If you ask a seasoned real estate attorney where most lawsuits begin, they won’t tell you that it’s always about a leaky roof or a cracked slab. They will tell you it’s about a broader concept known as "agency".

Many new licensees treat "agency" as a vocabulary word they memorized to pass the state exam, but in reality, California real estate agency relationships are the legal foundation of your entire career.

Understanding how agency fits into the broader framework of California real estate laws—like the rules we cover in our California Real Estate Laws & Compliance Guide—is an important step in a long and prosperous career. If you get agency right, you can avoid the vast majority of problems.

If you don’t, you are walking through a minefield blindfolded.

In plain English, agency is a legal relationship where one person (the principal) authorizes another person (the agent) to act on their behalf with third parties.

In California real estate, there are three key players:

Important Concept: There is a common misconception that you—the salesperson—are the "agent." Under California law, the Broker is the agent of the principal. You are an agent of the Broker. You act on the Broker's behalf to serve the client.

This might sound strange, but you don’t always need a signed contract to create an agency relationship. California law recognizes several ways to create this relationship:

1. Express Agency The "typical" and safest way to create agency. The principal and agent expressly agree to the relationship, usually via a written contract.

2. Implied Agency Your actions lead a person to believe you represent them, even without a written contract.

3. Ostensible (Apparent) Agency A principal allows a third party to believe someone is their agent, even if they aren’t formally authorized.

4. Agency by Ratification A principal accepts the benefits of an action performed by an unauthorized agent (or an agent acting outside their authority), effectively creating the agency retroactively.

Crucial Note: Agency is about authority and behavior, not who pays you. You can owe fiduciary duties in real estate even if you’re not getting a commission.

Exam Tip: On the California real estate exam, agency questions often focus on how these relationships are created, what fiduciary duties you owe a client, and when dual agency must be disclosed. Expect questions that test whether you understand who the broker represents and what happens when you slip into undisclosed dual agency.

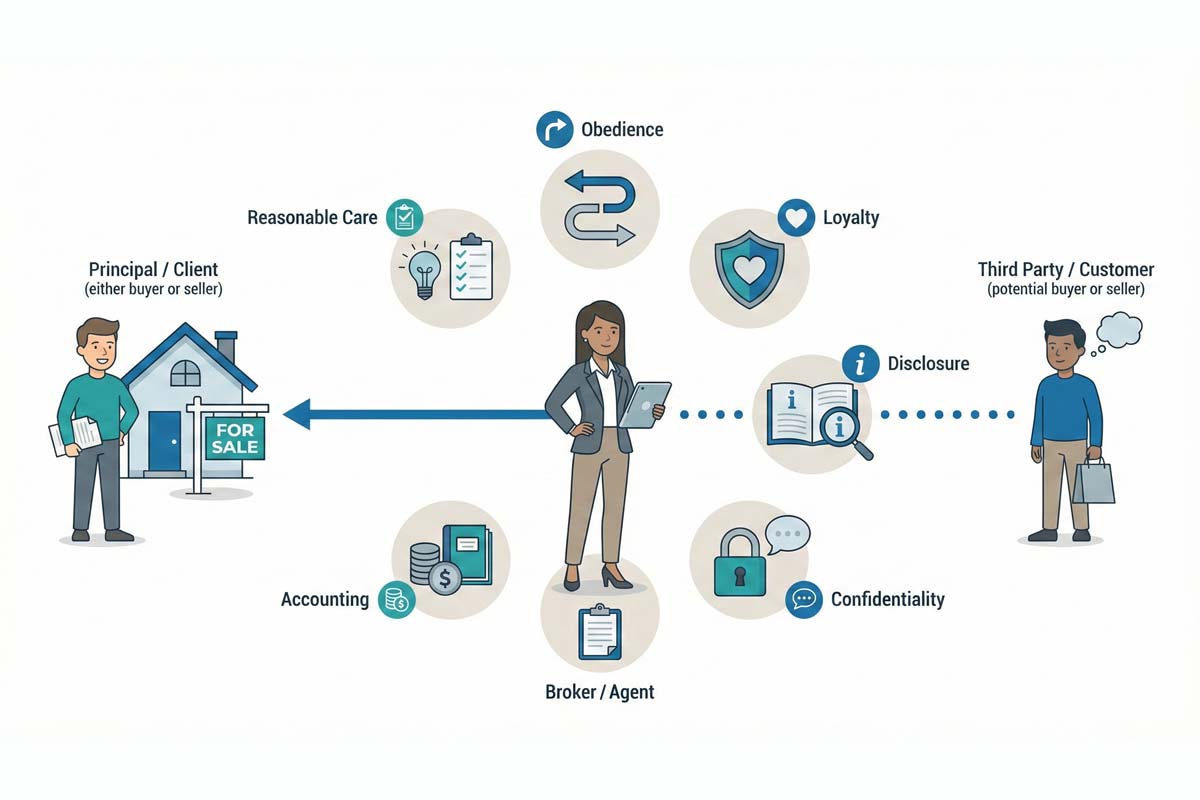

Once you are an agent, you owe your client fiduciary duties—the highest duties known to law. I teach students the acronym OLD CAR to remember them:

Agency doesn’t exist in a vacuum. Your status as a fiduciary connects directly to every other major compliance area. Here is what agency looks like in the real world:

Because you represent the client, you are the filter for information. You must strictly follow California disclosure laws to ensure every material fact reaches the client, protecting them from bad investments and you from negligence claims.

Your fiduciary duty of accounting means you must be meticulous with money. You must avoid commingling in California real estate, which involves mixing client trust funds with your own money—a major violation that triggers immediate DRE action.

Your duty of reasonable care requires you to understand California fair housing laws. You must treat all parties fairly and never inadvertently discriminate or steer clients, as this violates both federal law and your agency responsibilities.

Even your marketing is tied to agency. The advertising laws for California real estate agents mandate that you clearly identify your license status and brokerage so the public is never confused about who you actually represent.

In most one-to-four unit residential transactions, you’ll follow the DEC process to ensure compliance:

The Cost of Failure: This isn’t just paperwork. If you mishandle or fail to disclose agency properly, a court can decide you’re not entitled to a commission, even if you did all the work and closed the deal. A judge will not care how hard you worked if you were not legally authorized to perform the service.

In my years of consulting, I see the same agency mistakes repeated constantly. Here is what they look like in real life:

New agents often struggle to explain their role. Here is a simple script you can use to explain agency to a buyer or seller in 20 seconds:

“Mr./Ms. Client, I represent you in this transaction, which means I have a legal duty to put your financial interests ahead of my own. Everything you tell me stays confidential, and I’m required to disclose any facts that affect the value of the property so you can make the best decision possible.”

Using plain language like this builds trust immediately and sets the tone for a professional relationship.

The stakes are high. Violating agency law can lead to:

Agency law is learnable. If you want to see how agency fits alongside disclosure, advertising, fair housing, and trust fund rules, spend time with our California Real Estate Laws & Compliance Guide so your entire business rests on solid ground.

Avoiding Non-DRE-Approved Real Estate Schools in California

How Important Are Online Reviews for Real Estate Schools?

What Happens If You Fail the CA Real Estate Exam

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.