Imagine it’s 7:42 PM on a Tuesday. You are the listing agent on a home in Los Angeles and your phone is buzzing non-stop. You have nine offers in your inbox, three agents texting you for a "verbal status," and a seller who is overwhelmed and asking:

"Can we just pick the highest one and be done?"

This is the moment where careers are made or broken.

In a hot market, multiple offer scenarios are a standard pressure test. They are also a frequent trigger for disciplinary action because, under pressure, agents often cut corners. They might get sloppy with communication, inadvertently "shop" an offer, or fail to present every option clearly. To survive this without risking your license, you need a system rooted in the California Real Estate Laws & Compliance Guide.

You need a process that protects you and serves your client. Here is exactly how to handle the multiple-offer pressure cooker without crossing legal lines.

Let’s start with the absolute baseline. Under California fiduciary duties, a listing agent is expected to present offers and counteroffers promptly and diligently unless the seller has previously directed the agent otherwise in writing.

It doesn’t matter if the offer is $50,000 under ask. It doesn’t matter if it’s written on a standardized form or a less formal document—if it is a bona fide offer, the seller needs to see it.

Agents often get into trouble here by "pocketing" lowball offers because they don't want to waste their time. That is a violation of your fiduciary duty. To understand the risks of filtering information, read our guide on How to Avoid Misrepresentation in CA Transactions, which details why you must never lie about the existence or number of offers to drive up the price. If you claim you have five offers, you must actually have five offers in hand.

When you are juggling six different offers, relying on your memory is a recipe for disaster. You need a standardized way to present data to your client so they can make an informed decision based on facts, not just the purchase price. There are so many components in determining what constitutes a “good” offer and certainly price is one piece of the puzzle, but what about downpayment? What about credit score? What about the “certainty of close”?

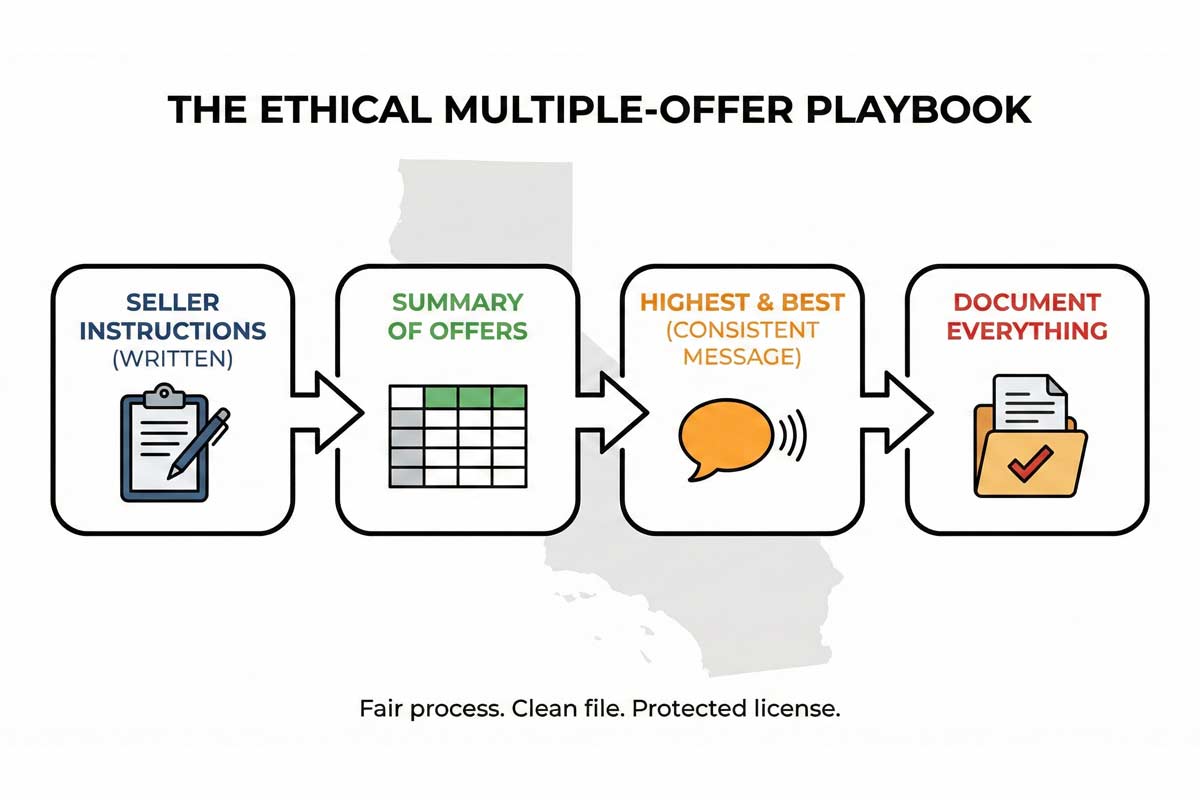

Before you even respond to the first agent, get the seller’s game plan in writing. Do they want to counter everyone? Do they want to accept the best one immediately? Do not act on a verbal "just handle it."

I teach my agents to build a "Summary of Offers" spreadsheet for the seller. It should include:

By stripping the emotion out, you help the seller see the net value. A higher offer with no lender commitment and 45-day contingencies is often worth less than a slightly lower, fully underwritten offer with a 10-day close.

Once you have reviewed the initial batch, you rarely accept one outright. You usually issue a Seller Multiple Counter Offer (SMCO).

This is where the ethics get tricky. You must treat all potential buyers fairly. You cannot give one agent a "heads up" on the price to beat while keeping the others in the dark. Your Ethical Duties require you to treat all parties honestly and fairly, even if you strictly represent the seller.

Buyer’s agents will ask you: "What do we need to write to get it?" or "What is the top offer right now?"

Be very careful. In California, offer terms are not automatically "confidential" unless the parties have a written confidentiality agreement—but disclosure still needs to be seller-directed, truthful, and applied consistently to avoid misrepresentation or favoritism.

If you tell Agent A that the high mark is $850k, and they bid $855k, you have effectively "shopped" the other buyer’s offer without giving them a chance to respond.

The Safer Approach: Communicate to all parties: "We have multiple competitive offers. The seller is requesting your highest and best offer by 5:00 PM tomorrow. Please maximize your price and tighten your terms."

When the heat turns up, it is tempting to leverage one buyer against another by sharing details. "Hey, I have an offer from a cash buyer, so you need to waive your appraisal."

Is that true? Or are you bluffing? If it’s true, you are likely safe (provided you have seller permission). If you are bluffing, you risk serious liability for misrepresentation and deceit.

Furthermore, you need to protect the data. You are collecting proof of funds, bank statements, and pre-approval letters. Adhering to strict Privacy Rules for Managing Client Information means you generally should not disclose the specific financial details or identity of a competing buyer to other agents. Keep those bank statements redacted or hidden when you are reviewing terms with anyone other than your client.

The most dangerous scenario in a multiple-offer situation is when you represent one of the buyers.

You are now a Dual Agent. You have a listing with five offers, and one of them is yours. The other agents will immediately suspect foul play. They will assume you are guiding the seller toward your buyer to increase your commission.

The risks multiply when you are navigating Dual Agency in California. If another offer fits the seller’s criteria better, your job is to present that clearly and document the seller’s decision—even if it’s not the outcome you’d personally prefer.

When the market is moving fast, you don't rise to the occasion; you fall to the level of your training.

If you don't have a systematic way to log, present, and counter offers, you will eventually make a mistake. You will forget to respond to an agent, or you will accidentally disclose a price cap when you shouldn't have.

Work with your broker or manager to create your spreadsheet template today. Script your "highest and best" response today. When that Tuesday night rush comes, you won't be panicking—you’ll be executing.

Note: This article is general education, not legal advice; when in doubt, follow your broker’s policy and get broker/legal guidance.

Why DRE Accreditation Matters More Than Online Reviews

Identification Requirements for the CA Exam

What to Bring to the California Real Estate Exam: Your Essential Checklist

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.