It might start with a text message at 9:30 PM.

You have the listing. You also have a serious buyer who wants to write an offer. The buyer texts you: “I really want this house. Just tell me what number I need to hit to beat the other offers.”

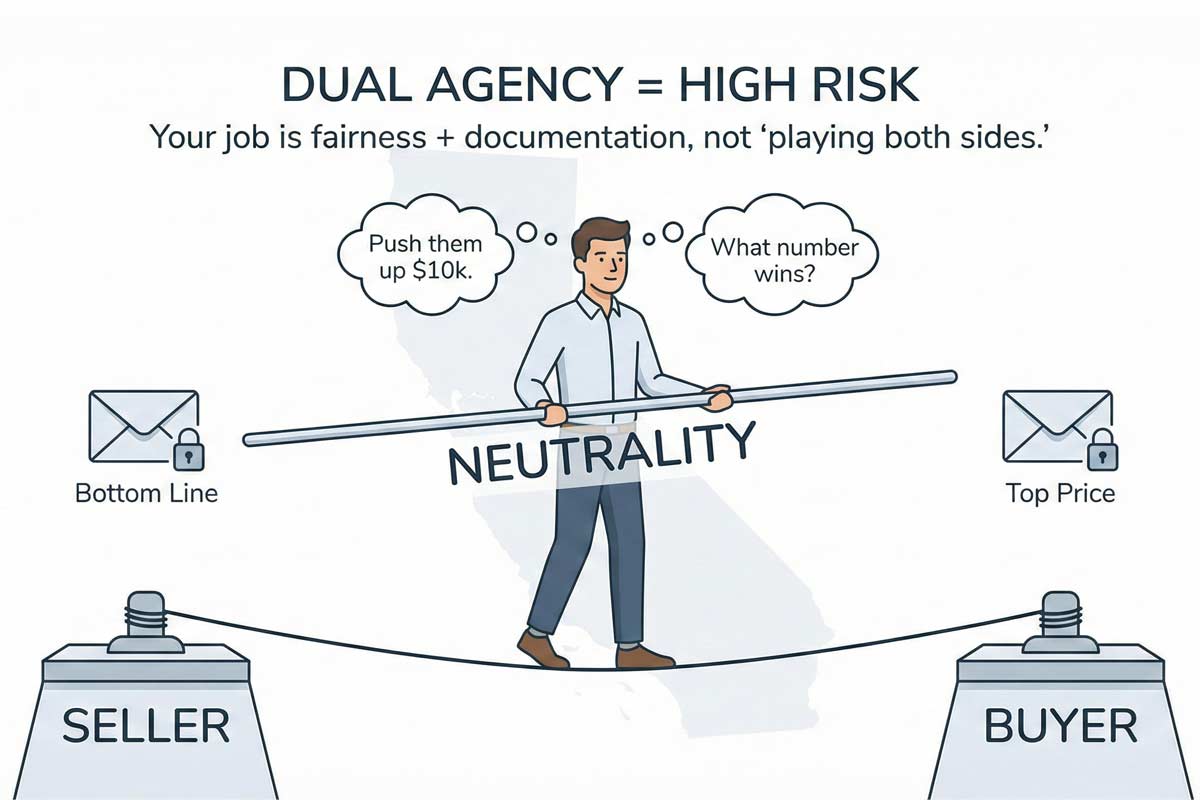

Or perhaps the seller leans across the kitchen table and whispers, “Since you’re representing that buyer, can’t you just push them up another $10k? You know they have the money.”

In that instant, you are navigating the core conflict of dual agency.

Dual agency is not just about collecting more commission. It is a balancing act where the slightest slip in confidentiality or neutrality can lead to complaints and a tarnished reputation.

In plain English, dual agency occurs when a single agent (or two agents under the same broker) represents both the buyer and the seller in the same transaction.

In a standard transaction, you are like a gladiator for your client. You fight for the best interests of your client. You use strategy, leverage, and information to win.

In dual agency, you cannot be a gladiator. You become a neutral facilitator. You still owe fiduciary duties to both parties—meaning you must protect their financial interests—but you lose the full ability to advocate for one side at the expense of the other.

Yes, dual agency is legal in California, but only with informed, written consent.

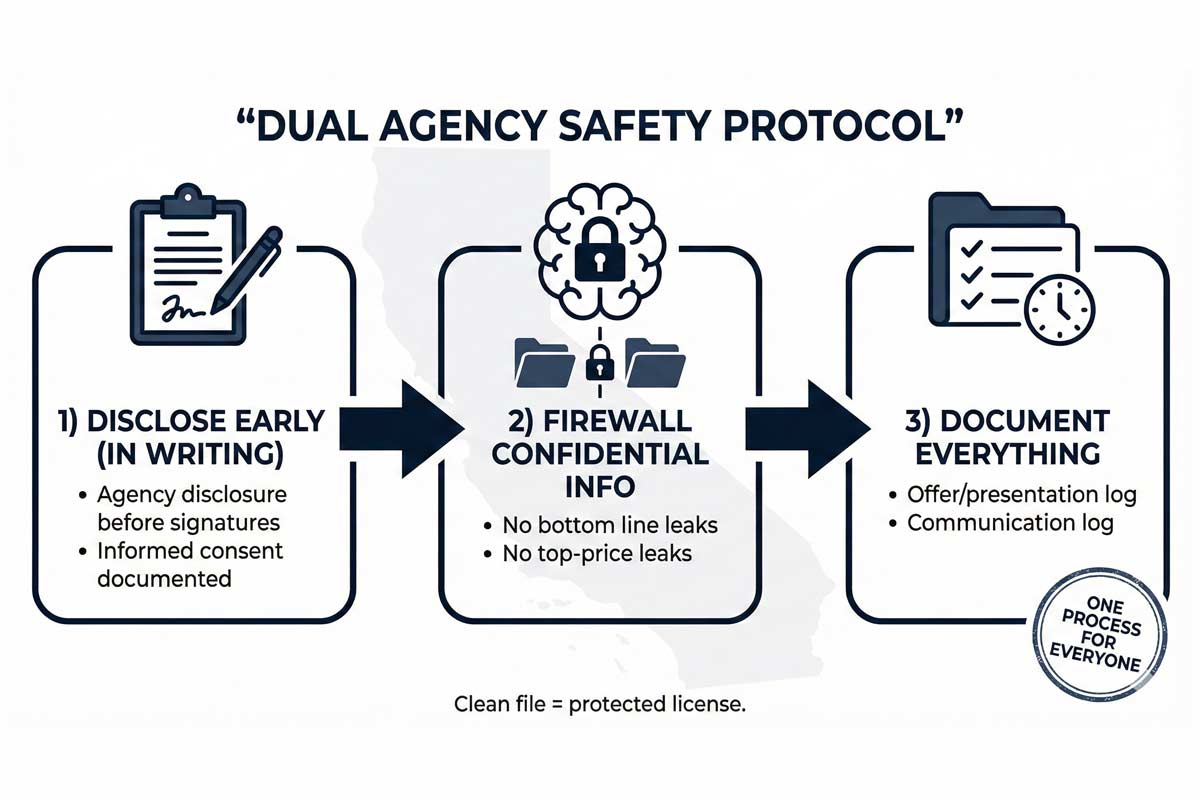

The danger isn’t the dual agency itself; the danger is sloppy disclosure. Best practice (and often required depending on the relationship and timing) is to disclose early—before signatures—so consent is informed and documented rather than rushed at the closing table.

You must provide the Disclosure Regarding Real Estate Agency Relationship (AD form) to the buyer before they sign an offer, and to the seller before they accept an offer.

If you fail to obtain this written consent properly, you may jeopardize your commission and expose yourself to discipline or civil claims. Worse, the transaction can create rescission/voidability risk depending on the facts. To navigate these waters safely, you need a strong grasp of the framework found in our California Real Estate Laws & Compliance Guide, which outlines the statutory foundation for agency relationships.

When you step into the role of a dual agent, your behavior must change immediately. You are no longer coaching one side against the other.

The Golden Rule: You owe fiduciary duties to both principals, but you must remain neutral on negotiation strategy and keep each party’s confidential bargaining info confidential unless authorized in writing.

Your obligations aren't just good manners; they are rooted in specific Ethical Duties Under the California Business & Professions Code that mandate honesty and fair dealing even when you can't advocate for price.

This is where most dual agents get into trouble. You know too much. For example, you might know the seller is super motivated because of a divorce. You know the buyer is willing to pay $50k over asking. You must firewall this information.

You must rigorously adhere to Privacy Rules for Managing Client Information, ensuring that a buyer’s financial ceiling never leaks. Practically, this means: don’t forward pre-approvals blindly, make certain that you redact account numbers, and keep documents inside your transaction system.

The risk multiplier explodes when you have a dual agency situation inside a multiple-offer scenario.

Imagine you have the listing. You have three offers from outside agents, and one offer from your own buyer client. The outside agents may immediately suspect you are favoring your own buyer to keep the full commission.

The Protocol:

When you hold the listing and also represent a buyer in a bidding war, the situation becomes volatile, requiring specific protocols for Handling Multiple Offers Ethically to ensure no party feels manipulated.

If a buyer wakes up three months later feeling they overpaid, or a seller feels they left money on the table, they will blame the dual agent. Your file should act as your shield.

Clear documentation is your best defense against accusations, helping you learn How to Avoid Misrepresentation in CA Transactions by proving exactly what was disclosed and when.

You need to know exactly what to say when the pressure is on. Memorize these to stay safe.

Scenario 1: The Seller wants you to push the buyer

Seller: "You know they have more money. Just get them up to $950k."

You: "I can certainly present a counter-offer at $950k from you. However, because I also represent the buyer, I cannot pressure them or share your confidential strategy. I can present your counter; I cannot coach either side with confidential info."

Scenario 2: The Buyer wants inside info

Buyer: "Come on, what's the lowest they'll take? I don't want to overpay."

You: "I understand, but because I am a dual agent, I cannot disclose the seller's confidential bottom line. My role is to facilitate the transaction fairly. Based on the comps we looked at, what price are you comfortable offering?"

Scenario 3: The Accusation

Buyer/Seller: "You're just pushing this deal to get a double commission."

You: "You're right to be cautious. Here's how I keep it neutral: I use a consistent process, I document every communication, and I have my broker oversee the file. If you prefer separate representation, we can absolutely arrange that."

Scenario A: The Simple Transaction

Situation: You represent the seller. An unrepresented buyer calls from the sign, views the home, and wants to write an offer.

Compliant Action: You immediately present the Agency Disclosure form. You explain you will be a dual agent. You recommend they seek independent representation if they want advocacy, because as a dual agent you cannot advise them the same way. If they proceed, you write the offer exactly as dictated, without suggesting a price.

Scenario B: The Material Fact

Situation: You are a dual agent. The seller tells you, "The basement floods in heavy rain, but don't put that on the Transfer Disclosure Statement."

Compliant Action: You explain to the seller that material facts must be disclosed by law. If the seller refuses, you cannot hide it. You must disclose the flooding to the buyer. Your duty of honesty overrides the seller's instruction to conceal defects.

Dual agency is not for the faint of heart, and it is certainly not for the disorganized. It requires a rigid adherence to procedure. You must separate your knowledge, document your steps, and prioritize the integrity of the transaction over the commission check.

Follow your broker’s policy.

Protect the file.

When done poorly, dual agency is the fastest way to create a complaint you can’t explain away.

(Note: General education only; follow your broker’s policies and consult counsel for specific legal questions.)

Common Mistakes Applicants Make on DRE Forms

Avoiding Non-DRE-Approved Real Estate Schools in California

California Real Estate Exam Rules & Testing Policies

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.