You passed the real estate exam, joined a brokerage, and ordered business cards. Week one feels like an adrenaline rush of “limitless potential.” By week four, the anxiety sets in. You’re staring Read more...

You passed the real estate exam, joined a brokerage, and ordered business cards. Week one feels like an adrenaline rush of “limitless potential.” By week four, the anxiety sets in. You’re staring at an empty CRM, your inbox is full of industry noise, and you haven’t had a “real” real estate conversation in days.

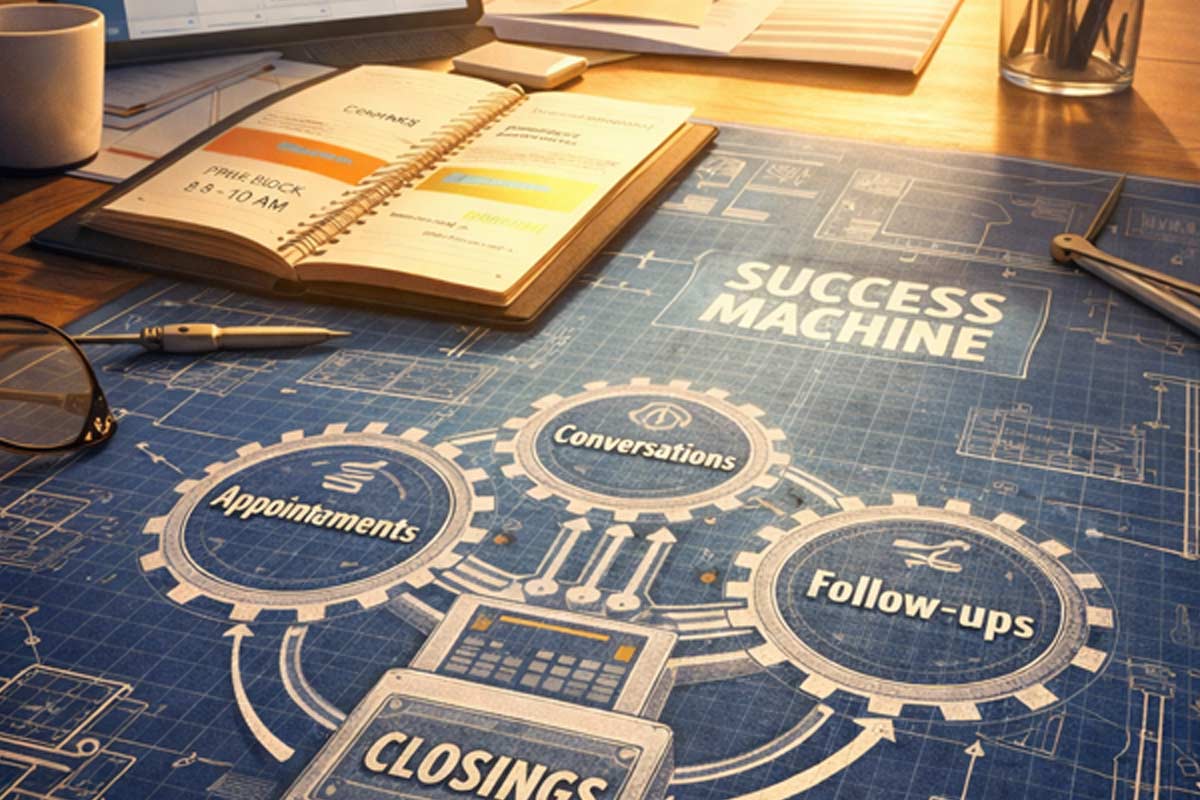

Most new agents fail here because they set outcome goals (like “I want to make $100k”) without building the machine required to produce them. In my 20+ years coaching California agents, I’ve seen the pattern: goals don’t fail because of a lack of hustle. They fail because they aren’t connected to a weekly scorecard and a daily plan.

If you want to survive year one, stop acting like an enthusiast and start acting like an operator.

The Operator Goal Stack Framework

To succeed, stop obsessing over the commission check and start obsessing over the architecture of your day.

Use the Operator Goal Stack:

Outcome Goals (The “What”): Lagging indicators like closings, GCI, or listings taken. You can’t control these directly—you can only influence them.

Input Goals (The “How”): Leading indicators: conversations, appointments set, and follow-ups completed.

System Goals (The “Machine”): Your infrastructure: protected time blocks, a weekly review, and a CRM that prevents leads from dying of neglect—starting with How to Build a Real Estate CRM That Actually Works.

Start With One 12-Week Sprint

Annual goals are too far away to create urgency. For a new agent, a year is an eternity of “I’ll start tomorrow.” Instead, operate in 12-week sprints. You get four “New Years” per year—and fast feedback loops.

Example goal sets for your first sprint:

The “Zero Database” Agent: Add 10 new contacts to your database per week through open houses, local networking, and community events.

The “Warm Network” Agent: Conduct 15 coffee chats or catch-up calls per week to re-announce your career and create referrals the right way.

Choose 3 Numbers That Matter (The Scorecard)

Stop tracking “busyness.” Remember that merely checking email does not equal work. Similarly, designing a flyer does not equal real work. For new agents, only three numbers reliably move the needle.

Metric

Weekly Target (Average)

Definition

New Conversations

40–50

Two-way conversations about real estate (sphere or new leads).

Appointments Set

1–2

A scheduled meeting (Zoom/in-person) to discuss a move timeline.

Follow-ups Completed

100+

Logged touches (call/text/email/DM) that advance a next step.

Pro Tip: These numbers are averages—not quotas. Some weeks will exceed them, others won’t. Consistency over 12 weeks is what creates results. If you aren’t hitting these averages, the problem usually isn’t the market—it’s your calendar. The Daily Habits of Top-Producing Agents are consistent because they protect the morning for these activities.

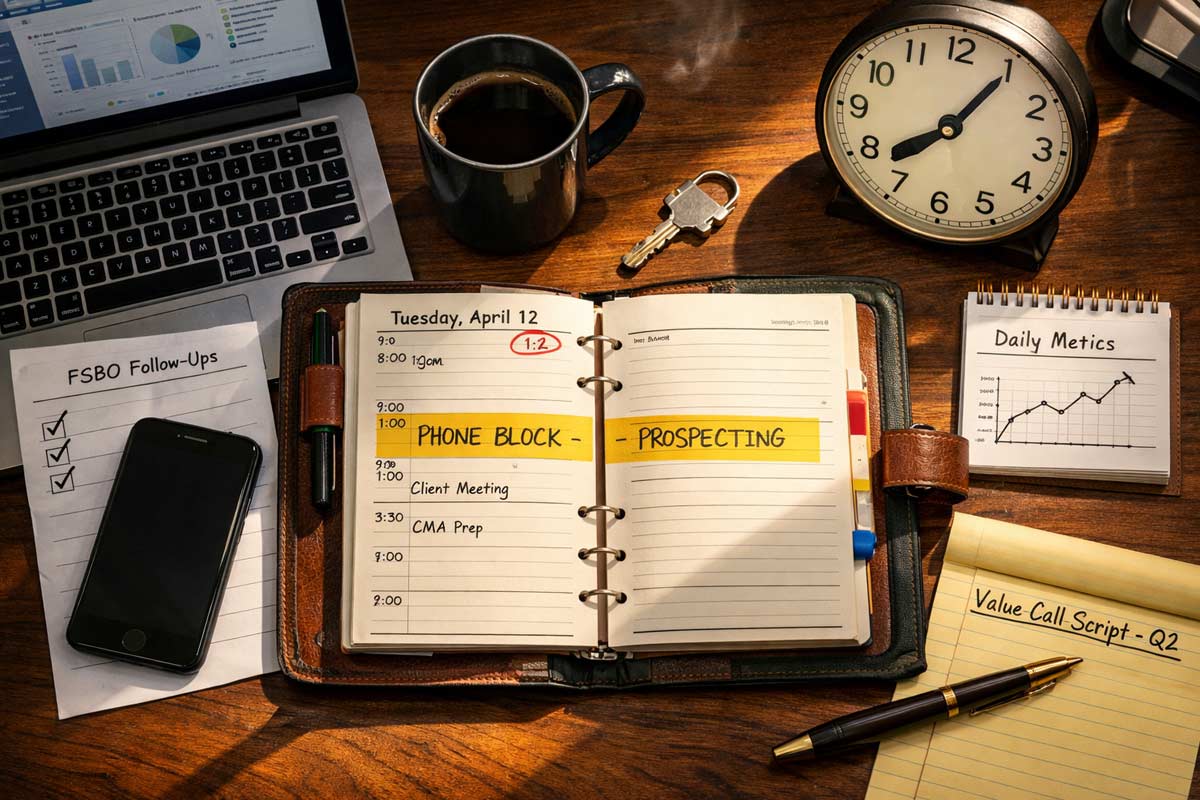

Translate Goals Into a Daily Plan

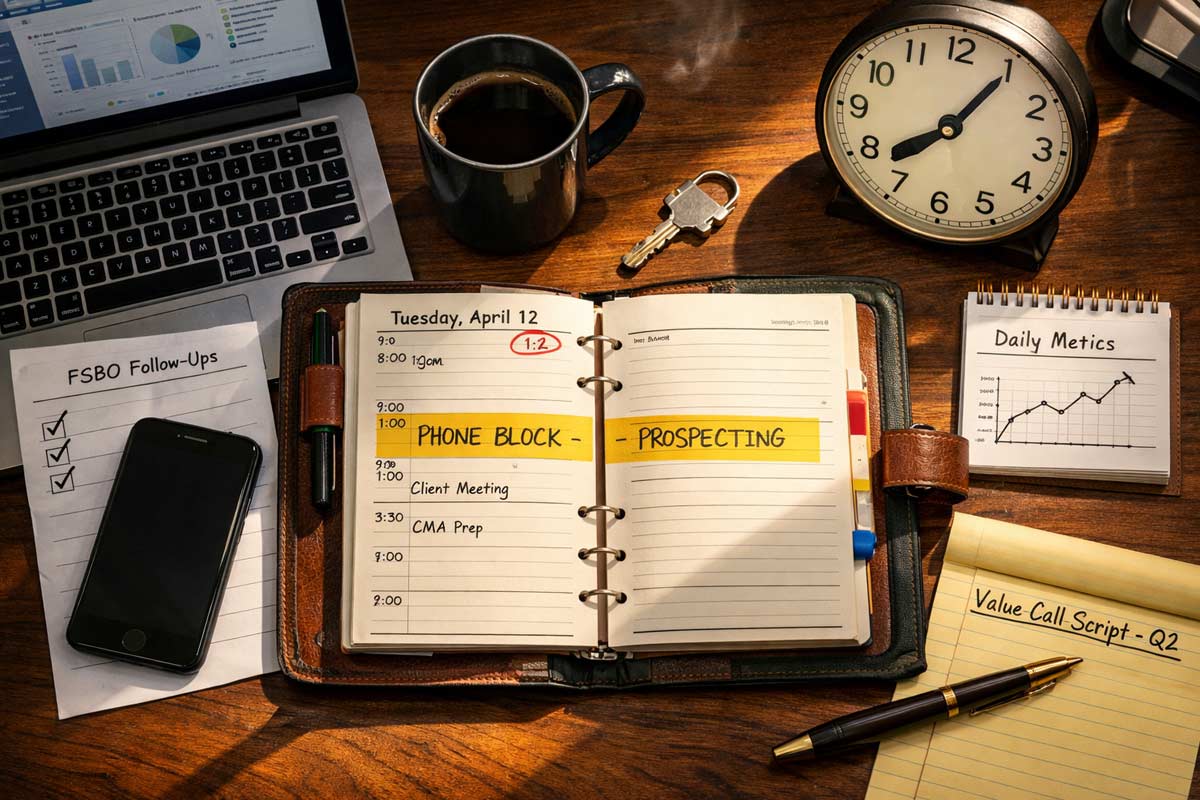

Your goals are fantasy until they’re time-blocked. An operator structures the day so input goals happen before the day’s chaos takes over.

Option 1: Standard New-Agent Schedule

8:00–10:00 AM: Pipeline Block (Non-Negotiable) — Outbound calls, follow-ups, open house nurture. No email. No scrolling. If it doesn’t directly create a conversation or an appointment, it doesn’t belong in this block.

10:00–11:00 AM: Admin/Ops Window — Email, paperwork, CRM updates.

1:00–2:00 PM: Visibility Block — Content creation, networking, event outreach.

3:00–5:00 PM: Appointments & Field Work — Showings, buyer consults, listing meetings.

Option 2: Aggressive Pipeline Schedule

Extend the Pipeline Block to 8:00–11:00 AM if you are in full "build mode" and need to generate immediate momentum.

If you want to keep your day from being hijacked, study Time Management for California Real Estate Agents—because if you don’t have an appointment, your job is to go create one.

5 Common Goal-Setting Mistakes

Setting income goals with no activity plan: “I want $200k” is a wish. “I will have 10 conversations/day” is a plan.

Copying a top producer’s goals: A veteran runs on referrals. Newer agents need to do more hunting and direct engagement. Don’t copy “maintenance” goals when you need growth goals.

The “Ghost Week”: Going hard for four days and disappearing for three kills momentum—and fuels the feast-or-famine cycle and contributes to Burnout for Real Estate Professionals.

Tracking too much: You don’t need 27 metrics. Track the three numbers in the scorecard above. Everything else is noise.

Letting escrow kill production: One deal in escrow isn’t a business. Keep prospecting or you’ll close and then go starve for the next two months.

Goal Templates (Copy/Paste)

Activity Goal: “For the next 12 weeks, I will have [Number] real estate conversations per week by [Prospecting Method] daily from [Start Time] to [End Time].”

Conversion Goal: “I will set [Number] appointments/week by following up with [Number] people from my CRM each morning.”

Structure Goal: “I will protect my calendar by batching admin/ops from [Start Time] to [End Time] and never allowing it into my morning pipeline block.”

Build the Full Skill Set

Goal-setting is step one—but it’s only one part of becoming a professional operator. To thrive in a competitive market, you need the full toolkit outlined in Real Estate Agent Skills California — from pipeline habits to systems, communication, and execution.

At ADHI Schools, we don’t just help you get licensed. We help you stay in business.

|

It’s 4:00 PM on a Friday. A repair request just came back with a $15,000 credit demand, the appraisal gap is widening, and the other agent is screaming into their speakerphone.

"This is an ethics violation!" Read more...

It’s 4:00 PM on a Friday. A repair request just came back with a $15,000 credit demand, the appraisal gap is widening, and the other agent is screaming into their speakerphone.

"This is an ethics violation!" they yell.

"I’m reporting you to the DRE! You’ll never sell a house in California again!"

If you’re like most agents, your stomach just did a somersault. You start mentally cataloging every email, every disclosure, and every text message, wondering if a single mistake is about to end your career.

The reality is this: The California Department of Real Estate (DRE) is not an "everything cop." They are the License Cop. Their jurisdiction is specific, and their mission is consumer protection—not settling playground disputes between agents.

The DRE in Plain English: License Cop, Not Everything Cop

The DRE exists to protect the public from those who hold a real estate license. Think of the DRE like the DMV for your professional life. If you drive 100 mph in a school zone, the DMV (via the police) cares. If you forget to wave at your neighbor or argue over who pays for gas, the DMV does not have jurisdiction.

The DRE typically enforces license law—conduct tied to your license that impacts consumers, such as truthfulness, disclosures, money handling, and advertising. They generally do not enforce the REALTOR® Code of Ethics (that’s the Association’s job). They do not enforce the "spirit of cooperation" (conflicts here are typically handled internally by your broker). And they certainly do not care if another agent thinks you were "rude" during a negotiation. For the full compliance map, start with our California Real Estate Laws & Compliance Guide.

Where the DRE Shows Up: The Real Discipline Triggers

When the DRE does step in, it’s because a licensee has crossed a line into territory that can trigger discipline. The "Short List" of enforcement usually falls into these buckets:

Trust fund mishandling: One of the fastest ways to invite serious discipline is mishandling other people’s money—especially commingling (mixing funds) or conversion (misusing funds). When in doubt, escalate to your broker. If you’re unclear on the mechanics, read Trust Fund Handling Rules for California Agents.

Material misrepresentation / nondisclosure: This typically involves failing to disclose a material fact—like a neighbor’s unpermitted boundary wall or a known soil subsidence issue—to a buyer.

Micro-scenario: An agent fails to disclose a known, recurring roof leak because "the seller said it was fixed." The buyer moves in, the ceiling stains again during the next storm, and the buyer's attorney finds an old repair estimate in the file history during the dispute. This creates a documented trail that can support a complaint. Check our guide on Common DRE Violations and How to Avoid Them.

Advertising violations: Because it’s public and easy to document, advertising is often the first place investigators look.

Micro-scenario: An agent runs Instagram ads with “Top OC Realtor Team” but omits the broker ID in the caption and leaves the license number off the graphic. Nobody complains for months—until a transaction goes sideways and the client screenshots the posts. That’s a documentable issue investigators can verify quickly. Start with Real Estate Advertising With Your License Number and Team Name & DBA Rules for California Agents.

Criminal convictions: Certain convictions or conduct "substantially related" to the license can trigger DRE action because they raise questions about honesty or fitness. If this applies, consult your broker and legal counsel early.

Failure to supervise: Your broker is generally responsible for supervising your activities. If a team or office has no documented supervision and review procedures, the DRE can discipline the employing broker alongside the agent.

Unlicensed activity: This includes "scope creep" where unlicensed assistants perform tasks like advising on contract terms or negotiating repairs during an open house.

Where the DRE Usually Doesn’t Show Up (And Who Does)

Most "threats" you hear in the field have nothing to do with the DRE. While the DRE may get involved indirectly if facts allege misrepresentation or fraud, use this table to triage typical conflicts:

Complaint About...

Typically Handled By...

DRE Involvement?

What to Do

Commission split disputes

Your broker / mandatory arbitration or mediation

Unlikely

Escalate to your broker

"Stolen" MLS photos or remarks

Local MLS committee

Unlikely

File a violation report with your MLS

A "rude" or "unprofessional" tone

Nowhere (Business conflict)

Usually none

De-escalate, document, move on

REALTOR® ethics violation

Local Association of REALTORS®

Usually none

File an ethics complaint with the Association

Breach of contract (Buyer vs. Seller)

Civil court / mediation

Indirect (if fraud is alleged)

Loop in your broker; consult counsel if needed

Fair Housing discrimination

CRD / HUD (and can overlap with DRE)

Can overlap

Consult broker/attorney immediately

Reality Check

A bad Yelp review or an angry email does not automatically become a DRE case. The DRE typically looks for an allegation tied to license law. If the complaint is “they were rude” or “they negotiated badly,” it often ends at intake triage because it isn’t a licensing enforcement issue.

The Investigation Pathway: From Complaint to Closure

If you want to understand what the DRE investigates, look at the process. It is clinical and evidence-driven. If you receive a letter, don't improvise—provide factual records and loop in your broker immediately.

Intake & triage: They screen for jurisdiction—meaning, is this a license-law issue or just a dispute?

Request for response: If it’s in-scope, you and your broker may be asked to respond and provide documentation.

Investigation: They may review transaction files, ads, and interview parties.

Possible outcomes:

Closed / no action: No violation found.

Citation / administrative resolution: Often for fixable compliance items like advertising errors.

Formal accusation / disciplinary process: For more serious allegations.

Checklist: If You Want to Stay Compliant, Do This:

Treat trust funds like evidence: Follow broker policy, use compliant trust procedures, and adhere to the Trust Fund Handling Rules for California Agents.

When in doubt: Disclose, document, and escalate to your broker.

Quarterly Marketing Audit: Review your signs, business cards, social media bios, and landing pages against the Real Estate Advertising With Your License Number requirements.

Keep a clean file: The DRE values a well-documented, organized file that tells a clear story of the transaction.

Involve your broker early: Your broker is your first line of defense and is legally required to supervise your conduct.

Your 3-Part Compliance Shield

You don't need to live in fear if you have a system. Treat your business with surgical competence:

Document Like a Defensive Pro: Every material conversation needs an email follow-up."Per our conversation..." is a strong phrase in your vocabulary to avoid Common DRE Violations.

Audit Your Advertising: Ensure your license number and broker's identity are conspicuous. Use our guide on Real Estate Advertising With Your License Number to help stay compliant.

Marketing & Team Hygiene: Ensure your team names and DBAs are registered properly. Refer to our guide on Team Name & DBA Rules for California Agents to ensure your branding isn't a liability.

The next time someone threatens you with a DRE report over a personality clash, take a breath. Look at your jurisdictional map. If you are operating with transparency and following license law, their threat is often empty noise. The DRE isn’t your shadow—your paperwork is.

To master the nuances of license law and protect your career, bookmark our master California Real Estate Laws & Compliance Guide.

|

I have spent over 20 years as a broker in California, training and supervising thousands of new licensees. In that time, I’ve developed a sixth sense for the “Quiet Quit.”

It starts with a subtle Read more...

I have spent over 20 years as a broker in California, training and supervising thousands of new licensees. In that time, I’ve developed a sixth sense for the “Quiet Quit.”

It starts with a subtle avoidance. An agent might stop showing up for the Tuesday sales meetings because they don’t have any "wins" to report. They tell their family that “it’s just a slow season” while watching their credit card balance climb to cover local association dues.

Often there isn’t a dramatic resignation; they simply fade out of the industry, seeing that the new career touted on LinkedIn six months ago never actually materialized.

This isn’t just the loss of a job; it’s the identity built in front of everyone that withers.

In California, the first-year dropout rate is high because the industry sells a dream while the reality requires surgical discipline. Most agents don't quit because they lack talent—they quit because they were never told how to survive this compounding decline.

1. No Business Plan (Productive Procrastination)

The biggest mistake I see is "productive procrastination." This is when an agent spends four days color-coding a CRM that contains zero leads or obsessing over the font on a business card.

This is where most agents fool themselves into thinking they are "building a business" when they are actually just maintaining an expensive hobby. If you don't have a daily lead-generation block—actual conversations with prospects, not administrative setup work—you are a tourist, not an agent yet. To stop the bleed, you must learn How to Create a Real Estate Business Plan (New Agents).

2. No Personal Brand (The Invisible Decline)

Invisibility is a death sentence in California's competitive markets. Many new agents hide behind their big-box brokerage’s logo, thinking the name on the building will do the heavy lifting. It won't.

The danger here is the lag factor. The damage of a weak brand isn’t felt today; it’s felt six months from now when the pipeline is bone-dry. The consequence is a phone that stays silent even when inventory shifts or interest rates drop. Essentially becoming a "secret agent," and secrets don't get paid. Overcoming this requires Branding Tips for New California Agents that force the agent into the public eye before the silence becomes entrenched.

3. Cash-Flow Shock (The Panic Check)

Let's talk about the moment the "dream" hits the bank account. Between DRE fees, REALTOR® association dues, and marketing costs, you are likely thousands of dollars in before the first escrow even opens.

In California, a standard escrow is 30 to 45 days. If it takes you four months to find a client, you are six months away from a check. Most agents quit when they hit the "Panic Check"—the moment they realize they have to retreat to their old 9-to-5 and explain to their peers why they couldn't make it. Cash-flow shock is a public retreat that most egos can't survive.

The Hard Truth: You were given a license, but you weren't given a survival manual. Quitting is a rational response to a lack of systems. If you find yourself avoiding your broker or lying to your spouse about how "busy" you are, it’s not a character flaw—it’s a systemic failure.

4. Social Media Confusion (Digital Noise vs. Value)

I see new agents posting photos of their lunch or generic "Happy Monday" graphics and wondering why their DMs are empty. This random posting is actually worse than silence because it creates a false sense of accomplishment.

In the current market cycle, the public is too sophisticated for "guru" posturing. If your digital presence doesn't provide data or inventory insights, you are just adding to the noise. You need a strategy for How New Agents Should Use Social Media in 2026 that builds authority rather than just seeking "likes."

5. Isolation & The Shame of "Looking Stupid"

Real estate can be a lonely business. When a deal falls apart, the isolation leads to a rapid collapse in motivation.

But the real killer is shame. New agents often stop asking questions because they don't want to "look stupid" in front of the high-producers in the office. They isolate themselves to hide their lack of progress, which only accelerates the Quiet Quit. Breaking this cycle requires a specific strategy on How to Stay Motivated as a New Agent that acknowledges the psychological toll of the first year.

6. The "Licensing Lie"

The California Department of Real Estate (DRE) exam ensures you know the basics of real estate law; passing does not guarantee you will make money. The industry’s onboarding narrative often suggests that "getting your license" is the hard part.>/p>

That is the Licensing Lie. Your license is merely a "permit to learn." The reality is that the first year is 10% real estate and 90% grueling lead acquisition. Lead acquisition isn't a chore you do to get to the real estate; lead acquisition is the real estate business.

The Survivor Mindset: Boring Consistency

The agents I’ve seen survive and thrive over the last two decades don't have "hustle" posters on their walls. They have boring consistency.

Survivors rely on observable behaviors:

The Calendar: Guarding lead-generation blocks like a doctor guards surgery time.

The CRM: Documenting every interaction, no matter how small or unlikely.

The Follow-Up: Calling when you said you would, even when there is no "news" to report.

The Decision Window

If you are currently feeling the weight of the Quiet Quit, you are at a fork in the road. You can continue to fade out, or you can admit that your current "plan" isn't working and reset your systems.

The first year is an exercise in attrition. Survival depends on your willingness to stop "playing house" and start operating a business. To move past the danger zone and build something that lasts, you need to understand the full career arc. It’s time to stop guessing and learn how to properly Start a Real Estate Career in California with your eyes wide open.

|

Disclaimer: This article provides operational and professional strategies for performance management. It is not a substitute for professional medical or psychological advice. If you are experiencing severe Read more...

Disclaimer: This article provides operational and professional strategies for performance management. It is not a substitute for professional medical or psychological advice. If you are experiencing severe mental health distress, please consult a licensed professional.

It’s 7:45 PM on a Tuesday. You’re finally sitting down to dinner when your phone buzzes. It’s a "quick question" from a buyer about an escrow contingency. Against your better judgment, you reply.

That one text turns into a 45-minute email chain with the lender and the listing agent. By 9:00 PM, you’re staring at the ceiling, mentally rehearsing tomorrow’s showings while your adrenaline spikes.

If this sounds familiar, you aren’t "working hard"—you’re redlining. At ADHI Schools, I’ve spent over 20 years coaching California agents through every market cycle, and I can tell you that burnout prevention for real estate professionals is not a luxury; it is a fundamental requirement for production. You don’t need a vacation; you need a sustainable operating cadence.

This guide is the operator’s plan to reduce your mental load, protect your commission, and build the real estate agent skill stack pillar that the top 1% use to stay at the top.

The Death Spiral: From "Busy" to Burnout

In a commission-based business, it is easy to mistake "constant access" for "high performance." However, ignoring the early warning signs of real estate agent burnout creates a dangerous downstream effect on your bank account.

The Symptoms To Consequences Bridge

If you ignore the symptoms, the professional consequences are inevitable:

Symptom: You dread opening your CRM or email.Consequence: Your follow-up slips and your pipeline dries up causing your panic level to increase.

Symptom: You have a "short fuse" with clients or TCs.Consequence: Your reputation takes a hit and your referrals drop causing you to work twice as hard to find new business.

Symptom: You are "always busy" but nothing moves.Consequence: You enter a cycle of "random activity" and your decision fatigue sets in causing you stop doing the high-ROI tasks that actually close deals.

Operational Strategies for Burnout Prevention for Real Estate Professionals

To survive the California market, you must stop being a "responder" and start being an "operator." This requires moving away from a reactive calendar and toward a structured system.

1. The "Two Windows Rule" (Communication Framework)

Window 1 (11:30 AM): Process all morning inquiries, lender updates, and escrow fires.

Window 2 (4:30 PM): Wrap up the day’s communication and set expectations for the following morning.

The Result: You train your clients that you are a professional with a schedule, not a 24-hour concierge. This single shift is the cornerstone of time management for California real estate agents.

2. One Source of Truth (The CRM)

Your brain is for processing information, not storing it. Trying to remember which buyer needs a disclosure sent and which listing needs a sign-post update is the fastest path to exhaustion. Learning how to build a real estate CRM that actually works is the only way to offload that mental weight. If it’s in the CRM, your brain can let it go.

3. Minimum Viable Habits

Don't try to overhaul your life. Pick three non-negotiables that keep your energy stable. For most top producers, this includes a set wake-up time, 60 minutes of proactive lead generation, and a "shutdown ritual." Mastering the daily habits of top-producing agents creates a performance floor that protects you even when the market gets volatile.

Practical Playbooks for the Fried Agent

The 2-Hour Daily Stabilizer

Before you open email or social media, spend the first two hours of your workday on Pipeline Defense.

0–30 mins: Review your CRM tasks.

30–90 mins: Proactive reach-out (calls/texts/notes).

90–120 mins: Appointment setting.

Why? If you spend the rest of the day fighting escrow fires or stuck in California traffic, you’ve already secured your future income.

The Boundary Scripts

The Late Night Text: "Hi [Name], I’m currently away from my desk for the evening, but I’ve prioritized this for my 8:30 AM updates. I’ll have an answer for you then!"

The "Urgent" Non-Urgent Item: "I want to ensure I give this the proper review. Let’s discuss this during my next update window at 4:30 PM."

The Operator’s Comparison

Feature

The Burnout Path (Reactive)

The Sustainable Path (Systematic)

Morning Routine

Checking emails in bed

CRM task review & proactive calls

Client Access

24/7 "on-call"

The Two Windows Rule

Goal Tracking

"I hope I close something"

Using how to set goals as a new real estate agent to track daily inputs

Recovery

Crashing from exhaustion

Scheduled "Hard Stops" and 24-hour disconnects

The 7-Day Reset Mini-Plan

If you're currently redlining, follow this sequence to regain control:

Day 1: Audit your phone. Turn off all non-human notifications (social, news, retail).

Day 2: Clean the CRM. Move every "reminder" out of your head and into the system.

Day 3: Set a "Hard Stop" time (e.g., 7:00 PM). The phone goes in a drawer.

Day 4: Schedule one 3-hour "Deep Work" block. No phone, no distractions.

Day 5: Proactive Triage. Update every active client before they ask you for a status report.

Day 6: Design your "Ideal Week" on paper, including gym time and family meals.

Day 7: Total disconnect. No real estate for 24 hours.

The Bottom Line on Sustainable Production

In the California market, burnout prevention for real estate professionals is an operational skill. If you operate without a system, the business will eventually consume your personal life and your health. If you operate with a system, you can handle higher volume with lower stress.

To build a career that lasts decades rather than months, you must master the fundamental Real Estate Agent Skills California requires. Stop reacting to the chaos and start engineering your success.

Burnout Prevention Checklist

One Source of Truth: Is every lead and task documented in your CRM?

The Two Windows Rule: Have you set specific times for client updates?

Pipeline First: Have you completed your 90-minute lead-gen block today?

Hard Stop: Is there a time tonight when you will officially "log off"?

Weekly Recovery: Is there a 24-hour block in your calendar for total disconnect?

Next Step: Build your foundation by exploring the full Real Estate Agent Skills California pillar to see how systems-first agents dominate the market.

|

The appraisal just came in $40,000 short on a Huntington Beach bungalow, and your seller is screaming that the appraiser "has it out for them." Or perhaps you’re in the tenth hour of a Silicon Valley Read more...

The appraisal just came in $40,000 short on a Huntington Beach bungalow, and your seller is screaming that the appraiser "has it out for them." Or perhaps you’re in the tenth hour of a Silicon Valley bidding war, and your buyer—usually a calm tech executive—is sobbing because they’re afraid of being outbid for the sixth time. In these high-stakes moments, your knowledge of the purchase agreement matters far less than your ability to steady the ship.

Your ability to manage emotions—yours and your clients’—is the #1 determinant of your survival and success in California real estate.

EQ: The Core of Your Professional Skill Stack

At ADHI Schools, we don’t view emotional intelligence for real estate agents as a "soft skill." It is a technical competency. Just as you must learn to navigate the Residential Purchase Agreement (RPA), you also have to learn to navigate the human limbic system. This guide is a deep dive into one specific layer of the Real Estate Agent Skills California framework: the ability to remain the clinical, calm authority when a transaction turns volatile.

To lead others, you must first lead yourself. If you are still finding your footing in the industry, learning How to Build Confidence as a New Agent is the prerequisite for the high-level EQ maneuvers required in today's market.

Why Emotional Intelligence is a Deal-Breaker for California Agents

Most deals don’t die because of the math; they die on tone. In California’s aggressive, high-priced markets, a lack of EQ creates a "feedback loop of anxiety" that leads to terminated escrows and burned bridges.

Terminated Escrows: Clients make permanent decisions based on temporary fears.

Reputation Damage: High-stress reactions can damage your standing with other agents, escrow officers, and lenders.

The "Anxiety Tax": Low EQ acts as a direct tax on your business. The agent pays this price in the form of lost commissions, zero referrals, and a brand associated with chaos rather than competence.

The Reality: EQ is a financial skill. You are either the one calming the room, or you are the one paying the price for the conflict.

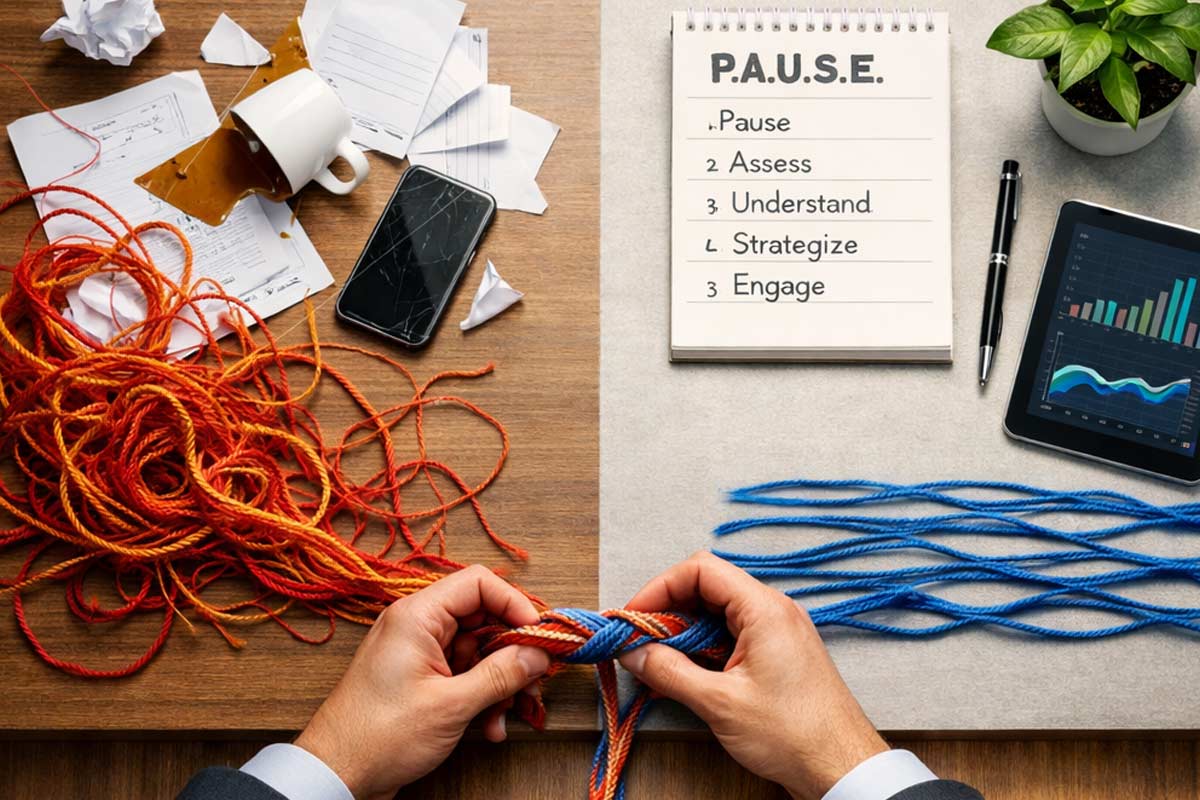

The ADHI EQ Protocol: P.A.U.S.E. to Lead

Having trained thousands of California agents over 20+ years, Kartik Subramaniam’s field-tested method for de-escalation is the P.A.U.S.E. protocol. When a deal gets "hot," do not react—lead.

P: Pause Your Physiology Take a three-second breath. Slow your speech. If your heart is racing, you cannot lead.

A: Acknowledge the Emotion. Name it out loud for the client. "I can see how frustrating this inspection report is for you."

U: Uncover the Need Fear is usually about security, money, or time. Is the seller mad about the repair, or afraid they won't have the cash for their next down payment?

S: Structure the Path Forward. Offer 2-3 clear, logical options to regain a sense of control.

E: Execute with Calm Authority. Direct the next concrete step immediately to move past the emotional block.

Firefight Scenarios (The Proof)

Here is how the protocol saves deals in real-world California "firefights."

Scenario: The Inspection Renegotiation Standoff

The Amateur's Reaction: "The buyer is being totally unreasonable. This deal might be dead."

The EQ Agent's P.A.U.S.E. Response: "I hear that this request feels like an insult after you've cared for this home for 20 years. But let's look at the goal: getting you to your new home in Arizona by the 15th. We can offer a credit, fix the major items, or hold firm and risk the buyer walking. Which keeps your moving truck on schedule?"

Why This Works: It validates the ego while refocusing on the client's ultimate objective.

Scenario: The Appraisal Gap Crisis

The Amateur's Reaction: "I can't believe this appraiser. We're going to have to ask the seller to drop the price, but they'll never do it."

The EQ Agent's P.A.U.S.E. Response: "The appraisal came in under our price, which is a common hurdle in this market. I know it’s stressful to think about the extra cash, but let’s look at the long-term value of this neighborhood. We can appeal the appraisal, negotiate something with the seller, or cover the gap. Which option feels most manageable for your monthly budget?"

Why This Works: It treats a crisis as a "common hurdle," lowering the client's panic levels through logical choice.

De-escalation Scriptbook for Tense Conversations

Keep these bolded lines in your "mental holster." Effective EQ fails when agents cannot Master Real Estate Terminology Fast and explain complex issues simply under pressure.

The Reframe: “I hear this is frustrating. Let’s look at what we can control in this situation.”

The Empathy Bridge: “If I were in your shoes, I’d feel the exact same way. Here is how we navigate this.”

The Clarity Check: “Before we react to this news, what is the most important outcome for your family right now?”

The Logic Pivot: “I understand the emotion behind that number, but the data the appraiser is looking at says 'X'. How do we bridge that gap?”

The Validation: "It makes total sense why you're feeling defensive about this request."

The Goal Alignment: "I want to make sure we don't let a temporary frustration get in the way of your move to San Diego."

The "Next Step" Directive: "We don't need to solve everything today. Let's just focus on the counter-offer strategy."

By mastering Communication Skills That Separate Top Agents from the Rest, you ensure your delivery remains as professional as your strategy.

The Strategic Pause: Silence is a powerful tool. After delivering an offer or counter, stop talking. Silence is uncomfortable for low-EQ agents; they will often fill it by revealing their client's bottom line.

Anchoring with Empathy: “I understand why that number feels right to you. Based on the current inventory in this zip code, however, the market is moving closer to...”

Pre-Negotiation EQ Check

Have I identified my client’s core fear (Money, Security, or Time)?

Am I calm enough to hear irrational terms without reacting defensively?

Am I prepared to use the "Strategic Pause" during the next call?

The 5-Minute Daily EQ Drill

You don't build EQ during the crisis; you build it in between deals. Practice The Post-Call 60: After any hard call, take 60 seconds to ask:

What emotion did I feel?

What emotion did my client feel?

Did I lead the conversation or just react to it?

The Path to Mastery

Emotional intelligence is the technical skill of building trust and closing deals when things go wrong. Mastering EQ is one of the Essential Skills Every New California Agent Must Master if they want to move from "surviving" to "thriving."

Reputations are built when deals are falling apart. To build a sustainable, high-income career, you must combine this emotional mastery with the full stack of Real Estate Agent Skills California.

Frequently Asked Questions

How can a real estate agent improve their emotional intelligence?

Improving EQ starts with physiological self-regulation and intentional reflection. Practice the P.A.U.S.E. protocol by consciously slowing your breathing and speech during tense calls, and use the "Post-Call 60" drill to analyze your reactions after every client interaction.

What is an example of emotional intelligence in real estate?

An example is staying neutral when a listing agent is aggressive during a multiple-counter-offer situation. A high-EQ agent recognizes the other agent's stress, refuses to mirror the aggression, and keeps their own client focused on the data rather than the conflict.

Why is EQ more important than IQ for California agents?

While IQ handles contracts and data, EQ keeps the deal alive during the "emotional middle" of escrow. Most California escrows fall through due to unmanaged stress or personality conflicts; EQ is the bridge that keeps buyers and sellers moving toward the finish line.

How does EQ help with real estate negotiations?

EQ provides a strategic advantage by allowing an agent to read the underlying motivations of the opposing party. By identifying what the other side is afraid of—such as a long closing date—you can frame your offer to provide them security while still winning the best terms for your client.

Can emotional intelligence be learned?

Yes, emotional intelligence is a set of skills—self-regulation, empathy, and social management—that can be developed through coaching and deliberate practice. Unlike IQ, which is relatively fixed, your ability to lead others through stress can be significantly improved with training and practice.

|

You are sitting in your car in a driveway in Irvine or Walnut Creek, staring at a repair request that just came in. Your seller is already livid because they feel they "gave away the house" on price. The Read more...

You are sitting in your car in a driveway in Irvine or Walnut Creek, staring at a repair request that just came in. Your seller is already livid because they feel they "gave away the house" on price. The buyer is threatening to walk over a water heater and some minor electrical work. Most agents at this moment start sweating, worried about their commission or the deal falling apart. They start "pushing" both sides, which usually results in everyone feeling like they lost.

Negotiation isn’t about being a "shark" or a "closer." In the California market, negotiation is a technical competency involving the structure of the deal, the flow of information, and the temperature of the room. Negotiation is one layer inside the broader Real Estate Agent Skills California framework—when you master it, everything else (pricing, scripts, client control) gets easier. Having coached thousands of California agents over the last 20+ years, I’ve seen that the most successful negotiators aren't the loudest—they are the most prepared.

Key Takeaways

To successfully present multiple offers in California, you must first acknowledge that your objective shifts depending on which side of the negotiating table you occupy.

Control the Frame: Whoever sets the parameters of the conversation usually wins.

Trade, Don't Give: Never concede a point without getting something in return.

Emotion vs. Numbers: Reframe emotional outbursts into transactional math.

Master the RPA: Leverage the timelines built into the California Residential Purchase Agreement.

The ADHI Negotiation Stack: A Five-Step Framework

To win consistently, you need a repeatable process. Use this stack to organize your thoughts before you pick up the phone:

CLARITY: Know exactly what your client needs (e.g., "Must close by the 15th") versus what they want ("A $5,000 credit").

LEVERAGE: Identify the pressure points. Is the seller in escrow on a replacement property? Is the buyer’s rate lock expiring?

OPTIONS: Never present a client with a "Yes/No" choice. Provide 2–3 paths forward to keep them in control.

TIMING: Use the clock and contract timelines to restore urgency. Formal notices can create clarity, but use them strategically and in line with your broker’s process.

DOCUMENT: If it isn't in writing, it didn't happen. Move verbal agreements to a C.A.R. form immediately.

The 30-Second Rule Before Any Negotiation Call

Before dialing the other agent, ensure you can answer these four questions:

What’s the ask? (The specific outcome you want)

What’s the trade? (What you are willing to give up to get it)

What’s the deadline? (When the offer or response expires)

What’s the written next step? (Which C.A.R. form will you send immediately after?)

12 Essential Real Estate Negotiation Tactics

1. Framing & Anchoring

When to use: Presenting the first offer or a counter-offer.

Why it works: The first number or condition mentioned sets the psychological "anchor."

Script: "Based on the four most recent comps in this area, we are coming in at $950k. This number reflects the current market reality while acknowledging the property's condition."

2. The "Two Options" Close

When to use: Resolving a deadlock.

Why it works: It prevents "analysis paralysis" and makes the client feel in control.

Script: ""We can either offer them a $3,000 credit toward their closing costs, or we can fix the roof leak ourselves prior to close. Which path would you prefer?"

3. Strategic Concession (The Trade)

When to use: Presenting the first offer or a counter-offer.

Why it works: If you give for free, they ask for more. If you trade, they realize concessions are expensive.

Script: "My seller is willing to leave the high-end refrigerator, but in exchange, we need to shorten the inspection contingency to 10 days."

4. Strategic Silence

When to use: Immediately after delivering a counter-offer or a hard "no."

Why it works: People are uncomfortable with silence and often talk themselves into a weaker position just to fill the void.

Script: [State your terms clearly]... [Wait 5–10 seconds].

5. Deadline Urgency

When to use: When the other side is dragging their feet on contingency removals.

Why it works: It forces a "fish or cut bait" moment using the contract timeline to restore clarity and urgency.

Script: "We’re past the agreed contingency timeline. My sellers want to stay on track for closing, so we need a clear update today on whether your buyer is removing contingencies or requesting an extension in writing."

6. Information Guarding

When to use: During initial "get to know you" calls with the other agent.

Why it works: Revealing your client's desperation (e.g., "They already bought a house in Texas") kills your leverage.

Script: "My clients are very motivated to find the right buyer who can appreciate the upgrades they've made."

7. Repair-to-Credit Pivot

When to use: After a difficult home inspection.

Why it works: Credits are cleaner for sellers and don't require the agent to manage contractors.

Script: "Rather than having the seller manage these repairs, why don't we do a $4,000 credit? It allows your buyer to choose their own contractors after they move in."

Real-world example: I’ve seen deals nearly die over a 12-item repair list where the seller felt “nickel-and-dimed.” We pivoted to a credit tied to two high-impact concerns (safety + major system), and the buyer accepted within an hour—because they didn’t want contractor scheduling to delay closing.

8. The "What If" Question

When to use: Testing the waters before a formal counter.

Why it works: It allows you to find boundaries without committing in writing first.

Script: "What if we could get closer to your price, but kept the closing date exactly where the seller needs it? Is that something your buyers would entertain?"

9. Escalation Positioning

When to use: In a highly competitive multiple-offer environment.

Why it works: It shows the seller your buyer is serious about winning without starting at their absolute ceiling.

Script: "We’ve included an escalation clause that beats the highest verifiable offer by $5,000, up to a cap of $1.1M." (Note: Ensure you know How to Present and Win Multiple-Offer Situations before using this).

10. The Appraisal Gap Anchor

When to use: When you know a property might not appraise at the offer price.

Why it works: It solves a future problem before it kills the deal.

Script: "We love your offer, but to move forward, we need a 'gap' clause stating the buyer will cover up to $20k if the appraisal comes in short."

Real-world example: In one coastal California deal, the buyer “won” at a premium price—then froze when the appraisal came in short. Because we had already framed a clear plan, the renegotiation became math, not panic, and escrow stayed alive.

11. Reframing Emotions back to Numbers

When to use: When a client is taking a negotiation personally.

Why it works: It detaches ego from the transaction.

Script: "I understand that their offer feels like an insult. But let’s look at the math: at this price, you still walk away with $400k in equity. Does $5,000 in emotion outweigh $400k in reality?"

12. The BATNA (Best Alternative To Negotiated Agreement) Thinking

When to use: Deciding whether to walk away.

Why it works: You cannot negotiate effectively if you are afraid to lose the deal.

Script: "If we can't reach an agreement here, we are prepared to go back on the market on Friday. We had three other parties at the open house who were very interested."

California-Specific Guardrails: Stay Clean, Stay Professional

Negotiation can be a high-wire act. California paperwork and brokerage policies vary—use these tactics as a framework and follow your broker’s specific process for notices, counters, and timelines.

You have 5+ offers that are materially similar in terms.

Financing types (e.g., all Conventional 20% down) are comparable.

The seller prioritizes simplicity and wants to "clear the field" quickly.

Avoid “Highest & Best” When:

Never Misrepresent Offers: Don’t play games with phantom offers. It’s unethical, risks your license, and can blow up trust with the other side instantly.

Verify the Lender: A high price means nothing if the lender can’t perform. Always call the loan officer.

Document Everything: Verbal agreements are worthless. Use the RR (Request for Repair) and RRRR (Seller Response to RR) forms correctly. If you are unsure of the phrasing, learn How to Explain Contract Terms to Clients Clearly so you don't over-promise.

Follow Broker Policy: Every brokerage has specific rules on escalation clauses. When in doubt, consult your manager.

Mini Playbooks: 3 Quick Scenarios

Scenario 1: Multiple Offers Appear

If you're on the listing side, don't just pick the highest price. A cash offer at $900k is often better than a financed offer at $920k with a massive appraisal gap. Master the strategy for How to Present and Win Multiple-Offer Situations to guide your seller.

Scenario 2: The Appraisal Gap Appears

When the appraisal comes in $30,000 short, you have three choices: price drop, more cash, or meet in the middle. When this happens, follow the step-by-step scripts in How to Handle Appraisal Gaps in California to save the escrow.

Scenario 3: The Repair Showdown

The buyer wants $10,000 in repairs; the seller wants zero. To keep escrow alive, follow How to Avoid Deal-Killing Mistakes—and focus on the "Big Three": Health, Safety, and Structural issues. Everything else is a trade.

Negotiation Is a Skill, Not a Personality

Many new agents believe you have to be born a "natural" negotiator. That is a myth. Negotiation is a practiced skill. When you walk into your next negotiation, remember: you aren't there to fight; you are there to solve a problem. Sticking to the Real Estate Agent Skills California framework ensures you remain the calm, clinical professional your clients hired.

Frequently Asked Questions

How do I negotiate repairs without losing the buyer?

Negotiating repairs requires prioritizing health and safety items while offering a credit for cosmetic or minor issues. This keeps the seller from feeling "nickeled and dimed" while ensuring the buyer feels the property is safe.

What should I say when the other agent goes silent?

When an agent goes silent, do not fill the void with concessions. Use a professional check-in: "I wanted to follow up on our counter-offer. My sellers are looking for a response so they can plan their weekend. Do you have an update from your clients?"

How do I negotiate contingencies in the California RPA?

Contingencies are negotiated by adjusting the number of days for the inspection, appraisal, and loan periods. Shortening these periods is a powerful trade when asking the seller for a lower price or credits.

What is the most important negotiation tactic for real estate agents?

The most important tactic is the Strategic Trade. Never give a concession without asking for something in return to maintain the value of your client's position.

Should I use an escalation clause in California?

Escalation clauses can be effective but must be used with caution and broker approval. Many California sellers prefer a "Highest and Best" call to avoid the complexity of multiple triggers.

Do This Before You Call the Other Agent:

What do we need vs. what do we want?

What is our real Plan B (BATNA)?

What deadline matters most right now?

What can we trade (not give)?

Which C.A.R. form is the cleanest path for this next step?

Ready to level up your professional game? Ensure you have mastered the complete list of Real Estate Agent Skills California to dominate your local market.

|

You’ve worked hard to build your business, but nothing halts momentum like a DRE deficiency notice—or worse, a license that slips into expired status. I’ve spent over 20 years helping California Read more...

You’ve worked hard to build your business, but nothing halts momentum like a DRE deficiency notice—or worse, a license that slips into expired status. I’ve spent over 20 years helping California agents and brokers at ADHI Schools navigate this process, and I’ve watched too many professionals pay an unnecessary "tax": late fees, avoidable delays, and lost commission because they didn’t budget for time and money.

If you plan ahead, the cost to renew a California real estate license is predictable. If you wait until the last minute, the price goes up—not just in dollars, but in stress.

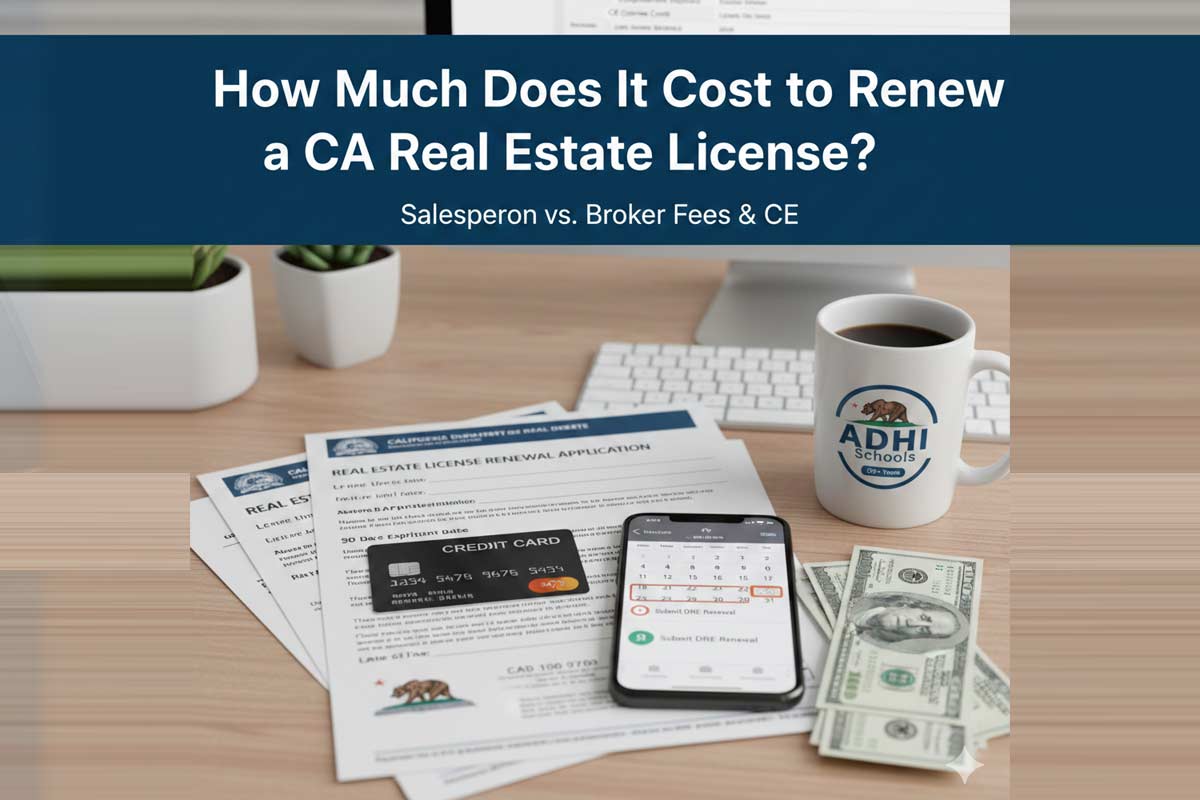

The Quick Answer: CA Renewal Cost Snapshot

Below are the renewal fees set by the California Department of Real Estate (DRE). These figures reflect the official DRE fee schedule (fees effective July 1, 2024, and current as of March 2026).

License Type

On-Time Renewal Fee

Late Renewal Fee (within 2 years)

Salesperson

$350

$525

Broker

$450

$675

Important: These are DRE filing fees only. Your total cost also includes continuing education (CE), which is provider-dependent. A realistic "total budget" for an on-time renewal is typically:

Salesperson: ~$400–$480 (DRE fee + CE range)

Broker: ~$550–$625 (DRE fee + CE range)

The Fee You Can’t Avoid: DRE Renewal Fees

The DRE renewal fee is non-negotiable. The cleanest way to pay is through the DRE eLicensing system, because it creates a clear electronic transaction record and supports the DRE’s standard online renewal workflow.

The on-time renewal nuance most agents miss

If you renew on time, California Business & Professions Code Section 10156.2 permits you to continue operating under your existing license after its expiration date unless the DRE notifies you of a deficiency. Your renewal is considered "on-time" if your eLicensing transaction is completed—or your mailed application is postmarked—by midnight on your expiration date.

Why the late fee is a trap

Miss the deadline and a Salesperson renewal jumps from $350 to $525—a $175 penalty (a 50% increase). Most importantly, if your license is expired and you haven’t submitted the complete renewal application, you cannot perform any activities requiring a license until your renewal is officially processed.

Plan your submission: Check our guide on How to Submit Your CA License Renewal Application for the smoothest filing flow.

The Second Big Cost: Continuing Education (CE) Tuition

Renewing a real estate license in California requires 45 hours of DRE-approved continuing education. The cost depends on the provider and delivery method.

Typical CE cost range: ~$99–$199.

First renewal vs. Subsequent renewal: First-time renewals require individual courses in specific mandatory topics. For subsequent renewals, licensees whose licenses expire on or after January 1, 2023, have the option to complete a 9-hour CE survey course that covers the seven mandatory subjects.

Provider Tip: Bundled 45-hour packages are almost always the best value. Buying courses "à la carte" often leads to missing a required component and paying twice.

Hidden Costs That Blindside People (The "Late Tax")

Beyond standard fees, these cost multipliers can inflate your real total:

Deficiency delays: Typos or incorrect course numbers trigger DRE follow-up. While there is no "fine," the cost is measured in weeks of business disruption while you wait for manual processing.

Multiple licenses: If you maintain a corporation license or an additional officer license, each carries its own renewal fee under the DRE fee schedule.

Rush premiums: Waiting until the last minute for CE often results in less time to shop around to make sure you are getting the best deal on CE.

To stay organized, use our Checklist for Renewing a California Real Estate License.

3 Budget Scenarios: What Will You Actually Pay?

1) Proactive Salesperson (Clean & On-Time)

DRE fee: $350

CE package: $50–$120

Total: ~$400–$470

3) "Scramble" Renewal (Late Salesperson)

Late DRE fee: $525

Last-minute CE: Cost doesn’t change but you are less likely to cross shop if under time pressure.

Total: ~$625+ (Plus the risk of commission loss during the gap).

How to Avoid Paying More Than You Need To

Finish CE early: Build at least a 30-day buffer for any certificate issues.

Submit early: eLicensing accepts applications up to 90 days before expiration.

Save proof: Save or print the confirmation page as a PDF and screenshot the transaction/confirmation number immediately after paying.

Audit your application: Double-check your 8-digit CE course numbers to avoid the common renewal mistakes agents make.

Frequently Asked Questions

What is the late renewal fee in California for a real estate license?

The late renewal cost is $525 for Salespersons and $675 for Brokers. This applies if you renew within two years after your license expires.

If I renew on time, can I keep working after my expiration date?

In many cases, yes. If your renewal is submitted on time, California law (B&P 10156.2) may allow you to continue operating unless the DRE notifies you of a deficiency and instructs you to stop. That’s why submitting early and saving proof of your transaction is critical.

Is the CE cost included in the DRE fee?

No. The DRE fee covers state processing; CE is paid separately to your chosen education provider.

Can I renew early?

Yes—renewals can be submitted up to 90 days before expiration.

Do brokers pay more than salespersons?

Yes. An on-time Broker renewal is $450, while a Salesperson renewal is $350.

Your Next Steps

Budgeting is just step one. Timing is step two.

First: Read How Long Does It Take to Process a CA Renewal? so you submit early enough to avoid a gap.

Then: Follow the clean filing workflow in How to Submit Your CA License Renewal Application (and save your confirmation as proof).

Finally: Anchor your entire renewal strategy with the full field manual: California Real Estate License Renewal Guide.

|

Imagine this: You’re three days away from taking a career-best listing when your broker calls. Your license has officially expired but you had no idea.

At ADHI Schools, I’ve spent over 20 years Read more...

Imagine this: You’re three days away from taking a career-best listing when your broker calls. Your license has officially expired but you had no idea.

At ADHI Schools, I’ve spent over 20 years helping California agents navigate the DRE rules. I’ve seen hundreds of agents lose momentum because they treated their renewal like a "quick five-minute form." In reality, a single typo or a misunderstood deadline can trigger weeks of DRE renewal delays.

If you want to keep your license active and your commissions flowing, you need to avoid these 10 common California real estate license renewal mistakes.

The 10 Most Common Renewal Mistakes

1. Waiting Until the Final Week To Register For Courses

Why it happens: Agents prioritize lead generation over paperwork, assuming they can cram all the hours into one day.

What it costs: Professional paralysis. If you miss the window, your license is technically "Expired," meaning you cannot legally perform any licensed activity or claim a commission for work done during that gap.

|

Imagine it’s Friday at 4:00 PM. You’re 14 days into a transaction in Irvine with a 21-day timeline.

The lender just called: the buyer’s debt-to-income ratio is blown because of a new car lease. Read more...

Imagine it’s Friday at 4:00 PM. You’re 14 days into a transaction in Irvine with a 21-day timeline.

The lender just called: the buyer’s debt-to-income ratio is blown because of a new car lease. Simultaneously, the appraisal came in $25,000 short, and the seller is refusing the Request for Repair because they feel "insulted."

In California’s deadline-driven, high-liability market, this is where most agents panic. They start "hustling"—calling everyone, venting, and hoping for a miracle.

But hope is not a strategy. After 20+ years of coaching California agents, I can tell you that a deal-killing mistake usually isn’t one big error—it’s a sequence of small misses: unclear expectations, missed deadlines, and sloppy communication.

To survive, you don't need more hustle; you need an operating system. California’s escrow structure—strict contingencies, statutory disclosures, and form-driven enforcement—leaves very little margin for improvisation. Mastering these Real Estate Agent Skills California is the difference between a top producer and a former agent.

What is a "Deal-Killer" in Practice?

In the California real estate ecosystem, a "deal-killer" is any process failure that leads to an unnecessary cancellation, a legal impasse, or a lender denial.

The Mechanism: It creates a "zombie escrow" where no one is committed, leading to a sudden, emotional cancellation on day 25.

Most Common Escrow Mistakes in California: The Top 10

1. Contingency Mistakes That Cost Commissions

Real Life: Assuming the "17-day period" is a suggestion and forgetting to deliver a Notice to Perform (NTP).

The Mechanism: It creates a "zombie escrow" where no one is committed, leading to a sudden, emotional cancellation on day 25.

Prevention: Every date goes in a shared calendar on Day 1. Never let a date pass without a formal removal or written extension.

Script: "The contract is our clock. If we don’t move today, we lose our leverage."

Deep Dive: Learn how to explain contract terms to clients clearly to avoid these timeline traps.

2. Poor Expectation Setting

Real Life: Telling a buyer "don’t worry, the seller will fix everything" before the inspection occurs.

The Mechanism: You’ve created a "fantasy" deal. When reality hits, the buyer feels betrayed.

Prevention: Conduct a "Pre-Escrow Reality Check." Explain that escrow is a series of hurdles, not a victory lap.

Script: "My job isn't to tell you what you want to hear; it’s to show you the obstacles before we hit them."

3. Disclosure and Document Sloppiness

Real Life: Delivering a messy, incomplete TDS (Transfer Disclosure Statement) late in the game.

The Mechanism: Late disclosures can re-open questions and trigger new review periods, giving the buyer a clean psychological "exit ramp" exactly when they are feeling most nervous.

Prevention: Sellers should complete all disclosures before going on the market.

Script: "We provide everything upfront so the buyer has no excuses to walk away later."

4. Repair Request Mistakes That Blow Up Negotiations

Real Life: Turning a Request for Repair into a personal conflict over cosmetic items.

The Mechanism: You lose the "Big Picture." The deal dies over a $500 water heater because the parties stopped looking at the math.

Prevention: Focus on "Health and Safety" first. Have a trade strategy—know what a roof repair actually costs before you ask for a credit.

Script: "We aren't solving feelings today; we are solving terms to get you to your next house."

Refine your approach: Review these negotiation tactics every California agent should know.

5. Appraisal Gap Mistakes in California

Real Life: The appraisal comes in $30k low, and you start complaining about the appraiser instead of the data.

The Mechanism: Blame creates paralysis. Without a data-driven plan, the buyer walks.

Prevention: Prepare an "Appraisal Package" for the appraiser at the start. If a gap occurs, have a three-way solution framework ready (buyer funds, seller price adjustment, or commission concessions where appropriate).

Script: "The data gave us a gap. Here are the three ways we bridge it to keep your move on track."

Strategy Guide: See our guide on how to handle appraisal gaps in California.

6. Multiple-Offer Confusion

Real Life: Picking the highest price—which happens to have the weakest financing and a 10-day close.

The Mechanism: The "highest price" often has the highest risk of "Buyer's Remorse."

Prevention: Use an offer comparison grid focusing on certainty and terms.

Script: "A high price is just a number on a page until the lender clears it. Let's look at the certainty."

Win the Bid: Master how to present and win multiple-offer situations.

7. Communication Blackouts (No Written Recap)

Real Life: Having a "great talk" with the other agent on the phone but never sending a follow-up email.

The Mechanism: "He said/She said" becomes the narrative when the deal gets tough.

Prevention: Every phone call ends with an email: "Per our conversation, we agreed to X..."

Script: "I'm going to send a quick recap of what we just discussed so we are both on the same page for our clients."

8. Failure to Control the Cancellation Pathway

Real Life: Letting the other side "drift" past deadlines without using professional forms.

The Mechanism: You lose the ability to control the narrative. If you don't use your forms, you are negotiating from "vibes," not the contract.

Prevention: Use the Notice to Perform (NTP) and Demand to Close Escrow (DCE) as professional tools, not weapons.

Script: "My seller requires me to issue this notice to keep our timelines in compliance with the contract."

9. Unforced Errors (Overpromising)

Real Life: Telling a buyer they can "definitely" build a pool or move a wall without checking local zoning or easements.

The Mechanism: Misrepresenting material facts leads to lawsuits and cancellations during the due diligence period.

Prevention: Never answer a question you aren't 100% sure of. Point to the experts (inspectors, city planning).

Script: "That’s a great question for the inspector/city. Let's get that in writing from them."

The 60-Second Escrow Triage Decision Tree

When a problem hits, stop. Don't react. Use this triage:

Is this a DEADLINE problem?

Action: Request/Grant an extension in writing today.

2.Is this a MONEY problem (Appraisal/Lending)?

Action: Identify the exact gap. Present 3 solutions: Seller credit, Buyer cash, or Price drop.

Is this an EMOTION problem?

Action: Pause. Label the emotion ("I can see you're frustrated"). Reframe to the goal: "Do you still want to be in [City] by next month?"

Quick Checklist: The Deal-Saver (Screenshot This)

Day 1: Calendar every contingency + "48-hour rule" reminders.

The Kickoff: Send a deadline email to all parties (Lender/Escrow/Title).

Weekly: Schedule a Tuesday "Lender Pulse Check."

Audit: Perform a disclosure completeness check by Day 2.

Paper Trail: Send a written recap after every negotiation call.

Escalation: Always have two options ready before calling your client with bad news.

The Escrow Operating System

Success in escrow is a repeatable cadence.

Phase

Action Item

Kickoff

Send a "Milestone Email" to all parties. Schedule an "Expectations Call."

Every Tuesday

Call the lender. Ask: "Is there any reason we won't fund on time?"

48 Hours Pre-Deadline

Confirm the inspection is scheduled or the appraisal is ordered.

Problem Hits

Identify issue → Draft Options A & B → Present recommendation.

Frequently Asked Questions

What are the most common reasons deals fall apart in California?

Beyond the "Big Three" (Appraisal, Inspection, Loan), most deals die because of "buyer's remorse" triggered by an agent who failed to manage the psychological timeline of the escrow.

What if the buyer’s lender changes the terms mid-escrow?.

Immediately request a "Loan Commitment Letter" and have your backup local lender review the file. If the terms change significantly, it may trigger a new disclosure period.

How do I keep a deal together when the seller is emotional?

Stop talking about the house and start talking about their "Next Step." Remind them why they are moving. Emotions live in the present; logic lives in the future goal.

Stop Improvising. Start Operating.

Most agents don’t lose deals because they’re lazy—they lose deals because they’re running escrow on improvisation. In California, that is a recipe for a $0 commission check. If you want to move from "surviving escrow" to "mastering the market," you need the full professional skill stack.

Build Your Professional Operating System: Real Estate Agent Skills California

|

Imagine a Friday afternoon and you’ve just listed a well-priced three-bedroom home. Within 72 hours, your inbox is a graveyard of PDF attachments. You have 12 offers, three "love letters" (which must Read more...

Imagine a Friday afternoon and you’ve just listed a well-priced three-bedroom home. Within 72 hours, your inbox is a graveyard of PDF attachments. You have 12 offers, three "love letters" (which must be handled with extreme caution related to Fair Housing), and a seller who is already mentally spending the overage.

In the high-velocity California real estate market, a multiple-offer situation isn't just a sign of success—it is a high-stakes test of your professional systems. At ADHI Schools, we teach this as a repeatable Multiple-Offer Operating System: a clinical, step-by-step method that removes emotion, protects the seller, and increases the odds of closing without post-acceptance drama.

This article serves as your field manual for presenting, positioning, and closing multiple offers without losing control of the transaction.

In California’s deadline-driven, high-liability market, this is where most agents panic. They start "hustling"—calling everyone, venting, and hoping for a miracle.

Navigation Cue:

Listing Agents: Focus on Sections 1, 2, 4, and 7.

Buyer’s Agents: Focus on Sections 1, 3, 5, and 6.

1. Define the Two Games: Listing-Side vs. Buyer-Side

To successfully present multiple offers in California, you must first acknowledge that your objective shifts depending on which side of the negotiating table you occupy.

The Listing Agent’s Game (Risk Mitigation): Your goal is to organize the data so the seller can make an informed, objective decision based on "certainty of close," not merely the highest number.

The Buyer’s Agent’s Game (Strategic Positioning): Your goal is to make your offer the "path of least resistance" for the listing agent and the highest "certainty" for the seller.

Mastering these dynamics is a foundational component of the Real Estate Agent Skills California framework that separates top-tier producers from the pack.

2. The Listing Agent’s Operating System (Step-by-Step)

Do not present offers one by one as they arrive, they should be presented together in a non-prejudicial manner. This creates emotional fatigue for the seller and leads to sloppy decision-making. Normalize the data using an Offer Summary Sheet. You are looking for more than just price; you are also looking for the buyer’s "skin in the game."

The Listing-Side Checklist

Before sitting down with your seller, vet every offer for these specific "lethal" details:

Completeness: Is the RPA fully executed? Are all boxes checked, or is it a "sloppy" submission?

Proof of Funds (POF): Does the liquid cash cover the down payment plus estimated closing costs?

Lender Vetting: Have you personally called the buyer’s lender to verify the strength of the pre-approval?

Contingency Periods: Are they standard (17/21 days) or aggressively shortened to 7 or 10?

Verification Risk: Are there any unverifiable claims (gifted funds, bonus income, stock liquidation timelines) that could delay underwriting?

Presentation Script: The "Clinical" Approach

The Script: "Mr. and Mrs. Seller, we have 12 offers. Our goal today isn't just to find the highest price, but the one most likely to cross the finish line. We’re going to look at these through three lenses: Net Proceeds, Certainty of Close, and Post-Closing Flexibility (Rent-backs)."

3. The Buyer’s Agent Playbook: How to Win Without Overpaying

To win a multiple-offer situation, you must address the listing agent's biggest fear: the deal falling out of escrow.

Offer Strength Levers

The Earnest Money Deposit (EMD): Increasing the EMD (within the 3% owner occupied liquidated damages cap) signals serious intent.

Seller-Centric Timing: Matching the seller’s preferred close date or offering a rent-back often outperforms a higher price with rigid timing.

Clean Paperwork: A messy offer is a red flag. Ensure your contract terms are explained clearly and the package is sent as a single, bookmarked PDF.

Script: The Buyer Coaching Call

The Script: "I know the list price is $800,000, but in this micro-market, that’s just the starting whistle. To win, we need to look at what 'winning' actually costs. Are you prepared to cover an appraisal gap of $20,000 if the bank doesn't see value like we do?"

Script: The Listing Agent "Intel" Call

The Script: "Hi [Name], this is [Agent] with [Brokerage]. I’m calling to understand what ‘strength’ looks like for your seller beyond price. Is certainty of close, specific timing, or post-closing flexibility the biggest concern for them right now?"

4. Highest & Best vs. Counters: The Logic Ladder

Choosing the wrong response strategy is one of the most common deal-killing mistakes. Use this logic to decide your next move:

Consider Using “Highest & Best” (SMCO) When:

You have 5+ offers that are materially similar in terms.

Financing types (e.g., all Conventional 20% down) are comparable.

The seller prioritizes simplicity and wants to "clear the field" quickly.

Avoid “Highest & Best” When:

One offer is already dominant in price and terms.

Buyer profiles vary widely (e.g., one cash vs. one hard money).

You want to maintain leverage without reopening the field to everyone and risking "buyer ghosting."

Bottom line: “Highest & Best” is a blunt instrument. Use it to simplify decisions—not to abdicate strategy.

5. Appraisal Gap Risk: A Cautionary Tale

In a multiple-offer situation in California, the purchase price often outpaces recent comparable sales. This is why appraisal strategy is one of the most overlooked factors in a multiple-offer situation in California.

The Failure Scenario: I’ve seen sellers accept the highest offer—$60,000 over list—only to be back on the market 21 days later when the appraisal came in low and the buyer would not cover the difference. This costs the seller momentum, leverage, and credibility.

To prevent this, you must handle appraisal gaps proactively by requiring "Appraisal Gap Coverage" language in the counter-offer, ensuring the buyer has the cash to bridge the difference between the bank’s value and the contract price.

6. Terms That Win Deals vs. Terms That Kill Deals

Winning Terms

Deal-Killing Mistakes

Verified "Pre-Approval" (not Pre-Qual)

Vague "Seller Credits" for repairs

Shortened Inspection/Loan periods

Incomplete disclosures

Appraisal Gap Coverage

Escalation clauses with no "cap"

21-day or shorter escrow

Misaligned closing dates with seller's move

Winning these situations requires high-level negotiation tactics. It’s about finding the "hidden" needs of the other party—often, a seller needs a 30-day rent-back more than they need an extra $5,000.

7. "Present Like a Pro": The Seller Meeting Agenda

This is the 20-Minute Seller Decision Framework we teach agents to use when emotions are highest. When you sit down with your seller to present multiple offers, follow this structure:

The Landscape: Summarize total inquiries vs. showings vs. offers.

The Summary Sheet: Present the top 3–5 offers side-by-side.

The "Certainty" Talk: Highlight which lenders are reputable and which buyers have verified cash "above" the down payment.

The Decision: Select the strategy (Multiple Counter vs. Highest and Best).

Master the System

Agents who master multiple-offer situations don’t rely on luck—they rely on systems. Multiple-offer mastery sits at the intersection of communication, negotiation, contract control, and emotional regulation.

If this article exposed gaps in how you present, negotiate, or structure offers, your next step is to master the full Real Estate Agent Skills California framework. Stop reacting to the market and start commanding the transaction.

|