You’re staring at your 45-hour renewal options and you notice a new line item: “Implicit Bias Training.”

The real question isn’t what it is—it’s whether missing it can delay your renewal.

Read more...

You’re staring at your 45-hour renewal options and you notice a new line item: “Implicit Bias Training.”

The real question isn’t what it is—it’s whether missing it can delay your renewal.

For California renewals tied to the post–January 1, 2023 CE rules, Implicit Bias is a mandatory DRE-required topic—and the only “gotcha” is how it must appear on your CE completion records depending on whether this is your first renewal or a later renewal.

This guide clarifies the rules so you can renew your license without a rejection.

Quick Answer: Do I Need This?

Yes. Implicit Bias Training is required as part of California’s renewal CE.

Requirement: 2 hours of DRE-approved Implicit Bias Training.

Does it add hours? No—it's part of your required 45 hours (not extra).

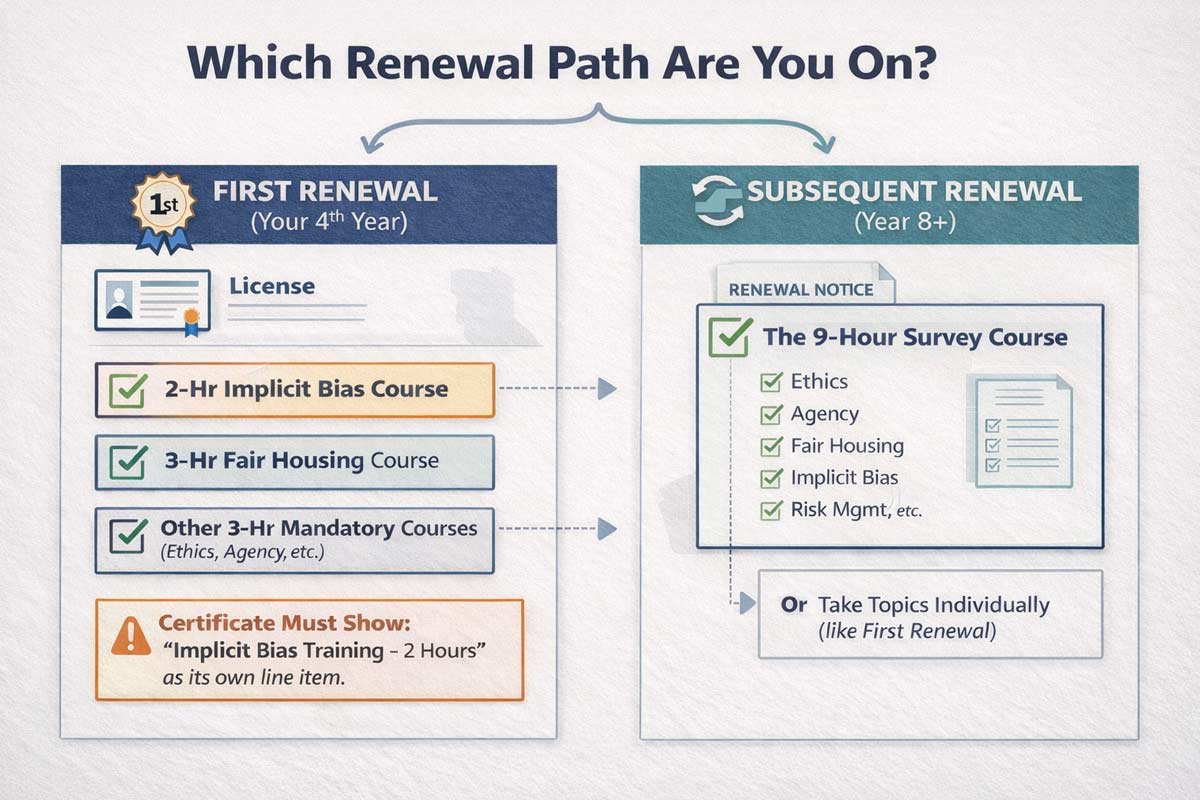

Key difference: First-time renewals must complete a standalone 2-hour Implicit Bias course. Subsequent renewals can satisfy it via the 9-hour survey course or by taking the mandatory topics as individual courses.

Related Resources:

California Real Estate License Renewal Guide

California Real Estate License Renewal Requirements (2026)

Why Is This Required? (SB 263)

This requirement comes from California’s CE rule updates implementing Senate Bill 263, which added a two-hour implicit bias training component and expanded the survey/update course to nine hours to cover the mandatory topics.

The curriculum focuses on understanding historical and systemic housing barriers and providing actionable steps to recognize unconscious bias in client interactions. The goal is risk management: protecting your license and ensuring compliance with Fair Housing laws.

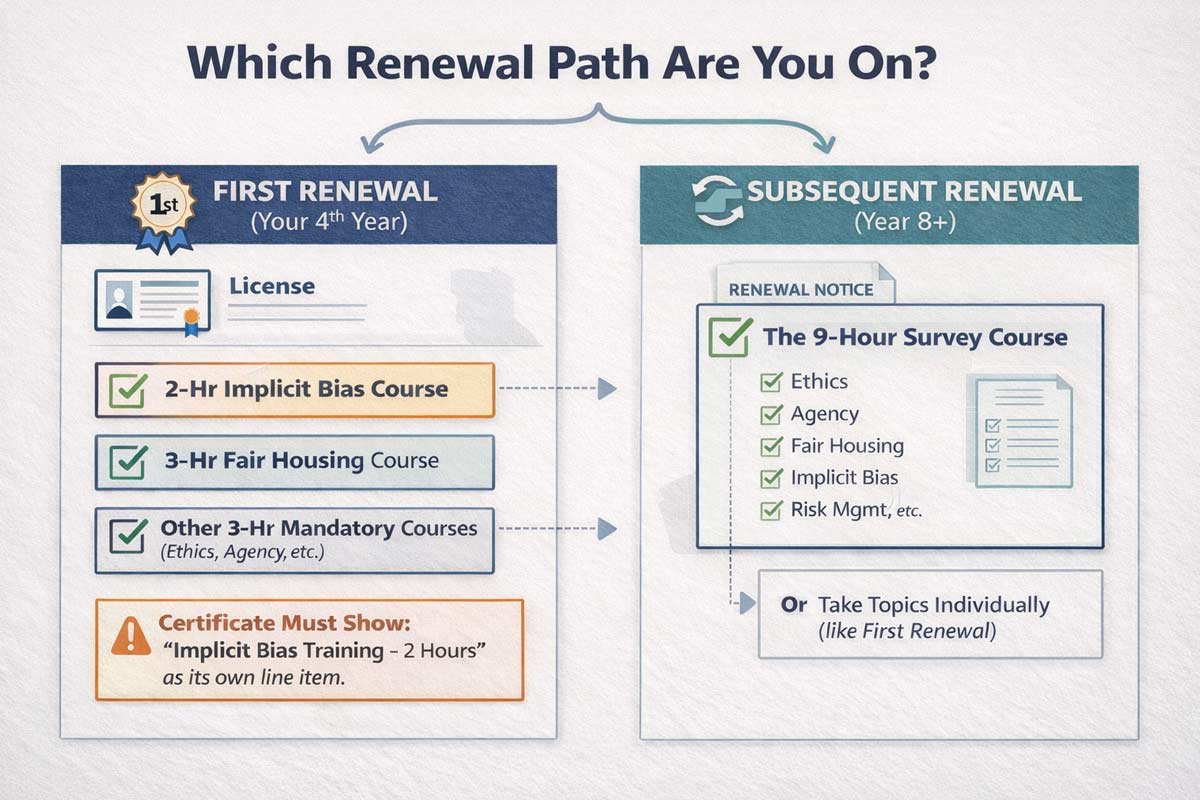

The "First Renewal" vs. "Subsequent" Rule

The Department of Real Estate (DRE) has precise rules for how this training appears on your certificate. This is where most licensees make mistakes.

Scenario A: This is Your First Renewal

If you are renewing for the very first time (your 4-year anniversary), you cannot use the "survey course" shortcut. You must take separate courses.

If you are a Salesperson:

Your 45 hours must include:

Four separate 3-hour courses: Ethics, Agency, Trust Fund Handling, Risk Management.

One 3-hour Fair Housing course (with the required interactive component).

One 2-hour Implicit Bias Training course.

At least 18 hours of Consumer Protection, plus remaining hours in Consumer Protection or Consumer Service.

If you are a Broker (or Officer):

The structure is similar, but adds one more mandatory topic:

Five separate 3-hour courses: Ethics, Agency, Trust Fund Handling, Risk Management, Management & Supervision.

One 3-hour Fair Housing course (with the interactive component).

One 2-hour Implicit Bias Training course.

At least 18 hours of Consumer Protection, plus remaining hours in Consumer Protection or Consumer Service.

The Certificate Rule: You need a completion record that clearly shows "Implicit Bias Training – 2 Hours" as its own course line item.

Operator Note: If you want the full breakdown of what counts and how the DRE buckets these hours, read our guide on California Real Estate License Renewal Requirements (2026).

Scenario B: This is a Second (or Later) Renewal

For second and subsequent renewals, you have two compliant paths:

The Survey Option: Take the single 9-hour CE survey course that covers all mandatory topics (including Implicit Bias).

The Individual Option: Take the mandatory topics as individual courses instead of the survey.

Broker licensees will often ask ADHI Schools if brokers have different CE requirements in CA? A key difference is all broker licensees renewing must take a Management and Supervision course, but first time salespersons renewing do not.

Does It Count Toward My 45 Hours?

Yes. Implicit Bias is not "extra" work. It fits inside your existing bucket.

License Renewal Type

Total Hours Required

Does Implicit Bias Count?

First Renewal

45 Hours

Yes (Counts as 2 mandatory hours)

Subsequent Renewal

45 Hours

Yes (Could be taken in a 9-hr Survey course)

Late Renewal

45 Hours

Yes (Same rules apply)

To see exactly how the math works for your specific license type, check our breakdown of how many CE hours are required for CA license renewal?

"Audit-Proofing" Your Renewal

The DRE audits a percentage of renewals every month. If you are pulled for an audit simply follow the requests that the DRE makes and respond in a timely manner.

The Audit Checklist:

Check the Provider: Ensure the course provider is DRE-approved. A "Diversity Training" certificate from your other corporate job does not count. It must have an four-digit DRE Sponsor Number listed on the certificate of completion. Learn exactly what courses count toward CE in California to avoid registering for an invalid course.

Verify the Year: If you took a Fair Housing course in 2021 that didn't have the new interactive component or implicit bias module, it is invalid for a 2026 renewal.

Keep Your Records: Keep your certificates longer than you think. DRE recommends retaining CE completion certificates up to five years in case of audit, and providers are required to maintain participant records for five years.

Common Mistakes That Reject Renewals

We see licensees panic-renew 24 hours before their license expires. That is when mistakes happen.

Mistake #1: The "HR" Course. Submitting a workplace harassment or bias certificate from a non-real estate employer.

Result: Rejected.

Mistake #2: The "Old" Course. DRE rule of thumb: Continuing education credit expires four years from the course completion date, so older certificates can trigger rejection codes during renewal processing.

Mistake #3: Taking Courses From a Provider That is Not Approved. Make sure to ask for the 4 digit sponsor number of any course provider before registering.

Stay Compliant, Stay Active

Implicit Bias training is now a standard part of doing business in California. It isn't just about checking a box; it's about protecting your license and serving a diverse client base professionally.

Don't let a missing 2-hour certificate pause your career. If you are unsure exactly which courses you need based on your license status, check the full roadmap below.

California Real Estate License Renewal Guide →

FAQ

1. Can I take Implicit Bias training online?

Yes. As long as the provider is DRE-approved for correspondence or online study, you can take the course entirely online.

Does my Fair Housing course cover Implicit Bias?

No. They are separate requirements. However, if you take the 9-Hour Survey Course (for subsequent renewals), both Fair Housing and Implicit Bias are included in that single 9-hour block.

I am over 70 years old. Do I still need this?

If you are eligible for the "70/30" exemption (70+ years old AND 30 years of continuous good standing), you are exempt from all CE, including Implicit Bias. You simply submit the exemption form.

What happens if I renew late?

If you renew within your two-year grace period, the requirements are the same: you must complete the 45 hours, including Implicit Bias, before you can reinstate your license and pay the appropriate late fee.

|

TL;DR: The 90-Minute Monthly Newsletter System (Beginner-Proof)

Pick a lane: Market Translator, Homeowner Value, or Buyer/Relocation.

Use one template: Stick to the same structure every Read more...

TL;DR: The 90-Minute Monthly Newsletter System (Beginner-Proof)

Pick a lane: Market Translator, Homeowner Value, or Buyer/Relocation.

Use one template: Stick to the same structure every month so you actually ship it.

Send monthly for 90 days: Focus on consistency first, then optionally move to bi-weekly once the habit is locked in.

Measure the right thing: Prioritize replies and booked conversations over "pretty design."

The Newsletter Mindset Shift: From Spam to Service

You have 250 contacts in your phone. Every time you think about emailing them, you panic. What do I say? Will they think I’m annoying?

Most agents treat a newsletter like a digital billboard. They blast out "Just Listed" photos and generic "Happy Spring" graphics. That isn't a newsletter; that’s noise. Your newsletter is a regular, valuable touchpoint that makes you the obvious choice when a real estate need arises.

In 20+ years as a California operator, I’ve rarely seen a consistent, value-first newsletter not produce replies—because it compounds familiarity. Every email is a trust deposit. This is the core of Real Estate Marketing Basics—the foundational system that shows California agents how marketing actually converts attention into conversations.

"Is this relevant enough that my ideal client might reply or forward it to a friend?"

Step 1: Choose Your "California Lane"

To avoid the Personal Branding Mistakes New Agents Make, you must pick a specific lane for the next 90 days. Your newsletter works best when it reinforces a clear positioning—something we break down further in Branding Yourself as a California Real Estate Agent.

Lane 1: The Local Market Translator: Explain what median price shifts in San Diego or DOM (Days on Market) in the Inland Empire actually mean for a homeowner's equity.

Lane 2: The Homeowner Value Engineer: Focus on Prop 19 benefits, ADU potential, and smart renovations. You help them manage their largest asset. Always frame these topics as educational and encourage homeowners to confirm details with a CPA, attorney, or their local jurisdiction.

Lane 3: The Buyer/Relocate Guide: Demystify the California buying process, neighborhood vibes, and school district nuances for newcomers.

Step 2: Set Up the Boring Stuff (So You Don’t Get Burned)

Before you write a single word, set these once to ensure you stay professional and compliant:

Sender name: “Kartik @ [Brokerage]” (Use your name; never use “No-Reply”).

Reply-to: Your real email address. Your goal is to start a dialogue.

Footer: Your full name, brokerage name, and DRE #. This is non-negotiable in California.

Unsubscribe link: Mandatory for every send.

One list only: Start with your sphere and warm contacts. Never buy a list.

Mobile check: Send a test to yourself and read it on your phone first.

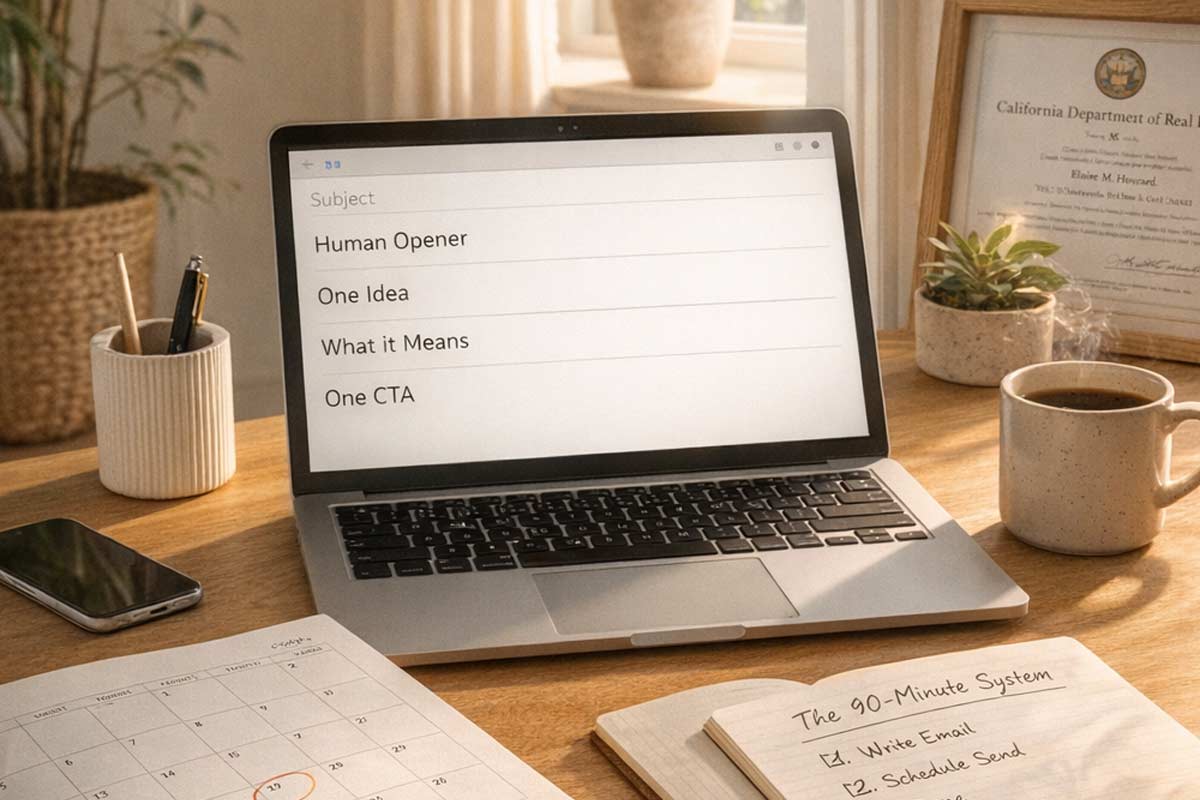

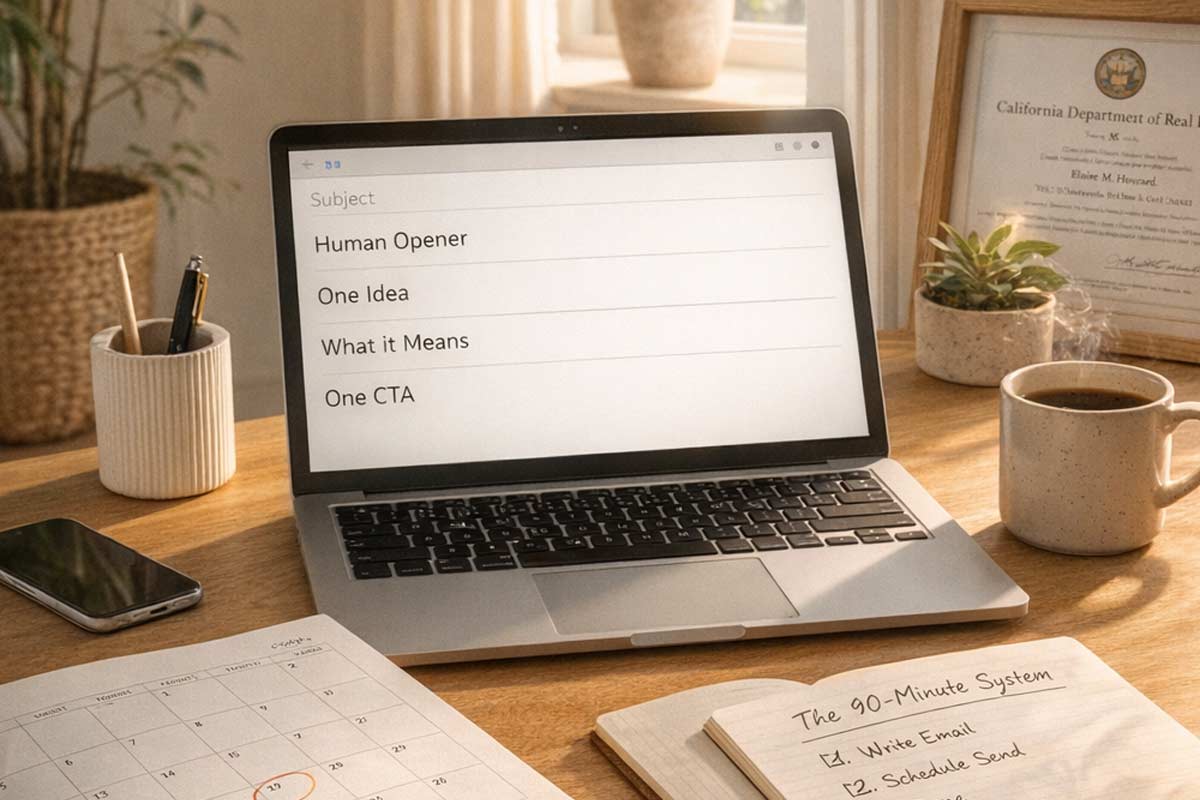

Step 3: The “Same Every Time” Newsletter Template

Your newsletter should feel like a familiar TV show: same format, new episode. This builds the consistency required for branding yourself.

Subject (Benefit + Place): “What today’s OC inventory shift means for you.”

Human Opener (2 sentences): Local and relevant. Example: "The line at Porto’s was wrapped around the block today—reminded me how fast things move in Buena Park."

One Idea: One chart, one story, or one principle (e.g., why interest rates shouldn't stop a move-up buyer).

What it Means for You: Translate the idea into a decision. Example: “If you’ve been waiting for a 6% rate, you might be missing the best equity window in five years.”

One CTA: One action only. (See the Keyword System below).

Signature & Compliance Footer: Name, Brokerage, and DRE #.

The CTA That Actually Works: “Reply With One Word”

People often won’t click a link, but they will reply if it’s easy. Pick one of these for your newsletter:

Reply Keyword

What They Get

VALUE

I’ll send a quick home value range for your specific neighborhood.

ADU

I’ll send the California ADU feasibility checklist.

BUY

I’ll send my “first 30 days” buyer game plan.

SELL

I’ll send my pricing and prep checklist for your specific zip code.

Tip: When someone replies, respond within 24 hours—even if it’s just to acknowledge and schedule a follow-up. Speed compounds trust.

Step 4: The California-Ready Content Menu

Pick one idea for your next edition.

Note: Always include a disclaimer that you are not providing tax or legal advice.

Market Intelligence: California Association of REALTORS® (C.A.R.) monthly data decoded for your city.

Homeowner Wealth: How Prop 19 might affect your parents' ability to downsize.

Transaction Truths: Why the "Appraisal Gap" is the most important term in a CA contract right now.

Hyperlocal Spotlight: The best coffee shop in your neighborhood for a morning meeting.

Step 5: Frequency (What You Can Sustain Wins)

If you’re new, start monthly. One newsletter sent 12 times a year beats two newsletters sent twice.

Months 1–2: Monthly (Build the habit).

Month 3+: Optional bi-weekly if you are consistently getting replies.

Your First Newsletter Should Be an Intro (Copy/Paste)

Subject: Quick note — I’ll send one helpful real estate email each month

Body:

“Hey — quick note. I’m starting a simple monthly email where I share one California real estate insight (prices, inventory, and practical homeowner tips). No spam, no daily blasts.

If you ever want out, you can unsubscribe at the bottom. If you want something specific, reply with what city or zip code you care about and I’ll tailor future emails for you.”

California Compliance: Stay Professional

Broker Review: Have your broker-of-record glance at your template.

Accuracy: Be meticulous about sourcing your data (C.A.R., MLS, etc.).

Reply Goal: Treat open rates as noisy; prioritize replies and booked conversations. If you get 1–3 replies per 100 sends, you are winning.

The System is the Secret

Mastering your newsletter is just one part of the Real Estate Agent Skills California ecosystem. This hub explores the full range of technical and interpersonal skills required to thrive in the Golden State.

Your first newsletter is the hardest.

Send it anyway.

Then send 11 more.

That’s when the system starts working for you.

FAQ: Real Estate Newsletters

How often should a real estate agent send a newsletter?

Start monthly. Once you can produce a monthly email in under 90 minutes without stress, you can consider moving to a bi-weekly cadence.

What should I avoid putting in my newsletter?

Avoid politics, "listing-only" blasts, and generic national news that doesn't explain the impact on a local California homeowner.

Do I need permission to email people?

Start with people who know you (sphere, clients, and opted-in leads). Use honest subject lines, include your business info and an unsubscribe link, stay CAN-SPAM compliant and never email people who have asked you to stop. When in doubt, consult your office's specific policy.

|

You’re stuck in traffic on the 405, your phone is buzzing with a frantic text about a repair contingency in Santa Monica, and you just realized you forgot to follow up with that listing lead from Sunday’s Read more...

You’re stuck in traffic on the 405, your phone is buzzing with a frantic text about a repair contingency in Santa Monica, and you just realized you forgot to follow up with that listing lead from Sunday’s open house.

You feel "busy," but your production doesn't reflect the chaos.

In my 20+ years of coaching thousands of California agents at ADHI Schools, I’ve seen this movie before. Most agents mistake motion for progress. They react to their inbox, their phone, and their fires, leaving their income to chance.

Top producers—the ones with consistent listing flow and a steady referral engine—don’t have more "hustle" than you. They have a better operating system.

They protect three specific pillars every single day:

Pipeline

Operations

Visibility

Here is the exact daily habit stack used by the most successful agents in the California market.

The 10 Daily Habits of Top-Producing Agents

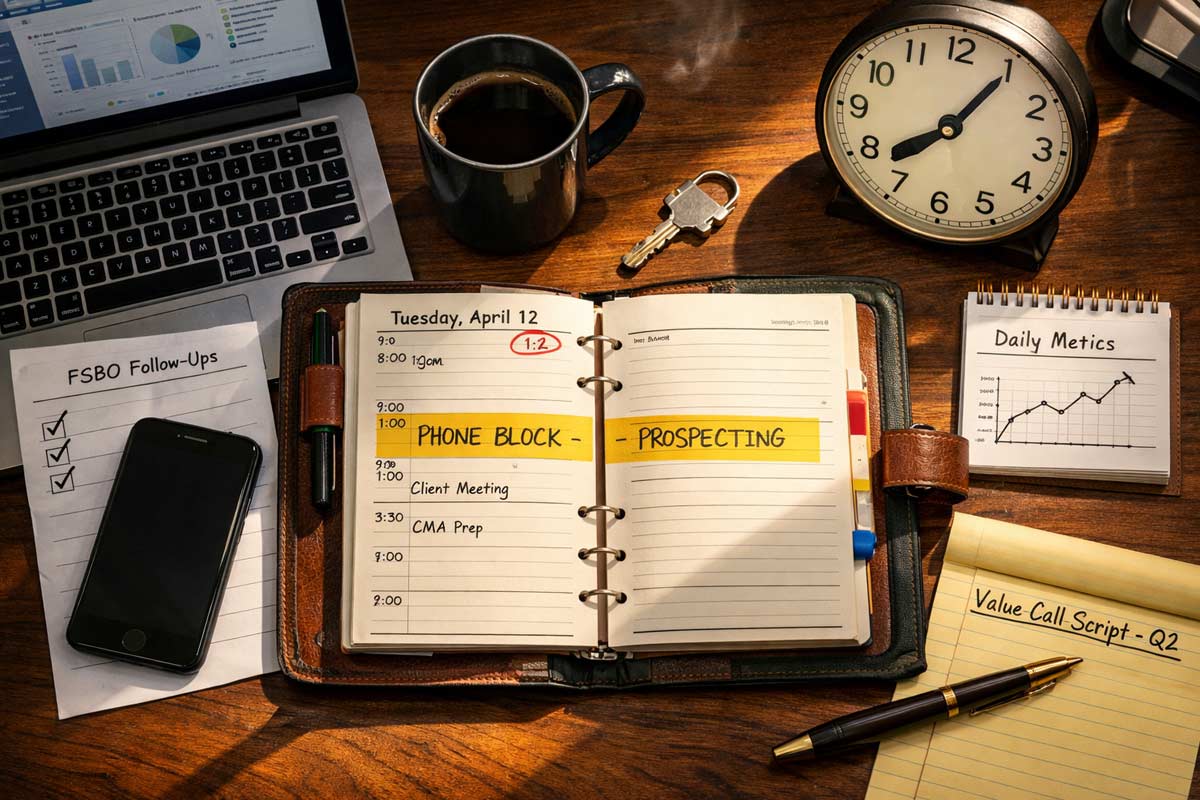

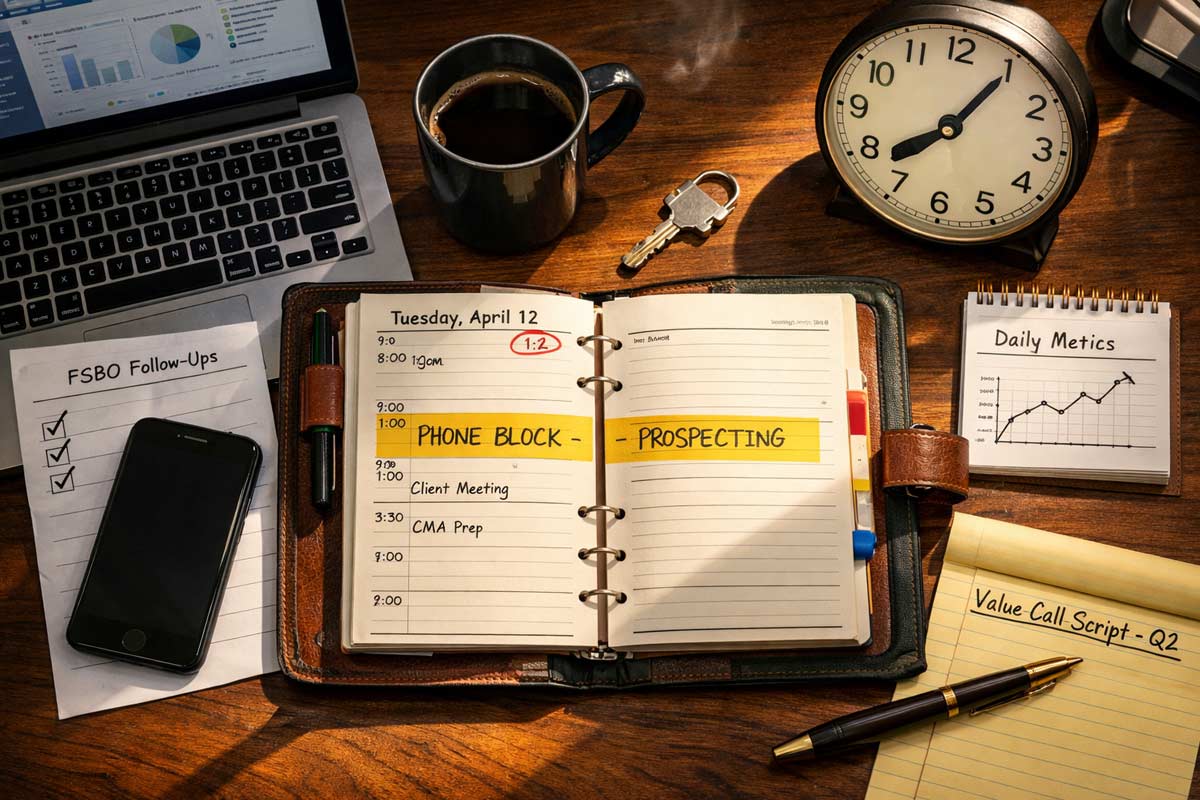

1. The Morning Pipeline Block

What they do: Spend the first 90 minutes of the workday on proactive outbound lead generation (calls, texts, or door knocking) before getting deep into email.

Why it works: Your pipeline is the only thing that guarantees future commissions. If you don't feed the engine first, the fires of the day will consume your time.

How to implement:

Set a "Do Not Disturb" on your phone from 8:00 AM to 9:30 AM.

Use a simple script: "Hi [Name], I was looking at the latest comps in [Neighborhood] and thought of you. Have you had any thoughts on the market lately?"

Common mistake to avoid: Checking your "Escrow is closing" emails first. That money is already earned; go find the money you haven't earned yet.

2. The 5-5-4 Follow-Up Loop

What they do: Every day, they contact 5 new leads, 5 past clients, and 4 people in their "active" sphere.

Why it works: Real estate is a game of attrition. Most deals are lost because an agent stopped calling after the second attempt.

How to implement:

Use your CRM to pull a daily "Touch List." If you're struggling with what to say, check out our guide on how to set goals as a new real estate agent to align these calls with your production targets.

Common mistake to avoid: "Checking in" without offering value (like a market update or a vendor recommendation).

3. Strict CRM Hygiene

What they do: Every conversation is logged, and every contact has a "Next Action" date before the agent closes their laptop.

Why it works: A top producer’s brain is for creating solutions, not storing dates. If it isn't in the CRM, it doesn't exist.

How to implement:

Spend 15 minutes at the end of every meeting logging notes. Tag leads by "Temperature" (Hot, Warm, Cold) so you know who to prioritize tomorrow. Learn how to build a real estate CRM that actually works to automate this process.

Common mistake to avoid: Keeping lead info on sticky notes or in your phone’s "Notes" app.

4. The "Deal Protection" Audit

What they do: A quick 20-minute daily review of all active escrows and pending contracts to ensure deadlines (contingencies, disclosures) are met.

Why it works: In California, missing a contingency date can cost your client thousands and cost you your reputation.

How to implement:

Create a checklist for every transaction.

Ask: "Who is the ball currently with—the lender, the escrow officer, or the other agent?"

Common mistake to avoid: Assuming the escrow officer or TC (Transaction Coordinator) is handling everything without your oversight.

5. One Daily Visibility Action

What they do: Produce one piece of "social proof" or community-focused content (a video tour, a market stat graphic, or a photo at a local business).

Why it works: Visibility amplifies ability. If people don't see you working, they assume you aren't.

How to implement:

Document, don't create. Take a photo of a home inspection or a beautiful kitchen during a showing.

Post it with a caption explaining a specific Real Estate Agent Skills California trait, like negotiation or local expertise.

Common mistake to avoid: Aiming for "viral" instead of "local and helpful."

6. The 15-Minute Market Pulse

What they do: Review the "Hot Sheet" in the MLS to see what went pending, what sold, and what price-dropped in their target zip codes.

Why it works: You cannot be an advisor if you don't know the inventory. Clients pay for your interpretation of the data.

How to implement:

Set an MLS alert for your primary farm areas.

Internalize the numbers: "The average days on market in Irvine just dropped to 12."

Common mistake to avoid: Relying on national news headlines instead of local MLS data.

7. Script & Objection Mastery

What they do: Practice handling common California objections (e.g., "The rates are too high," or "I want to wait for the market to crash") for 10 minutes.

Why it works: Professional athletes practice more than they play. Top agents practice so their delivery is natural and confident.

How to implement:

Roleplay with a partner or record yourself on your phone.

Focus on empathy first: "I hear you, and many of my clients feel the same way. What I’ve found is..."

Common mistake to avoid: Winging it during a high-stakes listing presentation.

8. Hard Energy Boundaries

What they do: Set specific "Off" times where they do not answer the phone, ensuring they recharge for the next day.

Why it works: High-performance requires recovery. Constant "on-call" status leads to the errors that kill deals.

How to implement:

Use "Auto-Reply" texts after 7:00 PM: "I am currently with my family, but I will return your call first thing tomorrow morning."

Review these strategies for burnout prevention for real estate professionals.

Common mistake to avoid: Answering non-emergency client texts at 10:00 PM (it trains them to disrespect your time).

9. The End-of-Day Shutdown

What they do: Clear the desk, review the calendar for tomorrow, and identify the "Big 3" tasks that must happen.

Why it works: You win the morning the night before. This prevents the "What should I do now?" paralysis at 9:00 AM.

How to implement:

The Shutdown Checklist:

Inbox to zero (or filed).

CRM tasks updated.

Tomorrow’s "Pipeline Block" list ready.

Common mistake to avoid: Ending the day mid-task without a plan for tomorrow.

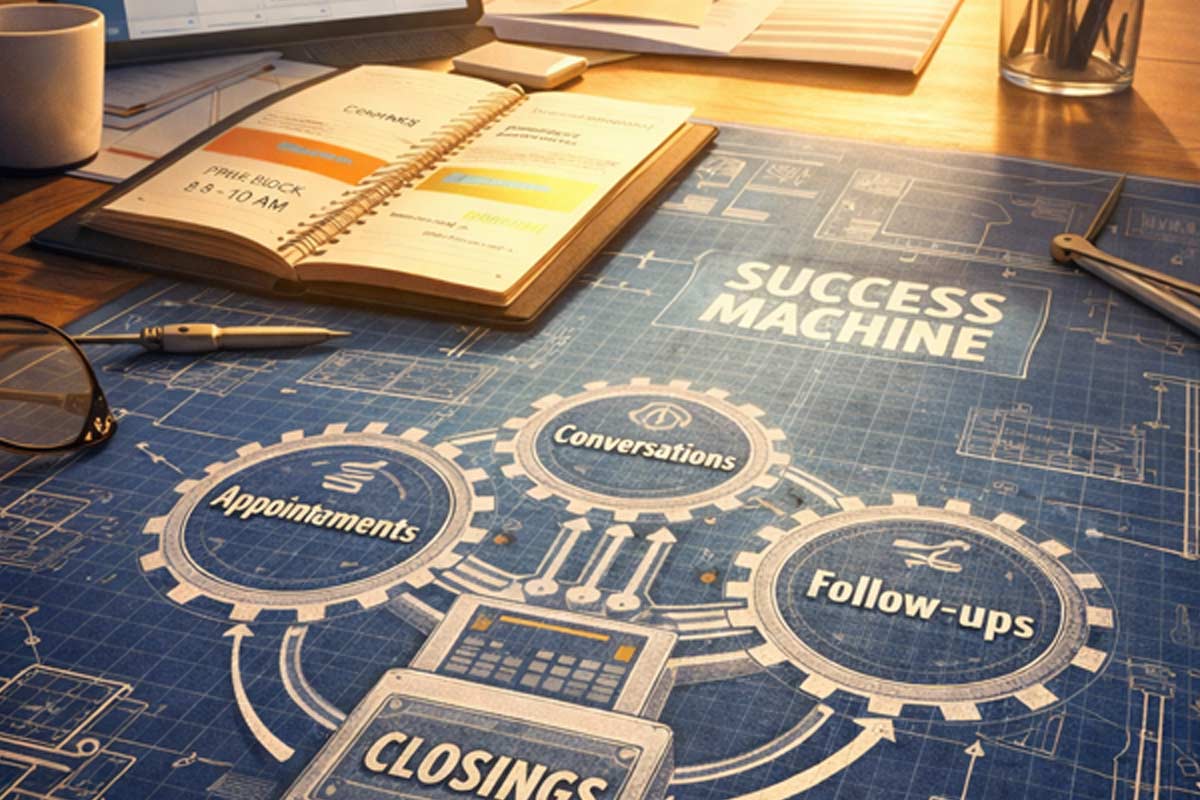

10. The 3-Number Scoreboard

What they do: Track three specific numbers at the end of every day: conversations, follow-ups completed, and one visibility asset shipped.

Why it works: What gets measured gets repeated. This turns "I was busy" into "I moved the business forward."

How to implement:

Use a sticky note, Notion, or your CRM dashboard.

Target: 10 conversations, 10 follow-ups, 1 visibility post (adjust as you scale).

Review weekly and identify what’s slipping—pipeline, operations, or visibility.

Common mistake to avoid: Tracking vanity metrics (likes, followers) instead of conversations and appointments.

Top Producer Reality Check: What They Don’t Do

Success is often about what you remove from your day. Top agents:

Don’t check email as the first act of the day.

Don’t keep lead information in text threads or DMs; it goes to the CRM.

Don’t take random vendor meetings during their Pipeline Block.

Don’t confuse "scrolling" and consuming social media with "creating" visibility.

What Top Agents Do Before 9:00 AM

Most California agents start their day in a "reactive" state. Top producers use the time before 9:00 AM to build a mental moat:

No Screens: Avoid the "inbox trap" for at least the first 30 minutes of waking.

Movement: A quick walk or workout to handle the high-stress nature of the industry.

Review the Big 3: Confirm the three non-negotiable tasks for the day before the world starts calling.

Daily Habits: New vs. Experienced Agents

Your routine should shift as your business matures:

New Agents (Years 1–2): 80% of your day should be pipeline and visibility. You have more time than clients; use it to build the database.

Experienced Agents (Years 5+): 50% pipeline/visibility and 50% systems and depth. Focus on deepening existing relationships and refining time management for California real estate agents to handle increased transaction volume.

Sample Daily Schedule: The California Operator Template

If your calendar keeps getting hijacked by non-urgent tasks, mastering your time as a real estate agent is your first priority. Use this block schedule to regain control.

Time

Activity

Focus

8:00 AM

Market Pulse

Review MLS Hot Sheets & local news.

9:00 AM

Pipeline Block

Non-negotiable outbound calls/prospecting.

10:30 AM

The Follow-Up Loop

Returning voicemails, texts, and emails.

12:00 PM

Lunch / Visibility

Eat at a local spot; post a "Day in the life" story.

1:30 PM

Operations & Admin

Listing prep, transaction review, CRM cleanup.

3:00 PM

Field Work

Showings, listing appointments, or door knocking.

5:30 PM

Shutdown

Plan tomorrow; set phone to "Do Not Disturb."

Why Most Agents Fail to Keep Habits (And the Fix)

Most agents fail because they are reactive. If your calendar is a blank slate, other people will write on it. This creates a "feast or famine" cycle that leads to burnout.

The Fix: The 2-Day Rule:

Never miss your daily habits two days in a row. If a closing goes sideways and you miss your morning calls today, that’s life. If you miss them tomorrow, that’s a choice. This isn’t about working longer hours—it’s about protecting the few actions that compound.

Start Here Today: The Minimum Viable Day (MVD)

If you are overwhelmed, do this 60-minute checklist to keep your business alive:

30 Minutes: Pipeline outreach (Contact 5 people).

15 Minutes: CRM Hygiene (Log calls/set next follow-ups).

10 Minutes: Visibility (Post one market update to social media).

5 Minutes: Plan tomorrow’s "Big 3" tasks.

Frequently Asked Questions

What do top producing agents do every day?

They prioritize "Revenue Generating Activities" (RGAs) like lead generation and follow-up during their peak energy hours and leave administrative tasks for the afternoon.

How many calls do top agents make per day?

Many top producers aim for 10–20 real conversations per day and increase volume during growth phases. The key metric is meaningful conversations, not just dials.

What is a good daily schedule for a real estate agent?

A good schedule is "time-blocked," meaning specific hours are dedicated to lead gen, client meetings, and admin. This prevents administrative "busy work" from eating into your prospecting time.

How do agents stay consistent without burnout?

By setting firm boundaries and treating their "recharge" time as a non-negotiable appointment on their calendar, just like a listing presentation.

Ready to Master the Business?

Habits are the foundation, but skills are the ceiling. If you want to move from "busy" to "profitable," you need to master the full stack of Real Estate Agent Skills California required for this unique market.

Next Steps for Your Growth:

New Agents: Start by setting your 90-day goals.

Mid-Career Agents: Audit your CRM system to find the holes in your follow-up.

|

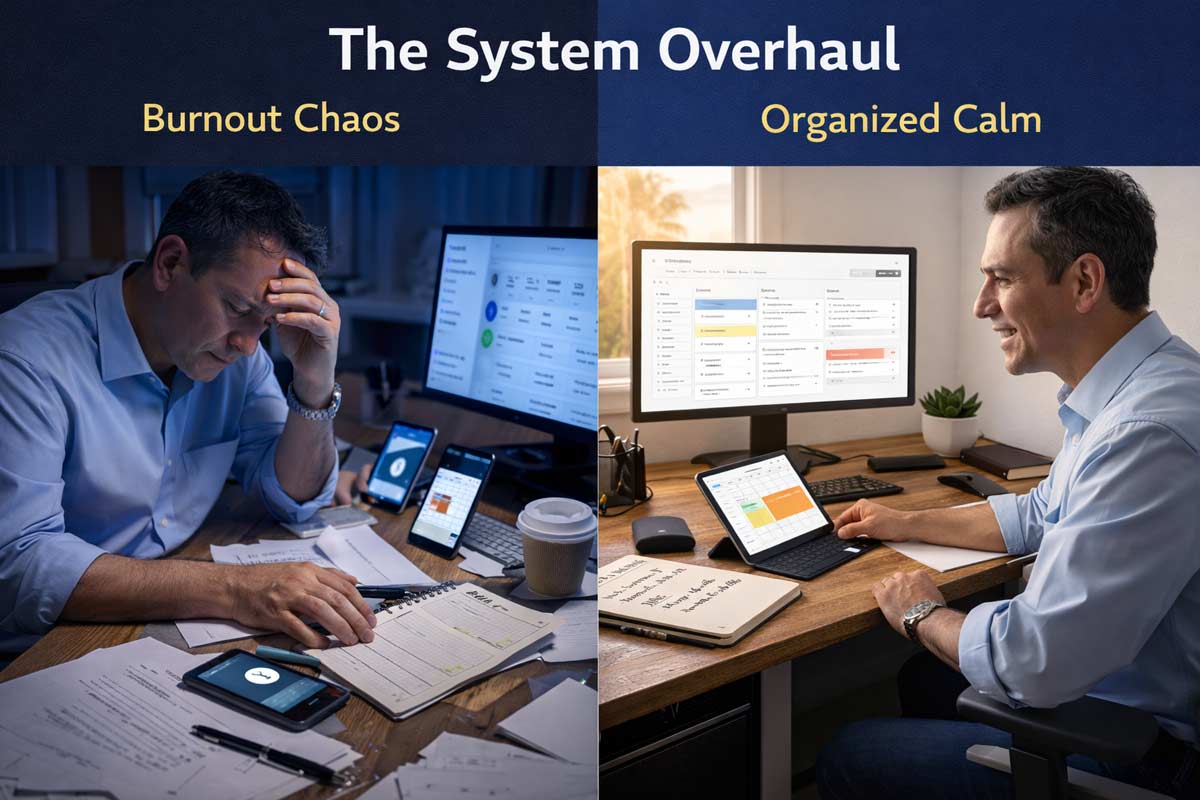

In California real estate, "busy" is sometimes viewed a badge of honor. But after 20 years of coaching and operating in this industry, I can tell you the truth: Busy isn't the goal. Profit and freedom Read more...

In California real estate, "busy" is sometimes viewed a badge of honor. But after 20 years of coaching and operating in this industry, I can tell you the truth: Busy isn't the goal. Profit and freedom are.

This guide provides a practical, operator-level time management system for California real estate agents designed to move you from a reactive state to a systems-first mindset. If you don't control your calendar, your clients, escrow officers, and the 405 freeway will control it for you.

To master the essential Real Estate Agent Skills California requires a shift from chasing the day to owning it.

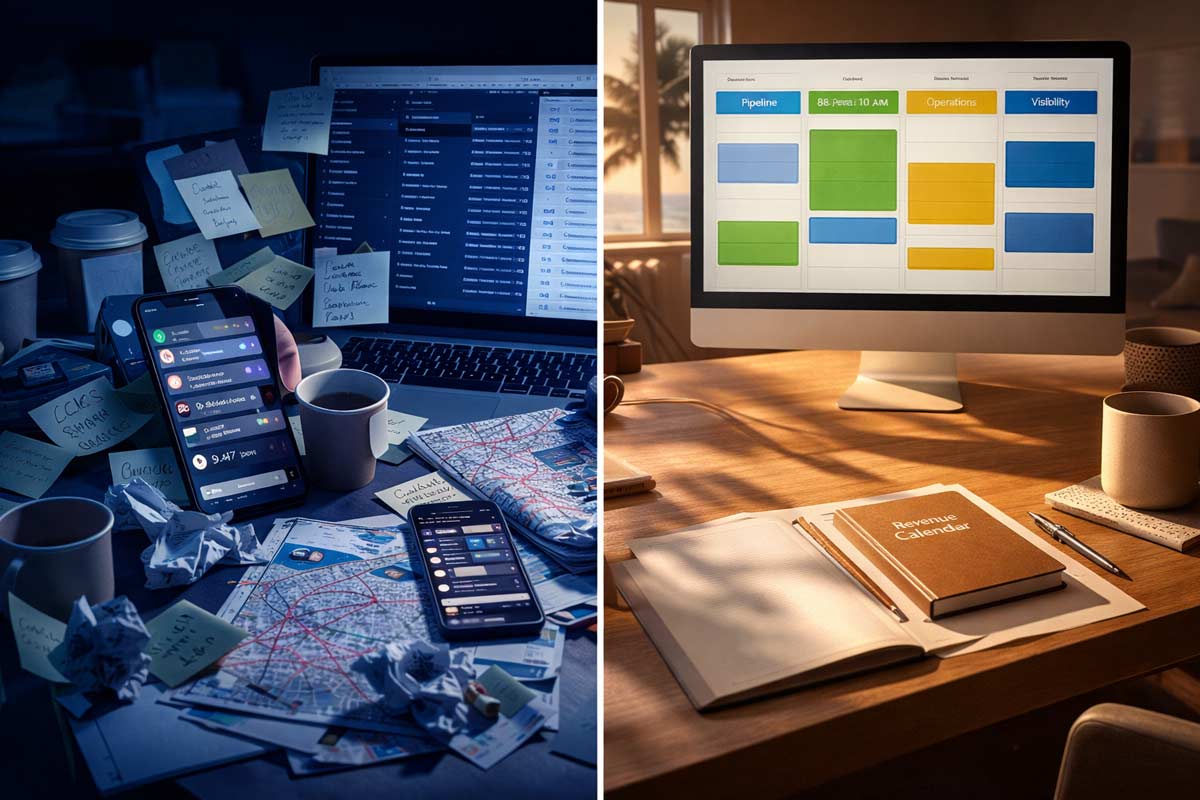

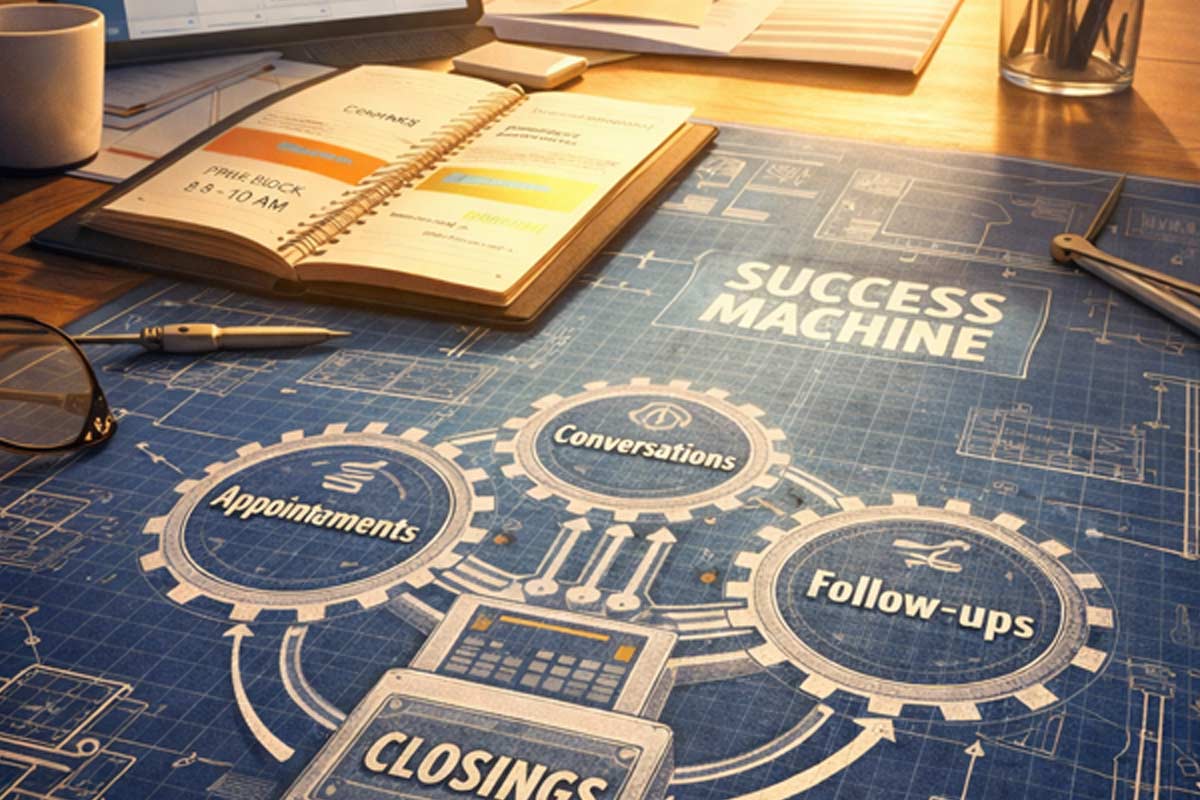

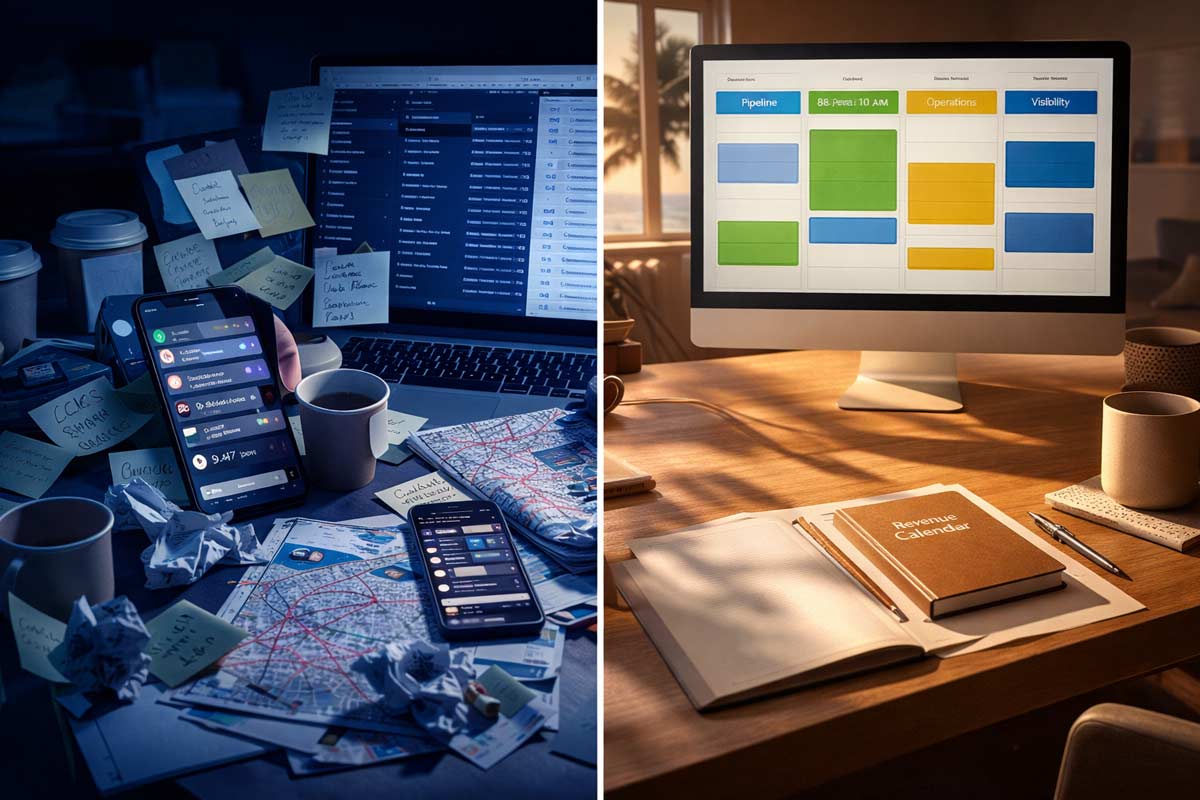

TL;DR: The California Operator System

The 3-Bucket Filter: If it creates revenue, it’s Pipeline. If it saves a deal, it’s Operations. If it builds the future, it’s Visibility.

The Morning Power: 8:00 AM – 10:00 AM is for non-negotiable follow-up. No email allowed.

The "One Window" Rule: Batch all escrow and admin tasks into a single 90-minute block.

The Guardrail: If it isn't on the calendar, it doesn't exist.

Reactive Calendar vs. Revenue Calendar

Most agents operate on a Reactive Calendar. You wake up, check your email, respond to a frustrated buyer, get lost in a DM rabbit hole, and suddenly it’s 2:00 PM. You’ve done "work," but you haven't generated a single dollar of future revenue.

A Revenue Calendar is designed to protect income-producing activities first.

Diagnostic: 5 Signs You Are Operating Reactively

You start your day by answering emails instead of making outbound calls.

You don't have a recurring "Follow-Up" block in your digital calendar.

An inspection or appraisal request can derail your entire afternoon.

You find yourself scrolling Instagram under the guise of "content research."

Your "lead generation" only happens when you realize you have no active escrows.

The 3-Bucket Decision Rule

To manage your time, you must categorize your tasks instantly. Stop treating an escrow signature with the same urgency as a cold lead follow-up. Use these filters:

Pipeline (Revenue): Does this create or advance a commission check today or tomorrow? (Follow-up, appointments, negotiations)

Operations (Delivery): Does this protect a deal currently in motion? (Disclosures, inspections, TC coordination)

Visibility (Future): Does this build my pipeline for 6 months from now? (Content creation, networking, database building)

The secret to consistency is ensuring all three buckets have a "home" in your week. This balance is one of the daily habits of top-producing agents that separates the earners from the hobbyists.

The California Agent Weekly Template

California real estate has a specific rhythm. Traffic is a factor, and weekend "work" is mandatory. Use this table as your base real estate agent schedule:

Time Block

Focus

Purpose

8am – 10am

Revenue (Pipeline)

Calls, texts, and CRM follow-up.

10am – 11:30am

Delivery (Operations)

Escrow Command Center / Admin.

12pm – 1pm

Recharge

Lunch / Personal time (No pings).

1pm – 5pm

Appointments / Field

Showings, listing presentations, previews.

5pm – 6pm

Future (Visibility)

Social media content / Networking.

The "New Agent" vs. "Busy Agent" Flex

New Agents: Spend 4+ hours daily in the Pipeline bucket. You need reps more than you need "systems" right now.

Busy Agents: Spend more time in Operations but must protect the 8 AM – 10 AM window at all costs to avoid the "income roller coaster."

Effective time management begins by knowing how to set goals as a new real estate agent—once your goals are clear, the calendar follows.

Win the Morning: The Follow-Up Operating System

The first two hours of your day dictate your commission check three months from now. Time management for California real estate agents lives or dies in the CRM.

The Daily Priority Stack:

New Leads: Contact within 5 minutes (or first thing in your 8 AM block).

Hot Nurtures: Clients likely to transact in the next 30–60 days.

Active Clients: Brief status updates (even if the update is "no news").

Past Clients: Staying top-of-mind for referrals.

To make this work, you need a system. Learning how to build a real estate CRM that actually works is the only way to automate your reminders so you don't spend hours "organizing" instead of "doing."

Escrow and Transaction Control

In California’s fast-paced escrow environment, a single inspection report can trigger 20 phone calls. If you handle these as they come in, you will never have a productive day.

The Escrow Command Center Rule: Schedule one "Operations Window" (e.g., 10:00 AM – 11:30 AM). Batch all your emails to escrow officers, lenders, and TCs during this time.

Kartik’s Tip: When a lender calls at 2:00 PM while you're at a showing, let it go to voicemail. Listen, then reply during your next designated admin block. Most "emergencies" are simply other people’s poor planning.

Open Houses & Traffic Realities

California traffic is a variable you must account for. If you have a showing in Irvine at 4:00 PM, you aren't "working" from 3:30 PM to 6:00 PM—you are commuting and showing.

The 20% Buffer: Always add 20% more time to travel than GPS suggests.

Weekend Recovery: If you work 6 hours on Saturday and Sunday, you must protect Monday morning as "Off" time to prevent the burnout cycle.

Pre-Prep: Don't print flyers on Sunday morning. Do all "Visibility" prep on Thursday so your weekend is focused on the people in front of you.

Burnout Guardrails (Energy Management)

"Always on" is a recipe for a short career. Sustainable time management requires energy management.

The Hard Stop: Pick a time (e.g., 7:00 PM) where the phone goes in the drawer.

The One True Day Off: One day a week, you are not an agent. You are a human being.

Boundary Scripts: "I’m headed into an appointment, but I will check this first thing at 8:00 AM tomorrow."

Effective burnout prevention for real estate professionals is built into the calendar, not added as an afterthought.

FAQ: Real Estate Time Management

How many hours should a real estate agent work?

A: Successful full-time agents typically work 40–50 hours per week, but the composition of those hours matters more than the total. 15 hours of focused lead generation is more valuable than 60 hours of "random busywork."

What’s a good daily schedule for real estate agents?

A: A high-production schedule starts with 2 hours of follow-up (8–10 AM), 90 minutes of admin/escrow (10–11:30 AM), and afternoons dedicated to appointments and field work.

How do I handle "looky-loo" buyers who waste my time?

A: Use a mandatory buyer consultation. If they won't meet for 20 minutes to discuss their needs and financing, they aren't worth a 2-hour drive.

What if a client gets mad because I didn't answer at 9:00 PM?

A: Set expectations early. Tell them: "I am fully focused on my clients from 8:00 AM to 7:00 PM. If you text after that, I'll have an answer for you first thing in the morning."

Implementation Challenge: The 14-Day Reset

Commit to this for the next 14 days before you customize:

Block 8:00 AM – 10:00 AM for lead follow-up only. No email. No social media.

Batch your "Operations" into one 90-minute window.

Identify 3 "Stop-Doing" items: Activities that resulted in zero revenue last week.

Time management isn't about doing more; it's about doing what matters. Master these systems, and you’ll find that a successful California real estate career doesn't have to cost you your sanity.

Ready to level up your entire business? Visit our Real Estate Agent Skills California hub to learn more about building a sustainable, high-performance career with ADHI Schools.

|

TL;DR: The System Summary

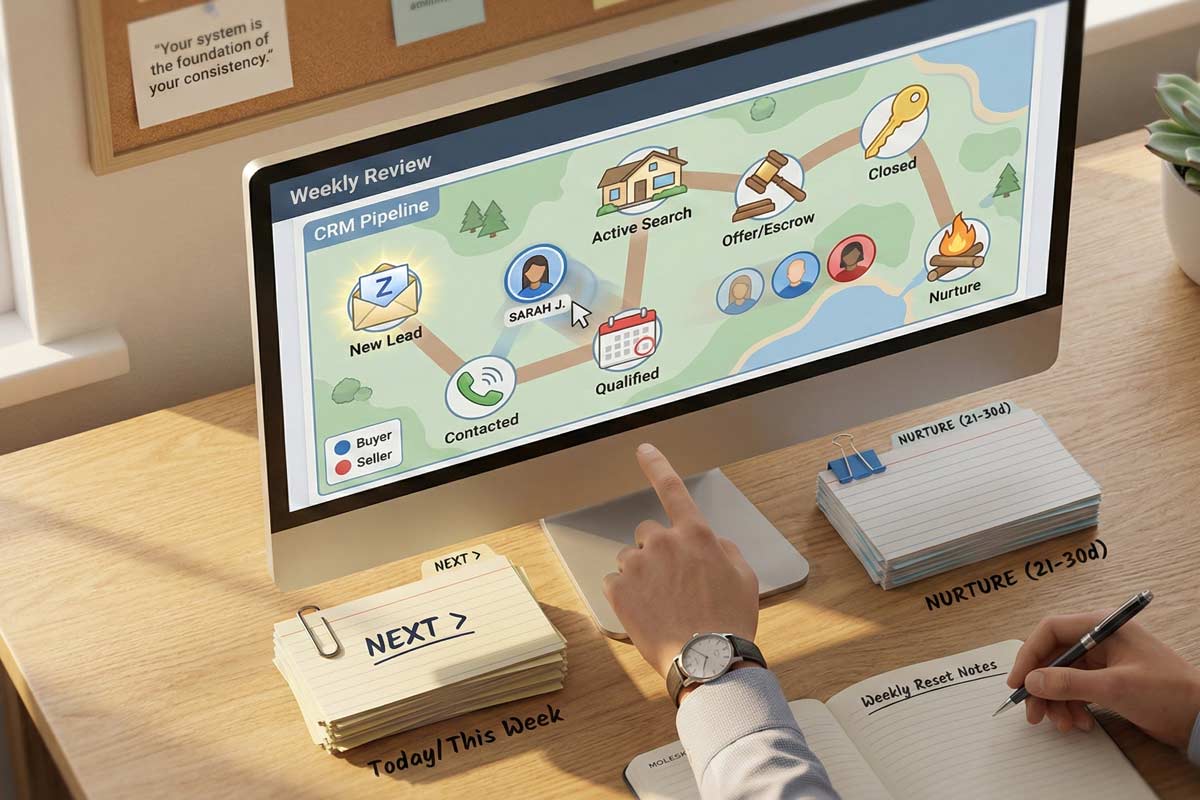

A successful real estate CRM is a daily follow-up machine, not a contact list. To make it work, you need:

Minimalist Data: Only track what helps you make Read more...

TL;DR: The System Summary

A successful real estate CRM is a daily follow-up machine, not a contact list. To make it work, you need:

Minimalist Data: Only track what helps you make the next call.

Strict Pipeline Stages: Define exactly where a lead sits in the journey.

The Golden Rule: Every contact must have a Next Step and a Next Date.

Daily Discipline: A 10-minute "CRM Block" to clear your tasks.

The CRM Graveyard: Why Most Systems Fail

Let’s be honest: Most California real estate agents have a "CRM graveyard." It’s a software subscription you pay for every month, filled with names you haven't called in 90 days and "leads" from an open house three years ago that were never categorized.

I’ve spent over 20 years coaching and operating in the California real estate education space, and I see the same mistake everywhere. Agents try to build a "database" when they should be building a real estate lead follow-up system.

If your CRM isn’t telling you exactly who to contact by 9:00 AM today, it’s not a CRM—it’s a hobby. In a market where you’re fighting 101 freeway traffic and juggling multiple escrows, speed-to-lead is the only metric that matters. If you aren't contacting an inbound lead within minutes, you are often competing with 3–5 other agents. Your CRM is what allows you to win that race.

CRM Setup in 30 Minutes (Beginner-Proof)

Don't spend weeks "researching" software. Pick a tool and follow this 30-minute sprint:

Create your 7 stages: Use the framework in the table below.

Set your required fields: Source, Lead Type, Stage, Next Follow-Up Date, Tags.

Configure 3 saved views: Today, This Week, Nurture.

Import 10 contacts: Start with your phone’s "recent" list or warm sphere.

Assign a Next Step + Next Date: Do this for every single one.

Calendar it: Put a recurring 10-minute CRM Block on your calendar for every weekday morning.

The CRM Build: Your Minimum Viable System

To build a real estate CRM that sticks, you need to strip away the "tech-bro" features most CRM for real estate agents are bloated with and focus on the core structure.

1.The Only Fields You Actually Need

Stop trying to fill out 50 fields of data. You’ll burn out. Stick to these:

Name & Contact Info: Phone and Email are the essentials.

Source: Zillow, Open House, Sphere, Referral.

Lead Type: Buyer, Seller, Investor, Renter.

Pipeline Stage: Where are they in the process?

Next Follow-Up Date: The most important field in your business.

Tags: FHA-Buyer, Inland-Empire-Retail, Probate, Past-Client, Hot-Lead.

Common Mistake: Don't create a "custom field" for every little detail. Use the "Notes" section for the story; use "Tags" for the category. Over-complicating fields is the fastest way to stop using the system.

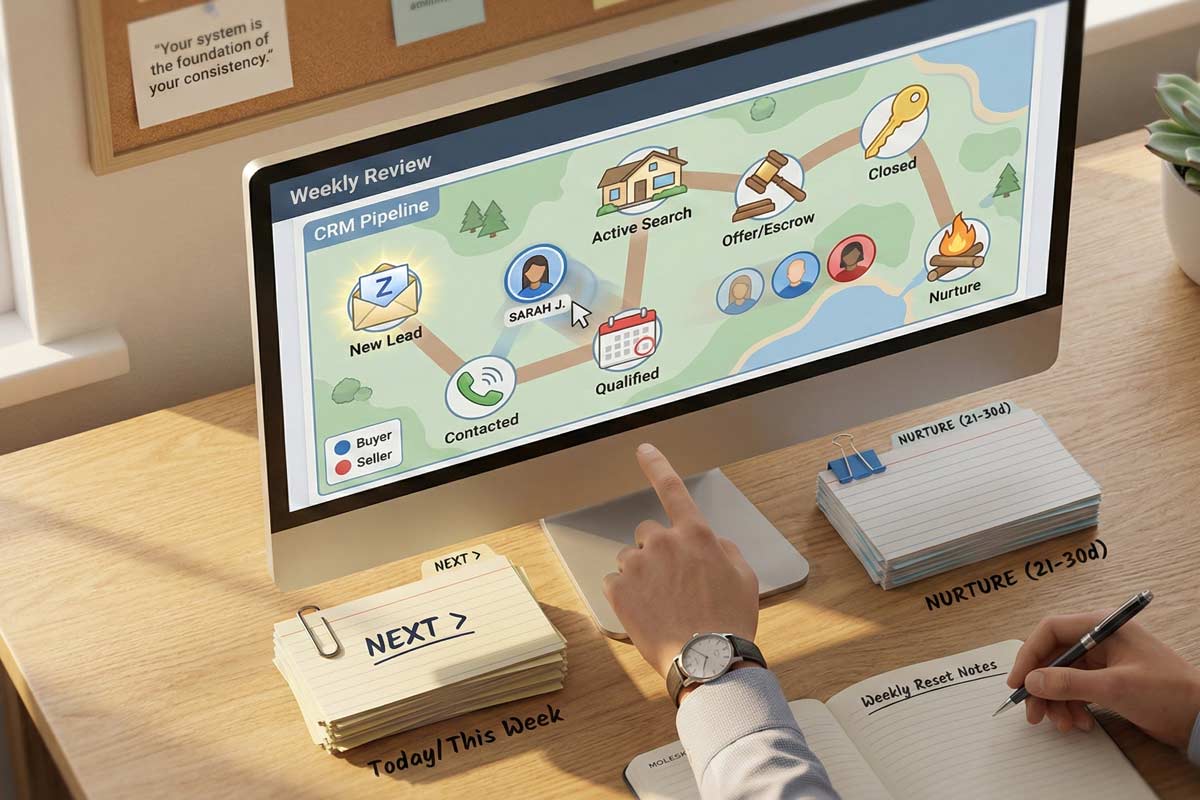

2. Your Pipeline Stages (Entry/Exit Criteria)

Your pipeline stages real estate logic must be tight. If you don't know why someone is in a specific stage, the system breaks.

Stage

What it means

Move forward when...

New Lead

Inbound or added, not contacted

You’ve attempted contact + set Next Date

Contacted

Two-way exchange happened

You have timeline + motivation basics

Qualified

Budget + timeline + reason confirmed

You scheduled consult/showing/listing appt

Active Search

You’re actively working inventory

They’re ready to offer or pause

Offer / Escrow

Under contract

You close or deal dies (then re-stage)

Closed / Past

Transaction complete

You set post-close follow-up + nurture

Nurture

6+ months out

They re-engage (then re-qualify)

The Follow-Up Engine (The Real Product)

Your real estate CRM workflow is only as good as your persistence. Most agents stop after two attempts. Top operators go further.

The “No-Response” Ladder

Use this framework when a lead goes quiet:

Touch 1 (Day 1): Call + short text: “Hey [Name], it’s Kartik—saw your inquiry about [area]. Quick question: are you looking to move in the next 30–90 days or just researching?”

Touch 2 (Day 2–3): Value text: “If you tell me your target city + price range, I’ll send 3 options that match your criteria today.”

Touch 3 (Day 5–7): Close-the-loop: “I don’t want to spam you—should I stop reaching out, or is there a better time next week?”

If no response occurs after Touch 3, move them to the Nurture stage and set a Next Date for 21–30 days out.

Workflow: The Daily Execution

A CRM is only as good as your Daily Habits. To stay organized, stop looking at "All Contacts." Instead, use these three saved views:

Today: Shows only leads where the Next Date = Today or is Overdue.

This Week: Shows leads with a Next Date within the next 7 days (for planning).

Nurture: Shows leads with a Next Date 21–30 days out.

The Daily & Weekly Rhythm

Success requires a Time Management for California Real Estate Agents strategy that protects your "system time."

Daily (10 Mins): Clear your "Today" view every morning. Log outcomes in one sentence. Set the next date.

Weekly Reset (15 Mins): Every Friday at 4:30 PM, review your pipeline. Drag leads back to the correct stages and ensure no one is missing a Next Date.

Automation vs. Human Touch

Automation should support you, not replace you.

Do Automate: Immediate "Thanks for reaching out" texts; Appointment reminders.

Don't Automate: Deep relationship building. If an automation can’t be answered with a human reply, it probably shouldn’t be sent.

Common Failure Points and Fixes

"I don't have time to update it."

Fix: Make the update process smaller. Log the outcome immediately after the call, not at the end of the day.

"I'm burning out on follow-up."

Fix: Read our guide on Burnout Prevention for Real Estate Professionals. Usually, burnout comes from the anxiety of forgetting someone, not the act of calling them.

"I'm in escrow chaos all week."

Fix: Use your CRM to set "reminders" for your active leads so you don't ignore your future income while processing current checks.

The Bigger Picture: Your CRM Is One Skill in the Stack

A CRM that works is revenue insurance—but it only performs when it’s paired with daily execution, clear targets, and protected time. As you Set Goals as a New Real Estate Agent, remember that your system is the foundation of your consistency.

If you want the complete operator framework behind follow-up, pipeline control, and professional consistency, start here: Real Estate Agent Skills California.

FAQ: Building Your Real Estate CRM

1. What should I put in the ‘Notes’ vs. ‘Tags’?

Tags are for categories you want to filter (e.g., "Buyer," "Past Client"). Notes are for the "story" and specific details from your last conversation (e.g., "Daughter is moving to San Diego in August").

2. What’s the best follow-up schedule for Zillow or open house leads?

High intensity for the first 10 days (5–7 touches), then transition to a 21-day "Nurture" cycle. Speed is everything in the first 48 hours.

3. How do I use a CRM when I’m in escrow all week?

The CRM is what protects your next paycheck while you’re busy earning the current one. Treat your escrow tasks like lead tasks. Use the CRM to remind you of contingency removals, but don't let your "Today" view of new leads go uncleared. Spend 5 minutes on leads, then 55 minutes on your escrow.

4. How many stages should my real estate pipeline have?

Keep it between 5 and 8 stages. Any more and you will spend more time organizing the list than calling the people on it.

|

The “Branding Panic” Reality

Most new agents think "branding" means picking a hex code, designing a logo on Canva, and maintaining a high-gloss Instagram aesthetic. The truth is that in the hyper-competitive Read more...

The “Branding Panic” Reality

Most new agents think "branding" means picking a hex code, designing a logo on Canva, and maintaining a high-gloss Instagram aesthetic. The truth is that in the hyper-competitive California real estate market, this is a dangerous distraction.

In California, branding isn't a decoration—it is pre-qualification. Before a lead ever picks up the phone, they have already vetted you online. They aren't looking for a celebrity; they are filtering for competence, trust, and consistency.

This article focuses on branding mistakes specifically, but branding is just one component of the broader Real Estate Agent Skills stack you need to succeed long-term. After 20+ years of coaching California agents at ADHI Schools, I’ve seen thousands of new licensees stall because they prioritized "vibes" over value. Despite what Instagram would have you believe, the goal of your brand isn’t fame; it is to create a predictable system for generating real estate leads.

The 60-Second Definition

Your brand is the pattern people remember: who you help, what you help them do, and proof you do it consistently. Branding is a functional system that supports your lead generation—it is not a vanity project. If you need a step-by-step framework, start with our guide on Branding Yourself as a California Real Estate Agent before you touch design tools.

12 Personal Branding Mistakes New Agents Make (And How to Fix Them)

1. Trying to Brand “For Everyone” (No Niche, No Message)

The Mistake: Posting generic "I love real estate" content and hoping anyone with a pulse calls you.

Why it Kills Trust: If you help everyone, you specialize in nothing. California consumers want a specialist.

The Fix: Pick a specific niche or neighborhood.

Do this today: Write down the one specific type of person you are best equipped to help right now (e.g., "First-time buyers in Eagle Rock").

2. Confusing Aesthetics with Positioning (Logo ≠ Brand)

The Mistake: Spending three weeks on a logo and zero hours on your value proposition.

Why it Kills Consistency: A logo doesn't sell a house; your ability to generate leads and navigate a CA purchase agreement does.

The Fix: Prioritize branding yourself as a real estate agent (California) based on your expertise first.

Do this today: Define your "Unique Value Proposition" in one sentence.

3. Copying Top Producers (The “Fake Luxury” Trap)

The Mistake: Renting a luxury car or posing in front of $10M listings you didn’t list to look "successful."

Why it Kills Trust: People can smell inauthenticity. It creates a "persona mismatch" when you finally meet in person.

The Fix: Match your branding to your actual inputs. Focus on being the "Hyper-Local Expert."

Do this today: Take a photo of yourself actually working—at a local coffee shop or touring a new listing.

4. Posting Randomly Instead of a Real Estate Marketing System

The Mistake: Posting a sunset today, a quote tomorrow, and nothing for three weeks.

Why it Kills Consistency: Inconsistency signals a lack of professional discipline. This is where agents skip the fundamentals covered in Real Estate Marketing Basics (California Edition) and mistake activity for strategy.

The Fix: Use content buckets (Market Updates, Behind the Scenes, Local Spotlights).

Do this today: Choose three "content buckets" and commit to posting one of each every week.

5. No Proof: Claims Without Evidence

The Mistake: Claiming to be an "expert" without showing any data, neighborhood knowledge, or process.

Why it Kills Trust: California buyers are data-driven. They need proof you know the market.

The Fix: Share "Proof Assets"—market trends, neighborhood walk-throughs, or process explainers.

Do this today: Find one interesting stat about your target zip code and explain what it means for buyers.

6. Over-Sharing Personal Noise

The Mistake: Posting what you ate for lunch more often than you post about real estate.

Why it Kills Leads: It creates noise, not value. Clients want a professional, not just a person with a phone.

The Fix: Follow the 80/20 rule: 80% professional value, 20% personal flavor.

Do this today: Audit your last 10 posts. If more than 3 have zero real estate relevance, delete the weakest one.

Quick gut check: If your brand disappeared tomorrow, would anyone in your database notice? If not, that’s not a failure—it just means you need a system.

7. Under-Selling: Hiding the CTA

The Mistake: Writing a great post but never asking for the business.

Why it Kills Leads: People won't take the next step unless you lead them there.

The Fix: Every piece of content should have a "Call to Action" (CTA).

Do this today: Add "DM me 'Market' for a copy of my neighborhood report" to your next post.

8. Talking Like a Brochure (Generic Slogans)

The Mistake: Using generic slogans like "Honesty, Integrity, Results."

Why it Kills Trust: These are "table stakes"—everyone says them, so they mean nothing.

The Fix: Speak to specific problems (e.g., "I help sellers find buyers even when inventory is low").

Do this today: Replace one generic adjective on your bio with a specific problem you solve.

9. Not Owning a “Signature Framework”

The Mistake: Having no repeatable way to explain your process to a lead.

Why it Kills Trust: It makes you look like you’re "winging it."

The Fix: Create a 3-step or 5-step "Roadmap to Closing."

Do this today: Outline the 5 steps you take a buyer through from consultation to keys.

10. Ignoring the Trust Engine: The Real Estate Newsletter

The Mistake: Relying solely on social media algorithms you don't own.

Why it Kills Consistency: If the algorithm changes, your brand disappears.

The Fix: Learn how to create a real estate newsletter to stay top-of-mind.

Do this today: Start a simple list of 50 people you know and send them a "market-at-a-glance" email.

11. Mistaking Followers for Leads (The Wrong Scoreboard)

The Mistake: Focusing on "Likes" from other agents instead of "Leads" from potential clients.

Why it Kills Leads: You end up performing for peers rather than serving prospects.

The Fix: Measure your brand by the number of conversations it starts.

Do this today: Check your DMs. Count how many "real estate" conversations you started this week.

12. Branding Over Skill-Building

The Mistake: Having a world-class brand but 1st-grade contract knowledge.

Why it Kills Trust: You will get the lead, but you will lose the client if you can't perform.

The Fix: Align your brand with actual Real Estate Agent Skills (California).

Do this today: Spend 30 minutes reading a standard CAR form instead of scrolling.

Brand Kit Lite: The Fast System

Avoid the "branding trap" by sticking to this simple checklist:

1-Sentence Positioning: "I help [Target Audience] in [Location] achieve [Outcome] without [Common Pain Point]."

3 Content Buckets: Market Data, Local Lifestyle, Process Explainers.

1 Lead Capture Habit: A bi-weekly real estate newsletter for agents to nurture your database.

1 Proof Asset: A "Neighborhood Guide" PDF you can offer for free.

California-Specific Reality Checks

In California, you aren't just competing with the agent down the street; you are competing with tech-enabled platforms and highly sophisticated consumers. Your brand must communicate high-level competence.

Practical advice for real estate agents in the Golden State: Your brand is built in small reps. It’s the consistency of your messaging followed by the consistency of your follow-up.

Real-World Scenario: The Random Posting Trap

An agent posts a "Sold" post from their office, and a generic "Happy Friday" on Friday. A potential seller sees a hobbyist. Contrast this with an agent who posts a video explaining why property taxes in Orange County are calculated the way they are. One is noise; the other is a brand.

Building Your Career Stack

Personal branding is a critical skill, but it is only one piece of the puzzle. To succeed in California, you must integrate your marketing with technical mastery and client service.

To see how branding fits into the bigger picture of your career, explore our comprehensive guide on Real Estate Agent Skills.

|

Disclaimer: This guide is for educational purposes only and does not constitute legal or professional real estate advice. Always consult with your broker and legal counsel regarding DRE advertising Read more...

Disclaimer: This guide is for educational purposes only and does not constitute legal or professional real estate advice. Always consult with your broker and legal counsel regarding DRE advertising compliance.

The Post-License Panic: From "Licensed" to "Hired"

You passed the exam, hung your license with a broker, and ordered business cards. Now, you’re sitting at a desk in your real estate office waiting for the phone to ring.

It doesn’t.

Most new agents treat marketing like a lottery—post a house tour on Instagram, buy a few Zillow leads, and pray for a commission check. After 20 years of coaching California agents and seeing which systems actually scale, I can tell you that "luck" is not a business strategy.

Marketing isn't about having a "big personality" or being a TikTok star. It is a repeatable operating system designed to solve one problem: making sure the right people know you exist, trust your expertise, and remember you when they’re ready to sign.

What “Marketing” Actually Means (California Edition)

In one of the most competitive real estate markets in the country, “marketing” is often misunderstood. California consumers are sophisticated—they’ve seen every “Top Producer” ad in the book. If you’re searching for a marketing plan for new real estate agents in California, what you really need is a simple operating system you can run every week—because that’s what creates clients.

To win, you must view your marketing as a four-stage pipeline:

Attract: Getting someone to stop scrolling or start a conversation.

Pre-qualify: Filtering out the "looky-loos" from the serious buyers/sellers.

Convert: Turning a conversation into a signed listing or buyer representation agreement.

Follow-up: Staying top-of-mind for the 3–12 months it takes a CA lead to actually move.

Marketing is NOT

Spending $500 on a logo before you’ve made a cold call.

Posting "Just Listed" photos of houses that aren't yours without permission.

Buying leads and letting them sit in a CRM without a phone call or other follow up.

The 4-Part Marketing Foundation

Before you spend a dime on ads, you need to stabilize your foundation. These are the basics that compound over time.

1. Positioning

This is "Who you help" and "What you're known for."

If you try to be the "California Expert," you’re the expert of nothing.

Actions: Define your farm (e.g., "The go-to condo specialist in Downtown Los Angeles"). Identify your unique value (e.g., "I help first-time buyers navigate FHA in high-cost counties").

Common Mistake: Being a generalist. To avoid this, read about Personal Branding Mistakes New Agents Make.

2. Proof

In California, skepticism is the default. You need assets that reduce skepticism and prove you can do the job.

Your First 5 Proof Assets (Even with zero closings):

1-page Zip Code Snapshot: Median price, Days on Market (DOM), and inventory trend for your farm area.

Open House Notes One-Pager: What buyers asked, what they ignored, and what moved them emotionally.

“Buyer Mistakes in CA” Mini Guide: A one-page PDF that shows you understand the process—this is marketing because it builds trust before you ever ask for an appointment.

Three Micro-Testimonials: Responsiveness, diligence, and follow-through from anyone you’ve helped (clients, colleagues, vendors).

Broker/Team Credibility Line: A factual, approved credibility line your broker is comfortable with (no hype, no unverifiable claims).

3. Pre-qualify & Convert

Marketing fails when it generates a lead but doesn't know what to do with it. You need a real estate lead follow-up system that includes the right questions.

The 5-Question Script (CA-Safe):

“Are you already speaking with a lender?”

“What’s your timeline if everything goes right?”

“Have you toured homes or open houses in the last 30 days?”

“Do you need to sell a home first?”

“What would make you say ‘let’s move’ within 2 weeks?”

The Appointment-Setters (CTAs):

“Want me to run a 10-minute price reality check for your zip code?”

“Want a 15-minute buyer game plan call so you know what you can win with in this market?”

4. Follow-Up

In California, most deals come from leads that “weren’t ready” the first time. Your follow-up system is your commission protection plan.

Actions: Set up a simple CRM. Create a "Long-Term Nurture" plan.

Common Mistake: Calling a lead once, getting no answer, and deleting them.

Common CA Marketing Mistakes

Avoid these traps that waste months of effort for new agents:

Buying leads before you have a repeatable follow-up cadence.

Posting listings you don’t represent without explicit permission or context.

Trying to be “Luxury” before you are trusted locally or understand the inventory.

No database hygiene: Failing to tag leads, leave notes, or remove duplicates.

Inconsistent schedule: Marketing in random bursts followed by weeks of silence.

Channels That Matter Most for New CA Agents

You cannot be everywhere. To learn how to get real estate clients in California, pick two of these to start:

Your Sphere (Database): This is your highest ROI. These are people who already know, like, and trust you.

Email Newsletters: A weekly touchpoint providing value. Learn How to Create a Real Estate Newsletter that people actually open.

Open Houses as Content Engines: Use an open house marketing plan where you film 3–4 videos while you’re there: a "Market Update," a "Home Feature," and a "Neighborhood Spotlight."

Google Business Profile: Essential for local SEO. If someone Googles "Agent near me," you want your name to appear with reviews. Learn the nuances of Branding Yourself as a California Real Estate Agent to stand out.

The 30-Day Marketing Plan for New California Agents

Stop theorizing. Here is your execution schedule for the next month.

Week

Focus

Key Task

Week 1

The Sphere

Call 10 people a day. Tell them you’re in the business and ask how they are.

Week 2

Local Credibility

Claim your Google Business Profile. Build a “Market Update” template for weekly use.

Week 3

Active Prospecting

Schedule 2 Open Houses. Use your "Open House Notes" one-pager to capture lead info.

Week 4

The Nurture

Send your first "Market Update" email to everyone you’ve talked to this month.

The "Minimum Viable" Daily List:

Add 2 new people to your database.

Send 5 personalized "Thinking of you" texts/DMs.

Post 1 local market data update to your Stories.

Compliance & Professionalism

The California Department of Real Estate (DRE) is vigilant. Your marketing must be as compliant as it is creative.

DRE Disclosures: In California, many advertisements must include your license ID and responsible broker identification—follow your broker’s policy and DRE guidance for each medium (print, digital, social, email, signage).

No "Guarantees": Avoid promising specific results unless you have the legal paperwork and broker approval to back it up.

Branding: Follow your brokerage policy for branding hierarchy and required identification across print, digital, and social.

Master the Skills Stack

Marketing is a powerful engine, but it’s only one part of the vehicle. Marketing is one spoke in the full skill stack—negotiation, contracts, timelines, and client psychology are what convert attention into commissions.

If you want the full “map,” start here: Real Estate Agent Skills California.

Your next move (today):

Pick two channels (sphere + newsletter, or open houses + newsletter).

Run the Week 1 plan.

Don’t change your system for 30 days.

FAQ Section:

Q: How much should a new agent spend on marketing?

A: Focus on "sweat equity" (calls/networking) first. Invest in a CRM and professional headshots before paid ads.

Q: Do I need a website as a new agent?

A: Use your brokerage-provided site and focus on your Google Business Profile for better local search results.

Q: How often should I post on social media?

A: Quality over quantity. 3 times a week with actual market data is better than daily generic "Happy Monday" posts.

Q: Is door knocking still effective in California?

A: Yes, if done with a "Give" (like a market report) rather than a "Take" (asking for a listing immediately).

Q: What is the best way to get reviews?

A: Ask for them immediately after a "win"—even if it's just helping someone understand their home's value.

TL;DR: The California Agent’s Marketing Blueprint

Marketing is a System: It is the repeatable process of Attract → Pre-qualify → Convert → Follow-up.

The CA Reality: High competition and sophisticated buyers mean "pretty" isn't enough; you need proof and persistence.

Focus on Inputs: Stop tracking "likes." Track outgoing calls, sent newsletters, and face-to-face meetings.

The Golden Rule: Choose two channels and master them before expanding.

|

I have spent over 20 years as a broker in California, training and supervising thousands of new licensees. In that time, I’ve developed a sixth sense for the “Quiet Quit.”

It starts with a subtle Read more...

I have spent over 20 years as a broker in California, training and supervising thousands of new licensees. In that time, I’ve developed a sixth sense for the “Quiet Quit.”

It starts with a subtle avoidance. An agent might stop showing up for the Tuesday sales meetings because they don’t have any "wins" to report. They tell their family that “it’s just a slow season” while watching their credit card balance climb to cover local association dues.

Often there isn’t a dramatic resignation; they simply fade out of the industry, seeing that the new career touted on LinkedIn six months ago never actually materialized.

This isn’t just the loss of a job; it’s the identity built in front of everyone that withers.

In California, the first-year dropout rate is high because the industry sells a dream while the reality requires surgical discipline. Most agents don't quit because they lack talent—they quit because they were never told how to survive this compounding decline.

1. No Business Plan (Productive Procrastination)

The biggest mistake I see is "productive procrastination." This is when an agent spends four days color-coding a CRM that contains zero leads or obsessing over the font on a business card.

This is where most agents fool themselves into thinking they are "building a business" when they are actually just maintaining an expensive hobby. If you don't have a daily lead-generation block—actual conversations with prospects, not administrative setup work—you are a tourist, not an agent yet. To stop the bleed, you must learn How to Create a Real Estate Business Plan (New Agents).

2. No Personal Brand (The Invisible Decline)

Invisibility is a death sentence in California's competitive markets. Many new agents hide behind their big-box brokerage’s logo, thinking the name on the building will do the heavy lifting. It won't.

The danger here is the lag factor. The damage of a weak brand isn’t felt today; it’s felt six months from now when the pipeline is bone-dry. The consequence is a phone that stays silent even when inventory shifts or interest rates drop. Essentially becoming a "secret agent," and secrets don't get paid. Overcoming this requires Branding Tips for New California Agents that force the agent into the public eye before the silence becomes entrenched.

3. Cash-Flow Shock (The Panic Check)

Let's talk about the moment the "dream" hits the bank account. Between DRE fees, REALTOR® association dues, and marketing costs, you are likely thousands of dollars in before the first escrow even opens.

In California, a standard escrow is 30 to 45 days. If it takes you four months to find a client, you are six months away from a check. Most agents quit when they hit the "Panic Check"—the moment they realize they have to retreat to their old 9-to-5 and explain to their peers why they couldn't make it. Cash-flow shock is a public retreat that most egos can't survive.

The Hard Truth: You were given a license, but you weren't given a survival manual. Quitting is a rational response to a lack of systems. If you find yourself avoiding your broker or lying to your spouse about how "busy" you are, it’s not a character flaw—it’s a systemic failure.

4. Social Media Confusion (Digital Noise vs. Value)

I see new agents posting photos of their lunch or generic "Happy Monday" graphics and wondering why their DMs are empty. This random posting is actually worse than silence because it creates a false sense of accomplishment.

In the current market cycle, the public is too sophisticated for "guru" posturing. If your digital presence doesn't provide data or inventory insights, you are just adding to the noise. You need a strategy for How New Agents Should Use Social Media in 2026 that builds authority rather than just seeking "likes."

5. Isolation & The Shame of "Looking Stupid"

Real estate can be a lonely business. When a deal falls apart, the isolation leads to a rapid collapse in motivation.

But the real killer is shame. New agents often stop asking questions because they don't want to "look stupid" in front of the high-producers in the office. They isolate themselves to hide their lack of progress, which only accelerates the Quiet Quit. Breaking this cycle requires a specific strategy on How to Stay Motivated as a New Agent that acknowledges the psychological toll of the first year.

6. The "Licensing Lie"

The California Department of Real Estate (DRE) exam ensures you know the basics of real estate law; passing does not guarantee you will make money. The industry’s onboarding narrative often suggests that "getting your license" is the hard part.>/p>

That is the Licensing Lie. Your license is merely a "permit to learn." The reality is that the first year is 10% real estate and 90% grueling lead acquisition. Lead acquisition isn't a chore you do to get to the real estate; lead acquisition is the real estate business.

The Survivor Mindset: Boring Consistency

The agents I’ve seen survive and thrive over the last two decades don't have "hustle" posters on their walls. They have boring consistency.

Survivors rely on observable behaviors:

The Calendar: Guarding lead-generation blocks like a doctor guards surgery time.

The CRM: Documenting every interaction, no matter how small or unlikely.

The Follow-Up: Calling when you said you would, even when there is no "news" to report.

The Decision Window

If you are currently feeling the weight of the Quiet Quit, you are at a fork in the road. You can continue to fade out, or you can admit that your current "plan" isn't working and reset your systems.

The first year is an exercise in attrition. Survival depends on your willingness to stop "playing house" and start operating a business. To move past the danger zone and build something that lasts, you need to understand the full career arc. It’s time to stop guessing and learn how to properly Start a Real Estate Career in California with your eyes wide open.

|

Disclaimer: This article provides operational and professional strategies for performance management. It is not a substitute for professional medical or psychological advice. If you are experiencing severe Read more...

Disclaimer: This article provides operational and professional strategies for performance management. It is not a substitute for professional medical or psychological advice. If you are experiencing severe mental health distress, please consult a licensed professional.

It’s 7:45 PM on a Tuesday. You’re finally sitting down to dinner when your phone buzzes. It’s a "quick question" from a buyer about an escrow contingency. Against your better judgment, you reply.

That one text turns into a 45-minute email chain with the lender and the listing agent. By 9:00 PM, you’re staring at the ceiling, mentally rehearsing tomorrow’s showings while your adrenaline spikes.

If this sounds familiar, you aren’t "working hard"—you’re redlining. At ADHI Schools, I’ve spent over 20 years coaching California agents through every market cycle, and I can tell you that burnout prevention for real estate professionals is not a luxury; it is a fundamental requirement for production. You don’t need a vacation; you need a sustainable operating cadence.

This guide is the operator’s plan to reduce your mental load, protect your commission, and build the real estate agent skill stack pillar that the top 1% use to stay at the top.

The Death Spiral: From "Busy" to Burnout

In a commission-based business, it is easy to mistake "constant access" for "high performance." However, ignoring the early warning signs of real estate agent burnout creates a dangerous downstream effect on your bank account.

The Symptoms To Consequences Bridge

If you ignore the symptoms, the professional consequences are inevitable:

Symptom: You dread opening your CRM or email.Consequence: Your follow-up slips and your pipeline dries up causing your panic level to increase.

Symptom: You have a "short fuse" with clients or TCs.Consequence: Your reputation takes a hit and your referrals drop causing you to work twice as hard to find new business.

Symptom: You are "always busy" but nothing moves.Consequence: You enter a cycle of "random activity" and your decision fatigue sets in causing you stop doing the high-ROI tasks that actually close deals.

Operational Strategies for Burnout Prevention for Real Estate Professionals

To survive the California market, you must stop being a "responder" and start being an "operator." This requires moving away from a reactive calendar and toward a structured system.

1. The "Two Windows Rule" (Communication Framework)

Window 1 (11:30 AM): Process all morning inquiries, lender updates, and escrow fires.

Window 2 (4:30 PM): Wrap up the day’s communication and set expectations for the following morning.

The Result: You train your clients that you are a professional with a schedule, not a 24-hour concierge. This single shift is the cornerstone of time management for California real estate agents.

2. One Source of Truth (The CRM)

Your brain is for processing information, not storing it. Trying to remember which buyer needs a disclosure sent and which listing needs a sign-post update is the fastest path to exhaustion. Learning how to build a real estate CRM that actually works is the only way to offload that mental weight. If it’s in the CRM, your brain can let it go.

3. Minimum Viable Habits

Don't try to overhaul your life. Pick three non-negotiables that keep your energy stable. For most top producers, this includes a set wake-up time, 60 minutes of proactive lead generation, and a "shutdown ritual." Mastering the daily habits of top-producing agents creates a performance floor that protects you even when the market gets volatile.

Practical Playbooks for the Fried Agent

The 2-Hour Daily Stabilizer

Before you open email or social media, spend the first two hours of your workday on Pipeline Defense.

0–30 mins: Review your CRM tasks.

30–90 mins: Proactive reach-out (calls/texts/notes).

90–120 mins: Appointment setting.

Why? If you spend the rest of the day fighting escrow fires or stuck in California traffic, you’ve already secured your future income.

The Boundary Scripts

The Late Night Text: "Hi [Name], I’m currently away from my desk for the evening, but I’ve prioritized this for my 8:30 AM updates. I’ll have an answer for you then!"

The "Urgent" Non-Urgent Item: "I want to ensure I give this the proper review. Let’s discuss this during my next update window at 4:30 PM."

The Operator’s Comparison

Feature

The Burnout Path (Reactive)

The Sustainable Path (Systematic)

Morning Routine

Checking emails in bed

CRM task review & proactive calls

Client Access

24/7 "on-call"

The Two Windows Rule

Goal Tracking

"I hope I close something"

Using how to set goals as a new real estate agent to track daily inputs

Recovery

Crashing from exhaustion

Scheduled "Hard Stops" and 24-hour disconnects

The 7-Day Reset Mini-Plan

If you're currently redlining, follow this sequence to regain control:

Day 1: Audit your phone. Turn off all non-human notifications (social, news, retail).

Day 2: Clean the CRM. Move every "reminder" out of your head and into the system.

Day 3: Set a "Hard Stop" time (e.g., 7:00 PM). The phone goes in a drawer.

Day 4: Schedule one 3-hour "Deep Work" block. No phone, no distractions.

Day 5: Proactive Triage. Update every active client before they ask you for a status report.

Day 6: Design your "Ideal Week" on paper, including gym time and family meals.

Day 7: Total disconnect. No real estate for 24 hours.

The Bottom Line on Sustainable Production

In the California market, burnout prevention for real estate professionals is an operational skill. If you operate without a system, the business will eventually consume your personal life and your health. If you operate with a system, you can handle higher volume with lower stress.

To build a career that lasts decades rather than months, you must master the fundamental Real Estate Agent Skills California requires. Stop reacting to the chaos and start engineering your success.

Burnout Prevention Checklist

One Source of Truth: Is every lead and task documented in your CRM?

The Two Windows Rule: Have you set specific times for client updates?

Pipeline First: Have you completed your 90-minute lead-gen block today?

Hard Stop: Is there a time tonight when you will officially "log off"?

Weekly Recovery: Is there a 24-hour block in your calendar for total disconnect?

Next Step: Build your foundation by exploring the full Real Estate Agent Skills California pillar to see how systems-first agents dominate the market.

|

You passed the real estate exam, joined a brokerage, and ordered business cards. Week one feels like an adrenaline rush of “limitless potential.” By week four, the anxiety sets in. You’re staring Read more...

You passed the real estate exam, joined a brokerage, and ordered business cards. Week one feels like an adrenaline rush of “limitless potential.” By week four, the anxiety sets in. You’re staring at an empty CRM, your inbox is full of industry noise, and you haven’t had a “real” real estate conversation in days.

Most new agents fail here because they set outcome goals (like “I want to make $100k”) without building the machine required to produce them. In my 20+ years coaching California agents, I’ve seen the pattern: goals don’t fail because of a lack of hustle. They fail because they aren’t connected to a weekly scorecard and a daily plan.

If you want to survive year one, stop acting like an enthusiast and start acting like an operator.

The Operator Goal Stack Framework

To succeed, stop obsessing over the commission check and start obsessing over the architecture of your day.

Use the Operator Goal Stack:

Outcome Goals (The “What”): Lagging indicators like closings, GCI, or listings taken. You can’t control these directly—you can only influence them.

Input Goals (The “How”): Leading indicators: conversations, appointments set, and follow-ups completed.

System Goals (The “Machine”): Your infrastructure: protected time blocks, a weekly review, and a CRM that prevents leads from dying of neglect—starting with How to Build a Real Estate CRM That Actually Works.

Start With One 12-Week Sprint

Annual goals are too far away to create urgency. For a new agent, a year is an eternity of “I’ll start tomorrow.” Instead, operate in 12-week sprints. You get four “New Years” per year—and fast feedback loops.

Example goal sets for your first sprint:

The “Zero Database” Agent: Add 10 new contacts to your database per week through open houses, local networking, and community events.

The “Warm Network” Agent: Conduct 15 coffee chats or catch-up calls per week to re-announce your career and create referrals the right way.

Choose 3 Numbers That Matter (The Scorecard)

Stop tracking “busyness.” Remember that merely checking email does not equal work. Similarly, designing a flyer does not equal real work. For new agents, only three numbers reliably move the needle.

Metric

Weekly Target (Average)

Definition

New Conversations

40–50

Two-way conversations about real estate (sphere or new leads).

Appointments Set

1–2

A scheduled meeting (Zoom/in-person) to discuss a move timeline.

Follow-ups Completed

100+

Logged touches (call/text/email/DM) that advance a next step.

Pro Tip: These numbers are averages—not quotas. Some weeks will exceed them, others won’t. Consistency over 12 weeks is what creates results. If you aren’t hitting these averages, the problem usually isn’t the market—it’s your calendar. The Daily Habits of Top-Producing Agents are consistent because they protect the morning for these activities.

Translate Goals Into a Daily Plan

Your goals are fantasy until they’re time-blocked. An operator structures the day so input goals happen before the day’s chaos takes over.

Option 1: Standard New-Agent Schedule

8:00–10:00 AM: Pipeline Block (Non-Negotiable) — Outbound calls, follow-ups, open house nurture. No email. No scrolling. If it doesn’t directly create a conversation or an appointment, it doesn’t belong in this block.

10:00–11:00 AM: Admin/Ops Window — Email, paperwork, CRM updates.

1:00–2:00 PM: Visibility Block — Content creation, networking, event outreach.

3:00–5:00 PM: Appointments & Field Work — Showings, buyer consults, listing meetings.

Option 2: Aggressive Pipeline Schedule

Extend the Pipeline Block to 8:00–11:00 AM if you are in full "build mode" and need to generate immediate momentum.

If you want to keep your day from being hijacked, study Time Management for California Real Estate Agents—because if you don’t have an appointment, your job is to go create one.

5 Common Goal-Setting Mistakes

Setting income goals with no activity plan: “I want $200k” is a wish. “I will have 10 conversations/day” is a plan.

Copying a top producer’s goals: A veteran runs on referrals. Newer agents need to do more hunting and direct engagement. Don’t copy “maintenance” goals when you need growth goals.