Key Takeaways:

DRE Approval is the Standard: If a provider is not approved by the California Department of Real Estate (DRE), your coursework will not be accepted for the state exam.

Verify Both Read more...

Key Takeaways:

DRE Approval is the Standard: If a provider is not approved by the California Department of Real Estate (DRE), your coursework will not be accepted for the state exam.

Verify Both Sponsor and Course: A school must have an active sponsor ID, and the specific course you take must be listed as an approved statutory offering. This typically starts with the letter “S”. ADHI Schools is S0348, for example.

Check the Payment Source: The company you pay should match the name on the official DRE listing to avoid lead-generation traps.

The “Cost of Getting Fooled”

For most California real estate license hopefuls, the goal is simple: get licensed as quickly and efficiently as possible. However, in the rush to start a new career, students can fall into the trap of enrolling in programs that lack the proper state-mandated credentials.

The "cost" of choosing a non-DRE-approved provider isn't just the registration fee—it's the weeks, or even months, of wasted time and the frustration of having your state application delayed or rejected if the certificates don’t qualify. In my 20+ years of helping California students navigate licensing requirements, I have seen far too many people forced to start from scratch because they missed one simple verification step.

How do I avoid non-DRE-approved real estate schools in California?

To avoid unapproved schools, verify the provider’s 4-digit DRE sponsor ID and specific course listing on the official DRE Statutory Course Search Page. Ensure the course titles match the DRE’s list of approved statutory courses (Principles, Practice, and an elective). Avoid any provider that uses vague terms like "state-aligned" without providing a specific DRE sponsor number.

Define the Real Risk (Without Speculation)

It is important to distinguish between a program that is "legal" and one that is "DRE-approved" for pre-licensing credit. For example, a general real estate investing course can be legitimate education, but it won’t satisfy the DRE’s statutory pre-licensing requirements.

Marketing vs. Approval

A company may have a professional website and high-production videos, but unless they are a DRE-approved statutory course provider, they cannot issue the certificates you need. In California, what matters is whether the sponsor and the specific statutory course are listed as DRE-approved. Once you confirm a provider is approved, online reviews for real estate schools become the next tool for judging actual support quality and course usability.

Exam Prep vs. Pre-licensing Credit

"Exam Prep" consists of practice questions designed to help you pass the test. "Pre-licensing" consists of the 135 hours of mandated education. If you just purchase a "Crash Course" thinking it satisfies the 135-hour requirement, your application may be rejected or delayed by the DRE.

The 5-Step Verification Checklist

Here’s the exact 5-step workflow I recommend students run before paying:

Verify the Sponsor and Course Listing: Use the official DRE Statutory Course Lookup. Search by the school name or Sponsor ID and ensure the specific course you are buying appears in their approved list.

What to screenshot/save: The Sponsor ID, the specific Course Title, the Course Category (Principles/Practice/Elective), and a screenshot of the DRE listing page.

Confirm the Course Category: Ensure the school offers the "Big Three": Real Estate Principles, Real Estate Practice, and a DRE-approved elective. Using a guide on how to know if a real estate school is legit in California can help you cross-reference these requirements.

Check for Pacing Requirements: DRE-approved programs enforce minimum completion-time requirements. If a provider promises you can finish all three courses in a single weekend, treat it as a major warning sign and verify their approval status in writing.

Review Expiration Policies: Does the course expire in 6 months? 12? Reputable providers typically publish clear terms regarding course access and extensions. You can find more on this in our guide on Red Flags When Choosing a Real Estate School.

Test the Support System: Call the school or use their live chat. Ask them to email you their DRE Sponsor ID and confirm the exact course title you are buying matches the DRE listing. If they cannot provide this in writing, it is difficult to verify their legitimacy.

Common Risk Signals & Misleading Patterns

You don’t need to guess if a school is legitimate. Look for these evidence-based patterns that often indicate a program may not be authorized to provide credit:

Vague Regulatory Language: Watch out for phrases like "Accepted nationwide" or "Curriculum based on California standards." Verification should always come from the DRE database, not marketing copy.

Missing Transparency: Reputable providers typically publish clear refund policies, identity verification procedures, and physical contact information. If these are missing, treat the provider as not verified.

The Payment Test: Make sure the company collecting your payment is the same sponsor shown on the DRE listing. Some websites are prep-only or lead-generation pages that can be mistaken for course providers.

What to Do If You Already Paid or Started

If you suspect your school might not be approved, take these practical steps:

Verify Immediately: Stop your studies and check the DRE database using the direct link provided above.

Request Identifiers: Email the school and ask for their DRE Sponsor ID and the exact approved course titles as they appear on the DRE website.

Evaluate the Trade-off: Sometimes it is better to pivot early than to finish a course only to have your application rejected. Understanding why DRE accreditation matters more than online reviews can help you realize that a non-approved course is actually the most expensive option because it provides no legal value.

FAQ

How do I check if a real estate school is DRE-approved in California?

Visit the official DRE Statutory Course Lookup and search by the school’s name or 4-digit Sponsor ID.

Are there lookalike real estate schools online?

Yes. Some websites are prep-only or lead-generation pages that can be mistaken for course providers.

Does ‘exam prep’ count for DRE credit?

No. Real estate exam prep is a study tool. You must still complete 135 hours of statutory education from an approved provider.

If a school is popular, does that mean it’s approved?

Not necessarily. Marketing reach does not equal approval. Always verify the DRE Sponsor ID before enrolling.

Do reviews matter if a school is approved?

Yes. Approval proves the school is legal; reviews prove the school is effective. Use both to make your decision.

What matters more: reviews or accreditation?

Accreditation (DRE Approval) is the "pass/fail" gate. Without it, reviews are irrelevant because the school cannot help you qualify for the exam.

Choosing the Right Path

Confirming that a school is legitimate is just the first step. Once you’ve filtered out non-approved providers, your goal shifts to finding a program that fits your learning style, timeline, and support needs.

DRE approval is the baseline—but the quality of instructors and the depth of materials are what determine your success on exam day. To see how the top-tier providers compare once you've done your due diligence, view our full breakdown of the Best Real Estate Schools in California.

|

If you are researching your next career move at 11:00 PM after a long shift or while the kids are finally asleep, you probably have one burning question:

Can you get a California real Read more...

If you are researching your next career move at 11:00 PM after a long shift or while the kids are finally asleep, you probably have one burning question:

Can you get a California real estate license online?

The short answer is: Mostly, but not entirely.

While the California Department of Real Estate (DRE) has embraced digital transformation—allowing you to complete your education and submit your paperwork from your couch—there are still physical "gatekeepers" that require you to show up in person.

The Reality Check: Online vs. In-Person

What You CAN Do Online

What You MUST Do In Person

Complete all 135 hours of pre-licensing courses.

Sit for the actual State Exam at a DRE exam center.

Submit your application via eLicensing.

Get your Live Scan (digital) fingerprints taken.

Pay your application and license fees.

Present valid government-issued photo ID.

Manage your license renewals later on.

Physically attend the testing center.

The Bottom Line: You can complete 100% of your required education online, but the State of California requires you to physically appear for your exam and your background check. It is important to check the fine print: while the "schooling" is digital, the "licensing" still has a few real-world milestones.

Defining "Online" in the California Licensing Process

When people ask about getting a California real estate license online, they are usually referring to the flexibility of the curriculum. In California, you are required to complete three college-level courses: Real Estate Principles, Real Estate Practice, and one elective.

At ADHI Schools, we’ve spent over 20 years helping students navigate this. We know that for a busy professional, the ability to take online real estate courses in California is the difference between starting a career and just dreaming about one.

However, the "license" itself isn't a digital download. It is a credential granted by the state after you prove your knowledge in a proctored, high-security environment.

The 18-Day Regulatory Rule For Coursework

In California, DRE regulations specify that a student must spend a minimum amount of time with their course materials before they are eligible to take a final exam. This is typically implemented as a seat-time requirement of 18 days per course. Because you must take three courses, your total minimum education time is 54 days—a timeline that applies even if you are the fastest reader in the state.

Step-by-Step: What Parts Can Be Done Online?

To help you plan, here is the numbered flow of the licensing process, showing exactly where the "online" part ends and the "real world" begins.

Pre-Licensing Education (Online): Complete your three courses (Real Estate Principles, Practice, and an elective). This takes a minimum of 54 days due to mandated study timers.

Application Submission (Online): Use the DRE eLicensing system to submit your combined Exam/License application.

Live Scan Fingerprints (In Person): You must visit a Live Scan provider to have your fingerprints electronically transmitted to the DOJ and FBI.

The State Exam (In Person): Once your application is processed, you will schedule a date to visit one of the five DRE testing centers (Sacramento, Oakland, Fresno, La Palma, or San Diego).

License Issuance (Digital/Mail): Once you pass, the DRE processes your results. You can often see your license number online before the paper certificate even arrives.

What Must Be Done In Person (And Why)

The DRE takes the integrity of the real estate profession seriously. The reasons you can't do it all from a laptop come down to two things:

Security and Compliance.

Exam Integrity: To prevent cheating and ensure that the person taking the test is actually the applicant, exams are held in monitored facilities where phones and notes are prohibited.

Identity Verification: Live Scan fingerprinting ensures that your criminal background check is tied to your actual identity, which requires a physical "chain of custody" at a licensed provider.

Expert Tip: If you’re in a rush, you’ll want to look into the fastest way to get a real estate license in California.

Timeline Planning

If you are trying to map out your calendar, your "online" progress is the most predictable part of the journey. Once you move into the "in-person" phase, you are at the mercy of DRE processing times and exam seat availability.

For most students, a realistic schedule involves finishing the online coursework while simultaneously preparing their paperwork. For a detailed breakdown of these phases, check out our California real estate license timeline. If you're wondering how those months look on a week-to-week basis, read our deep dive on how long it takes to become a real estate agent in CA.

Cost & Convenience Reality Check

While you save time and gas money by choosing to get a real estate license online in California, you still need to budget for the state-mandated fees.

As of 2026, the DRE fee for a salesperson exam is $100, and the original license fee is $350, totaling $450 paid directly to the state. Additionally, you will need to account for Live Scan fingerprinting. This involves a $49 state processing fee, plus a "rolling fee" charged by the private provider (typically $30–$45).

For a full breakdown of every nickel and dime, see our guide on how much it costs to get a real estate license in California.

Common Misconceptions

"I can take the state exam from home." No. You must travel to a DRE-approved testing site.

"Online courses are instant." No. California law requires you to spend a minimum amount of time with the material (typically 18 days per course).

"Once I finish courses, my license is automatic." No. Finishing courses only makes you eligible to apply for the state exam.

"Online = instant approval." Even if you submit online, the DRE may take several weeks to review your file and authorize you to test.

FAQ Section

Can I take the California real estate exam online from home?

No. The California State Exam must be taken in person at one of the Department of Real Estate’s designated testing centers to ensure exam security.

Can I complete the required real estate courses online?

Yes. You can complete all 135 hours of required pre-licensing education (Principles, Practice, and an elective) through an approved online provider like ADHI Schools.

Do I have to do Live Scan in person?

Yes. Live Scan requires a physical scan of your fingerprints by a certified technician at a licensed provider. This cannot be done via a smartphone or home scanner.

How long does it take if I do everything possible online?

Most students finish in 3 to 5 months. This accounts for the 54-day mandatory study period and current DRE administrative processing times.

What is the fastest way to get licensed in California?

The fastest route is to submit a "Combined" Exam and License application and complete your Live Scan immediately after finishing your online courses to avoid "dead time" while waiting for your test date.

How much does it cost to get licensed in California?

You should budget roughly $600 to $1,100 total. This includes your online course tuition, the $450 in DRE exam and license fees, and your Live Scan fingerprinting costs.

What is the most common reason people get delayed?

The most common delay is waiting to schedule the state exam. If you wait until after your courses are finished to start your DRE application, you may find yourself in a weeks-long queue for a testing seat.

Ready to Start Your Journey?

The road to a new career starts with the right map. While you can't do everything online, choosing a flexible, high-quality online education provider is the best way to maintain your current lifestyle while building a new one.

For a comprehensive look at the entire process, visit our California Real Estate License Guide.

|

Real Estate Compliance: Systems Over Luck

In my 20-plus years of educating California real estate professionals, I’ve seen thousands of agents move through the industry. Often what I notice is the ones Read more...

Real Estate Compliance: Systems Over Luck

In my 20-plus years of educating California real estate professionals, I’ve seen thousands of agents move through the industry. Often what I notice is the ones who stay out of trouble aren't necessarily the ones who memorized the entire Business and Professions Code; they are often the ones with consistent systems.

Most California DRE violations aren't the result of "bad" people doing "bad" things. They are the result of "busy" people doing "sloppy" things. The Department of Real Estate (DRE) is a consumer protection agency. Their job is to ensure the public is protected, and they do that by enforcing transparency, supervision, and documentation.

If you treat compliance as a "to-do" list rather than a "worry" list, you’ll find that the DRE isn't something to fear—it’s just the framework of your business.

What "A Violation" Means in Practice

A violation isn't always a dramatic headline. In the real world, enforcement is usually triggered by small, preventable issues that accumulate into compliance problems.

Complaint-Driven: A disgruntled client or a competing agent flags an ad or a missing disclosure.

Visibility Issues: When a yard sign or social media profile is missing key details, it becomes an easy target for a random inquiry or a complaint from the public.

Audit Triggers: The DRE performs audits of brokerages, including Investigative Audits (prompted by complaints) and Proactive Audits (routine checks, often targeting high-risk activities like property management).

Documentation Gaps: Most discipline stems from what is missing—a signature, a date, or a record of a deposit.

The DRE focuses on patterns of neglect. One typo on a flyer might result in a warning or a minor administrative penalty; a team of ten agents all advertising without license numbers suggests a broader failure of supervision.

The Top Common DRE Violation Categories

1. Advertising & Marketing Compliance

What it looks like: Business cards, yard signs, or Instagram posts that look "clean" but omit the required license information.

The trigger: Public visibility. A "For Sale" sign or a digital ad without the agent's DRE number is easily flagged by the public or competing brokers.

How to avoid it: Every piece of "first point of contact" material must have your license number and your broker's name. Review our guide on Real Estate Advertising With Your License Number for specific visibility and legibility rules.

Quick self-check:

Does my IG bio have my DRE # and Broker name?

Is my license number as prominent as the other contact info?

2. Trust Fund Mishandling

What it looks like: An agent receives an Earnest Money Deposit (EMD) check and keeps it in their car for a few days before handing it over.

The trigger: Delays in depositing or recording funds. If money isn't handled correctly, it raises flags for "commingling" or, in extreme cases, "conversion."

How to avoid it: Per B&P §10145 and Reg 2832, a broker must generally deposit trust funds within three business days following receipt. As a salesperson, you must deliver funds to your broker or escrow immediately.Refer to Trust Fund Handling Rules for California Agents for timing nuances.

Quick self-check:

Did I deliver this check the same day I received it?

3. Team Name & DBA Misuse

What it looks like: "The Premier Group" appears on a yard sign, but that name has not been submitted to and approved by the DRE as a DBA.

The trigger: Advertising under a business name not listed on the license. Audits specifically check for DBA approval.

How to avoid it:Any name used in your real estate business that is not your exact personal license name is a DBA and must be pre-approved by the DRE. To be approved, a DBA typically must include the surname of a licensee (e.g., broker or salesperson) and often uses a descriptor like "& Associates," "Group," or "Team." It cannot sound like a separate corporate entity (e.g., "Inc.," "Realty," "Properties" alone). You must have the DRE's approval letter on file before using the name.

4. Inadequate Supervision

What it looks like: A broker has 50 agents but hasn’t reviewed a transaction file in months.

The trigger: An agent makes a mistake, and the DRE discovers the broker had no oversight system.

How to avoid it: Brokers must establish written policies and review points. Agents must follow SOPs for every document.

Quick self-check:

Has my broker or manager looked over the mandatory documents in this active file?

5. Unverified Claims & Misrepresentation

What it looks like: Advertising "brand new electrical" without verification, or claiming "#1 Agent in the City" without citing a source.

The trigger: A buyer relies on an unverified claim (B&P §10140) that turns out false.

How to avoid it: Stick to the facts. If you can't verify it with a permit or a receipt, use qualifiers like "per seller" and cite the source for any "ranking" claims.

Quick self-check:

Can I prove this statement if an auditor asks for the source?

6. Transaction File Gaps (Completeness)

What it looks like: A file is "closed" but missing signatures or dates.

The trigger: Audit finds documents legally incomplete.

How to avoid it: Use a closing checklist. Do not move a file to "completed" until every required field is populated.

Quick self-check:

Is every "Initial Here" box actually initialed and dated?

7. Record Retention Failures

What it looks like: A transaction closed three years ago, but the agent deleted the emails and cannot produce the file.

The trigger: Audit requests a file from the previous three years.

How to avoid it: Per B&P §10148, you must retain transaction records for at least three years from the date of closing (or the listing date if the deal fell through). This includes listings, deposit receipts, and all substantive correspondence.

Quick self-check:

If the DRE asked for a file from three years ago today, could I produce it?

8. Unlicensed Activity

What it looks like: An unlicensed assistant "hosting" an open house and answering questions about property features.

The trigger: A client mentions the assistant discussed property features or terms.

How to avoid it:Know the line. Assistants can handle clerical tasks, schedule appointments, and courier documents, but they cannot show properties or negotiate terms. See What the California DRE Actually Enforces.

Quick self-check:

Am I letting an unlicensed person discuss price or property features with a client?

9. Fair Housing Advertising Violations

What it looks like: Using phrases like "adults only" or "perfect for young families."

The trigger: Advertising that indicates preference or limitation based on protected classes.

How to avoid it: Focus strictly on the property’s features, not the type of person you think should live there. Avoid references to neighborhood demographics or religious facilities.

Quick self-check:

Does my ad describe the house or the person I want to buy the house?

The Compliance Operating System

You don't need to be a lawyer to stay compliant. You just need a framework.

Standardized Templates: Use your association's (C.A.R.) forms. Don't draft your own "mini-contracts."

The Transaction Checklist: Use a "master list" for every file. If a signature is missing, the file isn't "done."

Weekly Compliance Habit: Spend 15 minutes every Friday reviewing your active ads and digital profiles to ensure DRE #s are visible.

The "Stop Sign" Rule: If a client asks you to do something that feels "grey" (like skipping a disclosure), stop and call your broker immediately.

Quick Compliance Checklist (Screenshot This)

License #: On every email, business card, and social profile.

Broker Name: Clearly visible on all marketing.

Trust Funds: Handed off to broker/escrow immediately (Salesperson) or deposited within 3 business days (Broker).

DBA: Team name is DRE-approved and includes required suffixes (Team/Group).

Disclosures: Provided to the buyer as early as possible.

File Completeness: Every signature, initial, and date is present.

Retention: All records stored securely for a minimum of 3 years (§10148).

Unlicensed Staff: Limited to administrative, non-licensed tasks only.

Supervision: Broker has established review points for all contracts.

Fair Housing: All advertising language focuses on property features, not people.

FAQs

What does the DRE actually enforce most often?

The DRE frequently cites issues related to trust fund mishandling, failure to supervise, and misrepresentation of material facts.

What triggers a DRE investigation?

Most investigations are reactive, triggered by consumer complaints or issues found during routine proactive office audits.

Can a first-time mistake get me disciplined?

Yes. While the DRE may issue a warning for minor technicalities, any violation of the Real Estate Law can lead to administrative penalties, license restriction, or suspension.

What’s the fastest way to clean up my advertising compliance?

Audit your social media "Linktree" and bio. Ensure your DRE number and broker’s name are visible without needing to click deep into your profile.

How long should I keep transaction records?

Per B&P §10148, you must keep records for at least three years. However, many brokerages require longer retention (5–7 years) for liability protection. Always follow your broker’s specific policy.

Stay Protected with the Master Guide

Compliance isn’t a personality trait; it’s a system you build into your business. By following these steps, you protect your license, your broker, and your clients. For a deeper dive into the specific statutes and requirements, visit our California Real Estate Laws & Compliance Guide.

|

Choosing a real estate school can feel like a high-stakes decision because in some ways it is. You are investing your time, money, and career aspirations into a regulated process.

Naturally, most Read more...

Choosing a real estate school can feel like a high-stakes decision because in some ways it is. You are investing your time, money, and career aspirations into a regulated process.

Naturally, most students turn to the digital "safety net": online reviews.

Reviews feel like certainty in an uncertain process. However, in professional licensing, a high star rating doesn't always translate to a smooth path to a license. Understanding how to weigh student feedback against regulatory facts is the difference between starting your career on time or getting stuck in a cycle of hidden fees and technical hurdles.

How important are reviews when choosing a real estate school?

Online reviews are a valuable secondary tool for evaluating student support and platform usability, but they should never be your primary filter. Reviews help you predict the student experience; DRE legitimacy predicts whether your effort produces a certificate accepted by the state. Always verify a school’s DRE approval and specific provider policies before relying on a star rating.

The Right Way to Use Reviews: "Triangulation"

In over 20 years of helping California students, I’ve seen a recurring pattern: students choose a school based on a high star rating, only to realize the "support" mentioned in ratings doesn't exist when they actually need help.

Instead of looking at reviews first, use a triangulation method:

Legitimacy First: Verify the school is currently on the DRE’s approved provider list. (Always verify directly on the DRE website, not from a third-party review profile.)

Fit Second: Ensure the format (live vs. online) matches your learning style.

Verification Third: Check the school’s specific terms regarding refunds, extensions, and certificate delivery—ask about typical turnaround times for certificates.

Reviews Last: Use student feedback to look for patterns that confirm or contradict the first three steps.

Before you trust a star rating, it is essential to understand how to know if a real estate school is legit in California.

High-Signal Categories: What to Actually Look For

When scanning student feedback, look for "Signal" reviews that mention specific operational details:

Support Responsiveness

Look for mentions of problem resolution, not just friendliness. Does the reviewer mention how long it took to get a response? You will have questions about certificates or exam applications; you need a school that provides more than just automated "ticket loops."

Provider Pacing Restrictions

Provider pacing restrictions are platform rules that limit how quickly you can progress—even if you are ready—such as cooldown periods, minimum intervals between module exams, or capped progress. Look for reviews that mention being "stuck" or unable to progress at a natural speed due to these platform-imposed caps.

Certificate Issuance and Turnaround

You cannot apply for the state exam without your completion certificates. Feedback mentioning delays in certificate processing is a high-signal warning of administrative friction that could delay your career by weeks.

Platform Reliability and Content Freshness

Look for mentions of whether the material feels current. This is one of the red flags when choosing a real estate school that impacts your actual learning.

Where Reviews Mislead: The "Expectation Gap"

Online feedback often contains "noise" that can lead you toward a poor decision.

The Exam Prep Mismatch: A student might hit a school with a negative review because they struggled with the state exam. It is vital to remember that pre-licensing education is not necessarily the same as exam readiness. A pre-licensing course fulfills legal education requirements; exam readiness depends on how you study and retain information under timed conditions.

The "Price Emotion" Trap: Low-cost providers often have high review volumes because people feel they "got a deal." However, "cheap" often comes with hidden costs like $50 extension fees or non-existent support.

The Campaign Effect: If you notice a sudden burst of reviews, treat it as a data point to investigate rather than assuming manipulation. Bursts can happen for innocent reasons—such as a new platform launch or a graduation cycle—so look for specifics in those ratings to see if they align with your needs.

The "3 Filters" for Evaluating Student Feedback

To find the truth in the comments section, apply these three filters:

Specificity: Does the review mention a specific process (e.g., "The refund took 3 days" or "The instructor answered my question about Disclosure laws")?

Recency: Is the feedback from the last 90–180 days? Real estate platforms and support teams change frequently.

Repetition: Is the same issue—such as a specific technical bug or a delay in certificates—mentioned by multiple unrelated reviewers?

Using these filters helps you avoid fake or unaccredited CA real estate schools that may use volume to mask poor service.

The Hierarchy: DRE Approval Outranks Popularity

In California, you are buying a certificate of completion that the DRE must accept. If a school has 10,000 five-star reviews but their provider identity is unclear or they aren't on the DRE’s current list, those reviews are irrelevant to your licensing outcome.

This is why DRE accreditation matters more than online reviews. You are managing "license risk"—the risk that your time and money won't result in a license. A legitimate school will always prioritize DRE compliance over appearing popular. For a deeper dive, see our guide on why DRE accreditation matters more than online reviews.

Checklist: How to Read Reviews Fast

Sort by "Most Recent": Is the platform and support currently functional?

Search Within Reviews: Use "Find" to search for keywords like refund, extension, support, phone, and certificate.

Verify the Provider: Ensure the school name on the review site matches the name on the DRE’s approved provider list.

Identify Throttles: Do students complain about being unable to finish the course due to "forced wait times" or pacing caps?

Check for CA Relevance: Ensure the reviewers are taking the California-specific curriculum.

Frequently Asked Questions

Are online reviews reliable for choosing a real estate school in California?

Reviews are reliable for gauging student support and platform usability, but they do not guarantee a school's legitimacy. Always use them as secondary evidence alongside a DRE approval check.

What matters more: online reviews or DRE approval?

DRE approval is non-negotiable. Without it, your certificates are not valid for licensing. Reviews only tell you how pleasant (or difficult) the process of obtaining those certificates might be.

How can I spot “provider pacing restrictions” in reviews?

Look for complaints about "wait times," "cooldowns," or being "locked out" of the next chapter. These reviews indicate the school has platform-imposed limits on how quickly you can study.

Do negative reviews mean a real estate school is bad?

Not necessarily. Many negative reviews stem from an "expectation gap" where students confuse pre-license education with state exam prep. Focus on reviews that mention technical failures or poor support.

Making a Grounded Decision

Reviews are a tool, but they aren't the blueprint. Your goal is to find a school that is transparent about its policies, responsive to your needs, and strictly compliant with California law.

Want a step-by-step framework to choose your school confidently?

Use the full evaluation system here: Best Real Estate Schools in California

|

Seeing the word "PASS" after you leave the Department of Real Estate (DRE) testing center is a massive milestone. You’ve successfully navigated the 150-question hurdle that stalls thousands of aspiring Read more...

Seeing the word "PASS" after you leave the Department of Real Estate (DRE) testing center is a massive milestone. You’ve successfully navigated the 150-question hurdle that stalls thousands of aspiring agents every year.

However, after over 20 years of preparing candidates for this moment, the most important truth I can share is this:

Passing the real estate exam is the end of your studies, but it is only the beginning of the licensing process. Understanding exactly what happens after you pass the CA real estate exam is critical to ensuring you don’t get stuck in a months-long "administrative gap" caused by paperwork errors or timing mistakes.

The Big Distinction: "Pass" vs. "License Issued"

A common mistake new candidates make is assuming they can hit the ground running the second they walk out of the testing center.

The Professional Reality: You do not have a license yet; you have a passing score. You cannot legally perform any activities that require a license—including representing yourself as a licensed salesperson to the public—until the DRE officially issues your license number and your status reflects as "Licensed" in their public database and your license is placed with a broker.

Consider this scenario: A candidate passes on Tuesday, celebrates on social media by calling themselves a "licensed agent," and begins soliciting clients on Wednesday. Because their license hasn't been officially issued, they are technically practicing without a license, which can lead to disciplinary action before their career even begins.

Two Common Paths After You Pass

Your next steps depend entirely on which application path you chose at the beginning of this journey.

Path 1: Exam + License Combo Applicants

If you filed the ,b>Salesperson Exam/License Application (RE 435) and paid both fees upfront, your path is generally the most streamlined.

What Happens Now: The DRE already has your intent to be licensed. Once your passing score is uploaded (usually within a few business days), they move straight to your background check and licensee issuance.

Your Move: Check if your license was issued here. This path is often the fastest when your file is clean and your fingerprints clear quickly.

Path 2: Exam-Only Applicants

If you only applied to take the test using form RE 400A, the DRE has no record of your license application yet.

What Happens Now: You must log into the DRE eLicensing system to download the Salesperson License Application (RE 202). You have exactly one year from your pass date to submit this application; if you miss that window, you must retake the exam - This is one of many reasons ADHI Schools recommends the combo exam/license application.

Your Move: This form must be submitted along with your Live Scan Service Request (RE 237) and the required licensing fee. Follow the DRE instructions for the current submission method (mail or other accepted electronic methods).

Decision Helper: Which path did I choose?

If you paid $450 in DRE fees up front, you are likely a "Combo" applicant. If you only paid the $100 exam fee and never submitted license materials, you are "Exam-Only." You can verify your application history by logging into your DRE eLicensing profile.

The Post-Pass Checklist: Actionable Steps to Your License

To avoid the "delay cycle," follow this checklist with the precision of a professional agent.

Verify Your Identity Consistency: Ensure the name on your application matches your government-issued ID exactly. For a refresher on why name matching is vital for identity consistency, see our guide on Identification Requirements for the CA Exam.

Access Forms via eLicensing: Use the DRE’s eLicensing portal to download your RE 202 (if applicable) and to track your status. Ensure you follow all current DRE instructions for how to submit these documents once completed.

Handle the Live Scan: If you haven't completed your fingerprints, do so immediately. The DRE cannot issue a license until they receive fingerprint responses from the DOJ and FBI.

Secure Your Sponsoring Broker: While the DRE can issue your license as Licensed NBA (No Broker Affiliation), you cannot perform licensed acts or earn commissions until you are affiliated with a responsible broker.

Maintain Professional Standards: Exam-day policies are strict, and the licensing process is strict too—don’t treat either casually. Refer to the California Real Estate Exam Rules & Testing Policies to remember the level of discipline the DRE expects from its applicants.

How Long Does It Take After Passing?

Processing times for after passing the California real estate exam fluctuate based on the DRE’s current volume. The DRE regularly updates their processing timeframes on their website, showing the "as of" dates for the applications they are currently reviewing.

Reviewable files (no missing signatures, correct fees, clear fingerprints) move through the system as soon as they are reached in the queue.

Deficient files (missing initials, mismatched names, or incorrect fees) are sent back to the applicant, which can add significant delays to the timeline.

To speed up the process:

Use the exact, current fee amount

Keep a copy of your Live Scan RE 237 with your ATI number to prove the fingerprints were transmitted.

Ensure all required signatures—including your sponsoring broker’s—are in the correct boxes.

If Something Goes Wrong: The Two Failure Modes

Even after passing, two common issues can stall your career:

The Administrative Loop: This is usually caused by sloppy paperwork. Revisit our list of What to Bring to the California Real Estate Exam as a reminder that professional success always starts with meticulous documentation and clean logistics.

The Support Gap: If you have colleagues who didn't make it this time, they may need to review our guide on What Happens If You Fail the CA Real Estate Exam to help them plan their retake.

Pro-Level Guidance: Think Like a Professional Already

The transition from "student" to "licensee" is your first official real estate transaction. Success in this business depends on paperwork discipline and responsiveness.

Be Meticulous: Real estate is a game of contracts. Treat your RE 202 with the same care you would a million-dollar purchase agreement.

Be Proactive: Check eLicensing regularly to see if your license number has been generated.

Build Habits Early: Use this waiting period to interview brokers and set up your business foundation.

FAQ: Post-Exam Essentials

How long after passing the CA real estate exam do I get my license?

It varies based on the DRE's current queue. "Combo" applicants often see results faster, but separate applications generally take several weeks for processing and background clearance.

Can I work as an agent after I pass the exam?

No. You cannot legally perform any acts requiring a license until your status is officially "Licensed" in the DRE database and you are working under a broker.

What if my name doesn’t match my documents?

This will cause an administrative delay. The DRE requires your legal name to be consistent across your ID, exam record, and background check.

What’s the difference between passing and getting a license issued?

Passing means you've met the testing requirement. "Issued" means the DRE has verified your application, fees, and background, granting you the legal authority to practice.

Your Next Step

Your journey to a successful real estate career is just beginning. To ensure you stay on the right track and avoid common pitfalls, bookmark our master guide:

California Real Estate Exam Guide

|

You’ve seen the word "PASS" on the screen at the exam center. It is a massive milestone, but it is important to understand one thing immediately:

Passing the real estate exam is not the same as having Read more...

You’ve seen the word "PASS" on the screen at the exam center. It is a massive milestone, but it is important to understand one thing immediately:

Passing the real estate exam is not the same as having a license issued.

Until the California Department of Real Estate (DRE) processes your formal application and issues a license number, you cannot legally perform acts requiring a license or collect a commission. This is the final administrative step between passing and practicing, and navigating it correctly prevents administrative delays that can push back your start date in the market.

ADHI Schools typically recommends the DRE Exam/License Combo application for speed. While it requires paying both the exam and license fees upfront, it often reduces the back-and-forth after you pass and helps you move from ‘passed’ to ‘license issued’ faster. That said, many applicants don’t choose the combo (or aren’t sure which path they’re on), so this guide walks you through exactly what to do after passing—step by step.

Quick Summary

Determine your path: Confirm if you filed a "Combo" or "Exam Only" application via eLicensing.

Background clearance: Ensure your Live Scan fingerprints are submitted; issuance is gated by the DRE's receipt and screening of DOJ/FBI reports.

Documentation: Submit the appropriate application and the required $350 fee (if not already paid).

Activation: Decide whether you’ll issue as "Inactive" or "Active" with an employing broker.

Verification: Check your status and Current Processing Timeframes on the official DRE website.

The 60-Second Post-Pass Checklist

Verify Exam Status: Confirm "Pass" reflects in your eLicensing account.

Check Application Type: If you filed the Combo, track your status—do not submit a second application.

Live Scan: Have you performed your fingerprints?

Broker Info: Do you have your employing broker’s license number? (Optional for issuance, required for "Active" status).

Form Accuracy: Ensure your name matches your government ID exactly to avoid identity mismatches.

Step 1: Identify Which Path You’re On

Before you fill out new forms, you must know if the DRE already has your license application.

If you...

Your Path is...

Your Next Move...

Paid the $450 combo fee

Combo Application

Monitor eLicensing. Ensure Live Scan is done.

Paid the exam fee only

Post-Pass Path

Submit Salesperson License Application + $350 fee.

If you are unsure which path you followed, review your initial How to Apply for the California Real Estate Exam steps or check your payment history in eLicensing.

Operator Tip: If you’re unsure, check your eLicensing payment and application history before submitting anything new—duplicate filings can slow the review process.

Step 2: Complete the Application Correctly

If you are on the "Post-Pass" path, you must submit the Salesperson License Application (RE 202).

Name Consistency: Use your legal name exactly as it appears on your ID.

Disclosure Accuracy: Be thorough regarding past criminal convictions or disciplinary actions. Inconsistencies here commonly trigger follow-up requests and delay issuance.

Avoid This Delay: Check the Common Mistakes Applicants Make on DRE Forms to ensure your paperwork doesn't get kicked back for a simple oversight.

Step 3: Live Scan & Background Clearance

The DRE will not issue an original license until DOJ and FBI reports are received and screened. This is often the "pending trap" where applications sit for weeks while background checks process.

The Form: Use the official Live Scan Service Request (RE 237).

The Process: Review the DRE’s Fingerprint Requirements to ensure you are using a certified provider.

Tracking: Keep your ATI number (found on the bottom of your Live Scan form) in case the DRE asks you to reference your submission.

Step 4: Fees and Document Hygiene

Fees must be exact. According to the official DRE Fee Schedule:

Salesperson Original License: $350

Salesperson Exam & License (Combo): $450

Operator Tip: Confirm the payment processed successfully and save the confirmation/receipt from eLicensing. If filing by mail, ensure you haven't missed a signature or a page. Unreadable uploads or incomplete paper packets are common "paper cuts" that add weeks to the process.

Step 5: Understanding Broker Affiliation

You can get your license number issued even if you haven't picked a company yet.

Active Status: Your employing broker provides their license number and signs your application (manually or via eLicensing).

Inactive Status: You submit the application without broker info. You will receive a license number, but you cannot legally perform real estate activities until you affiliate with an employing broker and activate your status.

What Delays Licenses (Operator Warnings)

Name Mismatch: Ensure your name on your Live Scan matches your DRE application exactly.

Missing Signatures: A single missing signature on a mail-in RE 202 will result in a deficiency letter.

Failed Payments: Always verify your transaction status in eLicensing before closing your browser.

Unreadable Uploads: Avoid blurry phone photos; use a proper scanner for all document uploads to the portal.

Real Scenarios from 20+ Years of Experience

The "Identity Mismatch" Delay: A student passed and mailed their RE 202 using a nickname. The DRE couldn't match the application to the Live Scan results (filed under a legal name), resulting in the application being set aside.

The Fix: Check your Live Scan receipt against your application before hitting "submit."

The "Sponsorship" Wait: A candidate believed they couldn't apply for their license until they were hired. They waited three weeks to even start the paperwork.

The Fix: Submit your license application immediately after passing; you can update your "employing broker" status in minutes once you make a hiring decision.

FAQ

How long after I pass does it take to get my license?

There is no "standard" time, but you can track progress via the DRE Current Timeframes page.

Do I need fingerprints if I already did Live Scan for the exam?

If the DRE already has your fingerprints on file for this application cycle, you typically don’t need to redo them.

What happens if my application is incomplete?

The DRE will notify you of the "deficiency." You will have to correct the error, which essentially puts your application at the back of the processing queue.

Can I work immediately after passing?

No. You must wait until your status shows as "Active" on the DRE Public License Lookup.

Your Next Step

Navigating the final steps of California licensing is about precision. By following this sequence, you reduce the risk of your application sitting on a desk for the wrong reasons.ADHI Schools typically recommends the DRE Exam/License Combo application for speed, but this guide ensures you can reach the finish line regardless of which path you chose.

Ready to ensure your paperwork is perfect?

Explore our California Real Estate License Guide for a complete roadmap.

|

When you begin the journey toward a California real estate license, the fear of choosing the "wrong" school is often the first hurdle. For most applicants, the natural instinct is to search for the most Read more...

When you begin the journey toward a California real estate license, the fear of choosing the "wrong" school is often the first hurdle. For most applicants, the natural instinct is to search for the most popular real estate schools in California.

I guess the logic is simple: if thousands of other students are using a specific program, it must be the “safest path” to passing the state exam.

However, in my 20+ years of helping students navigate the DRE’s 135-hour requirement, I’ve seen that popularity is often a reflection of marketing scale rather than individual student success. While high-volume schools offer certain advantages, "popular" does not always mean "best fit" for your specific learning needs or timeline.

How can I identify the most popular real estate schools?

Since the California DRE does not publicly rank schools by enrollment or pass rates, popularity is best identified through visibility signals like high search volume, large numbers of reviews on third-party platforms, and established partnerships with major brokerage firms. To find the Best Real Estate Schools in California, look past the volume and verify the school's specific support channels, course expiration policies, and the depth of their California-specific exam prep.

What Popularity Actually Signals (and What It Doesn't)

Before you enroll based on a brand name, it is important to distinguish between a school’s size and its effectiveness for your learning style.

What Popularity Signals

What Popularity Does NOT Signal

Broad Accessibility: Stable online platform and mobile app.

Individual Support: May default to automated tickets instead of live help.

Social Proof: Thousands of reviews to gauge user experience.

High Pass Rates: Large enrollment doesn’t guarantee higher exam success.

Familiarity: Frequent content on Instagram or Reddit builds recognition.

Curriculum Depth: National schools may miss California-specific law nuances.

How to Observe Popularity Signals Without a Brand List

Since enrollment data isn't public, you can verify a school’s "popular" status by looking for these three indicators:

Search Visibility: Are they consistently at the top of search results (be careful to look for "Sponsored" labels vs. organic rankings)?

Review Density: Do they have thousands of reviews on platforms like Trustpilot or Google, rather than just a few dozen?

Broker Mentions: Ask a local office manager which school they see most often on incoming certificates.

The "Fit Framework": An Operator’s Due Diligence Checklist

Instead of choosing the "biggest" school, use this checklist to verify the artifacts of a quality education. This is the same framework we use to evaluate the Best Real Estate Schools in California.

1. The Support Infrastructure

Don't just look for a "Help" button. Identify the channel :

The Test: Send an email or call the school on a Tuesday morning. Do you get a live human or a chatbot?

Instructor Access: Is there a designated time for live Q&A, or are you limited to searching a knowledge base?

2. Policy-Driven Costs (The "Expiration Trap")

Many popular, low-cost programs have rigid policies that can lead to unexpected fees:

Expiration Windows: Does the course expire in 6 months or 12?

Extension Fees: If you get busy and need another 30 days, is it a $50 fee or do you have to repurchase the entire course?

Retake Policies: If you fail a final school exam, is there a waiting period or an additional charge to retake it?

3. Seat-Time and Access Rules

Module Locking: Does the school force a specific "timer" on every page, or can you move at your own natural reading pace?

Content Freshness: Look for California-specific references. Does the material mention current CA-specific nuances?

Why Students Search for Popular Options

The 135-hour pre-licensing grind is a significant time investment. Students often gravitate toward online real estate schools in California that have high volume because they want to avoid "making a mistake."

This is especially true for those looking for the fastest way to get a real estate license in California. The logic is:"If it's popular, the system must be efficient." While often true for the tech platform, speed without comprehension can lead to multiple failed attempts at the state exam.

Two Paths: Real-World Scenarios

The Autonomous Learner: A student with a high degree of self-discipline chooses a high-volume online program. They don't need help, they never call the school, and they move through the material flawlessly. For them, popularity was a great signal for a stable platform.

The Momentum-Seeker: Another student chooses the same program but hits a point of confusion regarding Trust Fund Handling. They submit a support ticket but don't hear back for 48 hours. That delay causes them to lose momentum, and they eventually miss their 6-month completion window, resulting in a "re-enrollment fee" that makes the cheapest real estate school in California much more expensive in the long run.

Which Path Matches Your Learning Style?

"I need structure and peer interaction": Popularity in the online world doesn't replace the accountability of in-person real estate classes in California.

"I'm tech-focused and self-driven": You may find that the best online real estate schools in California offer the best mobile apps and user interfaces.

"I want the lowest entry price": You can often find the cheapest real estate schools in California among high-volume providers, provided you are confident you won't need extensions.

Common Mistakes When Choosing by Volume

1. Confusing "Top of Search" with "Top of Class"

Heavy advertising is a sign of a healthy marketing budget, not necessarily a superior educational outcome.

2. Overlooking "Generic" Content

Some national brands use "multi-state" materials. Always verify the content focuses on California-specific law and practice.

3. Assuming a "Popular" Prep is Enough

Many high-volume schools are excellent at the 135-hour requirement but provide only basic "practice questions" for the state exam. Real exam prep should include simulated exams and a targeted study plan.

Frequently Asked Questions

How do I know if a popular school is DRE-approved?

You can verify any school by searching the California DRE's searchable database of approved providers. Never enroll until you've confirmed their license status.

Are big national schools better than local California schools?

For this purpose, not really. Local California schools have more direct access to instructors who understand the specific nuances of the state exam and the licensing process in California that is unlike any other state.

Does a "popular" school have better pass rates?

There is no publicly available data to prove this. Pass rates are generally a reflection of the student's dedication and the quality of the school's specific "Exam Prep" product, not the size of the school.

What happens if I start with a popular school and want to switch?

You can usually switch, but your progress doesn’t transfer. You will likely have to restart the specific 45-hour course you were in and pay a new enrollment fee.

Making an Informed Choice

Popularity is a helpful data point, but it shouldn't be your only decision rule. Your goal isn't just to enroll—it's to get licensed.

If you’re ready to see how the top programs in the state stack up based on actual quality, support, and student outcomes, visit our main decision hub: Best Real Estate Schools in California.

|

If you just saw the word "FAIL" on your exam results, take a breath.

The California real estate exam is a rigorous barrier to entry designed to ensure only prepared professionals enter the industry. Read more...

If you just saw the word "FAIL" on your exam results, take a breath.

The California real estate exam is a rigorous barrier to entry designed to ensure only prepared professionals enter the industry. At ADHI Schools, I have spent over 20 years helping thousands of students navigate this exact moment.

What happens if you fail the CA real estate exam isn’t the end of your career—it is a reconnaissance mission. You now have firsthand experience with the testing environment and the specific phrasing of the questions. Here is your professional recovery plan to turn this detour into a license.

First: What Failing Actually Means

Procedurally, failing simply means you didn’t hit the required scoring threshold. According to the California Department of Real Estate (DRE) standards:

Salesperson Candidates: Must score at least 70%.

Broker Candidates: Must score at least 75%.

Quick Snapshot: Your Immediate To-Do List

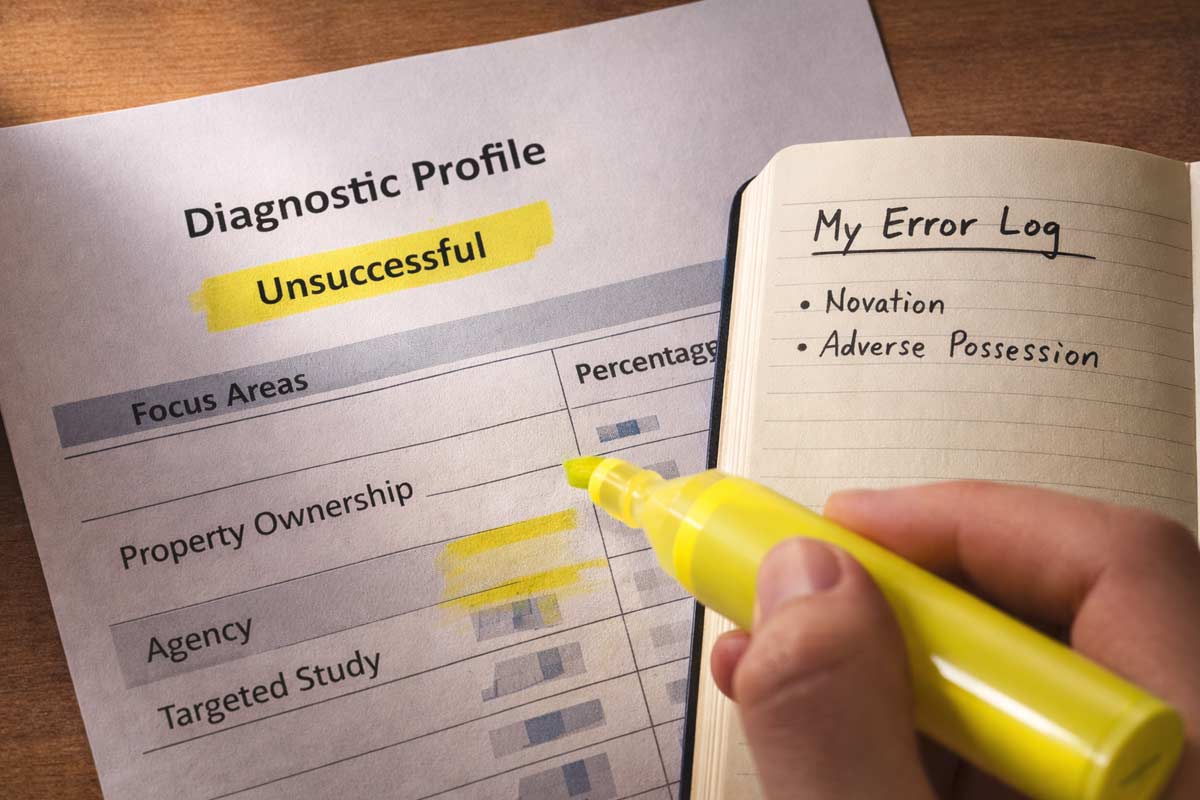

Review Today: Analyze your diagnostic profile to see which of the seven categories (e.g., Property Ownership, Land Use) need work.

Confirm Eligibility: Ensure you are still within your two-year application window.

Wait for the System: Do not attempt to reschedule until the DRE has fully processed your "Unsuccessful" result.

What Happens Immediately After You Fail

In California, you typically receive your results at the testing center. If you didn’t pass, you will receive a notification containing a diagnostic profile. This document is your roadmap; it breaks down your performance percentage in each major category.

The "Golden Hour" Reconnaissance

Before the specific details of the questions fade, perform a "brain dump":

Recall 10 Questions: Write down ten topics or specific questions that confused you.

Analyze Pacing: Did you finish with an hour to spare, or were you rushing to beat the clock?

The "Strategy" Check: Did you change your answers frequently? Real-world scenario: We often see students second-guess themselves from a passing score down to a failing one. Trust your first instinct.

Protecting Your Focus

Avoid a "panic spiral" by staying off unverified forums or Reddit. Every test-taker’s experience is subjective; trust your official diagnostic data over internet anecdotes that may lead to conflicting advice or wasted study time.

How to Retake the Exam

To reschedule the CA real estate exam, you must apply for a re-examination and pay the current fee.

The Re-Examination Rules

The Two-Year Eligibility Window: You must pass the examination within the two-year period following the date your initial application was filed. If you do not pass within this window, your application expires, and you must re-establish eligibility to try again.

Waiting for Results: DRE does not publish a fixed "waiting period" (such as 30 days) between attempts. However, you must wait until your results have been officially processed and received before you are eligible to reapply.

The "Submit Once" Rule: DRE explicitly warns candidates to submit their reschedule application only once—either online or by mail. Multiple submissions can lead to duplicate charges or your records being flagged for review.

One Date at a Time: You can only be scheduled for one exam date at a time. Rescheduling an existing appointment typically removes your current date.

Avoid the "System Flag": Attempting to obtain a new exam date before your previous results are processed can result in your records being withheld and the assessment of additional fees.

Verify Your Logistics

Before you head back, review the Identification Requirements for the CA Exam and the California Real Estate Exam Rules & Testing Policies to ensure no administrative errors disrupt your next attempt.

Why People Fail (and How to Fix It Fast)

Most failures fall into one of four patterns. Identify yours to adjust your strategy:

Failure Pattern

What it looks like

The Professional Fix

The Content Gap

Seeing terms like "Novation" or "Adverse Possession" and feeling lost.

Focus on the glossary. Real estate is a vocabulary test at its core.

The Strategy Gap

Narrowing it to two answers and always picking the wrong one.

Practice the "distractor" method: find why three answers are wrong instead of why one is right.

The Physiology Gap

Crashing or losing focus around question 100.

Build stamina. Take full-length, timed sets to mimic the 3-to-4-hour window.

The Logistics Gap

Arriving stressed due to traffic, ID issues, or prohibited items.

Review What to Bring to the California Real Estate Exam 48 hours early.

The 14-Day Comeback Plan

Don’t wait months to retake. Momentum is your ally.

Days 1–3 (Weakness Blitz): Study the two lowest-scoring categories on your diagnostic profile.

Days 4–7 (The Error Log): Take practice questions and write down why you missed them. Understanding the "why" prevents repeat mistakes.

Days 8–11 (Simulated Testing): Take full-length sets (150 questions for Salesperson, 200 for Broker). Build your sitting stamina for the actual 3-to-4-hour exam window.

Days 12–13 (High-Probability Review): Review Agency, Contracts, and Practice of Real Estate and Mandated Disclosures.

Day 14 (The Reset): Light review only. Confirm your location and pack your ID.

Simulating Success: The CrashCourseOnline.com Method

If your diagnostic profile showed gaps in specific areas, the most common mistake is to "just study more." You don't need more study; you need simulation. While nobody has the exact questions that are on the test, our proprietary system at crashcourseonline.com is engineered to closely simulate the concepts tested on the exam. We categorize our 1,100+ practice questions into the same seven categories found on your official results notice, allowing you to hyper-focus on your weakest subjects.

Frequently Asked Questions

How soon can I retake the California real estate exam?

DRE does not publish a fixed numeric wait time; however, you must wait until your current results are processed and received before the system will allow you to reapply.

How do I reschedule or reapply after failing?

The most efficient method is using the DRE eLicensing portal. You will select "Re-Examination," pay the fee, and select a new date.

Do my pre-license course certificates expire?

No. According to the DRE, pre-license course approvals for the three required college-level courses do not expire. You only need to focus on passing the state exam itself.

What happens if my two-year application window expires?

If you don't pass within two years of your application date, you must submit a new application, pay the initial fees, and re-establish eligibility.

Your Next Steps

This attempt didn't give you a license, but it gave you data. Now, we execute the plan. Once you clear this hurdle—and you will—you can look forward to What Happens After You Pass the CA Real Estate Exam.

For a comprehensive look at the entire journey, consult our California Real Estate Exam Guide.

Step 1: Download your diagnostic profile from the DRE eLicensing portal.

Step 2: Schedule your re-exam once the system allows to lock in your momentum.

Step 3: Start your Error Log based on your 10 "reconnaissance" questions.

Need a hand with the data?

If you have your diagnostic profile and aren't sure how to prioritize your study hours, reach out. We can help you build a targeted schedule based on your specific score breakdown.

|

Last Reviewed: February 2026 (Always verify the latest rules on the official California Department of Real Estate (DRE) website before your exam day.)

Quick Summary (TL;DR): To sit for the California Read more...

Last Reviewed: February 2026 (Always verify the latest rules on the official California Department of Real Estate (DRE) website before your exam day.)

Quick Summary (TL;DR): To sit for the California real estate exam, you must present a valid government-issued photo ID that matches your registration name. Electronic devices—including phones and smartwatches—are prohibited in the testing room. Plan to arrive at least 30 minutes early; severely late arrivals are often denied entry and may need to reschedule.

The biggest obstacle to passing your California real estate exam shouldn’t be the check-in desk. Every year, qualified candidates are turned away or disqualified—not for lack of study, but for violating a small set of non-negotiable exam-day rules.

With over 20 years of preparing candidates, I have seen the preventable errors that delay months of hard work. This guide cuts through the anxiety and gives you the rules you need so your only job on exam day is answering questions.

The 80/20 Rule: The Policies That Most Often Get Candidates in Trouble

Most exam-day issues stem from a handful of avoidable mistakes. Focus your attention here:

Identification issues: An invalid, expired, or unacceptable ID is the fastest way to be denied entry.

Prohibited personal items: Phones, watches, bags, and even your own pens can trigger disqualification if brought into the testing room.

Late arrival: Sessions begin promptly—arrive early or risk being denied entry and potentially forfeiting your exam fee.

Food, drink, and study materials: These are not permitted in the testing environment.

Not following instructions: Proctors enforce exam-security rules strictly.

Identification & Name-Match Policies: Your Non-Negotiable Entry Ticket

Your photo ID is your passport into the exam. The DRE is explicit about what is accepted and what is not.

What you must present

You must show one valid, original, government-issued photo ID from the authorized list:

A current state-issued driver’s license or DMV identification card.

A valid U.S. Passport (or a passport issued by a foreign government).

A valid U.S. Military identification card.

The critical name-match reality

Your registration and application must be under your legal name. Common friction points that lead to entry denial include:

Middle Names: Middle initial on one document vs. full middle name on another.

Life Changes: Marriage/divorce name changes not reflected consistently across your documents.

Shortened Names: Using nicknames like “Mike” vs. the legal name “Michael.”

Pro-Tip: If your identity cannot be verified cleanly against the roster, proctors may deny entry. Reconcile any discrepancies at least two weeks before your exam date.

For a full breakdown of documentation and common mismatch fixes, see Identification Requirements for the CA Exam.

Security Screening & Personal Belongings

Knowing the “logistics of the lobby” reduces day-of stress. Here is the standard flow at many exam sites:

Check-in: A proctor verifies your ID and matches you to the roster.

Storage: You will be directed to store personal belongings (typically in lockers, or a designated storage process if lockers are limited).

The Phone Rule: Phones must be powered off and stored as directed. Possession or use of a phone during the exam session—including during breaks—can lead to immediate disqualification.

Final Entry: Once cleared of personal items, you will be assigned a seat.

Best practice: Leave valuables at home or secured in your vehicle. Bring as little as possible to the site.

Prohibited Items: What Not to Bring

The DRE maintains an “Examination Control Information” list. Bringing prohibited items into the testing room can lead to immediate disqualification.

Category

Prohibited Items

Electronics

Cell phones, smartwatches, fitness trackers, tablets, laptops, cameras/recording devices.

Personal Items

Purses, wallets, keys, backpacks, briefcases, suitcases.

Stationery

Your own pens/pencils, paper, notes, flashcards.

Accessories

Hats/caps, lapel pins, tie tacks, smart glasses.

Consumables

Food, drinks/water bottles, gum, and candy.

"Bring Less, Bring Right" Checklist

To ensure a frictionless check-in, only have these items on your person when you approach the proctor:

Your valid, original government-issued photo ID.

Your car key (if not attached to a bulky keychain).

A light sweater or jacket (testing rooms can be chilly).

If you want the “positive list” of what to bring (so you don’t over-pack), read What to Bring to the California Real Estate Exam.

Timing Rules: Arrival, Late Policy, and Breaks

Arrival: Plan to arrive at least 30 minutes early to allow time for check-in, storage, and security.

Late policy: If you arrive after the session has started, you may be denied entry and required to reschedule (which can mean losing your slot and paying again).

Breaks: The exam is a continuous sitting. If you step out for any reason, assume your exam clock continues and follow the proctor’s procedure.

Test-Day Conduct: Disqualification & “Don’t Do This”

No communication: Don’t speak to or signal other candidates.

No copying: Don’t look at other screens or attempt to reconstruct questions to share later.

Absolute compliance: Follow proctor instructions immediately and without argument.

Violations can result in the exam being terminated and may affect future licensing applications.

Special Situations: Accommodations and “What If…”

Testing accommodations: If you need accommodations (e.g., extra time), you must request and receive approval through the official DRE process well before your exam date.

Medical/comfort aids: Items like insulin pumps or braces may require advance notice for screening—handle this early.

If you are turned away: Don’t panic. Fix the underlying issue (renew ID, correct name mismatch, etc.) and follow our recovery plan in What Happens If You Fail the CA Real Estate Exam.

Final Exam Day Checklist & Next Steps

If you follow these rules, you’ll clear check-in smoothly and can spend your mental energy on the exam itself.

If you pass, read: What Happens After You Pass the CA Real Estate Exam

For the complete roadmap and context, visit the: California Real Estate Exam Guide

Frequently Asked Questions (FAQ)

1. Can I wear a watch during the exam?

No. Watches (including smartwatches) are commonly prohibited. Plan to rely on the on-screen timer.

2. Can I bring my phone if it stays in the locker?

Yes, but it must be powered off and stored exactly as instructed. Do not access it during breaks.

3. What if my ID expired yesterday?

You will likely not be admitted. Your ID must be valid on the exam date.

4. Can I bring my own calculator?

Typically no. There is no longer any math on the California real estate exam and the testing sites no longer provide calculators or dry erase boards.

5. How early should I arrive?

At least 30 minutes before your scheduled start time.

|

You’ve passed the real estate exam, joined a brokerage, and ordered your business cards. Now comes the most pressing question every new California agent faces:

"Where do I get my first lead?"

The Read more...

You’ve passed the real estate exam, joined a brokerage, and ordered your business cards. Now comes the most pressing question every new California agent faces:

"Where do I get my first lead?"

The industry is flooded with marketing noise and subscription platforms promising instant closings. But after 20 years in the California real estate business, I’ve seen thousands of agents burn through their savings chasing the wrong leads.

The truth is that lead sources are far less important than your lead-to-relationship conversion and your consistency.

A lead isn't a commission check; it’s an introduction. California markets are fragmented—what works in Riverside won't always work in West LA.

To start a real estate career in California that actually lasts, you need a system, not just a tactic.

Key Takeaways

Trust over Tech: Your Sphere of Influence (SOI) remains the highest-converting lead source.

Sweat Equity: Open houses are the fastest way to meet "now" buyers without an upfront budget.

Speed Wins: The agent who follows up same-day—often within minutes—usually wins the client. This is often called “speed-to-lead”.

Local Authority: Consistency in a small "micro-farm" beats sporadic efforts across a whole city.

Ranked: The Best Lead Sources for New Agents

Note: "Skill Level" refers to your conversion and communication skill, not your personality type.

Lead Source

Cost

Time-to-Result

Skill Level

Best For...

Sphere of Influence (SOI)

Free

Days/Weeks

Low

Immediate trust & referrals

Open Houses

Free/Low

Days/Weeks

Medium

Meeting unrepresented buyers fast

Open House Follow-Up

Free

Days/Weeks

Medium

Turning “tourists” into clients

Database + CRM Follow-Up

Free/Low

Weeks

Medium

Staying top-of-mind consistently

Local Partner Referrals

Low

Weeks/Months

Medium

Warm intros from lenders/escrow

Agent-to-Agent Referrals

Low

Weeks/Months

Medium

Relocation + overflow clients

Community Networking

Low

Weeks/Months

Medium

Trust-building (schools, chambers)

Micro-Farming (100–300 homes)

Medium

Months

High

Long-term local dominance

Rentals / Landlords

Low

Weeks/Months

Medium

Leads that become buyers later

FSBO / Expireds

Low

Weeks

High

High-volume conversations

Online Inbound Basics

Low/Medium

Months

Medium

Compounding flow (reviews)

Paid Leads (Optional)

High

Days/Weeks

High

Agents with a break-even mindset

The Core Strategy: Where to Start

1. Your Sphere of Influence (SOI)

Your SOI includes friends, family, and past coworkers. These are people who already want you to succeed.

Why it works: Trust is pre-built. You aren't "selling"; you're informing.

Scenario: Instead of a sales pitch, try: "I'm not calling to sell you anything—I just wanted to let you know I'm officially with [Brokerage]. If you ever have a quick question about what's happening in our neighborhood, I'm happy to be your resource."

Do this this week: Call 5 people a day. Update their contact info in your CRM.

2. Open Houses as a Lead Engine

Don't just "sit" in a house. Use it as a platform. Learning how new agents should hold open houses effectively can transform a boring Saturday into three new buyer representation agreements.

Why it works: You meet active buyers in a specific zip code.

Scenario: When a visitor walks in: "Thanks for coming by. Most people I meet here are either neighbors or looking to move in the next 90 days—which one are you?"

Do this this week: Ask a top producer in your office to host their listing open this weekend.

3. Building Your Database

Every person you meet belongs in a CRM. You must build a real estate database from scratch to automate your "top of mind" awareness.

A Simple Follow-Up Cadence

Day 0: Quick text + “What stood out to you at the house?”

Day 1: Phone call (short, human).

Day 3: Value add (neighborhood note or listing link).

Day 7: Call + clarify timeline.

Month 2+: Monthly market update + personal check-in.

Expanding Your Reach

Local Partner & Agent Referrals

Lenders, escrow officers, and out-of-area agents are massive referral sources.

Why it works: These are professional, warm introductions.

#1 Rookie Mistake: Asking for leads before offering any value.

Do this this week: Invite a local lender to coffee to learn about their specific programs.

Community Networking & Micro-Farming

Become the "Digital Mayor" of a small area. Focus on 100–300 homes (a micro-farm) or your local PTA/Chamber.

Why it works: It builds "omnipresence" in a small, manageable pond.

Do this this week: Draft a simple, one-page market update for your specific neighborhood.

Online Inbound & Rentals

Claim your Google Business Profile and gather reviews immediately. Additionally, don't ignore renters; in California, today’s tenant is often next year’s first-time buyer.

FSBO / Expireds

Why it works: These are people with high "intent to sell."

Compliance Reminder: Strictly follow the National Do Not Call (DNC) Registry, respect all opt-outs, and follow your brokerage’s specific outreach policies.

What to Avoid: The "New Agent Traps"