Real estate is about more than just property. It's about people—where they come from, what they value, and how they choose to live. As a real estate agent, you will meet clients from all different backgrounds. Read more...

Real estate is about more than just property. It's about people—where they come from, what they value, and how they choose to live. As a real estate agent, you will meet clients from all different backgrounds. Some may celebrate holidays you've never heard of, speak languages you don't know, or follow traditions that might seem unusual to you. Understanding, respecting, and working with these differences is called "cultural competency." It's a skill that helps you connect with clients more profoundly, making them feel valued and understood.

In today's world, learning to meet clients' needs from many cultures isn't just a "nice to have"; it's necessary. Communities are becoming more diverse, and buyers, sellers, and investors come from all over. When you master cultural competency, you can reach more clients, handle issues more smoothly, and build a better brand for yourself. More importantly, you'll create a reputation as genuinely caring about the people you serve—not just about making a sale.

Why Cultural Competency Matters

Imagine working with a family who just moved to your area. They may be still learning the local language or have customs that affect what kind of home they want to buy. For example, some cultures prefer multi-generational households, where grandparents, parents, and children live under one roof. Others place special importance on facing specific directions for good luck or having a space for certain religious practices. If you don't understand these needs, you might push them toward homes that don't make sense for their lifestyle, causing confusion or frustration.

Cultural competency is more than just avoiding mistakes; it's about actively building trust with clients from diverse backgrounds. When you demonstrate respect for their traditions and values, and show genuine interest in their unique needs, clients feel valued and understood. This fosters open communication, allowing them to comfortably share their concerns and goals, which ultimately leads to finding the perfect property faster. This trust translates to happy clients, increased referrals, and a thriving business built on strong relationships.

Common Cultural Differences in Real Estate

One of the first things you may notice when working with clients from different cultural backgrounds is that communication styles vary. Some clients may be straightforward, saying precisely what they mean. Others may prefer a more indirect style, using hints or polite phrases rather than giving a straight answer. Understanding these differences helps you avoid misunderstandings. You also learn to read between the lines and pick up on body language cues.

Another difference may be in the decision-making process. In some cultures, buying a home is an individual choice. The client may act alone based on their personal needs. In other cultures, it might be a family decision that involves input from parents, grandparents, or even older siblings. Being aware of who influences the decision can help you guide conversations and show respect to everyone involved.

Cultural differences also appear in how holidays and special events are treated. While some buyers may not mind scheduling showings during significant holidays, others may find that disrespectful. Some families may have specific days they consider lucky or unlucky. By knowing about these customs, you can schedule showings, open houses, and meetings at times that respect their traditions.

Overcoming Language Barriers

Clear communication is crucial when working with diverse clients. While learning basic greetings in their language shows respect, translation apps and interpreters can bridge larger language gaps. Focus on clear, simple language, patience, and positive non-verbal cues to ensure understanding and build rapport.

Building Trust Through Cultural Awareness

Respecting cultural differences isn't just about language or traditions—it's about showing that you recognize each client as unique. When clients see that you are trying to understand their world, they feel safer and more comfortable. Maybe you learn about their festival traditions and avoid scheduling meetings on those special days. Or perhaps you ask them about the features they value most in a home and then listen closely to their answers rather than assuming what they want based on your own experiences.

Small gestures can make a significant difference in building trust. If a client prefers no shoes inside the home, kindly remove yours before entering. If another client has dietary restrictions and you offer refreshments at an open house, consider serving beverages or snacks they can enjoy. While seemingly minor, these actions send a strong message that you care about their comfort and can go a long way in building a strong client-agent relationship.

Over time, this level of respect can lead to deep trust. Clients who trust you are likely to follow your advice, open up about their needs, and feel confident that you have their best interests at heart. In a field like real estate—where the stakes are high—trust can be the difference between a smooth transaction and a deal that falls apart.

Practical Steps to Improve Your Cultural Competency

Becoming culturally competent is a journey, not a destination. It's a process that requires patience, dedication, and a genuine desire to learn. One of the best ways to start is by educating yourself. Read books about different cultures, watch documentaries that explain certain traditions or beliefs, and consider attending cultural fairs or community events where you can meet people from diverse backgrounds and learn firsthand about their customs. Remember, the more you know, the better you can serve your clients.

If your clients come from a particular cultural group, consider learning a few key phrases in their language. For instance, if your clients are Spanish-speaking, learning how to say 'hello' ('hola '), 'thank you' ('gracias '), and 'goodbye' ('adiós ') can go a long way. It shows effort even if you only know a few basic phrases. Look into language classes at a local community center or try an online course. Another idea is to seek mentorship from another agent with experience working with multicultural clients. They can share their successes, mistakes, and strategies.

In addition, feel free to ask clients what makes them most comfortable. If you need help respecting a particular tradition, politely ask them for guidance. Most people appreciate honest curiosity and the chance to explain their customs. Over time, you'll build a mental library of knowledge and experiences that make you a more effective agent.

Long-Term Benefits for Agents and Communities

Cultural competency helps you stand out as a real estate agent and make more sales because you can serve a broader range of clients. This can lead to more referrals and repeat business. It also helps your reputation, as people describe you as understanding, caring, and respectful. These qualities go a long way in an industry built on relationships.

On a larger scale, culturally competent agents help create stronger communities. When people feel accepted and understood, they are more likely to invest in their neighborhoods, build lasting friendships with neighbors, and contribute to the area's growth. By helping clients find homes where they feel comfortable and respected, you're also helping build a positive community environment.

This skill takes time to develop. You might make mistakes along the way or need help with what to do. But with patience, a willingness to learn, and an open mind, you can become the kind of agent clients trust with one of the most significant decisions of their lives. Over time, cultural competency will not only improve your business; it will also help create more welcoming and understanding communities.

Love,

Kartik

|

Buying a home is a significant milestone, and for most people, securing a mortgage is a crucial step in the process. Navigating real estate financing can seem daunting as interest rates fluctuate and housing Read more...

Buying a home is a significant milestone, and for most people, securing a mortgage is a crucial step in the process. Navigating real estate financing can seem daunting as interest rates fluctuate and housing markets grow more competitive. Understanding how to navigate the mortgage process is more important than ever, and it's essential to recognize that this journey can vary significantly based on location, economic conditions, and personal circumstances. This article provides essential home mortgage tips and insights to help you make informed decisions on your path to homeownership.

As a new real estate agent fresh out of real estate school, remember this vital principle: be your own best client. While this article is geared toward helping buyers navigate the complexities of qualifying for a mortgage, the advice within applies just as much to you as it does to them. The true path to wealth in real estate isn’t solely in the properties you sell but in the properties you acquire along the way. By investing in real estate, you secure your financial future and gain firsthand experience that will make you a more informed and credible advisor to your clients. Let every transaction remind you that the best investment you can make is in yourself.

Understanding Your Financial Readiness

Before diving into mortgage options, it's crucial to assess your financial readiness. This step is not just important, it's empowering. It involves:

Assessing Your Credit Score

Your credit score determines the interest rates and loan terms for which you qualify. A higher score generally translates to better terms.

To improve your credit score, pay bills on time, reduce credit card balances, and avoid opening new credit accounts unnecessarily.

For instance, a buyer with a credit score of 750 might secure a 5% interest rate, while a score of 650 could lead to a 6.5% rate—a difference that could cost tens of thousands over the life of a loan.

Evaluating Your Budget with the 28/36 Rule

The 28/36 rule is a helpful guideline that can provide you with a sense of direction. It suggests that up to 28% of your gross monthly income should go towards housing expenses, and your total debt should be at most 36% of your gross income.

Determine a comfortable down payment amount while considering other savings goals and expenses, such as emergency funds, retirement savings, and other financial commitments.

Exploring Mortgage Options

Once you have a good grasp of your finances, it's time to explore the different mortgage options available:

Types of Mortgages

Fixed-Rate Mortgages: Ideal for buyers who prefer predictable monthly payments and plan to stay in their homes long-term.

Adjustable-Rate Mortgages (ARMs): These have interest rates that adjust periodically, making them suitable for buyers who plan to move or refinance within a few years. I generally don’t recommend these.

Government-Backed Loans:

FHA loans: Great for first-time homebuyers with lower credit scores or limited down payments.

VA loans: Exclusively for veterans and eligible service members, offering competitive terms and no down payment.

USDA loans: Designed for rural properties, providing low or no down payment options for qualified buyers.

Interest Rates and Loan Terms

Economic conditions and your creditworthiness influence interest rates.

Use online mortgage calculators to compare the costs of a 15-year loan versus a 30-year loan.

For example, "Have you ever wondered how much that extra 0.5% interest rate could cost over 30 years? A quick calculation can show you the impact on your budget."

Preparing Your Mortgage Application

A well-prepared mortgage application can streamline the approval process.

Gathering Required Documents

Lenders typically require proof of income (pay stubs, tax returns), employment verification, credit history, and documentation of assets (bank statements, investment accounts).

Avoiding Common Pitfalls

Refrain from making major purchases or opening new lines of credit while your mortgage application is under review, as these actions can negatively impact your credit score and approval chances.

Finding the Right Lender

When it comes to finding the right lender, don't settle for the first one you come across. Take your time, do your research, and make a decision that you feel confident about.

Shop Around for the Best Rates

Compare interest rates, fees, and loan terms from various banks, credit unions, and mortgage brokers to find the most favorable offer.

Ask the Right Questions

Inquire about lender fees, interest rate lock options, prepayment penalties, and other concerns.

Making the Most of Pre-Approval

Getting pre-approved for a mortgage offers several advantages:

What Pre-Approval Means

A pre-approval indicates that a lender has reviewed your finances and will lend you a specific amount.

Strengthening Your Offer

In competitive real estate markets, being pre-approved demonstrates your seriousness as a buyer and can give you an edge over other offers.

Understanding Closing Costs

Be prepared for closing costs, including appraisal fees, title insurance, loan origination, and more.

Some lenders or sellers may offer to cover part of the closing costs. Feel free to negotiate or inquire about potential discounts.

Reviewing the Fine Print

Carefully review all loan documents before signing to ensure you understand the terms and conditions of your mortgage. This is crucial as it can help you avoid any surprises or misunderstandings later on. Pay close attention to the interest rate, loan term, prepayment penalties, and any other fees or conditions.

Tip: Carefully compare the final Closing Disclosure to your initial Loan Estimate to ensure all terms align as expected.

Securing a mortgage requires careful planning and informed decision-making. By understanding your financial readiness, exploring mortgage options, preparing a strong application, and finding the right lender, you can confidently navigate the process. Remember to get pre-approved, understand closing costs, and review loan documents thoroughly. These home mortgage tips empower you to make sound choices and achieve your homeownership dreams.

Love,

Kartik

|

Owning a home isn't just about having a place to sleep—it's also a way to build wealth and give yourself more financial options. One of the main ways this happens is through home equity, which is the Read more...

Owning a home isn't just about having a place to sleep—it's also a way to build wealth and give yourself more financial options. One of the main ways this happens is through home equity, which is the difference between what your home is worth and what you still owe on it. Over time, you build more equity as you pay down your mortgage or if your property value increases. The increase in value, called appreciation, is influenced by factors like the desirability of your neighborhood, local market conditions, and overall economic growth. Eventually, if you pay off your mortgage, you own the entire value of your home.

For example, if you purchase a home for $300,000 with a 20% down payment ($60,000), you start with $60,000 in equity. As you continue making mortgage payments and your home's value rises, that equity grows. In addition to building equity, homeowners may also benefit from tax deductions on mortgage interest and property taxes, which can lead to significant savings over time.

Building equity isn't always easy. If home prices drop, you might owe more than your home is worth. This is called "underwater" on your mortgage, where the outstanding balance exceeds your home's current value. It often happens when the housing market takes a downturn or if you began with a huge loan and the home's value didn't grow as expected. When this occurs, some people wait for the market to improve so their home value can rise again. Others look into options like loan modifications or refinancing—if their lender allows it—to make their payments more manageable. In short, being underwater can be stressful, but it doesn't have to be permanent.

There are several ways to build more equity:

Start with a more significant down payment: The more you pay upfront, the more equity you will have immediately.

Make extra or larger mortgage payments: Paying more than the minimum can help you owe less fast.

Refinance to a shorter term: A 15-year loan, for example, can build equity faster than a 30-year one.

Invest in home improvements: Upgrading kitchens, bathrooms, or other parts of the home can boost its value.

Keep up with regular maintenance: Performing repairs and upkeep helps preserve your home's value and supports steady equity growth.

Once you have enough equity—often around 20%—you can borrow against it using options like a home equity loan or a home equity line of credit (HELOC). Home equity loans provide a lump sum of money at a fixed interest rate, while HELOCs work like a credit card with a revolving line of credit and a variable interest rate. People often use these options to consolidate high-interest debt, cover emergencies, pay for college, or invest in more home improvements. While borrowing against equity can be helpful, it also comes with risks you must fully understand before moving forward.

Risks of Borrowing Against Equity:

Interest Rate Fluctuations. If you choose a HELOC, your interest rate might change over time, causing your monthly payments to fluctuate.

Fees and Closing Costs: Home equity loans and HELOCs can include extra costs, such as closing fees, appraisal charges, or annual fees.

Impact on Your Credit Score: Taking on more debt can lower your credit score especially if you borrow a significant amount.

When to Use Home Equity:

While borrowing against your home equity can be a helpful tool, it's essential to use it wisely. Consider tapping into your equity for investments that will likely increase your home's value (like a kitchen remodel), to consolidate high-interest debt, or for essential expenses such as education or medical bills. On the other hand, avoid using your home's equity for non-essential purchases or risky investments that may not pay off in the long run.

Before borrowing against your equity:

Think carefully about how you'll repay the loan.

Remember that your home is the security for the debt, and if you miss too many payments, you could risk losing it.

Ensure you have a steady income and a clear plan to repay your debts.

Consider the pros and cons, and if needed, speak with a financial expert for guidance.

Owning a home is a big step toward creating a stable financial future. You can make smarter decisions by understanding home equity, knowing how to build it, and being aware of the risks and best uses of borrowing against it. With patience, planning, and proper maintenance, your home can be a place of comfort and a powerful tool for reaching your long-term financial goals.

Love,

Kartik

|

As a real estate agent, you might encounter the misconception that the holiday season is a slow time for selling homes. With people busy with festivities and travel, it's easy to assume that listing a Read more...

As a real estate agent, you might encounter the misconception that the holiday season is a slow time for selling homes. With people busy with festivities and travel, it's easy to assume that listing a property during this time could be challenging. But don't let that common belief deter you! The truth is, the holiday season offers unique advantages that you can leverage to benefit your clients. Let's debunk this myth and explore why listing during the holidays can be a winning strategy for you and your sellers.

Less Competition - Your LIsting Shines Even Brighter

As a real estate agent, you can use the reduced competition during the holidays to your advantage. Many sellers mistakenly believe it's a bad time to list, perhaps due to misconceptions or advice from those who haven't had the benefit of a quality real estate license school. This leads to lower inventory, with the National Association of Realtors reporting a 15% drop in listings in December compared to the spring selling season. This presents a golden opportunity for you. With fewer homes on the market, your listings are more likely to grab attention and attract serious buyers.

Serious Buyers - Ready to Make a Move

While there might be fewer buyers overall during the holidays, those actively searching tend to be highly motivated. These buyers often have specific needs or timelines driving their search, such as year-end tax breaks, job relocations, or a desire to settle into a new home before the new year. Their urgency can translate into quicker closings and better offers.

Holiday Spirit - Capture the Magic

As a real estate agent, you can capitalize on the inherent charm of the holiday season. Encourage your clients to enhance their home's appeal with tasteful decorations, festive lights, and even the enticing aroma of freshly baked cookies. This creates a warm and inviting atmosphere that resonates with potential buyers on an emotional level, making the property more memorable and desirable. To maximize this effect, suggest professional staging that incorporates festive touches while maintaining a clean and spacious feel. Also, work with your clients to ensure their listing photos highlight the cozy holiday ambiance without appearing cluttered. This will help your listings stand out and attract more interest.

Favorable Timing for Sellers - Minimize Disruption, Maximize Opportunity

As a real estate agent, remember to highlight the advantages of holiday listings for your clients. With fewer showings, they can enjoy the festivities with minimal disruption to their routines. Plus, if they're planning to buy in the spring market, selling now allows them to secure their next home before the competition heats up. This strategic timing, something you likely learned in your real estate license school, can give them a real advantage and provide a smoother transition.

Considerations Before Listing - Plan for Success

When advising clients about holiday listings, be sure to address potential challenges while emphasizing the overall benefits. Acknowledge that limited showing schedules due to holiday gatherings and travel might require flexibility. Reassure them that with careful planning and open communication, these obstacles can be easily managed.

Ultimately, position holiday listing as a strategic move. Highlight the unique opportunities it presents, from reduced competition and motivated buyers to the captivating allure of a festively decorated home. By guiding your clients through the dynamics of holiday home selling and implementing effective marketing strategies, you can increase their chances of a successful and timely sale, further solidifying your value as their trusted real estate advisor.

So, are you ready to embrace the holiday season as a prime time for real estate success? By understanding the unique dynamics of the market during this period, you can effectively guide your clients and turn the "slow" season into a win-win for everyone. Remember, a well-prepared agent is a successful agent, and a quality real estate license school can equip you with the knowledge and skills to thrive in any market condition.

Want to learn more about maximizing your potential in the real estate industry? Contact us today or visit our website to explore our comprehensive real estate training programs and discover how we can help you achieve your career goals.

Love,

Kartik

|

Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, Read more...

Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, and stained glass windows are just a few examples of the architectural details that contribute to this character. However, the reality of owning an older home can present unexpected challenges. While those creaky floorboards might add to the charm, they could also signal underlying structural issues.

While there is no substitute for a physical inspection by a competent professional, I wanted to write an article on how to navigate some of the complexities of buying an older home to ensure your dream home becomes something other than a money pit. Because lots of our real estate school students dream of selling unique and historic homes it's important to keep in mind that it’s not just about the charm, it's also about being cautious and prepared.

Structural Integrity

Foundations: A solid foundation is crucial. Look for telltale signs like cracks, shifting, or evidence of water damage. Uneven floors, doors that stick, and cracks in the walls, particularly above windows and doors, can all point to foundation problems.

Cracks: Imagine the foundation as the base of a LEGO structure. If that base cracks or shifts, the LEGO bricks above will no longer fit together neatly. Cracks in walls, especially diagonal ones spreading from corners of windows or doors, show that the house's frame is being pulled out of shape by movement in the foundation below.

Uneven Floors: A sinking or uneven foundation can cause the floor joists above to sag or become misaligned. This leads to sloping or bouncy floors. Think of it like a table with uneven legs – it wobbles.

Sticking Doors: When a foundation shifts, it can distort the door frames. This makes doors difficult to open or close because they no longer fit squarely within the frame. It's like trying to fit a puzzle piece into the wrong spot.

Checklist:

Are the floors level?

Do doors and windows open and close smoothly?

Are there any visible cracks in the foundation walls?

Is there any evidence of water damage in the basement or crawlspace?

Roof: The roof is your first defense against the elements.

Checklist:

What is the age of the roof? (And what is the typical lifespan for that roofing material? - e.g., asphalt shingles typically last 20-30 years)

Are there any missing, damaged, or curled shingles?

Are there any signs of sagging or unevenness in the roofline?

Are there any signs of moss or algae growth? (This can indicate moisture problems.)

Are the gutters and downspouts in good condition? (Proper drainage is essential.)

Is there any evidence of water damage in the attic? (Look for stains, mold, or rot.)

Walls and Ceilings: Inspect walls and ceilings for cracks, water stains, or bowing. These imperfections could indicate structural issues, water damage, or poor maintenance.

Plumbing and Electrical Systems

Common Plumbing Problems in Older Homes

Plumbing: Older homes may have outdated plumbing systems, such as galvanized pipes, and be prone to corrosion and leaks. Inquire about the age of the plumbing and look for signs of leaks, low water pressure, or discolored water.

Checklist:

What type of plumbing pipes are used in the home?

What is the age of the plumbing system?

Are there any visible leaks or signs of water damage?

Is the water pressure adequate in all fixtures?

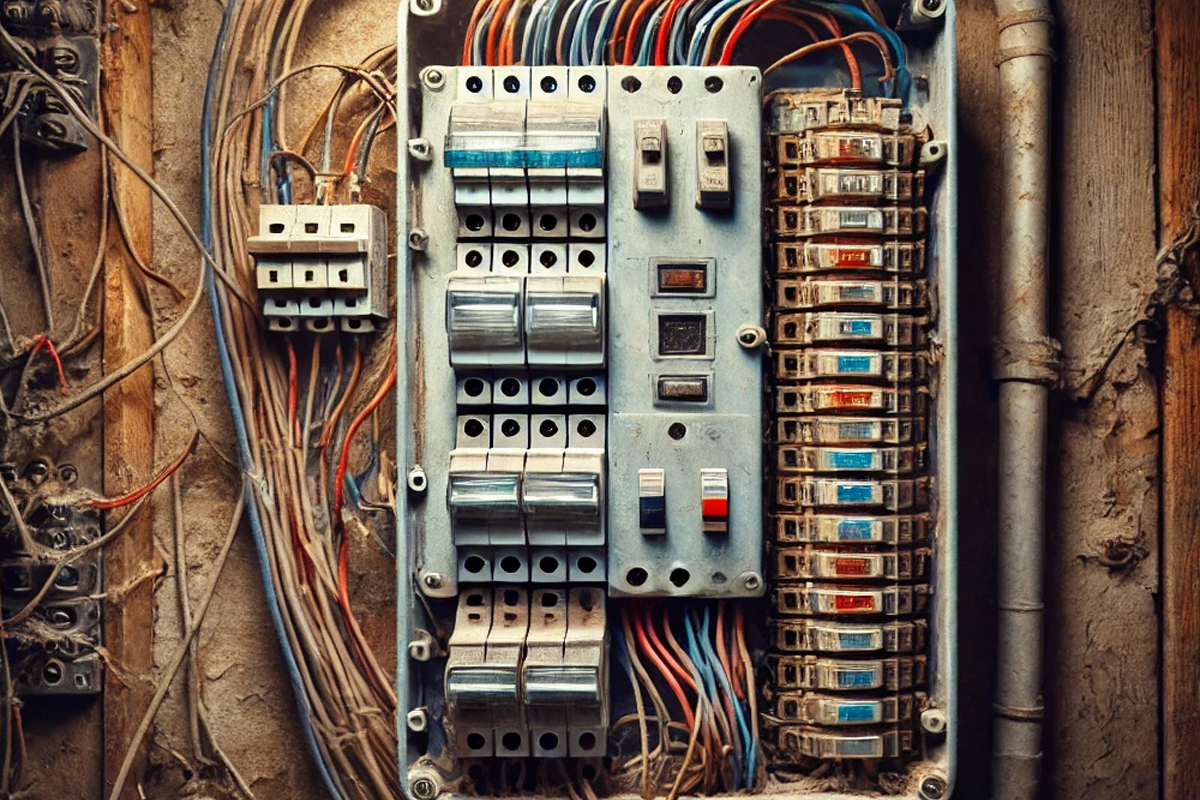

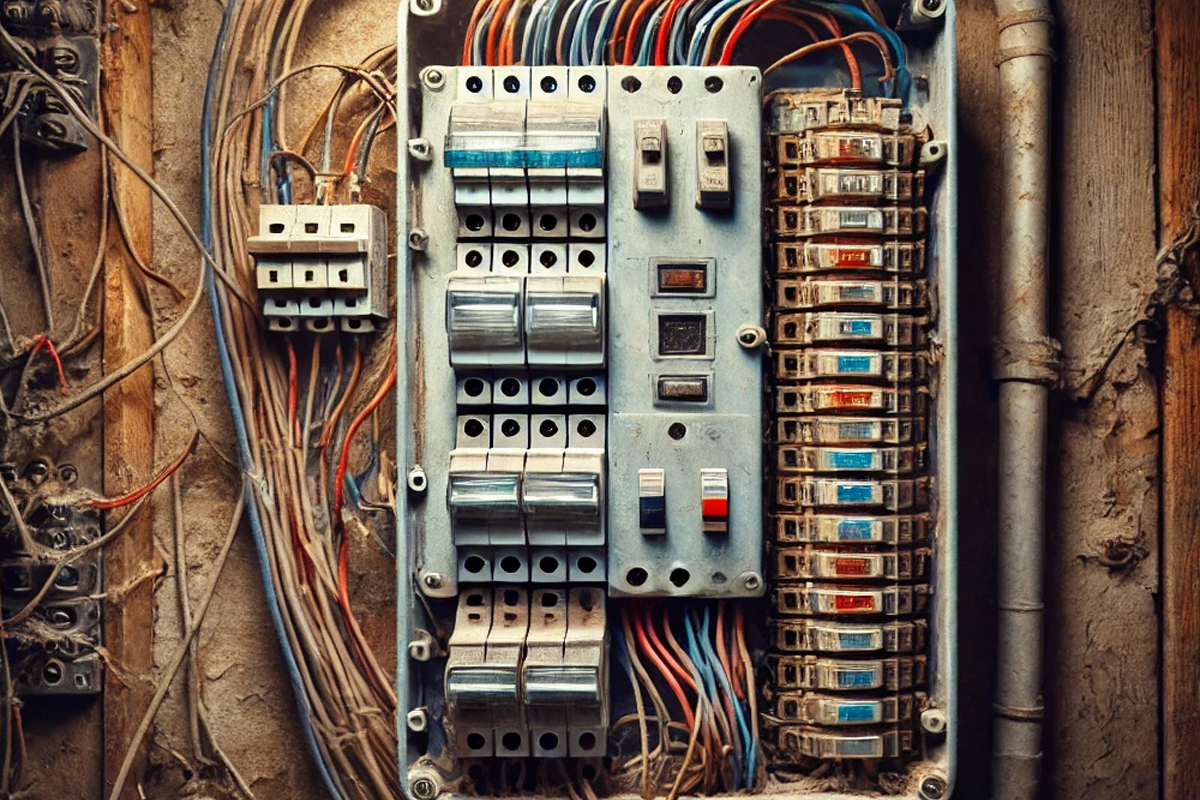

Electrical Safety Concerns

Electrical: An outdated electrical panel can be a safety hazard. Evaluate the panel for its capacity and age. Look for obsolete wiring (like knob-and-tube wiring), insufficient outlets, and any signs of electrical problems, such as flickering lights or frequent circuit breaker trips.

Knob and tube wiring is an old type of electrical wiring that was commonly used in homes from the late 1800s to the early 1900s. You can recognize it by its white ceramic knobs and tubes, which help hold and protect the wires.

The knobs are used to keep the wires attached to the wooden beams in the house, while the tubes are used when the wires need to pass through those beams. The system doesn't have a ground wire, which is used in modern wiring to help protect against electrical shocks and fires.

Because it's so old, knob and tube wiring doesn't meet today's safety standards and can't handle the amount of electricity we use now with all of our gadgets and appliances. That's why it's usually replaced if found in homes today, to make sure everything is safe and works well with modern electricity needs.

Checklist:

What is the age of the electrical panel?

What is the amperage of the electrical service?

Are there any signs of outdated wiring?

Are there enough outlets and circuits to meet your needs?

Hazardous Materials

Asbestos: Asbestos was commonly used in insulation, flooring, and siding in older homes. If you suspect asbestos-containing materials, hire a qualified professional for testing and abatement. Recent regulations have focused on safer removal methods to minimize health risks.

Lead Paint: Homes built before 1978 may contain lead-based Paint, which can be hazardous, especially for children. Lead paint testing and proper reduction are crucial. Modern encapsulation methods offer compelling alternatives to complete removal in some cases.

Heating, Ventilation, and Air Conditioning (HVAC)

System Age: HVAC systems have a limited lifespan, typically 15-20 years. Determine the age of the system and consider its remaining years of service. Older systems are less efficient and more prone to breakdowns.

Efficiency: Pay attention to signs of inefficient operation, such as uneven heating or cooling, drafts, and high energy bills. Consider upgrading to a modern, high-efficiency system to save money and reduce environmental impact. Look for systems with high SEER (Seasonal Energy Efficiency Ratio) and AFUE (Annual Fuel Utilization Efficiency) ratings.

Insulation and Energy Efficiency

Insulation Quality:

Inspect the attic, walls, and basement for adequate insulation.

Look for sufficient insulation depth (e.g., at least 12 inches in the attic) and check for any signs of moisture or pests.

Consider the type of insulation (e.g., fiberglass batts, blown-in cellulose) and its R-value, which indicates its thermal resistance. The higher the R-value, the more effective the insulation.

Poor insulation leads to higher energy bills and uncomfortable living conditions.

Windows and Doors: Check for drafts around windows and doors. Single-pane windows are notorious for heat loss. Consider upgrading to energy-efficient windows and doors to improve comfort and reduce energy consumption.

Potential for Renovations and Upgrades

Local Regulations: Research local zoning laws and building codes, especially if the home has historical status, as renovations might be restricted or require special permits.

Costs vs. Value: Get estimates for any necessary renovations and upgrades. Consider the potential return on investment and whether the improvements will significantly increase the home's value.

Financing Renovations: Explore financing options for renovations, such as home equity loans, personal loans, or government programs that offer incentives for energy-efficient upgrades.

Checking for Pest Infestations

Common Pests: Be vigilant for signs of termites (mud tubes, wood damage), rodents (droppings, gnaw marks), and other pests like carpenter ants (sawdust-like frass).

Signs of Infestation: Check for evidence of past pest control treatments. A history of infestations could indicate ongoing problems.

Water Damage and Mold

Signs of Damage: Look for water stains on ceilings, walls, and floors. Mold growth and musty odors are also red flags.

Sources of Water Damage: Inspect the roof, gutters, and drainage systems. Inquire about any history of flooding or leaks.

Legal and Insurance Issues

Property History: Research the property's history for past insurance claims, disclosures by the seller, and any known issues.

Insurance: Ensure that you can obtain homeowners insurance for the property. Older homes may present challenges or higher premiums due to age and potential risks.

Hiring a Professional Inspector

When hiring a home inspector, it's important to ask the right questions to ensure a thorough inspection. Here are some key questions to consider:

What is your experience with older homes?

What specific areas will you be inspecting?

Can you provide references from previous clients?

How long will the inspection take?

When will I receive the inspection report?

Choosing an Inspector: Select a qualified and experienced home inspector. Ask about their credentials, what they look for, and whether they have experience with older homes.

Understanding the Inspection Report: Carefully review the inspection report. Pay close attention to any significant issues and ask the inspector to explain any findings you need help understanding.

California specific pro-tip: In California, there is no state licensing requirement for home inspectors. This means that home inspectors in California are not regulated by any state agency, unlike in other states where inspectors must be licensed. As a result, the burden often falls on the consumer to ensure they are hiring a qualified and experienced inspector. It’s recommended to look for inspectors who are certified by reputable organizations, such as the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI), as these certifications typically require passing an exam, completing a certain number of inspections, and adhering to a strict code of ethics and standards of practice.

Common Problems by Era

Victorian Homes (pre-1900) are often characterized by knob-and-tube wiring, asbestos insulation, and foundation issues due to their age.

Mid-Century Homes (1950s-1960s): These homes may feature outdated plumbing, such as galvanized pipes, and are known for using aluminum wiring, which can pose a safety hazard.

Buying an older home can be a rewarding experience, but it's essential to approach the process with realistic expectations and a keen eye for potential problems. By conducting thorough inspections, consulting professionals, and addressing any issues proactively, you can minimize risks and enjoy the unique charm and character of your older home for years to come.

Love,

Kartik

|

Even though the concept of a real estate license might seem straightforward, many might not appreciate its comprehensive role in a real estate professional's career. From ensuring legal compliance Read more...

Even though the concept of a real estate license might seem straightforward, many might not appreciate its comprehensive role in a real estate professional's career. From ensuring legal compliance to fostering market integrity, this license is the cornerstone of professional real estate practice. It's not just a legal requirement, but a fundamental pillar of the real estate industry. In this article, I wanted to delve into the true essence of a real estate license, its necessity, and the benefits it brings to both professionals and their clients.

Types of Real Estate Licenses

For those venturing into the real estate industry, the choice often boils down to two primary licenses:

Real Estate Salesperson: Allows you to conduct transactions under the supervision of a licensed broker.

Real Estate Broker: This position empowers you to operate independently, manage a team of salespersons, and potentially own your own brokerage. It's a testament to your expertise and a stepping stone to a successful career in real estate. Keep in mind that requirements vary by state. For example, one state may require 60 hours of pre-licensing education, while another may require over 250. Always research the regulations specific to your area. This empowerment is a testament to your expertise and a stepping stone to a successful career in real estate.

Why Are Licenses Important?

Real estate licenses serve several critical purposes:

Consumer Protection: Licensing ensures that practitioners meet minimum standards, safeguarding clients from unethical or unprofessional practices.

Professional Standards: Education and making candidates pass real estate exams help ensure that agents and brokers possess a solid grasp of real estate law, ethics, financing, property management basics, and market principles.

Market Trust: A licensed professional builds trust and credibility, drawing in clients who prioritize expertise and ethical standards. Your license represents more than a mere credential; it is a mark of reliability within the real estate community.

How to Obtain a Real Estate License

While the exact process varies by state, you’ll typically follow these steps:

Consumer Protection: Licensing ensures that practitioners meet minimum standards, safeguarding clients from unethical or unprofessional practices.

Meet Prerequisites: You must usually pass any required background checks.

Complete Pre-Licensing Education: Enroll in a state-approved real estate program covering real estate principles, laws, ethics, finance, and property valuation.

Pass the State Exam: After completing your education, you’ll take a state-administered exam. This test covers property law, financing, contracts, land use, and ethical practices. Success here ensures you have a foundational understanding of the industry’s core concepts.

Maintaining and Renewing Your License

Earning your license is just the start. To keep it active and in good standing, you’ll need to:

Fulfill Continuing Education Requirements: Stay up-to-date with evolving laws, market trends, and industry best practices by completing regular coursework.

Renew Your License Periodically: States usually require real estate license renewal every two to four years. Ensure you meet all renewal criteria, pay applicable fees, and submit the documentation on time.

Uphold Ethical and Legal Standards: Always comply with state regulations and industry ethics. Operating with an expired or revoked license can lead to fines, legal action, or permanent disqualification, significantly impacting your career and reputation in the industry.

The Benefits of Having a Real Estate License

Holding a real estate license offers several advantages:

Legal Authority: You can represent buyers, sellers, landlords, and tenants, earning commissions and building a rewarding career.

MLS Access: Gaining access to the Multiple Listing Service (MLS) provides a comprehensive database of properties, streamlining the search process and boosting your efficiency.

Expert Negotiation and Advocacy:Licensed professionals add value by advocating for their clients’ best interests. They use their market knowledge and negotiation skills to secure favorable terms, ensuring clients achieve their real estate goals.

Professional Growth: Join professional organizations—such as the National Association of Realtors ®—and benefit from industry resources, networking events, and advanced training programs. These organizations can provide you with valuable insights, networking opportunities, and access to advanced training, all of which can contribute to your professional growth and success in the industry.

Career Versatility: Explore various niches, from residential and commercial sales to property management, investment consultancy, and even luxury market specialization.

Certification: Additional certifications or designations, like working with first-time buyers or handling luxury properties, can demonstrate specializations. These certifications can enhance your credibility and marketability, showing potential clients you have specialized knowledge and experience in a particular real estate area.

Continuous Learning Needed: A license is the starting line, not the finish line. The industry evolves, and so must your knowledge and skills. Continuous learning is not just a requirement, it's a key to staying competitive in the real estate market. This emphasis on continuous learning is a reminder of the necessity of staying updated and competitive in the industry.

Next Steps

If you’re ready to begin your journey:

Research State Requirements and Enroll in Pre-Licensing Courses: Visit your state’s official real estate licensing board website and find an approved real estate school like ADHI Schools. This emphasis on research and preparation will make you feel equipped and ready to start your journey.

Join Professional Organizations: Consider joining the National Association of Realtors® or other reputable groups for ongoing education, market insights, and networking opportunities.

A real estate license is key to unlocking a dynamic, customer-focused career. With the proper preparation, dedication to learning, and commitment to advocating for your clients’ best interests, you’ll be well on your way to thriving in this rewarding industry.

Love,

Kartik

|

The Impact of School Districts on Home Values

In the affluent town of Palo Alto, California, known for its top-ranked public schools and proximity to Silicon Valley, the median home price soars Read more...

The Impact of School Districts on Home Values

In the affluent town of Palo Alto, California, known for its top-ranked public schools and proximity to Silicon Valley, the median home price soars to over $3.5 million—nearly five times the state average. This stark contrast underscores a broader phenomenon: the undeniable link between school district quality and home values. For families with school-age children, the appeal of excellent schools often outweighs other considerations when choosing where to live. However, while strong school districts drive up property values and attract investment, underperforming schools can have the opposite effect, contributing to economic challenges and diminished community appeal.

Buyers will inevitably ask our real estate school graduates, 'How are the schools?' To address this, we should examine the complex relationship between school district quality and home values, exploring the factors that contribute to this connection and its implications for homeowners, buyers, and communities. But this is not just a matter of economics; it has profound social implications that cannot be ignored.

Factors That Influence Home Values in Strong School Districts

The connection between school district quality and home values stems from a variety of factors:

Academic Performance: Metrics like test scores, graduation rates, and college acceptance rates are often key indicators of school quality. Neighborhoods with high-performing schools consistently command higher home prices as parents prioritize academic outcomes for their children.

School Reputation and Rankings: Perception matters. Well-ranked schools in national and state evaluations tend to attract more homebuyers, even if those rankings only partially capture the school's actual quality.

Educational Programs and Resources: Specialized programs such as STEM initiatives, arts education, and robust extracurricular activities can significantly enhance a school’s appeal, boosting the desirability of homes in the area.

Teacher Quality: A strong teaching staff, characterized by experience, qualifications, and low turnover rates, is another major draw for families, adding to the prestige and performance of a school district.

School quality significantly shapes local economies by driving home values and influencing overall housing market trends.

The Economic Impact

Property Taxes: School districts are largely funded by local property taxes, creating a feedback loop where desirable districts see rising home values, which in turn generate more funding for schools. This cycle perpetuates disparities between affluent and less affluent areas.

Demand and Supply: Top-rated school districts often face high demand for limited housing stock. This scarcity drives prices upward, creating a competitive housing market where families are willing to pay a premium.

Return on Investment: Homes in desirable school districts typically retain or increase in value over time, making them a smart long-term investment. Even for buyers without children, the resale value of such homes remains a compelling incentive.

Affordability and Gentrification: Rising property values in sought-after districts can price out lower-income families, potentially leading to gentrification and displacement. This dynamic raises questions about equity and access to high-quality education.

Social and Community Impacts

The economic dynamics of strong school districts—such as increased property taxes and competitive housing markets—extend beyond finances, shaping the very fabric of local communities. These economic trends inevitably influence social structures and community engagement, revealing deeper implications for residents and neighborhoods.

Demographics: The quality of a school district often influences the socioeconomic and other demographics of a community. Affluent families are more likely to move into areas with strong schools, potentially exacerbating segregation.

Community Involvement: Strong schools foster a sense of community pride and engagement. Parents are more likely to participate in school activities, local governance, and volunteer efforts, further strengthening the neighborhood.

Amenities and Development: The presence of high-performing schools attracts additional investments in community amenities like parks, libraries, and local businesses, which further enhance property values.

Socioeconomic Disparities: The cycle of affluent communities benefiting from better-funded schools while less affluent areas struggle highlights a critical equity issue. This disparity perpetuates systemic inequalities that can have long-term societal consequences.

Although the social and community benefits of strong school districts are significant, they are not without challenges. A closer look at these complexities highlights key nuances, such as equity issues and market fluctuations, which underscore the importance of a balanced and inclusive approach.

Considerations and Nuances

Beyond Test Scores: While test scores are often the most visible metric of a school’s success, factors like school safety, diversity, and climate are equally important for families and communities.

Hyperlocal Variations: Even within highly rated school districts, there can be significant variations in school quality, influenced by factors like school size, administration, and community support.

Market Fluctuations: Economic downturns and housing market volatility can affect property values in even the most desirable school districts, though these areas often recover more quickly.

Equity in School Funding: The reliance on property taxes to fund schools often perpetuates disparities, with wealthier areas enjoying better resources. Addressing this inequity is crucial for fostering more balanced opportunities.

Alternative Schooling Options: The availability of charter and private schools adds another layer of complexity to the relationship between school districts and home values. In areas with high-performing private or charter schools, families may prioritize access to these institutions over public schools, potentially reducing the pressure on housing demand within certain districts. Conversely, the presence of prestigious private schools can increase overall home values in a region, as families seek proximity to these institutions regardless of the quality of the local public schools. This dynamic illustrates how alternative schooling options can shape housing markets in unexpected ways.

The impact of school quality extends far beyond the classroom, shaping everything from local economies to social structures. But this influence comes with a price, raising concerns about housing affordability and equity.

To address these issues, policymakers should consider several specific actions:

Increase State and Federal Funding: Allocate more resources to schools in lower-income areas to reduce disparities in educational quality and resources.

Implement Property Tax Reforms: Explore alternative funding models, such as pooling property taxes across districts, to ensure a more equitable distribution of school funding.

Support Holistic Education Metrics: Encourage policies that evaluate schools beyond test scores, including factors like student engagement, safety, and extracurricular opportunities.

The connection between school district quality and home values is both powerful and complex. Strong schools benefit not just individual families but entire communities, boosting local economies and fostering a sense of well-being. However, this relationship also creates challenges, such as rising housing costs, widening inequalities, and systemic barriers that leave many behind.

For homebuyers and homeowners, understanding this connection is key to making decisions that align with their priorities. But the responsibility for addressing these deeper issues lies with policymakers. By tackling funding gaps, looking beyond test scores to evaluate schools, and exploring creative solutions, we can build a fairer system—one that ensures all families and communities have access to the benefits of excellent education.

Love,

Kartik

|

Imagine waking up on a frigid winter morning to discover your heater has stopped working. Or picture a water heater that suddenly malfunctions around holiday time. Would you be ready to handle the cost Read more...

Imagine waking up on a frigid winter morning to discover your heater has stopped working. Or picture a water heater that suddenly malfunctions around holiday time. Would you be ready to handle the cost and hassle alone, or would a home warranty lift some of that burden?

Fresh out of real estate school, most new real estate agents typically start by working with buyers. As a buyer agent, being able to negotiate with sellers to cover the buyer's home warranty cost is crucial. This ensures protection for the buyer should any issues arise after the escrow closes.

I wanted to delve into home warranties and evaluate whether or not they truly offer peace of mind.

What is a Home Warranty?

A home warranty is a service contract that may cover the repair or replacement of major home systems like appliances, HVAC, plumbing, and electrical systems. Unlike home insurance, which protects against damage from unexpected events like fires or storms, a home warranty covers the normal wear and tear that daily use can inflict on a home.

The Benefits of Home Warranties

Peace of Mind: As new homeowner Sarah J. recounted, "Having a home warranty gave me such a profound sense of security. When my water heater broke, I didn't panic. I just called the warranty company, and they took care of everything." This level of reassurance is what a home warranty can offer.

Budgeting: Home warranties help you avoid unexpected and potentially expensive repair bills. You typically pay a service call fee, but the warranty company covers the rest within the limits of your contract.

Long-term Savings: Consider this: a new refrigerator costs $1,500, and a furnace replacement can easily exceed $5,000. With a home warranty costing around $500-$800 per year and service fees, you could save thousands over the long term. This could be a smart financial move for any homeowner.

Great for Older Homes: A home warranty can be especially beneficial if home warranty can be especially beneficial if you're buying an older home with aging appliances and mechanical and plumbing systems.

Ideal for First-time Homebuyers: New homeowners often need more experience to diagnose and handle home maintenance issues. A warranty simplifies the process by connecting you with qualified service providers.

Potential Downsides of Home Warranties

Coverage Denials: One of the biggest complaints about home warranties is the denial of claims, which can happen due to pre-existing conditions, lack of proper maintenance, or issues outside the contract's scope. Industry data suggests that as many as 20% of claims are denied initially, though some may be approved upon appeal.

Service Issues: Finding qualified technicians and scheduling timely repairs can sometimes be challenging.

Cost vs. Benefit: Weigh the warranty premium and service call fees against the potential repair costs. However, for many homeowners, the peace of mind and protection against catastrophic expenses outweigh these limitations.

How to Choose the Right Home Warranty

Compare Companies: Research different home warranty providers, comparing their coverage options, costs, and customer reviews.

Read the Fine Print: Carefully examine the contract, paying close attention to coverage limits, exclusions, and claim procedures.

Check Customer Reviews: Look for companies with a strong reputation for customer service and fair claim handling.

Ask the Right Questions: Don't hesitate to ask potential providers these key questions:

What is the average response time for service requests?

Are there any limits on the number of service calls I can make annually?

What are the common reasons for claim denials?

Can I choose my service technician?

Home warranties can offer valuable protection and peace of mind, especially for first-time homebuyers or those purchasing older homes. However, weighing the potential benefits against the costs and limitations is crucial. Choosing the proper warranty and understanding your contract thoroughly is key to a positive experience.

Love,

Kartik

|

Only Sign with a Brokerage Once You Ask These 5 Questions!

Starting your real estate career or considering a move to a new brokerage is an exciting step, but it’s also one that requires careful thought. Read more...

Only Sign with a Brokerage Once You Ask These 5 Questions!

Starting your real estate career or considering a move to a new brokerage is an exciting step, but it’s also one that requires careful thought. Joining a brokerage is a lot like choosing a business partner—it’s a decision that can shape your career success, professional growth, and overall satisfaction. Before you commit, ask these five essential questions to ensure you’re making the right choice.

1. What Is the Brokerage’s Commission Structure and Fee Schedule?

Your earning potential starts with understanding how a brokerage structures its commissions and fees. To get the full picture, ask:

Splits and Caps: What percentage of commissions will I keep? Is there a cap after which I retain 100%?

Fees: Are there recurring costs for desk space, transaction processing, or other services?

Extras: Will I be charged for training, marketing tools, or technology platforms?

For instance, some brokerages might offer an 80/20 split with a $15,000 cap, while others may opt for a flat fee model. Knowing these details upfront helps you evaluate how much you’ll take home versus what you’ll invest in being part of the brokerage.

2. What Training and Mentorship Programs Do You Offer, Especially for New Agents?

A good brokerage invests in its agents’ success, especially if you’re new to the industry. Look for structured training and mentorship opportunities that will set you up for long-term growth. Key questions include:

Structured Training: Are there formal programs covering topics like contracts, negotiations, and lead generation?

Mentorship: Can I be paired with an experienced agent for one-on-one guidance?

Frequency and Costs: How often are training sessions held, and are they included in the fees?

For example, a brokerage that offers weekly training sessions and access to a dedicated mentor can provide the confidence and skills you need to thrive in the competitive real estate market.

3. How Does The Brokerage Generate Leads, and What Is the Lead Distribution Policy?

Leads are the lifeblood of a successful real estate career. It’s crucial to understand how a brokerage approaches lead generation and distribution. Here’s what to ask:

Lead Sources: Does the brokerage provide leads, and how are they generated (e.g., marketing campaigns, referrals)?

Distribution Policy: Are leads distributed evenly among agents, or based on experience or performance?

Agent Responsibility: If I’m responsible for generating my own leads, what support does the brokerage offer?

For example, some brokerages provide leads through their website and allocate them to agents on a rotating basis, while others require agents to handle their own lead generation entirely. Understanding this system will clarify your potential pipeline.

Pro Tip: Most real estate brokerages are not going to offer leads, but many teams will.

4. What Marketing and Technology Resources Does the Brokerage Provide?

In today’s digital-first world, having access to modern marketing and technology tools is a must. To evaluate the brokerage’s resources, ask:

Marketing Tools: Do they provide a personal website, branding materials, or social media support?

Technology Infrastructure: Are tools like CRMs, transaction management software, or e-signature platforms included?

Costs: Are these tools covered in my fees, or will I need to pay extra?

A brokerage that equips you with cutting-edge resources can save you time, enhance your professionalism, and help you attract more clients.

5. Can You Describe the Company Culture and Work Environment?

A positive and supportive work environment is crucial for both your productivity and well-being. To assess the brokerage’s culture, ask:

Values and Communication: What are the brokerage’s core values, and how do they guide day-to-day operations?

Team Dynamics: Are there opportunities for collaboration and support among agents?

Networking and Events: Does the brokerage host events, workshops, or team-building activities?

For example, a brokerage with a collaborative team environment and regular networking opportunities can help you build meaningful relationships and grow your business.

Pro Insight: Speak with Current Agents

Even if you are still in real estate school or preparing for the real estate exam, don’t hesitate to ask if you can speak with a few current agents at the brokerage. Their firsthand perspectives can provide invaluable insights into the work environment, the level of support offered, and what it’s really like to work there.

Your Success Starts with the Right Brokerage

Your future in real estate begins with the right foundation. Take these questions to your next brokerage meeting to ensure the brokerage aligns with your goals, values, and needs. Remember, the right brokerage isn’t just a place to work— they are a partner in your success.

Love,

Kartik

|

Starting in real estate school and breaking into the real estate world can feel like stepping into a high-pressure and rapidly evolving industry. There are contracts to learn, open houses to host, and Read more...

Starting in real estate school and breaking into the real estate world can feel like stepping into a high-pressure and rapidly evolving industry. There are contracts to learn, open houses to host, and a constant stream of new information to absorb. Yet, amidst all the hustle, one cornerstone of success rises above the rest: networking.

It shouldn’t be surprising that building a strong network is essential for new agents. The intimidating question is “How do you establish connections when you're just starting out?”

The good news is that networking isn't about being pushy or overly polished; it's about forming genuine relationships. In this guide, you'll find practical tips to help you build a thriving network based on authenticity and trust, helping to set your real estate career in motion.

Understand the Power of Networking in Real Estate

Forget the stereotype of the slick, fast-talking salesperson. In today's market, real estate thrives on relationships. Networking is the foundation of the industry, and success often comes down to trust and connection. Clients want to work with agents they know, like, and trust. Focus on providing value by:

Share helpful advice.

Stay informed about local market trends.

Position yourself as a resource.

When people see you as someone who genuinely cares about their needs, the business you want naturally follows.

Define Your Networking Goals

Before diving into events and meetups, take a moment to clarify your objectives.

Identify your target audience: Are you passionate about helping first-time homebuyers? Do you dream of working with luxury clients? Or are you drawn to investors? Knowing who you want to help will guide your networking efforts.

Set measurable goals: Instead of vague aspirations like 'meet more people,' aim to collect some stated number of new connections per month. This clear direction will keep you focused and motivated in your networking efforts.

Align with your career vision: Consider how your networking activities support your long-term goals. Are you working to become a top local agent or build a referral-based business? Keep the big picture in mind.

Start with Your Inner Circle

Leverage existing relationships: Friends, family, former colleagues, or even the barista at your favorite café can help spread the word about your new career. Who knows - Your most substantial network may already be within reach.

Announce your new role on social media: Share your excitement and update your profiles to reflect your new path. A simple post can spark conversations and referrals.

Ask for introductions: Don't be shy about asking your inner circle to connect you with people they know. A friend-of-a-friend introduction could lead to your first sale.

Attend Local Events and Join Real Estate Groups

Get out there and meet people face-to-face!

Participate in local events: Attend Chamber of Commerce meetings, charity fundraisers, and community festivals. Don't overlook smaller gatherings like HOA meetings or school fundraisers, which can also be great for meeting locals.

Join industry groups: Connect with peers through local real estate associations or online communities. Sharing insights with other professionals can open unexpected doors.

Volunteer and sponsor: Increase your visibility by sponsoring a local sports team, organizing a neighborhood cleanup, or volunteering at a soup kitchen. These activities build goodwill and name recognition.

Master the Art of the Elevator Pitch

Opportunities to connect often come at unexpected moments. Be prepared with a short, engaging introduction that highlights your value.

Craft a 30-second pitch: For example: "I'm a real estate agent who loves helping first-time homebuyers navigate the exciting journey to their dream home. I focus on making the process smooth and stress-free."

Or

“I’m a real estate agent who specializes in helping investors identify properties that align with their financial goals. Whether it’s finding undervalued assets, analyzing cash flow potential, or navigating complex transactions, I provide the expertise and resources to make every investment a strategic success.”

Be conversational: Your pitch should feel natural, not rehearsed. Practice until you can deliver it confidently.

Engage on platforms like LinkedIn, Instagram, and Facebook: Share your expertise and connect with potential clients and industry professionals. By consistently sharing helpful, engaging, or entertaining posts, newer agents can build trust and connection, making their eventual sales pitches more effective and well-received.

Post valuable content: You must schedule an appointment with a Share market updates, home-buying tips, and success stories to position yourself as a helpful resource.

Join local groups and forums: Participating in community discussions online is an easy way to make connections and grow your influence.

Collaborate with Other Professionals

Real estate doesn't exist in a vacuum.

Build partnerships: Form relationships with mortgage brokers, home inspectors, contractors, and interior designers. These professionals often refer clients and appreciate referrals in return.

Create mutual opportunities: For example, a mortgage broker could refer pre-approved buyers to you, while you could recommend their services to your clients. Collaboration helps everyone succeed.

Follow Up and Stay Top of Mind

Networking is just the first step. Staying connected turns acquaintances into clients.

Follow up promptly: Send a quick, personalized email or connect on LinkedIn after meeting someone.

Stay organized: Use a CRM or a simple calendar to track contacts and schedule follow-ups.

Add value regularly: Share helpful articles, send holiday greetings, or provide market updates to maintain relationships without overwhelming your contacts.

Be Consistent and Patient

Networking is a marathon, not a sprint. It's important to stay patient and committed to your efforts, knowing that every connection brings you closer to your goals.

Commit to consistency: Attend events regularly, engage on social media, and follow up with new connections. Over time, these efforts compound into meaningful relationships.

Celebrate small wins: Every connection counts, whether a new lead or a productive conversation.

Learn from setbacks: Only some contacts will lead to immediate results. Use each interaction as a learning opportunity and keep building.

Networking is the cornerstone of success for new real estate agents. By building genuine relationships, you can grow your business, establish trust, and position yourself as a go-to expert in your market.

Start small, stay consistent, and always look for ways to add value. Whether a friendly conversation at a local event or a thoughtful follow-up email, every connection brings you closer to your goals.

Your journey in real estate is just beginning—get out there and start building your network today!

Love,

Kartik

|