Imagine this scenario: You are a broker with a busy property management division. A tenant hands you a security deposit check for $2,000. You’re in a rush, so you deposit it into your general business operating account, intending to transfer it to the trust account on Monday.

Even if you transfer the money on Monday morning, you have already broken the law.

In California real estate, that mistake has a name: commingling of trust funds – illegally mixing a client’s money with your own.

Mishandling of trust funds is one of the most common reasons the California Department of Real Estate (DRE) disciplines licensees.

This article is part of our California Real Estate Laws & Compliance Guide, designed to keep you safe, compliant, and in business. Let’s break down exactly what commingling is, how it differs from conversion, and how you can avoid the audit nightmares that end careers.

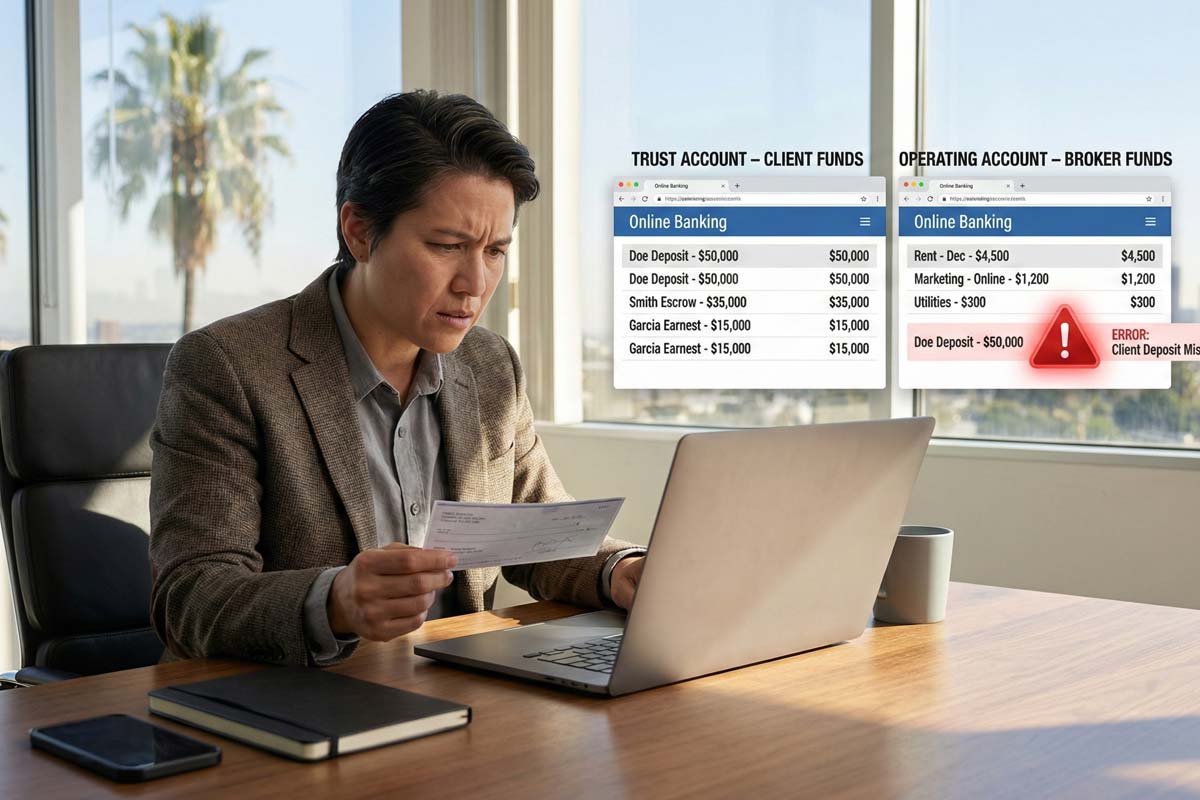

In California real estate, commingling is the illegal practice of mixing a client’s money (trust funds) with the broker’s or agent’s personal or general business funds.

Think of it this way: As a real estate professional, you have two distinct "pockets."

Commingling happens when you put Pocket B money into Pocket A. Even if you don't spend it, the mere act of mixing the funds is a violation of the California Business and Professions Code.

New agents often confuse these two terms. You will see this distinction on the real estate exam, so memorize it now:

The Golden Rule: Commingling is the gateway drug to conversion. That’s why the DRE comes down hard on commingling even when “no one got hurt.”

To avoid commingling, you must identify "Trust Funds" immediately. Trust funds are anything of value received by a broker or salesperson on behalf of a principal or another person in a transaction.

Common examples include:

Because you have a fiduciary duty to your client—a concept we dive deeper into in our California Agency Law Explained for New Agents article—you are holding this money in trust. It is not yours.

Often commingling isn't malicious; it’s sloppy. Here are the street-level scenarios where new agents get into trouble.

The Scenario: A tenant wants to pay rent via Venmo or Zelle. You let them send it to your personal Venmo account, planning to write a check to the owner later.

The Violation: You have just commingled. That rent money is sitting in your personal account ecosystem.

The Fix: Never accept trust funds into a personal digital wallet. Use a designated business trust account or have the tenant pay the landlord directly.

The Scenario: You get an earnest money check on Friday. You leave it in your desk drawer over the weekend and forget about it until the following Thursday. You realize you’re late, so you deposit it into your personal account just to "get it in the bank."

The Violation: Leaving the check in your desk that long is mishandling trust funds. But if you then panic and deposit it into your personal account, you’ve now committed commingling – which is far more serious.

The Fix: Deposit funds immediately (usually within 3 business days) into the proper trust account or escrow.

The Scenario: Your business account is short $500 for a marketing bill. You "borrow" $500 from the trust account, knowing you have a commission check coming tomorrow to replace it.

The Violation: This is conversion (theft), fueled by commingling.

The Fix: Never, ever touch trust funds for operating expenses.

Transparency is key here. Just as you must follow California Disclosure Laws (Complete Breakdown) regarding property defects, you must be transparent about where the money is going.

The California DRE has the power to audit your books at any time. They do not need a warrant; your license grants them that right.

Commingling trust funds is one of the most serious trust account violations in California real estate, and the penalties reflect that severity:

The DRE takes this seriously because it is a matter of public trust. When you promote yourself, you're telling the public they can trust you with their money. That's why our Advertising Laws for California Real Estate Agents aren’t just about fonts and disclaimers – they’re about not misleading people about how safely you handle deposits and rent.

Compliance is about habits, not willpower. Implement these best practices immediately.

If you are studying for your California real estate exam, expect at least a handful of questions on this topic. The exam writers love to trick you with the difference between commingling and conversion.

Exam Tip: If the question mentions “mixing” funds, the answer is commingling. If the question mentions “misappropriating” or “using” funds, the answer is conversion.

Is commingling illegal in California real estate? Yes. It is a violation of the California Business and Professions Code and is grounds for license suspension or revocation.

How long does a broker have to deposit trust funds in California? Generally, a broker has three business days following the receipt of funds to deposit them into a trust account, a neutral escrow, or give them to the principal.

What is the difference between commingling and conversion? Commingling is the mixing of client funds with personal/business funds. Conversion is the actual use or theft of those funds for the agent’s benefit.

Can a broker keep their own money in a trust account? A broker may only keep a very small amount (typically up to $200) of their own funds in the trust account for the sole purpose of covering bank service fees. Anything beyond that is commingling.

Commingling is a preventable risk. By setting up the right accounts and following a strict "hands-off" policy with client money, you protect your license and your clients.

I’ve watched smart, well-meaning agents lose years of work over a single sloppy trust-fund decision. There is no commission big enough to justify that risk.

Ready to master the rest of the rulebook? Continue your study with our California Real Estate Laws & Compliance Guide to ensure you are fully prepared for both the state exam and your first year in the field.

Avoiding Non-DRE-Approved Real Estate Schools in California

Most Popular Real Estate Schools in California

California Real Estate Exam Rules & Testing Policies

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.