It is 4:45 PM on a Friday. You are heading out for the weekend when a text hits your phone. It’s your buyer: “I can’t do this. My job situation just got shaky, and I need to get out of the deal. Now.” Or perhaps it’s a seller, frustrated that the buyer is two days late on contingency removals, demanding you “cancel the deal and take the backup offer.”

In these moments, your value as an agent isn’t in your salesmanship; it’s in your ability to remain the calmest person in the room. Having coached agents through thousands of transaction crises over the last 20 years at ADHI Schools, I can tell you that successful cancellations aren’t just about emotions—they are about the clock and the contract.

In California, cancellation is a procedure, not a vibe. Your license, your reputation, and your buyer’s deposit depend on your ability to stop the panic and start the process.

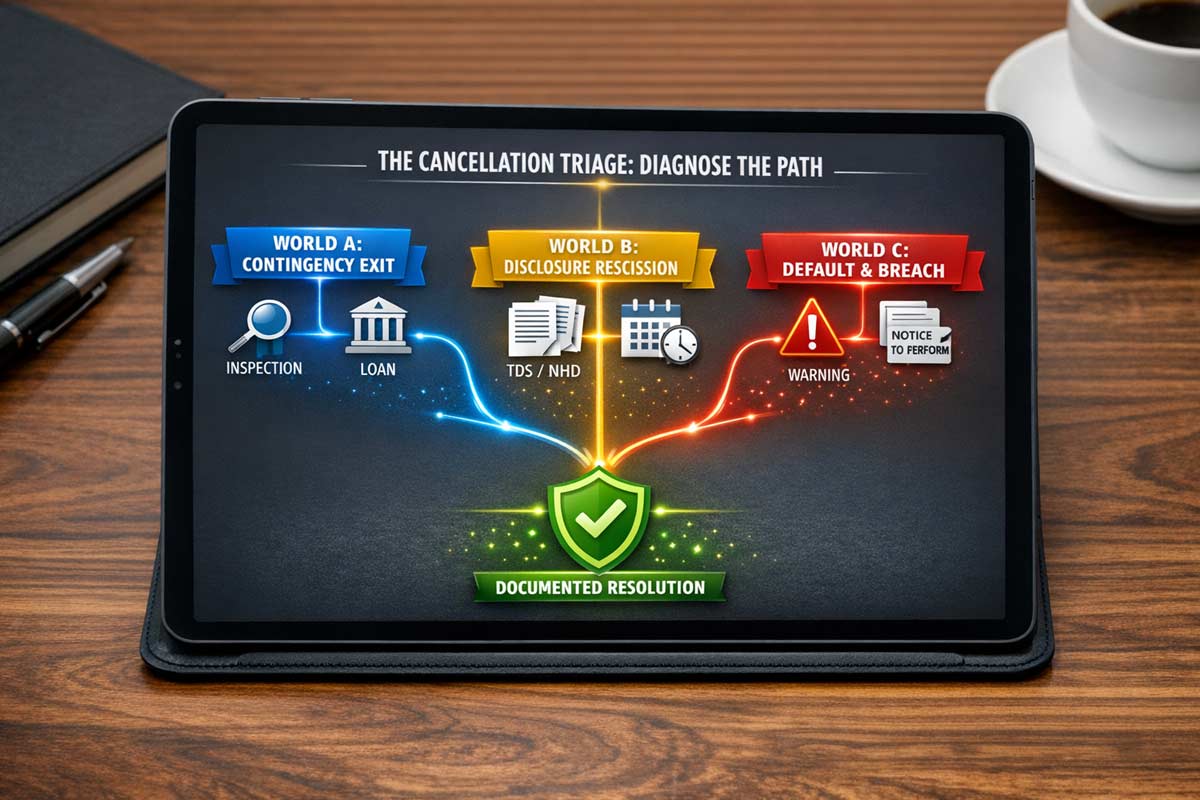

Quick Answer: In California, most cancellations fall into three buckets: (1) active contingency exit, (2) disclosure-related rescission windows (when applicable), or (3) default/breach workflows that require written notice and a cure period. Your job is to identify which bucket you’re in, then build a clean paper trail that protects the client and your license.

Before you touch a single form, you must diagnose which "world" the cancellation lives in. Most disputes happen because an agent used a "breach" workflow for a "contingency" problem. To stay within the California Real Estate Laws & Compliance Guide, you must categorize the situation immediately.

"I understand you want to cancel. To protect you and your deposit, I need to know: Is this about an inspection issue, a loan problem, a disclosure you just received, or something the other side didn’t do?"

Buyers often have the cleanest exit paths, but only while the clock and contingencies still protect them. To protect your buyer, you must master Purchase Agreement Basics, specifically how contingencies function as a safety net.

Material Change Trigger: If the issue changes money, timing, possession, or legal rights, pause and escalate to your broker before sending notices.

Sellers often feel trapped, and in some ways they are. In California, a seller cannot simply cancel because they found a better offer or "changed their mind." You must use the CAR Forms Every New Agent Should Know to create a defensible paper trail.

The contract may include a seller's contingency allowing them to cancel if they cannot find a new home within a set period. However, even with a Seller's Contingency, they must strictly adhere to the timelines in the SPRP (Seller Purchase of Replacement Property) addendum.

The contract may suggest who should receive the deposit, but in practice, the money often does not move until there are mutual written instructions or a legal resolution. This is a key point to emphasize when you explain Agency Disclosure Form AD to your clients.

| Scenario | What the contract often suggests | What happens in practice | Why it gets stuck |

|---|---|---|---|

| Buyer is Inside Contingency Period | Full refund to Buyer | Escrow holds funds | Seller may dispute the buyer’s basis or timing and refuse to sign a release. |

| After Removal | Seller (Liquidated Damages) | Given to Seller but may result in a prolonged dispute | Liquidated damages require a properly formed clause and specific statutory limits. |

| Late Disclosure | Full refund to Buyer | Generally released to Buyer if contract permits | If the seller feels the buyer used the disclosure as a "pretext" to exit. |

| Seller Default | Full refund to Buyer | Escrow holds funds | Seller may dispute that a default actually occurred. |

"Escrow typically requires mutual written instructions or a legal directive to release funds. My goal is to make our paperwork so clean and our timelines so defensible that the other side is pressured to sign the release."

A common myth is that every buyer has a universal "3-day cooling-off period." This is false. This right is typically triggered only when certain statutory disclosures (like the TDS) are delivered after the contract is signed. Failure to handle these correctly can lead to claims involving California Anti-Fraud Rules in Real Estate.

Operational Steps for Rescission:

If you are facing a potential cancellation right now, follow these steps in order:

In California real estate, the difference between a veteran and a novice is how they handle a "dead" deal. A novice sees a crisis; a veteran sees a checklist. By leaning on a strict compliance framework, you turn a high-stakes emotional event into a routine administrative procedure.

Document, Deliver, and Disclose.

Disclaimer: This article is for educational purposes only and does not constitute legal advice. California real estate laws and C.A.R. forms are subject to frequent change. Always consult with your broker or a qualified real estate attorney regarding specific transaction disputes or legal interpretations.

Avoiding Non-DRE-Approved Real Estate Schools in California

Most Popular Real Estate Schools in California

California Real Estate Exam Rules & Testing Policies

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.