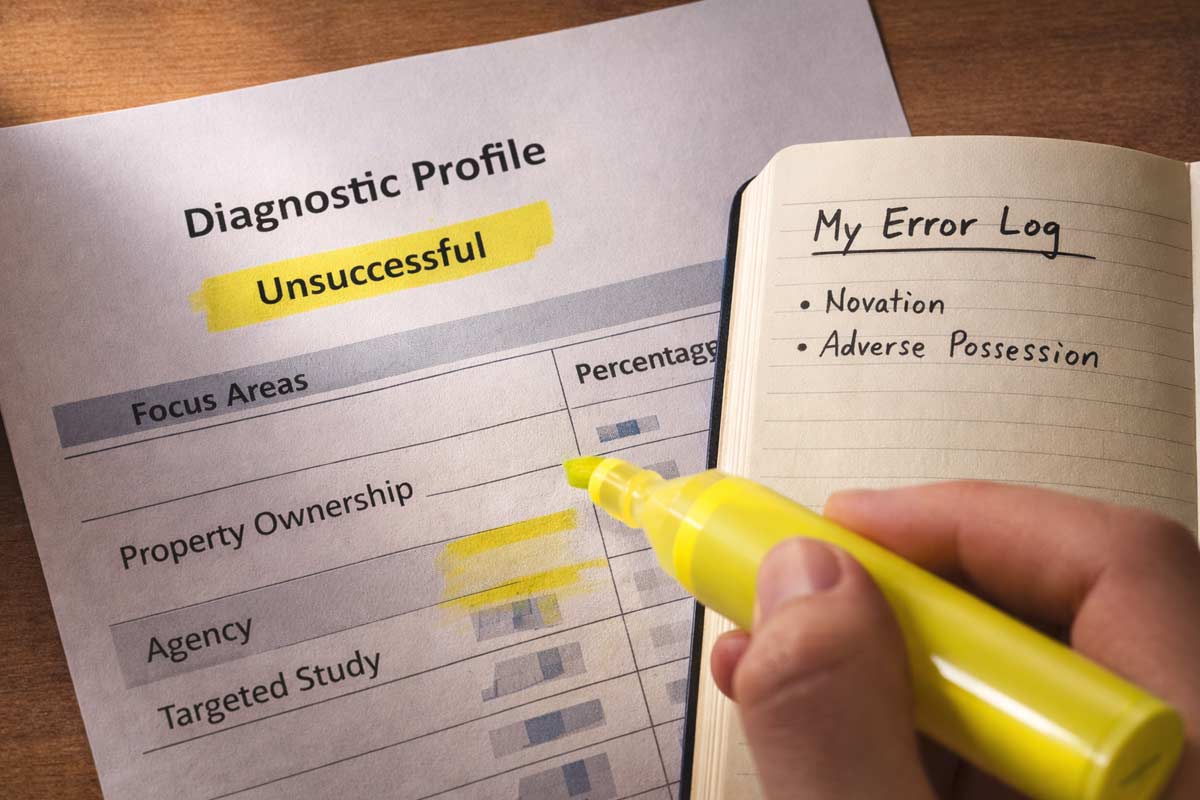

Review Today: Analyze your diagnostic profile to see which of the seven categories (e.g., Property Ownership, Land Use) need work.

Confirm Eligibility: Ensure you are still within your two-year application window.

Wait for the System: Do not attempt to reschedule until the DRE has fully processed your "Unsuccessful" result.

What Happens Immediately After You Fail

In California, you typically receive your results at the testing center. If you didn’t pass, you will receive a notification containing a diagnostic profile. This document is your roadmap; it breaks down your performance percentage in each major category.

The "Golden Hour" Reconnaissance

Before the specific details of the questions fade, perform a "brain dump":

Recall 10 Questions: Write down ten topics or specific questions that confused you.

Analyze Pacing: Did you finish with an hour to spare, or were you rushing to beat the clock?

The "Strategy" Check: Did you change your answers frequently? Real-world scenario: We often see students second-guess themselves from a passing score down to a failing one. Trust your first instinct.

Protecting Your Focus

Avoid a "panic spiral" by staying off unverified forums or Reddit. Every test-taker’s experience is subjective; trust your official diagnostic data over internet anecdotes that may lead to conflicting advice or wasted study time.

How to Retake the Exam

To reschedule the CA real estate exam, you must apply for a re-examination and pay the current fee.

The Re-Examination Rules

The Two-Year Eligibility Window: You must pass the examination within the two-year period following the date your initial application was filed. If you do not pass within this window, your application expires, and you must re-establish eligibility to try again.

Waiting for Results: DRE does not publish a fixed "waiting period" (such as 30 days) between attempts. However, you must wait until your results have been officially processed and received before you are eligible to reapply.

The "Submit Once" Rule: DRE explicitly warns candidates to submit their reschedule application only once—either online or by mail. Multiple submissions can lead to duplicate charges or your records being flagged for review.

One Date at a Time: You can only be scheduled for one exam date at a time. Rescheduling an existing appointment typically removes your current date.

Avoid the "System Flag": Attempting to obtain a new exam date before your previous results are processed can result in your records being withheld and the assessment of additional fees.

Verify Your Logistics

Before you head back, review the Identification Requirements for the CA Exam and the California Real Estate Exam Rules & Testing Policies to ensure no administrative errors disrupt your next attempt.

Why People Fail (and How to Fix It Fast)

Most failures fall into one of four patterns. Identify yours to adjust your strategy:

Failure Pattern

What it looks like

The Professional Fix

The Content Gap

Seeing terms like "Novation" or "Adverse Possession" and feeling lost.

Focus on the glossary. Real estate is a vocabulary test at its core.

The Strategy Gap

Narrowing it to two answers and always picking the wrong one.

Practice the "distractor" method: find why three answers are wrong instead of why one is right.

The Physiology Gap

Crashing or losing focus around question 100.

Build stamina. Take full-length, timed sets to mimic the 3-to-4-hour window.

The Logistics Gap

Arriving stressed due to traffic, ID issues, or prohibited items.

Review What to Bring to the California Real Estate Exam 48 hours early.

The 14-Day Comeback Plan

Don’t wait months to retake. Momentum is your ally.

Days 1–3 (Weakness Blitz): Study the two lowest-scoring categories on your diagnostic profile.

Days 4–7 (The Error Log): Take practice questions and write down why you missed them. Understanding the "why" prevents repeat mistakes.

Days 8–11 (Simulated Testing): Take full-length sets (150 questions for Salesperson, 200 for Broker). Build your sitting stamina for the actual 3-to-4-hour exam window.

Days 12–13 (High-Probability Review): Review Agency, Contracts, and Practice of Real Estate and Mandated Disclosures.

Day 14 (The Reset): Light review only. Confirm your location and pack your ID.

Simulating Success: The CrashCourseOnline.com Method

If your diagnostic profile showed gaps in specific areas, the most common mistake is to "just study more." You don't need more study; you need simulation. While nobody has the exact questions that are on the test, our proprietary system at crashcourseonline.com is engineered to closely simulate the concepts tested on the exam. We categorize our 1,100+ practice questions into the same seven categories found on your official results notice, allowing you to hyper-focus on your weakest subjects.

Frequently Asked Questions

How soon can I retake the California real estate exam?

DRE does not publish a fixed numeric wait time; however, you must wait until your current results are processed and received before the system will allow you to reapply.

How do I reschedule or reapply after failing?

The most efficient method is using the DRE eLicensing portal. You will select "Re-Examination," pay the fee, and select a new date.

Do my pre-license course certificates expire?

No. According to the DRE, pre-license course approvals for the three required college-level courses do not expire. You only need to focus on passing the state exam itself.

What happens if my two-year application window expires?

If you don't pass within two years of your application date, you must submit a new application, pay the initial fees, and re-establish eligibility.

Your Next Steps

This attempt didn't give you a license, but it gave you data. Now, we execute the plan. Once you clear this hurdle—and you will—you can look forward to What Happens After You Pass the CA Real Estate Exam.

For a comprehensive look at the entire journey, consult our California Real Estate Exam Guide.

Step 1: Download your diagnostic profile from the DRE eLicensing portal.

Step 2: Schedule your re-exam once the system allows to lock in your momentum.

Step 3: Start your Error Log based on your 10 "reconnaissance" questions.

Need a hand with the data?

If you have your diagnostic profile and aren't sure how to prioritize your study hours, reach out. We can help you build a targeted schedule based on your specific score breakdown.

|

TL;DR: The Bottom Line

The Answer (in plain English): No — you can’t be authorized to schedule or take the California real estate exam until the Department of Real Estate Read more...

TL;DR: The Bottom Line

The Answer (in plain English): No — you can’t be authorized to schedule or take the California real estate exam until the Department of Real Estate (DRE) verifies you’ve completed all 135 hours (three 45-hour courses).

The Risk: Submitting your application while you’re “still finishing” your last course is the fastest way to trigger a DRE deficiency notice and delay.

The Solution: Finish your courses, secure your certificates, and follow the "clean-file sequence" to move from candidate to licensee without bureaucratic friction.

Most confusion comes from mixing up applying to the DRE with scheduling an exam date—scheduling your state exam can only happen after DRE approval.

The Truth Table: What You Can (and Can’t) Do Right Now

Action

Possible before 135 hours?

Outcome / Practical Advice

Submit DRE application

Yes (don’t)

Triggers a deficiency notice and adds weeks of delay.

Get Authorization to Schedule

No

The DRE won’t issue an exam invite until your file is 100% complete.

Choose an exam date

No

You can’t access the eLicensing calendar until you’re approved.

Study & exam prep

Yes

Recommended — this is the only “shortcut” that actually works.

The Speed Trap: Why "Almost Done" Is Still a "No"

In my 20-plus years of training thousands of agents at ADHI Schools, I’ve seen one mistake repeat more than any other: the Speed Trap.

It usually starts with a highly motivated candidate who is halfway through their third course. They look at the DRE’s current processing times—which fluctuate—and think they’ve found a loophole. They decide to mail their exam application today, assuming that by the time a DRE processor actually opens their envelope, they will have finished the course and can just "send in the final certificate later."

This is a high-stakes gamble that almost nobody wins. The DRE does not "hold" your spot in line while you finish your homework. If a processor opens your application and the course completion certificate is missing, the process doesn’t pause—it breaks. You won’t just lose time; you’ll lose your momentum and you'll be waiting for a deficiency notice and a new review cycle before you can fix it.

The DRE’s system is built to verify eligibility first — clean files move faster than hopeful ones. In practice, the fastest candidates aren’t the ones who rush—they’re the ones who submit a file with nothing for the DRE to question.

The 135-Hour Rule, Explained Simply

To qualify for the California real estate salesperson exam, state law requires the completion of three DRE-approved pre-licensing courses, totaling 135 hours:

Real Estate Principles (45 hours)

Real Estate Practice (45 hours)

An Elective Course (45 hours—most of our students choose Finance, Appraisal, or Legal Aspects)

Enrollment in these courses is subject to California’s minimum time-in-course rules (usually enforced as a minimum number of days per course). You cannot "crash" these courses in a weekend; the regulatory framework is designed to ensure a minimum level of exposure to the material before you are given the ability to test out.

The "Completed" Checklist

The DRE only considers a course "complete" when you have checked these three boxes:

Time Requirement: You have spent the mandated number of days enrolled in the course (18 calendar days typically).

Examination: You have passed the final exam for that specific course with a score of 60% or higher with ADHI Schools.

Documentation: You have received a formal course completion certificate or transcript showing the exact course title and your legal name as it appears on your government-issued ID.

Until you have all three certificates in your possession, you are not an eligible candidate for the state exam.

The Real Answer: "Exam Before Hours" Scenarios

Let’s break down the specific scenarios candidates use to try and bypass the timeline.

Can I schedule the exam before finishing 135 hours?

No. In California, you don’t simply call a testing center and pick a date like you would for a haircut. You must first apply to the DRE. They review your education proof, and only then do they issue an Authorization to Schedule (also known as an Exam Invite). Until you’re approved, you’re not “in line” for an exam seat.

Can I take the state exam before finishing 135 hours?

No. There is no "provisional" testing. The education is a statutory prerequisite. Without the 135 hours, you aren't a candidate; you're just someone with an incomplete application.

What if I’m 90% done with my last course?

No. The DRE does not recognize partial credit. Whether you have 0 hours or 134 hours, the result is the same: Ineligible. You must wait until the final certificate is issued before mailing your application packet.

What if my course is done, but I’m waiting for my certificate?

No. Do not mail your application with a note saying "Certificate coming soon."

What if I finished courses years ago?

Only If. In many cases, older course completion records can still be usable, but the safest move is to verify your course titles and the provider's approval status to make sure you're applying under current DRE rules. If you are unsure if your older classes still count, check our California Real Estate License Guide to ensure your education aligns with today’s standards.

The Fastest Path: The "Clean-File" Sequence

Complete the 135 Hours: Finish Principles, Practice, and your Elective.

Gather Your Proof: Secure all three course completion certificates. Ensure your name matches your government-issued ID exactly.

Submit the "Combined" Application: Use form RE 435 (Salesperson Exam/License Application). Most first-time applicants should use the combined path so you don’t create a second processing cycle after passing.

The Waiting Window: Once your application is mailed, the DRE enters a review period where they process your file.

Pro-Tip: Start with the California Real Estate License Guide for a detailed step-by-step process.

What You Should Do While Waiting for Your Exam Date

The period between mailing your application and receiving your Authorization to Schedule is not "dead time." If you just sit and wait, you are actually slowing yourself down. Use this window to handle the "back-office" of your new career:

Live Scan Fingerprints:You don't have to wait until you pass the exam to do your background check. Doing it now means your license can be issued almost immediately after you pass.

Master the Material: The 135 hours of pre-licensing education is the "what." Now you need to learn the "how" of passing the exam. This is when you should be high-quality exam prep tools.

Brokerage Interviews: You can't actually sell real estate without a broker. Use this time to interview different firms. You can learn more about this by reading: Do You Need to Join a Brokerage Before Applying for a License?.

Planning Your Launch: And if you’re trying to plan the first 30 days after activation, read: What Happens After You Get Your California Real Estate License?.

Name Matching Audit: Double-check that your certificates, your application, and your driver’s license all use the same name. If one says "Jim" and the others say "James," fix it now.

3 Costly Mistakes That Will Slow You Down

1. The "In-Progress" Application

As discussed, mailing your application while still enrolled in a course is a guaranteed delay. The DRE is a high-volume government agency; they do not have the resources to "match" a late certificate to an existing file easily. Your file will be set aside, a DRE deficiency notice will be generated, and you will likely have to start the waiting clock all over again.

2. Using the Wrong Application Form

Candidates often use the "Exam Only" form (RE 400) because it's shorter. However, this means after you pass the exam, you have to submit another application for the license itself. This can add significant time to the total process. Always use the combined exam and license application to bypass that second wait.

3. Underestimating the State Exam

I've seen students finish their 135 hours, wait for an exam date, and then fail the exam because they thought the state test would be as easy as the course quizzes. If you fail, you have to reschedule and pay the fee again. This is one of the Top Reasons People Fail to Get Licensed in California.

FAQ: Your Timeline Questions, Answered

Can I apply to the DRE before finishing classes?

Technically, you can mail the form, but it will be treated as a deficient file and you’ll receive a deficiency notice. The DRE requires all three course completion certificates to be included in the initial packet to prove eligibility.

What is an "Authorization to Schedule"?

This is the document the DRE sends you once they have approved your 135 hours and your application. It grants you access to the eLicensing system where you can finally pick your date, time, and location for the exam.

How long are the course certificates valid?

Currently, there is no expiration date on pre-licensing course completions in California.

Is there any way to skip the 135 hours?

Only if you are a member of the California State Bar.

What happens if I pass the exam but haven't picked a broker?

Your license will be issued in "Inactive" status. You won't be able to perform any acts requiring a license or earn commissions until you officially "hang your license" with a broker. See What Happens After You Get Your California Real Estate License? for the next steps.

Speed Comes From Sequence, Not Shortcuts

In the world of California real estate, "slow is smooth, and smooth is fast." The desire to rush the process is understandable—this is a career that offers incredible freedom and income potential. But trying to take the California real estate exam before completing 135 hours is a tactical error that almost always backfires.

True efficiency is found in the "clean-file" sequence: complete your courses, gather your proof, and submit a perfect application. By doing the work correctly the first time, you ensure that once you pass the exam, you are ready to hit the ground running.

Next step (don’t guess):

Start here: California Real Estate License Guide

Ready to begin your courses? → ADHI Schools Pre-Licensing Packages

Choosing a broker next? → Do You Need to Join a Brokerage Before Applying for a License?

|

The "License Cliff": Why Agents Can Stall in the First 30 Days

You pass the state exam, celebrate, and then the email arrives from the DRE: "Your license is active." Suddenly, the guided path of mandatory Read more...

The "License Cliff": Why Agents Can Stall in the First 30 Days

You pass the state exam, celebrate, and then the email arrives from the DRE: "Your license is active." Suddenly, the guided path of mandatory courses and proctored exams ends. You are no longer a student with a syllabus; you are a business owner with a blank canvas.

If you aren’t careful, you can end up on the wrong side of what we call the “License Cliff”.

Without guidance or deadlines, new agents can drift into "luxury cosplay"—spending weeks on logos and business cards while their momentum evaporates. Here’s what to do after you get your California real estate license in the first 30 days to move from "licensed" to "in business."

The 30-Day Launch Sequence

????The Day 1–2 Checklist: Immediate Momentum

Identify 3 Brokerages: Do not over-analyze. Pick three based on proximity and reputation.

Call the Managers: Request a "New Agent Interview." Do not wait for an "opening."

Audit Your Finances: Make sure you can cover 3–6 months of dues + basic expenses.

Phase 1: The Mandatory First Step – Hang Your License

Practically speaking, you can’t operate solo in California. Your license becomes usable when it’s placed under a supervising broker. Your broker sponsors your license and provides the supervision and compliance umbrella that lets you practice.

Who is this for?

The Solo Agent: You want to build your own brand from Day 1 and keep a higher split.

The Team Agent: You want provided leads and high accountability.

ADHI Recommendation: For most brand-new agents, training beats split—by a lot. A training-heavy team environment provides the systems you need to survive Year 1.

The Brokerage Interview Scorecard

Onboarding: Is there a structured 30-day plan or just a desk?

Costs: What are the monthly tech, desk, and E&O (Errors & Omissions) fees?

Live Training: Can you shadow a listing presentation or an inspection this week?

Directive: Schedule 3–5 interviews. Your goal is a qualified launchpad for your first 12–24 months. If you’re still navigating the timing of your application, read Do You Need to Join a Brokerage Before Applying for a License?.

Phase 2: Setup Week – Activating Your Toolkit

Once sponsored, your first week is about technical setup. Avoid the "Branding Black Hole" and focus on permission-to-play tasks.

Your First 7-Day Setup Checklist

Task

Action Item

Compliant Signature

Include your Name, DRE License #, and Brokerage info (required for compliant advertising).

CRM Import

Export your phone and social media contacts. This is your "Sphere of Influence."

MLS & Supra

Get your MLS login and set up your Supra key for lockbox access.

The "Ask" Rule

Bookmark your broker's guidelines. When unsure on a disclosure, pause and ask your broker.

Phase 3: Your First 30 Days – The "Conversation Engine"

In real estate, Activity > Results. You cannot control a closing, but you can control your scoreboard.

Your First 30-Day Activity Scoreboard

10 New Conversations: Direct, two-way dialogues about the market.

5 Value-Add Follow-Ups: Sending a useful report or link (not just "checking in").

1 Hosted/Shadowed Open House: Your field laboratory for meeting neighbors.

1 Practice RPA: Write a mock Purchase Agreement using your broker’s templates.

Reality Snapshots

The “Ghost” Agent: I’ve seen students pass the exam but wait 60 days to pick a broker. By then, their momentum is dead.

The Branding Trap: One agent spent $500 on a custom logo before their first sphere call. Six months later, they were out of the business with a beautiful, empty website.

The Open House Win: A new agent hosted an open house for a top producer. They didn't sell that house, but met a neighbor who listed with them four months later. That one conversation turned into a $25k commission.

The Top 3 Post-License Traps

"I need a perfect brand first": Your brand is competence and responsiveness. Use your brokerage's templates for 6 months while you learn the contracts.

Tool Overload: You will be pitched "guaranteed leads" by dozens of vendors. The Fix: Use only what your brokerage provides for the first 90 days.

The Expert Fear: You don't need to know everything. Your script is: "That's a great question. Let me confirm this with my broker/manager so I give you the exact answer."

FAQ

"Can I get my license first and choose a broker later?"

Technically yes, but you are losing momentum. Read Top Reasons People Fail to Get Licensed in California to see why delay is the enemy of success.

"What if I feel unprepared?"

The exam proves you know the law; the first 30 days prove you can follow a system. If you haven't finished your hours yet, check Can You Take the Exam Before Completing All 135 Hours? to speed up your timeline.

"What does my broker actually do?"

They are your regulatory partner. They review your files for compliance, provide legal contracts, and pay your commissions. They are the "adult in the room" for your professional liability.

Your Next Step

Getting licensed was the "license to learn." Now, you must execute. If you are still navigating the pre-license requirements, solidify your foundation with our complete California Real Estate License Guide.

Open your calendar now and block 9:00 AM – 11:00 AM tomorrow for "Brokerage Research and Outreach." Treat it like an appointment.

|

The “Order of Operations” Confusion

The path to a California real estate license is often clouded by outdated advice, social media "gurus," and aggressive brokerage recruiting scripts. This creates Read more...

The “Order of Operations” Confusion

The path to a California real estate license is often clouded by outdated advice, social media "gurus," and aggressive brokerage recruiting scripts. This creates a massive point of confusion: many aspiring real estate professionals believe they must be "hired" before they can even apply for the state exam.

Mistaking this sequence leads to lost momentum and unnecessary procedural errors.

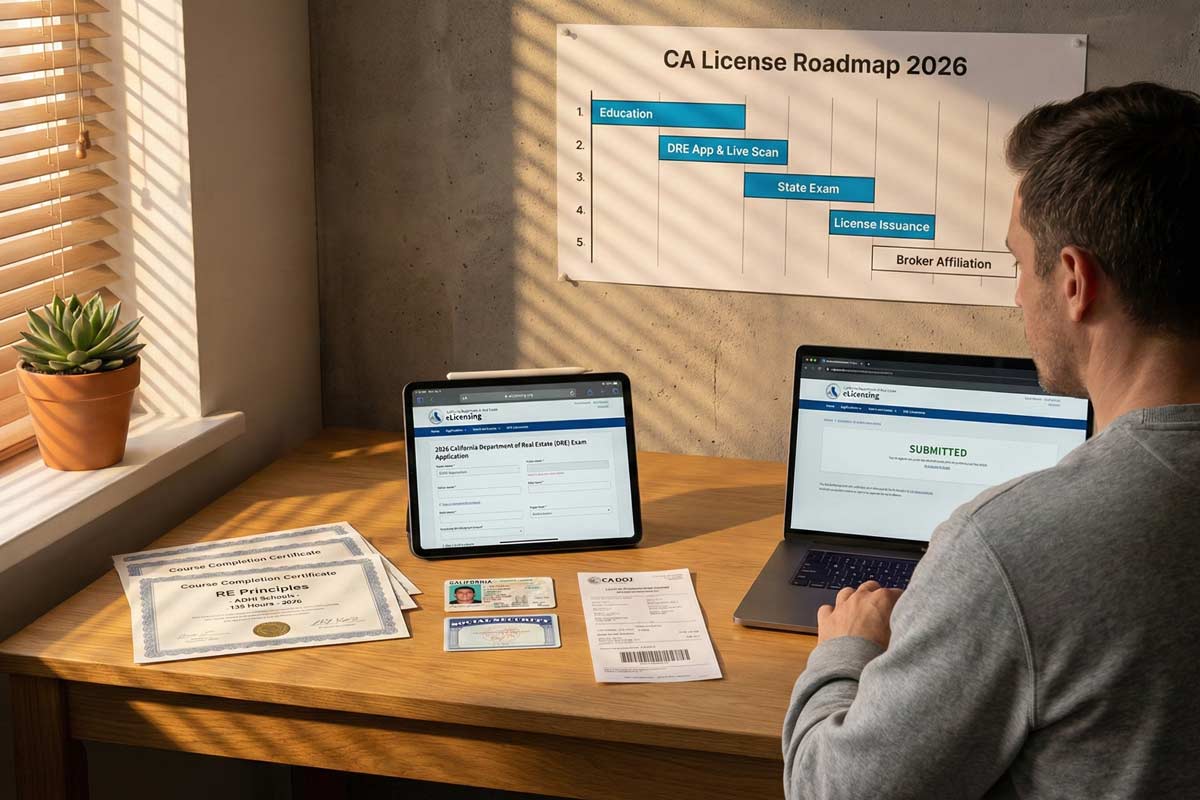

The typical order is: pre-license school → exam application → passing the state exam → license number issuance → brokerage affiliation.

In my 20+ years of guiding thousands of students at ADHI Schools, I’ve seen this confusion cause more delays than the exam itself. This guide provides the exact roadmap to avoid those traps.

Do You Need a Broker to Apply for a California Real Estate License?

No—you don’t need a broker to apply for or take the California real estate exam. You can complete the education and application without a sponsoring broker affiliation. But you can’t legally practice real estate or earn commissions until your license is placed with a supervising brokerage.

Do You Need a Broker to Take the California Real Estate Exam?

Absolutely not. The Department of Real Estate (DRE) allows any individual who has met the 135-hour education requirement to sit for the exam. You are applying as an individual, not as a representative of a firm. You can take the exam as an individual, regardless of brokerage affiliation.

The Correct California Timeline: A Step-by-Step Roadmap

Following the state-mandated order of operations is the only way to ensure you don’t waste time.

Complete Your 135 Hours of Pre-License Education: You must finish three college-level courses. Can You Take the Exam Before Completing All 135 Hours? No—you must have your certificates in hand first.

Apply for the State Exam & Submit Fingerprints: You submit your application and Live Scan fingerprints to the DRE. You do not need a broker’s signature for the exam application.

Note: The biggest avoidable delays are simple mismatches—your name, ID, and course certificates must match exactly.

Pass the California Real Estate Salesperson Exam: This is your primary hurdle.

Receive Your License Number from the DRE: The DRE issues your license number after clearing criminal background. You can complete this entire process independently and without broker affiliation.

Affiliate with a Brokerage to Practice (“Hang Your License”): Once you have a license number, you must place your license with a supervising broker so you can legally practice and earn commissions.

Pro Tip: If you want the full start-to-finish roadmap, use our California Real Estate License Guide.

Key Terms Demystified

Understanding DRE terminology prevents "bureaucratic paralysis."

“Applying for a License” vs. “Practicing”: Applying is between you and the State. Practicing is between you and a Broker. You can do the first without the second.

“Hanging/Placing Your License”: This means officially associating your license with a Broker of Record. This is what moves your license into a status that allows for commissions.

Independent Contractor Reality: You are a 1099 contractor. The broker supervises your licensed activity; however, you generate your own business unless the brokerage specifically provides leads.

What Happens After You Get Your California Real Estate License? The focus shifts from "passing the test" to "building a business."

When (and Why) to Talk to Brokerages Early

Research is smart; commitment is premature. You should interview brokerages while you wait for your exam date to assess:

New Agent Training: Does the broker have a formal mentorship program?

Commission Splits & Fees: What is the actual "take-home" after all fees?

Lead Generation Support: Do they provide leads or just "coaching"?

Compliance Support: Who reviews your contracts to keep you out of court?

Costly Mistakes to Avoid

Waiting to Apply Until You Find a Broker: I’ve watched students wait 90 days "shopping brokerages" while their exam eligibility window and motivation evaporated. Don't wait. Apply the moment you have your certificates.

Choosing a Brand Over Training: I once spoke to an agent who picked a famous global brand for the "vibe," but quit after 4 months because no one showed them how to actually get business. Top Reasons People Fail to Get Licensed in California often trace back to a lack of early support.

Losing Momentum After the Exam: The gap between passing the exam and finding a broker should be days, not months.

Your 7-Day Action Plan

Day 1-2: Finish your current education course module.

Day 3: Draft a shortlist of 3-5 local brokerages to research.

Day 4: Prepare 8 questions to ask future brokers (focus on training and splits).

Day 5: Double-check your DRE exam/license application for errors (name match, IDs, and certificates).

Day 6-7: Submit your application to the DRE.

Frequently Asked Questions (FAQ)

Can I apply for the CA real estate exam without a brokerage?

Yes. Affiliation is not required to apply for or take the exam.

Do I need a sponsor broker for the exam?

No. Sponsoring brokers are required for practicing, not for taking the exam.

Can I interview brokerages before I’m licensed?

Yes, and you should. Most brokers are happy to speak with prospective agents who are currently in school.

What if I join a brokerage now—does it speed up the DRE?

No. The DRE processes applications in the order received, regardless of which brokerage you intend to join.

What if I pass the exam but don’t pick a brokerage?

You will have a license number, but you cannot legally represent clients or collect a penny in commission until you associate your license with a broker.

Can my license expire if I don’t join a brokerage right away?

Your license remains valid once issued, but you must still meet renewal requirements and continuing education deadlines every four years, regardless of whether you are affiliated with a broker.

Next Steps on Your Licensing Journey

The brokerage choice is critical for your success in the field, but it is not a prerequisite for the state exam. Focus on your 135 hours and your application first.

For the complete, step-by-step licensing roadmap (start to finish), use our California Real Estate License Guide.

|

It starts with a burst of energy. You decide to take control of your career, enter a new industry, and prepare to get your first clients.

But then, life happens. The 135-hour requirement feels like Read more...

It starts with a burst of energy. You decide to take control of your career, enter a new industry, and prepare to get your first clients.

But then, life happens. The 135-hour requirement feels like a mountain. The DRE website looks like a maze of 1990s-era forms. Suddenly, six months have passed, and you haven’t even scheduled your exam.

This is the "Licensing Spiral": a cycle where administrative confusion and life interruptions kill your momentum until your goals disappear entirely.

In my 20+ years of coaching thousands of candidates at ADHI Schools, I’ve realized that failing to get licensed is rarely about a lack of intelligence. It is almost always a result of predictable, procedural friction points. If you fix the one friction point you’re stuck on, the rest becomes straightforward.

Key Takeaways

Process > Intelligence: Administrative errors kill more careers than the actual exam does.

Timelines Matter: Processing times and scheduling delays can quietly derail you.

Momentum is King: If you aren't moving forward, you are moving backward. Use the rescue checklist below to restart.

The 60-Second Licensing Map

To get your license, you must follow this exact sequence. If you are currently stalled, you are stuck at exactly one of these five steps:

Complete 135 Hours: Finish three approved college-level courses.

Apply & Schedule: Submit your Combined Exam/License Application to the DRE.

Pass the State Exam: Score 70% or better on the 150-question test.

Submit License Application: Ensure background checks and fees are finalized.

Affiliate with a Broker: Find a sponsoring broker to "activate" your license.

For a complete, step-by-step blueprint of the licensing journey, see the California Real Estate License Guide.

10 Reasons People Fail (And How to Fix Each)

1. The "Casual Study" Fallacy

The Mistake: Picking up the material only when you "have time."

The Consequence: You lose continuity and momentum, making it harder to retain complex legal concepts as you move through the modules.

Fix Today: Open your calendar and block out exactly 90 minutes for tomorrow morning. Consistency beats intensity every time.

2. Misunderstanding the Application Window

The Mistake: Waiting until you have "mastered" every page of the material before looking at the DRE application.

The Consequence: DRE processing can take weeks. Waiting to “feel like you’re ready” before applying adds a massive "dead zone" where your knowledge goes cold.

Fix Today: Understand the nuances of the timeline by reading Can You Take the Exam Before Completing All 135 Hours? to see when you should actually apply.

3. The "Name Mismatch" Error

The Mistake: Using a nickname or maiden name on your Live Scan (fingerprints) that doesn’t match your official DRE application.

The Consequence: This creates a manual "flag" in the DRE system, potentially delaying your eligibility by 30–60 days while they reconcile your files.

Fix Today: Look at your government-issued ID. Ensure every form you sign matches that ID character-for-character.

4. The Memorization Trap

The Mistake: Taking the same practice quiz 50 times until you "know the answers."

The Consequence: You aren’t learning the law; you’re learning the pattern of a quiz. When the DRE rephrases the question on exam day, you will fail.

Fix Today: Do mixed sets of questions and track wrong answers by topic. If you can’t explain the logic of the correct answer out loud, you don’t know it yet.

5. The "Post-Pass" Momentum Kill

The Mistake: Celebrating the passing score but failing to file the final paperwork or pay the licensing fees.

The Consequence: Your passing score has an expiration date. If you don't file the application for your license promptly, you will have to retake the entire state exam.

Fix Today: Decide whether you are going inactive vs. active, and complete the post-pass steps immediately. Follow our guide on What Happens After You Get Your California Real Estate License? to ensure you cross the finish line.

6. Paralysis by Analysis (The Research Trap)

The Mistake: Spending weeks in online forums asking "Which school is best?" instead of starting.

The Consequence: Research is often just a sophisticated form of procrastination used to mask the fear of starting a new career.

Fix Today: Start with ADHI Schools—ideally today—and finish Lesson 1 of your first course. Clarity comes from action.

7. Distraction by Brokerage Interviews

The Mistake: Interviewing 10 different brokerages before you even have an exam date.

The Consequence: You are focusing on Step 5 when you are still at Step 1. This drains the mental energy you need for the state exam.

Fix Today: Realize you don't need a broker to get the process started. Get the facts here: Do You Need to Join a Brokerage Before Applying for a License?

8. Underestimating Logistics & Fees

The Mistake: Failing to budget for the multi-step fee structure.

The Consequence: You pass the exam but "wait for the next paycheck" to pay the licensing fee, which turns into a multi-month delay.

Fix Today: Set aside the DRE exam/license fees plus Live Scan vendor fees now so money never becomes a stall point.

9. Trusting Forum Myths Over DRE Facts

The Mistake: Following advice from "someone on Reddit" regarding current DRE regulations.

The Consequence: Regulations change. Relying on outdated anecdotes can lead to rejected applications or missed deadlines.

Fix Today: Only trust official DRE publications or ADHI Schools that handles these filings daily.

The 10-Minute Rescue Checklist

If you are here...

Your next 60 minutes...

The Momentum Builder...

Haven't started courses

Enroll in ADHI Schools.

Complete Chapter 1 immediately.

Stuck mid-course

Audit your calendar; identify the "leak."

Block 90 mins for tomorrow; no excuses.

Finished courses, no exam date

Submit your application (eLicensing preferred).

Verify your ID name matches exactly.

Waiting for DRE processing

Establish a "Study Retention" schedule.

Keep studying 20–30 min/day to prevent decay.

Passed, but no license yet

Check your status on eLicensing.

If not a combo app, submit the license app quickly.

FAQ: Common Licensing Questions

Can I take the California real estate exam before finishing my 135 hours?

You must complete the three required courses to be eligible for an exam date. However, you can often save time by understanding exactly when to submit your application and what documentation to send so you don’t create a "dead zone" while the DRE processes your file. See our 135-hour timing guide for the specific strategy.

Do I have to use eLicensing for my application?

No, but the DRE states that eLicensing is significantly faster for processing. If you choose to use paper (Form RE 435), it must be mailed with original signatures.

What’s the most common reason people fail the California real estate exam?

Over-thinking. Candidates often try to apply "real world" logic or stories they heard from friends rather than relying on the specific legal definitions found in the textbook.

The Path Forward: Stop Stalling

Stalling is a normal part of the process, but it doesn't have to be the end of your story. The difference between a "former student" and a "top producer" is simply the willingness to fix these procedural errors and keep moving.

For the step-by-step map: Start with the California Real Estate License Guide.

For the "After-Pass" plan: Read What Happens After You Get Your California Real Estate License?

For a proven system: If you want the courses, the structure, and the veteran coaching to avoid these mistakes entirely, ADHI Schools is built for exactly that.

Let’s get to work.

|

Agency Is Where Agents Get Sued

If you ask a seasoned real estate attorney where most lawsuits begin, they won’t tell you that it’s always about a leaky roof or a cracked slab. They will tell you Read more...

Agency Is Where Agents Get Sued

If you ask a seasoned real estate attorney where most lawsuits begin, they won’t tell you that it’s always about a leaky roof or a cracked slab. They will tell you it’s about a broader concept known as "agency".

Many new licensees treat "agency" as a vocabulary word they memorized to pass the state exam, but in reality, California real estate agency relationships are the legal foundation of your entire career.

Understanding how agency fits into the broader framework of California real estate laws—like the rules we cover in our California Real Estate Laws & Compliance Guide—is an important step in a long and prosperous career. If you get agency right, you can avoid the vast majority of problems.

If you don’t, you are walking through a minefield blindfolded.

What Is “Agency” in California Real Estate?

In plain English, agency is a legal relationship where one person (the principal) authorizes another person (the agent) to act on their behalf with third parties.

In California real estate, there are three key players:

The Principal: The client (buyer or seller).

The Agent: Technically, this is the Broker under whom your license hangs.

The Third Party: The person on the other side of the deal who you don’t technically represent.

Important Concept: There is a common misconception that you—the salesperson—are the "agent." Under California law, the Broker is the agent of the principal. You are an agent of the Broker. You act on the Broker's behalf to serve the client.

How an Agency Relationship Is Created

This might sound strange, but you don’t always need a signed contract to create an agency relationship. California law recognizes several ways to create this relationship:

1. Express Agency The "typical" and safest way to create agency. The principal and agent expressly agree to the relationship, usually via a written contract.

Crucial Update: Following the August 2024 NAR Settlement, "Express Agency" is no longer just a best practice for buyers—it is the rule. You are now required to have a signed Buyer Representation Agreement before touring a home. If you unlock a door without this contract, you are starting your career non-compliant.

Scenario: A seller signs a Residential Listing Agreement authorizing you to market their home, or a buyer signs a Representation Agreement before you show them a property.

2. Implied Agency Your actions lead a person to believe you represent them, even without a written contract.

Scenario: You represent the seller, but you start giving a potential buyer negotiation advice. Your conduct leads the buyer to reasonably believe you are advocating for them, creating an implied agency.

3. Ostensible (Apparent) Agency A principal allows a third party to believe someone is their agent, even if they aren’t formally authorized.

Scenario: A landlord knows you are showing their vacant units to tenants and doesn't stop you. Because the landlord allowed this, the tenants reasonably believe you have authority to act.

4. Agency by Ratification A principal accepts the benefits of an action performed by an unauthorized agent (or an agent acting outside their authority), effectively creating the agency retroactively.

Scenario: You present an offer to a "For Sale By Owner" seller who has not hired you. The seller likes the price, accepts the offer, and agrees to pay you. By accepting the benefit of your work, the seller "ratifies" the agency relationship for that transaction.

Crucial Note: Agency is about authority and behavior, not who pays you. You can owe fiduciary duties in real estate even if you’re not getting a commission.

Types of Agency You Must Know

Seller’s Agent (Listing Agent): You represent the seller exclusively. Your goal is to get the best terms for the seller while treating the buyer honestly.

Buyer’s Agent: You represent the buyer exclusively. This protects the buyer's interests in price and terms.

Dual Agency: The same broker represents both the buyer and the seller.

The Catch: In California, the Broker is the dual agent, meaning every salesperson under that broker falls under the dual agency umbrella for that transaction.

The Rule: You must remain neutral. You cannot tell the seller the buyer will pay more, nor tell the buyer the seller will take less, without express written permission. Undisclosed dual agency is one of the fastest ways to lose your commission and face a lawsuit. Courts and the DRE view undisclosed dual agency as a serious betrayal of trust.

Exam Tip: On the California real estate exam, agency questions often focus on how these relationships are created, what fiduciary duties you owe a client, and when dual agency must be disclosed. Expect questions that test whether you understand who the broker represents and what happens when you slip into undisclosed dual agency.

Fiduciary Duties: The “OLD CAR” Framework

Once you are an agent, you owe your client fiduciary duties—the highest duties known to law. I teach students the acronym OLD CAR to remember them:

O – Obedience: You must obey lawful instructions. If the client says “no open houses,” you don’t hold open houses.

L – Loyalty: You must put the client’s interest above your own. You cannot steer a client to a house just to get a higher commission.

D – Disclosure: You must disclose all material facts affecting the property’s value or desirability.

C – Confidentiality: You must keep your client’s price, terms, and motivation private forever.

A – Accounting: You must properly handle all money and documents entrusted to you.

R – Reasonable Care: You must act with the skill of a professional. If you don’t know the answer, don’t guess.

Agency Is the Hub of Compliance

Agency doesn’t exist in a vacuum. Your status as a fiduciary connects directly to every other major compliance area. Here is what agency looks like in the real world:

Disclosure (The “D” in OLD CAR)

Because you represent the client, you are the filter for information. You must strictly follow California disclosure laws to ensure every material fact reaches the client, protecting them from bad investments and you from negligence claims.

Trust Funds (The “A” in OLD CAR)

Your fiduciary duty of accounting means you must be meticulous with money. You must avoid commingling in California real estate, which involves mixing client trust funds with your own money—a major violation that triggers immediate DRE action.

Fair Housing (Duty of Care & Obedience)

Your duty of reasonable care requires you to understand California fair housing laws. You must treat all parties fairly and never inadvertently discriminate or steer clients, as this violates both federal law and your agency responsibilities.

Advertising (Honest Representation)

Even your marketing is tied to agency. The advertising laws for California real estate agents mandate that you clearly identify your license status and brokerage so the public is never confused about who you actually represent.

Required Agency Disclosure Forms (The DEC Process)

In most one-to-four unit residential transactions, you’ll follow the DEC process to ensure compliance:

Disclose: Provide the “Disclosure Regarding Real Estate Agency Relationship” (Form AD) before you sign a listing or write an offer.

Elect: Elect who you represent in your Listing Agreement or Buyer Representation Agreement.

Confirm: Confirm that same agency relationship again in the Purchase Agreement (RPA).

The Cost of Failure: This isn’t just paperwork. If you mishandle or fail to disclose agency properly, a court can decide you’re not entitled to a commission, even if you did all the work and closed the deal. A judge will not care how hard you worked if you were not legally authorized to perform the service.

Common Agency Mistakes to Avoid

In my years of consulting, I see the same agency mistakes repeated constantly. Here is what they look like in real life:

Accidental Dual Agency: You answer detailed strategy questions from a buyer at your open house and then write the offer without clearly disclosing dual agency. If the buyer later claims you were supposed to protect them, you’re now exposed as an undisclosed dual agent, which courts and the DRE treat very harshly.

Breach of Confidentiality: You tell a buyer’s agent, “My sellers are divorcing and need to sell fast,” without authorization. You’ve just handed the other side leverage and opened the door to a claim that you sabotaged your own client’s negotiating position.

Improper Trust Fund Handling: You accept an earnest money check made out to you personally instead of the title company or broker. Handling checks this way looks like commingling and can trigger an immediate trust account audit and potential license discipline.

How to Explain Agency to a Client (Script)

New agents often struggle to explain their role. Here is a simple script you can use to explain agency to a buyer or seller in 20 seconds:

“Mr./Ms. Client, I represent you in this transaction, which means I have a legal duty to put your financial interests ahead of my own. Everything you tell me stays confidential, and I’m required to disclose any facts that affect the value of the property so you can make the best decision possible.”

Using plain language like this builds trust immediately and sets the tone for a professional relationship.

Consequences of Violating Agency Law

The stakes are high. Violating agency law can lead to:

Civil litigation - Clients suing for damages if they overpaid or undersold because you mishandled agency.

DRE discipline - Suspension or revocation of your license.

Commission forfeiture - Courts can deny you a commission if your agency was not properly disclosed, even if you closed the deal.

Agency law is learnable. If you want to see how agency fits alongside disclosure, advertising, fair housing, and trust fund rules, spend time with our California Real Estate Laws & Compliance Guide so your entire business rests on solid ground.

|

The Fastest Way to Lose Your License

Imagine this scenario: You are a broker with a busy property management division. A tenant hands you a security deposit check for $2,000. You’re in a rush, so Read more...

The Fastest Way to Lose Your License

Imagine this scenario: You are a broker with a busy property management division. A tenant hands you a security deposit check for $2,000. You’re in a rush, so you deposit it into your general business operating account, intending to transfer it to the trust account on Monday.

Even if you transfer the money on Monday morning, you have already broken the law.

In California real estate, that mistake has a name: commingling of trust funds – illegally mixing a client’s money with your own.

Mishandling of trust funds is one of the most common reasons the California Department of Real Estate (DRE) disciplines licensees.

This article is part of our California Real Estate Laws & Compliance Guide, designed to keep you safe, compliant, and in business. Let’s break down exactly what commingling is, how it differs from conversion, and how you can avoid the audit nightmares that end careers.

What Is Commingling in California Real Estate?

In California real estate, commingling is the illegal practice of mixing a client’s money (trust funds) with the broker’s or agent’s personal or general business funds.

Think of it this way: As a real estate professional, you have two distinct "pockets."

Pocket A: Your money (commissions earned, operating funds).

Pocket B: The client’s money (earnest money, rents, security deposits).

Commingling happens when you put Pocket B money into Pocket A. Even if you don't spend it, the mere act of mixing the funds is a violation of the California Business and Professions Code.

Commingling vs. Conversion

New agents often confuse these two terms. You will see this distinction on the real estate exam, so memorize it now:

Commingling (Mixing): Depositing client funds into a personal account. You haven't necessarily spent it, but you’ve mixed it with your own money.

Conversion (Essentially Theft): Actually using that client money for your own purposes (e.g., paying your car payment with a client’s earnest money).

The Golden Rule: Commingling is the gateway drug to conversion. That’s why the DRE comes down hard on commingling even when “no one got hurt.”

Trust Funds in California Real Estate (What Money Is Dangerous to Commingle?)

To avoid commingling, you must identify "Trust Funds" immediately. Trust funds are anything of value received by a broker or salesperson on behalf of a principal or another person in a transaction.

Common examples include:

Earnest money deposits from buyers.

Rents collected for landlords.

Security deposits from tenants.

Repair reserves held for property management.

Homeowner Association (HOA) dues (if managed by the broker).

Because you have a fiduciary duty to your client—a concept we dive deeper into in our California Agency Law Explained for New Agents article—you are holding this money in trust. It is not yours.

How Commingling Happens in Real Life

Often commingling isn't malicious; it’s sloppy. Here are the street-level scenarios where new agents get into trouble.

1. The "Personal App" Trap

The Scenario: A tenant wants to pay rent via Venmo or Zelle. You let them send it to your personal Venmo account, planning to write a check to the owner later.

The Violation: You have just commingled. That rent money is sitting in your personal account ecosystem.

The Fix: Never accept trust funds into a personal digital wallet. Use a designated business trust account or have the tenant pay the landlord directly.

2. The "Desk Drawer" Deposit

The Scenario: You get an earnest money check on Friday. You leave it in your desk drawer over the weekend and forget about it until the following Thursday. You realize you’re late, so you deposit it into your personal account just to "get it in the bank."

The Violation: Leaving the check in your desk that long is mishandling trust funds. But if you then panic and deposit it into your personal account, you’ve now committed commingling – which is far more serious.

The Fix: Deposit funds immediately (usually within 3 business days) into the proper trust account or escrow.

3. The "Short-Term Loan"

The Scenario: Your business account is short $500 for a marketing bill. You "borrow" $500 from the trust account, knowing you have a commission check coming tomorrow to replace it.

The Violation: This is conversion (theft), fueled by commingling.

The Fix: Never, ever touch trust funds for operating expenses.

Transparency is key here. Just as you must follow California Disclosure Laws (Complete Breakdown) regarding property defects, you must be transparent about where the money is going.

DRE Rules, Audits & Consequences

The California DRE has the power to audit your books at any time. They do not need a warrant; your license grants them that right.

What Triggers an Audit?

Consumer Complaints: A client feels their money was mishandled.