You’ve spent weeks staring at practice real estate exams and memorizing the difference between joint tenancy and community property.

You passed.

You have that provisional sense of accomplishment. But here is the unvarnished truth: Passing the California real estate exam tested your memory. Choosing your brokerage will test your judgment—and the wrong choice can be more expensive than a failed test.

In California, your broker is your supervisor. Your brokerage isn't just a place to hang your license; it is a professional partnership where they are responsible for your conduct and you are responsible for their reputation. This interview is a risk audit.

Imagine this: It’s 8:00 PM on a Thursday. You’re in your first escrow. The buyer’s agent is screaming about a missed disclosure deadline on the Transfer Disclosure Statement (TDS). If you miss this window, you risk triggering cancellation disputes, the potential loss of your client’s deposit, a DRE complaint, and significant professional liability. You call your broker. It goes to voicemail. You call the office manager. No answer. You are alone, and your license is on the line.

New agents don’t fail because they lack “hustle.” They fail because they lack structured support. This guide is designed to transform you from a nervous applicant into a confident investigator.

Do not walk into the office until you have these items in your hand:

Before you step into an office, you need to know who you are talking to. Not every brokerage is built for a rookie. First, you must Decode the Model. Is this a training-centric firm, a “desk-fee farm,” or a high-volume team? If you aren't sure which path fits your personality, stop and read Should You Join a Team or Go Solo before you schedule the meeting.

Next, scan for online red flags. Look at their social media. Are they constantly recruiting “unlimited potential” but showing zero photos of actual training sessions? For a deeper dive into the specific warning signs I’ve seen over the last 20 years, see our guide on Red Flags When Choosing Your First Brokerage.

REALITY CHECK: Policy Varies, Presence Doesn't Exact review gates vary by brokerage based on their specific insurance requirements and workflow, but the presence of these gates is non-negotiable. If there is no formal checkpoint, you are flying without a parachute.

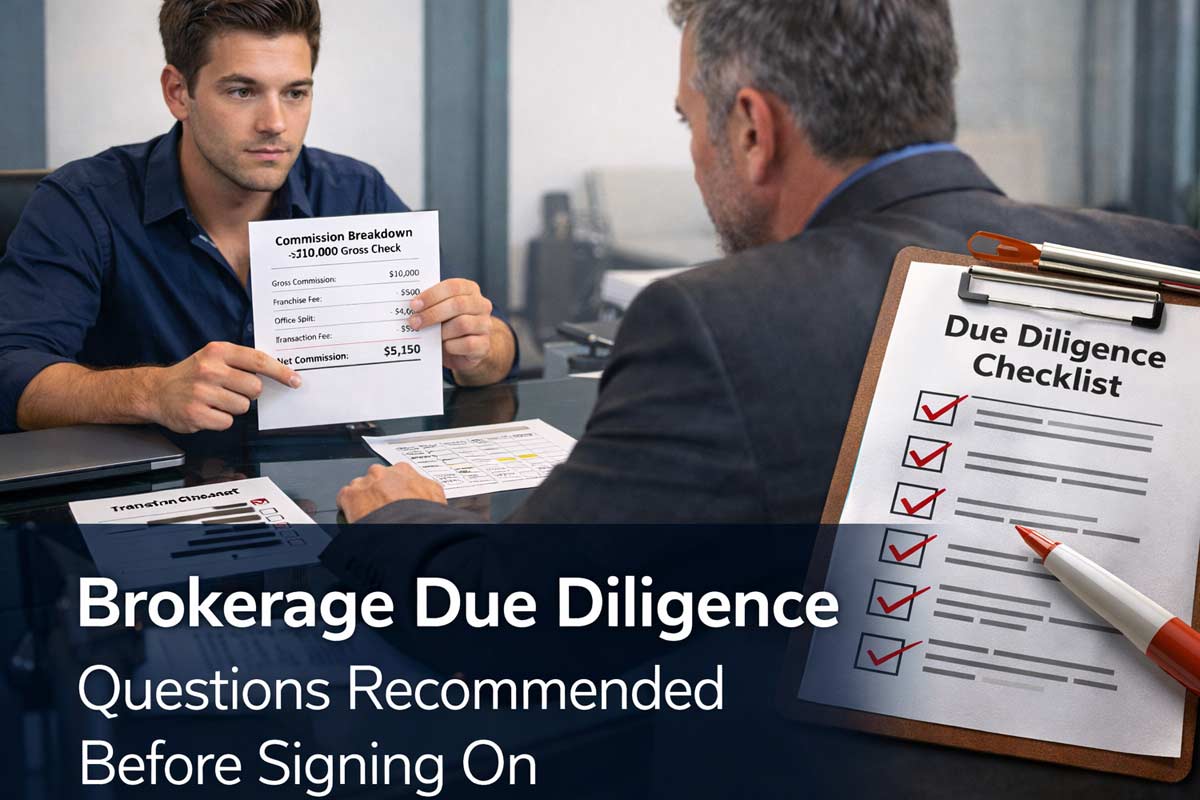

CRITICAL: If you don’t understand how “off-the-top” fees can gut your paycheck, stop and read Commission Splits Explained for New Agents before you sign anything.

REALITY CHECK: Lead Ownership Trap (Teams) I’ve seen agents join a team and bring in a $1.2M listing from their own cousin. Because they hadn't audited the agreement, the team leader took 50% despite providing zero help. Worse, when the agent left, the leader claimed "ownership" of the cousin in the CRM. Audit your lead ownership before you sign.

Group these into your notes to pressure-test their operations.

Walk out of the room if they cannot provide these four things:

If you are comparing two brokerages, lay their proof side-by-side and compare only these four data points:

Grade each brokerage from 1 (Poor) to 5 (Excellent) in these categories:

The Walk-Away Rule: If Training, Broker Access, or Compliance average below a 4, do not join. No split compensates for a failed deal, a DRE complaint, or a damaged reputation in your first year.

Now that you know how to audit a firm, see our list of the Best Brokerages for New Agents in California to see who tends to score well on these criteria.

The brokerage you choose is the most important business decision of your first year. Treat it like a million-dollar acquisition. Once you have chosen the right supervisor to protect your license, your next step is to master the roadmap to actually close deals. Follow our sequence to Start a Real Estate Career in California correctly.

What if no brokerage in my area meets a “4” on the scorecard? Keep looking. In major California markets, there are hundreds of options. If you must compromise, never compromise on Broker Access or Compliance. You can buy your own training, but you cannot buy protection from a DRE audit or a ruined reputation.

What should I email the broker after the meeting if they didn’t provide proof? Send this: "Thank you for the time today. To help me make my final decision, could you please email over the written fee schedule, the $10,000 commission breakdown example, and the training syllabus for next month that we discussed?"

In the event of a claim, am I always responsible for the E&O deductible? Usually, yes. It can range from $1,000 to $5,000 or more. You need to know this number upfront so you can budget for it in your "keep the lights on" plan.

Should my broker review offers before submission in California? Yes. While the DRE allows for various supervisory structures, it is a professional best practice to have a broker or manager review your first several offers and disclosure packets to protect your license and your client.

How do I verify training is real? Ask to be a guest. A brokerage with a strong training program is proud to show it off. If they claim it is "proprietary" and can only be seen after you sign a contract, they are likely hiding a lack of substance.

Common Mistakes Applicants Make on DRE Forms

Identification Requirements for the CA Exam

Avoiding Non-DRE-Approved Real Estate Schools in California

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.