You’ve passed the real estate exam, your license is hanging at a brokerage, and the initial celebration has subsided. Now, you’re staring at a blank calendar and a quiet phone. It’s what I call the Read more...

You’ve passed the real estate exam, your license is hanging at a brokerage, and the initial celebration has subsided. Now, you’re staring at a blank calendar and a quiet phone. It’s what I call the “post-license cliff”. This moment is particularly acute in California, where high competition meets complex markets, and the pressure to “figure it out fast” can lead new agents toward expensive, ineffective shortcuts.

If you’re a new real estate agent in California wondering how to get your first clients without buying leads, this article is your playbook. Securing your first three clients isn't just about income—it’s about proof of concept. In my 20+ years of working in the California real estate market, I’ve noticed the agents who survive the first year are those who replace "hustle" with systems and processes.

What Success Looks Like in 30 Days

Before we dive in, let’s define a "win." Success in your first month isn't measured by closed escrows—it’s measured by inputs.

These inputs work because they maximize trust-building touches, not impressions.

If you follow this operating system, your 30-day scoreboard should look like this:

100+ Real Conversations: 5 per business day.

40+ Contacts: Added to your database.

4 Open Houses: Hosted during the month.

1–2 Buyer Consultations: Booked as a direct result of consistent follow-up.

Practice Over Profit: The First 3 Principle

This is the phase where most new real estate agents in California either build momentum—or quietly stall. Your first three clients are your learning labs. You are building the muscle memory of a professional. Success here comes from

Practice + Proximity + Follow-up

not expensive marketing.

Before You Prospect: Two Things You Must Set Up This Week

Before you pick up the phone, you need a professional foundation. California’s disclosure-heavy environment means your first clients are as much about the learning process as closing deals.

1. Broker Expectations: Sit down with your broker or team lead. Ask for (a) upcoming open house opportunities, (b) "floor time" for walk-ins (if this is still a thing in your area), and (c) their preferred CRM.

2. Compliance Guardrails: This is California—disclosures matter. Don’t wing it. Don't promise specific financial outcomes, keep all communications professional, and stay within your brokerage’s legal policies.

Pathway 1: The "Inner Circle" Strategy (The Database)

The Reality: Your first client is almost always someone you already know, or someone they know. People do business with people they trust.

The Action Plan: Stop "announcing" your career and start consulting. Use these micro-scripts to offer value:

The Call: "I’ve officially launched my real estate practice. I’m not calling for business—I just want to be your resource. If you ever need a quick valuation or want to know what’s moving in the neighborhood, I'm here."

The Text: "Hey! Just wrapped up my licensing. If you ever have a random real estate question or need a vendor recommendation, feel free to reach out!"

Micro-Credibility Boost:

Avoid: “I just got licensed and I’m looking for clients.”

Use: “I’m building my practice and want you to have a real resource.”

The 14-Day Follow-Up Cadence:

Day 0: Initial outreach (Call/Text).

Day 7: Value Touch (Send a quick, one-page market snapshot of their specific zip code).

Day 14: The Soft Ask: "I’m helping a few people find homes this month. Do you know anyone else thinking about a move this year?"

The Deeper Resource:

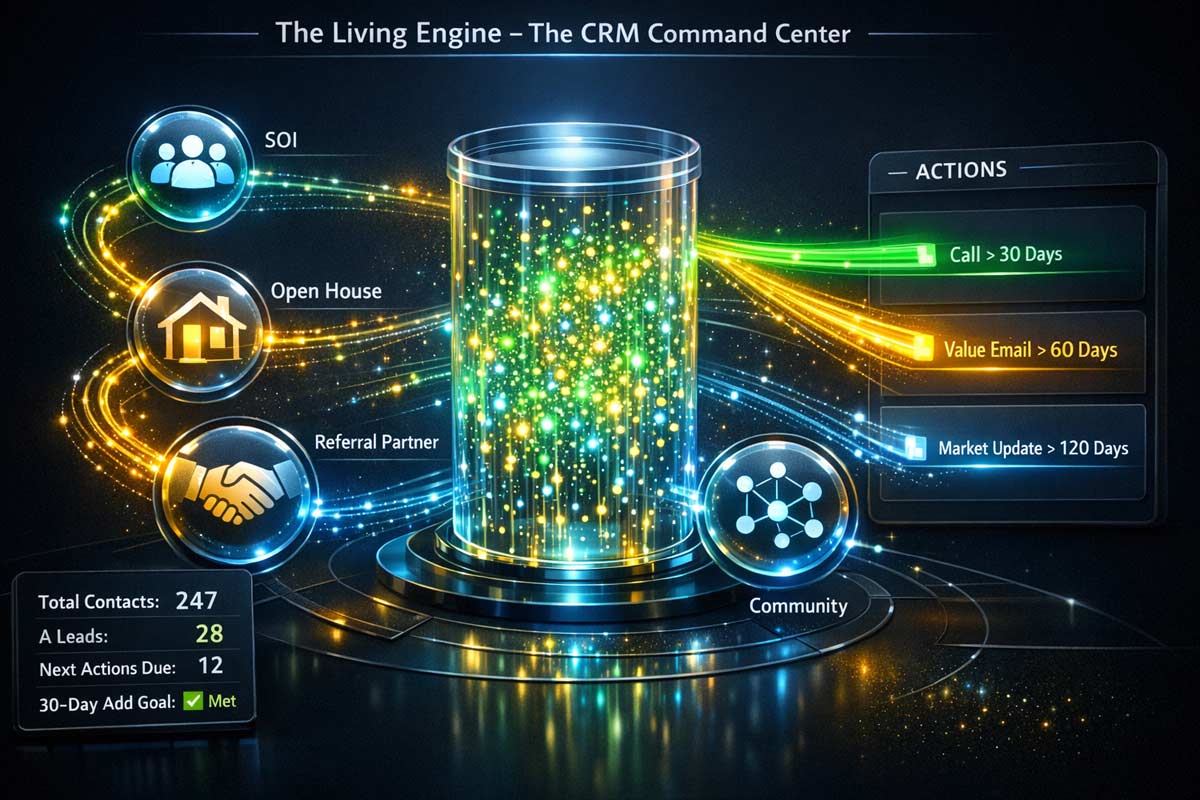

A "system" is simply: Name + Source + Last Contact + Next Action. In week one, a spreadsheet is fine. To move toward a sustainable pipeline, you need to build a real estate database from scratch.

Pathway 2: The Open House Capture & Conversion

The Reality: Open houses are one of the few places consumers actually expect to talk to an agent. It is a high leverage use of your time.

The Action Plan (The 3-Step Flow):

The Welcome: "Welcome! Are you from the neighborhood or just starting your search?"

The Qualification: "Have you seen anything else in this price point, or are you still getting a feel for the local inventory?"

The Close for the Next Step: "I have a list of three similar homes nearby that aren't on everyone's radar yet. Would you like me to send those over?"

A productive open house for a new agent isn’t measured by attendance—it’s measured by 2–3 follow-up conversations scheduled within 48 hours.

The Deeper Resource:

To turn a handshake into a contract, you need a specific follow-up method. Learn the full process in our guide: How New Agents Should Hold Open Houses in California.

Pathway 3: Leverage Office Inventory & Stale Leads

The Reality: While most agents chase "perfect" leads, you can find your first three clients by looking where others don't.

High-volume agents often ignore these opportunities because they require follow-up instead of marketing scale.

The Action Plan:

Support High-Volume Listings: Call top listing agents in your office. Offer to host their "stale" listings or prospect the surrounding neighborhood for them.

Renters-to-Buyers: Many people attending open houses are currently renting. Position yourself as the guide who helps them transition.

The Guardrails: Always follow "Do Not Call" rules and brokerage policy. Your job is service, not pressure.

Once you've mastered these manual methods, you can explore broader

lead sources for new California agents to scale.

The Two Moments That Start Real Careers

Moment #1: Someone trusts you enough to ask a "small" question (e.g., "What's my neighbor's house listed for?").

Moment #2: You followed up when the "rockstar" agent in your office forgot to.

Neither moment looks dramatic—but both are how real careers actually start.

Practical Pitfalls

Most new agents quit because they confuse activity with income-producing actions. This is how agents stay ‘busy’ for six months and exit the industry silently.

The below activities do NOT count as prospecting:

Perfecting your logo or business cards.

Scrolling Instagram for "content ideas."

Endlessly "tinkering" with CRM tags.

Watching "motivational" YouTube videos.

Re-designing your email signature.

The only 3 activities that count:

Real conversations

Intentional follow-up

Studying local inventory.

Managing this focus is the difference between a hobby and a career. Implement these New Agent Time Management Strategies to stay on track.

Your 30-Day Plan (Simple Version)

Week

Primary Focus

Daily Minimum

Week 1

Database Outreach + 1 Open House

5 Conversations

Week 2

Follow-ups + 1 Open House

5 Conversations

Week 3

Repeat + Book 1 Buyer Consult

5 Conversations

Week 4

Tighten Pipeline + Ask for Referrals

5 Conversations

Note: Five conversations means real two-way dialogue—not texts sent or DMs unanswered.

The Path Forward

Finding your first three clients is the hardest part of this business because it requires the most faith. But once you close that third deal, the "imposter syndrome" fades.

Mastering these first three clients is how you build a durable practice, not just a fleeting side hustle.

For the complete framework on launching correctly—from mindset to long-term planning—your next step is our foundational guide: Start Your Real Estate Career in California.

|

One of the most common questions we hear sounds like: “I upgraded to a broker license—do I have extra CE hours now?” or “Do I have to take different classes than when I had my sales license?”

The Read more...

One of the most common questions we hear sounds like: “I upgraded to a broker license—do I have extra CE hours now?” or “Do I have to take different classes than when I had my sales license?”

The confusion is understandable. In California, brokers carry a higher level of legal responsibility—so it feels like the DRE should require more education. The reality is simpler: the total hours are the same, but the required subject mix is where brokers can get tripped up.

Key Takeaways

Total Hours: Brokers and salespersons both complete 45 hours of DRE-approved CE each 4-year renewal cycle.

The Content Mix: Brokers must include Management and Supervision as a mandatory topic (salespersons don’t on their first renewal).

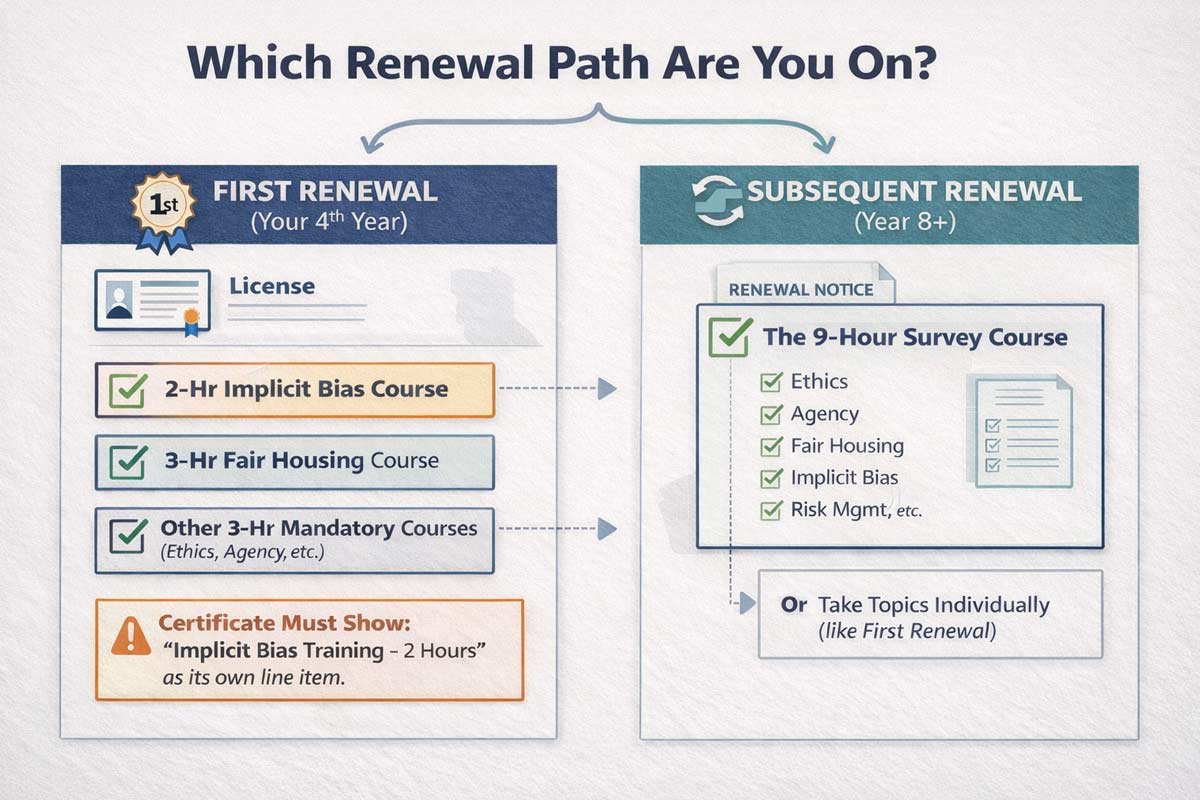

The 9-Hour Survey: For second and subsequent renewals (for licenses expiring on/after Jan 1, 2023), a 9-hour survey can cover all mandatory topics in one course.

Interactive Requirement: For licenses expiring on/after Jan 1, 2023, Fair Housing must include an interactive, participatory component.

Quick Answer: Broker vs. Salesperson CE

In California, brokers and salespersons both need 45 hours of continuing education to renew. The difference is what’s inside the 45 hours: brokers must ensure they complete Management and Supervision as part of their mandatory topic mix. While the total hour count is identical, the DRE requires brokers to undergo specific training related to their role as a potential supervisor.

Comparison Table: Salesperson vs. Broker Renewal

Feature

Salesperson (First Renewal)

Broker (First Renewal)

Second+ Renewals (Both)*

Total Hours

45 hours

45 hours

45 hours

Mandatory Core Courses

4 Subjects (3-hrs each)

5 Subjects (3-hrs each)

Included in 9-hour survey

Fair Housing

3-hr + Interactive Implicit Bias

3-hr + Interactive Implicit Bias

Included in 9-hour survey

Implicit Bias

2-hr Required

2-hr Required

Included in 9-hour survey

Mgmt. & Supervision

Not Required

Required

Included in 9-hour survey

*Applies to licenses expiring on/after Jan 1, 2023, and late renewals filed after that date.

What’s the Same for Everyone?

Regardless of license type, the DRE’s CE structure is built around consumer protection—so the baseline framework stays consistent. That’s why the California Real Estate License Renewal Requirements don’t "punish" brokers with extra hours.

The 4-year renewal cycle applies to everyone.

The total is always 45 hours—no "broker bonus hours."

Mandatory topics + consumer protection hours are the backbone of every renewal package.

What’s Different for Brokers?

If the hours are the same, why does broker CE feel different? Accountability.

A broker isn’t just responsible for their own files—they’re responsible for the supervision standard in the office: policies, advertising compliance, trust fund handling, and risk reduction. That’s why Management and Supervision is explicitly part of the broker requirement - even on the first renewal.

Operator Scenarios: Where Brokers Actually Get Exposed

The Supervision Trap: A broker assumes "supervision" just means reviewing contracts. In reality, brokers can be on the hook for agent advertising and compliance breakdowns across the entire team.

Trust Fund Risk: Most salespersons never touch trust fund handling—brokers live inside it. Small process errors can turn into big consequences during a DRE audit.

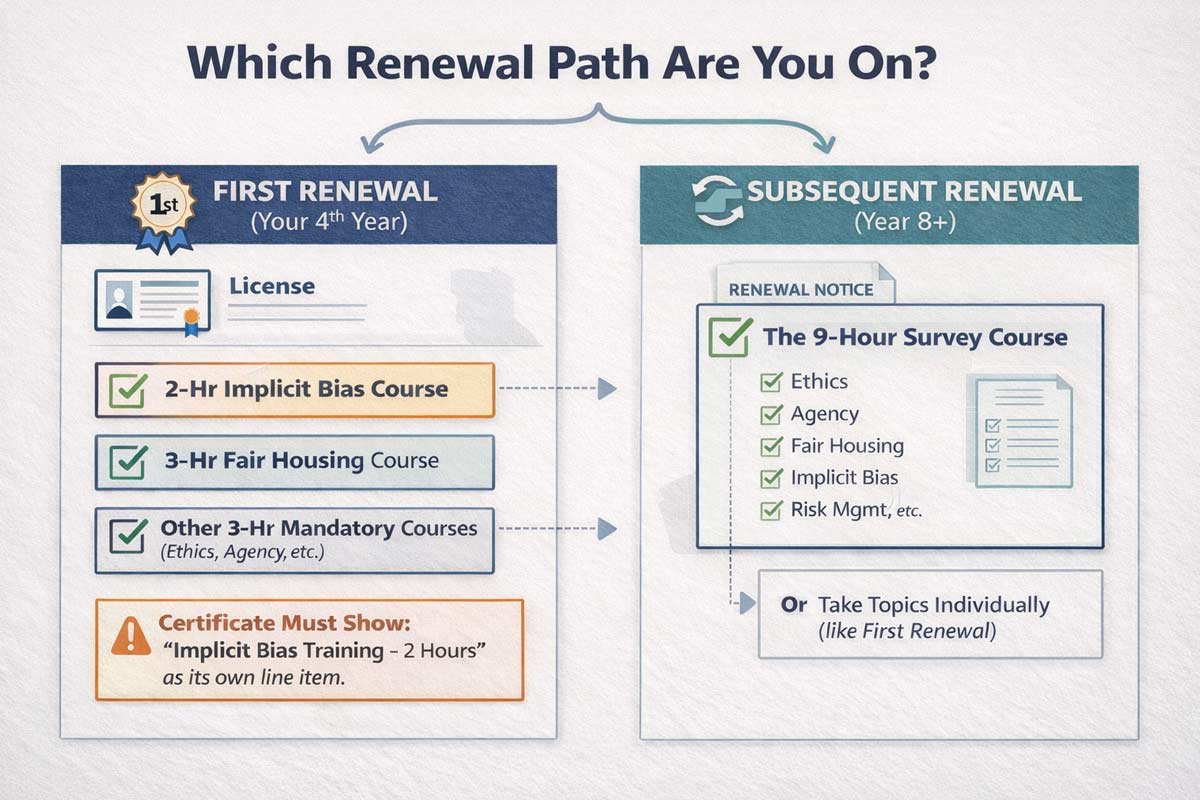

First Renewal vs. Subsequent Renewals

This is where people accidentally choose the wrong package. Your path depends on your renewal "generation."

1) First Renewal

First renewal requires the mandatory subjects as individual courses, plus the required Fair Housing and Implicit Bias components.

Salespersons: 4 separate 3-hour courses (Ethics, Agency, Trust Funds, Risk Management) + 3-hour interactive Fair Housing + 2-hour Implicit Bias.

Brokers: All of the above PLUS a 3-hour Management and Supervision course.

To avoid confusion, view the full roadmap here: California Real Estate License Renewal Guide

2) Second and Future Renewals

For licenses expiring on/after Jan 1, 2023, the DRE allows a 9-hour survey course that covers all mandatory topics (including Management and Supervision) in a single module. You then complete the remaining hours with electives—ideally from clearly qualified Courses That Count Toward CE in California.

7 Common Mistakes That Trigger Delays

REALTOR® Ethics vs. DRE Ethics: Assuming NAR training counts (it usually doesn’t unless the provider specifically issued a DRE-approved CE certificate).

Non-Interactive Fair Housing: Taking an old-style text course for Fair Housing when your license expires after Jan 1, 2023.

Missing Implicit Bias: Failing to ensure the 2-hour standalone course is in your package. See: Does California Require Implicit Bias Training for Renewal?

Overbuying Hours: Thinking brokers need more than 45. Confirm yourCalifornia CE hour requirements before paying.

Unverified Providers: Using a "national" school that lacks a California DRE Sponsor Number.

Waiting Until the Final 24 Hours: Because of the 15-hour exam limit (see below), you literally cannot finish 45 hours in one day.

Wrong Package Type: A broker taking a salesperson package and missing the Management and Supervision credit.

Step-by-Step: Choosing the Right CE Package

Verify Sponsor Details: Ensure the school is DRE-approved.

Check Fair Housing: Confirm it includes the "interactive participatory component."

Respect the 24-Hour Rule: The DRE limits licensees to completing final examinations for a maximum of 15 credit hours per 24-hour period. If you have 45 hours of testing to do, you need at least three separate 24-hour windows to complete your exams.

FAQ

Do brokers need more CE hours than salespersons in California?

No. Both license types require 45 hours every four years.

Is Management and Supervision required for brokers?

Yes. It is mandatory for all broker renewals (first and subsequent).

What is the 9-hour survey course?

It's a condensed course covering all seven mandatory subjects, available only for second and subsequent renewals.

Does Fair Housing have to be interactive?

For licenses expiring on or after Jan 1, 2023, yes. This includes late renewals filed after that date.

How early can I renew?

You can submit your renewal via eLicensing up to 90 days before your expiration date.

Broker renewal shouldn’t create uncertainty or cause you to buy the wrong package. The goal is simple: meet the DRE requirements cleanly, protect your license, and keep your business.

|

You’ve passed the real estate exam, your license is issued, and you’ve chosen a broker. Then, Monday morning hits. You sit at your desk, and the "post-license cliff" sets in: your calendar is empty, Read more...

You’ve passed the real estate exam, your license is issued, and you’ve chosen a broker. Then, Monday morning hits. You sit at your desk, and the "post-license cliff" sets in: your calendar is empty, and your phone isn't ringing.

The temptation for most new California agents is to reach for a credit card and buy leads. Every real estate office has that guest speaker pitching a magical "lead-gen tool" for $199 a month.

That is a short-term fix for a long-term problem.

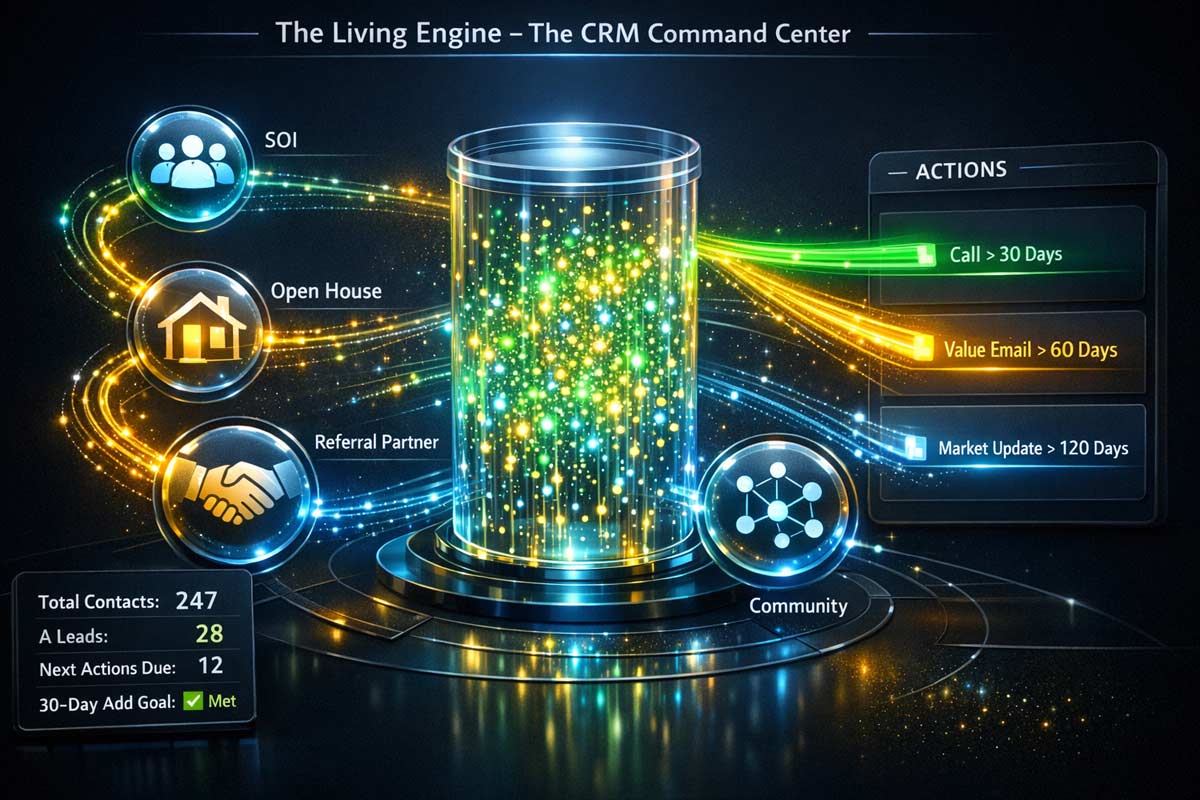

In our industry, your database is your business. It is the only asset you truly own. One clean database can produce repeat clients for 10 years; one lead-buy produces, at best, a one-time conversation.

A database doesn’t magically create deals—it creates conversations, and conversations create appointments.

A "from scratch" database isn't about empty contacts—it's about missing the system for consistent, targeted follow-up.

By the end of this guide, you will have a clear, 30-day roadmap to move from zero contacts to a professional follow-up system that produces consistent commissions.

Real Estate Database Essentials

A database is not just a list of names or an exported CSV file from your phone. A database is a list with memory. It records context (notes) and creates the next action (follow-up date).

What Should You Track in a Real Estate Database?

To turn a contact list into a revenue-generating database, you need specific data points. If you don't know what columns to make in your spreadsheet, copy this exact template:

Full Name: Identify clearly (e.g., Maria Lopez)

Phone & Email: Ensure reliable contact info

Preferred Contact Method: Respect communication style (Text, Call, Email)

City/Neighborhood: Crucial for hyper-local California markets

School District/Commute Corridor: The “why” behind their location

Relationship Status: How do you know them? (Sphere, Open House, Referral)

Source: Lead origin (Referral, Social, Vendor)

Tags/Categories: A/B/C ranking, Buyer, Seller

Last Contact Date: Track cadence

Next Follow-Up Date: Ensure action is scheduled

Notes: Kids’ names, pets, hobbies, real estate goals

Your First Database Rule: One Contact = One Next Action

If someone is worth saving, they’re worth scheduling. Every new entry in your system must have either:

A next follow-up date, OR

A "Do Not Contact" note.

There is no third option. Why: if it isn’t scheduled, it won’t happen.

Choose Your Tool (Without Overcomplicating)

Do not get stuck "tool shopping." You can lose weeks comparing software features while making zero phone calls.

Choose a system based on your current volume:

Google Sheets (0–100 Contacts): The fastest way to start. Google Sheets is free, searchable, and forces you to learn the mechanics of data entry.

Basic/Free CRM (100–300 Contacts): Many brokerages provide a CRM included when you join (like BoldTrail (formerly KV Core) or Chime). Use what you already have before paying for a third-party tool.

Full CRM (300+ Contacts): Only invest in premium platforms once you have a consistent lead flow and need advanced automation.

The Rule: If you have under 100 contacts, start with a spreadsheet. If you spend more than two days "researching" CRMs, you are procrastinating. Pick one and execute.

The 8 Best Places to Get Your First 100 Contacts

You aren't starting from zero; you’re starting from "unorganized." Here is where to find your first 100 entries:

Phone Contacts: Export your contact list. Don’t “clean first.” Import them, then add 25 per day for four days. Momentum beats perfection.

Past Coworkers: Start with 10 you’d confidently ask for advice. You were a professional before you were an agent; these people already trust your work ethic.

The Gym/School/Hobby Circle: Anyone you see at least once a month belongs in the database.

Vendors: Your lender, escrow officer, and local contractors. Tag these as “Vendors” to build a referral exchange.

Open House Sign-ins: This is your primary engine. Rule: If they sign in, they go into your database before you leave the property—while the conversation is still fresh enough to write real notes. Learn how new agents should hold open houses to maximize this capture.

Social DMs: Look at who “likes” your posts. Message them: “Hey [Name], I’m updating my professional directory—what’s the best email to send my local market reports to?”

Community Groups: Local neighborhood associations or Facebook groups (be the helper, not the solicitor).

Out-of-Area Agents: Tag them as “Referral Partners.” A small group of active agents outside your zip code can become your most consistent referral pipeline.

Clean Data Beats Big Data (Hygiene)

Before you chase "more contacts," fix the basics. A messy database is a useless database.

Standardize Names: "Mike Smith," not "Mike S." or "Dad's Friend."

One Primary Contact: Identify one main phone number and email per person.

Merge Duplicates: Do not have three entries for the same person.

Add "Source": Always know where a lead came from so you can track ROI later.

Fix Bouncebacks: If an email bounces or a number is wrong, update it the same day.

The "DNC" Tag: Create a "Do Not Contact" tag so you don’t burn relationships by calling people who asked you to stop.

Tagging & Segmentation: The Power of "A-B-C"

If you treat everyone in your database the same, you will burn out. You must segment your contacts so you know who to call first.

The Starter Tag Framework

Tag Category

Examples

Purpose

Ranking

A (Referral source), B (Met once), C (Cold)

Prioritizes your daily call list.

Timeline

Hot (0–3 mo), Warm (3–12 mo), Long-term

Focuses your energy on immediate deals.

Type

Buyer, Seller, Investor, Vendor, Referral Partner

Determines what kind of content you send.

Source

Open House, Sphere, Referral

Tracks which lead sources for new California agents are working.

The Follow-Up Operating System

Building the list is only 20% of the work. The remaining 80% is the follow-up.

Successful agents use new agent time management strategies to ensure they aren't just "busy," but productive.

Follow-Up Cadence

"A" Leads (Referral Sources): Contact every 30 days.

"B" Leads (Met Once/Acquaintances): Contact every 60–90 days.

"C" Leads (Cold/Distant): Contact every 120–180 days (about twice a year) with broad value.

Value-Based Scripts

The "Permission" Text (Low Pressure, High Reply):

"Hey [Name]—quick question. Would it be helpful if I kept you posted when something notable happens in [Neighborhood] (sales, price changes, anything meaningful)? If yes, what’s the best email for you?"

The "Market Micro-Update" (Email/Text):

"Hey [Name], I saw that a house just like yours around the corner sold for [Price]. It's interesting to see how [City] is holding up right now. Let me know if you’d ever like a quick look at your current home value!"

The "Direct Ask" (Voice):

"I'm taking on a couple more clients this month. Who do you know that’s mentioned moving, upsizing, downsizing, or investing—even if it’s ‘later this year’?"

30-Day Build Plan

Follow this checklist to go from a blank screen to a functioning business engine.

The 30-Day Database Blueprint

Week 1: The Foundation. Create your spreadsheet using the template fields above. Import phone contacts. Apply "A, B, C" rankings to the first 50 people.

Week 2: The Reach Out. Add 25 more names. Send the "Permission" text script to everyone tagged "A" or "B."

Week 3: The Expansion. Log all responses. Call those who replied. Research how to find your first 3 clients as a new agent to convert these conversations into appointments.

Week 4: The Routine. Establish a "Minimum Daily Action": Add 5 new people, contact 5 existing people, and log 5 sets of notes.

Common Mistakes That Kill Databases

Over the last 20+ years, Kartik Subramaniam has seen thousands of students launch their careers.

The ones who fail usually hit these eight pitfalls:

Waiting until you "feel ready" to start calling.

Saving contacts with no notes (you will forget who they are).

Failing to use tags, leading to a "messy" list you eventually ignore.

No "Next Follow-Up" date— if it isn't scheduled, it won't happen.

Relying on "Likes"— social media engagement is not a database relationship.

Buying leads before you’ve exhausted your free sphere of influence.

Sounding like a salesperson instead of a local guide.

Ignoring Open Houses as a primary way to feed the database engine.

Kartik's Insider Tip:

“I’ve seen agents turn a 'maybe next year' lead into a $30,000 commission simply because they had a 'follow up in 6 months' tag and actually made the call.

Most agents quit after one 'no.' The database ensures you are there when the 'no' turns into a 'now.'”

Start Your Career the Right Way

A database is the difference between a "job" and a "business." Without it, you are unemployed every time a transaction closes.

With it, you have a predictable stream of referrals and repeat clients.

If you are ready to move beyond the basics, it is time to look at the bigger picture of your professional development.

If you’re building your first-year foundation in California, that’s the full roadmap.

Start a Real Estate Career in California →

|

Many aspiring agents begin their journey with a specific conviction:

"I need to be in a classroom”

It makes sense. To get a California real estate license, you must complete 135 hours of college-level Read more...

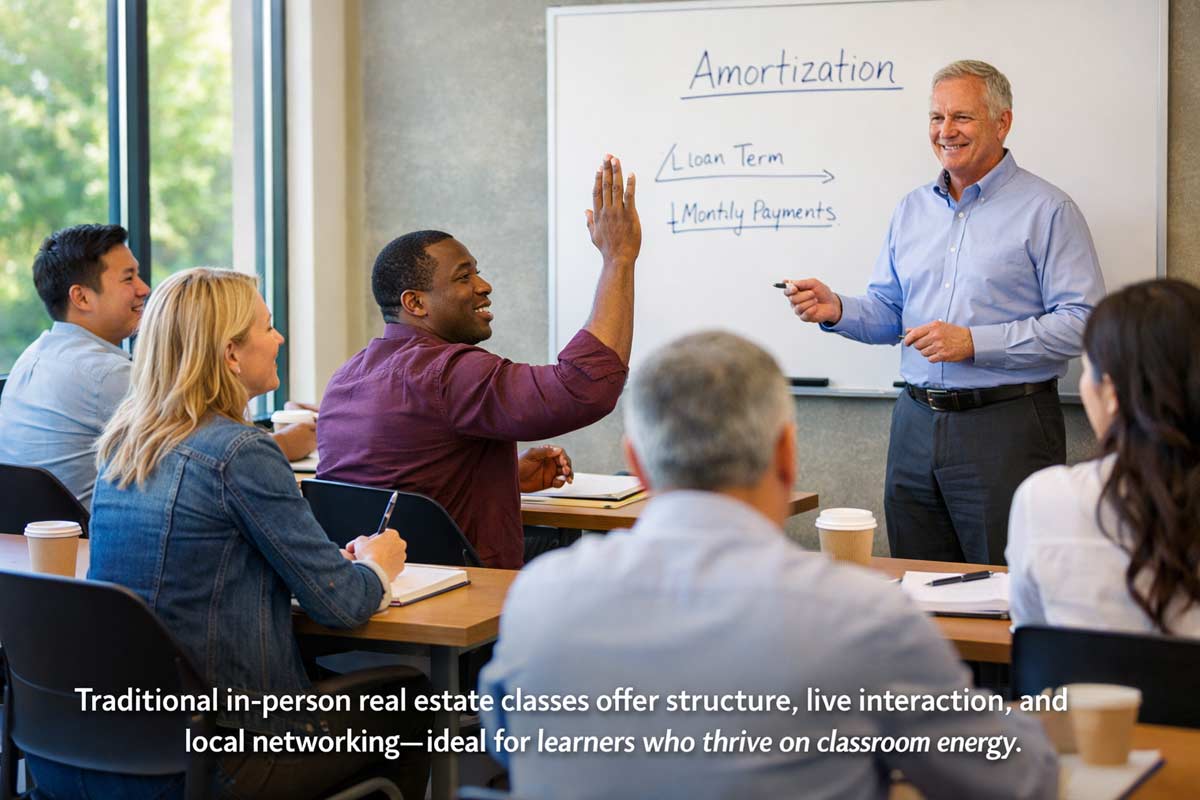

Many aspiring agents begin their journey with a specific conviction:

"I need to be in a classroom”

It makes sense. To get a California real estate license, you must complete 135 hours of college-level pre-licensing education. For many, the idea of sitting alone in front of a computer screen for weeks on end is a recipe for procrastination.

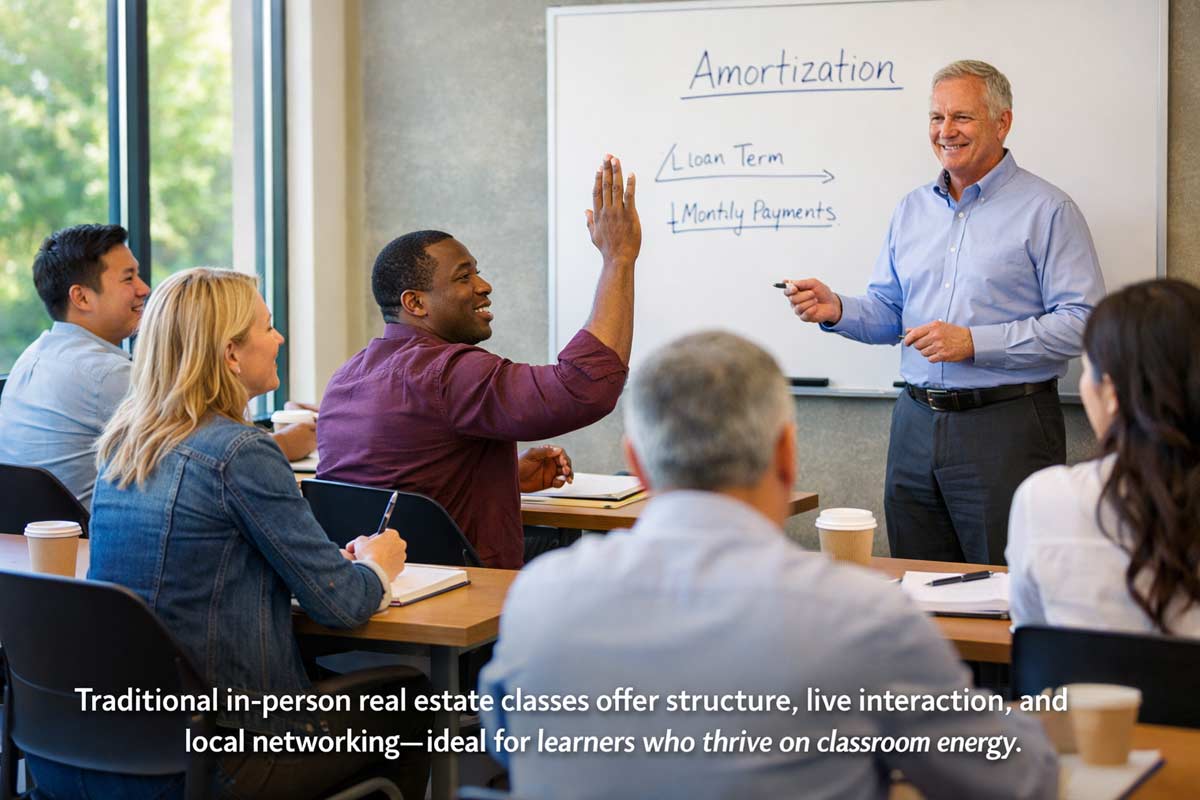

You aren’t necessarily looking for a physical desk; you are looking for the "in-person effect"—the structure of a schedule, the ability to ask a live human a question, and the accountability that comes from knowing a class is starting with or without you.

In this guide, we evaluate how to find the best in-person real estate schools in California and explore how modern "live instruction" provides a viable path for busy professionals.

Defining Your Options: Classroom vs. Live Online vs. Self-Paced

Choosing the wrong format is one of the most common reasons we see students struggle to reach the state exam. In California, the Department of Real Estate (DRE) permits both "Live" and "correspondence" (home study) formats. Most modern live-instruction programs—including those delivered via Zoom—are often classified as distance or correspondence delivery, but they aim to replicate the traditional classroom experience.

Format

Best For...

What You Get

The Trade-off

Physical Classroom

Total separation from home distractions.

In-room energy & local networking.

Commute time, parking, & rigid schedules.

Live Instructor-Led (Zoom)

The "In-Person Effect" without the drive.

Live real estate classes with real-time Q&A.

Requires a quiet space and stable Wi-Fi.

Self-Paced Online

Maximum flexibility or strict budgeting.

Pre-recorded or text-based modules.

Requires strong self-discipline and time blocks.

If you are currently weighing your budget against your learning style, you may want to cross-reference the cheapest real estate schools in California to see how these formats impact your total investment.

How to Evaluate Any "In-Person Style" Program

Based on my 20+ years of preparing California license applicants, a school shouldn't just be "near you"—it needs to be effective. Use these criteria to evaluate any provider:

DRE Approval & Compliance: Verify the school is legally vetted by the California Department of Real Estate for the required three courses.

Instructor Access: If you are stuck on a concept like Negative Amortization, can you get a live answer?

Schedule Reliability: Does the school have a consistent calendar, or do they frequently cancel sessions?

Student Support: Is there a team available to help with certificates and DRE applications?

Exam-Prep Synergy: The 135-hour certificates are the legal requirement, but the state exam is the hurdle. The most popular real estate schools in California often weave exam strategy into every live session.

The Reality of Physical Classrooms in California

Who Should Still Choose a Physical Classroom?

While digital options are growing, the traditional classroom still serves a specific group of learners. You should consider a true in-person school if:

You lack a quiet, private space at home to attend a live digital session.

You thrive on the physical energy of a room and prefer face-to-face networking.

You live or work within 15 minutes of a reputable classroom.

The "Commute Friction" Factor

In practice, we’ve observed that for students in high-traffic hubs like LA, Orange County, or the Inland Empire, the commute is the friction that kills consistency. If a class starts at 6:00 PM and you are stuck on the 405 or the 10, the stress of the drive often leads to missed sessions. In our experience, we often see completion rates fall off fast after two missed sessions.

For those who need to finish quickly, it’s worth comparing these logistics against the fastest real estate license programs in California.

The Modern Solution: Live Instructor-Led Zoom Classes

At ADHI Schools, we focus on delivering the "in-person effect" through scheduled, live-streamed sessions. This format is designed for the modern California life:

The Full-Time Professional: Join class after work without needing to find parking downtown.

The Parent: Stay home and engage in high-level instruction while remaining accessible to your family.

The "Accountability" Learner: You show up because there is a live expert waiting to teach you. This is why many consider it among the best online real estate schools in California for those who dislike traditional "self-paced" modules.

Related Deep Dives

The Big Picture: Best Real Estate Schools in California

Speed: Fastest Real Estate License Programs in California

Budget: Cheapest Real Estate Schools in California

Flexibility: Best Online Real Estate Schools in California

Reputation: Most Popular Real Estate Schools in California

Decision Framework: Finding Your Fit

Do you have the self-discipline to read 1,000+ pages of dry material alone?

Yes: Self-paced online might work.

No: You need a live instructor. (Go to Step 2).

Is there a DRE-approved physical classroom nearby and you can reliably attend?

Yes: Physical classroom is a solid option.

No: The drive will likely become a barrier. (Go to Step 3).

Do you want the structure of a classroom with the comfort of home?

Yes: Live Instructor-Led Zoom is your best bet.

No: If you just want the lowest price and no schedule, self-paced is your default.

FAQ: In-Person Schools vs. Live Instruction

Are in-person real estate classes required in California?

No. You can fulfill your 135-hour requirement via classroom or correspondence formats.

Is live Zoom considered "in-person"?

Legally, it is usually categorized as correspondence or distance learning, but functionally, it offers the same real-time interaction as a physical classroom.

What if I work full time?

Live Zoom instruction is a top choice for full-time workers. It provides the rigid schedule needed for discipline without the added 5–10 hours a week of California traffic.

Choosing Your Path

The "best" school is the one that fits your life well enough to let you finish. While a physical building has its benefits, the flexibility of live instructor-led classes has become the most practical option for many busy Californians.

Ready to see how ADHI Schools stacks up? Explore our comprehensive breakdown of the Best Real Estate Schools in California or join one of our upcoming live sessions to experience the "in-person effect" for yourself.

|

The most common question I’ve heard over the last 20+ years helping students get licensed in California is: "How fast can I get this done?"

It’s an understandable question. You’re ready for a Read more...

The most common question I’ve heard over the last 20+ years helping students get licensed in California is: "How fast can I get this done?"

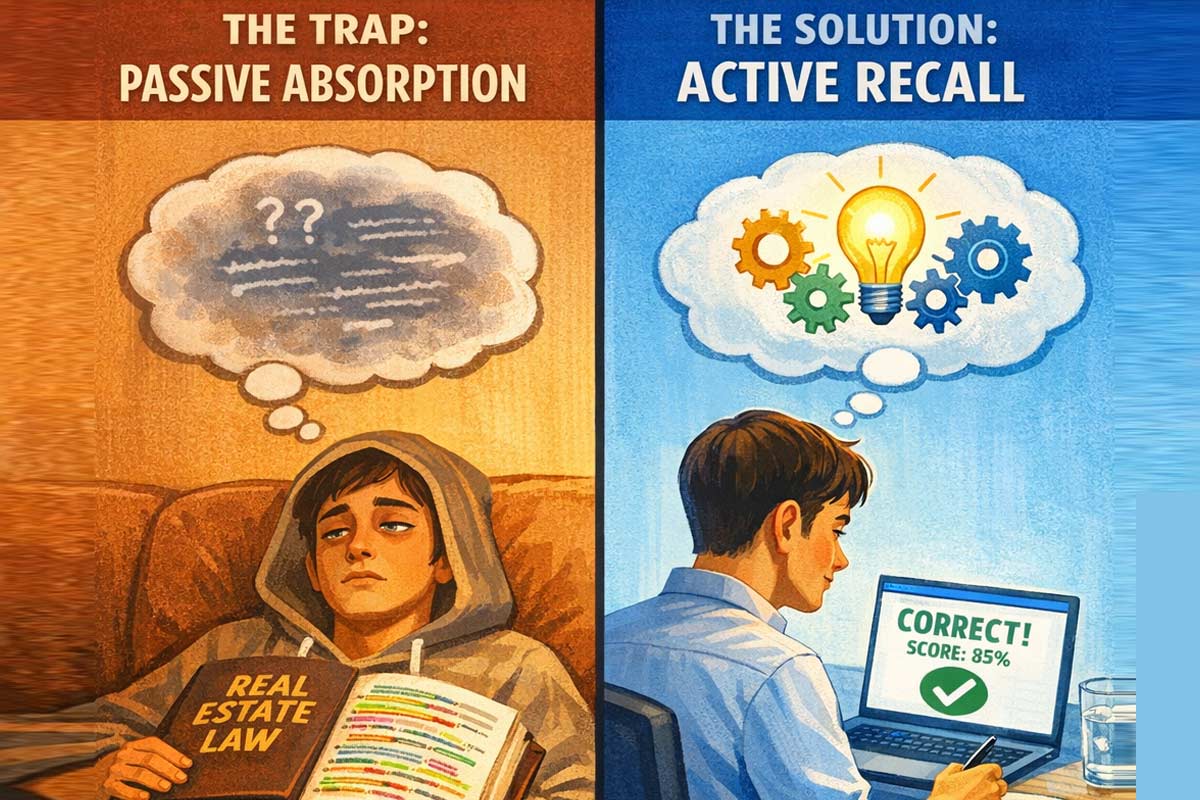

It’s an understandable question. You’re ready for a career change, and the only thing standing between you and your first commission is three courses and an exam. However, there is a massive difference between "finishing the courses" and "being ready to pass the exam."

Marketing headlines often promise "Get your license in weeks," but the reality of the California Department of Real Estate (DRE) requirements and your own life schedule usually tell a different story.

Quick Take: The Reality Check

While the absolute legal minimum time to complete your pre-licensing education is roughly 54 days (due to DRE-mandated holding periods), most successful students finish in 3 to 5 months. Speed is a tool, but consistency is what actually gets you to the finish line.

In California, most students are completing 135 hours of statutory pre-licensing education (three 45-hour courses)—but calendar time depends on consistency and minimum completion windows.

The California Baseline: What You Must Complete

In California, the DRE requires you to complete three college-level courses before you can even apply for the state exam:

Real Estate Principles

Real Estate Practice

One Elective (e.g., Legal Aspects, Finance, or Appraisal)

Each of these courses is designed around a 45-hour curriculum. For home-study/online statutory courses, providers generally can’t allow the student to test out of a course if fewer than 18 days pass from the date you’re granted access to the materials—so the course final typically won't unlock until at least Day 18.

With three courses, that means the mathematical minimum is 54 days. If a school tells you that you can finish all three in a single weekend, they aren't being honest about California law.

Realistic Timelines: 3 Common Student Paths

How long you will take depends entirely on your weekly cadence. Over the decades, I’ve seen students fall into one of these three tracks:

The California Real Estate Completion Timeline

Track

Weekly Hours

Est. Completion

Who It’s For

Fast Track

18–20 Hours

8–10 Weeks

Full-time students or those between jobs.

Balanced Track

9–10 Hours

4–5 Months

Professionals with a 9-to-5 and families.

Slow & Steady

3–5 Hours

6–12 Months

Busy schedules; highest risk of drop-off.

1. The Fast Track

This requires a "deep work" approach. You are treating school like a part-time job.

What causes delays: Burning out by Week 4 or hitting a wall on complex topics like Finance.

Next Step: If this is you, block out time every morning before the world wakes up.

2. The Balanced Track

This is where 70% of our students live. It’s sustainable and allows for life to happen without derailing your progress.

What causes delays: Skipping a full week due to a work project and losing "the thread" of the material.

Next Step: Commit to a non-negotiable "Saturday Study Session" to supplement short weekday bursts.

3. The Slow & Steady Track

While possible, this track has the highest risk of drop-off. The longer you take, the more you forget what you learned in the first course.

What causes delays: Passive reading and the "start-stop" cycle.

Next Step: You need a high-accountability structure or a physical class to keep you moving.

Real Estate School Time vs. Total Time to Get Licensed

Finishing school is just Phase 1. To plan your career launch, you must account for the DRE’s administrative timeline:

School Completion: 8 weeks to 6 months (as shown above).

DRE Application Processing: After finishing your 135 hours, you submit your application. As of January 12, 2026, the DRE was processing Sales Combo Exam/License applications received approximately one month prior. You should check the the DRE processing page regularly for live updates.

Exam Scheduling: Once approved, qualified examinees can self-schedule via eLicensing as late as 6:00 AM on the day of the exam, depending on site availability.

Exam Day: The Salesperson exam is a 3-hour session consisting of 150 multiple-choice questions. You need a 70% to pass the sales exam and a 75% to pass the brokers.

What Actually Slows Students Down (The Hidden Time Traps)

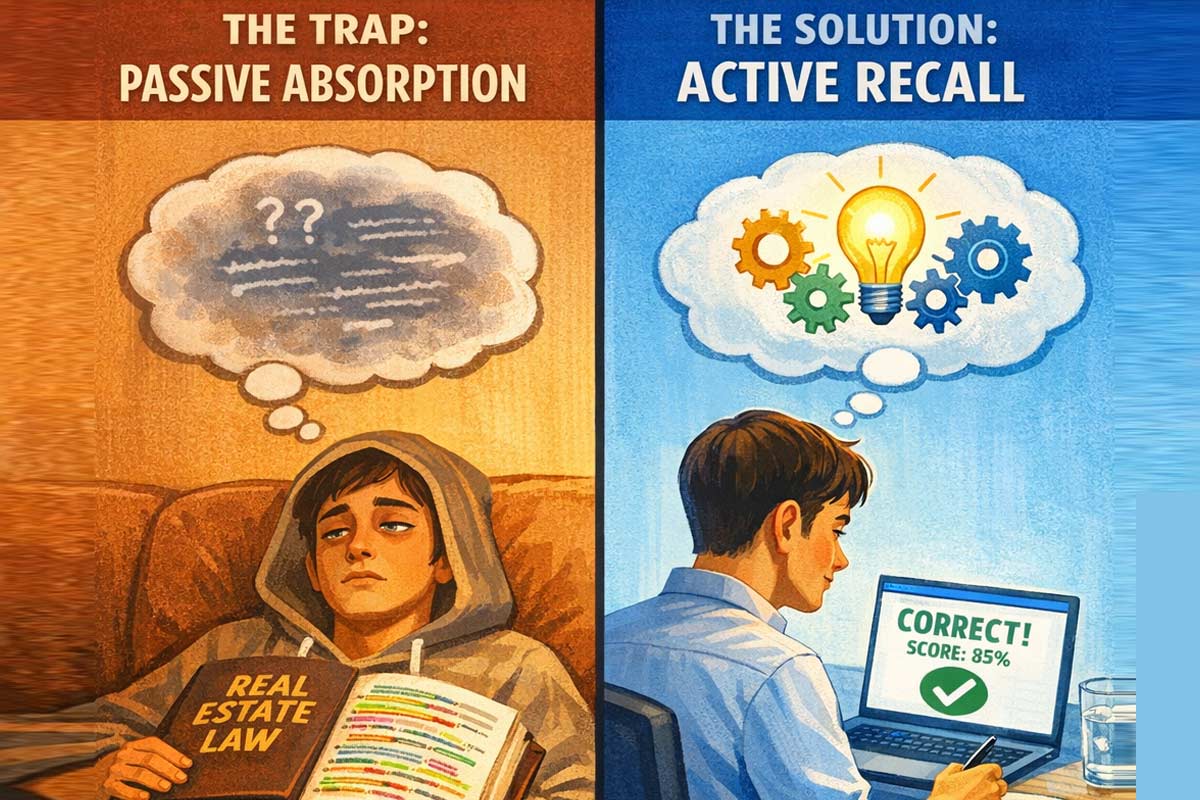

Most students don't fail because the material is too hard; they fail because they lose their momentum. After 20 years of observation, these are the biggest "time killers":

Trap #1: Passive Studying

I’ve seen students spend three weeks "reading and highlighting" a textbook without taking a single practice quiz. They feel like they are working, but they aren't retaining anything. When they finally take a quiz and fail, they get discouraged. This cycle of effort without retention is what leads to the common question: do online real estate classes actually prepare you? The answer hinges on your strategy.

Trap #2: The "Sequential" Prep Mistake

A common trap is waiting until you finish all three courses to even look at exam prep materials. This often leads to a "re-learning" phase that can add weeks to your timeline. My advice: start lightweight recall on Principles while you are still working through Practice.

Trap #3: The "Week 3" Motivation Dip

The first two weeks are fueled by excitement. By week three, the novelty wears off. Without a system, this is where most people quit. If you find yourself stalling, you need to learn how to stay motivated during real estate school to push through the mid-course slump.

How to Finish Faster Without Cutting Corners

If you want to move quickly, you don't skip the material—you optimize how you consume it.

Audit Your Environment: You can't learn "Legal Aspects of Real Estate" while watching TV. Success requires the optimal study setup for real estate school—a dedicated space where your brain knows it’s time to work.

Use the "Error Log" Method: Instead of re-reading chapters you already know, spend 80% of your time on the 20% of topics you keep getting wrong in practice quizzes.

Ask for Help Early: Don't spend three days Googling a concept. Use your instructor access. A five-minute explanation from an expert who responds quickly when you’re stuck can save you five hours of frustration.

The Planning Framework: Pick a Timeline, Then a School Structure

Your timeline shouldn't just be a wish; it should dictate which school you choose. If you need to be done in 3 months, you need a school that provides a clear roadmap, recorded or live instruction, and a support team that responds quickly when you're stuck.

Don't just take my word for it. Look at the data and what students say about online real estate schools (2026) to see which formats actually lead to completion versus which ones just leave you with a PDF and a prayer.

Frequently Asked Questions

Can I finish real estate school in 2 weeks? No. For online courses, providers generally cannot unlock the final exam until at least Day 18 of the course. Since you need three courses, the absolute minimum in California is 54 days.

What if I work a full-time job? Most students do. Expect a timeline of 4 to 6 months. By dedicating a little time every night and some time on the weekends, you can stay on track without burning out.

Can I take the three courses at the same time? It depends on the provider's structure. Most successful students find that focusing on one course at a time maintains better momentum, though you can start the 18-day clock for the next course as soon as the previous block has lapsed.

What is the fastest realistic schedule if I work full-time? A sample plan: 60 minutes of study every weekday morning, 30 minutes of practice quizzes during lunch, and one 4-hour "deep dive" on Saturday. This puts you on the "Balanced Track" (4-5 months).

What happens if I take a long break? A good course provider can keep your enrollment active for up to one year. However, if you take a break longer than two weeks, you will likely need to spend extra time reviewing previous material to reset, which extends your total timeline.

Final Thoughts

A realistic timeline is the sum of California’s legal requirements, your weekly consistency, and the support structure of your chosen school. Don't aim for the "fastest" possible route if it means you'll be unprepared for the actual state exam.

Ready to see which program aligns with your goals?

Compare the Best Real Estate Schools in California

|

A DRE-approved real estate school is a California provider authorized to deliver the 135 hours of prelicensing education required for licensure.

If you are researching how to get your real estate license, Read more...

A DRE-approved real estate school is a California provider authorized to deliver the 135 hours of prelicensing education required for licensure.

If you are researching how to get your real estate license, you have likely seen the phrase “DRE-approved real estate school” and a statutory sponsor ID on every website you visit. In California, this isn’t just some kind of badge of honor—it is a legal necessity.

However, there is a common misconception among applicants that "approval" is a seal of excellence or a guarantee of a high pass rate. In my 20+ years of helping students navigate the California Department of Real Estate (DRE) requirements, I have seen many students get a false start at another program based solely on the word "approved," only to realize later that the curriculum was outdated or the support was non-existent and they come to us to actually finish.

This guide clarifies exactly what DRE approval means, what it doesn't mean, and how to verify a provider in minutes so you don't waste time or money.

Quick Take: DRE Approval Basics

The Minimum Standard: Approval means the DRE has verified the school’s curriculum meets the state's 135-hour prelicensing requirement.

The Sponsor ID: Every legitimate provider must have a DRE-issued Sponsor ID number that starts with the letter “S” for pre-license coursework.

Course-Specific: Approval is granted to specific courses, not the school as a whole.

Certificate Validity: Only DRE-approved courses issue completion certificates accepted with a California exam application.

Not an Endorsement: The DRE does not "rank" schools or vouch for the quality of the student experience.

What Does “DRE-Approved” Actually Mean?

In plain English, a California DRE-approved real estate school is a private vocational provider that has submitted its curriculum, policies, and instructors to the Department of Real Estate for review and received authorization to offer statutory courses.

When a school is approved, it means the DRE has determined that their courses satisfy the legal requirements for licensure. This is tied to two things:

The Provider: The entity (the school) is registered with a DRE Sponsor ID.

The Course: Each specific course (Real Estate Principles, Practice, and an elective) has its own individual six-digit approval number.

It is important to understand that DRE approval is the "floor," not the "ceiling." It ensures the school follows the law, but it does not measure how well the school actually teaches the material or supports its students.

What the DRE Approval Process Generally Covers

The DRE doesn't just hand out approvals. To become a DRE-approved real estate school, a provider typically must demonstrate compliance in several administrative and academic areas:

Required Curriculum: Courses must cover the specific California-mandated topics. For prelicensing, this is the DRE-approved 135-hour structure (three 45-hour courses).

Administrative Record-Keeping: Schools must have a system to track student registration, completion dates, and exam scores for at least five years.

Course Final Exams: The DRE sets rules on how final exams are proctored and timed.

Instructor Standards: While the DRE sets basic qualifications for who can teach, the role of instructors in CA real estate education varies widely between schools in terms of actual daily availability and engagement.

Takeaway: Approval ensures the "paperwork" of your education is valid so the state will accept your application.

How to Check if a Real Estate School is Truly DRE Approved

Never take a school’s word for it. In my experience, students occasionally run into "national" providers whose courses are not specifically formatted for California's unique legal landscape. Use this DRE course provider verification checklist to protect your investment:

Locate the Sponsor ID: Look for a 4-digit number (e.g., S0XXX) on the school’s website, usually in the footer or on the "About" page.

Search the Official DRE Course Lookup: Use the Department of Real Estate’s statutory course search tool (not a school’s internal list).

Verify the Course Type: Select "Statutory/Pre-License" from the dropdown menu.

Match the Name: Search by the School/Sponsor name. Ensure the results show the specific courses you need (Principles, Practice, and an Elective).

Red Flags: Misleading Language to Watch For

When comparing programs, you may encounter marketing language designed to sound like "approval" without meeting the DRE’s specific criteria:

"Nationally Accredited" with no DRE mention: Accreditation is different from DRE approval. A school can be accredited by a third party but still not be a California real estate prelicensing course DRE-approved provider.

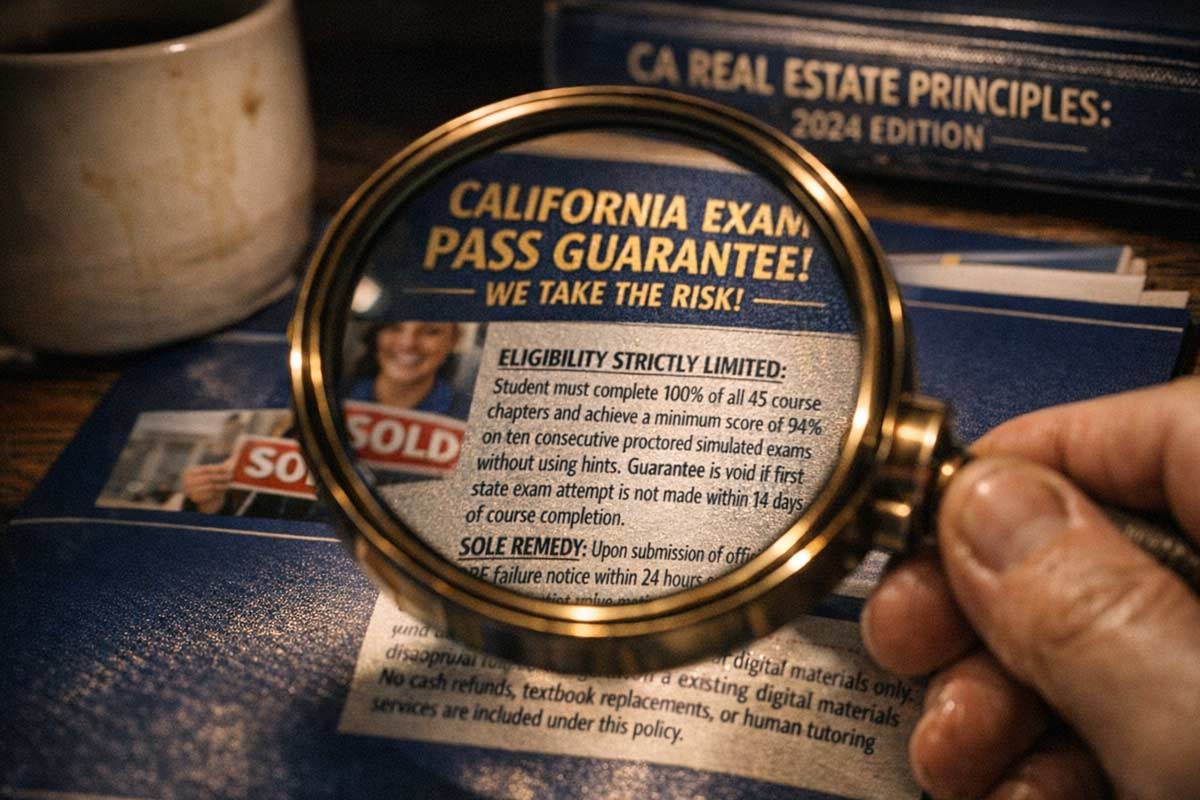

Guarantees without Transparency: Be wary of schools that offer a "money-back guarantee" but hide the requirements in fine print. Before you buy, you should understand what to look for in a CA real estate exam pass guarantee to ensure it actually protects you.

Ambiguous Course Hours: If a school claims you can finish the "135 hours" in three days, they are likely out of compliance. California law requires a minimum time frame (usually 18 days per course) to complete the material.

Approval vs. Quality: The Next Step

Once you have verified that a school is legally approved, your work isn't done. Approval only means the DRE says the school can teach; it doesn't say they should be the ones teaching you.

To find the best real estate schools in California, you need to look past the Sponsor ID and evaluate the actual learning experience.

Feature

DRE Approval (The Minimum)

High-Quality Standards (The Goal)

Curriculum

Covers legal topics

Regularly updated for current state exam trends

Support

Required to have a contact

Live, California-based experts available daily

UX/Tech

Must function

Modern, mobile-friendly, and intuitive

Exam Prep

Not required for approval

Deep banks of practice questions and crash courses

FAQs About DRE-Approved Schools

Q: Is every real estate school in California DRE-approved?

A: No. There are many "educational" sites that offer coaching or "secrets," but unless they have a Sponsor ID and approved statutory courses, they cannot issue the certificates you need to take the state exam.

Q: What does DRE-approved mean for my certificate?

A: It means the certificate of completion you receive will be recognized by the DRE when you submit your Salesperson Exam Application.

Q: Can a school be approved but still provide a bad experience?

A: Absolutely. Many students regret choosing the cheapest “approved” school because the material was a "wall of text" with zero instructor support.

Q: Is a DRE-approved course enough to pass the state exam?

A: Typically, no. Prelicensing courses teach you the law. Passing the exam requires specific "test-taking" logic. This is why many students ask are crash courses worth it in California? to bridge the gap between "learning" and "passing."

Choosing the Right Path

Verifying approval protects your eligibility. Choosing the right school protects your time, confidence, and momentum. Verifying that a program is a DRE-approved real estate school is step one. It protects you from fraud and ensures your hours will count. However, step two is choosing a partner that will actually help you start your career.

If you are ready to move beyond the basics of "approval" and want to find a program that fits your learning style, read our full breakdown on how to choose a real estate school in California.

For a complete look at the top-rated providers in the state, visit our guide on the Best Real Estate Schools in California.

|

For most aspiring agents, the road to licensure can feel like a high-stakes race. You’ve invested time in your pre-licensing courses, and now the state exam stands between you and your new career. It Read more...

For most aspiring agents, the road to licensure can feel like a high-stakes race. You’ve invested time in your pre-licensing courses, and now the state exam stands between you and your new career. It is natural to feel a sense of anxiety during this phase; most students aren’t looking for "magic" solutions—they are looking for certainty.

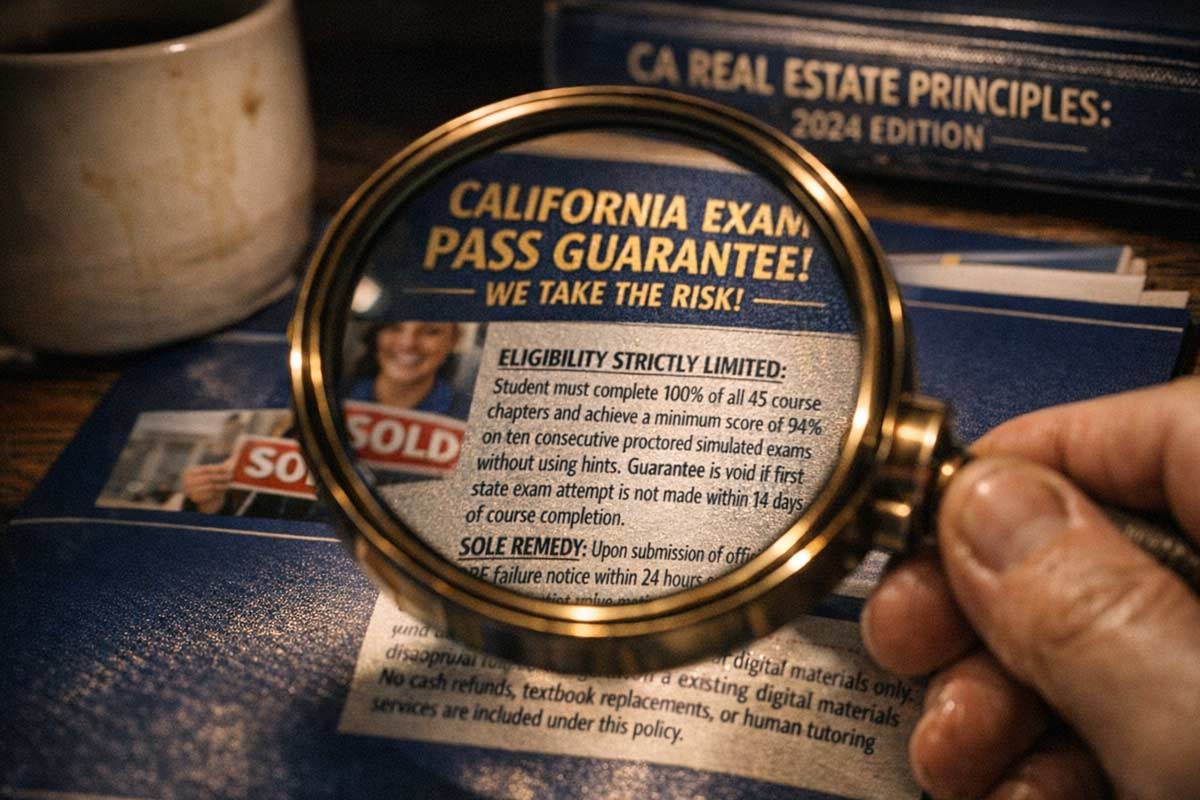

This is exactly why some education providers offer a CA real estate exam pass guarantee. At first glance, these claims act as a safety net, promising that if you don't pass, the school will "make it right." However, for the discerning student, it is important to understand that a "guarantee" is often a marketing label rather than a meaningful protection of your time or money.

By understanding the fine print behind these claims, you can avoid the common traps of real estate school marketing. This guide provides an insider’s framework to help you audit these policies so you can choose a program based on actual support rather than just a slogan.

Defining the Two Common "Guarantees"

Before you sign up, you must distinguish between the two primary types of "safety nets" offered by California real estate schools.

1. The Pass Guarantee

This is a claim that the school stands behind its curriculum’s effectiveness. Typically, it suggests that if you fail the state exam, you are entitled to a specific remedy. While the name implies you are "guaranteed" to pass, the reality is that the school is simply defining what happens if you don't. Knowing how to choose a real estate school in California requires looking past the title of the guarantee to the actual remedy provided.

2. The Satisfaction Guarantee

A satisfaction guarantee is usually focused on the initial experience. It typically offers a refund window (e.g., "money back within 48 hours") if you decide the course format or the user interface isn't a good fit for your learning style. These are often heavily restricted once you have accessed a certain percentage of the course material.

Why Many Guarantees Don't Actually Protect Students

It sounds comforting to hear that a school "guarantees" your success, but many of these policies don't reduce the actual risks involved: lost time, weak preparation, and lack of support.

Consider the remedy. In many cases, a real estate school satisfaction guarantee or pass guarantee simply offers "continued access" to the same materials you just used. If the system didn't work for you the first time, simply using it longer may not solve the underlying issue.

Furthermore, many guarantees come with "performance requirements" that are often difficult to meet, such as achieving a 90% or higher on every single practice exam before your state date. If you miss one requirement, the guarantee is void.

The core point is simple: if the remedy is just "keep using the same system," it may not be addressing why you struggled in the first place. You also need to ensure the school is legitimate by understanding what makes a real estate school DRE-approved.

The "Guarantee Audit Checklist": What to Ask

When evaluating a CA real estate exam pass guarantee, use this checklist to peel back the marketing layers:

Eligibility and "Gotchas"

Attendance & Completion: Do you have to complete 100% of the course and every quiz?

Score Requirements: Must you pass a "proctored" final with a specific high score?

Attempt Limits: Does the guarantee only apply to your very first attempt at the state exam?

The Actual Remedy

Refund vs. Extension: Are they giving your money back, or just extending your login for another 30 days?

Coaching: Does the guarantee trigger actual one-on-one help, or just more automated practice questions?

Hidden Fees: Are there "re-enrollment" fees or costs for updated physical textbooks?

Timeline and Documentation

The Time Window: How long is the access, and is it realistic for CA’s current exam scheduling wait times?

Proof of Failure: What documentation (like the DRE fail notice) do they require, and how quickly must you submit it?

What Actually Matters More Than a Guarantee

In my 20+ years of preparing candidates for the California real estate exam, I have seen that "guarantees" rarely correlate with high pass rates. Instead, the most successful students prioritize specific quality signals that actually predict a passing score.

Instructor Availability: Can you actually get help from a human when you are stuck on a concept like "negative amortization"? The role of instructors in CA real estate education cannot be overstated.

Question Bank Realism: Does the exam prep pass guarantee come with a simulator that mirrors the actual DRE interface and phrasing?

Deep Explanations: Quality prep tells you why an answer is wrong, not just which one is right.

Support Response Speed: If you email a question on Wednesday, do you get an answer before your exam on Monday?

Structured Study Plans: A school that provides a clear milestone-based plan is more valuable than one that just offers a "guarantee" without a map.

The "Try Before You Buy" Decision Rule

If a school is confident in their product, they shouldn't need to hide behind a pass guarantee. The best way to judge a school is through a guest pass or a sample lesson.

The Rule: If a school won’t let you preview the learning experience or watch a sample lecture, treat the guarantee as noise. You are better off seeing if the teaching style clicks with you before you commit your time and money. This is especially true when deciding are crash courses worth it in California, as the intensity of those sessions requires a teaching style you can actually follow.

Evaluating Support Windows as Policy

Rather than looking for a "guarantee," look for a school’s "support window." Some programs offer extended access—for instance, providing four months of access to a crash course—specifically because they recognize that the DRE scheduling process can be slow.

View these not as guarantees of a result, but as support structures. A policy that gives you ample time to study, review, and retake practice exams is a practical tool. It acknowledges the reality of the California licensing timeline without making empty marketing promises.

Choosing the Right Path

Choosing a school is the first major business decision you will make in your real estate career. Don't let a "pass guarantee" distract you from checking the essentials: instructor quality, content freshness, and institutional transparency.

If you are ready to compare options objectively, use our comprehensive guide on the Best Real Estate Schools in California to see how different providers stack up beyond the marketing headlines.

FAQ: CA Real Estate Exam Guarantees

What does an exam pass guarantee mean in California?

Typically, it means if you fail the state exam, the school will provide some form of compensation—usually an extension of your course access or, more rarely, a partial refund—provided you met all their study requirements.

Are "Money Back" guarantees real?

They exist, but they are often "Satisfaction Guarantees" that expire a few days after purchase or after you have opened a certain number of course chapters. Always read the refund policy before buying.

What is the best way to ensure I pass the CA exam?

Consistent practice with a modern exam simulator, attending live or recorded instructor-led sessions, and following a structured 60-day study plan are much more effective than relying on a guarantee policy.

|

In California, the Department of Real Estate (DRE) maintains a rigorous standard for what must be taught. Because of this, many students assume that every DRE-approved real estate school is essentially Read more...

In California, the Department of Real Estate (DRE) maintains a rigorous standard for what must be taught. Because of this, many students assume that every DRE-approved real estate school is essentially the same. After all, if they all cover the same 135 hours of mandated material, why does it matter where you go?

The reality is that while the curriculum is standardized, the delivery, support, and outcomes vary wildly. This framework helps you evaluate real estate school quality in California without relying on price or marketing claims. In my two decades of coaching students to pass the California exam and launch their careers, I’ve watched many come to us after a false start elsewhere. They often chose a program based on the lowest price, only to lose months—and momentum—in the process.

In this guide, “quality” means: (1) you finish the coursework, (2) you get real help when stuck, and (3) you’re actually prepared for the state exam.

Course Format — What Actually Matters

The "best" format is the one you will actually finish. Life in California is busy, and a format that worked for your friend might not work for your particular schedule. When evaluating a school, you need to look at how the content is delivered and reinforced.

Choosing Your Delivery Method

Self-Paced Online: Best for the self-motivated student who needs total flexibility.

Livestream or In-Person (Zoom-based): Best for those who need accountability and real-time interaction.

The Operator Criteria Most Schools Dodge

Deadline & Extension Policy: What happens if life hits? Ask what it costs to extend your access if you don't finish in the initial window.

Certificate Speed & Reliability: How fast do certificates generate after you pass a final? If a school takes a week to "process" a digital certificate, you lose a week of your DRE application window.

Mobile Experience: You should be able to study on your phone as easily as a desktop. If the dashboard is clunky on mobile, you won't use it during small pockets of free time.

Kartik’s Insider Tip: Understanding Online vs. In-Person Real Estate Schools in CA: Pros & Cons is the first step in narrowing your search.

Student Support — The Hidden Differentiator

Most students don't think about support until they are stuck on a complex concept or facing a technical glitch. In practice, most preventable delays come from certificate processing issues or unanswered support tickets—not from course difficulty. This is where budget schools usually cut corners.

What "Good" Support Looks Like

Content Support: Access to instructors who can explain the why behind the question.

Published Response-Time Standard: A professional school should set clear expectations. Ideally, you receive a human response within one business day.

Technical & Admin Help: Assistance with DRE applications is just as important as the coursework.

Real-World Scenario: Imagine you have a tech issue the night before a self-imposed deadline. If the school has no support or escalation path, you lose your momentum.

Before you pay, run the Support Test today. Email a specific question about the California exam. You’ll know who’s real pretty quickly.

Understanding What Matters Most When Choosing a Real Estate School often comes down to who is there to pick up the phone when you’re confused.

Exam Readiness & Pass Rate Transparency

"99% Pass Rate!" is a common marketing headline, but these numbers are often noise. To find the truth, you must look for exam readiness transparency.

The DRE does not publish a public school-by-school pass-rate leaderboard, so most pass-rate claims you see are self-reported. To verify these claims, ask these questions:

Which exam does this rate refer to? Is it the school final or the actual California State Exam?

What is the time period and sample size?

Is it first-time test takers only?

Are "inactive students" excluded from the denominator?

If they won’t define the metric, treat it as a marketing number.

If a school cannot provide a clear methodology, look at The 10 Biggest Differences Between California Real Estate Schools to see how they stack up in areas like practice exam quality. High-quality practice exams with detailed rationales are a better predictor of your success than a vague marketing percentage.

The Quality Scorecard

If you want a full shortlist approach, start with Best California Real Estate Schools and then apply this rubric to your top choices.

Category

What to Look For

Score (0–2)

Format Fit

Matches your schedule and learning style.

/2

Mobile UX

High-quality interface on all devices.

/2

Support Speed

Human response within 24 business hours.

/2

Assessment Quality

Practice exams mirror state exam difficulty.

/2

Transparency

Clear extension, refund, and pass-rate policies.

/2

Total Score

/10

8–10: High-confidence choice.

6–7: Acceptable, but verify support and practice exam quality before paying.

0–5: High risk; likely to cost you more time and money in the long run.

Before you commit, it helps to know How to Compare California Real Estate Schools (Step-by-Step Guide) so you can compare apples to apples.

FAQ (California‑Specific)

Q: Does DRE approval guarantee quality?

A: No. It only means the school meets the minimum legal requirements. It says nothing about the quality of the teaching or support.

Q: What support do I need if I work full‑time?

A: You need a school with a published response‑time standard—the ability to get a clear, helpful answer waiting for you the next morning.

Q: How long should the courses take realistically?

A: While the legal minimum is 7.5 weeks, most working adults take 10–16 weeks to finish without rushing and truly master the material.

Wrapping it Up

Choosing a school is the first business decision you make as a future agent. Don't base it on the lowest price; base it on the highest probability of success.

12 Questions to Ask Any California Real Estate School

Use this list to separate schools with real systems from schools with good sales pages. Copy and paste these into an email or ask them over the phone:

Can I see a sample lesson and the actual student dashboard today?

What does the mobile experience look like for quizzes and videos?

What’s your average response time for student questions?

Do you offer phone support, or only email/tickets?

What hours is support available (evenings/weekends)?

If my certificate doesn’t generate, what’s the escalation path?

How long do I have to finish each course? What do extensions cost?

What’s your refund policy in plain English?

What practice exams do you provide—and do they include rationales?

Is exam prep included, or sold separately?

When you say “pass rate,” which exam is that—and what’s the methodology?

If I fail the state exam, what’s your remediation or study plan?

|

If you are currently researching how to get your real estate license, you’ve likely noticed that most programs look similar on the surface. They all offer the required 135 hours of pre-licensing curriculum, Read more...

If you are currently researching how to get your real estate license, you’ve likely noticed that most programs look similar on the surface. They all offer the required 135 hours of pre-licensing curriculum, and they all promise to help you succeed. However, the biggest hidden variable in your success isn't the syllabus—it’s what happens when you get stuck.

In over 20 years of preparing students for the California Department of Real Estate (DRE) exam, I have seen a consistent pattern: students don’t usually fail because the material is "too hard." They fail because they encounter a confusing concept, can’t get a clear answer, and their momentum dies.

As a practicing real estate broker, I regularly see how academic theory meets the high-stakes reality of commercial and residential transactions. That bridge between the textbook and the "street" is built by your instructor.

While a DRE-approved real estate school is the baseline for legal compliance, high-quality instruction is the multiplier that turns "hours completed" into "exam-ready understanding." This guide provides an objective framework to help you evaluate instructor support before you spend a dime on tuition.

What California Real Estate Instructors Actually Do (Beyond "Teaching")

In a self-paced world, some believe an instructor’s only job is to read slides. In reality, an elite instructor functions as a bridge between dense legal text and a passing score. Their role includes:

Clarifying High-Stakes Concepts: Topics like agency relationships and trust fund handling are nuanced. An instructor should provide the "why" behind the law, often using a "Deal Autopsy" approach—breaking down exactly why a specific contract clause exists.

Correcting Misconceptions: It is common for students to "calcify" a wrong idea early. Instructors catch these errors—like the difference between a fixture and personal property—before they lead to missed questions on the state exam.

Teaching Exam Strategy: The DRE writes questions in a specific way. Instructors show you how to identify "distractor" answers and decode the logic of the exam.

Providing Real-World Context: Understanding how a $12 million lease negotiation hinges on a single "Exclusive Use" clause makes the theory of contracts much easier to memorize.

Maintaining Momentum: Knowing you have a lifeline reduces the friction of studying, making it more likely you’ll actually finish the 135-hour requirement.

The 5-Part “Instructor Quality Scorecard”

When you choose a real estate school in California, use this rubric to grade their support model:

Criteria

What to Look For

Access Model

Does the school offer live Q&A, scheduled office hours, or direct messaging?

Response Time

Will you get an answer within 24–48 business hours, or do questions sit for a week?

Explanation Depth

Do they provide a personalized explanation, or just point you to a page number?

Exam Alignment

Can the instructor map your confusion to how the topic is framed on the state exam?

Consistency

Is help available for all three required courses (Principles, Practices, and Elective)?

Verification Questions to Ask Before You Enroll

"If I don’t understand the math for a prorated tax question, who can I talk to?"

"Are your instructors active brokers with California-specific experience?"

"Can I see a sample of a recent Q&A session or instructor-led webinar?"

Identifying "Bad Support" Patterns

You should be wary of schools that treat instructional support as an afterthought. Common red flags include:

The Black-Hole Inbox: You email a question and receive no response, or a generic "read chapter 4" reply.

Technical-Only Support: The school is great at fixing login issues but has no one available to explain the "Rule against Perpetuities."

"Forum-Only" Help: You are forced to rely on other students in a forum who may be just as confused as you are.

No Support for Working Adults: If office hours are only held during business hours, they aren't helpful for students with full-time jobs.

Instructor Support vs. Self-Paced Learning

Self-paced models can work for students with a background in law or finance. However, you should prioritize a school with high instructor access if:

This is your first time taking a professional licensing exam.

It has been several years since you were in a traditional classroom setting.

English is your second language (ESL).

How Support Translates to Exam Readiness: Real Scenarios

To illustrate the difference, consider these real-world scenarios handled by instructors:

The "Smart Fridge" Trap: A student is confused about the difference between fixtures and personal property. We share a real-world example where an agent wrote "All appliances included" instead of specifying the brand-new smart fridge, leading to a major dispute at closing. This story makes the "Method of Attachment" test (MARIA) unforgettable for the exam.

The $15,000 Disclosure Error: We often discuss a scenario where a missing disclosure cost an agent $15,000 in a settlement because they lacked broker review. This emphasizes the "Agency" and "Disclosure" sections of the exam, showing students that these aren't just definitions—they are career-saving protocols.

The Complex Lease: When students struggle with contract clauses, we look at how an "Exclusive Use" clause can make or break a commercial deal. Seeing how a high-stakes deal (like securing an art studio for an Academy Award winner) depends on contract clarity helps students master the "Contracts" portion of the pre-licensing curriculum.

The "Crash Course" Factor: While a CA real estate exam pass guarantee sounds nice, the instruction leading up to the test is what sticks. Often, crash courses worth it in California are only effective if you’ve had solid instructor support during your initial 135 hours.

Final Thoughts on School Choice

DRE approval is the legal minimum; instructor access is the variable that determines whether you pass efficiently or get stuck in a cycle of retakes. As you evaluate the Best Real Estate Schools in California, don't just look at the price tag—look at the experience behind the curriculum.

Frequently Asked Questions

Q: Does the California DRE require schools to have instructors?

A: Yes, DRE-approved schools must have designated instructors, but the level of access varies wildly between "budget" schools and "full-service" schools.

Q: Can I talk to an instructor if I’m doing an online-only course?

A: In a quality program, yes. Online courses should still offer "office hours" or a dedicated messaging system where licensed instructors answer questions.

Q: How much does instructor support usually cost?

A: At most reputable schools, it is built into the tuition. Be cautious of schools that charge "per question" or require a secondary subscription for access to live help.

|

You’re staring at your 45-hour renewal options and you notice a new line item: “Implicit Bias Training.”

The real question isn’t what it is—it’s whether missing it can delay your renewal.

Read more...

You’re staring at your 45-hour renewal options and you notice a new line item: “Implicit Bias Training.”

The real question isn’t what it is—it’s whether missing it can delay your renewal.

For California renewals tied to the post–January 1, 2023 CE rules, Implicit Bias is a mandatory DRE-required topic—and the only “gotcha” is how it must appear on your CE completion records depending on whether this is your first renewal or a later renewal.

This guide clarifies the rules so you can renew your license without a rejection.

Quick Answer: Do I Need This?

Yes. Implicit Bias Training is required as part of California’s renewal CE.

Requirement: 2 hours of DRE-approved Implicit Bias Training.

Does it add hours? No—it's part of your required 45 hours (not extra).

Key difference: First-time renewals must complete a standalone 2-hour Implicit Bias course. Subsequent renewals can satisfy it via the 9-hour survey course or by taking the mandatory topics as individual courses.

Related Resources:

California Real Estate License Renewal Guide

California Real Estate License Renewal Requirements (2026)

Why Is This Required? (SB 263)

This requirement comes from California’s CE rule updates implementing Senate Bill 263, which added a two-hour implicit bias training component and expanded the survey/update course to nine hours to cover the mandatory topics.

The curriculum focuses on understanding historical and systemic housing barriers and providing actionable steps to recognize unconscious bias in client interactions. The goal is risk management: protecting your license and ensuring compliance with Fair Housing laws.

The "First Renewal" vs. "Subsequent" Rule

The Department of Real Estate (DRE) has precise rules for how this training appears on your certificate. This is where most licensees make mistakes.

Scenario A: This is Your First Renewal

If you are renewing for the very first time (your 4-year anniversary), you cannot use the "survey course" shortcut. You must take separate courses.

If you are a Salesperson:

Your 45 hours must include:

Four separate 3-hour courses: Ethics, Agency, Trust Fund Handling, Risk Management.

One 3-hour Fair Housing course (with the required interactive component).

One 2-hour Implicit Bias Training course.

At least 18 hours of Consumer Protection, plus remaining hours in Consumer Protection or Consumer Service.

If you are a Broker (or Officer):

The structure is similar, but adds one more mandatory topic:

Five separate 3-hour courses: Ethics, Agency, Trust Fund Handling, Risk Management, Management & Supervision.

One 3-hour Fair Housing course (with the interactive component).

One 2-hour Implicit Bias Training course.

At least 18 hours of Consumer Protection, plus remaining hours in Consumer Protection or Consumer Service.

The Certificate Rule: You need a completion record that clearly shows "Implicit Bias Training – 2 Hours" as its own course line item.

Operator Note: If you want the full breakdown of what counts and how the DRE buckets these hours, read our guide on California Real Estate License Renewal Requirements (2026).

Scenario B: This is a Second (or Later) Renewal

For second and subsequent renewals, you have two compliant paths:

The Survey Option: Take the single 9-hour CE survey course that covers all mandatory topics (including Implicit Bias).

The Individual Option: Take the mandatory topics as individual courses instead of the survey.

Broker licensees will often ask ADHI Schools if brokers have different CE requirements in CA? A key difference is all broker licensees renewing must take a Management and Supervision course, but first time salespersons renewing do not.

Does It Count Toward My 45 Hours?

Yes. Implicit Bias is not "extra" work. It fits inside your existing bucket.

License Renewal Type

Total Hours Required

Does Implicit Bias Count?

First Renewal

45 Hours

Yes (Counts as 2 mandatory hours)

Subsequent Renewal

45 Hours

Yes (Could be taken in a 9-hr Survey course)

Late Renewal

45 Hours

Yes (Same rules apply)

To see exactly how the math works for your specific license type, check our breakdown of how many CE hours are required for CA license renewal?

"Audit-Proofing" Your Renewal

The DRE audits a percentage of renewals every month. If you are pulled for an audit simply follow the requests that the DRE makes and respond in a timely manner.

The Audit Checklist:

Check the Provider: Ensure the course provider is DRE-approved. A "Diversity Training" certificate from your other corporate job does not count. It must have an four-digit DRE Sponsor Number listed on the certificate of completion. Learn exactly what courses count toward CE in California to avoid registering for an invalid course.

Verify the Year: If you took a Fair Housing course in 2021 that didn't have the new interactive component or implicit bias module, it is invalid for a 2026 renewal.

Keep Your Records: Keep your certificates longer than you think. DRE recommends retaining CE completion certificates up to five years in case of audit, and providers are required to maintain participant records for five years.

Common Mistakes That Reject Renewals

We see licensees panic-renew 24 hours before their license expires. That is when mistakes happen.

Mistake #1: The "HR" Course. Submitting a workplace harassment or bias certificate from a non-real estate employer.

Result: Rejected.

Mistake #2: The "Old" Course. DRE rule of thumb: Continuing education credit expires four years from the course completion date, so older certificates can trigger rejection codes during renewal processing.

Mistake #3: Taking Courses From a Provider That is Not Approved. Make sure to ask for the 4 digit sponsor number of any course provider before registering.

Stay Compliant, Stay Active

Implicit Bias training is now a standard part of doing business in California. It isn't just about checking a box; it's about protecting your license and serving a diverse client base professionally.

Don't let a missing 2-hour certificate pause your career. If you are unsure exactly which courses you need based on your license status, check the full roadmap below.

California Real Estate License Renewal Guide →

FAQ

1. Can I take Implicit Bias training online?

Yes. As long as the provider is DRE-approved for correspondence or online study, you can take the course entirely online.

Does my Fair Housing course cover Implicit Bias?

No. They are separate requirements. However, if you take the 9-Hour Survey Course (for subsequent renewals), both Fair Housing and Implicit Bias are included in that single 9-hour block.

I am over 70 years old. Do I still need this?

If you are eligible for the "70/30" exemption (70+ years old AND 30 years of continuous good standing), you are exempt from all CE, including Implicit Bias. You simply submit the exemption form.

What happens if I renew late?

If you renew within your two-year grace period, the requirements are the same: you must complete the 45 hours, including Implicit Bias, before you can reinstate your license and pay the appropriate late fee.

|