Your hand hovers over the dial. The script is pulled up on your screen, but the words feel unnatural and obvious at the same time.

In your head, you already sound like a telemarketer.

You’re terrified Read more...

Your hand hovers over the dial. The script is pulled up on your screen, but the words feel unnatural and obvious at the same time.

In your head, you already sound like a telemarketer.

You’re terrified of blanking mid-sentence or, worse, getting hit with a question that knocks you off your path.

Here is the field-tested truth:

Top-producing agents aren't "naturals." They’re just prepared.

Whether you are working a buyer lead, a social media inquiry, or a guest at an open house, scripts are your foundation. This isn't about memorization; it's about building the muscle memory required to stop worrying about your next word and start listening to the client’s needs.

The Core Thesis: Scripts aren't lines to memorize. They are reps to build automaticity. You are training your brain to handle the structure of a deal so your mind is free to think and lead.

The 3-Level Progression: From Memorization to Mastery

In my 20+ years coaching California agents, I’ve seen thousands try to "wing it." They fail because they have no floor. Use this ladder to build your skills.

Level 1: Memorize the FRAME (The "GPS" of the Call)

Most agents fail because they try to memorize a script word-for-word. The moment a prospect goes off-script, the agent’s brain reboots.

The Goal: Know the structural milestones of the interaction.

The Drill: Summarize your script into three "anchor" points.

Connection: "I saw you were looking at the Main Street property—what was it about that home that caught your eye?"

Motivation: "Are you looking for something with that specific layout, or just that neighborhood?"

The Ask: "I’m seeing a few others in that pocket with similar features; would you like to see those this weekend?"

Level 2: Drill for Fluency (Diagnostic Reps)

Note: These characters are diagnostic tools to help you find your "natural" baseline; they are not your final delivery voice.

The Goal: Pacing and tonal control.

The Drill: Set a 60-second timer. Say your script 5 times, changing your "character" each rep:

Whispering: Focuses on crisp enunciation.

Over-excited: Highlights where you sound too "salesy."

Calm/Bored: Helps you find a neutral, professional baseline.

Fast-paced (Stress Test): Tests your ability to keep words fluid under pressure.

Final Rep: The "Curiosity" voice—slow, helpful, and inquisitive.

Level 3: Pressure-Test with Chaos

In the real world, people interrupt. They say, "I'm busy," or "Who is this again?"

The Goal: Progressive recovery.

The Drill: Have a partner interrupt you mid-sentence with a random objection. Your goal isn't to be perfect—it's to see how quickly you can get back into the "Frame."

The Target: Aim for a 7-second recovery initially, working your way down to a 3-second pivot back to the conversation.

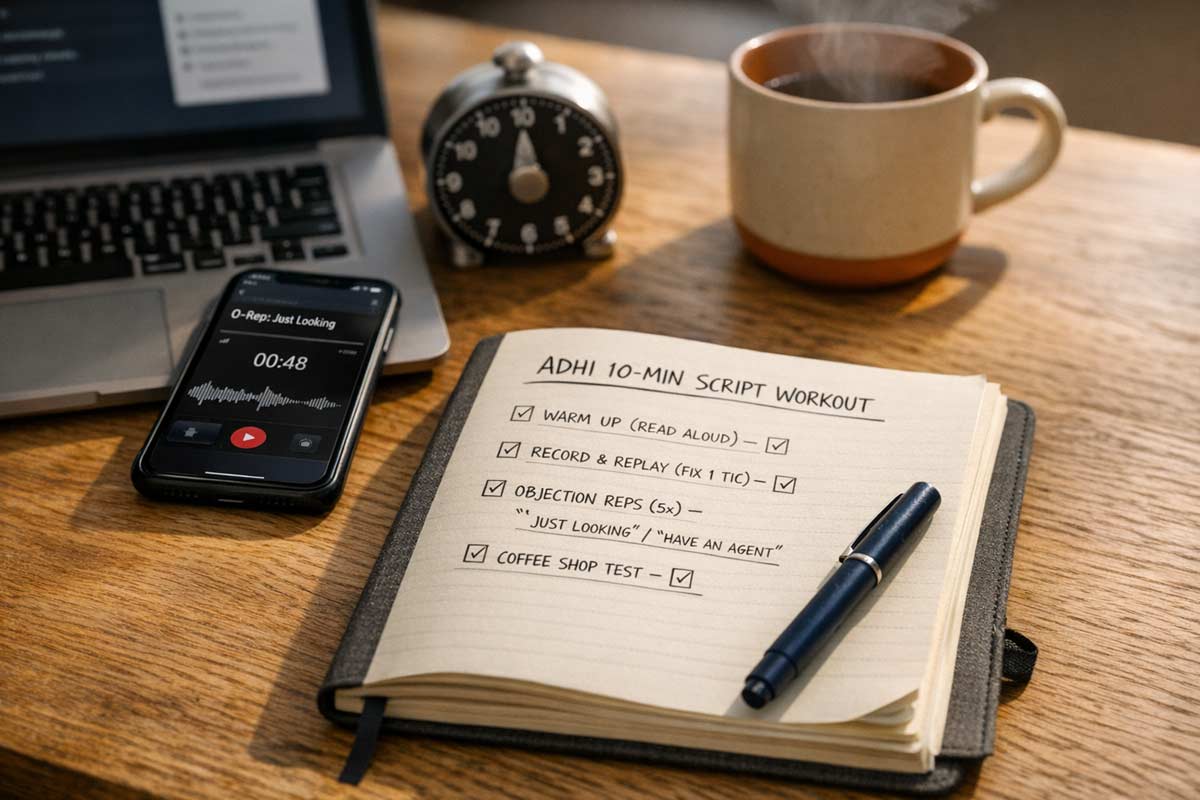

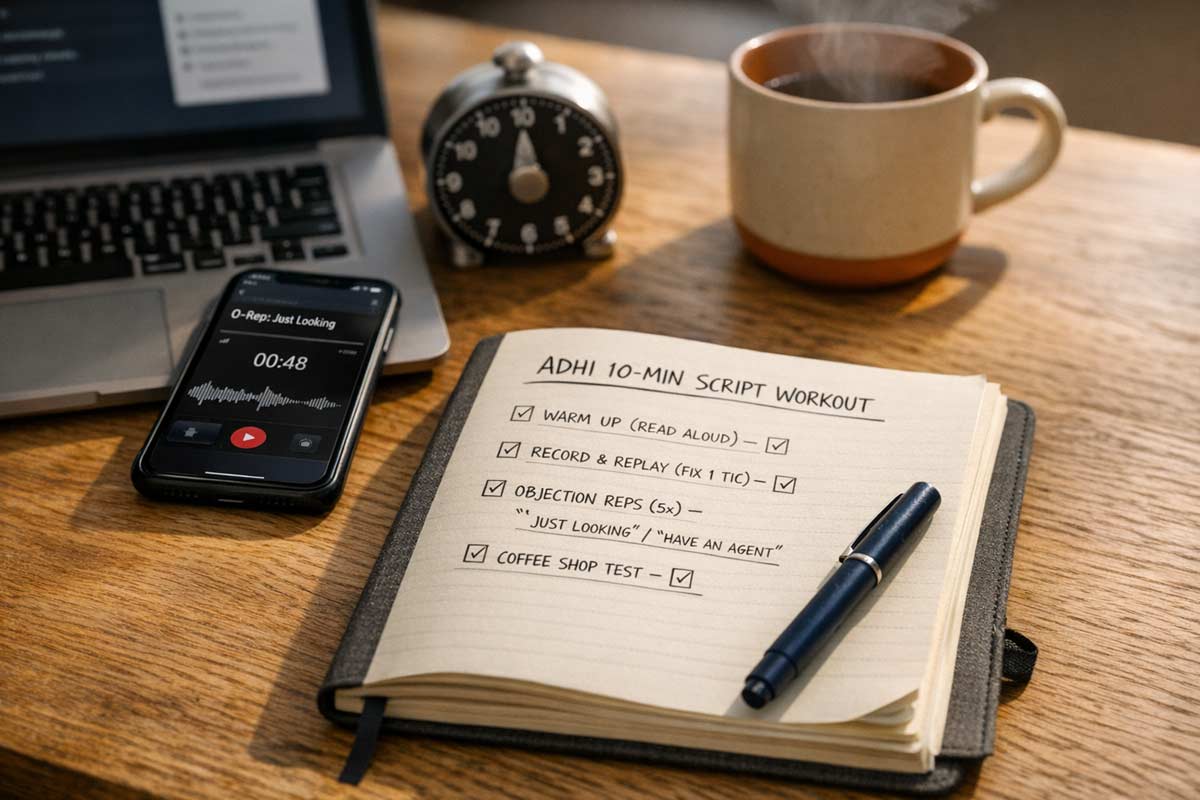

The ADHI 10-Minute Daily Script Workout

This is your non-negotiable morning habit. Like a pre-flight checklist, it must be done before you touch the phone.

Min 1–2: Warm-Up. Read your script aloud.

Min 3–5: Record & Replay. Fix one verbal tic per session.

Min 6–8: Objection Reps. Drill responses using diagnostic characters.

Min 9–10: The Coffee Shop Test. Simplify language until it sounds natural.

The “Don't Sound Robotic” Fix: The 1-1-1 Method

Robotic agents deliver monologues. Professionals lead dialogues. Use this formula to stay human:

1 Consistent Opening Line

1 Personalized Sentence

1 Clean Question

The Big 5 Objections: Recovery Drills

"We already have an agent."

Response: "That's great. It's so important to have someone you trust in this market."

Pivot: "If anything ever changes, what's the best way for me to stay in touch with you?"

"I'm just looking."

Response: "Of course, most of my best clients started out just browsing."

Pivot: "Are you looking for a 'forever home' or more of an investment opportunity?"

"How did you get my number?"

Response: "I’m an agent with [Brokerage] and I’m following up on your inquiry regarding the property on [Address/Area]."

Pivot: "I apologize if I caught you at a bad time—were you still looking for information on that home, or has your search changed?"

"Will you cut your commission?"

Response: "I understand that the fee is a factor in your net return. I’m curious, is your priority the cost of the service, or the net amount you walk away with at closing?"

Pivot: "Would you be open to seeing how our specific marketing and negotiation services are designed to protect that net return?"

"Send me an email."

Response: "I'd be happy to. I have a lot of data I can send."

Pivot: "To make sure I don't clutter your inbox with things you don't need, which two or three things are most important to you right now?"

The Bridge: From Practice to Production

Fluency equals authority. When you don't fumble for words, you look like a seasoned professional who understands the market.

The "Messy" Middle: To stay calm and lead the conversation when escrow hurdles arise, master the Negotiation Basics for New California Agents.

Securing the Listing: Knowing your frame keeps you in control when you learn How New Agents Should Handle Their First Listing Appointment with confidence.

The Buyer Consultation: Fluency is your best tool for answering tough questions during your How to Prepare for Your First Buyer Consultation.

Building Credibility: You can learn How to Avoid the “New Agent Mistakes” That Hurt Credibility simply by sounding like a peer to the veteran brokers you'll be negotiating against.

The 7-Day Challenge

Commit to the 10-Minute Daily Workout for exactly seven days. Do not skip a morning. By Day 8, the phone won't feel like a 500-pound weight. You are building a system that turns "fear of the phone" into a reliable, professional skill.

If you’re ready to master the skills that separate the top earners from the rest, the next step is building your professional foundation. Our Start Real Estate Career in California guide is where your journey begins—start it with a system designed for success.

FAQ Section

What scripts should I learn first? Focus on the "Lead Follow-up" script.

How do I practice scripts without a partner? Use the "Record & Replay" method.

How long should I practice scripts daily? 10 to 15 minutes of high-intensity practice is better than an hour of casual reading.

What is the #1 practice mistake? Practicing in your head instead of aloud.

|

The “license high” is real.

You finish your real estate courses, pass the California state exam, and hang your license with a reputable brokerage. For a few weeks, adrenaline carries you. Then the Read more...

The “license high” is real.

You finish your real estate courses, pass the California state exam, and hang your license with a reputable brokerage. For a few weeks, adrenaline carries you. Then the silence hits. Your phone doesn’t ring. Your inbox is empty. The Instagram-ready office you built feels like a stage set for a play that never starts.

This is the Motivation Collapse—the predictable emotional drop-off that occurs when licensing ends and the tactical reality of real estate begins.

In my 20+ years of training and supervising thousands of California agents across multiple market cycles, I’ve learned that the ones who survive aren’t the most “inspired.” They are the ones who realized that motivation is not the problem; the lack of a structure is.

Diagnosis: Why New Real Estate Agent Motivation Dies

Before you can fix your motivation, you must understand why it’s failing. It isn’t a character flaw; it’s a structural misalignment.

Delayed Feedback Loops: Real estate has no immediate payoff. You can work 60 hours a week for three months and have $0 to show for it.

The “No Scoreboard” Problem: Without a boss or a clock-in system, you have no objective measure of success. If you didn’t close a deal today, you feel like you failed, even if you did the right work.

Toxic Social Comparison: You see "Top Producers" on social media posting about $10M listings. Comparing your "Chapter 1" to their "Chapter 20" leads to immediate FOMO.

Identity Whiplash: You went from being a "Student" with clear goals to a "Business Owner" with total ambiguity.

If this sounds like your current daily reality, you aren't failing; you're just operating without a scaffold.

This transition is one of the core reasons Why Most New Agents Quit in the First Year. If you’re still orienting yourself, start with our complete guide on how to Start a Real Estate Career in California before trying to optimize your mindset.

The Reframe: Discipline Over Feelings

Motivation is a feeling, and feelings are unreliable. If you only prospect when you "feel" like it, you don't have a business; you have a hobby.

The Trap of Productive Procrastination

I see this constantly: A new agent spends three weeks tweaking hex colors on a logo, another rewrites their bio for the tenth time, and another sits with ten CRM tabs open but makes zero calls.

None of those actions risk rejection—still the brain labels them as “work.”

In reality, this is just fear dressed up as an office task. To survive, you must pivot to discipline—doing the high-value, high-fear work precisely because you don’t feel like doing it. This is a foundational element I cover when teaching How to Create a Real Estate Business Plan (New Agents).

5 Survival Systems to Combat Real Estate Burnout

Activity-Based Scoreboards: Stop tracking income; you can't control it yet. Start tracking inputs. Create a daily scoreboard for things you 100% control: outbound calls, hand-written notes, and face-to-face meetings scheduled. If you hit your numbers, you won the day—regardless of your bank balance.

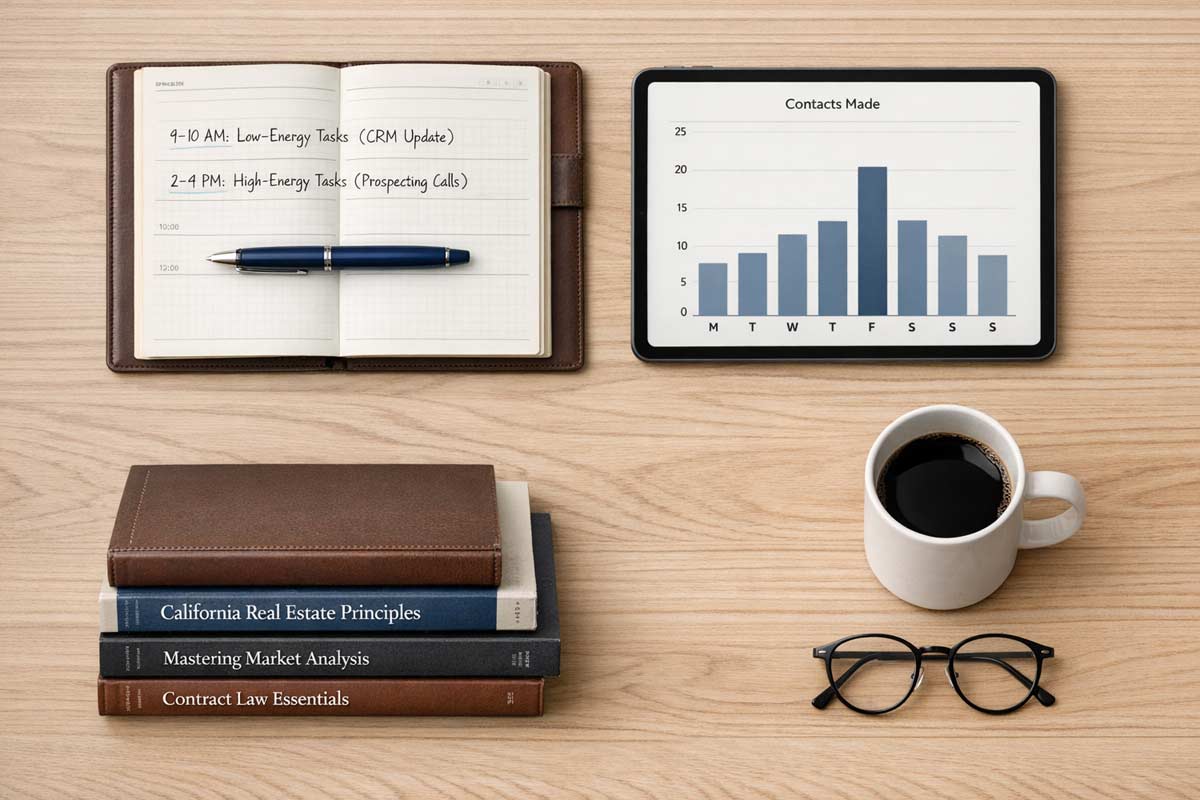

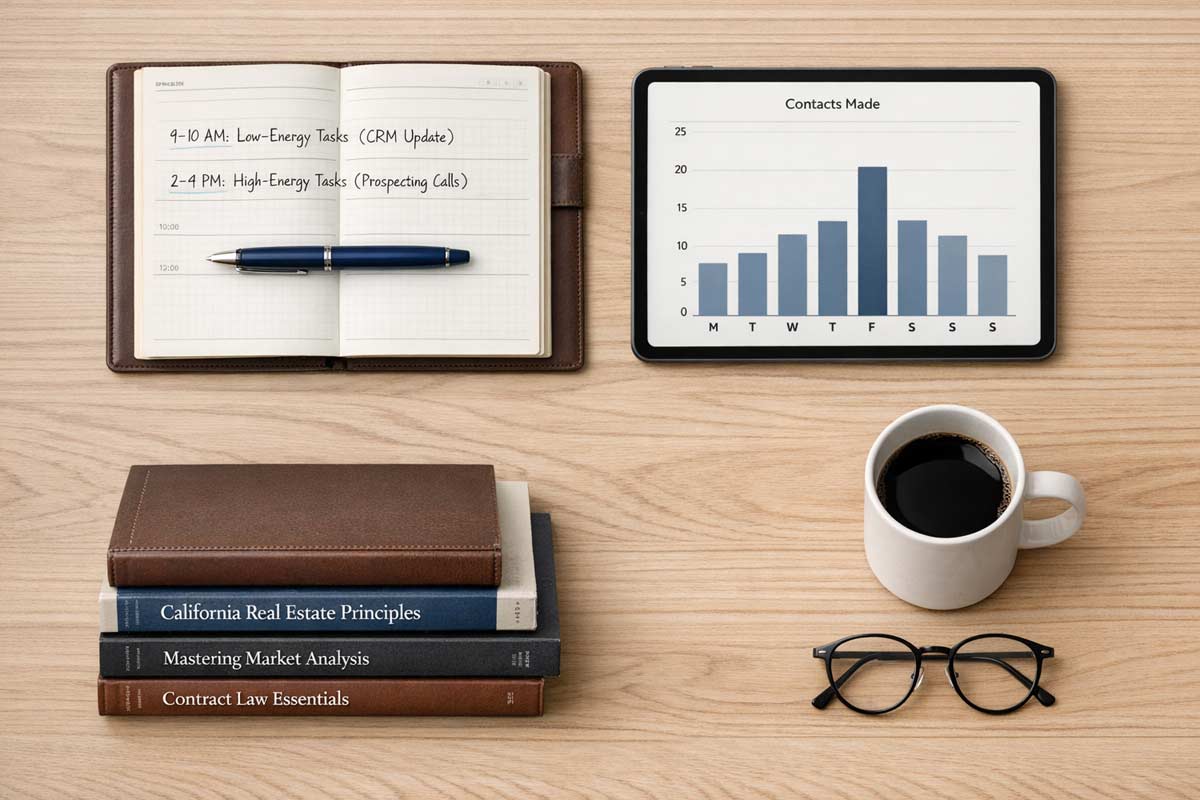

Calendar-First Discipline: Your calendar is your only boss. Block 8:00 AM to 11:00 AM for lead generation. No email, no "office chatter," and no social media scrolling. If it isn't on the calendar, it doesn't exist.

Lead Generation Before Branding: You cannot brand a business that has no clients. I’ve watched agents spend thousands on lifestyle photography before they could even explain a California RPA. Priority 1 is direct outreach. Branding Tips for New California Agents should support your outreach, not replace it.

Energy Management (Not Hustle): The "24/7 hustle" narrative is a recipe for a short career. Identify your "Peak Energy" times for negotiations and "Low Energy" times for administrative tasks. Burnout is a system failure, not a lack of effort.

The Isolation Kill Switch: Isolation is where doubt festers. When you are a new agent, your own head is a "bad neighborhood"—don't go in there alone. Mandate a weekly meeting with your broker. Also, learn How New Agents Should Use Social Media in 2026 to build a professional community, not just to compare yourself to influencers.

Tactical Reality Check: What “Normal” Actually Looks Like

Many agents quit because they have a distorted view of the timeline. Here is the non-glamorous reality of a successful first year in the California market:

Timeline

The Reality of Progress

Months 1–3

Invisible Skill-Building. You are learning how to talk and handle rejection. Expect $0.

Months 4–6

The Pipeline Phase. Initial leads are warming up. You might enter your first escrow.

Months 7–12

The Stabilization Phase. Consistent daily activity starts to yield predictable closings.

Most agents quit in Months 2–4. This isn't because they failed at the job; it's because they failed to realize that "nothing happening" is often just invisible competence-building.

Zoom Out to the Career Arc

Motivation is a spark, but systems are the fuel. As you move through your first 18 months, you will find that "staying motivated" becomes less of a struggle because you are becoming competent. Confidence is simply the byproduct of repeated, disciplined action.

If you want to shorten the painful part of this curve, your next step isn’t finding more motivation—it’s choosing structure over motivation. Start with the fundamentals, then layer on the tactics.

FAQ: Staying Motivated as a New Agent

Q: How long does it take for a new real estate agent to get their first lead?

A: In California’s competitive market, a lead can be generated on Day 1 through your sphere of influence, but a "cold" lead typically requires 30–60 days of consistent daily prospecting before a pipeline begins to form.

Q: How many hours should a new agent spend on lead generation?

A: You should spend 70% of your work week on lead generation until you have at least three active escrows. In a standard 40-hour week, that is roughly 28 hours of direct outreach.

Q: What is the best way to handle the "slow periods" in real estate?

A: Shift your focus from "results" to "refinement." Use the slow periods to audit your systems, update your CRM, and increase your outbound volume to ensure the next peak arrives sooner.

|

You’ve passed the real estate exam, hung your license with a broker, and got your first box of business cards.

Then, the silence hit.

Most new agents in California fall into the "motivation spiral." Read more...

You’ve passed the real estate exam, hung your license with a broker, and got your first box of business cards.

Then, the silence hit.

Most new agents in California fall into the "motivation spiral." You start with high energy, realize you don't have a boss telling you what to do, and quickly drift into "research" (scrolling Instagram) or "branding" (tweaking a logo no one has seen). Before long, the excitement turns to dread.

In my experience coaching thousands of new agents through ADHI Schools, I’ve seen this pattern over and over. Failure in this business rarely comes from a lack of talent; it comes from a lack of a plan and a measurable scoreboard. If you want to survive your first year, you need an operational field manual, not a 40-page theoretical document.

A business plan is not a static document. It’s a weekly operating system you should execute on even when you’re tired.

The 1-Page Real Estate Business Plan (Copy/Paste This)

A business plan is simply a set of decisions made in advance so you don’t have to "think" when you wake up.

The 60-Minute Build Checklist

Open a blank document and answer these points. If you spend more than an hour on this, you’ve drifted into procrastination.

Target Client: Pick two zip codes or one demographic (e.g., first-time buyers in Riverside).

Your Offer: Pick one "rookie-safe" value prop (see below).

Your ONE Lead Pillar: SOI, Open Houses, Cold Outreach, or Social Media.

Weekly Calendar: Set fixed blocks for prospecting and follow-up.

Weekly Activity Scoreboard: Define your "Input" numbers.

Budget & Runway: How much cash is in the bank today?

Tech Setup: Is your MLS, CRM, and e-signature software active?

14-Day Proof: Define what “working” looks like in two weeks (e.g., 20 conversations + 1 appointment held).

5 Rookie-Safe Offers (Choose One)

New agents often struggle with "positioning" because they lack a track record. Instead of selling "experience," sell a specific process:

The Hyper-Local Listing Concierge: "I run a pricing + prep timeline so sellers don’t guess—want me to walk you through it?"

The First-Time Buyer Roadmap: "I’ve mapped out the local lender and grant programs for first-timers; should I send you a copy?"

The Condo Seller Packet: "I have a pre-listing kit for this building with the HOA requirements and recent comps; want to see it?"

The Open House Matchmaking Offer: "I’ll send you the top 3 deals in your specific price range every Tuesday; want on the list?"

The Pricing & Prep Walkthrough: "I can give you a 30-minute walkthrough with a repair/ROI checklist to maximize your net; are you free Tuesday?"

To refine how you present these, review these Branding Tips for New California Agents.

The Scoreboard: The Numbers That Control Your Motivation

New agents quit because they focus on "closings," which are lagging indicators. You can’t control when a deal closes, but you can control how many people you talk to today.

Activity (Input)

Weekly Target

Daily Target (Mon-Fri)

Why It Matters

New Conversations Logged

50

10

Finding "hand-raisers."

Follow-Ups

75

15

Most closings come from the 4th+ contact.

Appointments Held

2

—

Face-to-face (or Zoom) builds trust.

Contacts Added + Notes

50

10

If it isn't in the CRM, the lead doesn't exist.

When you feel the "dread" setting in, look at your scoreboard. In my experience, if the numbers are high, your progress becomes predictable. This is the secret to How to Stay Motivated as a New Agent.

Your Example Weekly Calendar (Copy/Paste)

You cannot manage what you do not schedule. Use this as your baseline:

Mon–Fri 9:00 AM – 11:00 AM: Lead pillar activity (Calls, Invites, DMs).

Mon–Fri 11:00 AM – 12:00 PM: Follow-up + CRM notes.

Tue/Thu 4:00 PM – 6:00 PM: Preview homes (Inventory research).

Sat/Sun: Open House (Host if possible; attend if you can't get one yet) + Sunday night prep.

Sun 7:00 PM – 7:20 PM: The 20-Minute Reset. Clean CRM, set follow-ups, and schedule next week’s prospecting blocks.

The 90-Day Execution Plan: A Brutally Specific Grind

Weeks 1–2: The Launch Phase

Build Your SOI List: Export your phone and email contacts. Goal: 120 names.

The Outreach Script: Call 5 people and text 5 people per day. "I’m with [Brokerage] now and I specialize in [Offer]. If you hear anyone mention buying or selling this year, I’d be grateful if you’d connect us."

The CRM: Log every single interaction.

Weeks 3–8: The System Phase

Implement 1-3-7-21: Follow up with every new lead on Day 1, Day 3, Day 7, and Day 21.

Market Knowledge: Preview 5 homes per week in your target zip codes.

Weeks 9–12: The Review & Diagnostic

The Scoreboard Audit:

If 0 conversations: You have a discipline/system issue.

If conversations but no appointments: You have an offer/script issue.

If appointments but no clients: You have a follow-up/conversion issue.

The Reset Rule: If you miss a day, don't spiral. Reset the clock to zero and start fresh tomorrow morning.

Choose Your ONE Lead Pillar (Stop the Chaos)

1. SOI/Referrals (Sphere of Influence)

Daily Actions: 5 calls, 5 texts, 5 social media interactions.

Success Metric (14 Days): 50 outreaches + 5 coffee meetings or consultations.

2. Open Houses

The Offer: "I’ll send you the 3 best buys in this neighborhood this week—text me your price range."

Daily Actions: Mon-Wed: Secure a listing. Thu-Fri: Prepare "Invite Lists." Sat-Sun: Host the event.

Success Metric: 10 guest sign-ins via QR code + 10 follow-up calls made by Monday noon.

3. Cold Outreach (Expireds/FSBOs)

Daily Actions: 2 hours of morning calls to homeowners who failed to sell or are trying to sell alone. Follow your brokerage policy and DNC rules; don't freestyle.

Success Metric (14 Days): 100 contacts + 10 real conversations + 1 appointment held.

4. Social Media Machine

Daily Actions: 3 short videos per week, 10 DMs to local followers, 1 weekly "market update" text to your SOI. Use these Social Media Best Practices for Realtors to ensure you’re actually creating leads.

Budget & Runway (The Part Everyone Avoids)

California is an expensive state for real estate professionals. You must know your "burn rate."

The Formula: Runway = (Savings / Monthly Burn)

Startup Estimate: DRE Fees, MLS dues, Association Dues (NAR/CAR), and E&O insurance. Treat $2,000–$4,000 as a planning estimate.

The Reality Check: If you don't have 6 months of savings, you probably need a "paid runway"—a side job, savings, partner income, or a brokerage lead source. Desperation is when agents start cutting corners on disclosure, honesty, and compliance. This financial pressure is a major reason Why Most New Agents Quit in the First Year.

“Busywork Traps” to Identify and Avoid

If a task doesn’t involve a conversation with a human, it’s likely a trap.

The Training Loop: Watching endless YouTube videos instead of prospecting.

Logo/Website Tinkering: Nobody cares about your font if you don't have a listing.

The CRM Perfection Trap: Rebuilding your CRM tags and pipelines instead of actually using it to call people.

The Checklist Rule: If the task doesn't directly create a conversation or an appointment, it's not a priority today.

Mini Case Studies: The Plan in Action

The "Passive Poster"

The Problem: Posted on Instagram daily but had 0 leads.

The Fix: Switched to the "Social Media Machine" pillar. They added 10 DMs per day to local residents.

Result: They secured two serious buyer consultations and a warm listing lead within 60 days.

The "Timid Rookie"

The Problem: Afraid to call their SOI.

The Fix: Used the "First-Time Buyer Roadmap" offer. It gave them a reason to call ("I have a new map for first-time buyers, want a copy?").

Result: Logged 50 CRM notes in a week and set their first "Appointment Held" by Friday.

Your Next 3 Steps

Fill out the one-page plan now. Don't wait for "perfect" clarity.

Set your weekly calendar. Use the template above to block your time.

Start your scoreboard. Log your first 10 conversations tomorrow morning.

Want the full roadmap?

Read our comprehensive guide: Start a Real Estate Career in California

It lays out the timeline, exact costs, and what to do first.

FAQ: Real Estate Business Planning

What should my real estate business plan include?

At a minimum, it must include your target market, your primary lead generation pillar, a daily activity scoreboard, and a budget for California-specific dues and fees.

Do I need a business plan to join a brokerage?

Technically, no. Most brokerages will hire anyone with a license. However, without one, you’re relying on hope instead of a system.

How many hours a day should a new agent prospect?

In my experience, a new agent should spend at least 2 hours every morning on lead generation and 1 hour on follow-up.

How much money do I need to start?

Aim for 6 months of living expenses. If you can’t, ensure you have a "paid runway" (side income) so you don't make desperate decisions out of financial fear.

How long should a business plan be?

One page. If it’s longer, you won't look at it. If you won't look at it, you won't follow it.

|

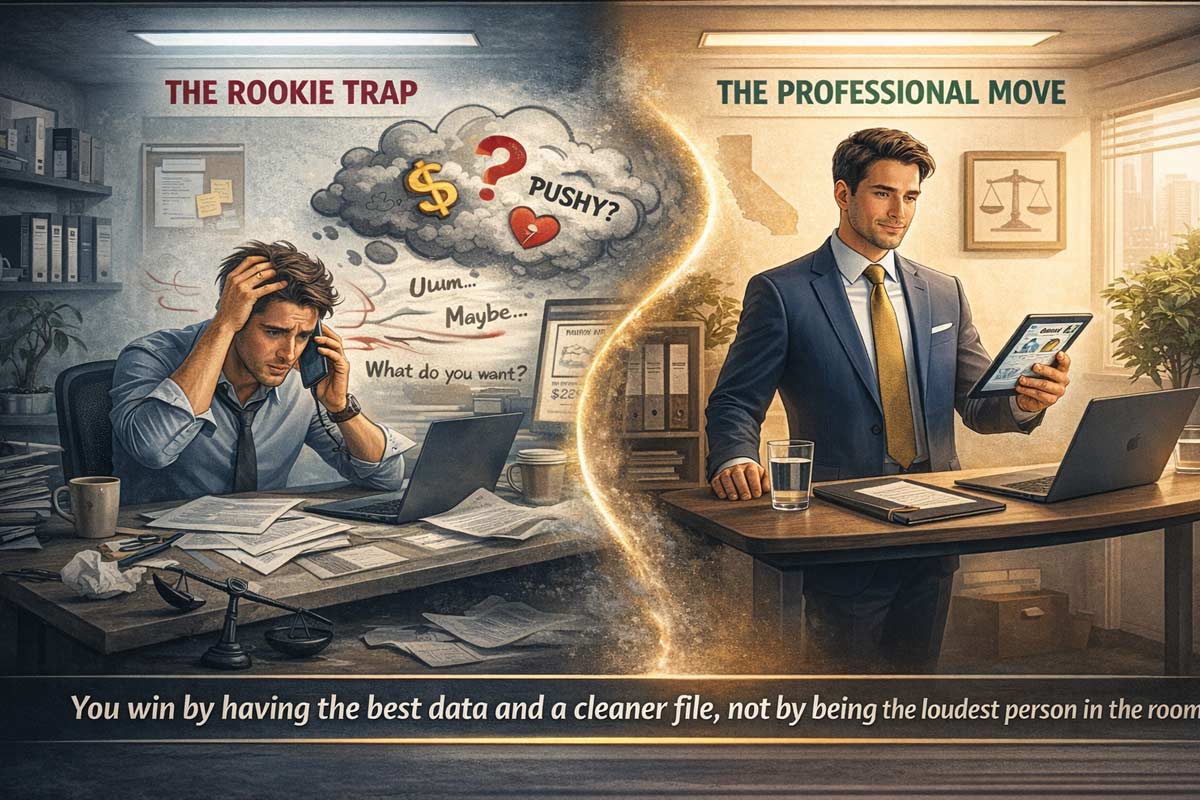

TL;DR: The Negotiation Mindset

Preparation > Personality: You don’t win by being the loudest person in the room; you win by having the best data and a cleaner file.

Trade, Don't Cave: Read more...

TL;DR: The Negotiation Mindset

Preparation > Personality: You don’t win by being the loudest person in the room; you win by having the best data and a cleaner file.

Trade, Don't Cave: Never give a concession (like a price drop) without getting something in return (like a shorter contingency period).

The Silence Protocol: State your position, then stop talking. The first person to fill the silence usually loses leverage.

Negotiation isn’t about "winning" a fight; it’s about navigating a series of high-stakes trade-offs to reach a closing. For most new agents, the first counteroffer feels like a personal attack or a sudden emergency.

Negotiation is one piece of your first-year system—right alongside client consultations, scripts, and credibility. If you want the full roadmap for your first 12 months, start here: Start Your Real Estate Career in California.

Phase 1: Prep the File (Don’t Negotiate From Vibes)

New agents often enter negotiations with "hope" as their primary strategy. Professional negotiators use data. Before you pick up the phone to discuss an offer, you must be the most informed person in the transaction.

The Three-Point Data Anchor

The Comps: Have the 3 most relevant sales ready (closest match, most recent; expand the radius/time if the area is thin).

The Motivation: Why is the other party moving? A seller who already bought their next home has a different "pain point" than one testing the market.

The Broker's Pulse: Call the listing agent before writing the offer. Ask: "What is most important to your seller besides price?" Sometimes it’s a specific closing date or a rent-back period.

Phase 2: Set the Frame (The Pre-Negotiation)

The biggest mistake is starting the negotiation when you receive the counteroffer. The negotiation actually starts at your first client meeting. If you haven't managed your client's expectations, you’ll spend more time negotiating against them than against the other agent.

This is exactly why your first buyer consultation matters—your negotiation leverage is built before you ever write an offer. See: How to Prepare for Your First Buyer Consultation.

The Script: Managing the "Lowball" Urge

"I understand you want a deal, but in this market, an insulting offer doesn't start a negotiation—it ends the conversation. If we want them to take us seriously, we need to show them we are a serious, qualified buyer."

Phase 2B: Listing Appointments Are Where Negotiation Leverage Is Created

Most new agents think negotiation starts at the counteroffer. On the listing side, it starts when you set pricing strategy, condition expectations, showing windows, and how you’ll handle repairs and credits. If you can’t frame that conversation confidently, you’ll “give away” leverage later in escrow.

Read this before you take your first seller meeting: How New Agents Should Handle Their First Listing Appointment.

Phase 3: Make Clean Moves (State, Reason, Silence)

When it’s time to deliver an offer or a response, brevity is your best friend. In California's competitive market, "clean" offers move to the top of the pile.

Clean offers come with proof: a fully underwritten approval, verification of funds, and a timeline that matches the seller’s reality. A clean offer has a strong price, a solid lender, and minimal "clutter" (unnecessary personal property requests).

The Script: Delivering a Response

"My clients have reviewed your counter. We are coming up to [Price], but we are keeping the inspection period at 10 days to ensure a fast move for your seller. This is our best move to keep the deal together."

State your number. State your reason. Stop talking. If you want these to come out calm under pressure, you don’t “read” scripts—you drill them. Use this system: How to Practice Real Estate Scripts Effectively.

Phase 4: Trade, Don't Cave

A "concession" is a gift. A "trade" is a business move. If the seller asks for a $5,000 credit for repairs, don't just say yes or no. Use it to improve your client's position elsewhere.

The "If/Then" Strategy

"If we agree to the $5,000 repair credit, then we need the buyer to xxxxx." (Note: High-stakes moves like removing contingencies should only be done if your buyer is fully informed and your broker supports the strategy based on the specific file.)

"If we move the closing date up by two weeks, then we need the seller to leave the appliances."

The "Silence Protocol": 3 Rules for High-Stakes Calls

Strategic silence is the hardest skill for new agents to master because they feel the need to "sell" their position.

Deliver the "Hard" News: State the price or the refusal clearly.

Count to Ten (Internally): Do not add "I know it's a lot" or "My clients were thinking...".

Wait for the "Blink": Let the other agent respond first. They will often reveal their client's true bottom line just to fill the quiet.

Avoid These "New Agent Mistakes"

Most negotiation failures are really credibility failures. If you want the full “don’t look new” checklist, read: How to Avoid the “New Agent Mistakes” That Hurt Credibility.

The "Don't Say This" Table

Instead of saying...

Say this...

Why?

"My clients are really nervous."

"My clients are very focused on the inspection results."

Avoids sounding weak; stays focused on the contract.

"I'm new, so I'm not sure if..."

"I'll double-check the current market data and get back to you."

Protects your authority.

"They'll probably take $X."

"We are prepared to discuss terms that reflect current market value."

Never give away your client's bottom line without a formal counter and consent from your client.

Real-World Scenarios: From Battle to Close

Scenario A: The Multiple Offer Bidding War

The Situation: You represent a buyer. There are 5 other offers. The listing agent says, "Bring your highest and best."

The Play: Don't just raise the price. Negotiate on terms.

Script: "We’ve tightened our timelines and provided a full underwritten approval from the lender. We aren't just the highest offer; we are the most certain to close."

The Logic: Sellers take a slightly lower price if it means 100% certainty they won't have to go back on the market in three weeks.

Scenario B: Inspection Repair Credit Without Killing the Deal

The Situation: Buyer wants a $7,500 credit. Seller says no—“we’re not fixing anything.”

The Play: Offer two clean options (not a fight).

Script: “Totally understood. To keep momentum, we can do Option A: $X credit and we release inspection immediately, or Option B: no credit and we adjust price to reflect the defect based on contractor bids. Which is better for your seller?”

Logic: You’re trading certainty and speed for dollars—cleanly.

FAQ: California Negotiation Essentials

How do I negotiate if I’m a brand-new agent?

Lean on the data, not your tenure. When you cite specific comps and market trends, the other agent is negotiating against the market, not your experience level.

What matters most besides price in California negotiations?

Certainty and speed. In a high-demand market, sellers prioritize offers that limit contingencies (if safe), offer a fast closing, or provide a "rent-back" period that lets them move without stress.

How do I ask the listing agent what the seller wants?

Be direct. "Besides the price, what are the two most important things to your seller in an ideal offer?" This often reveals needs regarding the closing date or specific repairs.

Should I waive contingencies to win a bidding war?

Only under the guidance of your broker and after a thorough discussion with your buyer. It is a high-risk move that can lead to a lost deposit if the deal falls through. I would only recommend this is in a narrow set of scenarios where all parties are going into it with eyes wide open and fully understand the consequences.

Pre-Negotiation Checklist (Understand This Before Every Negotiation)

Before you counter, confirm you have:

3 Comps + Data Sentence: Why is your number justified?

The Motivation Matrix: Timeline, rent-back needs, and certainty.

Concession Menu: What will you trade (not give away) to get the deal?

Broker Approval: Direct guidance on high-stakes terms (contingencies/timing).

|

Disclaimer: This article is for educational purposes. It is not legal advice. Always consult your managing broker and/or attorney for guidance.

The "30-Second Elevator Pitch" for Clients

In the Read more...

Disclaimer: This article is for educational purposes. It is not legal advice. Always consult your managing broker and/or attorney for guidance.

The "30-Second Elevator Pitch" for Clients

In the high-speed environment of California real estate, paperwork can feel like an obstacle to a deal. However, the Agency Disclosure (Form AD) is not just "another form"—it is a consumer protection shield. For a new agent, the goal is to present this document as a tool for clarity.

Agent Script: "This form answers one question: Who do I work for? It’s not about commission—it’s about loyalty. It explains your options—buyer’s agent, seller’s agent, or dual agency—so you know exactly where my loyalty sits before we go any further."

What Is the AD Form? (And What It’s Definitely Not)

The sole purpose of Form AD is transparency. It educates the consumer on the types of real estate agency relationships available and the "fiduciary duties" (utmost care, integrity, and loyalty) that brokers owe their clients.

Where You’ll See This Form: Agency disclosure rules apply to transactions covered by the statute’s definitions—commonly 1–4 residential sales/leases, and they also extend to commercial real property transactions under the Civil Code definitions.

California licensing law and brokerage policy still require clear disclosure and consent when your role changes—especially regarding dual agency.

Myth vs. Reality

Myth: "If I sign this, I’m officially hiring you as my exclusive agent."

Reality: This is a disclosure, not a contract. It does not "lock" a client into a representation agreement or guarantee payment.

Myth:"It’s just a formality; I can sign it at the end of the escrow."

Reality: Missing this form is a statutory compliance problem. It is the kind of file defect that shows up when a deal blows up: commission disputes, client complaints, or someone picking apart your paperwork. It weakens your file if a fee dispute or complaint ever erupts.

The 3 Agency Relationships Demystified

As we emphasize in our training courses, you must be able to explain the "Big Three" relationships without hesitation.

Agency Type

Who is the Client?

What You Owe

What You Cannot Do

One-Sentence Client Explanation

Seller’s Agent

The Seller

Utmost care, integrity, honesty and loyalty.

Cannot disclose the client’s confidential bargaining position (bottom line, motivations, price flexibility) without permission.

"I represent the Seller's interests exclusively to get them the best terms possible."

Buyer’s Agent

The Buyer

Utmost care, integrity, and loyalty.

Cannot disclose the client’s confidential bargaining position (bottom line, motivations, price flexibility) without permission.

"I am your advocate, focused solely on finding you the right home and protecting your interests."

Dual Agency

Both Parties

Fiduciary duty (utmost care, integrity, honesty, loyalty) to both parties; honest and fair dealing/good faith; reasonable skill and care; disclosure of known material facts; and required confidentiality.

Cannot disclose the client’s confidential bargaining position (bottom line, motivations, price flexibility) without permission.

"I facilitate the deal for both sides, but I cannot use one side's confidential info to advantage the other."

Legal Timing for Agency Disclosure Form AD in California

These are three separate legal requirements. Treat them like three boxes you must check—for every file.

AD Delivery (Civ. Code §2079.14)

Seller: The listing agent must provide the disclosure before entering into the listing agreement.

Buyer: The buyer’s agent must provide it as soon as practicable before (i) a buyer-broker representation agreement is signed and (ii) execution of the buyer’s offer.

Refusal Protocol (Civ. Code §2079.15)

|

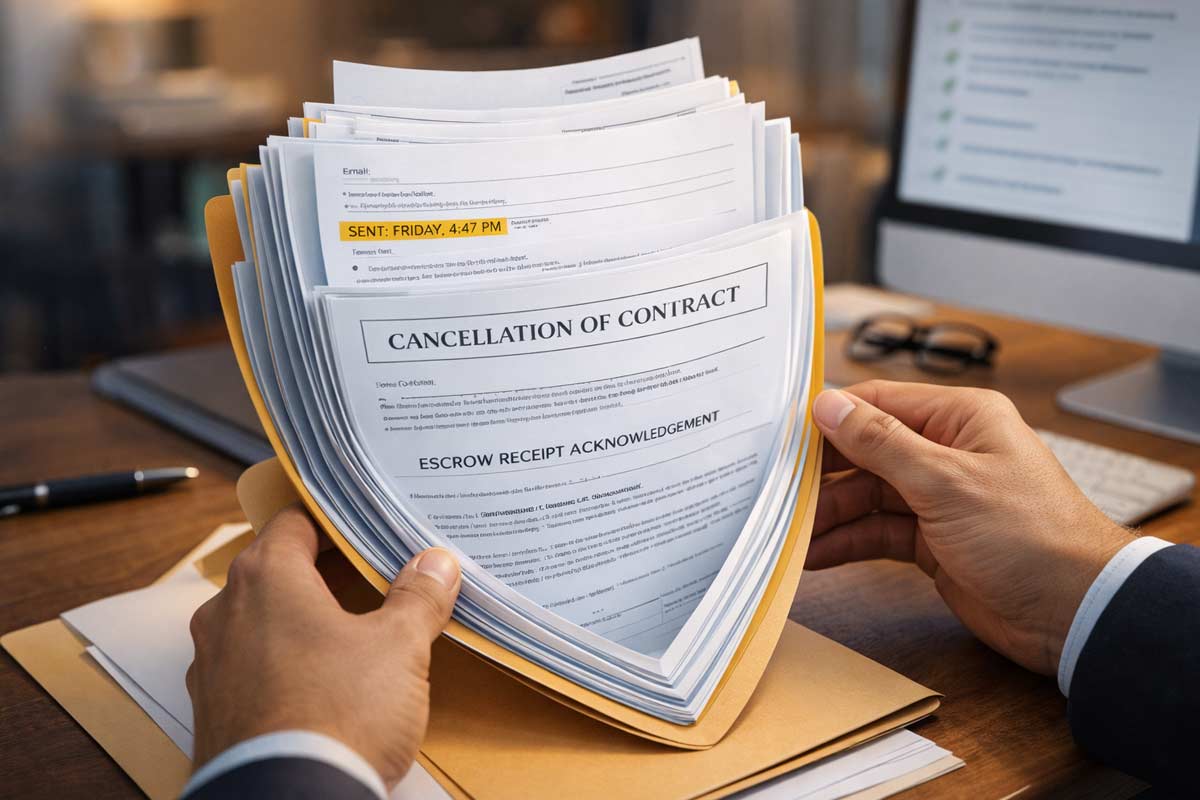

The Cancellation Moment: From Panic to Procedure

It is 4:45 PM on a Friday. You are heading out for the weekend when a text hits your phone. It’s your buyer: “I can’t do this. My job situation Read more...

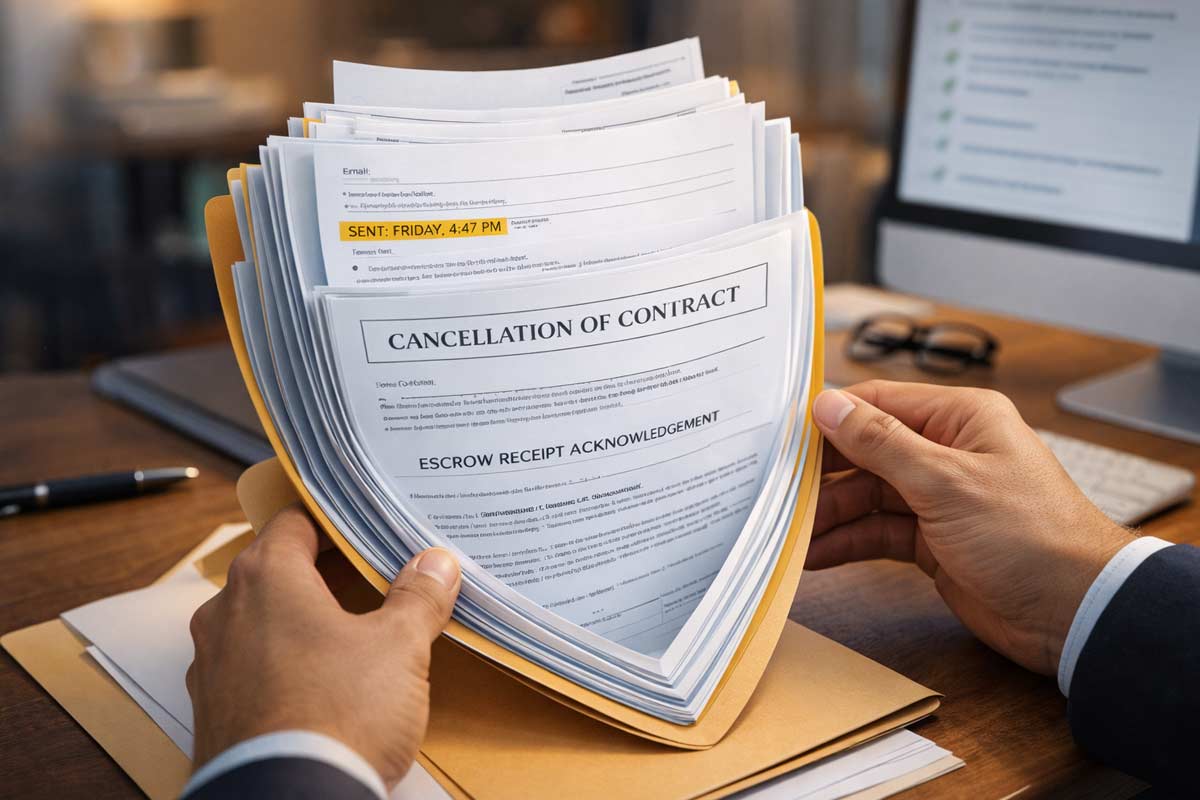

The Cancellation Moment: From Panic to Procedure

It is 4:45 PM on a Friday. You are heading out for the weekend when a text hits your phone. It’s your buyer: “I can’t do this. My job situation just got shaky, and I need to get out of the deal. Now.” Or perhaps it’s a seller, frustrated that the buyer is two days late on contingency removals, demanding you “cancel the deal and take the backup offer.”

In these moments, your value as an agent isn’t in your salesmanship; it’s in your ability to remain the calmest person in the room. Having coached agents through thousands of transaction crises over the last 20 years at ADHI Schools, I can tell you that successful cancellations aren’t just about emotions—they are about the clock and the contract.

In California, cancellation is a procedure, not a vibe. Your license, your reputation, and your buyer’s deposit depend on your ability to stop the panic and start the process.

Quick Answer: In California, most cancellations fall into three buckets: (1) active contingency exit, (2) disclosure-related rescission windows (when applicable), or (3) default/breach workflows that require written notice and a cure period. Your job is to identify which bucket you’re in, then build a clean paper trail that protects the client and your license.

The 60-Second Triage: Diagnose the Right to Cancel

Before you touch a single form, you must diagnose which "world" the cancellation lives in. Most disputes happen because an agent used a "breach" workflow for a "contingency" problem. To stay within the California Real Estate Laws & Compliance Guide, you must categorize the situation immediately.

The Three-Worlds Model:

World A: Contractual Exit Paths (Contingencies): The buyer is within their active contingency period and chooses to exit based on findings (e.g., an inspection report or loan denial).

World B: Statutory/Disclosure-Based Rescission: Rights that may be triggered by the delivery of specific disclosures (like the TDS or NHD) after the contract has been signed.

World C: Default & Breach Workflows: One party has failed to perform a contractual obligation. This requires a formal notice and a cure period before anyone can walk away.

The Agent’s Script:

"I understand you want to cancel. To protect you and your deposit, I need to know: Is this about an inspection issue, a loan problem, a disclosure you just received, or something the other side didn’t do?"

Buyer's Playbook: The Procedural Exit Paths

Buyers often have the cleanest exit paths, but only while the clock and contingencies still protect them. To protect your buyer, you must master Purchase Agreement Basics, specifically how contingencies function as a safety net.

Operational Examples:

Inspection Findings: A buyer discovers a foundation issue during their investigation period and decides the repair is cost prohibitive.

Loan Denial: A buyer's lender issues a formal denial letter before the loan contingency is removed.

The Contingency Exit Checklist:

Identify the Active Contingency: Ensure the specific contingency has not been waived or removed in writing. Be cautious, as commercial transactions might have “passive” contingency removal.

Check the Clock: Verify the deadline in the contract. Even if a deadline has passed, if the seller hasn't given the buyer a formal “notice to perform”, the buyer may still have an exit path—consult your broker immediately.

Document the Basis: The buyer should be able to document a contingency-related basis consistent with the contract and brokerage standards.

Serve Written Notice: Use the appropriate cancellation and release of deposit forms found in your current brokerage library.

Notify Escrow: Ensure a copy of the signed cancellation is delivered to the escrow holder.

Material Change Trigger: If the issue changes money, timing, possession, or legal rights, pause and escalate to your broker before sending notices.

Seller's Playbook: Rights Are a Process, Not a Power

Sellers often feel trapped, and in some ways they are. In California, a seller cannot simply cancel because they found a better offer or "changed their mind." You must use the CAR Forms Every New Agent Should Know to create a defensible paper trail.

Operational Example:

Missed Deposit Deadline: The buyer fails to deposit the Earnest Money Deposit (EMD) within the three-day contractual window. The seller serves a written Notice to Perform. If the buyer fails to "cure" within the specified timeframe, the seller may proceed to cancel.

What a Seller Generally CANNOT Do:

Cancel because the buyer is slightly late (without first serving a formal notice).

Cancel because they want to sell to a different party.

Unilaterally take the deposit from escrow without mutual instructions or a legal directive.

The Seller’s Escalation Sequence:

Notice to Perform: This is the formal warning. It gives the buyer a specific cure period (often 2 days, but check the contract) to perform the required action.

Wait the Cure Period: You cannot cancel while the clock is running.

Cancel for Default: If the buyer still hasn't performed after the cure period ends, the seller may move to cancel.

The contract may include a seller's contingency allowing them to cancel if they cannot find a new home within a set period. However, even with a Seller's Contingency, they must strictly adhere to the timelines in the SPRP (Seller Purchase of Replacement Property) addendum.

The Earnest Money Matrix: Reality vs. Theory

The contract may suggest who should receive the deposit, but in practice, the money often does not move until there are mutual written instructions or a legal resolution. This is a key point to emphasize when you explain Agency Disclosure Form AD to your clients.

Scenario

What the contract often suggests

What happens in practice

Why it gets stuck

Buyer is Inside Contingency Period

Full refund to Buyer

Escrow holds funds

Seller may dispute the buyer’s basis or timing and refuse to sign a release.

After Removal

Seller (Liquidated Damages)

Given to Seller but may result in a prolonged dispute

Liquidated damages require a properly formed clause and specific statutory limits.

Late Disclosure

Full refund to Buyer

Generally released to Buyer if contract permits

If the seller feels the buyer used the disclosure as a "pretext" to exit.

Seller Default

Full refund to Buyer

Escrow holds funds

Seller may dispute that a default actually occurred.

The Deposit Script:

"Escrow typically requires mutual written instructions or a legal directive to release funds. My goal is to make our paperwork so clean and our timelines so defensible that the other side is pressured to sign the release."

Disclosure Rescission: The Rescission Window

A common myth is that every buyer has a universal "3-day cooling-off period." This is false. This right is typically triggered only when certain statutory disclosures (like the TDS) are delivered after the contract is signed. Failure to handle these correctly can lead to claims involving California Anti-Fraud Rules in Real Estate.

Operational Steps for Rescission:

Confirm Delivery: Note the exact timestamp and method (email, hand-delivery, etc.).

Calendar the Deadline: Rescission periods vary, for example with the TDS based on if it is an entirely new disclosure form or a modification to an already delivered TDS.

Send Notice Promptly: If the buyer chooses to rescind, delivery must happen before the window closes.

The Crisis Checklist

If you are facing a potential cancellation right now, follow these steps in order:

Identify the Bucket: Work with your broker/manager to determine whether this a Contingency exit, a Statutory Rescission, or a Default?

Pull Contract Deadlines: What was the original date for performance?

Confirm Contingency Status: Has a formal contingency removal been signed in writing?

Confirm Disclosure Timestamps: When was the disclosure delivered and how?

Decide Workflow: Do you need a Cancellation form or a Notice to Perform first?

Write + Deliver Notice: Use the contractual method and loop in your broker per office policy.

Notify Escrow: Send the signed documents immediately to stop the clock.

The Paper Trail Rule: Summarize all verbal conversations in a follow-up email. "Per our phone call at 2:00 P.M..."

Compliance Traps: Where Good Agents Get Disciplined

The Backdate Trap: Never backdate a signature to make a deadline look met. This is fraud.

The Verbal Authorization Trap: Never sign a cancellation for a client because they "told you to" over the phone.

The Disclosure Hide Trap: If a buyer cancels because of a negative inspection report, that report generally must be disclosed to the next buyer.

The Pressure Tactic Trap: Threatening a buyer with the loss of their deposit to force them into a deal is high-risk behavior.

Your System Is Your Shield

In California real estate, the difference between a veteran and a novice is how they handle a "dead" deal. A novice sees a crisis; a veteran sees a checklist. By leaning on a strict compliance framework, you turn a high-stakes emotional event into a routine administrative procedure.

Document, Deliver, and Disclose.

Disclaimer: This article is for educational purposes only and does not constitute legal advice. California real estate laws and C.A.R. forms are subject to frequent change. Always consult with your broker or a qualified real estate attorney regarding specific transaction disputes or legal interpretations.

|

Please be sure to check with your broker/manager on unique circumstances and that you are following local best practices.

The "Paper Trail" Rule: In California real estate, if it isn’t in Read more...

Please be sure to check with your broker/manager on unique circumstances and that you are following local best practices.

The "Paper Trail" Rule: In California real estate, if it isn’t in writing, it didn’t happen. To protect your license and your client’s deposit, you must confirm: deadlines, deposit receipts, disclosure receipts, contingency periods, and repair agreements in the file.

Your buyer wants to write an offer.

Congratulations!

But as the initial rush of adrenaline fades, it’s replaced by a sinking feeling. You’re staring at the C.A.R. California Residential Purchase Agreement (RPA)—the 16-page "operating system" of your deal.

Your client is asking, "What does this paragraph mean?" and your managing broker is asking if you've seen the seller disclosures. I’ve spent over 20 years coaching agents through these moments. This guide is your pseudo-mentor-in-the-room to help you navigate the Residential Purchase Agreement California with confidence.

New Agent Quick-Start: 5 Things to Do Immediately After Acceptance

Mark the Calendar: Calculate "Day 1" (the day after acceptance) and circle the COE date.

EMD Verification: Call your buyer and ensure they have a verified phone number for escrow to confirm wire instructions.

Audit the File: Confirm you have a fully executed RPA with all signatures and initials.

Order Inspections: Initiate these immediately to ensure you stay within your investigation window.

Confirm Delivery: Verify that the signed acceptance was delivered to the other side and document the timestamp.

What is the C.A.R. RPA?

The C.A.R. Residential Purchase Agreement (RPA) is the most commonly used standard-form contract used by California real estate agents to facilitate home sales. It acts as the legal "rulebook," outlining price, contingencies, and the specific responsibilities of both buyer and seller.

Main Parts of the RPA Explained:

Agency & Representation Disclosures: Confirmation that the How to Explain Agency Disclosure Form AD was delivered (a separate, mandatory requirement).

Price & Financing Terms: A summary of the purchase price, EMD, and loan details.

Closing & Possession: When the buyer officially gets the keys.

Inclusions/Exclusions: What stays (fixtures) and what goes (personal property).

Allocation of Costs: Who pays for inspections, reports, and home warranties.

Contingencies: The buyer’s "safety nets" for investigation and financing.

Disclosures: The seller's history and knowledge of the property.

Remedies: What happens in the event of a breach of contract.

Coaching Tip: Open your current digital RPA and use Cmd+F (Mac) or Ctrl+F (Windows) to search these specific keywords for quick navigation: Deposit, Escrow, Time Period, Days, Contingency, Investigation, Disclosures, Repair, Possession, Mediation, Arbitration, Liquidated Damages.

The RPA Map: Decisions & Search Terms

Decision you’re making

Search this in the RPA

What it controls

Rookie mistake

Paper-trail proof

Price & Financing

"Purchase Price", "Loan"

Final sales price and loan terms.

Leaving loan terms blank.

RPA + Proof of Funds in transaction file.

Deposit (EMD)

"Deposit", "Escrow"

How much "skin" the buyer has in the game.

Missing the delivery deadline.

Escrow deposit receipt PDF + email confirmation.

Time Periods

"Time Period", "Days"

Every contractual deadline.

Thinking "days" always means business days.

Digital calendar with all dates circled.

Investigations

"Investigation", "Inspection"

The buyer's right to check the home.

Not ordering inspections immediately.

Reports + written agent confirmation.

Appraisal/Loan

"Appraisal", "Lender"

Buyer’s exit if value or loan fails.

Promising "no problem" with value.

Written appraisal/Loan status update.

Disclosures

"TDS", "SPQ"

Seller’s legal history of home.

Late delivery (triggers exit rights).

Signed Receipt of Disclosures acknowledgment.

Repairs/Credits

"Repairs", "Request"

Negotiated fixes or price drops.

Promising repairs verbally.

C.A.R. addendum + contractor receipts.

Possession

"Possession", "Occupancy"

When the buyer gets the keys.

Giving keys before escrow closes.

C.A.R. possession agreement in file.

Disputes

"Mediation", "Arbitration"

How you fight if things go south.

Forgetting to check initials.

Initial sections in signed RPA.

When is the RPA Binding? (Acceptance & Delivery)

California purchase agreement explained: A contract is not binding just because everyone signed it. It is binding once there is Acceptance AND Delivery.

Where to look: Search "Acceptance" and "Delivery."

The Agent Move: Immediately after the final party signs, email the fully executed document to the other agent.

Paper Trail: Save the email confirming acceptance was delivered with a visible timestamp.

Timelines, Days, and Deadlines

In California, time is a contractual commitment.

Where to look: Search "Time Period" and "Days."

The Evergreen Rule: In many contracts, if a deadline falls on a weekend or holiday, performance may roll to the next business day—confirm this in your specific contract and with your broker.

Client Translation: "We treat every deadline as a hard commitment. If we miss one, the other side may gain the right to cancel our deal."

Inclusions & Exclusions: What Stays?

Arguments over refrigerators and chandeliers can kill a deal at the eleventh hour.

Where to look: Search "Inclusions," "Exclusions," "Fixtures," and "Personal Property."

Rookie Mistake: Writing "All appliances included" is too ambiguous.

Paper Trail: Maintain a written list with photo confirmation. If anything is negotiated during the process, document it with a C.A.R. addendum or possession agreement (this could be done on a few different forms so confirm current form name/version with broker).

Contingencies: Inspection, Appraisal, and Loan

Contingencies are your buyer’s exit ramps. For a deep dive on how to manage these forms, see our guide on CAR Forms Every New Agent Should Know.

Where to look: Search "Contingency" and "Investigation."

The Agent Move: Use the RPA contingency removal (Form CR) to document every step.

Client Translation: "These are your safety nets. We have a set period to do our homework. If the house isn’t what we thought, we can walk away with your deposit intact—as long as we act before the deadline."

Disclosures: Managing Risk

Late or corrected disclosures can reopen investigation windows or create new cancellation rights—treat disclosure delivery as a high-risk clock.

Coach Kartik's Experience: I once worked with an agent who delivered a supplemental disclosure two days before closing. Because it revealed a prior roof leak not mentioned in the SPQ, the buyer gained a fresh right to cancel, and they used it to renegotiate a $10,000 credit. Documentation is your shield here.

Where to look: Search "Disclosures" and "TDS."

The Agent Move: Use the California Real Estate Laws & Compliance Guide to ensure your file meets the statutory requirements.

Repairs, Credits, and Allocation of Costs

Where to look: Search "Costs," "Fees," and "Repairs."

The Compliance Rule: Never promise a specific repair outcome until it is signed by both parties. Ensure the scope is in writing: who is doing the work, what is being fixed, by when, and how proof of completion will be delivered.

Cancellations: Notices and Defaults

Cancellations usually happen after a party fails to meet a deadline.

Where to look: Search “Notice,” “Perform,” “Default,” “Cancel,” and “Remedies.”

The Process: If a buyer misses a deadline, the seller typically issues a Notice to Buyer to Perform (NBP). If the buyer still doesn't comply within the window stated in the contract, the seller may have the right to cancel.

Deep Dive: For a full map of this process, see Cancellation Rights in California Transactions.

Possession and Rent-Backs

Where to look: Search "Possession" and "Occupancy."

The Agent Move: If the seller is staying past the close of escrow, you need a C.A.R. possession agreement (confirm the current form name/version with your broker).

Dispute Resolution and Liquidated Damages

Where to look: Search "Mediation," "Arbitration," and "Liquidated Damages."

The Safeguard: Missing a deadline can trigger contractual remedies or cancellation rights—treat deadlines as hard and confirm with your broker.

Wire Fraud Safeguard: I recently saw a spoof attempt where a buyer received "updated" wire instructions via email. Because they followed the rule to call a known number from the escrow company's official website, they realized the email was fraudulent and saved their $50,000 deposit.

The Move: Confirm the last 4 digits of the account verbally before sending. See California Anti-Fraud Rules in Real Estate for more.

RPA Milestone Checklist

Immediately After Acceptance:

Verify Delivery of Acceptance timestamp.

Mark the Deposit Due Date as stated in your accepted RPA (Common example: 3 days).

Within the Investigation Window:

Order all inspections (Home, Pest, Roof, Drainage, etc.).

Log the Disclosure Delivery Target date.

Before Contingency Removal Deadline:

Review appraisal value and loan status.

Confirm contingency removal strategy with client and broker.

Before Close (COE):

Conduct the final walkthrough.

Verify Escrow deposit receipt PDF is saved to the transaction file.

From Agent to Professional

Mastering the RPA is about becoming a diligent project manager. It’s not about being a lawyer; it’s about protecting your client’s interests through every "search term" and "time period."

This guide is just one piece of the puzzle. For the full picture on staying lawsuit-free, visit our California Real Estate Laws & Compliance Guide.

FAQ

What is the C.A.R. RPA?

The RPA is the most commonly used standard-form contract for California home sales, detailing the terms, conditions, and timelines of the transaction.

Is the RPA legally binding?

Generally, yes, once signed by all parties and delivered. However, specific performance depends on meeting all conditions. Consult your broker for edge cases.

What’s the difference between acceptance and delivery?

Acceptance is the act of signing the agreement. Delivery is the act of providing that signed document to the other party (or their agent). Both must occur for the contract to be binding.

What does liquidated damages mean in plain English?

It is a pre-agreed amount (usually capped at 3% for owner-occupied residential property) that the seller can keep as a penalty if the buyer breaches the contract.

What happens if contingencies aren’t removed?

The contract stays alive, but the seller can issue a Notice to Buyer to Perform (NBP). If the buyer still doesn’t remove them within the cure period stated in the contract, the seller may have the right to cancel.

Can the seller cancel after acceptance?

Generally, no. The seller cannot cancel just because they got a better offer. They can usually only cancel if the buyer fails to perform on contractual obligations.

How do I prevent wire fraud in escrow?

Always verify wire instructions via a phone call to a known, trusted number from a prior transaction or the escrow company's official website.

|

Disclaimer: This guide is for educational purposes only and does not constitute legal advice. Real estate laws and DRE regulations are subject to change. Always consult with your supervising broker Read more...

Disclaimer: This guide is for educational purposes only and does not constitute legal advice. Real estate laws and DRE regulations are subject to change. Always consult with your supervising broker and legal counsel regarding specific transaction concerns.

Fraud Isn’t a Mask—It’s a Shortcut

In the movies, fraud often looks like a villain in a dark room. In California real estate, fraud usually looks like a "shortcut" on a Tuesday afternoon. It is the pressure to backdate a signature because the client is "on a plane," or the temptation to omit a minor leak in the disclosures to keep a deal from falling apart.

New agents often believe that if they didn't intend to lie, they aren't committing fraud. However, for the Department of Real Estate (DRE), procedural sloppiness often looks identical to intentional deception.

Your job isn't to be overly paranoid (although there is a saying that “only the paranoid survive”); it’s to be procedurally sharp.

This guide provides a little bit of the "armor" you need to ensure your transactions remain compliant and your license remains secure.

Fraud 101: Intent vs. Negligence vs. Document Integrity

To stay compliant, you must understand how the DRE classifies misconduct. Misrepresentation can be "intentional" or "negligent," but both can trigger serious discipline.

Intentional Fraud: A deliberate, knowingly false statement (or omission) made to induce a party to act.

Negligent Misrepresentation: Making a claim without a reasonable basis for believing it is true (e.g., "The HOA allows ADUs" without checking).

Document Integrity Misconduct: Altering documents, forging initials, or backdating signatures. Backdating to make it appear a deadline was met can be treated as misrepresentation and document tampering and can trigger DRE discipline.

7 Fraud Traps (with Scripts + Next Steps)

1. Wire Fraud / Fake Escrow Instructions

An email arrives from "Escrow" at 4:45 PM on a Friday with "updated" wire instructions.

Red Flags: Grammar errors, extreme urgency, or a "look-alike" email domain (e.g., @escrow-title.com vs @escrowtitle.com).

Do This: "I've received an email regarding wire changes. I am calling the escrow officer at my independently verified office number now to confirm this before we proceed."

Don’t Do This: Forward the email to your client without voice verification. This increases the risk of reliance and complications if the client acts on fraudulent data.

2. Identity Impersonation (Seller/Buyer)

A "Seller" contacts you via text to list a vacant lot they own "free and clear." They are permanently "traveling" and cannot meet.

Red Flags: Refusal to video chat; requests for an immediate, below-market cash sale.

Do This: Request a government-issued ID and a recent utility bill. Send a physical mailer to the tax billing address on file to verify the owner received your listing package.

3. Forged Signatures / “Sign for Me” Pressure

The client says, "I can't get to my phone, just hit 'sign' for me so we don't miss the deadline."

Do This: "For your protection and to maintain the legal audit trail, the signatures must be executed by you through the approved platform. I cannot sign on your behalf."

Don’t Do This: Use a client’s login. This nukes the integrity of the entire file.

4. Altered Terms After Signature

You realize you forgot to check a box for a refrigerator after the buyer signed.

Do This: Use an amendment. Both parties must sign any change to an executed document.

Don’t Do This: "Check the box" yourself. This is a material alteration and can trigger serious discipline.

5. Non-Disclosure Pressure

The seller says, "The roof leak was tiny and we patched it. Don’t mention it so we don't scare the buyer."

Do This: "California law requires us to disclose any material fact that affects value or desirability. If a buyer would want to know, we must disclose it." Review the CAR Forms Every New Agent Should Know to document the history properly.

6. Undisclosed Credits / Side Agreements

The buyer and seller agree to a $5,000 "carpet credit" paid outside of escrow to keep the lender from seeing a low appraisal.

Red Flags: Any agreement involving money that isn't on the final settlement statement.

Do This: "All credits and price adjustments must be disclosed to the lender via a formal addendum. Handling this 'outside of escrow' can be considered mortgage fraud."

Don’t Do This: Facilitate "side letters" or cash-under-the-table repairs. This bypasses the spirit of the purchase agreement and creates liability for all parties.

7. Inflated Repair Invoices / Kickbacks

A contractor offers you a "referral fee" for recommending them for the Request for Repair work so they can charge more and “give you the difference”.

Do This: "I don't accept anything tied to referrals; it may violate RESPA and/or brokerage policy. My recommendations are based on quality of service only."

Don't Do This: Accept gift cards or credits tied to referrals.

The Agent Armor System: A Mechanical Approach to Integrity

Compliance isn't a feeling; it's a system. Use these mechanical rules to protect your license:

The Material Change Trigger: If it changes money, timing, possession, agency, or disclosures, you MUST call your broker before you respond or draft the change.

The "Clean Accept" Rule: Never rely on email-only confirmations for contract terms. Use the proper mechanics to finalize changes through the escrow process.

Version Control Naming: Adopt a strict naming convention to prevent using the wrong draft: 123Main_RPA_v3_2025-12-26_BuyerInitials.pdf.

Verification Rule: Never use a contact number provided inside an email asking for money. Only use independently verified numbers from your brokerage directory.

The "Stop the Thread" Rule: If you suspect an email account is compromised, stop replying in that thread immediately.

CAR Form Sloppiness Trap (Audit Triggers)

Data from the DRE Real Estate Bulletin summary (October 2024) indicates that a large portion of audits uncovered recordkeeping violations. Sloppiness creates the appearance of deception. Avoid these audit triggers:

Missing Agency Timing: You must properly explain Agency Disclosure Form AD before the client signs the contract. Doing it "later" looks like you are hiding a conflict.

Inconsistent Timelines: If the "Date of Delivery" on a notice doesn't match the signature timestamp, you are at risk regarding cancellation rights in California transactions.

Unclear Acceptance Trail: Counters or addenda referenced in the RPA that are not fully executed or dated create "who accepted what, when?" ambiguity.

Unchecked Boxes: Leaving critical boxes blank in the RPA creates ambiguity that an auditor may interpret as a post-closing alteration.

Suspecting Fraud Mid-Transaction: The Response Protocol

Pause. Do not let the "closing pressure" force you into a mistake.

Preserve Evidence. Save email headers and screenshot texts immediately.

Switch Channels. Stop communicating through the suspicious channel. Move to a verified phone call.

Notify Broker. Never "fix it quietly." Your broker is your first line of defense.

Document. Write an internal memo for your file detailing the red flag and the steps you took to verify the truth.

California Real Estate Fraud Prevention Checklist

NEVER backdate a signature (even if the party signed late).

NEVER use "white-out" or cross out terms without all parties initialing.

NEVER provide "side-letters" or credits that aren't disclosed to the lender.

NEVER share your Docusign login with a client.

Protecting Your Moat

Compliance is the moat that protects your career. By maintaining a clean audit trail and prioritizing document integrity, you ensure that your focus stays on growth rather than defense. For a complete look at the regulatory landscape, visit our California Real Estate Laws & Compliance Guide.

FAQ: California Anti-Fraud Rules

Is backdating a signature illegal?

It can be unlawful and is always high-risk. If it changes the truth of the timing to deceive a party or a lender, treat it as strictly prohibited.

What is an agent’s duty regarding material facts?

In California, you must disclose any fact known to you (or that should be known via a diligent visual inspection) that affects the value or desirability of the property. When in doubt, disclose.

Can I be disciplined if my client lied and I didn't know?

Yes, if a "reasonable agent" would have noticed the red flags. You are expected to exercise "due diligence," not just passive acceptance.

|

The Real Reason Cold Calling Feels “Salesy” (And How to Fix It Fast)

Most new agents pick up the phone like a hunter: “How do I get a listing? How do I get an appointment?”

That intent changes Read more...

The Real Reason Cold Calling Feels “Salesy” (And How to Fix It Fast)

Most new agents pick up the phone like a hunter: “How do I get a listing? How do I get an appointment?”

That intent changes your voice. You rush. You over-explain. You push.

To stop sounding salesy, you don’t need a “slicker” script. You need a cleaner objective:

Your job is not to sell on the first dial. Your job is to start a professional conversation.

To stop sounding salesy, you don’t need a “slicker” script. You need a cleaner objective:

We do that with a simple framework:

Permission + Local Context + Micro-Commitment

By the end of this guide, you’ll have 3 word-for-word scripts, a 10-point objection cheat sheet, and a 7-day plan you can run immediately.

The “Conversation-First” Framework: The 5-Step Blueprint

Here’s the structure closers use because it’s low-pressure and repeatable:

Permission Opener (disarm & respect)

Clear Reason for the Call (specific, local, honest)

Tiny Value Hook (a micro-insight)

Easy Diagnostic Question (invites dialogue, not defense)

Low-Pressure Next Step (a micro-commitment, not a meeting)

Script vs. Mindset: Rookie vs. Closer

Feature

Rookie (Salesy) Approach

Closer (Professional) Approach

Primary goal

Get appointment/listing now

Start a professional relationship

Opener

“Hi, I’m looking for the owner…”

“I know I’m calling out of the blue—quick question…”

Value hook

“I can get you top dollar!”

“A couple homes near you moved fast—local activity is changing.”

Handling “No”

Push harder or hang up

Offer a micro-exit (email / quick follow-up time)

Success metric

Appointments set

Quality contacts + scheduled follow-ups

Coaching note: You’re not trying to “win” the call. You’re trying to earn permission to continue.

Script #1: The Universal Permission Opener (Word-for-Word)

Never pitch someone who hasn’t agreed to listen.

Variant A: Friendly & Professional

“Hi [Name], this is [Your Name] with [Brokerage]. I know I’m calling out of the blue—do you have 60 seconds, or did I catch you at a bad time?”

Pacing: Say it slowly. Then stop talking.

Variant B: Neighborly Inquiry

“Hi [Name], [Your Name] here. I’m a local agent—do you mind if I ask you a quick question about the neighborhood?”

Variant C: Calm & Direct

“Hi [Name], [Your Name] with [Brokerage]. I’ll be brief—is now a bad time?”

(This often gets a “No, go ahead.”)

If they say “No” / “I’m busy” (Micro-Exits)

Don’t vanish. Preserve the relationship.

Text pivot: “No problem at all. Would it be easier if I just texted you a one-line local update instead?” (Follow your laws regarding opt-in text messaging)

Time lock: “Totally fair. Would later today or tomorrow morning be better for a 2-minute question?”

Your win: permission to call back at a specific time.

Script #2: California Circle Prospecting (Truthful Versions Only)

Circle prospecting = calling around a real market event (sale, listing, open house activity, inventory shift).Rule: Only say what you can verify. No fake buyers. No fake “off-market” talk.

Before you call: pick ONE true local fact

Examples you can verify quickly:

“A home around the corner sold fast.”

“Inventory is tight in this ZIP.”

“A few homes have been sitting longer recently.”

Keep it simple. You’re not delivering a data report—just a reason you’re relevant.

Version A (ONLY if true): You actually have an active buyer

“Hi [Name], I’m [Your Name] with [Brokerage]. I know this is out of the blue—do you have 60 seconds?”(Pause)“I’m calling because I’m actively representing a buyer looking for a home in this immediate area, and inventory has been tight.”

Diagnostic question (low pressure):

“Have you heard of anyone nearby who might be planning a move in the next few months?”

Version B (always safe): Inventory tracker (no fake buyer)

“Hi [Name], [Your Name] with [Brokerage]. Quick question—do you have 60 seconds?”(Pause)“I’m calling because I’m tracking inventory in this area for a few households who want to move locally, and I’ve noticed there hasn’t been much fresh activity right around you.”

Tiny value hook (no made-up stats):

“In some pockets nearby, homes have been moving quicker than people expect—so I’m checking in locally.”

Diagnostic question:

“If you ever moved—what would trigger it for you? More space, downsizing, job change…?”

Prefer face-to-face over phone? Use:

Door-Knocking Script for California Neighborhoods

Script #3: Warm Follow-Up (After Open House, Sign-In, Lead Form)

This is where new agents stop being “random callers” and start being professionals.

Structure: Gratitude → Specific recall → Diagnostic → Easy offer

“Hi [Name], it’s [Your Name] with [Brokerage]. Thanks again for stopping by my open house at [Address] on [Day].”

“Quick question—when you left, was that home a hard ‘no,’ or are you still comparing options?”(Pause)“Based on what you told me you want, would it be helpful if I sent you two or three similar options to look at tonight?”

Coaching note: The goal is not to schedule a 60-minute meeting. It’s to earn the next conversation.

To generate better warm leads (and better follow-up notes), master: Open House Script for New Agents

The 10-Point Objection Cheat Sheet (California Edition)

Use this structure:

Acknowledge → Pivot → Ask (micro-commitment)

1) “Not interested.”

Rookie panic move: “Okay, bye.”

Closer response: “Totally understand. I didn’t expect you to be thinking about selling today. I’m just calling as a local resource—would you be open to me emailing you a one-line local update once in a while so you can track your equity?”

Goal: permission to talk (or permission for a short follow-up)

2) “I already have an agent.”

Rookie panic move: “Oh… okay.”

Closer response: “That’s great—having someone you trust matters most. Quick question: if they were unavailable and you needed a second opinion fast, would you be open to keeping one backup contact?”

Goal: permission to stay in their orbit

3) “Just send me the information.”

Rookie panic move: “What’s your email?” (and they vanish)

Closer response:“Happy to. Quick preference: are you more interested in what’s selling right now, or what your home might be worth in today’s market?”

Goal: steer them into a 2-question conversation, then capture contact

4) “How did you get my number?”

Rookie panic move: “Uhh… a lead provider?”

Closer response: “Fair question. I use lawful, reputable public-record and neighborhood data tools. And if you’d rather not be contacted again, just tell me and I’ll make sure you’re removed.”

Goal: keep trust + respect opt-out

5) “Call me later.”

Rookie panic move: “Okay.” (and they forget you)

Closer response: “No problem—what’s better: today at 5 or tomorrow morning? I’ll keep it to two minutes.”

Goal: lock a specific time

6) “Take me off your list / Stop calling.”

Rookie panic move: argue or explain

Closer response: “Absolutely. I’ll remove you right now. Have a good one.”

Goal: compliance and professionalism (protect your license and your broker)

7) “Are you calling to list my house?”

Rookie panic move: immediate pitch

Closer response: “Not necessarily. I’m calling to be a local resource and understand what homeowners are seeing and planning. If you ever moved, would you stay local or head somewhere else?”

Goal: open dialogue without pressure

8) “What’s your commission?”

Rookie panic move: quote numbers to a stranger

Closer response: “Good question. Fees depend on the service level and the situation. If you ever wanted to explore it, I’d walk you through a clear fee schedule—are you thinking about selling soon or just curious?”

Goal: determine intent and avoid negotiating on cold call

9) “Rates are too high / Market is awful.”

Rookie panic move: debate headlines

Closer response: “Totally fair—headlines are loud. That’s why I focus on local reality. Would it be helpful if I sent you a simple local snapshot so you can see what’s actually happening near you?”

Goal: permission to send local info

10) “Wrong number / I’m a renter.”

Rookie panic move: scramble into a pitch

Closer response: “Thanks for telling me—my mistake. Before I let you go, are you planning to buy in [City] this year, or not on your radar?”

Goal: only if the tone is friendly; otherwise exit clean

Next step when you actually secure a meeting:Prepare for that buyer consult with: Buyer Consultation Script (California Agents)

The System: Scorecard + 7-Day Launch Plan

New Agent Weekly Scorecard

Metric

Target (Week 1)

Notes

Dials

25–50/day

Consistency > hero days

Conversations (2+ min)

2–5/day

If 0, opener/timing/list issue

Contacts captured

1–3/day

Micro-commitment strength

Follow-ups scheduled

1–2/day

Lock times, don’t “floating follow-up”

Appointments

Bonus

Don’t obsess Week 1

Diagnosing your bottleneck (coach yourself)

Low conversations (e.g.,

|

TL;DR: The Agent’s Quick-Start Guide

The Mission: Transition from an "unpaid tour guide" to a "fiduciary consultant" by leading a structured diagnostic process.

The 15-Minute Phone Flow: A verbatim Read more...

TL;DR: The Agent’s Quick-Start Guide

The Mission: Transition from an "unpaid tour guide" to a "fiduciary consultant" by leading a structured diagnostic process.

The 15-Minute Phone Flow: A verbatim script to qualify leads and book the deep-dive consultation.

The 30-Minute Playbook: A timed framework for the in-person meeting to uncover "deal-killer" obstacles.

California Precision: Language focused on the C.A.R. RPA, contingency periods, and deposit protection.

The High-Stakes First Conversation

In the high-speed California market, a transaction rarely dies because of a bad inspection—it dies because of a missed question in the first meeting. I have seen countless escrows in markets like the Inland Empire or Orange County implode because an agent didn't verify if a down payment was liquid, coming from a 1031 exchange, or was a gift fund that hadn't yet been documented.

The buyer consultation is your Transaction Control Room. It is the single most important leverage point for preventing 90% of future transaction drama. By the end of this guide, you will have a word-for-word framework to build trust, verify financial credibility, and establish yourself as a professional advisor.

Agent Action: Print the 30-minute agenda in Section C and place it in a professional folder.

Psychology/Why It Works: : Buyers relax when the process is clearly led. When you lead with a visible agenda, you signal that you are a project manager capable of navigating the complex California disclosure environment.

The 5 Goals of a Flawless Buyer Consult

Before you conclude the meeting, you must have clarity on these five success metrics:

The “Why”: Their true motivation and "hard-stop" timeline (e.g., school start dates or lease ends).

The “How”: Verified financial readiness (Monthly comfort zone vs. max approval).