If you choose your first brokerage based on the commission split alone, you will lose money—probably a lot of it.

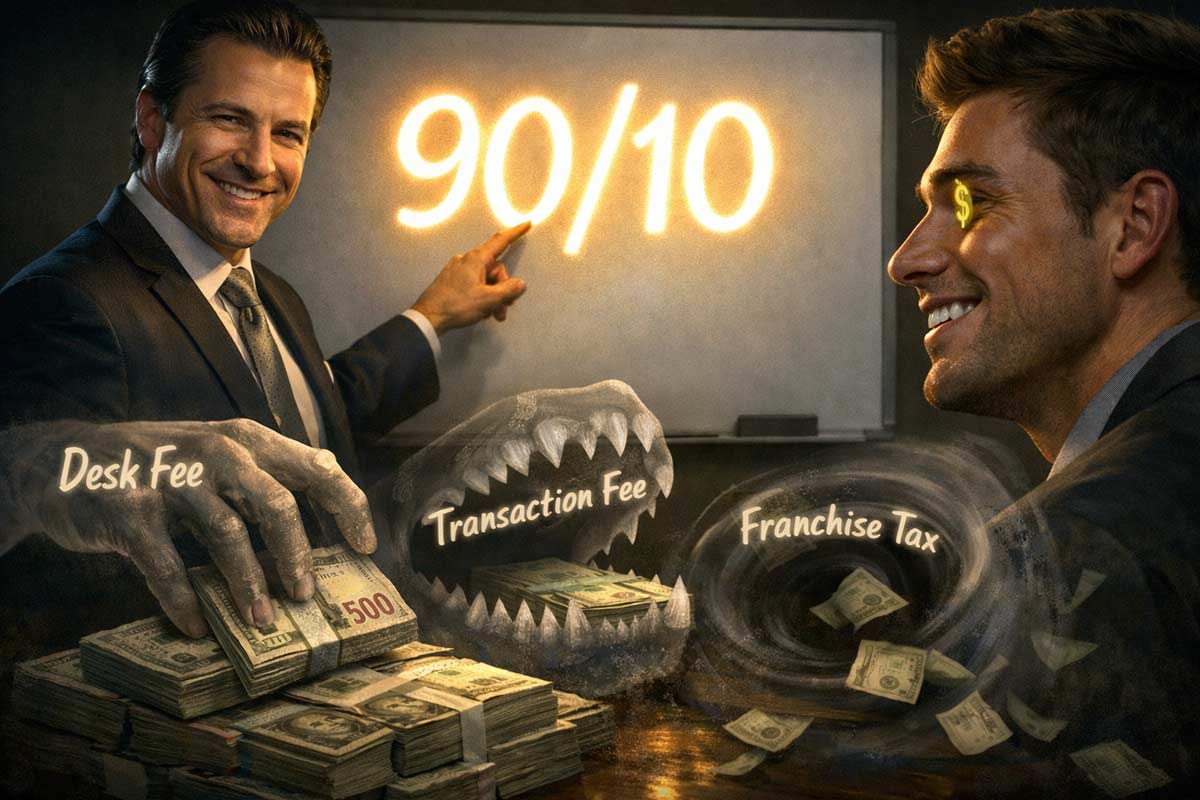

I have spent over 20 years watching new agents walk into a recruiter’s office, see a “90/10” split on a whiteboard, and start spending the money in their heads. Then reality hits. The "Smiling Recruiter" forgot to mention the $500 monthly desk fee, the transaction fees, and the fact that there is zero training to help you actually get a contract signed.

As you Start a Real Estate Career in California, your biggest risk isn't a low split; it's a high split that comes with no support, leaving you with 100% of zero.

To make a smart decision, you must stop using recruiter jargon and start using mine.

To find the truth, use this calculation. "Your Share" is the dollar amount the broker hands you after their split but before they subtract desk fees, insurance, or transaction costs.

Takeaway: A "90% split" often results in a 65% effective split once the monthly "rent" is paid.

| Model | The Pitch | The Reality | Choose This ONLY If... |

|---|---|---|---|

| The Apprenticeship | "We'll teach you everything." | 50/50 or 60/40. High support. | You need a mentor to review every file. |

| The Ladder | "Earn more as you grow." | Graduated splits (e.g., 60% to 80% as you grow). | You have a clear 12-month lead-gen plan. |

| The Illusion | "Keep 100% of the cash." | You are a tenant, not a partner. | You have a massive, proven database. |

| The Gauntlet | "Cap your fees, then keep it all." | High pressure to hit the "cap" fast. | You have cash reserves. |

| The Safety Net | "We pay you a base salary." | Rare; heavy oversight/shackles. | You value stability over high upside. |

Takeaway: Match the model to your current skill level, not your future ego.

I once reviewed a contract for a student who was promised an 80/20 split. After we calculated the "menu" below, their effective split was 52%. They walked away. Here is how those fees are usually grouped:

Kartik’s Note: Paying over $200/month for a desk without a documented, daily training schedule is a major red flag when choosing a brokerage.

Assumption: A $1M sale at 2.5% ($25,000 GCI).

| Metric | 85/15 "Cloud/Boutique" | 60/40 Traditional |

|---|---|---|

| Initial Share | $21,250 | $15,000 |

| Monthly Desk Fee | –$500 | $0 |

| Franchise/Admin Fee | –$1,500 | $0 |

| Transaction Fee | –$500 | –$250 |

| NET TO AGENT | $18,750 | $14,750 |

| Effective Split | 75% | 59% |

| Support Provided | Software login + FAQ | Structured coaching & contract review |

The Logic: If the 60/40 model provides the systems that help you close one deal a month, while the 85/15 model leaves you to figure out lead-gen alone (leading to zero deals), the "lower" split is more profitable over time.

An agent joins a "Cap" brokerage with a $20,000 annual cap and $800/month in fixed fees.

You join a team on an 80/20 brokerage split. The team takes a 50% split for providing the lead.

Before signing, put both offers side-by-side:

| Item to Audit | Brokerage A | Brokerage B |

|---|---|---|

| Nominal Split % | ||

| Monthly Fixed Costs ($) | ||

| Per-Transaction Fees ($) | ||

| Off-the-top Franchise % | ||

| Who pays for the CRM? | ||

| Documented Weekly Training? |

Don't ask "what is the split?" That's a rookie question. Use these scripts from our guide on How to Interview a Brokerage as a New Agent:

For 19 out of 20 new agents, the Apprenticeship/Traditional model is the only logical choice.

I’ve seen too many agents go for a 100% split only to miss a critical disclosure contingency because no one was available to review their file on a weekend. That "saved" commission disappears the moment you're hit with a legal claim.

Year one is about risk mitigation. You need a broker who is financially incentivized to make sure you don't crash. Once you've closed three deals, you have the leverage to look at the Best Brokerages for New Agents in California that offer higher splits for producers.

Takeaway: Buy the education in Year 1 so you can own the market in Year 5.

1. Can I negotiate my split?

Yes, but as a new agent, your leverage is low. Focus on negotiating for better tools or waived initial fees rather than the split.

2. What is a "Cap"?

A ceiling on what the broker takes. After you pay them a set amount (e.g., $20k), you keep 100% for the rest of the anniversary year.

3. What is a typical split for a new agent in CA?

Usually between 50/50 and 70/30. Anything higher often indicates a lack of provided leads or support.

4. Is 100% commission ever worth it?

Only if you are a "business in a box" with your own systems, leads, and staff. For a rookie, it's a liability.

5. Do teams take another split?

Yes. Team splits are separate from and usually in addition to brokerage splits.

6. What fees are "normal" in California?

A transaction fee ($250-$500) and E&O insurance are standard. Watch out for hidden "marketing" or "admin" fees.

7. What if the brokerage provides the leads?

Expect a referral fee (25-40%) to be taken before the split is calculated.

8. What is a transaction fee vs. a TC fee?

Transaction fees go to the broker. TC (Transaction Coordinator) fees go to the professional who manages your escrow paperwork.

9. How do splits work on leases?

Often a flat fee or a much higher split (e.g., 50/50) because the dollar amounts are lower.

10. Should I join a high-split brokerage if I'm part-time?

No. Part-time agents need more supervision because they aren't in the office daily to catch changes in law or contracts.

11. Does the split change if I represent the buyer vs. the seller?

Usually no, but check your independent contractor agreement.

12. How do I avoid Red Flags When Choosing Your First Brokerage?

If they talk about the "split" for 30 minutes but can't show you a training calendar, walk out.

Your goal is not to find the perfect split. Your goal is to find the first broker who will turn you from a liability into an asset.

The commission split is just one piece of your launch plan. To build your complete, step-by-step career blueprint and avoid the "learning tax" most rookies pay, start here:Start a Real Estate Career in California.

Why DRE Accreditation Matters More Than Online Reviews

Identification Requirements for the CA Exam

What to Bring to the California Real Estate Exam: Your Essential Checklist

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.