It happens in a split second.

You’re negotiating a deal at 9:45 PM. The listing agent says, “My seller is worried your buyers can’t close.” To prove them wrong, you pull up your client’s Proof of Funds (POF) on your phone, take a screenshot, and text it to the listing agent.

You just sent a text containing your client’s full account number, current balance (which is $300k higher than the offer price), and home address to a third party.

That single screenshot just violated your client’s financial privacy and compromised their negotiating leverage (now the seller knows they can pay more). If that image gets forwarded or saved to an unsecured cloud, you may be blamed for the leak and exposed to discipline or civil claims.

Privacy in real estate isn’t just about being polite. It is about protecting your license from the kinds of complaints that start with “My agent gave away my personal information.”

What Counts as Confidential Client Information in California Real Estate?

Many agents think “privacy” just means not giving out the gate code. In reality, the definition is much broader. As an agent, you routinely handle private identity, financial, and negotiation information that can harm a client if mishandled.

The Four Big Categories:

- Identity & Contact Info: Names, personal email addresses, phone numbers, and current home addresses.

- Financials: Bank statements, 401(k) balances, credit score screenshots, and pre-approval letters with specific conditions.

- Negotiation Strategy: Motivation ("They have to move by June"), bottom line ("They'll take $850K"), or urgency ("They're divorcing").

- Transaction Documents: The purchase agreement itself, counter-offers, and transfer disclosure statements (TDS).

Safeguarding this data is a critical part of real estate practice. Understand the statutory framework that governs these responsibilities. Review the California Real Estate Laws & Compliance Guide, which outlines the baseline for agency relationships and duty of care.

What Can I Share With the Listing Agent?

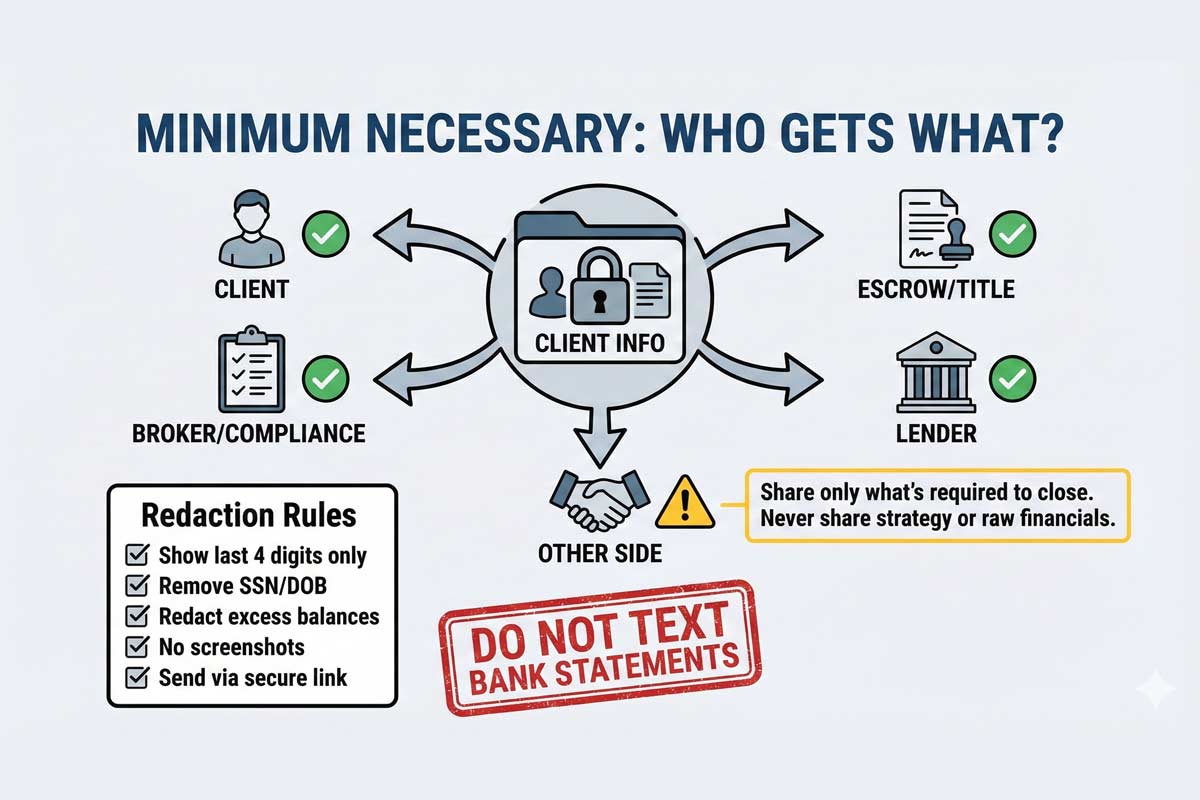

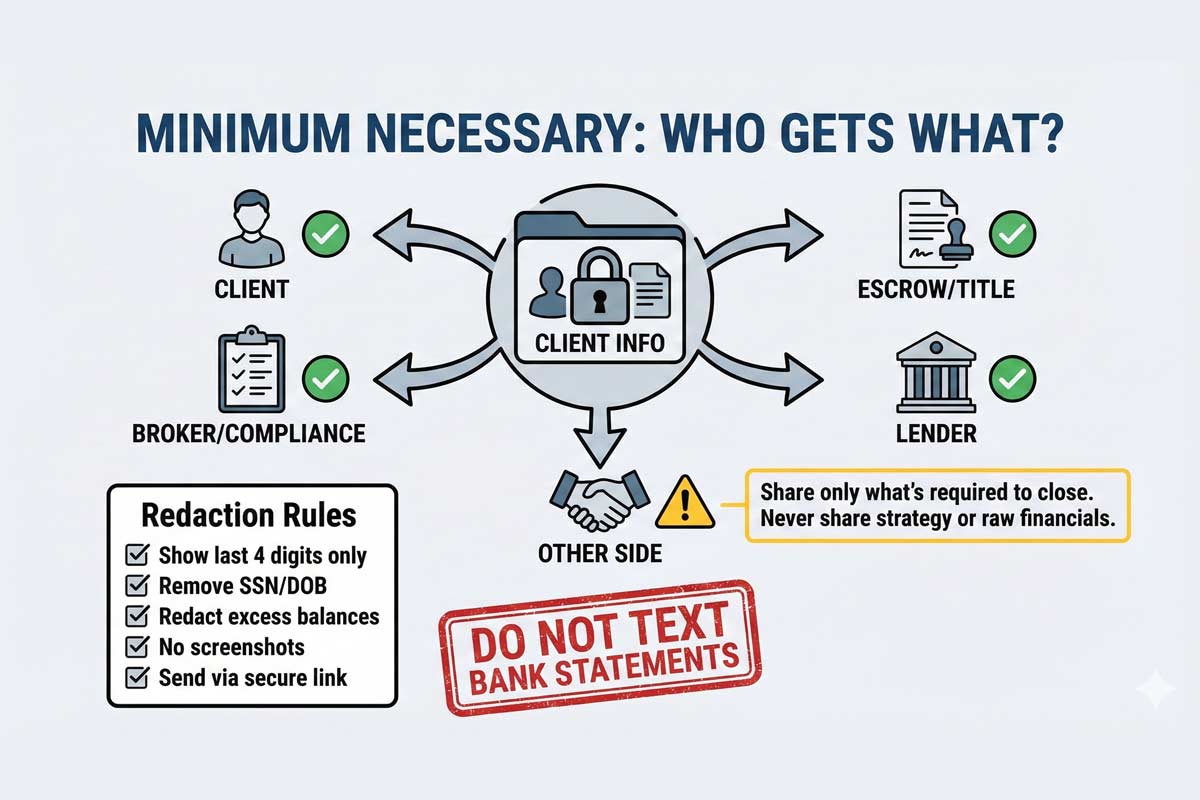

The guiding principle for privacy is "Minimum Necessary." Share only what’s necessary to move the transaction forward, only with parties who need it, and never share strategy or financial details without explicit client authorization.

Who is a "Need-to-Know" Party?

- Client(s): The principal.

- Broker / Office Compliance: For file review and oversight.

- Escrow / Title: As needed to open orders and clear title.

- Lender: As needed for funding conditions.

- Appraiser / Inspector: Only access/property details required for their job.

- Other Side’s Agent: Minimum necessary to close; never client strategy.

The Golden Rule: If it helps your client’s position and you have permission, share it. If it hurts them or they haven’t authorized it, keep it private.

| DO |

DON'T |

| DO share the pre-approval letter (after redacting sensitive info). |

DON'T forward a raw bank statement showing account numbers. |

| DO redact account numbers and excess balances before sending. |

DON'T send full bank statements or unedited screenshots. |

| DO use secure transaction management platforms (DocuSign, SkySlope). |

DON'T leave physical files visible in your car or on a coffee shop table. |

| DO discuss material facts about the property condition. |

DON'T discuss your client’s divorce or job transfer as “negotiating leverage” without written consent. |

Strict adherence to these boundaries is not optional

It is rooted in your Ethical Duties Under the California Business & Professions Code, which mandates that agents treat all parties with honesty while maintaining loyalty to their principal.

Can I Share Proof of Funds With the Listing Agent?

Yes, but you must do it carefully to balance credibility with privacy.

- When it’s appropriate: To prove your buyer has the ability to close, especially for cash offers or large down payments.

- What to send: A redacted bank statement or a letter from the financial institution stating "verified funds in excess of purchase price."

- What NOT to send: Unedited statements, screenshots from your phone, or documents showing the client’s total net worth far beyond the purchase price.

- How to send: Upload to a secure transaction platform or send a password-protected PDF link; avoid standard email attachments if possible.

Proof of Funds: What to Redact (And What Not to Send)

Sending unredacted financial documents is one of the most common ways agents expose their clients to identity theft and negotiation loss.

Redaction Rules That Are Non-Negotiable:

- Black out account numbers: Show the last 4 digits only.

- Black out SSN/DOB: They should not be visible in anything you transmit to the other side.

- Remove full balances: Show only the amount needed to support the offer’s funding story (cash to close or down payment + reserves), and redact excess.

- Remove home address: Unless necessary for the lender, black it out.

- Convert to PDF: Never send screenshots; they are unprofessional and harder to secure.

- Rename the file: Add "REDACTED" to the filename so you know it’s the safe version.

The 5 Most Common Privacy Failures (And the Fix for Each)

In 20+ years of training California agents, I’ve seen that most privacy violations aren't malicious—they are sloppy.

1. The "Forward" Button Fiasco

- What happens: You forward an email chain to the lender or other agent, forgetting that three emails down, your client vented about their bottom line.

- Why it’s risky: You just handed the other side your playbook.

- Do this instead: Never forward chains. Start a new email. Copy-paste only the relevant text.

2. The Unredacted Proof of Funds

- What happens: You send a bank statement showing $1.2M in liquid cash when the offer is only $900k.

- Why it’s risky: The seller now knows your buyer can pay full price, weakening your client’s bargaining position.

- Do this instead: Redact strictly. Only show enough funds to cover the down payment and closing costs.

3. The Screenshot Camera Roll

- What happens: You take photos of checks, IDs, or docs. They save to your personal camera roll, which backs up to your family iCloud.

- Why it’s risky: Your client’s IDs, account numbers, and private financial info are now mixing with your vacation photos.

- Do this instead: Use a scanning app that saves directly to a secure drive or your transaction platform (e.g., SkySlope) and does not save to the camera roll.

4. The Accidental Group Text

- What happens: You start a group text with the lender, escrow, and buyer, then accidentally add the Listing Agent to discuss repairs.

- Why it’s risky: You might accidentally reveal your client’s desperation or strategy to the opposing negotiator.

- Do this instead: Avoid group texts for strategy. Keep sensitive discussions verbal or in one-on-one emails.

5. Sloppy Fact Transmission

- What happens: You are managing five deals and accidentally send Client A’s counter-offer to Client B, or mix up their repair requests.

- Why it’s risky: Failing to verify what you share is a primary way to learn How to Avoid Misrepresentation in CA Transactions the hard way.

- Do this instead: Verify the source and accuracy of every fact before you hit send.

If You Already Messed Up: Containment Protocol

If you realize you sent sensitive info to the wrong person, act immediately.

- Ask recipient to delete: Call immediately (don't text) and ask them to delete the email/text and confirm.

- Notify broker: Inform your manager so they can prepare for any fallout. Do not try to "fix it quietly"—that's how small mistakes become disciplinary events.

- Notify client: Be professional and brief. "I inadvertently sent X to Y. I have asked them to delete it."

- Document it: Keep a log of what happened and who received it.

- Change access: If you sent a link to a folder, rotate the link or revoke access immediately.

Dual Agency: Confidentiality Rules That Will Get You Disciplined

Privacy becomes mission-critical when you represent both the buyer and the seller. Dual agency is where confidentiality mistakes happen fastest.

The Sealed Envelope Rule

Treat confidential strategy like it’s in a sealed envelope. You don’t open it for the other side. Information about material facts (the roof leaks) must flow freely. Information about price, terms, and motivation must stay sealed.

Mini Scenario:

Your buyer asks, "Why are they selling?"

Risky Answer (reveals confidential motivation): "They are getting divorced and need cash fast."

Safe Answer: "I can’t discuss the seller’s personal motivations, but I can address objective terms: timing, possession, and contingencies."

For a deeper dive into the specific disclosures and boundaries required here, refer to our Dual Agency in California (Legal Guide).

The Paper Trail & Systems: Your Privacy Operating Procedure

You need a repeatable system so you don't have to think about privacy—you just execute it.

Privacy Checklist Before You Hit Send:

Your SOP

- Centralize Docs: All documents live in your transaction management platform.

- Naming Conventions: Name files clearly (e.g., "123_Main_St_POF_REDACTED.pdf") so you don't attach the wrong version.

- Device Security: Enable 2-Factor Authentication (MFA) on your email. Your email is the master key to your client’s data.

Privacy is License Protection

Privacy is not about secrecy; it is about security. When you treat your client’s information with care, you build trust and maintain a clean file.

Tighten your systems. Redact the account numbers. Follow your broker's policy.

Protect the file, and the file will protect you.

(Note: General education only; follow your broker’s policies and consult counsel for specific legal questions.)