Cap or capitalization rates are a widely used metric for assessing real estate investments. However, not every piece of advice you’ll find online is accurate, and many investors still struggle to understand what this is. From simplistic interpretations of a property’s income potential to overreliance on a single metric, various cap rate myths can lead even experienced investors astray. In this article, I wanted to tackle some of the most common cap rate misconceptions and help you better understand what the cap rate can and can’t tell you.

Before we dive into the myths, let’s start with a quick refresher. A cap rate represents a property’s net operating income (NOI) divided by market value. It’s essentially a snapshot of what kind of return you could expect if you purchased a property outright (without financing) and held it for an entire year. Although cap rates are a valuable starting point, they are not magic numbers that guarantee investment success. With that context in mind, let’s debunk a few myths.

One of the most common cap rate myths is falling into the trap of thinking a higher cap rate automatically equals a superior investment. A high cap rate can be misleading, as it doesn't account for all the risks involved.

One of the biggest misunderstandings new investors have about cap rates is relying on them as the sole indicator of value. It's tempting to simplify investment analysis, but this can be a costly mistake. A cap rate provides a snapshot of return based on current income and value—not a prediction of future performance.

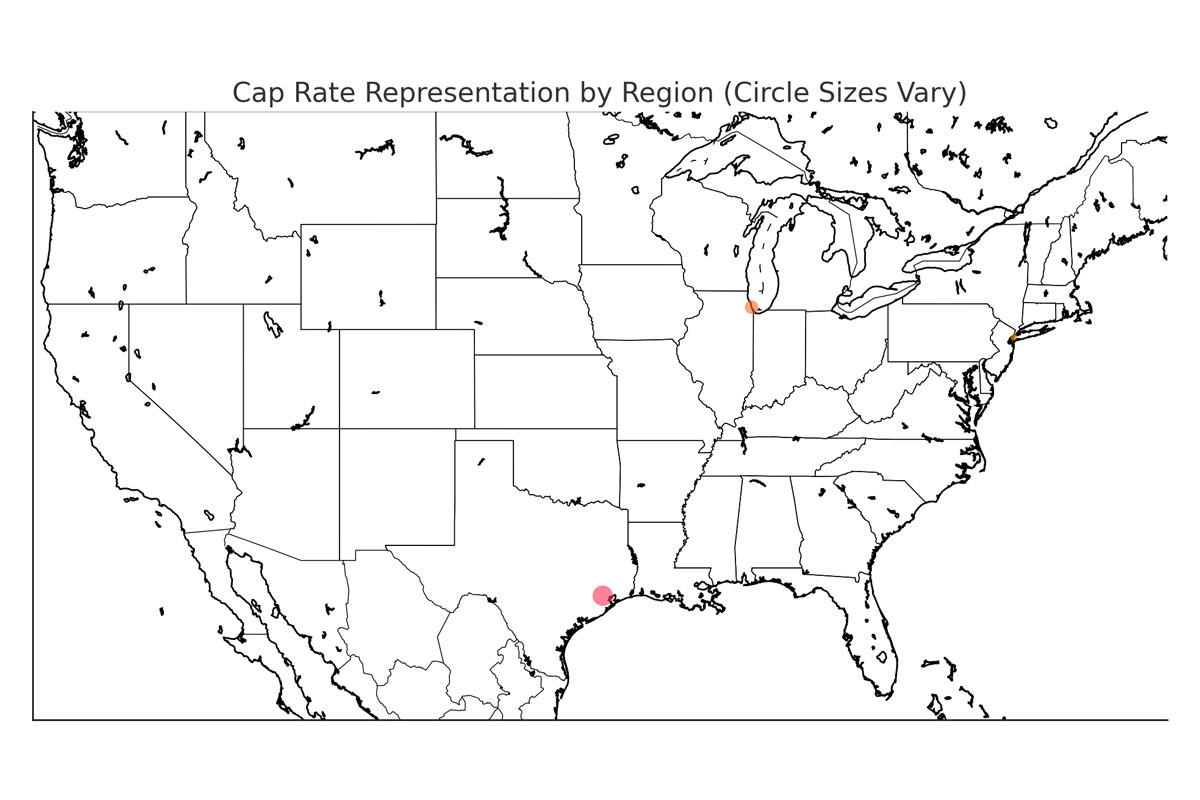

Another big cap rate misconception is that a solid cap rate is the same in every city, every neighborhood, and every property class. If you read investment forums, you’ll see advice like “always aim for an 8% cap rate,” as if this golden number applies everywhere.

Experienced investors and analysts sometimes dismiss cap rates as a “beginner’s tool.” This leads to misunderstandings about cap rates as being too simplistic. While sophisticated investors employ advanced metrics like Internal Rate of Return (IRR) or Discounted Cash Flow (DCF) models, that doesn’t diminish the usefulness of a cap rate.

Another cap rate misconception is assuming that once you’ve calculated a cap rate, it stays relevant indefinitely. Markets evolve, rental incomes shift, and property valuations fluctuate, all of which can alter the cap rate over time.

Some investors rely heavily on cap rates to understand risk, assuming that a specific cap rate implicitly signals low or high risk. This is another instance of misunderstanding cap rates, as they cannot capture all the nuances of a property’s risk profile.

Some investors think cap rates matter only for all cash purchases and that they become irrelevant once you introduce a mortgage. This is a more technical cap rate myth, but it can misguide investors looking at leverage.

Now that I’ve debunked several cap rate misconceptions, here are a few tips on using this metric effectively:

The key to avoiding cap rate myths is understanding what a cap rate measures and recognizing its limitations. By debunking these cap rate misconceptions, you’ll be better positioned to make informed decisions, whether adding your first investment property to your portfolio or fine-tuning your approach as a seasoned real estate entrepreneur. When used correctly—within the broader context of detailed due diligence.

Hope this helps

Love,

Kartik

Avoiding Non-DRE-Approved Real Estate Schools in California

Most Popular Real Estate Schools in California

California Real Estate Exam Rules & Testing Policies

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.