A $10,000 deposit from a client sits in your center console. You’re headed to a listing appointment, then a kid's soccer game, and you figure you’ll drop the check at the escrow office tomorrow morning. Read more...

A $10,000 deposit from a client sits in your center console. You’re headed to a listing appointment, then a kid's soccer game, and you figure you’ll drop the check at the escrow office tomorrow morning. It’s just 12 hours, right?

Many trust fund cases begin with a dispute—a deal falls apart, a buyer wants their EMD back, or an escrow officer denies receiving a check on time. When the finger-pointing starts, the DRE looks at the custody trail, not your "intent."

Do this now: In modern times, it’s true that agents are less likely to take checks directly, remember if you have client funds in your possession, call the escrow officer immediately to confirm their intake hours, document the receipt in the transaction file (send a timestamped email to escrow and your broker confirming you have it), and deliver the funds today.

Trust Fund Handling: The 2-Minute Summary

The Destination: Place funds in a neutral escrow depository or the broker’s trust account according to legally imposed timeframes.

The Risk Window: Brokers treat custody as starting the second you take possession of client money.

The Safest Practice: Maintain consistent, high-standard documentation for every cent received.

The Top Risks: Commingling and Conversion are the primary causes of disciplinary actions.

What Actually Counts as “Trust Funds”?

The most common trust funds agents handle are Earnest Money Deposits (EMD), Rents, and Security Deposits. While other items like advance fees can technically be trust funds, treat these as edge cases—never touch them without the broker’s written instruction.

From an operational standpoint, your safest practice is to maintain robust documentation across all price points. If a DRE auditor sees a gap in a small transaction, they can infer there are systemic failures in your system.

Where Trust Funds Go in a Clean File

Operationally, there are two standard paths used in California real estate to handle client money.

Neutral Escrow Depository: The safest and most common path. You deliver funds directly to the escrow company named in the contract.

Broker’s Trust Account: A specifically designated account maintained by the broker, titled as a trust account.

The 4 Violations That Actually Get People Disciplined

The DRE is surgical about auditing money. To audit-proof your career, you must understand the concrete actions that trigger an investigation.

1. Commingling (Mixing Funds)

Audit Trigger: An auditor finds client funds deposited into a broker’s operating account or an agent’s personal account.

Hard Control: Safest practice: All trust fund checks go unendorsed directly to escrow or the broker’s trust account.

Refuse physical cash: Direct the client to obtain a cashier's check instead.

Depository compliance: If your broker forbids mobile deposit (many do), deliver the physical instrument directly to the designated depository.

2. Conversion (Using Funds)

Audit Trigger: A trust account balance drops below the total amount owed to all beneficiaries, often discovered after a client complaint.

Hard Control: Never "borrow": : Never use a deposit for unauthorized purposes, even if you plan to reimburse it later. Totally illegal.

Build a "defense file": Create documentation in real time (not after the fact) that explains every dollar with matching receipts and the trust account should be reconciled monthly.

3. Failure to Account (Sloppy Records)

Audit Trigger: A broker or agent cannot provide a clear paper trail for a specific deposit during a routine file review.

Hard Control: Retain proof: Keep copies of every deposit confirmation, receipt, or proof of delivery.

Cross-reference: Identify every deposit with the specific property address and client name according to DRE rules.

4. Delay / Failure to Deposit

Audit Trigger: An auditor cross-references the date on the EMD check with the date on the Escrow Receipt.

Hard Control: Timestamped communication: Document the moment you receive funds.

Exposure limit: If the timeline exceeds 3 business days, your exposure spikes.

For more on how the state monitors these audit trails, see our guide on what the California DRE actually enforces.

The Clean Trust-Fund Handling Sequence

Follow this sequence to ensure your file is defensible from the moment you take custody:

Verify Payee: Confirm the payee is the correct legal entity before you accept custody.

Secure Receipt: Document receipt of check.

No Endorsement: Never sign the back of a client's deposit check.

Approved Custody: Do not hand checks to unapproved third parties (unlicensed assistants, TCs, etc.).

Physical Storage: Store checks in a locked, designated place in your office. Never leave trust funds in your car.

Deliver & Confirm: Deliver the funds same day whenever possible and obtain a signed receipt.

Chain-of-Custody Email: Send the timestamped email to your broker and escrow. This is a core professional standard in our California Real Estate Laws & Compliance Guide.

FAQ: High-Intent Questions

Can I hold the deposit check overnight?" Generally, yes, but the risk of loss or theft makes this a failure in most brokerage policies. Deliver it immediately.

Does my Transaction Coordinator (TC) count as me?" Yes. Delegation does not transfer responsibility. If your TC or assistant mishandles a check, the DRE holds you and your broker accountable for the lack of supervision.

What if the buyer gives me the check on a Friday night?" Document the receipt Friday night, store the check in a locked location (not your car), and deliver it per your broker's Monday morning intake process.

What about wire instructions and wire fraud?" Always verify wire instructions via a phone call to a known, verified number. Never accept last-minute changes via email.

The Clean File Standard

Trust fund handling is about creating a defensible file. By following these hard controls and maintaining a strict chain of custody, you ensure that even a surprise investigation results in a clean file. Understanding these operational rules is the first step in avoiding common DRE violations and how to avoid them.

For more on state requirements, return to our California Real Estate Laws & Compliance Guide.

Disclaimer: This article provides general best practices and does not constitute legal advice. Always confirm your broker’s written policy.

|

An expired real estate license is a total freeze on your ability to earn commissions.

If your license isn’t active, you can’t represent clients—period.

The goal of this guide is to move you Read more...

An expired real estate license is a total freeze on your ability to earn commissions.

If your license isn’t active, you can’t represent clients—period.

The goal of this guide is to move you from "almost expired" to "renewed" with the cleanest submission possible. This is your operational roadmap.

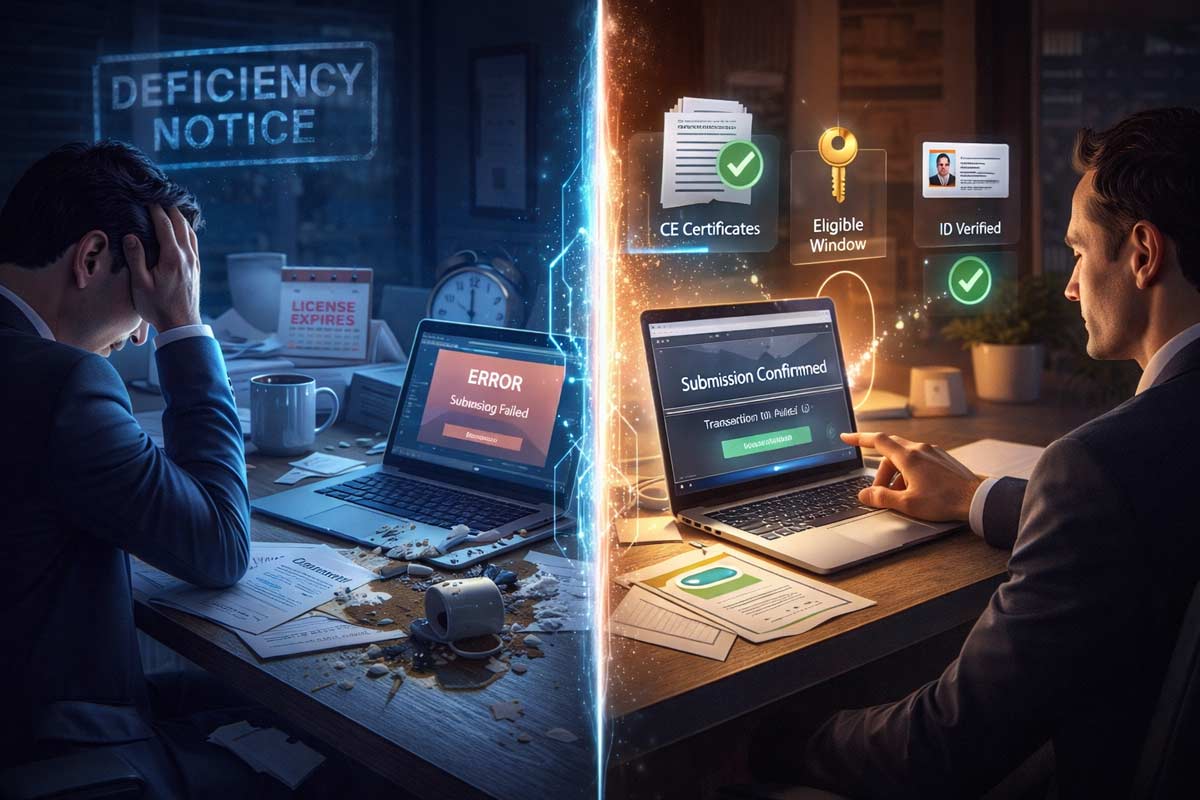

Before You Hit Submit: The 4 Gatekeepers

Do not start your application for license renewal on eLicensing until these four things are true. Most renewal delays happen because agents submit before their records or documents are actually ready.

Confirm Your Eligibility Window: The DRE opens renewal only within an eligible window (typically 90 days before expiration). The eLicensing portal is the source of truth—if the "Renew" option isn't available in your profile, you aren't eligible to submit yet. Keep in mind that you can complete the CE courses anytime in the four years preceding expiration, but the application can’t be submitted until at least 90 days prior to expiration.

CE Proof in Hand: Have your Continuing Education (CE) completion certificates ready. You must verify that the provider numbers, course identifiers, and completion dates match exactly what you will enter. When you take the courses through ADHI Schools, the course completion certificates will start with 6404 for each CE course. For a full list of required courses, refer to our Checklist for Renewing a California Real Estate License.

Record Alignment: Ensure your legal name and contact details on file match your current identification. Even small mismatches (name formatting, address changes, or a stale email) can slow the file and trigger a manual review.

Broker Readiness (Salespersons Only): Confirm your broker or office manager knows they must approve the renewal inside their own portal. Your application is not considered "complete" by the DRE until your broker takes this step.

At-a-Glance Submission Checklist

✅ Eligible window visible in eLicensing

✅ CE completion certificates (PDFs) open on screen

✅ Name and contact details match your DRE record

✅ Salespersons: Broker notified and ready to approve

Takeaway: If any of these are off, fix them first. Submitting incorrect data is the fastest way to get your license stuck in the DRE’s manual review pile. See our guide onCalifornia Renewal Mistakes to avoid common "stuck points."

The Clean Submission Sequence

Step 1: Gather Your Renewal Packet

Organize these inputs before opening the eLicensing portal:

Your CA license number: Use the number exactly as shown in your DRE profile.

CE Certificates: Specifically the provider numbers and course identifiers exactly as shown on your certificates.

Payment Method: A valid credit or debit card. (To plan your budget, see How Much Does It Cost to Renew a CA Real Estate License?).

Broker Info (Salespersons): Your responsible broker’s license number and email.

Step 2: Choose Your Channel

Online (eLicensing): The standard path. Provides the fastest processing and immediate confirmation.

Mail Submission: Use only when the portal requires supporting documentation or your situation is not supported online. If you mail it, use a trackable service (USPS Tracking, FedEx, or equivalent).

Step 3: The Portal Walkthrough

Access: Log into eLicensing.

Data Entry: Do not retype from memory. Copy the identifiers and provider numbers directly from your PDF certificates. Even a minor typo in a course ID can stall verification and trigger a deficiency or manual review.

Validation: Review the summary page carefully before clicking through to payment.

Salesperson Alert: Your renewal is NOT complete until your broker signs in to their own portal and approves your application. Confirm with your broker or office manager that this step is finished immediately after you submit.

Step 4: Payment and Recovery

The DRE portal can be temperamental. To avoid double charges:

Click "Submit" only once.

If the screen freezes, wait a couple of minutes before refreshing.

Recovery Step: If you are unsure if it went through, log out, log back in, and check for a confirmation or receipt before attempting a second payment.

Step 5: Your Paper Trail (Non-Negotiable)

Portals glitch and emails disappear. Your paper trail is your insurance policy if there’s ever a question about what you submitted and when.

Screenshot the final confirmation page with the transaction ID.

Download the PDF summary of the application you just filed.

Archive the email receipt. You may need these while waiting for the record to update. See How Long Does It Take to Process a CA Renewal? for typical wait times.

What Happens After You Submit

Tracking Status: Use eLicensing as your primary status tracker to see if the application is "Pending" or "Processed."

Downstream Confirmation: Use the Public License Lookup as the final confirmation once the record officially updates with your new expiration date.

Your goal state is a "renewed/processed" status in eLicensing and an updated expiration date on the public lookup.

When to Escalate

If you are >14 days from expiration: Check eLicensing every 48 hours. It is normal for the update to take a week or more.

If you are

|

A buyer consultation is a structured first meeting where you confirm readiness, set expectations, and build a clear plan to tour and write offers without chaos.

The greatest fear for a newly licensed Read more...

A buyer consultation is a structured first meeting where you confirm readiness, set expectations, and build a clear plan to tour and write offers without chaos.

The greatest fear for a newly licensed agent is the "imposter moment"—that split second during a meeting where you worry the client will realize you’ve never closed a deal.

After 20+ years of training thousands of California agents, I can tell you the secret to overcoming this: System > Vibes. Buyers aren’t buying your resume; they are buying your process. A buyer isn't looking for a historian; they are looking for a pilot. They want someone who can navigate the turbulence of the California market, protect their earnest money, and reduce their risk. Your first buyer consultation isn't a casual chat—it is a structured risk-reduction meeting. When you lead with a system, your experience level becomes secondary to your competence.

Quick Start: The Buyer Consultation Essentials

The Credibility Kit: A physical or digital packet that proves you are organized.

The 45-Minute Agenda: A timed sequence that keeps you in the driver’s seat.

The "Pro" Questions: Moving the conversation from "what" they want to "why" they want it.

Defined Next Steps: Never leave a meeting without a calendar invite for the next milestone.

The Real Purpose of a Buyer Consultation

Most new agents treat the first buyer consultation like a casual meet-and-greet. That’s backwards. The buyer consultation is where you set expectations, confirm readiness, and create a shared plan—so nobody wastes weekends touring homes that were never realistic.

The Two Topics You Must Cover Early: Representation + Compensation

In today's market, transparency is your highest-value currency. Your goal isn’t to “sell” an agreement. It’s to remove confusion: who represents whom, how compensation works, and what gets confirmed before you ever write an offer.

The Script: "Before we look at homes, I’ll explain how representation works and how agents get compensated so there are zero surprises later. My job is to make this simple and protect you."

First Buyer Consultation Checklist (What to Bring)

Don't show up with just a business card. To look like a pro, you should provide a "Credibility Kit" (physical or a clean PDF). This functions as your "silent resume."

1-Page Agenda: Shows you value their time and have a plan.

Buyer Intake Worksheet: A form to capture their needs.

Lender Checklist: Documents needed for a full underwritten pre-approval.

"How I Work" One-Pager: Explicitly states your communication hours and showing protocols.

Buyer Profile Snapshot: A proprietary summary containing:

Core search criteria & geographic "must-haves."

Timeline and move-in constraints.

Financing status and monthly comfort zone.

Top 3 "Dealbreaker" features.

Agreed-upon communication pace.

Offer-Ready Checklist: What must be true before writing an offer (pre-approval verified, proof of funds ready, decision-makers aligned).

The 45-Minute Consultation Agenda

Control the clock, and you control the room. Follow this timed sequence to ensure you cover the essentials without rambling.

Time

Section

Purpose

0–2 Min

The Frame

"Today is about making sure you’re protected and ready."

2–12 Min

Goals & Constraints

Deep dive into their "Why" and their timeline.

12–20 Min

Financing Reality

Verify pre-approval status; discuss monthly comfort vs. max qualification.

20–35 Min

The Market & Process

Explain the CA purchase process and representation/compensation.

35–45 Min

Next Steps

Confirm representation, set the showing plan, and schedule the first tour.

Conversion Scripts: The Open and The Close

The "how" you say it matters as much as the "what."

Opening Frame Script (2 minutes)

"Here’s the plan: we’ll confirm your goals, your financing readiness, today’s market reality, and how we’ll work together. By the end, you’ll have a clear next step on the calendar. Does that sound like a good use of our time?"

Closing Script (Lock Next Step)

"Based on what you told me, the next step is simple: we’ll confirm financing, I’ll send 8–12 verified options, and we’ll tour on [Day]. I’m going to send the calendar invite now—does 10:00 AM or 1:00 PM work better?"

Buyer Consultation Questions for New Agents

A pro asks; an amateur tells. Use these questions to diagnose the situation.

Motivation & Timing

"What happens if we don’t find a home in the next 60 days?"

"On a scale of 1–10, how ready are you to move into a new home right now?"

Financing Readiness

"Are you fully pre-approved (credit run + docs reviewed), or just pre-qualified?"

"What monthly payment feels comfortable—not just what you can technically qualify for?"

"Do you have proof of funds ready for down payment and closing costs if we need to move fast?"

Risk + Offer Strategy

"If we love a home, are you the type who wants to move fast and compete—or do you prefer to wait for a ‘perfect deal’?"

"How do you feel about inspections: are you cautious and thorough, or more comfortable taking calculated risks to win a property?"

Decision + Communication

"When a decision needs to be made, how do you prefer to communicate—call, text, or email?"

"If the right home hits on a weekday, can you tour within 24–48 hours?"

5 Mistakes That Hurt New Agent Credibility

I’ve seen these errors cost agents five-figure commissions.

Selling Yourself Instead of the Process: Buyers care about their house. Talk 20% about you and 80% about the steps you take to protect them.

Skipping the Financing Talk: Make it a standard policy: "Before we do private tours, I need a real pre-approval on file so we don’t fall in love with a home we can’t win."

The "Zillow Trap": Zillow is great for discovery. My job is to verify what’s truly available and what’s already in escrow—so you don’t waste time chasing ghosts.

No Defined Next Step: Never end with "Let me know if you see anything." Always set a specific time for the next follow-up.

Ignoring the Spouse/Partner: Only talking to the "vocal" one. Always ask the quieter partner for their thoughts.

Warning: Rookie Red Flags

Refuses to share any financing info or talk to a lender.

Won't commit to having all decision-makers present for the consult.

Refuses to commit to any calendar date or next step.

Scripts for Success

Avoid high-pressure sales talk. Use these "consultative" lines instead. For more help on delivery, see our guide on how to practice real estate scripts effectively.

Handling Unrealistic Criteria: "I want to be honest—at that price point in this neighborhood, we usually see homes that need significant work. Are you open to a fixer, or should we look one town over?"

The "I Don’t Guess" Rule: "That’s a great question regarding the zoning. I don’t want to give you a 'maybe'—let me verify that with the city and get back to you by 5:00 PM."

FAQ: Buyer Consultation Long-Tail Queries

What if the buyer isn't pre-approved yet?

Don't refuse the meeting and use the consultation to introduce them to your preferred lender and explain that in California, an offer without a pre-approval is usually noncompetitive.

How do I handle a buyer who only talks about Zillow?

Acknowledge it as a discovery tool, then pivot to your MLS access.

"My system provides real-time data on which homes are actually available and which are already in escrow."

What if they refuse to sign a Buyer Representation Agreement?

Don't panic. Focus on the value of your "Credibility Kit."

If they still won't sign, work with your broker to offer a "trial period" for the first three showings.

This is part of the negotiation basics for new California agents that builds trust through flexibility.

How do I avoid looking "new"?

By learning how to avoid the ‘new agent mistakes’ that hurt credibility, such as being disorganized or over-promising.

Professionalism is a choice.

The buyer consultation is your opportunity to move from "agent" to "trusted advisor." By following a system, you remove the anxiety of the unknown. Once you've mastered the buyer side, you'll find these skills translate when you learn how new agents should handle their first listing appointment.

If you are ready to build a business based on systems and results, the first step is getting your foundation right.

Start a Real Estate Career in California with ADHI Schools today.

|

The “Order of Operations” Confusion

The path to a California real estate license is often clouded by outdated advice, social media "gurus," and aggressive brokerage recruiting scripts. This creates Read more...

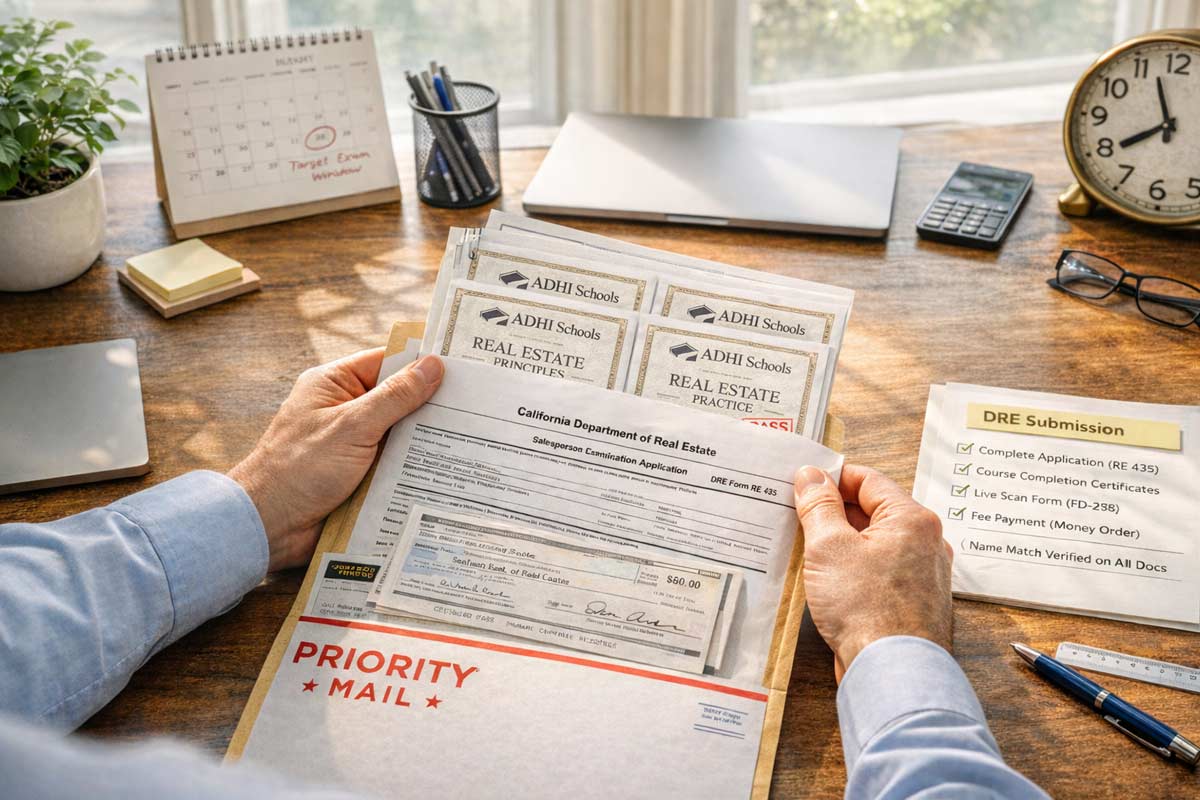

The “Order of Operations” Confusion

The path to a California real estate license is often clouded by outdated advice, social media "gurus," and aggressive brokerage recruiting scripts. This creates a massive point of confusion: many aspiring real estate professionals believe they must be "hired" before they can even apply for the state exam.

Mistaking this sequence leads to lost momentum and unnecessary procedural errors.

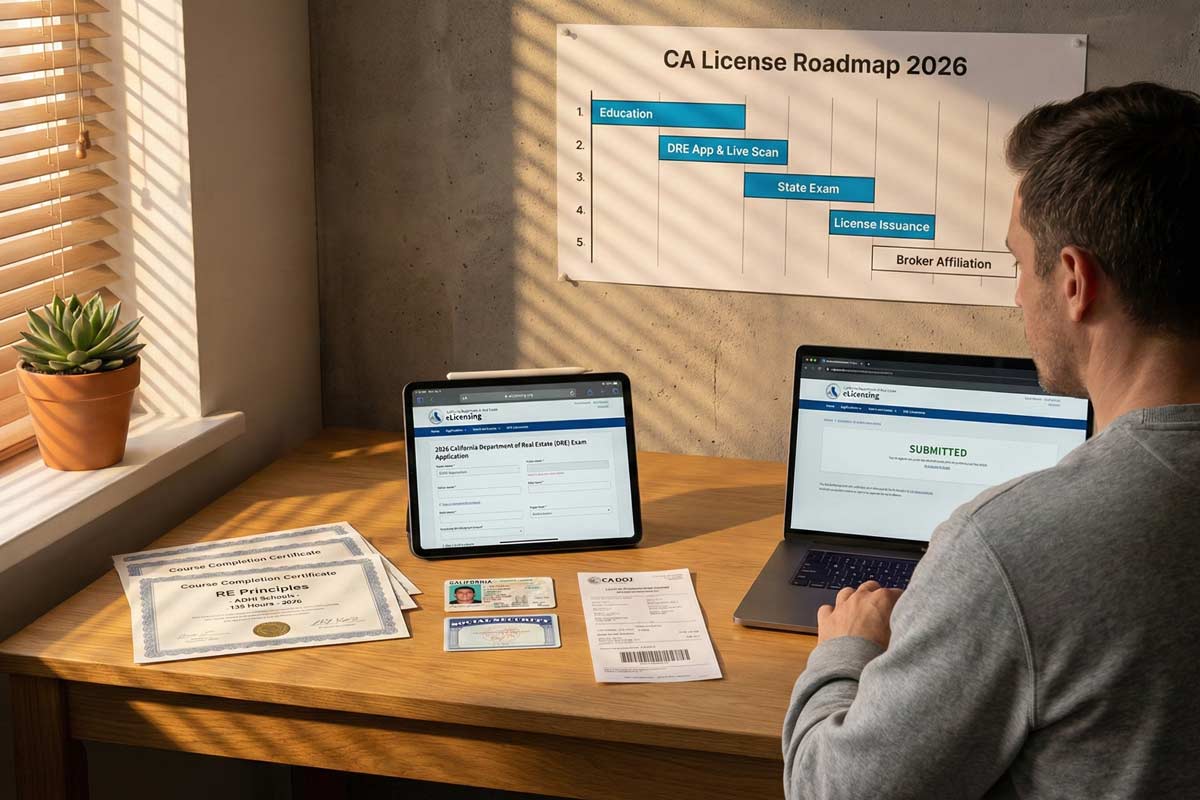

The typical order is: pre-license school → exam application → passing the state exam → license number issuance → brokerage affiliation.

In my 20+ years of guiding thousands of students at ADHI Schools, I’ve seen this confusion cause more delays than the exam itself. This guide provides the exact roadmap to avoid those traps.

Do You Need a Broker to Apply for a California Real Estate License?

No—you don’t need a broker to apply for or take the California real estate exam. You can complete the education and application without a sponsoring broker affiliation. But you can’t legally practice real estate or earn commissions until your license is placed with a supervising brokerage.

Do You Need a Broker to Take the California Real Estate Exam?

Absolutely not. The Department of Real Estate (DRE) allows any individual who has met the 135-hour education requirement to sit for the exam. You are applying as an individual, not as a representative of a firm. You can take the exam as an individual, regardless of brokerage affiliation.

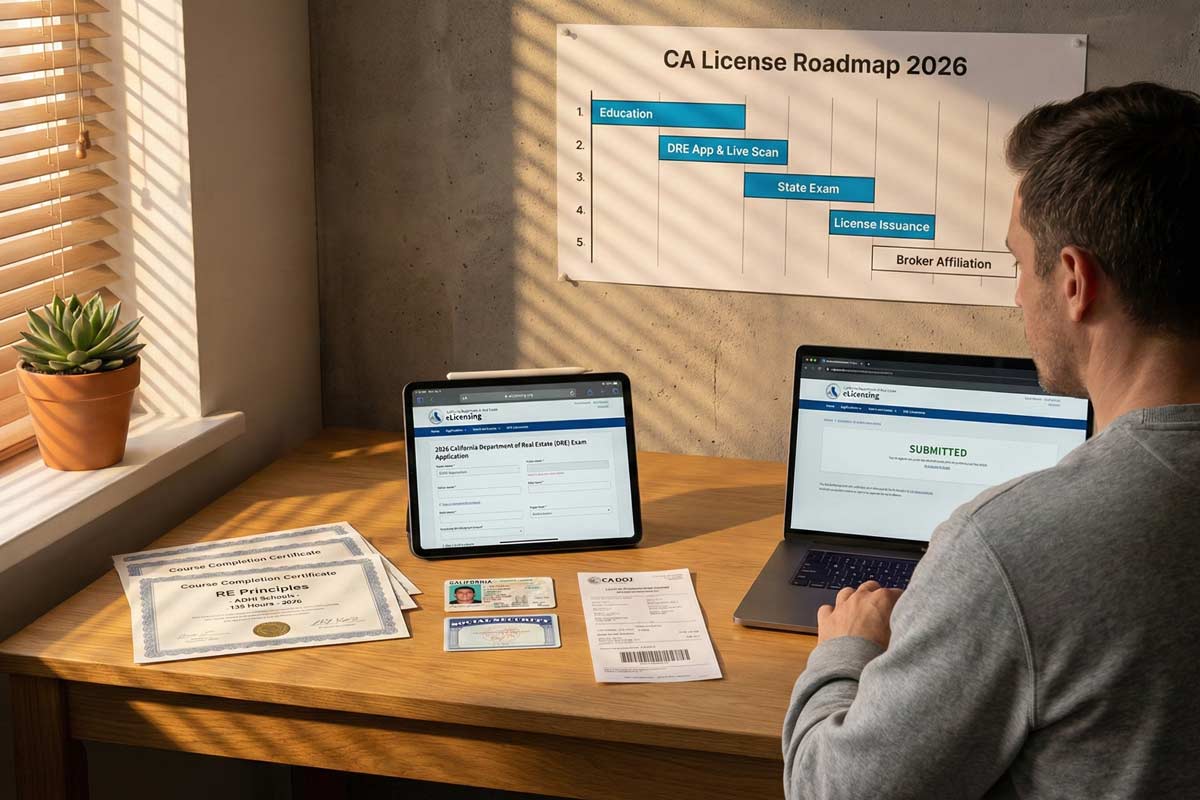

The Correct California Timeline: A Step-by-Step Roadmap

Following the state-mandated order of operations is the only way to ensure you don’t waste time.

Complete Your 135 Hours of Pre-License Education: You must finish three college-level courses. Can You Take the Exam Before Completing All 135 Hours? No—you must have your certificates in hand first.

Apply for the State Exam & Submit Fingerprints: You submit your application and Live Scan fingerprints to the DRE. You do not need a broker’s signature for the exam application.

Note: The biggest avoidable delays are simple mismatches—your name, ID, and course certificates must match exactly.

Pass the California Real Estate Salesperson Exam: This is your primary hurdle.

Receive Your License Number from the DRE: The DRE issues your license number after clearing criminal background. You can complete this entire process independently and without broker affiliation.

Affiliate with a Brokerage to Practice (“Hang Your License”): Once you have a license number, you must place your license with a supervising broker so you can legally practice and earn commissions.

Pro Tip: If you want the full start-to-finish roadmap, use our California Real Estate License Guide.

Key Terms Demystified

Understanding DRE terminology prevents "bureaucratic paralysis."

“Applying for a License” vs. “Practicing”: Applying is between you and the State. Practicing is between you and a Broker. You can do the first without the second.

“Hanging/Placing Your License”: This means officially associating your license with a Broker of Record. This is what moves your license into a status that allows for commissions.

Independent Contractor Reality: You are a 1099 contractor. The broker supervises your licensed activity; however, you generate your own business unless the brokerage specifically provides leads.

What Happens After You Get Your California Real Estate License? The focus shifts from "passing the test" to "building a business."

When (and Why) to Talk to Brokerages Early

Research is smart; commitment is premature. You should interview brokerages while you wait for your exam date to assess:

New Agent Training: Does the broker have a formal mentorship program?

Commission Splits & Fees: What is the actual "take-home" after all fees?

Lead Generation Support: Do they provide leads or just "coaching"?

Compliance Support: Who reviews your contracts to keep you out of court?

Costly Mistakes to Avoid

Waiting to Apply Until You Find a Broker: I’ve watched students wait 90 days "shopping brokerages" while their exam eligibility window and motivation evaporated. Don't wait. Apply the moment you have your certificates.

Choosing a Brand Over Training: I once spoke to an agent who picked a famous global brand for the "vibe," but quit after 4 months because no one showed them how to actually get business. Top Reasons People Fail to Get Licensed in California often trace back to a lack of early support.

Losing Momentum After the Exam: The gap between passing the exam and finding a broker should be days, not months.

Your 7-Day Action Plan

Day 1-2: Finish your current education course module.

Day 3: Draft a shortlist of 3-5 local brokerages to research.

Day 4: Prepare 8 questions to ask future brokers (focus on training and splits).

Day 5: Double-check your DRE exam/license application for errors (name match, IDs, and certificates).

Day 6-7: Submit your application to the DRE.

Frequently Asked Questions (FAQ)

Can I apply for the CA real estate exam without a brokerage?

Yes. Affiliation is not required to apply for or take the exam.

Do I need a sponsor broker for the exam?

No. Sponsoring brokers are required for practicing, not for taking the exam.

Can I interview brokerages before I’m licensed?

Yes, and you should. Most brokers are happy to speak with prospective agents who are currently in school.

What if I join a brokerage now—does it speed up the DRE?

No. The DRE processes applications in the order received, regardless of which brokerage you intend to join.

What if I pass the exam but don’t pick a brokerage?

You will have a license number, but you cannot legally represent clients or collect a penny in commission until you associate your license with a broker.

Can my license expire if I don’t join a brokerage right away?

Your license remains valid once issued, but you must still meet renewal requirements and continuing education deadlines every four years, regardless of whether you are affiliated with a broker.

Next Steps on Your Licensing Journey

The brokerage choice is critical for your success in the field, but it is not a prerequisite for the state exam. Focus on your 135 hours and your application first.

For the complete, step-by-step licensing roadmap (start to finish), use our California Real Estate License Guide.

|

The "License Cliff": Why Agents Can Stall in the First 30 Days

You pass the state exam, celebrate, and then the email arrives from the DRE: "Your license is active." Suddenly, the guided path of mandatory Read more...

The "License Cliff": Why Agents Can Stall in the First 30 Days

You pass the state exam, celebrate, and then the email arrives from the DRE: "Your license is active." Suddenly, the guided path of mandatory courses and proctored exams ends. You are no longer a student with a syllabus; you are a business owner with a blank canvas.

If you aren’t careful, you can end up on the wrong side of what we call the “License Cliff”.

Without guidance or deadlines, new agents can drift into "luxury cosplay"—spending weeks on logos and business cards while their momentum evaporates. Here’s what to do after you get your California real estate license in the first 30 days to move from "licensed" to "in business."

The 30-Day Launch Sequence

????The Day 1–2 Checklist: Immediate Momentum

Identify 3 Brokerages: Do not over-analyze. Pick three based on proximity and reputation.

Call the Managers: Request a "New Agent Interview." Do not wait for an "opening."

Audit Your Finances: Make sure you can cover 3–6 months of dues + basic expenses.

Phase 1: The Mandatory First Step – Hang Your License

Practically speaking, you can’t operate solo in California. Your license becomes usable when it’s placed under a supervising broker. Your broker sponsors your license and provides the supervision and compliance umbrella that lets you practice.

Who is this for?

The Solo Agent: You want to build your own brand from Day 1 and keep a higher split.

The Team Agent: You want provided leads and high accountability.

ADHI Recommendation: For most brand-new agents, training beats split—by a lot. A training-heavy team environment provides the systems you need to survive Year 1.

The Brokerage Interview Scorecard

Onboarding: Is there a structured 30-day plan or just a desk?

Costs: What are the monthly tech, desk, and E&O (Errors & Omissions) fees?

Live Training: Can you shadow a listing presentation or an inspection this week?

Directive: Schedule 3–5 interviews. Your goal is a qualified launchpad for your first 12–24 months. If you’re still navigating the timing of your application, read Do You Need to Join a Brokerage Before Applying for a License?.

Phase 2: Setup Week – Activating Your Toolkit

Once sponsored, your first week is about technical setup. Avoid the "Branding Black Hole" and focus on permission-to-play tasks.

Your First 7-Day Setup Checklist

Task

Action Item

Compliant Signature

Include your Name, DRE License #, and Brokerage info (required for compliant advertising).

CRM Import

Export your phone and social media contacts. This is your "Sphere of Influence."

MLS & Supra

Get your MLS login and set up your Supra key for lockbox access.

The "Ask" Rule

Bookmark your broker's guidelines. When unsure on a disclosure, pause and ask your broker.

Phase 3: Your First 30 Days – The "Conversation Engine"

In real estate, Activity > Results. You cannot control a closing, but you can control your scoreboard.

Your First 30-Day Activity Scoreboard

10 New Conversations: Direct, two-way dialogues about the market.

5 Value-Add Follow-Ups: Sending a useful report or link (not just "checking in").

1 Hosted/Shadowed Open House: Your field laboratory for meeting neighbors.

1 Practice RPA: Write a mock Purchase Agreement using your broker’s templates.

Reality Snapshots

The “Ghost” Agent: I’ve seen students pass the exam but wait 60 days to pick a broker. By then, their momentum is dead.

The Branding Trap: One agent spent $500 on a custom logo before their first sphere call. Six months later, they were out of the business with a beautiful, empty website.

The Open House Win: A new agent hosted an open house for a top producer. They didn't sell that house, but met a neighbor who listed with them four months later. That one conversation turned into a $25k commission.

The Top 3 Post-License Traps

"I need a perfect brand first": Your brand is competence and responsiveness. Use your brokerage's templates for 6 months while you learn the contracts.

Tool Overload: You will be pitched "guaranteed leads" by dozens of vendors. The Fix: Use only what your brokerage provides for the first 90 days.

The Expert Fear: You don't need to know everything. Your script is: "That's a great question. Let me confirm this with my broker/manager so I give you the exact answer."

FAQ

"Can I get my license first and choose a broker later?"

Technically yes, but you are losing momentum. Read Top Reasons People Fail to Get Licensed in California to see why delay is the enemy of success.

"What if I feel unprepared?"

The exam proves you know the law; the first 30 days prove you can follow a system. If you haven't finished your hours yet, check Can You Take the Exam Before Completing All 135 Hours? to speed up your timeline.

"What does my broker actually do?"

They are your regulatory partner. They review your files for compliance, provide legal contracts, and pay your commissions. They are the "adult in the room" for your professional liability.

Your Next Step

Getting licensed was the "license to learn." Now, you must execute. If you are still navigating the pre-license requirements, solidify your foundation with our complete California Real Estate License Guide.

Open your calendar now and block 9:00 AM – 11:00 AM tomorrow for "Brokerage Research and Outreach." Treat it like an appointment.

|

You’re at a coffee shop with a potential seller. They lean in and ask: “What’s the risk if we don’t disclose that old roof patch from three years ago?”

You hesitate. You glance at your phone. Read more...

You’re at a coffee shop with a potential seller. They lean in and ask: “What’s the risk if we don’t disclose that old roof patch from three years ago?”

You hesitate. You glance at your phone. You say, “I think…”

In that three-second pause, you just had credibility bleed.

Clients don't fire you because you’re new; they leave because you look unprepared, vague, or chaotic. Professionalism is not a personality trait—it is a system of repeatable signals.

TL;DR: The New Agent Credibility Fix

No Guessing: “I’ll verify and follow up by ___.”

Bring Structure: Agenda + comps + next steps (every time).

Own the Calendar: Deadlines don’t manage themselves.

Disclosures = Risk Management: Early delivery, clean tracking, zero surprises.

Practice Decision Trees: Scripts are branching logic, not lines to memorize.

12 New Agent Mistakes That Kill Your Credibility

1. The "I Think" Guess

The Mistake: Answering a technical or market question with "I think..." or "I’m pretty sure..."

Why It Hurts: In California, “I think” sounds like “I’m gambling with your equity.”

The Professional Fix: Use the Expert Deferral Script: "Great question. I’m not going to guess. I’m going to verify it and text/email you the correct answer by 4:00 PM."

Credibility Phrase Bank (Steal These):

“I’m not guessing.I’ll verify and send you the exact answer by 4:00 PM.”

“Here’s the timeline. I’ll own the next step and keep you ahead of deadlines.”

“Let me translate this into plain English, then we’ll decide.”

“I’ll recap this in writing so nothing gets lost.”

2. Showing Up Without a Printed Agenda

The Mistake: Entering a first listing appointment and asking,

"So, what would you like to talk about?"

Why It Hurts: If the client has to lead the meeting, they don't need you.

The Professional Fix: Bring three copies of a one-page agenda: one for them, one for you,

and one as a backup. It signals you have a process for their success from day one.

3. Over-Talking to Fill the Silence

The Mistake: Talking incessantly because you’re nervous.

Why It Hurts: Silence is a high-status negotiation tool; over-talking signals nervousness and uncertainty. Calm beats charisma.

The Professional Fix: Study negotiation basics to understand that the person asking the questions controls the room. The first person who starts explaining is usually the one giving away leverage.

4. Robotic Script Delivery

The Mistake: Using a script exactly as written without adjusting for tone or context.

Why It Hurts: You sound like a telemarketer. Clients can sense when you’re "doing a routine."

The Professional Fix: You must practice real estate scripts until they become "decision trees"—you know the intent of the words, not just the order.

5. Skipping the Buyer Discovery Phase

The Mistake: Taking a buyer to see houses before conducting a formal first buyer consultation.

Why It Hurts: You look like a tour guide. It suggests you have no system for protecting their time.

The Professional Fix: Push for an office or Zoom consultation. Use a standardized questionnaire to uncover their "must-haves" vs. "nice-to-haves."

6. Vagueness on California Timelines

The Mistake: Not explaining the common contingency periods (e.g., 3, 7, or 17 days) clearly.

Why It Hurts: California contracts are timeline-heavy. If a client is surprised by a "Notice to Perform," you lose their trust instantly.

The Professional Fix: Create a "Transaction Calendar" for every client. Explain the most common contingency timelines in your contract before they sign.

Micro-checklist:

Put all deadlines in a shared calendar invite.

Send a one-page timeline PDF the same day.

Confirm the “Next deadline” at the end of every call.

The Contingency Scare: A rookie agent forgot to track the inspection contingency deadline. On day 18, the listing agent sent a "Notice to Perform." The buyer panicked, thinking they were in trouble (they may have been if the inspections weren’t even ordered). The agent had to spend three days in "damage control" because they hadn't pre-framed the timeline.

7. Not Pre-Framing the RPA Before the First Offer

The Mistake: Waiting until the offer is written to introduce the 25-page California Residential Purchase Agreement.

Why It Hurts: Clients feel ambushed by massive paperwork. Ambush destroys trust.

The Professional Fix: Give a 3-minute “RPA orientation” during the consult: what they’ll see, what matters, and how you’ll translate it into plain English.

8. Sloppy Email and Documentation

The Mistake: Missing subject lines, typos, or disorganized attachments.

Why It Hurts: Sloppy emails = sloppy contracts (in the client’s mind).

The Professional Fix: Use a clear format: [Property Address] - [Document Name] - [Action Required].

9. Answering Outside Your Expertise

The Mistake: Giving tax, legal, or structural engineering advice.

Why It Hurts: It’s a liability and makes you look like you don't understand professional boundaries.

The Professional Fix: Build a "Partner List." When asked about taxes, say: "That’s a great question for a CPA. I have two my clients use; would you like their contact info?"

10. Being "Always Available"

The Mistake: Answering every text in 30 seconds at 11:00 PM.

Why It Hurts: It signals you aren't busy. High-demand professionals have boundaries.

The Professional Fix: Set communication expectations early. Tell clients you respond between 8:30 AM and 6:30 PM. Add: "Emergencies are different—if something is truly time-sensitive, call me."

11. Reactionary Negotiation

The Mistake: Passing an offer to a client without a summary or strategy.

Why It Hurts: It makes you a "delivery person," not a negotiator.

The Professional Fix: Before calling the client, analyze the offer against the comps and prepare a "Net Sheet."

12. Treating Disclosures as "Admin" instead of Protection

The Mistake: Treating disclosures like paperwork instead of risk management.

Why It Hurts: The fastest way to lose trust with a real estate client is a surprise after the fact.

The Professional Fix: Always default to the TDS. If you’re asking whether it’s disclosable, treat it as disclosable until your broker says otherwise.

Micro-checklist:

Deliver disclosures as early as possible.

Track the exact date of receipt and review.

Confirm in writing: “No surprises later.”

Common Rookie Realtor Mistakes (Quick List)

Guessing on technical questions instead of verifying.

Winged meetings without a printed agenda.

Filling silence with over-explanations.

Robotic script reading instead of conversational mastery.

Skipping the formal consultation to go "tour" houses.

Fumbling CA timelines like contingency removals.

Ambushing clients with the 25-page RPA at the last minute.

Messy email habits that signal a lack of discipline.

Giving legal/tax advice outside of professional scope.

Lacking boundaries around late-night availability.

Presenting offers without a summary or strategy.

Downplaying disclosures and risking future lawsuits.

The Credibility System: Your Daily Protocol

To start a real estate career in California and actually thrive, you need to turn these fixes into daily discipline:

Prep (30 min): Comps + form set + agenda + timeline before every meeting.

Lead the Meeting: Frame → Discovery → Recommendation → Next Step.

Recap in Writing (2 hours): Bullets + deadlines + who owns what in an email.

Own the Next Step: If it’s important, it gets a specific date and time on the calendar.

FAQ: Building Credibility in California

How do I sound confident if I’m brand new?

Confidence comes from the process, not the result. If you follow a checklist, you don't have to be confident in yourself—you just have to be confident in the system.

Should I admit I’m new?

Don't lead with it, but don't lie. Pivot to your team:

"I’m a newer associate at [Brokerage Name], so you get my full focus, backed by my broker’s 30 years of experience and our firm's legal team."

What if a client asks how many deals I’ve done?

Don’t inflate numbers. Be honest and pivot to process:

"You’re getting my full focus, plus broker oversight and a transaction system that prevents mistakes in timelines and disclosures."

Your Professional Path Forward

You don’t need a decade of experience to be the most professional person in the room.

You simply need a repeatable process that removes doubt.

Pick Your Lane (Do this this week):

Buyers: Master your first buyer consultation so you stop being a tour guide and start being a decision coach.

Sellers: Run a real first listing appointment with a printed agenda and a clear pricing conversation.

Confidence: Practice real estate scripts as decision trees so you don’t freeze when clients throw curveballs.

Stop trying to sound experienced. Start sounding prepared.

|

It starts with a burst of energy. You decide to take control of your career, enter a new industry, and prepare to get your first clients.

But then, life happens. The 135-hour requirement feels like Read more...

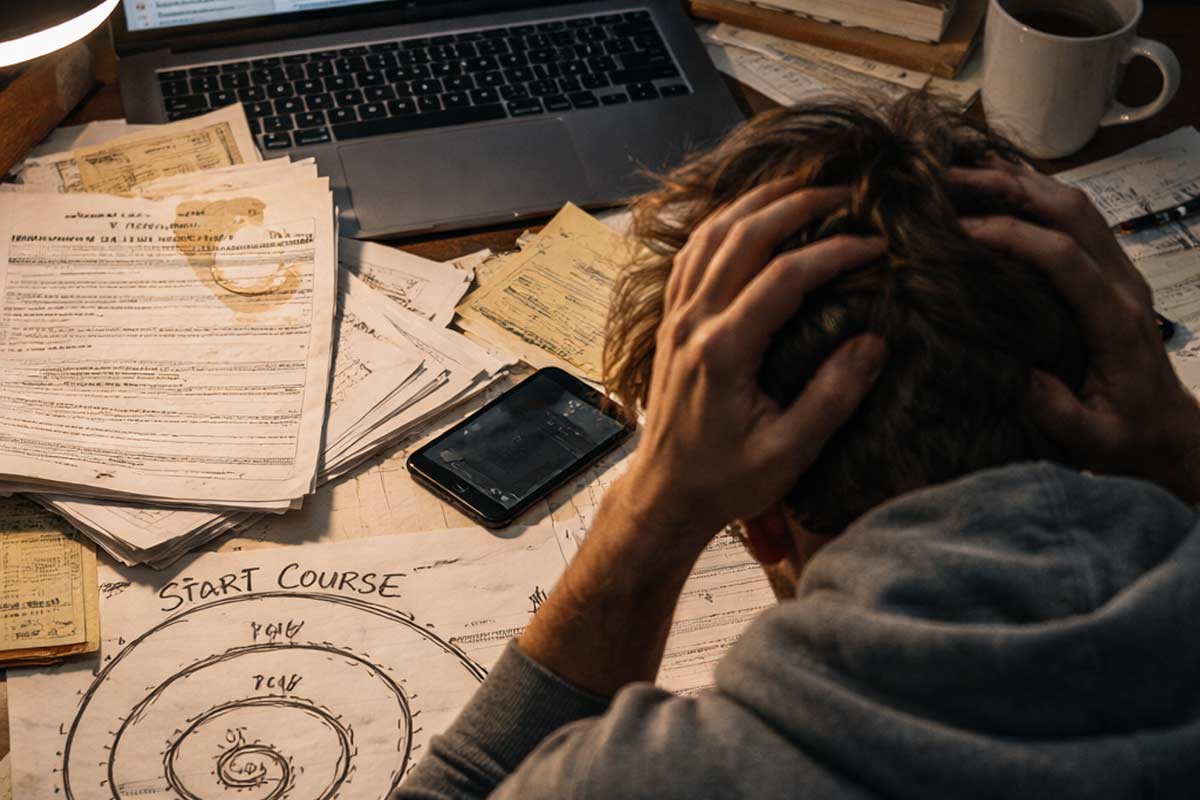

It starts with a burst of energy. You decide to take control of your career, enter a new industry, and prepare to get your first clients.

But then, life happens. The 135-hour requirement feels like a mountain. The DRE website looks like a maze of 1990s-era forms. Suddenly, six months have passed, and you haven’t even scheduled your exam.

This is the "Licensing Spiral": a cycle where administrative confusion and life interruptions kill your momentum until your goals disappear entirely.

In my 20+ years of coaching thousands of candidates at ADHI Schools, I’ve realized that failing to get licensed is rarely about a lack of intelligence. It is almost always a result of predictable, procedural friction points. If you fix the one friction point you’re stuck on, the rest becomes straightforward.

Key Takeaways

Process > Intelligence: Administrative errors kill more careers than the actual exam does.

Timelines Matter: Processing times and scheduling delays can quietly derail you.

Momentum is King: If you aren't moving forward, you are moving backward. Use the rescue checklist below to restart.

The 60-Second Licensing Map

To get your license, you must follow this exact sequence. If you are currently stalled, you are stuck at exactly one of these five steps:

Complete 135 Hours: Finish three approved college-level courses.

Apply & Schedule: Submit your Combined Exam/License Application to the DRE.

Pass the State Exam: Score 70% or better on the 150-question test.

Submit License Application: Ensure background checks and fees are finalized.

Affiliate with a Broker: Find a sponsoring broker to "activate" your license.

For a complete, step-by-step blueprint of the licensing journey, see the California Real Estate License Guide.

10 Reasons People Fail (And How to Fix Each)

1. The "Casual Study" Fallacy

The Mistake: Picking up the material only when you "have time."

The Consequence: You lose continuity and momentum, making it harder to retain complex legal concepts as you move through the modules.

Fix Today: Open your calendar and block out exactly 90 minutes for tomorrow morning. Consistency beats intensity every time.

2. Misunderstanding the Application Window

The Mistake: Waiting until you have "mastered" every page of the material before looking at the DRE application.

The Consequence: DRE processing can take weeks. Waiting to “feel like you’re ready” before applying adds a massive "dead zone" where your knowledge goes cold.

Fix Today: Understand the nuances of the timeline by reading Can You Take the Exam Before Completing All 135 Hours? to see when you should actually apply.

3. The "Name Mismatch" Error

The Mistake: Using a nickname or maiden name on your Live Scan (fingerprints) that doesn’t match your official DRE application.

The Consequence: This creates a manual "flag" in the DRE system, potentially delaying your eligibility by 30–60 days while they reconcile your files.

Fix Today: Look at your government-issued ID. Ensure every form you sign matches that ID character-for-character.

4. The Memorization Trap

The Mistake: Taking the same practice quiz 50 times until you "know the answers."

The Consequence: You aren’t learning the law; you’re learning the pattern of a quiz. When the DRE rephrases the question on exam day, you will fail.

Fix Today: Do mixed sets of questions and track wrong answers by topic. If you can’t explain the logic of the correct answer out loud, you don’t know it yet.

5. The "Post-Pass" Momentum Kill

The Mistake: Celebrating the passing score but failing to file the final paperwork or pay the licensing fees.

The Consequence: Your passing score has an expiration date. If you don't file the application for your license promptly, you will have to retake the entire state exam.

Fix Today: Decide whether you are going inactive vs. active, and complete the post-pass steps immediately. Follow our guide on What Happens After You Get Your California Real Estate License? to ensure you cross the finish line.

6. Paralysis by Analysis (The Research Trap)

The Mistake: Spending weeks in online forums asking "Which school is best?" instead of starting.

The Consequence: Research is often just a sophisticated form of procrastination used to mask the fear of starting a new career.

Fix Today: Start with ADHI Schools—ideally today—and finish Lesson 1 of your first course. Clarity comes from action.

7. Distraction by Brokerage Interviews

The Mistake: Interviewing 10 different brokerages before you even have an exam date.

The Consequence: You are focusing on Step 5 when you are still at Step 1. This drains the mental energy you need for the state exam.

Fix Today: Realize you don't need a broker to get the process started. Get the facts here: Do You Need to Join a Brokerage Before Applying for a License?

8. Underestimating Logistics & Fees

The Mistake: Failing to budget for the multi-step fee structure.

The Consequence: You pass the exam but "wait for the next paycheck" to pay the licensing fee, which turns into a multi-month delay.

Fix Today: Set aside the DRE exam/license fees plus Live Scan vendor fees now so money never becomes a stall point.

9. Trusting Forum Myths Over DRE Facts

The Mistake: Following advice from "someone on Reddit" regarding current DRE regulations.

The Consequence: Regulations change. Relying on outdated anecdotes can lead to rejected applications or missed deadlines.

Fix Today: Only trust official DRE publications or ADHI Schools that handles these filings daily.

The 10-Minute Rescue Checklist

If you are here...

Your next 60 minutes...

The Momentum Builder...

Haven't started courses

Enroll in ADHI Schools.

Complete Chapter 1 immediately.

Stuck mid-course

Audit your calendar; identify the "leak."

Block 90 mins for tomorrow; no excuses.

Finished courses, no exam date

Submit your application (eLicensing preferred).

Verify your ID name matches exactly.

Waiting for DRE processing

Establish a "Study Retention" schedule.

Keep studying 20–30 min/day to prevent decay.

Passed, but no license yet

Check your status on eLicensing.

If not a combo app, submit the license app quickly.

FAQ: Common Licensing Questions

Can I take the California real estate exam before finishing my 135 hours?

You must complete the three required courses to be eligible for an exam date. However, you can often save time by understanding exactly when to submit your application and what documentation to send so you don’t create a "dead zone" while the DRE processes your file. See our 135-hour timing guide for the specific strategy.

Do I have to use eLicensing for my application?

No, but the DRE states that eLicensing is significantly faster for processing. If you choose to use paper (Form RE 435), it must be mailed with original signatures.

What’s the most common reason people fail the California real estate exam?

Over-thinking. Candidates often try to apply "real world" logic or stories they heard from friends rather than relying on the specific legal definitions found in the textbook.

The Path Forward: Stop Stalling

Stalling is a normal part of the process, but it doesn't have to be the end of your story. The difference between a "former student" and a "top producer" is simply the willingness to fix these procedural errors and keep moving.

For the step-by-step map: Start with the California Real Estate License Guide.

For the "After-Pass" plan: Read What Happens After You Get Your California Real Estate License?

For a proven system: If you want the courses, the structure, and the veteran coaching to avoid these mistakes entirely, ADHI Schools is built for exactly that.

Let’s get to work.

|

TL;DR: The Bottom Line

The Answer (in plain English): No — you can’t be authorized to schedule or take the California real estate exam until the Department of Real Estate Read more...

TL;DR: The Bottom Line

The Answer (in plain English): No — you can’t be authorized to schedule or take the California real estate exam until the Department of Real Estate (DRE) verifies you’ve completed all 135 hours (three 45-hour courses).

The Risk: Submitting your application while you’re “still finishing” your last course is the fastest way to trigger a DRE deficiency notice and delay.

The Solution: Finish your courses, secure your certificates, and follow the "clean-file sequence" to move from candidate to licensee without bureaucratic friction.

Most confusion comes from mixing up applying to the DRE with scheduling an exam date—scheduling your state exam can only happen after DRE approval.

The Truth Table: What You Can (and Can’t) Do Right Now

Action

Possible before 135 hours?

Outcome / Practical Advice

Submit DRE application

Yes (don’t)

Triggers a deficiency notice and adds weeks of delay.

Get Authorization to Schedule

No

The DRE won’t issue an exam invite until your file is 100% complete.

Choose an exam date

No

You can’t access the eLicensing calendar until you’re approved.

Study & exam prep

Yes

Recommended — this is the only “shortcut” that actually works.

The Speed Trap: Why "Almost Done" Is Still a "No"

In my 20-plus years of training thousands of agents at ADHI Schools, I’ve seen one mistake repeat more than any other: the Speed Trap.

It usually starts with a highly motivated candidate who is halfway through their third course. They look at the DRE’s current processing times—which fluctuate—and think they’ve found a loophole. They decide to mail their exam application today, assuming that by the time a DRE processor actually opens their envelope, they will have finished the course and can just "send in the final certificate later."

This is a high-stakes gamble that almost nobody wins. The DRE does not "hold" your spot in line while you finish your homework. If a processor opens your application and the course completion certificate is missing, the process doesn’t pause—it breaks. You won’t just lose time; you’ll lose your momentum and you'll be waiting for a deficiency notice and a new review cycle before you can fix it.

The DRE’s system is built to verify eligibility first — clean files move faster than hopeful ones. In practice, the fastest candidates aren’t the ones who rush—they’re the ones who submit a file with nothing for the DRE to question.

The 135-Hour Rule, Explained Simply

To qualify for the California real estate salesperson exam, state law requires the completion of three DRE-approved pre-licensing courses, totaling 135 hours:

Real Estate Principles (45 hours)

Real Estate Practice (45 hours)

An Elective Course (45 hours—most of our students choose Finance, Appraisal, or Legal Aspects)

Enrollment in these courses is subject to California’s minimum time-in-course rules (usually enforced as a minimum number of days per course). You cannot "crash" these courses in a weekend; the regulatory framework is designed to ensure a minimum level of exposure to the material before you are given the ability to test out.

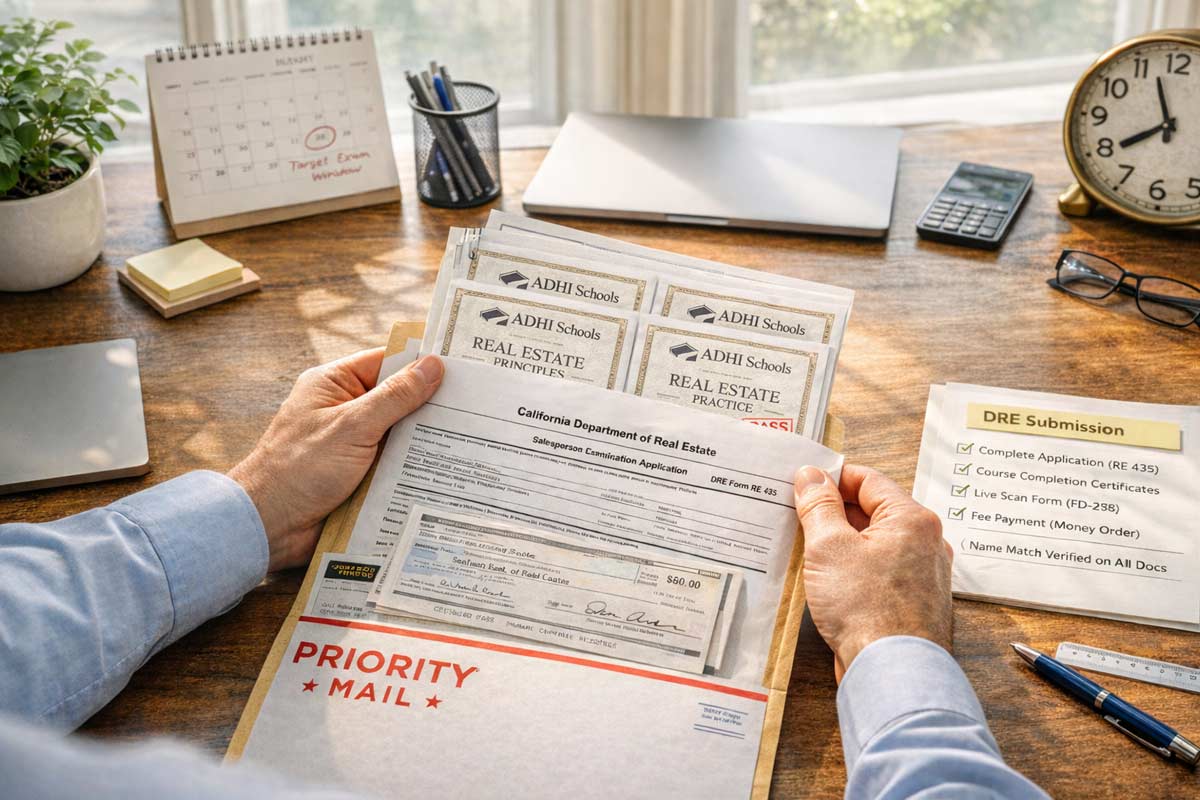

The "Completed" Checklist

The DRE only considers a course "complete" when you have checked these three boxes:

Time Requirement: You have spent the mandated number of days enrolled in the course (18 calendar days typically).

Examination: You have passed the final exam for that specific course with a score of 60% or higher with ADHI Schools.

Documentation: You have received a formal course completion certificate or transcript showing the exact course title and your legal name as it appears on your government-issued ID.

Until you have all three certificates in your possession, you are not an eligible candidate for the state exam.

The Real Answer: "Exam Before Hours" Scenarios

Let’s break down the specific scenarios candidates use to try and bypass the timeline.

Can I schedule the exam before finishing 135 hours?

No. In California, you don’t simply call a testing center and pick a date like you would for a haircut. You must first apply to the DRE. They review your education proof, and only then do they issue an Authorization to Schedule (also known as an Exam Invite). Until you’re approved, you’re not “in line” for an exam seat.

Can I take the state exam before finishing 135 hours?

No. There is no "provisional" testing. The education is a statutory prerequisite. Without the 135 hours, you aren't a candidate; you're just someone with an incomplete application.

What if I’m 90% done with my last course?

No. The DRE does not recognize partial credit. Whether you have 0 hours or 134 hours, the result is the same: Ineligible. You must wait until the final certificate is issued before mailing your application packet.

What if my course is done, but I’m waiting for my certificate?

No. Do not mail your application with a note saying "Certificate coming soon."

What if I finished courses years ago?

Only If. In many cases, older course completion records can still be usable, but the safest move is to verify your course titles and the provider's approval status to make sure you're applying under current DRE rules. If you are unsure if your older classes still count, check our California Real Estate License Guide to ensure your education aligns with today’s standards.

The Fastest Path: The "Clean-File" Sequence

Complete the 135 Hours: Finish Principles, Practice, and your Elective.

Gather Your Proof: Secure all three course completion certificates. Ensure your name matches your government-issued ID exactly.

Submit the "Combined" Application: Use form RE 435 (Salesperson Exam/License Application). Most first-time applicants should use the combined path so you don’t create a second processing cycle after passing.

The Waiting Window: Once your application is mailed, the DRE enters a review period where they process your file.

Pro-Tip: Start with the California Real Estate License Guide for a detailed step-by-step process.

What You Should Do While Waiting for Your Exam Date

The period between mailing your application and receiving your Authorization to Schedule is not "dead time." If you just sit and wait, you are actually slowing yourself down. Use this window to handle the "back-office" of your new career:

Live Scan Fingerprints:You don't have to wait until you pass the exam to do your background check. Doing it now means your license can be issued almost immediately after you pass.

Master the Material: The 135 hours of pre-licensing education is the "what." Now you need to learn the "how" of passing the exam. This is when you should be high-quality exam prep tools.

Brokerage Interviews: You can't actually sell real estate without a broker. Use this time to interview different firms. You can learn more about this by reading: Do You Need to Join a Brokerage Before Applying for a License?.

Planning Your Launch: And if you’re trying to plan the first 30 days after activation, read: What Happens After You Get Your California Real Estate License?.

Name Matching Audit: Double-check that your certificates, your application, and your driver’s license all use the same name. If one says "Jim" and the others say "James," fix it now.

3 Costly Mistakes That Will Slow You Down

1. The "In-Progress" Application

As discussed, mailing your application while still enrolled in a course is a guaranteed delay. The DRE is a high-volume government agency; they do not have the resources to "match" a late certificate to an existing file easily. Your file will be set aside, a DRE deficiency notice will be generated, and you will likely have to start the waiting clock all over again.

2. Using the Wrong Application Form

Candidates often use the "Exam Only" form (RE 400) because it's shorter. However, this means after you pass the exam, you have to submit another application for the license itself. This can add significant time to the total process. Always use the combined exam and license application to bypass that second wait.

3. Underestimating the State Exam

I've seen students finish their 135 hours, wait for an exam date, and then fail the exam because they thought the state test would be as easy as the course quizzes. If you fail, you have to reschedule and pay the fee again. This is one of the Top Reasons People Fail to Get Licensed in California.

FAQ: Your Timeline Questions, Answered

Can I apply to the DRE before finishing classes?

Technically, you can mail the form, but it will be treated as a deficient file and you’ll receive a deficiency notice. The DRE requires all three course completion certificates to be included in the initial packet to prove eligibility.

What is an "Authorization to Schedule"?

This is the document the DRE sends you once they have approved your 135 hours and your application. It grants you access to the eLicensing system where you can finally pick your date, time, and location for the exam.

How long are the course certificates valid?

Currently, there is no expiration date on pre-licensing course completions in California.

Is there any way to skip the 135 hours?

Only if you are a member of the California State Bar.

What happens if I pass the exam but haven't picked a broker?

Your license will be issued in "Inactive" status. You won't be able to perform any acts requiring a license or earn commissions until you officially "hang your license" with a broker. See What Happens After You Get Your California Real Estate License? for the next steps.

Speed Comes From Sequence, Not Shortcuts

In the world of California real estate, "slow is smooth, and smooth is fast." The desire to rush the process is understandable—this is a career that offers incredible freedom and income potential. But trying to take the California real estate exam before completing 135 hours is a tactical error that almost always backfires.

True efficiency is found in the "clean-file" sequence: complete your courses, gather your proof, and submit a perfect application. By doing the work correctly the first time, you ensure that once you pass the exam, you are ready to hit the ground running.

Next step (don’t guess):

Start here: California Real Estate License Guide

Ready to begin your courses? → ADHI Schools Pre-Licensing Packages

Choosing a broker next? → Do You Need to Join a Brokerage Before Applying for a License?

|

Disclaimer

This article is for educational purposes only and does not constitute legal advice. California real estate practices are governed by state law, evolving MLS rules, and Read more...

Disclaimer

This article is for educational purposes only and does not constitute legal advice. California real estate practices are governed by state law, evolving MLS rules, and specific brokerage policies. Always follow the direction of your broker, counsel or manager, before advising clients, submitting files, or sending notices.

The Escrow Avalanche

Your offer was just accepted. Within minutes, your inbox is flooded with a dozen PDFs, a timeline from escrow, and a frantic text from your client.

Welcome to the Escrow Avalanche.

For a new agent, the volume of paperwork in a real estate transaction can feel like a mountain of red tape. However, these documents are your protective gear. As I often remind our students:

“Amateurs see forms; professionals see a timeline of protection.”

To survive your first two years, you don't need to memorize every form in the library—you need to understand the "usual suspects" and the proof they provide.

The Big 3 Ecosystem

1. The Contractual Foundation: The RPA

The Residential Purchase Agreement (RPA) is the master blueprint. It defines the price, the Close of Escrow (COE), and the contingency periods.

Rookie Pain: If you don't master this, a single missed checkbox could cost your client their deposit or result in your file being kicked back by compliance. Start here: Purchase Agreement Basics (CAR RPA Explained).

2. The Disclosure Shield: TDS, SPQ, and AVID

The Transfer Disclosure Statement (TDS) is the seller’s statutory disclosure document. The Seller Property Questionnaire (SPQ) is a widely used C.A.R. disclosure supplement that often adds detail beyond the TDS.

The AVID: This form documents your visual inspection and what you observed. It doesn’t replace other legal duties—but it can become critical evidence of your standard of care.

Rookie Pain: If you saw something obvious (stains, cracks, water marks) and your file has no documentation, you and your broker become easy targets later when someone claims “the agent must have known.”

3. The 2025 Standard: Buyer Representation (Two Rules, One Deadline)

There are two overlapping requirements—MLS rules (post-settlement) and California law.

MLS rule (post-settlement, effective Aug 17, 2024): If you are an MLS Participant “working with” a buyer, you must have a written buyer agreement BEFORE you “tour” a home with them (in-person or live virtual).

California law (AB 2992 / Civ. Code §1670.50, effective Jan 1, 2025): A buyer-broker representation agreement must be executed as soon as practicable, but no later than the buyer’s execution of an offer to purchase.

Rule of thumb: Treat “before touring” as your default deadline unless your broker requires something even earlier. Also note: AB 2992 limits initial term length (commonly 90 days) and restricts renewals—so don’t use open-ended buyer agreements.

The Transaction Timeline: Protection + Proof

Phase 1: Pre-Touring & Engagement

Form AD (Agency Disclosure): Explains agency relationships and should be delivered early—and no later than the timing required before a buyer signs a representation agreement and/or executes an offer, consistent with broker policy. You must know How to Explain Agency Disclosure Form AD clearly to prevent implied agency disputes and buyer misunderstandings.

Buyer’s Investigation Advisory (BIA): Explicitly reminds the buyer that they—not the agent—are responsible for investigating the property’s condition.

Protection: Clarifies legal roles and inspection duties before the search begins.

Proof: Signed and dated Form AD and BIA in your transaction folder.

Phase 2: The Offer & Acceptance

The RPA: Sets the "clocks" for the entire deal.

Wire Fraud Advisory (WFA): Warns clients not to trust emailed “changes” to wire instructions and to verify all instructions using a known, independently verified phone number.

Protection: Establishes the contract and guards against cyber-scams.

Proof: Fully executed contract with DocuSign completion certificates + platform audit trails (ZipForm/Glide).

Phase 3: Disclosures & Investigation Window

While often 17 days, never assume—always read the negotiated timeline in your specific contract.

TDS, SPQ, and NHD (Natural Hazard Disclosure): Plus any required statutory or local disclosures for your specific area.

Protection: Creates a documented disclosure record and helps establish what was known and when—but it does not eliminate the buyer’s duty to investigate or the agent’s duty to disclose material facts.

Proof: A platform audit trail showing the exact date and time of delivery.

Phase 4: Negotiations & Repairs

Request for Repair (RR) / Seller Response (RRRR): The formal exchange for property fixes.

Amendment of Existing Agreement (AEA): Used if terms like price or credits change after the original contract was executed.

Protection: Moves repair discussions from verbal promises to written, enforceable terms.

Proof: Fully executed forms with platform audit trails. Note: Your brokerage may use different labels; always use the specific repair/amendment forms your broker requires.

Phase 5: If the Deal Starts Dying

If a client misses a deadline or a party wishes to exit, you must understand Cancellation Rights in California Transactions to protect the deposit. Always confirm the correct notice with your broker or TC before sending.

Notice to Buyer to Perform (NBP): The "warning shot" for missed deadlines.

Protection: Prevents the deal from sitting in legal limbo.

Proof: Timestamped email with full headers or platform-generated delivery report.

Phase 6: Closing Week

Verification of Property (VP):The final walkthrough.

Protection: Confirms the home is as promised before the buyer commits to loan funds.

Proof: Form VP signed by the buyer prior to the Close of Escrow.

Kartik’s Compliance Corner

The "Passive" Myth: Contingencies do not automatically expire. You must secure a written Contingency Removal (CR) form. While some brokerages use different labels, the goal is a clear, written record of removal.

The Evidence Log: In a dispute, "I sent it" is not enough. To defend against fraud and disputes, read our guide on California Anti-Fraud Rules in Real Estate and ensure your file contains DocuSign completion certificates or platform audit trails.

The "Backdate" Trap: If a client or another agent asks you to backdate a signature to "save a deadline," stop. This is a major ethical violation. Call your broker immediately.

[ROOKIE MISTAKE] Don't rely on verbal agreements for repair credits. If a credit isn't documented on an Amendment or Seller Response, it is extremely difficult to enforce and creates a dispute magnet for your broker.

Actionable Checklist: Your Compliance System

Consistent File Naming: Save PDFs as PropertyAddress_FormName_Date.

Standard Proof Artifacts: Ensure your file includes DocuSign completion certificates, platform audit trails, or emails with full headers and timestamps for every mandatory disclosure.

Avoid Blanks: Unfilled lines on an RPA create ambiguity. Always consult your manager on how to mark sections that do not apply to your specific deal.

If you can control your delivery and your deadlines, you can control your risk.

We recommend you save this checklist, build a "Proof" folder template in your email, and run your first few files past your broker. For a deeper dive into the regulations shaping your career in 2025, visit our California Real Estate Laws & Compliance Guide.

Frequently Asked Questions

Q: Do I need a buyer agreement to show houses in California now?

Per MLS policies tied to the 2024 settlement, MLS participants are generally required to have a written agreement before "touring" a home (including in-person and live virtual tours). This typically does not apply to visitors walking into an open house. California law (AB 2992) also requires a signed agreement as soon as practicable, but no later than the execution of a buyer’s offer.

Q: Can a seller cancel if contingencies aren’t removed on time?

In residential property in California, contingencies do not typically expire automatically. If a deadline is missed, a seller typically delivers a Notice to Buyer to Perform (NBP), giving the buyer a short cure period (governed by the terms of the notice) to perform before the seller gains the right to cancel.

Q: How often does C.A.R. update their forms?

C.A.R. updates forms on a regular release cycle (commonly mid-year and year-end), and additional revisions can occur when industry rules change. Best practice: always pull forms from the current library in zipForm®/Glide and confirm your brokerage is using the latest release notes.

|

The “license high” is real.

You finish your real estate courses, pass the California state exam, and hang your license with a reputable brokerage. For a few weeks, adrenaline carries you. Then the Read more...

The “license high” is real.

You finish your real estate courses, pass the California state exam, and hang your license with a reputable brokerage. For a few weeks, adrenaline carries you. Then the silence hits. Your phone doesn’t ring. Your inbox is empty. The Instagram-ready office you built feels like a stage set for a play that never starts.

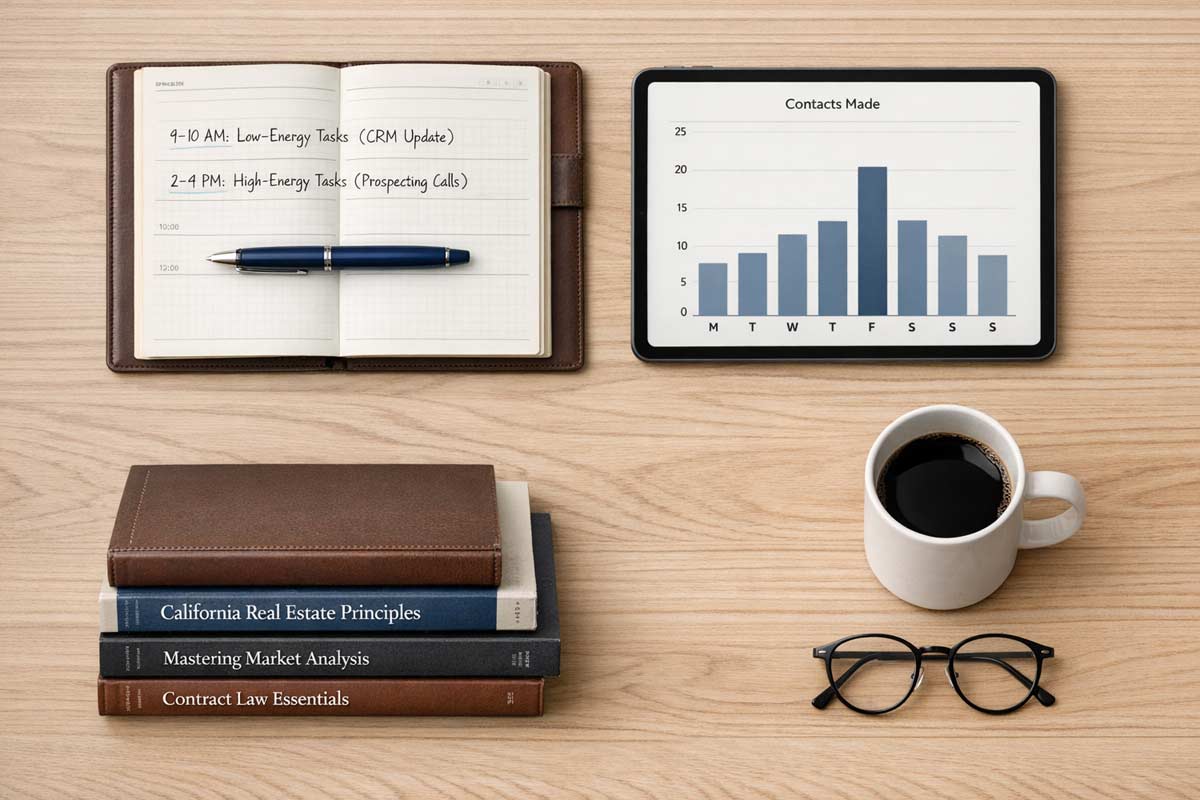

This is the Motivation Collapse—the predictable emotional drop-off that occurs when licensing ends and the tactical reality of real estate begins.

In my 20+ years of training and supervising thousands of California agents across multiple market cycles, I’ve learned that the ones who survive aren’t the most “inspired.” They are the ones who realized that motivation is not the problem; the lack of a structure is.

Diagnosis: Why New Real Estate Agent Motivation Dies

Before you can fix your motivation, you must understand why it’s failing. It isn’t a character flaw; it’s a structural misalignment.

Delayed Feedback Loops: Real estate has no immediate payoff. You can work 60 hours a week for three months and have $0 to show for it.

The “No Scoreboard” Problem: Without a boss or a clock-in system, you have no objective measure of success. If you didn’t close a deal today, you feel like you failed, even if you did the right work.

Toxic Social Comparison: You see "Top Producers" on social media posting about $10M listings. Comparing your "Chapter 1" to their "Chapter 20" leads to immediate FOMO.

Identity Whiplash: You went from being a "Student" with clear goals to a "Business Owner" with total ambiguity.

If this sounds like your current daily reality, you aren't failing; you're just operating without a scaffold.

This transition is one of the core reasons Why Most New Agents Quit in the First Year. If you’re still orienting yourself, start with our complete guide on how to Start a Real Estate Career in California before trying to optimize your mindset.

The Reframe: Discipline Over Feelings

Motivation is a feeling, and feelings are unreliable. If you only prospect when you "feel" like it, you don't have a business; you have a hobby.

The Trap of Productive Procrastination

I see this constantly: A new agent spends three weeks tweaking hex colors on a logo, another rewrites their bio for the tenth time, and another sits with ten CRM tabs open but makes zero calls.

None of those actions risk rejection—still the brain labels them as “work.”

In reality, this is just fear dressed up as an office task. To survive, you must pivot to discipline—doing the high-value, high-fear work precisely because you don’t feel like doing it. This is a foundational element I cover when teaching How to Create a Real Estate Business Plan (New Agents).

5 Survival Systems to Combat Real Estate Burnout

Activity-Based Scoreboards: Stop tracking income; you can't control it yet. Start tracking inputs. Create a daily scoreboard for things you 100% control: outbound calls, hand-written notes, and face-to-face meetings scheduled. If you hit your numbers, you won the day—regardless of your bank balance.

Calendar-First Discipline: Your calendar is your only boss. Block 8:00 AM to 11:00 AM for lead generation. No email, no "office chatter," and no social media scrolling. If it isn't on the calendar, it doesn't exist.

Lead Generation Before Branding: You cannot brand a business that has no clients. I’ve watched agents spend thousands on lifestyle photography before they could even explain a California RPA. Priority 1 is direct outreach. Branding Tips for New California Agents should support your outreach, not replace it.

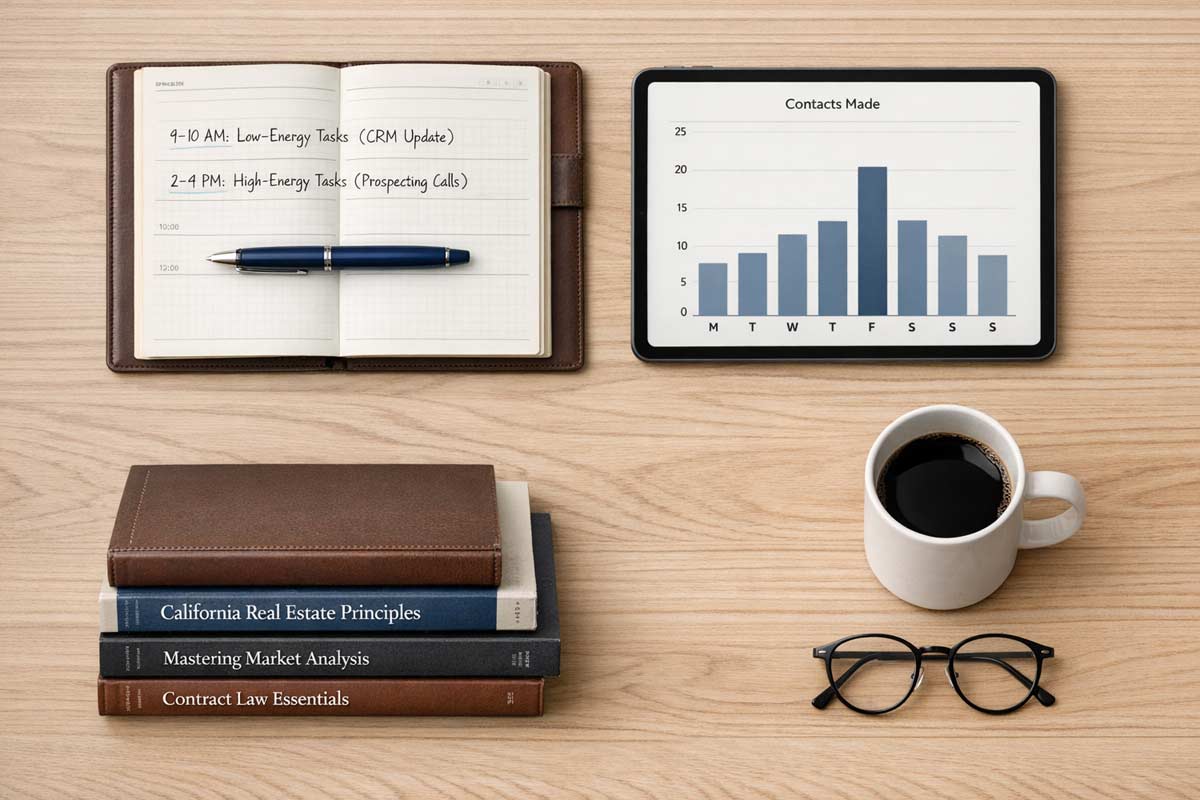

Energy Management (Not Hustle): The "24/7 hustle" narrative is a recipe for a short career. Identify your "Peak Energy" times for negotiations and "Low Energy" times for administrative tasks. Burnout is a system failure, not a lack of effort.

The Isolation Kill Switch: Isolation is where doubt festers. When you are a new agent, your own head is a "bad neighborhood"—don't go in there alone. Mandate a weekly meeting with your broker. Also, learn How New Agents Should Use Social Media in 2026 to build a professional community, not just to compare yourself to influencers.

Tactical Reality Check: What “Normal” Actually Looks Like

Many agents quit because they have a distorted view of the timeline. Here is the non-glamorous reality of a successful first year in the California market:

Timeline

The Reality of Progress

Months 1–3

Invisible Skill-Building. You are learning how to talk and handle rejection. Expect $0.

Months 4–6

The Pipeline Phase. Initial leads are warming up. You might enter your first escrow.

Months 7–12

The Stabilization Phase. Consistent daily activity starts to yield predictable closings.

Most agents quit in Months 2–4. This isn't because they failed at the job; it's because they failed to realize that "nothing happening" is often just invisible competence-building.

Zoom Out to the Career Arc

Motivation is a spark, but systems are the fuel. As you move through your first 18 months, you will find that "staying motivated" becomes less of a struggle because you are becoming competent. Confidence is simply the byproduct of repeated, disciplined action.

If you want to shorten the painful part of this curve, your next step isn’t finding more motivation—it’s choosing structure over motivation. Start with the fundamentals, then layer on the tactics.

FAQ: Staying Motivated as a New Agent

Q: How long does it take for a new real estate agent to get their first lead?

A: In California’s competitive market, a lead can be generated on Day 1 through your sphere of influence, but a "cold" lead typically requires 30–60 days of consistent daily prospecting before a pipeline begins to form.

Q: How many hours should a new agent spend on lead generation?

A: You should spend 70% of your work week on lead generation until you have at least three active escrows. In a standard 40-hour week, that is roughly 28 hours of direct outreach.

Q: What is the best way to handle the "slow periods" in real estate?

A: Shift your focus from "results" to "refinement." Use the slow periods to audit your systems, update your CRM, and increase your outbound volume to ensure the next peak arrives sooner.

|