Notice: This guide is for informational purposes only and does not constitute legal advice. California housing laws are subject to frequent legislative updates; always consult with a qualified land-use attorney, local planning department, and the applicable utility agency for property-specific feasibility.

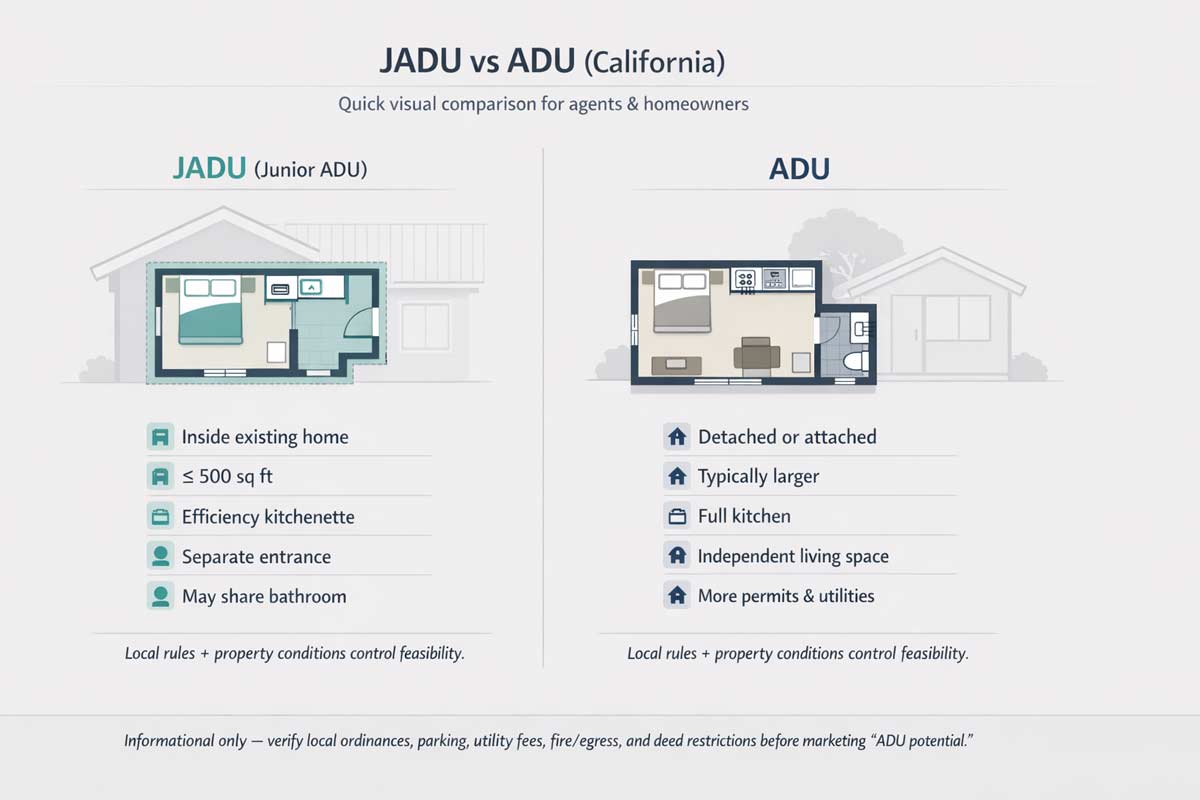

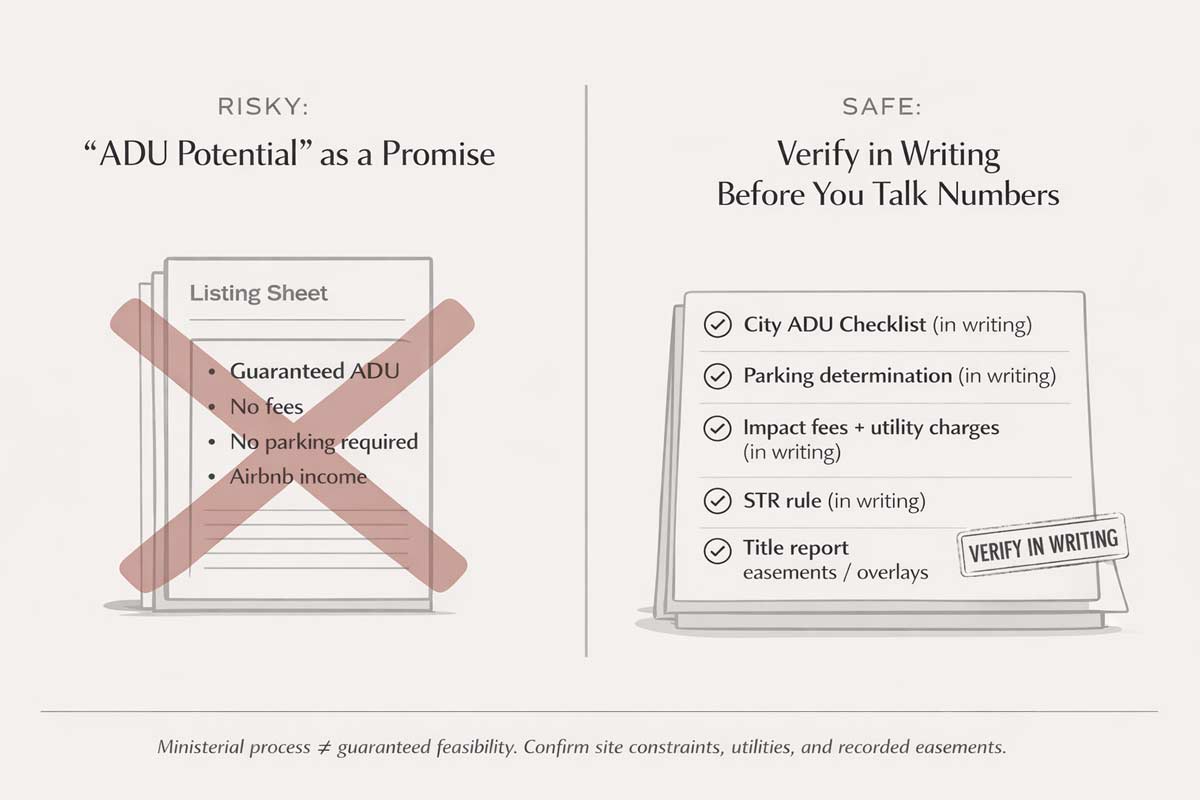

Accessory Dwelling Units (ADUs) can be a major inventory-growth lever in California — but “ADU potential” is also one of the easiest ways for an agent to create liability if it’s marketed like a guarantee. This guide is part of our California Real Estate Laws & Compliance Guide and focuses on what agents need most: the state’s ministerial (no-hearing) process and the administrative “shot clocks” designed to prevent permit stalling — plus the exact items you should verify in writing before you talk numbers.

California’s ADU framework is no longer “local preference.” It’s a state-enforced ministerial system: cities must approve ADU applications that meet objective standards, and they must process them on strict timelines.

“Ministerial” just means that there’s a checklist that has to be followed, and as long as everything on that checklist is done the approval doesn’t require a hearing. However, it’s still not a guarantee until the city confirms the application is complete and compliant.

Cities have a 15-business-day window to determine whether an application for an ADU is complete. If the permitting agency does not make a timely completeness determination, the application is treated as complete for timing purposes and the next clock starts.

Once an application is complete, the city generally has 60 days to approve or deny it. Missing that deadline can trigger “deemed approved” status, subject to the statutory mechanics (and tolling if the applicant requests delay).

State ADU law preempts conflicting local standards. Cities can add rules, but they must stay within the state framework and use objective standards — not subjective “we don’t like it here” discretion.

If the city denies, it must provide a full written set of correction comments describing what’s wrong and how to fix it. This is designed to prevent the “drip-feed denial” tactic.

Parking rules are often 0 spaces in common scenarios (especially conversions) but be sure to confirm local and state rules.

This is where agent marketing can get folks in hot water.

Agent Tip: To protect your commission and your client, never market “ADU short-term rental income” unless you have verified the city’s specific STR ordinance in writing.

Most “ADU denials” aren’t philosophical. They’re constraints: hillside grading, coastal, fire severity, biological, historic, sewer/water limitations, or recorded easements.

If a client wants more than just an ADU, they may ask about SB 9. While ADUs add "accessory" units, SB 9 allows for primary density increases through ministerial lot splits and two-unit developments.

Summary of SB 9 (2025-2026 Updates):

This is a critical due diligence item for investors. While a single-family home (SFH) is typically exempt from statewide rent control under the Costa-Hawkins Rental Housing Act, adding an ADU can change that.

If a client wants more than just an ADU, they may ask about SB 9. While ADUs add "accessory" units, under AB 1482 depending on the property type, ownership structure, and required tenant notices

VERIFY IN WRITING: Before you market “rent upside,” have the buyer/owner confirm (a) whether the property is covered by a local rent stabilization ordinance, and (b) whether AB 1482 applies or an exemption applies — preferably with a landlord-tenant attorney or written guidance from a credible local housing/rent authority.

Use language like this:

Property may be eligible for an ADU (subject to city review, utility capacity, and recorded easements). Buyer to verify ADU feasibility, fees, parking, and rental restrictions with the City and utility providers.

Avoid language like:

The shift from local control to a state-mandated ADU framework has created a massive opportunity for California homeowners, but for real estate agents, it has also moved the goalposts for professional liability. Mastering ADU rules is no longer just about knowing square footage; it is about protecting your clients from expensive permitting delays and "soft" denials.

As we move through 2026, the key to a successful ADU-focused transaction is transparency. By using the "administrative shot clocks" provided by SB 543 and the streamlined pathways of AB 1154, you can help your clients navigate the process with confidence—provided you never mistake "potential" for a "guarantee."

Staying "compliance-first" is what separates top-tier agents from the rest. By facilitating the right conversations with the right experts, you protect your commission, your reputation, and your client’s investment.

Avoiding Non-DRE-Approved Real Estate Schools in California

How Important Are Online Reviews for Real Estate Schools?

What Happens If You Fail the CA Real Estate Exam

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.